Markets

2 Healthcare Shares to Purchase at a Low cost

Healthcare shares is probably not probably the most thrilling investments for some, however overlooking these companies may imply you move up nice firms. These are the companies that present important services and products in a variety of market environments and financial landscapes.

Whereas not all healthcare shares are created equal, discovering intriguing companies to place money into and including these to a well-diversified basket of investments can enlarge your returns over the long term. Listed here are two shares to think about including to your purchase basket proper now which might be buying and selling at a reduction however may current a stable worth proposition for long-term traders.

1. Teladoc

Teladoc Well being (NYSE: TDOC) has actually dissatisfied traders over the previous couple of years following its pandemic-period successes. Decelerating progress, deep unprofitability, and a collection of administration adjustments (together with the surprising departure of longtime CEO Jason Gorevic) have understandably led many traders to unload the inventory in droves.

The corporate simply appointed a brand new CEO, Chuck Divita, who comes from an intensive background within the healthcare house. Previously, Mr. Divita held the roles of government vp and CFO at GuideWell, a non-public well being options firm that additionally runs Florida Blue, one of many high well being plan suppliers within the state of Florida.

When it comes to its progress story, most of Teladoc’s latest unprofitability has been associated to non-cash bills, together with impairment costs for pandemic acquisitions and stock-based compensation. Teladoc reported one other web loss, in line with , within the first quarter of 2024, totaling $82 million, or $0.49 per share, a large enchancment from the billions in web losses it was reporting a couple of years in the past.

The corporate introduced in optimistic adjusted earnings of $63 million in Q1, a 20% improve from one yr in the past. Income grew modestly, rising 3% yr over yr to $646 million. This was pushed by a 1% improve in entry charges income and a 14% improve in different income from the year-ago quarter.

Breaking down phase enrollment, it is price noting that built-in care members rose 8% yr over yr, whereas its persistent care enterprise completed the quarter with 9% extra sufferers enrolled than one yr in the past. Keep in mind that the corporate serves about 90 million digital care members worldwide. Teladoc additionally introduced in working money move of about $9 million within the three-month interval.

The inventory is buying and selling down by round 60% from its place one yr in the past. Now, I am not right here to say that traders ought to go all in on Teladoc and scoop up giant portions of the inventory. It has lots to show to its shareholders, which nonetheless contains myself, and there is work to do to get again to stable monetary footing.

For traders with a well-diversified funding portfolio and a wholesome threat urge for food, a small place on this inventory could possibly be a worthwhile endeavor. For these nonetheless holding onto the inventory, like myself, it is perhaps price ready to see how the corporate performs underneath new management and as it really works to develop its current management in a broad, rising, addressable market.

2. DexCom

DexCom (NASDAQ: DXCM) is without doubt one of the leaders within the diabetes care house. The corporate makes steady glucose displays (CGMs), which characteristic a spread of use instances to assist sufferers monitor blood sugar ranges. CGMs can be utilized by people with each Sort 1 and Sort 2 diabetes and, in some instances, by these with prediabetes.

At the moment, DexCom controls the lion’s share of the CGM market, with a footprint amounting to roughly 40% of this multibillion-dollar business. It shares management of this house with its two primary opponents, Abbott Laboratories and Medtronic. As the most important participant on this house, DexCom stands to learn significantly from the rising demand for its merchandise because the prevalence of diabetes accelerates worldwide. There’s additionally room for a number of profitable gamers on this house.

Some estimates present that there can be as many as 643 million people dwelling with diabetes worldwide by the yr 2030. Keep in mind that roughly 1.5 million people are recognized with diabetes annually within the U.S. alone. And with roughly 2 million lives utilizing its CGM merchandise on the time of this writing, DexCom has loads of progress alternative left to pursue.

DexCom has seen shares fall by roughly 15% over the trailing 12 months, and never as a result of progress is slowing. Quite the opposite, income is rising steadily, the corporate is worthwhile, and its money place is wanting more and more enticing.

This inventory fluctuation is probably going because of adjustments in investor sentiment, the rise of therapies concentrating on diabetes, and the GLP-1 (glucagon-like peptide) drug craze that has hit each the load loss and diabetes markets, dragging diabetes gadget shares down throughout the board in latest months.

Nevertheless, for long-term traders, these elements aren’t essentially a cause to miss the enterprise. From a monetary perspective, the corporate is doing extraordinarily nicely. Income totaled $921 million within the first quarter of 2024, whereas web earnings got here in at $146 million. These figures represented will increase of 24% and 198%, respectively, from one yr in the past. It additionally boasted about $3 billion of money and investments on its stability sheet.

The corporate has loved strong progress from the launch of its latest-generation CGM, the G7, which is marketed as probably the most correct in the marketplace with the quickest warm-up time. DexCom additionally just lately garnered approval from the U.S. Meals and Drug Administration for its Stelo CGM, which is particularly for folks with kind 2 diabetes who usually are not utilizing insulin and is the primary glucose biosensor the company has permitted to be used with out a prescription.

This represents DexCom’s entry into a major and untapped portion of the diabetes care house, that includes as much as 25 million lives by administration’s estimations. Shares could also be down now, however it is a high quality enterprise with a superior progress runway that would repay for devoted traders over the following 5 to 10 years. Even a modest place on this inventory on sale is perhaps nicely definitely worth the effort and capital.

Must you make investments $1,000 in Teladoc Well being proper now?

Before you purchase inventory in Teladoc Well being, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for traders to purchase now… and Teladoc Well being wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $791,929!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 8, 2024

has positions in DexCom and Teladoc Well being. The Motley Idiot has positions in and recommends Abbott Laboratories and Teladoc Well being. The Motley Idiot recommends DexCom and Medtronic and recommends the next choices: lengthy January 2026 $75 calls on Medtronic and quick January 2026 $85 calls on Medtronic. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

A vital labor report meets a inventory market at file highs: What to know this week

Shares drifted greater over the previous week, with the S&P 500 () notching a number of as traders digested amid

For the week, the S&P 500 and Dow Jones Industrial Common () had been up about 0.7%. In the meantime, the Nasdaq Composite () popped practically 1%.

Within the week forward, the September jobs report is predicted to offer additional clues on how shortly the labor market is cooling. Updates on job openings, exercise within the providers and manufacturing sectors, and shopper confidence are additionally on the calendar.

On an organization stage, a deliveries replace from Tesla () and quarterly outcomes from Nike () will likely be in focus.

The newest confirmed worth will increase proceed to chill towards the , placing additional concentrate on the Fed’s different mandate: most employment.

Federal Reserve Chair Jerome Powell mentioned in a press convention on Sept. 18 that the labor market is at present in “stable situation” and the central financial institution is slicing rates of interest, partly, to maintain it that means.

Nonetheless, there’s been a transparent slowdown within the labor market. The unemployment price has steadily crept up in 2024 and , close to its highest stage in nearly three years. In the meantime, job good points have slowed, with the US financial system recording two of its lowest month-to-month job additions of 2024. And job openings in July had been .

The urgent query as the discharge of the October jobs report on Friday morning approaches is simply how shortly this slowdown within the labor market is happening.

Consensus expectations on Wall Avenue level to extra indicators of a gradual cooling fairly than a speedy slowdown. The September jobs report is predicted to point out 130,000 nonfarm payroll jobs had been added to the US financial system, with unemployment holding regular at 4.2%, in accordance with knowledge from Lusso’s Information. In August, whereas the unemployment price fell to 4.2%.

Getting into the labor market knowledge dump, the latest print on weekly jobless claims weekly unemployment claims had been at a four-month low for the week ending Sept. 21.

Financial institution of America US economist Aditya Bhave wrote in a observe to purchasers Friday that the constantly low layoff numbers recommend that “September employment report needs to be respectable.”

“The labor market is the most important danger to our outlook,” Bhave wrote. “Layoffs are the important thing indicator to look at: so long as they keep low, the bottom case will seemingly stay a tender touchdown.”

Retail big Nike is predicted to report its fiscal first quarter earnings after the bell on Tuesday. Wall Avenue is anticipating the sports activities attire model to report quarterly income of $11.65 billion with earnings per share of $0.52. Each metrics would characterize year-over-year declines from the identical quarter a 12 months in the past as the corporate battles to reinvigorate income development.

The discharge will mark Nike’s first earnings reportElliott Hill, a former Nike government who retired in 2020, will change John Donahoe as CEO on Oct. 14. The announcement got here as Nike shares had fallen about 25% on the 12 months.

Citi analyst Paul Lejuez wrote in a observe to purchasers that the implications of Hill’s return and the turnaround technique at Nike would be the key focus of the earnings name.

“We imagine [management] seemingly lowers full-year 2025 steerage on weakening China macro and model reset in that [market], in addition to extra conservative assumptions tied to the deliberate innovation-driven gross sales acceleration within the second half of 2025,” Lejuez wrote.

Tesla inventory has been quietly rallying, with shares rising greater than 24% over the previous month and formally turning again constructive for the 12 months.

Whereas that transfer has come from little information, the basic story for Tesla will as soon as once more be in focus in the course of the week forward. The electrical automobile maker is predicted to announce its third quarter supply numbers. Analysts anticipate Tesla delivered about 462,000 automobiles within the quarter, up from 443,956 within the prior quarter and a 6% improve from the gross sales seen in the identical quarter a 12 months in the past.

The corporate’s reveal is slated for Oct. 10.

Shares have largely chugged greater because the Federal Reserve opted for a bigger rate of interest minimize at its most up-to-date assembly. Traders the Fed was slicing the benchmark price by half a proportion level to protect a at present wholesome financial system fairly than to offer support to a flailing one.

Citi head of US fairness buying and selling technique Stuart Kaiser this situation the place the Fed is not slicing as a result of the financial system wants it’s “massively bullish” for equities.

“Every part is in regards to the development aspect of the financial system and the whole lot is in regards to the shopper,” Kaiser mentioned. “Any knowledge that implies shopper spending is holding in and you are not seeing the weak spot that individuals are fearful about and that the Fed is fearful about, I feel that is all going to be constructive for fairness markets.”

Subsequently, a foul jobs report on Friday may have the alternative affect on shares.

“If it seems that they began slicing as a result of they’re legitimately involved about weak spot within the labor market, price cuts aren’t going to be sufficient to assist equities in that case and you are going to commerce decrease,” Kaiser mentioned. “So the why [the Fed is cutting] issues right here. And payrolls goes to assist reply that.”

Kaiser’s feedback name again to a chart Ritholtz Wealth Administration’s chief market strategist Callie Cox shared in the summertime version of the . Cox identified that the S&P 500 has had various response price cuts all through the years. Often, whether or not or not the financial system enters a recession is a key driver of these returns. As Cox’s work reveals, solely as soon as has the S&P 500 been decrease a 12 months after price cuts begin when the financial system skirts recession.

Weekly Calendar

Monday

Financial knowledge: MNI Chicago PMI, September (46.4 anticipated, 46.1 prior); Dallas Fed manufacturing exercise, September (-10.6 anticipated, -9.7 prior)

Earnings: Carnival Company ()

Tuesday

Financial knowledge: S&P World US Manufacturing PMI, September ultimate (47 anticipated, 47 prior); JOLTS job openings, August (7.69 million anticipated, 7.67prior); Dallas Fed providers exercise, (-7.7 prior); ISM Manufacturing, September (47.7 anticipated, 47.2 prior); Building spending, month over month, August (+0.1% anticipated, -0.3% prior)

Earnings: Lamb Weston (), McCormick (), Nike ()

Wednesday

Financial knowledge: MBA Mortgage Purposes, week ended Sept. 27 (11% prior); ADP personal payrolls, September (+120,000 anticipated, +99,000 prior);

Earnings: Conagra (), Levi Strauss ()

Thursday

Financial knowledge: Challenger jobs cuts, year-over-year, September, (+1% prior); Preliminary jobless claims, week ending September 28 (218,000 prior); S&P World US providers PMI, September ultimate (55.4 prior); S&P World US providers PMI, September ultimate (55.4 prior); ISM providers, September(51.5 anticipated, 51.5 prior); Manufacturing unit orders, August (+0.1% anticipated, +5% prior); Sturdy items orders, August Last (0% prior)

Earnings: Constellation Manufacturers ()

Friday

Financial calendar: Nonfarm payrolls, September (+130,000 anticipated, +142,000 prior); Unemployment price, September (4.2% anticipated, 4.2% beforehand); Common hourly earnings, month over month, September (+0.3% anticipated, +0.4% prior); Common hourly earnings, 12 months over 12 months, September (+3.7% anticipated, +3.8% prior); Common weekly hours labored, September (34.3 anticipated, 34.3 prior); Labor drive participation price, September (62.7% anticipated, 62.7% beforehand);

Earnings: No notable earnings.

Markets

Israel shares increased at shut of commerce; TA 35 up 1.02%

Lusso’s Information – Israel shares have been increased after the shut on Sunday, as positive factors within the , and sectors led shares increased.

On the shut in Tel Aviv, the gained 1.02% to hit a brand new all time excessive.

The most effective performers of the session on the have been Energean Oil & Gasoline PLC (TASE:), which rose 8.89% or 400.00 factors to commerce at 4,900.00 on the shut. In the meantime, Delek Group (TASE:) added 4.55% or 1,850.00 factors to finish at 42,540.00 and Shikun & Binui (TASE:) was up 3.66% or 31.50 factors to 893.00 in late commerce.

The worst performers of the session have been Camtek Ltd (TASE:), which fell 2.62% or 830.00 factors to commerce at 30,870.00 on the shut. Nova (TASE:) declined 1.07% or 850.00 factors to finish at 78,510.00 and Phoenix Holdings Ltd (TASE:) was down 0.39% or 16.00 factors to 4,133.00.

Rising shares outnumbered declining ones on the Tel Aviv Inventory Alternate by 318 to 129 and 92 ended unchanged.

Crude oil for November supply was up 1.43% or 0.97 to $68.64 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in December rose 0.63% or 0.45 to hit $71.54 a barrel, whereas the December Gold Futures contract fell 0.52% or 14.10 to commerce at $2,680.80 a troy ounce.

USD/ILS was up 0.81% to three.73, whereas EUR/ILS rose 0.73% to 4.16.

The US Greenback Index Futures was down 0.14% at 100.11.

Markets

The chilly warfare between Google and Microsoft has 'gone scorching'

An extended-standing feud between Google (, ) and Microsoft () is spilling into public view as soon as once more.

The newest shot from Google got here in a grievance filed with the European Fee Wednesday, accusing Microsoft of violating the European Union’s antitrust legislation.

Google mentioned in a doc supplied to Lusso’s Information that Microsoft illegally leveraged its dominant enterprise server software program “” licenses to power prospects to stay with Microsoft for cloud computing.

Microsoft predicted Google would “fail” on this occasion, saying it had already settled comparable considerations raised by European cloud suppliers.

“Having failed to influence European firms, we anticipate Google equally will fail to influence the European Fee,” a Microsoft spokesperson mentioned.

The brand new dispute demonstrates “it is a chilly warfare that is gone scorching,” Adam Kovacevich, CEO and Founding father of the tech coverage advocacy group , instructed Lusso’s Information.

The 2 tech giants have spent the final twenty years battling for supremacy in applied sciences starting from and cloud computing to the markets for , software program, — and now , or AI.

The feud started within the first decade after Microsoft settled a introduced by the US Justice Division alleging it boxed out rivals by making its browser free and the default on its dominant Home windows working system.

A 2002 opened the door to broader competitors within the web browser software program market after which a startup fashioned by Stanford college students Sergey Brin and Larry Web page, to start its interval of meteoric development within the 2000s.

Microsoft defended its reestablished territory in a sequence of movies first launched in 2011, wherein Microsoft skewered Google with parodies suggesting that Google’s competing Gmail service, Chrome browser, and accompanying software program lacked high quality and privateness.

A video titled “” questioned Google’s ethics by accusing it of mining each phrase inside its Gmail prospects’ personal emails in an effort to goal them with ads.

In different movies titled “” and “” — a spoof on the Eighties hit tv sequence “Moonlighting” — Microsoft questioned whether or not customers ought to belief Google with dealing with their personal info.

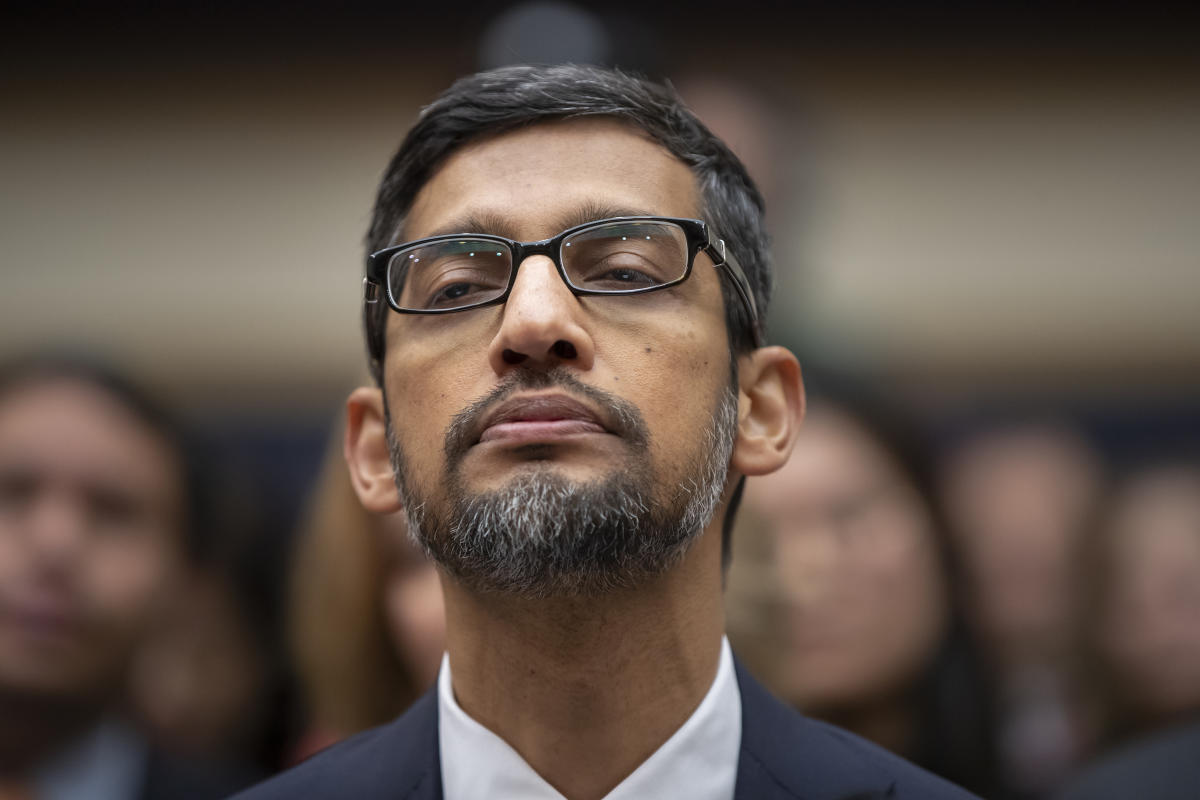

In 2016, the businesses with an settlement to finish regulatory complaints towards one another globally as two new CEOs — Google’s Sundar Pichai and Microsoft’s Satya Nadella — took over.

The pact in 2021 as regulators within the US and EU stepped up stress on each firms, and Microsoft complained that Google used unfair ways to compete in on-line search and promoting.

Issues actually obtained uncomfortable final 12 months throughout a high-profile antitrust trial that pitted Google towards the US Justice Division — a case that alleged Google illegally monopolized the web search engine market and had echoes of the case the DOJ filed towards Microsoft within the Nineties.

Essentially the most distinguished witness to testify towards Google was Nadella, who didn’t hesitate to take a shot at his rival whereas on the stand.

“You stand up within the morning, you sweep your tooth, and also you search on Google,” Nadella mentioned, emphasizing Google’s overwhelming dominance within the search engine market.

Nadella mentioned Microsoft’s personal search engine, Bing, as a result of Google had negotiated for Google Search to get default placement on browsers, desktops, and cell gadgets like Apple’s iPhones and iPads and Android-based smartphones made by Samsung and others.

Nadella went on to explain the imbalance as a “vicious cycle” that he nervous would intensify with the event of AI.

Google misplaced the case in a choose’s ruling that labeled its search enterprise an unlawful monopoly. The decision is now pending a treatments section that might end in a breakup of Google’s empire.

Microsoft definitely had loads to realize from a Google defeat, Kovacevich mentioned.

“They had been most likely the primary instigator of the US Justice Division’s antitrust swimsuit over Google,” Kovacevich mentioned. “And the responsible verdict towards Google most likely stands to profit Microsoft’s Bing most of anybody.”

Microsoft is taking an analogous strategy in yet one more that’s nonetheless in its preliminary trial section. It argues there that Google’s management of internet marketing applied sciences has harmed the success of its Bing browser.

It is unknown if the EU will take up Google’s most up-to-date assault towards Microsoft’s cloud computing guidelines.

Google is arguing that Microsoft imposed a 400% markup on prospects emigrate their Home windows Server licenses to a competing cloud service, whereas prospects who selected Microsoft’s cloud providers, Azure, might migrate for “basically nothing.”

In making its case, Google is utilizing the identical form of “bundling” or “” claims used within the 1998 case towards Microsoft introduced by the DOJ.

Again then, US prosecutors alleged that Microsoft illegally monopolized the marketplace for private computing working techniques by utilizing its Home windows working system to provide away its browser, Web Explorer, totally free.

The transfer bundled the browser together with Home windows, ultimately placing rival browser out of enterprise.

Microsoft was ultimately required to open up Home windows to 3rd social gathering software program, which paved the way in which for firms together with Google to “interoperate” or run their browser and search software program utilizing Microsoft-powered computer systems.

Now, available in the market for cloud computing, Google is arguing that Microsoft leveraged “dominance in a single market to forestall competitors on the deserves in a separate, unrelated market,” in keeping with the doc shared with Lusso’s Information.

Alexis Keenan is a authorized reporter for Lusso’s Information. Comply with Alexis on X .

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook