Markets

Many Wall Road executives are frightened about Trump however cautious of Harris

By Michelle Value, Carolina Mandl and Lananh Nguyen

WASHINGTON/NEW YORK (Reuters) – Many Wall Road executives have reservations about backing both candidate within the U.S. presidential election, frightened that former President Donald Trump’s insurance policies will harm the economic system however cautious Vice President Kamala Harris will lean too far left.

Whereas a number of Wall Road heavy-hitters together with Invoice Ackman, John Paulson and George Soros have backed a candidate, many different senior executives are nonetheless weighing the financial insurance policies central to the carefully fought race and the ramifications for authorized and democratic establishments, in response to conversations with two dozen executives in current weeks.

Regardless of a observe file implementing Wall Road-friendly measures, Republican candidate Trump’s insurance policies threaten to create financial and coverage instability, many executives stated.

Whereas Harris can be a secure pair of arms, she has solely been the Democratic candidate since late July when President Joe Biden exited the race and stays an enormous unknown, they stated. Many fear the Vice President will proceed Biden’s regulatory crackdown on profitable Wall Road companies.

Among the many executives have been Republican and Democrat supporters, together with a handful who’re publicly backing Trump or Harris, and others with no apparent partisan affiliation.

“Most count on Trump to proceed the place he left off, which is actually extra populist, protectionist and aggressively deregulatory,” stated Bruce Mehlman, companion at bipartisan lobbying agency Mehlman Consulting with shoppers in all sectors.

“However they’re keen to higher perceive who Harris is and what she believes,” Mehlman stated, including it didn’t seem that Harris’ Wednesday financial speech had provided extra perception for Wall Road corporations.

As together with his first presidency, Trump is promising to chop taxes and laws, however most executives stated the advantages may very well be erased by his deliberate import tariffs which may spark inflation, whereas tax cuts may widen the U.S. deficit. Trump ramped up his deliberate tariffs in feedback this week.

Karoline Leavitt, Trump marketing campaign Nationwide Press Secretary, stated in a press release that Wall Road buyers need Trump to win as a result of they do not forget that his insurance policies “fueled progress, drove down inflation, and saved extra money in everybody’s pockets.”

Billionaire investor and Trump backer Paulson advised Reuters on the sidelines of a September New York occasion at which Trump outlined his financial plan that tariffs would increase revenues, serving to to cut back the deficit.

Harris’ plan, which analysts predict can be higher for the economic system, requires mountaineering taxes, probably denting firm earnings and shares however partly offsetting an anticipated widening of the deficit. She has stated little on monetary coverage however has touted her powerful stance on banks as a former prosecutor and stated she is going to proceed Biden’s assault on hidden financial institution charges.

A Harris spokesperson pointed Reuters to endorsements by a whole bunch of economists and CEOs.

In an e-mail to Reuters, billionaire entrepreneur and Harris backer Mark Cuban famous that shares rose when firm taxes have been increased, including: “Something that could be a step in direction of decreasing the deficit is a plus.” However he stated that each candidates are making guarantees they might not have the ability to hold. “Neither candidate’s insurance policies have any particulars about how they might get handed.”

For a lot of corporations, a Harris White Home and Republican Senate, which might block tax will increase and drive Harris to choose moderates for high jobs, is the best-case situation.

To this point, donors tied to the securities and funding sectors have given $8.7 million to the Biden/Harris marketing campaign versus about $3 million to Trump, information from nonpartisan donations tracker OpenSecrets as of Aug. 21 exhibits.

These contributions, capped within the hundreds of {dollars}, come from people and political motion committees (PACs) and usually are not complete as a result of there are a number of different methods to route money to help candidates.

STABILITY, POPULISM

In a nod to the coverage whiplash and personnel churn of Trump’s first presidency, his felony conviction and position within the Jan. 6, 2021 assault on the U.S. Capitol, some executives additionally frightened Trump would undermine Democracy and the rule of legislation. A number of flagged issues about his stances on Federal Reserve independence, immigration and abortion.

Michael Shiny, chief govt of the Structured Finance Affiliation, a Washington foyer group representing lenders and buyers, stated that along with Jan. 6, a few of his members had soured on Trump as a consequence of his position in serving to to overturn federal abortion rights when president.

“I might say monetary companies voters are break up fairly evenly,” stated Shiny, whom Trump nominated in 2018 to run authorities housing company Ginnie Mae. Many will vote “with their hearts” for Harris, he added.

The position of populism in personnel picks was one other theme. A number of executives fretted Harris would follow Biden’s progressive company heads, though a number of stated they consider she could also be friendlier to the business than Biden.

“She is sensible and pragmatic,” stated Jon Henes, Harris’ nationwide marketing campaign finance chair in 2020 and CEO of company consultancy C Road Advisory Group, including Harris believes in smart regulation that permits for transparency and certainty.

A extra populist Trump and Republican get together could decide inexperienced loyalists hostile to Wall Road to guide the companies, some executives stated, though others consider he would once more decide conventional business conservatives.

Trump’s appointment of Cantor Fitzgerald CEO Howard Lutnick as co-chair of his transition staff could also be an excellent signal, some stated. Lutnick is tapping his Wall Road community to workers a possible second Trump administration.

Lindsey Johnson, CEO of the Shopper Bankers Affiliation, stated Trump can “draw from a deep nicely of those who have been within the Administration final time which have nice expertise within the monetary business.”

(Writing and reporting by Michelle Value in Washington D.C.; Reporting by Carolina Mandl and Lananh Nguyen in New York; Extra reporting by Douglas Gillison, Tatiana Bautzer, Saeed Azhar, Laura Matthews, Pete Schroeder, Makailah Gause and Megan Davies; Modifying by Nick Zieminski)

Markets

S&P 500: Dip-Shopping for Stays the Go-To Technique If Subsequent Resistance Proves Cussed

Prior to now month, the S&P 500 and Nasdaq have loved stable positive factors, with international markets largely on target to finish September within the inexperienced.

The long-term uptrend, which has been constructing for almost two years, just lately picked up momentum due to the Federal Reserve.

With a daring 50 foundation level price reduce, the Fed kicked off what many anticipate to be a continued cycle of financial easing.

Markets are already anticipating one other price reduce on the subsequent assembly.

Importantly, latest financial information reveals no indicators of a looming recession, suggesting these price cuts aren’t a rescue try however reasonably a calculated transfer to stimulate development.

The Folks’s Financial institution of China additionally contributed to the constructive sentiment by reducing rates of interest, unlocking over $140 billion in lending capability to assist obtain its 5% development goal for the yr.

As markets look to finish the week on a excessive, let’s check out how the technical image is shaping for key indexes.

S&P 500: Pullback within the Offing?

The S&P 500 has been a beacon of power, just lately pushing previous its earlier all-time highs.

This breakout indicators strong market demand, pushed largely by expectations of additional price cuts and favorable financial circumstances.

From a technical perspective, this transfer has firmly established 5,720 factors as a crucial help stage.

If the present pullback extends, this zone could act as the primary line of protection for the bulls, providing a chance for merchants to re-enter the market.

Past 5,720 factors, a deeper correction might goal the 5,660 stage, the place the upward trendline intersects.

This convergence of help ranges means that any draw back will probably be restricted, permitting the broader uptrend to stay intact.

On the upside, the spherical variety of 5,900 factors represents the subsequent vital resistance stage.

If bullish momentum continues, the market might make a swift transfer towards this psychological barrier, setting the stage for additional positive factors.

The bulls have clear targets forward, with each technical indicators and sentiment favoring continued upside.

Nasdaq Eyes New Peaks

The Nasdaq, whereas barely trailing the S&P 500, has exhibited indicators of power. The index just lately broke by means of a key resistance stage of round 18,000 factors, a sign that momentum is constructing.

This breakout above a serious psychological stage marks a pivotal second for the index, because it opens the trail towards a retest of the all-time excessive close to 18,600 factors.

From a technical perspective, the NASDAQ’s subsequent goal is obvious—attacking this earlier peak.

If a pullback happens earlier than the Nasdaq hits 18,600, merchants ought to look ahead to help on the 18,000 stage, which beforehand acted as resistance.

This zone now serves as a key inflection level for each short-term merchants and long-term traders.

Ought to the the index breakthrough 18,600, the subsequent logical goal for the bulls shall be 19,000 factors.

A sustained rally towards 19,000 would additional reinforce the uptrend, with technical indicators corresponding to RSI and transferring averages signaling continued bullish momentum.

DAX Surges with Practically Vertical Positive aspects

The German DAX leads the pack this month with a 3.34% return, reflecting near-vertical positive factors after breaking above 19,000 factors.

Within the occasion of a shallow correction, help is anticipated across the earlier highs of 18,900 to 19,000 factors, retaining the bullish momentum intact.

***

Disclaimer: This text is written for informational functions solely. It’s not supposed to encourage the acquisition of belongings in any approach, nor does it represent a solicitation, supply, suggestion or suggestion to take a position. I want to remind you that each one belongings are evaluated from a number of views and are extremely dangerous, so any funding choice and the related danger is on the investor’s personal danger. We additionally don’t present any funding advisory providers. We are going to by no means contact you to supply funding or advisory providers.

Associated Articles

Markets

S&P, Dow futures hover close to flatline forward of contemporary US financial knowledge

Lusso’s Information — US inventory futures had been broadly muted on Friday as buyers awaited the discharge of a raft of financial knowledge, together with new client spending figures and the Federal Reserve’s most well-liked gauge of inflation.

By 06:31 ET (10:31 GMT), the contract was largely unchanged, had shed 5 factors or 0.1%, and had edged down by 43 factors or 0.2%.

The benchmark posted its third report shut this week on Thursday, including 23 factors or 0.4%.

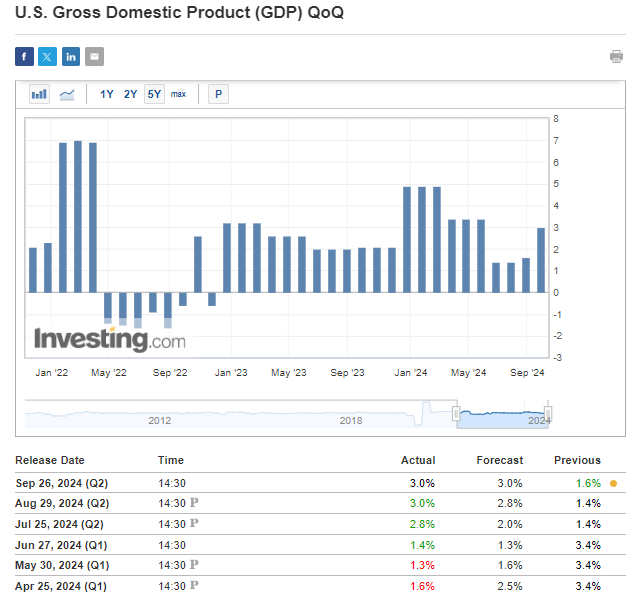

Underpinning the rise had been figures displaying that weekly jobless claims dropped by greater than anticipated, whereas a last studying of US gross home product confirmed that the world’s largest financial system expanded by 3% within the second quarter.

The numbers helped to spice up hopes that the financial system and labor market had been on stable footing because the Fed alerts its intent to maneuver forward with a coverage easing cycle following an outsized rate of interest reduce final week.

Client spending, PCE knowledge forward

Buyers will seemingly be preserving shut tabs on contemporary private spending and inflation knowledge, which might present a glimpse into the well being of the US financial system because the Fed approaches extra anticipated price reductions later this yr.

Private spending, which accounts for greater than two-thirds of financial exercise, is tipped to have grown by 0.3% in August, slowing from 0.5% within the prior month.

In the meantime, economists anticipate the non-public consumption expenditures (PCE) worth index, which is utilized by Fed officers as a tracker of inflation, to rise by 0.2% on a month-to-month foundation in August, matching July’s tempo. 12 months-on-year, the studying is seen cooling to 2.3% from 2.5%.

When stripping out unstable objects like meals and gas, the PCE worth index is projected to stay in keeping with July’s month-on-month price of 0.2% and pace up barely to 2.7% from 2.6% on an annualized foundation.

European shares rally to report excessive

European inventory markets touched a contemporary report excessive in mid-morning dealmaking on Friday, fueled by momentum from a China-led rally in Asia.

Stories that China was mulling new stimulus measures — on prime of a slew of latest help insurance policies aimed toward stabilizing the ailing financial system — powered shares within the nation to their finest week since 2008.

Luxurious shares in Europe, which derive a lot of their revenues from gross sales in China, had been additionally bolstered. Shares in high-end vogue teams like LVMH, Kering (EPA:), Hermes, Hugo Boss, and Burberry all superior, whereas vehicle shares gained as effectively.

Oil uneven

Oil costs edged up on Friday, as merchants assessed the stimulus measures out of China and the prospect of elevated output from Libya and the OPEC+ oil group.

As of 06:47 ET, futures had added 0.3% to $71.30 per barrel, whereas US West Texas Intermediate crude futures had risen by 0.4% to $67.94 a barrel.

In Libya, competing factions staking claims to regulate the nation’s central financial institution agreed on Thursday to finish the dispute, which had crimped home oil manufacturing and exports. Analysts cited by Reuters instructed that over 500,000 barrels per day (bpd) of Libyan provide might return to markets.

Elsewhere, the Group of the Petroleum Exporting International locations and its allies, often called OPEC+, are planning to reverse 180,000 bpd of deep ongoing output cuts in December.

Buyers are weighing the outlook for a potential uptick in provide with an enormous stimulus package deal out of China earlier this week. Analysts have flagged that it stays unsure if the measures will enhance exercise on this planet’s prime oil importer.

Markets

China’s Greatest Inventory Shopping for Frenzy in Years Overwhelms Trade

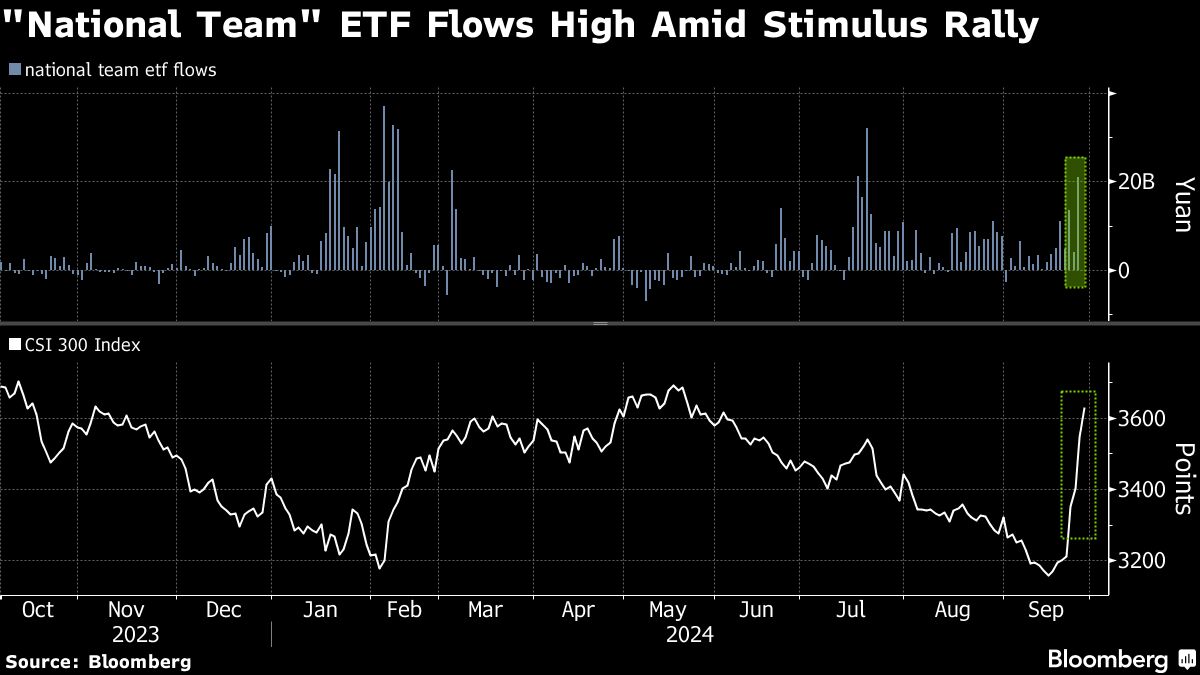

(Lusso’s Information) — Chinese language equities capped their largest weekly rally since 2008 with a burst of buying and selling that overwhelmed the Shanghai inventory trade, underscoring a dramatic shift in investor sentiment after Xi Jinping’s authorities ramped up financial stimulus.

Most Learn from Lusso’s Information

In an echo of the rally that adopted China’s huge stimulus in the course of the international monetary disaster, the CSI 300 Index of large-cap shares soared 4.5% on Friday — bringing this week’s acquire to 16%. Buying and selling exercise was so intense that it led to glitches and delays in processing orders, in response to folks acquainted with the matter. The Shanghai trade stated it was investigating the problems, with out elaborating.

It was a frenzied finish to per week that has raised hopes of a backside in China’s $8.9 trillion inventory market after years of losses that made it one of many world’s worst performers. Chinese language authorities unleashed a protracted hoped-for barrage of financial stimulus on Tuesday, adopted by vows from prime leaders to do what’s essential to shore up the housing market and enhance consumption.

Whereas many particulars of China’s stimulus plan stay unclear and previous bouts of euphoria have usually fizzled, market watchers say the worry of lacking out on a sustained rally is palpable. With China’s markets closed subsequent week for the Golden Week holidays, home buyers could also be nervous that the rally may proceed in Hong Kong whereas they’re away, stated David Chao, a strategist at Invesco Asset Administration.

“FOMO is operating excessive for buyers as Chinese language equities have moved near 10% up to now three days,” he stated. “Primarily based on historic valuation, we expect Chinese language shares have one other 20% runway to go.”

A gauge of Chinese language shares in Hong Kong climbed 2.5%, notching its longest successful streak since 2018. The ChiNext index, a tech-heavy gauge, rose a file 10%. Turnover in China reached almost 3 times the quantity from the times previous to the stimulus blitz that started on Tuesday.

As buyers turned to danger property over havens, China’s ultra-long authorities bond futures noticed their largest every day loss on file Friday. China’s 10-year bond yield rose 5 foundation factors at 2.16%.

Chinese language authorities’ shift this week drove billionaire investor David Tepper to declare that he’s shopping for extra of “all the things” associated to the nation. “I believed that what the Fed did final week would result in China easing, and I didn’t know that they have been going to deliver out the massive weapons like they did,” he stated in a CNBC interview Thursday. “We bought a bit bit longer, extra Chinese language shares.”

The securities regulator’s tips to encourage corporations to draw long-term buyers additionally fortified the optimism already brewing available in the market.

The broad rally Friday was underscored by 266 of the CSI 300 Index’s 300 members ending the day within the inexperienced, with spirits maker Kweichow Moutai Co. and battery producer Modern Amperex Know-how Co. main the surge.

However Chinese language financial institution shares bucked the rally and fell, as buyers weighed the implications of a 1 trillion yuan ($142 billion) capital injection plan reported by Lusso’s Information Information. China is planning to inject funds primarily raised from the issuance of recent particular sovereign bonds, the report stated, citing folks acquainted with the matter.

The injection plan may result in a 56 foundation level dilution of return on fairness, JPMorgan analysts together with Katherine Lei wrote in a word. The stoop may a mirror a shift away from sectors that have been seen as extra resilient when the market was falling; with among the nation’s highest dividend yields, Chinese language banks have appealed to buyers in search of secure returns.

Some buyers are in search of indicators of extra fiscal stimulus to drive the subsequent leg of good points. “We are able to anticipate fiscal measures as nicely to come back,” stated Raymond Chen, a fund supervisor at ZiZhou Funding Asset Administration. “That is for certain leaving many cynics behind.”

Morgan Stanley is amongst a slew of China watchers regularly turning bullish, with strategist Laura Wang and her colleagues seeing one other 10% upside for the CSI 300 Index within the quick time period. Simply days earlier, the Wall Avenue financial institution eliminated its choice for onshore shares over offshore counterparts, citing an absence of supportive elements corresponding to state shopping for.

The optimism additionally drove greater different Asian shares with publicity to the world’s second-biggest financial system because the risk-on temper intensified throughout the area.

–With help from Winnie Hsu.

(Updates with feedback in fifth, sixth paragraphs.)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday