Markets

3 Good AI Shares Billionaires Are Shopping for for the three Levels of the Synthetic Intelligence Increase

A latest report from UBS World Wealth Administration estimates that synthetic intelligence income will attain $1.2 trillion by 2027. The analysts imagine “AI would be the most profound innovation and one of many largest funding alternatives in human historical past.”

The report breaks the funding alternative into three layers: (1) the enabling layer, (2) the intelligence layer, and (3) the appliance layer. Listed under are three good AI shares (one for every layer) that billionaires have been shopping for within the second quarter.

-

Andreas Halvorsen of Viking World Traders purchased 1.3 million shares of Nvidia (NASDAQ: NVDA).

-

Ken Griffin at Citadel Advisors purchased 1.1 million shares of Amazon (NASDAQ: AMZN).

-

David Shaw at D.E. Shaw & Co. purchased 689,000 shares of Datadog (NASDAQ: DDOG).

Here is what buyers ought to about these shares.

1. Nvidia: The enabling layer

UBS analysts outline the primary stage of the (AI) increase because the enabling layer. It includes and public clouds that present infrastructure and platform companies required to develop AI purposes. UBS estimates income from the enabling layer will complete $516 billion by 2027.

Nvidia matches neatly into this class. The obvious motive for its inclusion is dominance in information heart graphics processing items (GPUs). Nvidia accounted for 98% of information heart GPU shipments final 12 months, and it holds 90% market share in AI chips based on Morgan Stanley analyst Joseph Moore. Forrester Analysis just lately wrote, “With out Nvidia’s GPUs, trendy AI would not be doable.”

Nvidia additionally supplies software program libraries and developer instruments via its CUDA platform that streamline the constructing of GPU-accelerated purposes. Moreover, the corporate has additionally launched an entire AI-as-a-service product referred to as DGX Cloud. It brings collectively supercomputing infrastructure, pretrained machine studying fashions, and software program that help AI utility growth throughout use circumstances starting from autonomous robots to recommender techniques.

Trying forward, Nvidia is properly positioned to carry its management place in AI chips regardless of more and more powerful competitors from semiconductor corporations like AMD and Broadcom. To cite Forrester Analysis, “The corporate’s innovation, roadmap, and imaginative and prescient are clear and have saved it shifting at lightspeed in comparison with different semiconductor producers for AI chips.”

Wall Road expects Nvidia’s earnings to compound at 37% yearly over the following three years. That consensus makes the present valuation of 57 occasions earnings seem like an inexpensive entry level. These figures give a PEG ratio of 1.5, which is a cloth low cost to the three-year common of three.1.

2. Amazon: The intelligence layer

UBS analysts outline the second stage of the factitious intelligence increase because the intelligence layer. It includes corporations that use information property to construct the massive language fashions (LLMs) and machine studying fashions that energy synthetic intelligence purposes. UBS estimates income from the intelligence layer will complete $255 billion in 2027.

Amazon matches neatly into the primary and second classes. Amazon Internet Companies, the most important public cloud when it comes to income, supplies entry to infrastructure and platform companies that help the event of AI fashions and purposes. Amazon Bedrock is one instance. It is a generative AI growth platform that lets companies fine-tune pretrained fashions, together with the Titan household of fashions developed by Amazon.

Moreover, Amazon customers spend $443,000 per minute on {the marketplace}, based on Goldman Sachs. That affords the corporate a deep understanding of shopper tastes and choice, and its generative AI purchasing assistant (Rufus) makes use of that info to reply questions and make product suggestions. As of Sept. 18, Rufus is formally accessible to all U.S. prospects.

In accordance with a latest survey of IT executives from Goldman Sachs, roughly 30% of purposes run in public clouds immediately, however that quantity is projected to method 50% in three years. As the most important public cloud, Amazon Internet Companies is uniquely positioned to learn as demand for AI companies will increase, just because it already has the most important buyer base and companion ecosystem.

Wall Road expects Amazon’s earnings to extend at 22% yearly over the following three years, which makes the present valuation of 45 occasions earnings look cheap. These figures give a PEG ratio of two.1, a reduction to the three-year common of two.9.

3. Datadog: The appliance layer

UBS analysts outline the third stage of the factitious intelligence increase as the appliance layer. It includes corporations that use information property and fashions from the intelligence layer to develop AI software program. UBS estimates income from the appliance layer will complete $395 billion in 2027.

Datadog matches into this class. The corporate makes a speciality of observability software program. Its platform includes a broad vary of merchandise that assist companies monitor, troubleshoot, and consider the efficiency of essential IT infrastructure and purposes. A number of merchandise depend upon AI. As an illustration, Watchdog is an AI engine that accelerates incident decision by automating anomaly detection and root trigger evaluation

Equally, Bits AI is a conversational interface that lets growth and operations groups question observability information utilizing pure language. It simplifies investigations, streamlines incident administration, and quickens the remediation of efficiency issues. Likewise, LLM Observability is a monitoring instrument purpose-built for the massive language fashions that energy generative AI purposes.

Analysis firm Gartner just lately ranked Datadog as a number one observability platform vendor for the fourth consecutive 12 months. The corporate additionally has a powerful presence in a number of particular person observability verticals, equivalent to log evaluation, sever monitoring, and utility efficiency monitoring. Moreover, Forrester Analysis has acknowledged its management in AI for IT operations.

Morgan Stanley analyst Sanjit Singh views Datadog as one of many software program corporations greatest positioned to monetize generative AI. Wall Road expects the corporate’s income to develop at 23% yearly via 2026. That makes the present valuation of 17.9 occasions gross sales seem like an inexpensive entry level for affected person buyers.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for buyers to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. has positions in Amazon and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Amazon, Datadog, Goldman Sachs Group, and Nvidia. The Motley Idiot recommends Broadcom and Gartner. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

The chilly warfare between Google and Microsoft has 'gone scorching'

An extended-standing feud between Google (, ) and Microsoft () is spilling into public view as soon as once more.

The newest shot from Google got here in a grievance filed with the European Fee Wednesday, accusing Microsoft of violating the European Union’s antitrust legislation.

Google mentioned in a doc supplied to Lusso’s Information that Microsoft illegally leveraged its dominant enterprise server software program “” licenses to power prospects to stay with Microsoft for cloud computing.

Microsoft predicted Google would “fail” on this occasion, saying it had already settled comparable considerations raised by European cloud suppliers.

“Having failed to influence European firms, we anticipate Google equally will fail to influence the European Fee,” a Microsoft spokesperson mentioned.

The brand new dispute demonstrates “it is a chilly warfare that is gone scorching,” Adam Kovacevich, CEO and Founding father of the tech coverage advocacy group , instructed Lusso’s Information.

The 2 tech giants have spent the final twenty years battling for supremacy in applied sciences starting from and cloud computing to the markets for , software program, — and now , or AI.

The feud started within the first decade after Microsoft settled a introduced by the US Justice Division alleging it boxed out rivals by making its browser free and the default on its dominant Home windows working system.

A 2002 opened the door to broader competitors within the web browser software program market after which a startup fashioned by Stanford college students Sergey Brin and Larry Web page, to start its interval of meteoric development within the 2000s.

Microsoft defended its reestablished territory in a sequence of movies first launched in 2011, wherein Microsoft skewered Google with parodies suggesting that Google’s competing Gmail service, Chrome browser, and accompanying software program lacked high quality and privateness.

A video titled “” questioned Google’s ethics by accusing it of mining each phrase inside its Gmail prospects’ personal emails in an effort to goal them with ads.

In different movies titled “” and “” — a spoof on the Eighties hit tv sequence “Moonlighting” — Microsoft questioned whether or not customers ought to belief Google with dealing with their personal info.

In 2016, the businesses with an settlement to finish regulatory complaints towards one another globally as two new CEOs — Google’s Sundar Pichai and Microsoft’s Satya Nadella — took over.

The pact in 2021 as regulators within the US and EU stepped up stress on each firms, and Microsoft complained that Google used unfair ways to compete in on-line search and promoting.

Issues actually obtained uncomfortable final 12 months throughout a high-profile antitrust trial that pitted Google towards the US Justice Division — a case that alleged Google illegally monopolized the web search engine market and had echoes of the case the DOJ filed towards Microsoft within the Nineties.

Essentially the most distinguished witness to testify towards Google was Nadella, who didn’t hesitate to take a shot at his rival whereas on the stand.

“You stand up within the morning, you sweep your tooth, and also you search on Google,” Nadella mentioned, emphasizing Google’s overwhelming dominance within the search engine market.

Nadella mentioned Microsoft’s personal search engine, Bing, as a result of Google had negotiated for Google Search to get default placement on browsers, desktops, and cell gadgets like Apple’s iPhones and iPads and Android-based smartphones made by Samsung and others.

Nadella went on to explain the imbalance as a “vicious cycle” that he nervous would intensify with the event of AI.

Google misplaced the case in a choose’s ruling that labeled its search enterprise an unlawful monopoly. The decision is now pending a treatments section that might end in a breakup of Google’s empire.

Microsoft definitely had loads to realize from a Google defeat, Kovacevich mentioned.

“They had been most likely the primary instigator of the US Justice Division’s antitrust swimsuit over Google,” Kovacevich mentioned. “And the responsible verdict towards Google most likely stands to profit Microsoft’s Bing most of anybody.”

Microsoft is taking an analogous strategy in yet one more that’s nonetheless in its preliminary trial section. It argues there that Google’s management of internet marketing applied sciences has harmed the success of its Bing browser.

It is unknown if the EU will take up Google’s most up-to-date assault towards Microsoft’s cloud computing guidelines.

Google is arguing that Microsoft imposed a 400% markup on prospects emigrate their Home windows Server licenses to a competing cloud service, whereas prospects who selected Microsoft’s cloud providers, Azure, might migrate for “basically nothing.”

In making its case, Google is utilizing the identical form of “bundling” or “” claims used within the 1998 case towards Microsoft introduced by the DOJ.

Again then, US prosecutors alleged that Microsoft illegally monopolized the marketplace for private computing working techniques by utilizing its Home windows working system to provide away its browser, Web Explorer, totally free.

The transfer bundled the browser together with Home windows, ultimately placing rival browser out of enterprise.

Microsoft was ultimately required to open up Home windows to 3rd social gathering software program, which paved the way in which for firms together with Google to “interoperate” or run their browser and search software program utilizing Microsoft-powered computer systems.

Now, available in the market for cloud computing, Google is arguing that Microsoft leveraged “dominance in a single market to forestall competitors on the deserves in a separate, unrelated market,” in keeping with the doc shared with Lusso’s Information.

Alexis Keenan is a authorized reporter for Lusso’s Information. Comply with Alexis on X .

Markets

Freeport cranks up copper output as rivals scour for offers to develop

By Ernest Scheyder

(Reuters) – Freeport-McMoRan (NYSE:) is turbo-charging its output throughout three continents with no plans to hitch a buyout frenzy sweeping the mining business, a technique that analysts say positions the corporate effectively to capitalize on the clear power transition’s rising demand for the purple metallic.

Used broadly throughout the worldwide financial system, copper is a perfect conductor of electrical energy and simply malleable, qualities which have made it broadly in style to be used in wiring, engines, development gear, electronics and different units.

International demand is poised to leap a minimum of 60% by 2050, in accordance with the Worldwide Vitality Company. Analysts at Jefferies anticipate costs for the purple metallic to rise greater than 40% within the subsequent two years.

But new copper mines are proving troublesome to develop, due partly to opposition from Indigenous teams, conservationists, native communities and others.

The troublesome backdrop has pushed BHP, Rio Tinto (NYSE:), Glencore (OTC:) and different diversified miners of iron ore, nickel and different essential minerals to hunt for offers to spice up their copper output even whereas balancing shareholders’ expectations for payouts.

Phoenix-based Freeport has lengthy centered totally on copper – it produces 9% of world provides, greater than another firm – and now finds itself within the uncommon place of with the ability to focus on increasing mines it already owns and avoiding the distraction of a buyout.

“We’re actually, actually centered on creating worth from the property that we have now,” Kathleen Quirk, who grew to become Freeport’s CEO in June, advised Reuters forward of the LME Week convention in London, one of many world’s largest annual gatherings of mining executives. “I do not see Freeport as having to aggressively exit and must overpay for issues.”

Freeport expects to provide 800 million kilos (362,874 metric tons) of copper yearly as quickly as 2027 by leaching the metallic from piles of previous waste rock at its U.S. mines beforehand considered nugatory.

Drones and helicopters have been putting in irrigation strains atop miles-long waste piles that launch an acid resolution to tease out low concentrations of copper.

The leached copper will price a 3rd much less to provide than Freeport’s laborious rock mines – already a few of the most cost-effective within the business, in accordance with analysts – and won’t require a smelter for processing. Freeport estimates it could have to spend a minimum of $10 billion on a brand new mine to imitate output from leaching.

“It is an enormous alternative for us and one which we’re pursuing aggressively,” Quirk mentioned.

That leaching plan alone would produce practically half the copper that Anglo American (JO:) – which BHP tried unsuccessfully to purchase earlier this 12 months – mined throughout the whole globe in 2023.

‘STICK TO THEIR KNITTING’

Freeport has 4 different enlargement initiatives underway that would add greater than 1 billion kilos (453,592 metric tons) of copper yearly to its manufacturing in coming years, together with greater than 500 million kilos (226,796 metric tons) yearly by 2025 in the US.

One other is in Indonesia, the place it’s increasing Grasberg, the world’s second-largest copper mine. Freeport can also be hoping to barter an extension of its mining rights past 2041 with the brand new Indonesian president, who takes workplace subsequent month.

The corporate is getting ready its software now to increase the license and Chairman Richard Adkerson – who led the final spherical of negotiations when he was CEO – plans to hitch the discussions, Quirk mentioned.

“Indonesia is a part of the material of our firm as we have been working laborious to enhance the livelihood of the folks, present advantages to the federal government, all whereas offering returns on investments for our shareholders,” she mentioned. “I need to proceed that constructive relationship.”

In Chile, Quirk mentioned the regulatory local weather has improved below President Gabriel Boric after a interval of uncertainty fueled by an unsuccessful try to vary the nation’s structure final 12 months.

“Chile is a extra steady setting for buyers now,” mentioned Quirk. An software to broaden the El Abra mine, which counts state-owned Codelco as a minority associate, ought to by filed subsequent 12 months, she mentioned.

Freeport’s inventory has risen 30% the previous 12 months as buyers have warmed to the corporate’s plans to broaden current operations. Seventeen of the 24 analysts that monitor Freeport’s inventory suggest shopping for it and none suggest promoting, in accordance with LSEG Workspace.

“Freeport is a workhorse in my portfolio,” mentioned Derek Bone of the Optica Uncommon Earths & Essential Supplies ETF, which holds shares of Freeport. “I would like them to stay to their knitting.”

Quirk, who had been Adkerson’s deputy for greater than 20 years, is going through a problem recruiting employees in the US, the place the corporate has moved because of this to deploy autonomous vehicles.

“I am hoping that with everyone centered on our future financial system and the way it would require extra use of metals, we’ll get the perfect and brightest into our business to assist us,” mentioned Quirk.

That’s high of thoughts for Freeport’s clients, who’re gobbling up extra copper.

Nvidia (NASDAQ:), for instance, mentioned in March it could use copper cables for AI knowledge facilities – slightly than fiber optic cables.

“That bodes effectively for copper demand over the long run,” mentioned Steve Schoffstall of the Sprott Vitality Transition Supplies ETF, which holds Freeport shares. “Corporations like Freeport are in a great spot.”

Markets

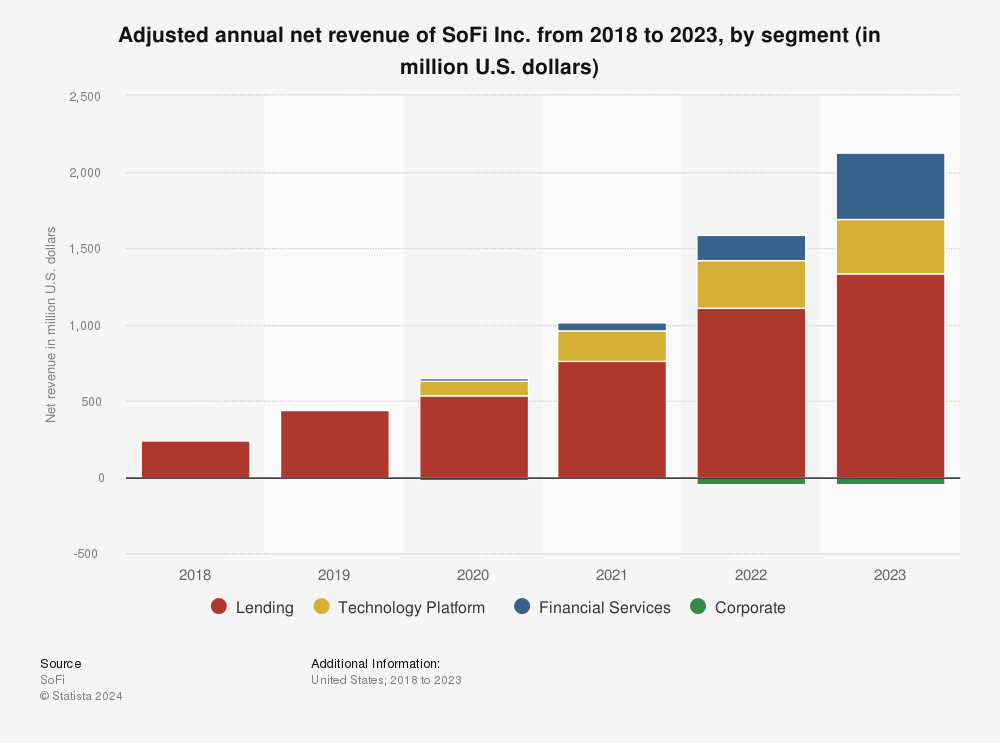

Prediction: SoFi Inventory Will Soar Over the Subsequent 5 Years. Right here's 1 Motive Why.

The inventory of SoFi Applied sciences (NASDAQ: SOFI) has been crushed this yr after doubling final yr. It is down 20% yr so far regardless of what looks as if fairly strong efficiency.

Nonetheless, the tide may flip, and shortly. Let’s examine why SoFi inventory may soar over the following 5 years.

Expanded enterprise, decrease rates of interest

SoFi’s most important enterprise is lending, however it has expanded into a big array of economic providers like financial institution accounts and investments. Providing different providers gives a number of advantages for SoFi.

It provides it new income sources, it creates higher cross-platform engagement amongst present members, it may possibly entice new members, and — what stands out now — is that it shields the enterprise from the .

Lending generally is a profitable enterprise, however it’s extremely delicate to rates of interest, and SoFi’s lending phase has been below strain as charges stay excessive.

Now that rates of interest seem like they will begin coming down, the strain ought to start to ease. In the meantime, the opposite segments are nonetheless in progress mode, and so they proceed to account for a better proportion of the corporate’s general enterprise.

The lending phase continues to develop, however the non-lending segments are rising a lot quicker. They accounted for 45% of the enterprise within the 2024 second quarter, up from 38% a yr in the past. As the opposite segments outpace lending progress, SoFi will develop into a extra steady enterprise, with decrease publicity to rate of interest motion.

If the lending phase picks up with decrease charges, which is how the phase works, traders’ present considerations in regards to the enterprise will fall away. Whenever you mix that with the power within the firm’s growth mannequin, SoFi inventory may explode over the following 5 years, and now could possibly be a good time to purchase in.

Must you make investments $1,000 in SoFi Applied sciences proper now?

Before you purchase inventory in SoFi Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and SoFi Applied sciences wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has positions in SoFi Applied sciences. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook