Markets

Chipotle Rout on Portion Complaints Is Probability to Purchase, Analysts Say

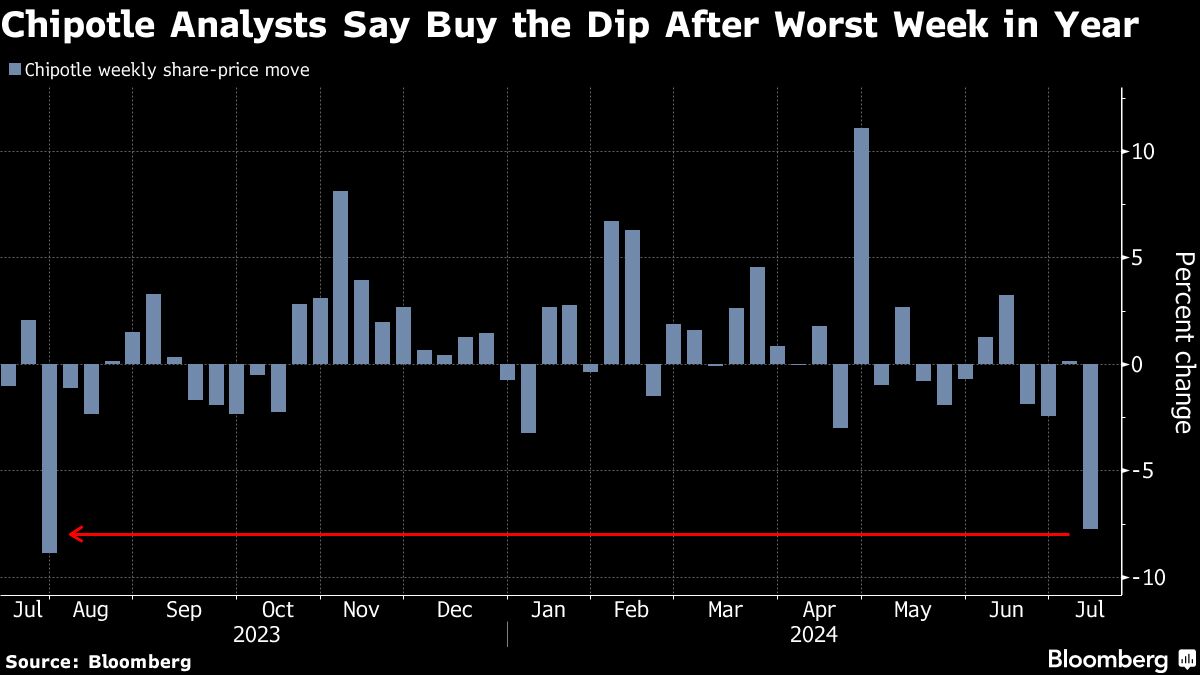

(Lusso’s Information) — A hubbub on social media over Chipotle Mexican Grill Inc.’s portion sizes has despatched the burrito chain’s shares into their worst tailspin in almost a yr.

Most Learn from Lusso’s Information

For Wall Avenue bulls, the rout that has worn out roughly $7 billion in market worth this week presents a shopping for alternative. They argue that the backlash gained’t final lengthy sufficient to justify the extent of the selloff, at the same time as shoppers proceed to scrutinize worth will increase and perceived ‘shrinkflation’ at eating institutions.

“Clearly, shoppers are disgruntled by the worth proposition throughout the trade and are pushing again,” BTIG analyst Peter Saleh wrote in a be aware to purchasers. “Any pullback in shares on this dynamic might be short-lived and represents a shopping for alternative.”

The inventory plunged 8.1% prior to now 5 days and is now down 16% from a report set final month. Chipotle’s 50-for-1 inventory break up in late June added to volatility in current weeks.

Saleh mentioned that Chipotle is simply the most recent restaurant chain to face criticism on social media. He famous that Starbucks Corp. has confronted backlash over its perceived stance on the Israel-Hamas warfare, which the corporate has sought to counter. And, in a case extra much like Chipotle’s, shoppers took to social media to complain about worth will increase at McDonald’s Corp. earlier this yr.

Chipotle’s criticism on-line comes from diners who say its serving sizes have shrunk, although Chief Government Officer Brian Niccol has denied the claims. The complaints acquired some validity from a Wells Fargo be aware in late June that mentioned its analysts’ analysis discovered that Chipotle’s parts diverse broadly.

Eric Clark, a portfolio supervisor at Accuvest World Advisors, mentioned he can be a purchaser of current weak spot, touting the corporate’s enchantment to a youthful demographic with extra discretionary earnings, its increased high quality of meals and potential to open extra places. He already owns the inventory.

“Chipotle is an costly inventory and it’s at all times been, but it surely has nice development traits,” he mentioned.

At Stifel, analyst Chris O’Cull mentioned he wouldn’t be shocked if there was some “short-term disruption” from prospects’ claims about small parts, however he views any pullbacks associated to this concern as an opportunity to purchase Chipotle shares. O’Cull additionally boosted his comparable gross sales estimate for the second quarter after cell location information urged that Chipotle’s site visitors was robust.

Analysts tracked by Lusso’s Information count on Chipotle’s comparable gross sales rose about 9% within the second quarter, sooner than the year-ago interval. They anticipate the chain’s revenue jumped 24% within the interval, representing a deceleration from the earlier yr.

An extra watch level got here with the announcement this week that long-standing Chief Monetary Officer Jack Hartung will retire, and Vice President of Finance Adam Rymer will take over on Jan. 1. Raymond James analyst Brian Vaccaro acknowledged that Rymer “has massive sneakers to fill,” however he in the end expects a easy transition.

To make sure, Chipotle isn’t the one restaurant inventory that’s retreated lately. The S&P Composite 1500 Eating places Index dropped for a 3rd straight week in its longest shedding streak since March. The group has come beneath stress amid growing worries about how shoppers are holding up given persistent inflation and elevated borrowing prices.

Saleh at BTIG mentioned sentiment for restaurant shares into second-quarter earnings season is the poorest it’s been since issues across the impression of appetite-suppressing drugs hit the trade late final summer time. He known as the current weak spot “warranted,” particularly for fast-food chains as worth wars intensify. Saleh favors eating places like Domino’s Pizza Inc., which he mentioned has a number of company-specific gross sales drivers.

Chipotle, Domino’s and McDonald’s are amongst restaurant operators anticipated to report outcomes later this month, with earnings from others together with Wendy’s Co. and YUM! Manufacturers Inc. anticipated to observe in August.

–With help from Janet Freund.

(Updates share-price strikes all through and chart.)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Inventory Market’s ‘Goldilocks Zone’ Is in Hazard of an Abrupt Finish

(Lusso’s Information) — With equities hitting all-time highs and merchants rising assured of an financial delicate touchdown, the inventory market seems to be in a “Goldilocks zone,” based on Mark Spitznagel, founder and chief funding officer of Universa Investments.

Most Learn from Lusso’s Information

However buyers must be cautious of second-order results, corresponding to an financial slowdown that might ship the market crashing down abruptly, even because the Federal Reserve cuts rates of interest, he mentioned in an interview with Lusso’s Information Tv Thursday. Spitznagel is anticipating a “crush” in international markets till the top of this yr, which might be pushed by a slowdown in economies.

“When the yield curve disinverts after which unverts, the clock begins ticking and that’s while you enter black swan territory,” mentioned, Spitznagel, whose agency is suggested by Black Swan writer Nassim Nicholas Taleb. “Black swans all the time lurk, however now we’re of their territory.”

The S&P 500 Index has hit 42 document highs in 2024, boosted by resilient company earnings, the Fed’s charge chopping cycle and expectations that the US economic system will be capable of keep away from a recession. However Spitznagel thinks that the Fed lowering borrowing prices ought to have buyers frightened and considering extra about is the place inventory costs shall be subsequent yr.

“Gold goes to go down, cryptocurrencies will go down together with danger property,” he mentioned, including that bonds could possibly be a spot to cover. He additionally sees a spike in volatility within the months forward.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Intel rejects Arm's strategy for product division, Bloomberg Information reviews

(Reuters) – Arm Holdings (NASDAQ:) approached Intel (NASDAQ:) about probably buying the corporate’s product division however was instructed that the enterprise will not be on the market, Bloomberg Information reported on Thursday.

The British chip agency didn’t categorical curiosity in Intel’s manufacturing operations, the report added, citing an individual aware of the matter.

The report didn’t point out any monetary particulars, nor did it say whether or not the talks are nonetheless ongoing or have been deserted.

Arm declined to touch upon the report, whereas Intel didn’t instantly reply to a request for remark exterior common enterprise hours.

As soon as the dominant power in chipmaking, Intel ceded its manufacturing edge to Taiwanese rival TSMC and failed to provide a extensively desired chip for the generative AI growth capitalized on by Nvidia (NASDAQ:) and AMD (NASDAQ:).

Qualcomm (NASDAQ:) has additionally approached Intel to discover a possible acquisition of the troubled chipmaker, Reuters reported earlier this month, in what may very well be a transformational deal within the sector.

Intel has been making an attempt to show its enterprise round by specializing in AI processors and making a chip contract manufacturing enterprise, referred to as a foundry.

The corporate plans to pause development on factories in Poland and Germany, and cut back its actual property holdings.

Markets

What's Driving Warren Buffett's Large Funding In Sirius XM's $8B Market Cap

Warren Buffett is persons are curious why. Let’s break it down together with his personal phrases.

First off, it’s not in regards to the latest 1-for-10 reverse inventory cut up. “[Stock splits] change nothing in regards to the underlying enterprise,” Buffett has usually reminded of us. So, what’s driving this transfer?

Do not Miss:

Buffett’s obtained of Sirius XM’s enterprise. He is no stranger to subscription-based fashions. “As a former paperboy,” Buffett as soon as stated, he’s accustomed to how subscription income works. Plus, he is a fan of the service. Phrase on the road is he is significantly keen on the “Siriusly Sinatra” channel. And it’s not simply the music; Buffett values firms with sturdy market positions. Sirius XM? It is obtained a monopoly on satellite tv for pc radio within the U.S. and holds a stable spot within the podcast sport.

See Additionally: Groundbreaking buying and selling app with a ‘Purchase-Now-Pay-Later’ characteristic for shares tackles the $644 billion margin lending market –

Then there’s the administration issue. Buffett famously stated, “Our favourite holding interval is without end” however solely when an organization has “excellent administration.” Jennifer Witz, Sirius XM’s CEO, has been with the corporate since 2002, climbing the ranks to her present function. She’s obtained the expertise and importantly, she’s obtained pores and skin within the sport – proudly owning practically 12.1 million shares. That sort of dedication from management is one thing Buffett respects.

Trending: These 5 entrepreneurs are value $223 billion –

Lastly, all of it comes down to cost. Buffett realized from Benjamin Graham, the “father of worth investing.” He is nonetheless a price investor at coronary heart. “I’ll purchase the inventory provided that its worth is engaging relative to the decrease finish of my estimated earnings vary,” Buffett as soon as defined. Sirius XM trades at a ahead price-to-earnings ratio of 6.4, one of many least expensive in Berkshire Hathaway’s portfolio. With a price-to-earnings-to-growth (PEG) ratio of 0.64, it is clear why Buffett finds it interesting.

So, why is Buffett shopping for Sirius XM hand over fist? Easy. He understands the enterprise, trusts the administration and thinks the value is true.

Learn Subsequent:

Up Subsequent: Rework your buying and selling with Benzinga Edge’s one-of-a-kind market commerce concepts and instruments. that may set you forward in immediately’s aggressive market.

Get the most recent inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?