Markets

Tremendous Micro Laptop inventory plunges on report of DOJ probe

AI server maker Tremendous Micro Laptop () inventory tumbled 15% Thursday after The Wall Road Journal reported that the corporate is .

The Journal, citing unnamed sources, stated the DOJ is investigating the corporate for potential accounting violations. The difficulty was first delivered to gentle by the short-selling agency Hindenburg Analysis in August in a that accused Tremendous Micro Laptop of “obvious accounting pink flags,” in addition to “undisclosed associated occasion transactions” and “sanctions and export management failures.”

Tremendous Micro declined to touch upon the matter.

Tremendous Micro makes AI server gear that makes use of Nvidia’s GPUs, and Wall Road analysts consider it’s . Its enterprise flourished initially of 2024 because the tech trade has created a slew of AI software program with growing energy calls for — and therefore, demand for merchandise like Supermicro’s. It’s one of many AI-driven shares that has surged to file ranges, and even with its decline Thursday, shares are nonetheless up 57% from final 12 months.

Its features originally of the 12 months. However the inventory has fallen from highs above $1,200 in mid-March earlier than becoming a member of the index. Shares dropped in early August when the corporate in its fiscal fourth quarter earnings report, and later within the month once more when the corporate .

In reference to each the scathing Hindenburg report and Tremendous Micro’s delayed submitting, CEO Charles Liang wrote in a letter to prospects on Sept. 3, “Neither of those occasions impacts our merchandise or our capability and capability to ship the modern IT options that you just depend on daily. Our manufacturing capabilities are unaffected and proceed working at tempo to fulfill buyer demand.”

The corporate in August reported earnings per share of $6.25 for the fourth quarter, decrease than the $8.25 analysts had anticipated. Its income of $5.3 billion got here in just under Wall Road’s estimate of about $5.32 billion, however greater than doubled from the prior 12 months.

Liang stated in his letter, “[W]e don’t anticipate any materials adjustments in our fourth quarter or fiscal 12 months 2024 monetary outcomes.” Nonetheless, JPMorgan analyst Samik Chatterjee lately downgraded the inventory to Impartial from Chubby, from $950 to $500. Shares fell as little as $373 Thursday earlier than recovering within the afternoon to round $400.

Almost 37% of Wall Road analysts nonetheless suggest shopping for the inventory as of Thursday afternoon, based on Lusso’s Information consensus estimate. Analysts see shares rising to $685 over the subsequent 12 months.

Laura Bratton is a reporter for Lusso’s Information.

Markets

Trump Media Co-Founders Moved Shortly to Money In Their Stake

(Lusso’s Information) — The previous contestants on Donald Trump’s TV present The Apprentice who co-founded his media startup wasted no time offloading hundreds of thousands of shares within the firm after restrictions that prevented promoting had been lifted.

Most Learn from Lusso’s Information

Andy Litinsky and Wes Moss’s United Atlantic Ventures bought greater than 7.5 million Trump Media & Expertise Group Corp. shares inside per week after a lock-up settlement expired final week, based on a regulatory submitting on Thursday. The stake would have been price at the very least $88 million, primarily based on the bottom worth the place shares have traded throughout common hours because the restrictions had been lifted.

The gross sales possible made a pleasant payout for the pair who helped co-found Trump Media, which owns the X-lookalike social media platform Fact Social, despite the fact that the restrictions stopping them from cashing within the inventory for practically six months theoretically value them tons of of hundreds of thousands of {dollars}.

The previous president and present Republican nominee has insisted he has no plans on promoting shares and has apparently saved that pledge by means of Tuesday, the earliest day such a transfer would have been disclosed. His present stake of practically 115 million shares is price $1.6 billion, although the foundations round him turning the place into money restrict how rapidly any sale might occur.

Buyers anticipated that Litinsky and Moss would offload inventory, and are additionally braced for a flurry of gross sales from Patrick Orlando, whose fund, ARC World Investments II LLC, sponsored the special-purpose acquisition firm that merged with Trump Media to take it public. There have been no filings indicating Orlando has bought shares.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Factbox-Over 350,000 Florida prospects with out energy as a result of approaching Hurricane Helene

(Reuters) -Greater than 350,000 properties and companies in Florida have been with out energy on Thursday as hurricane Helene seemed poised to make landfall within the state’s Massive Bend area, in response to information from PowerOutage.us.

Hurricane Helene churned towards Florida’s Panhandle area, bringing the specter of a probably lethal storm surge to a lot of the shoreline.

Helene has intensified into an especially harmful Class 4 hurricane, and it’s nearing the northeast Gulf coast, the U.S. Nationwide Hurricane Middle stated on Thursday. It was anticipated to make landfall this night.

The utility firm with the most important variety of prospects affected was Florida Energy & Gentle Firm, which had 137,897 purchasers with out energy.

It was adopted by Duke Vitality (NYSE:), with 133,948 prospects lower off within the state.

“We anticipate landfall will convey probably the most important injury to our infrastructure within the Panhandle and Massive Bend space that can possible trigger prolonged outage durations,” Todd Fountain, Duke Vitality storm director, stated in an announcement.

Listed below are the most important outages by utility in Florida:

Energy Firms Outages

Florida Energy & Gentle Firm 137,897

Tampa Electrical 58,430

Lee County Electrical Coop 8,074

Duke Vitality 133,948

Withlacoochee River Electrical Coop 12,140

Complete 366,035

Markets

Tremendous Micro Pc Plummeted Immediately — Ought to You Purchase the AI Inventory Earlier than Its Inventory Cut up on Oct. 1?

Tremendous Micro Pc (NASDAQ: SMCI) inventory bought crushed immediately following a report that the corporate is being investigated by the Division of Justice (DoJ). The server specialist’s share value closed out the day’s buying and selling down 12.2%, and it had been down as a lot as 18.6% earlier within the session.

The Wall Avenue Journal reported immediately that the DoJ is within the early levels of conducting an investigation into Supermicro. In response to the report, the investigation is probably going linked to allegations of dangerous accounting practices that have been made in a word revealed by Hindenburg Analysis on the finish of August.

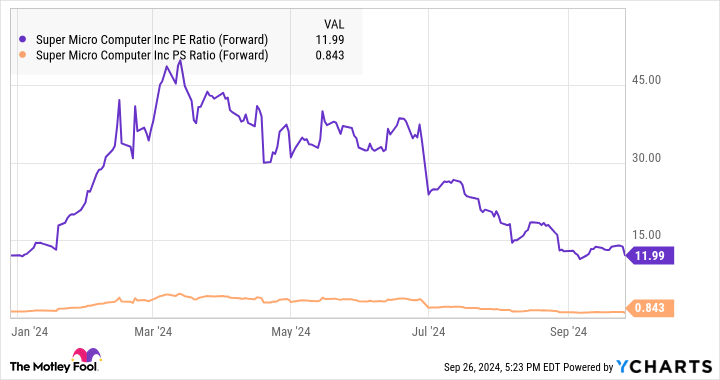

Following immediately’s huge sell-off, Supermicro inventory is now down 66% from the excessive that it reached earlier this 12 months. Regardless of the valuation pullback, the corporate continues to be on monitor to proceed with a 10-for-1 that may take impact on Oct. 1.

Is Supermicro a purchase forward of its inventory cut up?

Supermicro has been hit with some intense bearish pressures currently, but it surely’s doable that destructive sentiment surrounding the inventory has develop into overblown. For starters, the DoJ has not but introduced an official investigation into the corporate. Even when an investigation have been to happen, that would not essentially imply that any impropriety had truly occurred.

The Division of Justice has usually been making use of extra scrutiny to big-tech and monetary firms currently, having has launched antitrust fits in opposition to firms together with Apple, Alphabet, and Visa. Supermicro is unlikely to face antitrust scrutiny, however the DoJ’s current surge of exercise supplies background context that is price conserving in thoughts.

If an investigation into Supermicro by the DoJ is underway, Hindenburg’s allegations that it had discovered proof of latest accounting violations by the tech firm may have been a key catalyzing issue. Nevertheless it’s essential to understand that Hindenburg is a brief vendor, and it income when valuations for firms it has positioned bets in opposition to decline.

The shortage of visibility on the corporate’s outlook signifies that Tremendous Micro Pc inventory will not be a great match for traders with out above-average threat tolerance. Then again, traders who’re prepared to embrace threat and uncertainty may wind up scoring huge returns by treating current sell-offs as a shopping for alternative.

Following immediately’s inventory pullback, Supermicro is now buying and selling at simply 12 instances this 12 months’s anticipated earnings and fewer than 85% of anticipated gross sales. Even with expectations that the enterprise will see cyclical moderation, that is a cheap-looking valuation for a corporation that has been seeing stellar gross sales and earnings progress because of synthetic intelligence (AI)-driven demand. If the tech specialist scores wins with liquid-cooling applied sciences that assist differentiate its high-performance rack servers, Supermicro inventory may push by current controversies and are available roaring again.

Must you make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for traders to purchase now… and Tremendous Micro Pc wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $756,882!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Apple, and Visa. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?