Markets

Xi Jinping simply fired his big cash cannon on the fallacious goal

Certain, Wall Road. Go forward. Journey the dragon.

There was a second of grace on Tuesday for buyers, market analysts, and finance’s prime brass when Beijing to attempt to reinvigorate China’s croaking economic system. Pan Gongsheng, a governor of the Folks’s Financial institution of China, the nation’s central financial institution, introduced that 800 billion yuan, or about $114 billion, could be injected into the inventory market. Policymakers additionally mentioned they had been discussing elevating a fund designed to stabilize shares and introduced guidelines permitting Chinese language banks to maintain much less cash in reserve, releasing up 1 trillion yuan to exit asloans. Additionally they lowered the Folks’s Financial institution of China’s medium-term lending price and key rates of interest for banks and clients. Homebuyers may now put much less cash down on their purchases — an try to breathe life into China’s moribund property market.

The instant response from Wall Road was all-out jubilee. For the reason that pandemic, China’s chief, Xi Jinping, has performed little to cease the bleeding within the nation’s property market or to get China’s ailing shoppers to begin spending cash once more. The misplaced almost 1 / 4 of its worth. . International buyers are pulling document quantities of cash overseas. This week’s bulletins despatched Wall Road right into a state of rapture, hoping that the Chinese language Communist Celebration is now, as in years previous, ready to catch a falling knife. The Golden Dragon index — a group of Nasdaq-traded firms that do most of their enterprise in China — rallied 9% following the bulletins. Monetary-news speaking heads heralded this as a transparent signal from Beijing that policymakers had been getting actual about stopping China’s descent right into a deflationary funk. There could be extra mergers and acquisitions! Decrease charges might imply extra private-equity exercise! The well-known Beijing “bazooka” might lastly be on the way in which!

However honey, they’re delusional.

Xi’s Beijing lacks the need and the ability to show China’s economic system round. On the coronary heart of its issues is an absence of shopper demand and a property market going by a deep, slow-moving correction. Xi is ideologically against jump-starting shopper spending with direct stimulus checks. No will. As for the ability, Goldman Sachs estimated that would require 7.7 trillion yuan. China’s property market is so overbuilt and indebted that the trillions in stimulus wanted to repair the issue — and make the native governments that financed it entire once more — would make even a rapacious fundraiser like . The “stimulus” China’s policymakers are providing is a drop in a nicely, and so they know that. Wall Road ought to too. However I assume they have not discovered.

The measures the CCP introduced are meant to make it simpler for Chinese language individuals to entry capital and purchase property, however entry to debt is just not the issue right here. Folks within the nation don’t need to spend cash as a result of they’re already sitting on massive quantities of real-estate debt tied to declining properties. Seventy % of Chinese language family wealth is invested in property, which is an issue since analysts at Société Genéralé discovered that housing costs have fallen by as a lot as 30% in Tier 1 cities since their 2021 peak. Land purchases helped fund native governments so they might spend on faculties, hospitals, and different social companies — now that financing mechanism is out of whack. Sinking costs in these sectors, or what economists name deflation, has unfold to the broader economic system. The most recent shopper worth inflation report confirmed that costs rose by simply 0.3% in August in comparison with the 12 months earlier than, the bottom worth progress in three years, prompting considerations that deflation will take maintain, spreading to wages and killing jobs.

Provided that context, many Chinese language individuals are not wanting to spend. Shoppers are buying and selling all the way down to , and second-quarter retail gross sales grew by solely 2.7% from the earlier 12 months. In a current observe to purchasers, the enterprise surveyor China Beige Ebook mentioned that enterprise borrowing had barely budged since all-time lows in 2021, in the course of the depths of the pandemic. Backside line: It would not matter how low-cost and simple it’s to entry loans if nobody desires to take one out.

“These principally supply-side measures would definitely be useful if the issue in China was that manufacturing was struggling to maintain up with progress in demand,” Michael Pettis, a professor of finance at Peking College and a Carnegie Endowment fellow, mentioned in a current submit on X. “However with weak demand as the principle constraint, these measures usually tend to increase the commerce surplus than GDP progress.”

Probably the most direct approach to spur demand in a deflating economic system is to ship checks to households. However once more, . The Chinese language president , who believed that direct stimulus distorts markets and results in uncontrollable inflation. This flies within the face of what economists would suggest for China’s scenario, however those that criticize the way in which Xi does issues .

It is clear that Beijing’s current strikes will not clear up China’s core financial issues. And Wall Road’s pleasure misses one other key downside: The measures aren’t even all that huge. Name it a bazooka or a blitz or no matter, however this stimulus is tiny in contrast with what we have seen from the CCP up to now. In 2009, the federal government to save lots of the economic system in the course of the international monetary disaster. In 2012, it on infrastructure tasks. In 2015, it injected over $100 billion into ailing regional banks and devalued its foreign money to . The CCP has proven that it is prepared to take dramatic motion to stabilize the economic system. The worth of that motion, although, is huge debt constructed up all around the monetary system, held particularly by property firms, state-owned enterprises, and native governments. Up to now, financial easing calmed gyrations within the monetary system, however progress has by no means been this sluggish, and debt has by no means been this excessive. The issue doesn’t match the worth tag right here.

The Chinese language Communist Celebration has a bubble on its fingers, and it would not need to blow far more or see it burst in spectacular style. Plus, there’s Xi, who appears pretty tired of restructuring the property market. He desires authorities funding to deal with growing frontier know-how and boosting exports to develop the economic system out of its structural debt issues. However these new streams of revenue have but to materialize for China, and establishing them will take time and dealing by commerce battle, principally with the US and the European Union. Think about the easing measures we’re seeing as one thing like a second for markets to catch their breath — a respite from what has been a continuing stream of dangerous financial information. However a respite is all it’s.

is a senior correspondent at Enterprise Insider.

Learn the unique article on

Markets

5 Key Charts to Watch in World Commodity Markets This Week

(Lusso’s Information) — London Steel Alternate’s annual LME Week gathering is underway, bringing collectively merchants and analysts amid copper’s newest upswing. Sugar futures are on observe for his or her greatest month since January. And US utilities are outshining different trade teams within the S&P 500, thanks partly to AI demand.

Most Learn from Lusso’s Information

Listed below are 5 notable charts to think about in international commodity markets because the week will get underway.

Copper

Copper has been on a roller-coaster journey this 12 months, with a surge of funding and a significant brief squeeze in New York driving costs to a document in Could. Buyers then pulled of their horns as doubts in regards to the Chinese language economic system rose to the fore. The newest positioning knowledge indicators that they’re not chasing the rally as exhausting as they did final time round.

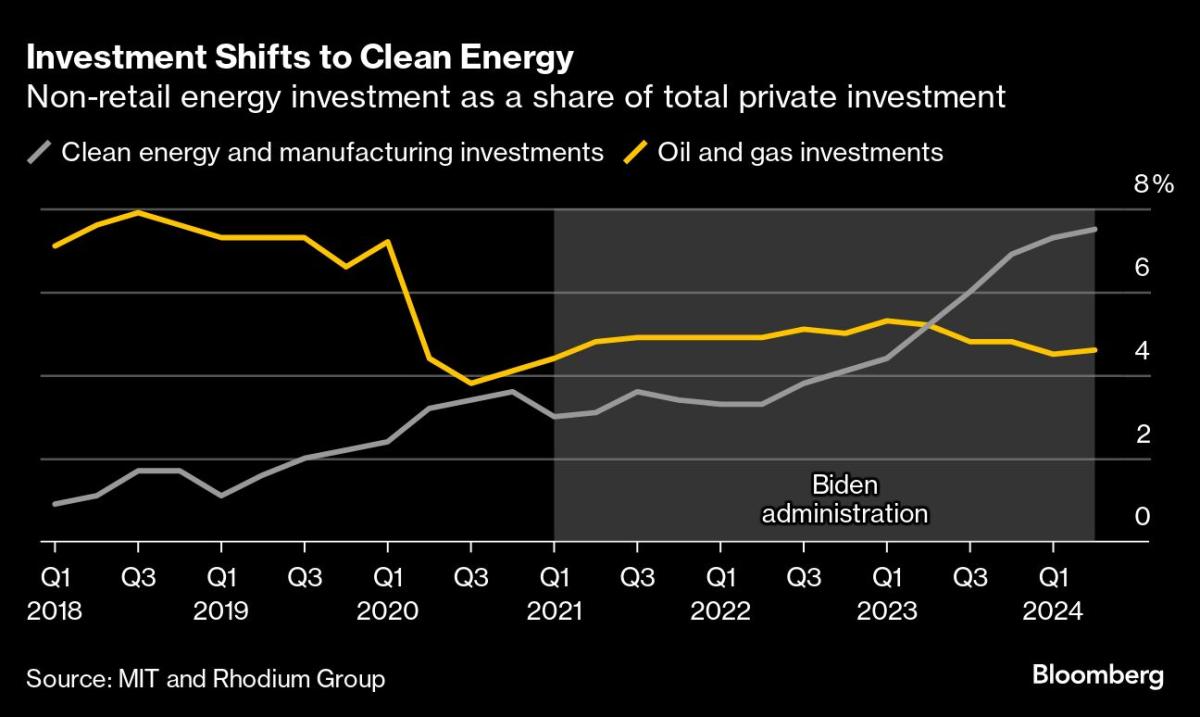

Vitality Investments

The US is mobilizing a lot funding into clear vitality that it now tops even the height of America’s fracking revolution within the 2010s. The wave of spending triggered by Joe Biden’s signature local weather regulation is ready to be the president’s greatest and most-enduring home achievement. His insurance policies helped drive about $493 billion of recent funding into the manufacturing and widespread deployment of photo voltaic panels, electrical autos and different emission-cutting expertise since mid-2022, based on knowledge analyzed by the Massachusetts Institute for Know-how and analysis agency Rhodium Group.

Pure Fuel

Europe enters its heating season this week with an enormous pure gasoline stockpile to defend itself from surprising provide outages. The continent’s websites are about 94% full — above historic averages, however barely under final 12 months’s ranges — sufficient to maintain some merchants watchful as they carefully monitor persevering with storage build-up earlier than the freezing climate spreads.

Energy Suppliers

The utilities sector is outshining different industries on the S&P 500 Index within the final three months. Shares of US energy suppliers racked up massive features within the third quarter on market giddiness over prospects of surging electrical energy demand from synthetic intelligence-focused knowledge facilities. Utilities are on tempo to high the 11 trade teams of the S&P Index because the quarter attracts to an in depth, with features pushed by plant operators Vistra Corp. and Constellation Vitality Corp., which simply inked an influence provide cope with Microsoft Corp. Vistra is noteworthy as a result of it’s additionally holding its rating as one of the best performing inventory within the broader S&P 500 for the 12 months, after shares greater than tripled.

Sugar

Sugar has been on a tear in September resulting from a poor outlook from Brazil, the world’s high exporter. Whereas promising manufacturing forecasts in India and Thailand lower brief final week’s rally on Friday, sugar futures are nonetheless on tempo for the most important month-to-month acquire since January. Extreme drought in Brazil has been hurting sugar-cane yields, elevating fears of additional cuts to manufacturing estimates. Merchants might be carefully watching the circulation of vessels transport sugar from the South American nation in October, since any easing of exports means international patrons might battle to search out provides within the ultimate months of 2024.

–With help from Geoffrey Morgan, Doug Alexander, Dayanne Sousa and Alex Tribou.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

NZ's Fonterra upgrades dividend payout coverage

(Reuters) – New Zealand dairy agency Fonterra mentioned on Monday it has upgraded its dividend payout coverage and can now pay shareholders 60% to 80% of its earnings, in contrast with a median of fifty% for the earlier 5 years.

The corporate can be concentrating on a better common return on capital, elevating it to 10-12%, up from 9-10% earlier.

“Fonterra is in a powerful place, delivering outcomes nicely above its five-year common, which places it able to consider the subsequent evolution of its strategic supply,” mentioned CEO Miles Hurrell.

Final week, the Auckland-based firm reported earnings from persevering with operations for fiscal 2024 of 70 NZ cents per share, hitting the highest finish of its outlook vary.

It declared a last dividend of 25 NZ cents per share in addition to a particular dividend of 15 NZ cents apiece.

The corporate mentioned it intends to make a “important” capital return to shareholders upon divestment of its shopper enterprise.

Earlier this 12 months, it had flagged a full or partial sale of its world shopper unit to unencumber capital.

Markets

Right here's the Finest-Performing S&P 500 Inventory of 2024 (Trace: It's Not Nvidia)

Energy utilities aren’t at all times seen as probably the most thrilling option to make investments, however traders may must rethink that opinion, as a result of the top-performing S&P 500 index inventory of the 12 months is retail electrical energy and energy technology utility Vistra (NYSE: VST), up a whopping 210% this 12 months. That beats Nvidia‘s (NASDAQ: NVDA) 155% improve. The 2 occasions should not unconnected. This is why and the way Vistra inventory has carried out so nicely this 12 months.

Information facilities, electrical energy demand, and clear vitality

It is no secret that the burgeoning demand for synthetic intelligence (AI) purposes is the rationale for the step change in expectations for demand. That is what’s fueling elevated demand for graphics processing models (GPUs) and high-performance computing chips. That is nice information for know-how corporations like Nvidia and .

Whereas the latter are obvious beneficiaries, there are additionally information heart gear corporations like Vertiv Holdings. If you’re on the lookout for a worth play on the theme, then the heating, air flow, air con, and refrigeration sector, notably Johnson Controls, is price .

Nevertheless, I digress. This text’s point of interest is the necessity to energy information facilities and elevated electrical energy demand. Particularly, it’s in an surroundings the place policymakers stay dedicated to the clear vitality transition. That is the place corporations and utilities like Vistra and Constellation Power (NASDAQ: CEG) come into play.

Vistra

Vistra is a retail electrical energy and energy technology firm. On the finish of 2023, it counted 4 million retail clients, and the acquisition of Power Harbor in March added one other 1 million. The Harbor Power deal additionally added 4,000 megawatts (MW) of nuclear technology to associate with the 36,702 MW with which Vistra ended 2023, with 2,400 MW from nuclear.

As such, the deal made Vistra “the biggest aggressive energy generator within the nation” and made it the second-largest aggressive nuclear generator within the U.S. Buyers are falling in love with nuclear vitality as a clear, sustainable, and zero-carbon baseload choice. That is notably related as coal-powered crops are being closed down in accordance with the clear vitality transition.

The clear vitality transition

Whereas no one doubts that the transition will happen, it is also indeniable that sentiment over the tempo of the transition has modified, too. The long-term coverage outlook stays favorable to renewable vitality; pure fuel will possible be a big a part of vitality technology for many years.

That is additionally excellent news for Vistra, as a result of about 24,000 MW of its present 41,000 MW capability comes from pure fuel. As such, the rise within the inventory worth this 12 months additionally displays a extra favorable view of pure fuel and a vote of confidence in Vistra’s 6,400 MW nuclear functionality.

Enter Amazon and Microsoft

The three greatest cloud service suppliers are Amazon Net Companies, Microsoft‘s Azure, and Alphabet‘s Google Cloud, and they should guarantee long-term energy to assist their information facilities. As such, Microsoft and Amazon accomplished long-term energy buy agreements (PPA) with Vistra this 12 months.

Nonetheless, it is the 20-year PPA that Microsoft just lately signed with Constellation Power that has excited the market. Microsoft is buying energy for its information facilities, and Constellation will restart the Three Mile Island nuclear plant to ship on the settlement. That is a optimistic for the market, and so is the value that Microsoft is prepared to pay for the facility.

In accordance with Reuters, Microsoft is paying as much as $115 per megawatt-hour (MWh) within the settlement. That compares favorably with Vistra’s whole realized worth of $51.20 MWh within the second quarter of 2024.

A inventory to purchase

The bull case for Vistra rests on the concept that there’s important upside potential for future market pricing for nuclear-powered vitality, given the Microsoft/Constellation deal and burgeoning demand stimulated by AI. Vistra’s acquisition of Power Harbor strengthened that case. As well as, Vistra just lately introduced it was shopping for the remaining 15% of its Vistra Imaginative and prescient subsidiary (which homes its zero-carbon nuclear, vitality storage, and photo voltaic technology companies) for $3.085 billion.

Vistra’s pure fuel, nuclear, and renewable capabilities are optimistic belongings for the clear vitality transition. Contemplating these components, it is no shock that the sector is scorching. Including falling rates of interest (utilities are sometimes seen as rate of interest delicate as a consequence of their debt masses) is a recipe for sharp worth appreciation.

Do you have to make investments $1,000 in Vistra proper now?

Before you purchase inventory in Vistra, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and Vistra wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Constellation Power, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Johnson Controls Worldwide and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook