Markets

Large Chapter Information Crushes EV Shares

Electrical car (EV) shares cratered this week after Fisker filed for chapter. The troubled automaker by no means acquired off the bottom after a promising car was stricken by poor software program. Whereas a failure does not say a lot in regards to the different operators within the trade, it does not bode nicely for the market’s willingness to fund EV losses long-term.

In keeping with knowledge offered by , EV makers Faraday Future Clever Electrical (NASDAQ: FFIE) fell as a lot as 26.9% and VinFast (NASDAQ: VFS) dropped 9.9%. The 2 producers are down 23.1% and eight.5% respectively for the week as of two:45 p.m. ET. Charging corporations Blink Charging (NASDAQ: BLNK) and ChargePoint (NYSE: CHPT) fell 14.1% and 20.1% respectively at their lows and are actually down 12.8% and 19.5% on the week.

The collapse of Fisker and the fallout

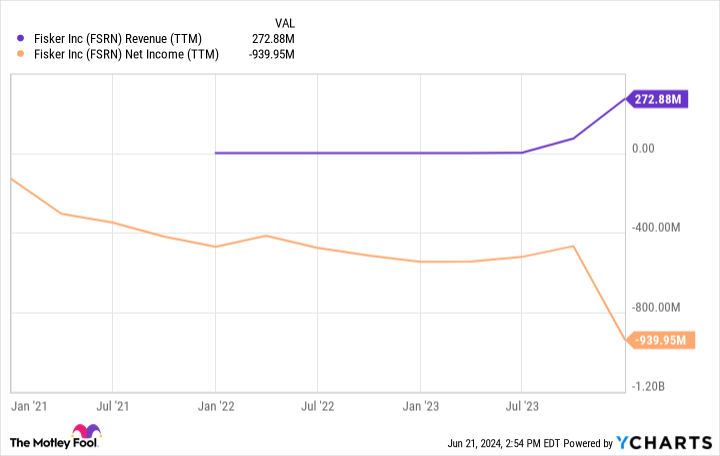

Fisker had a variety of issues buyers could not repair. Software program was a problem and manufacturing by no means hit manufacturing objectives. However the different drawback was demand.

Electrical car demand progress has slowed as extra provide got here onto the market. For corporations that have not already constructed mature provide chains and generated vital gross sales and earnings, the dearth of demand meant rising losses.

With extra choices, consumers did not have a lot sympathy for start-up EV corporations as a result of they might discover different choices that had prime quality and had been available. Fisker was the primary domino to fall, however it will not be the final.

Faraday and VinFast look quite a bit like Fisker’s operations and will not have a lot of a lifeline left.

The market’s new EV scrutiny

Losses weren’t an issue when inventory costs had been excessive as a result of corporations might merely promote inventory to fund operations. However as inventory costs fall that turns into tougher.

Debt markets shut first after which fairness markets do not wish to fund operations, which begins a downward spiral that is nearly unattainable to cease.

I believe most EV makers will attain the identical destiny if they don’t seem to be acquired first.

The impression on charging shares

Charging shares weren’t spared from the sell-off and for good motive. Demand issues for EV producers imply much less demand for chargers. And if there are fewer EV producers they’ll negotiate higher phrases for his or her customers and commoditize charging networks.

ChargePoint and Blink Charging additionally do not have a lot better financials than the EV producers themselves, which you’ll see beneath.

The EV market is crumbling

The issue is not whether or not or not individuals are utilizing electrical autos, it is whether or not or not the businesses making EVs and chargers can become profitable promoting merchandise. To this point, just one U.S. EV firm has change into worthwhile and even that might not be sustainable.

Corporations which have been shedding cash yr after yr do not seem like they will be capable of flip operations round and the market is not prepared to fund operations indefinitely. That does not bode nicely for EV shares long-term and I believe this is only one of various dangerous weeks to return for the trade.

Do you have to make investments $1,000 in ChargePoint proper now?

Before you purchase inventory in ChargePoint, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for buyers to purchase now… and ChargePoint wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $801,365!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

California governor vetoes contentious AI security invoice

By David Shepardson and Anna Tong

WASHINGTON/SAN FRANCISCO (Reuters) -California Governor Gavin Newsom on Sunday vetoed a hotly contested synthetic intelligence security invoice after the tech trade raised objections, saying it may drive AI corporations from the state and hinder innovation.

Newsom mentioned the invoice “doesn’t consider whether or not an AI system is deployed in high-risk environments, includes essential decision-making or using delicate knowledge” and would apply “stringent requirements to even essentially the most fundamental capabilities — as long as a big system deploys it.”

Newsom mentioned he had requested main consultants on generative AI to assist California “develop workable guardrails” that focus “on growing an empirical, science-based trajectory evaluation.” He additionally ordered state businesses to broaden their evaluation of the dangers from potential catastrophic occasions tied to AI use.

Generative AI – which might create textual content, pictures and movies in response to open-ended prompts – has spurred pleasure in addition to fears it may make some jobs out of date, upend elections and doubtlessly overpower people and have catastrophic results.

The invoice’s creator, Democratic State Senator Scott Wiener, mentioned laws was mandatory to guard the general public earlier than advances in AI grow to be both unwieldy or uncontrollable. The AI trade is rising quick in California and a few leaders questioned the way forward for these corporations within the state if the invoice grew to become legislation.

Wiener mentioned Sunday the veto makes California much less secure and means “corporations aiming to create a particularly highly effective expertise face no binding restrictions.” He added “voluntary commitments from trade will not be enforceable and infrequently work out effectively for the general public.”

“We can not afford to attend for a significant disaster to happen earlier than taking motion to guard the general public,” Newsom mentioned, however added he didn’t agree “we should accept an answer that’s not knowledgeable by an empirical trajectory evaluation of AI programs and capabilities.”

Newsom mentioned he’ll work with the legislature on AI laws throughout its subsequent session. It comes as laws in U.S. Congress to set safeguards has stalled and the Biden administration is advancing regulatory AI oversight proposals.

Newsom mentioned “a California-only strategy could be warranted – particularly absent federal motion by Congress.”

Chamber of Progress, a tech trade coalition, praised Newsom’s veto saying “the California tech economic system has at all times thrived on competitors and openness.”

Amongst different issues, the measure would have mandated security testing for lots of the most superior AI fashions that value greater than $100 million to develop or people who require an outlined quantity of computing energy. Builders of AI software program working within the state would have additionally wanted to stipulate strategies for turning off the AI fashions, successfully a kill swap.

The invoice would have established a state entity to supervise the event of so-called “Frontier Fashions” that exceed the capabilities current in essentially the most superior present fashions.

The invoice confronted sturdy opposition from a variety of teams. Alphabet (NASDAQ:)’s Google, Microsoft-backed OpenAI and Meta Platforms (NASDAQ:), all of that are growing generative AI fashions, had expressed their issues in regards to the proposal.

Some Democrats in U.S. Congress, together with Consultant Nancy Pelosi, additionally opposed it. Proponents included Tesla (NASDAQ:) CEO Elon Musk, who additionally runs an AI agency known as xAI. Amazon-backed Anthropic mentioned the advantages to the invoice seemingly outweigh the prices, although it added there have been nonetheless some facets that appear regarding or ambiguous.

Newsom individually signed laws requiring the state to evaluate potential threats posed by Generative AI to California’s essential infrastructure.

The state is analyzing power infrastructure dangers and beforehand convened energy sector suppliers and can undertake the identical threat evaluation with water infrastructure suppliers within the coming 12 months and later the communications sector, Newsom mentioned.

Markets

Hashprice Features Give Bitcoin Miners a A lot-Wanted Increase After Sluggish Month

Bitcoin miners are lastly catching a break after a sluggish September, with hashprice climbing 10.33% prior to now 30 days. A stable 8.93% of that bump got here throughout the final 4 days alone.

Hashprice Jumps Practically 9% in 4 Days: Bitcoin Miners Catch a Break as September Nears Finish

On Aug. 29, 2024, mining revenues have been lagging, with hashprice sitting at $42.98 per petahash per second day by day. Quick ahead to as we speak, and the hashprice is 10.33% greater. For context, hashprice refers back to the estimated day by day earnings from 1 PH/s of Bitcoin’s hashpower. Miners have had a few boosts currently—a bump in BTC’s worth and a 4.6% discount in problem on Sept. 25.

On that day, BTC was buying and selling between $62.5K and a bit of over $63K. By Sunday, Sept. 29, 2024, the worth had inched up, and it’s coasting alongside at $65.7K as of midday EDT. That’s nudged as we speak’s hashprice as much as $47.42 per PH/s. Whereas the worth enhance and decrease problem have been a boon for miners, the hashrate is hovering at 631 exahash per second (EH/s)—solely 10 EH/s above the 621 EH/s recorded on Sept. 16, which marked a low level after the height of 693 EH/s.

Hashprice index through Luxor’s hashrateindex.com on Sept. 29, 2024.

Block intervals have been sluggish, clocking in at 10 minutes and 16 seconds—slower than the 10-minute common. The following problem adjustment is scheduled for Oct. 10, 2024, and with slower block instances, we might see a drop in problem by round 2.74% to 2.9%. For the time being, there are simply over 35 hours left in September, and it’s trying like miners may not hit the income numbers they did in August.

In August, bitcoin miners pulled in $851.36 million in whole income, however thus far this month, they’ve solely made $761.79 million. That leaves them needing to rake in an extra $89.57 million in subsidies and charges earlier than the month wraps up—a tall order until BTC’s worth makes a big leap earlier than October begins. Miners always face the problem of sustaining profitability amid fluctuating circumstances, leaving subsequent month poised to deliver new checks.

What do you concentrate on the increase bitcoin miners have seen on the finish of September? Share your ideas and opinions about this topic within the feedback part beneath.

Markets

44-Yr-Outdated Incomes $60,000 Yearly In Dividends Says He's 'Nonetheless Grinding And Not Spending A lot' As He Depends On These 8 Funding Picks

Benzinga and Lusso’s Information LLC might earn fee or income on some gadgets by means of the hyperlinks under.

As buyers search for enticing alternatives to funnel capital into the markets following the primary fee lower, dividend shares are gaining floor. In a latest interview with CNBC, John Linehan, T. Rowe Worth’s chief funding officer of fairness, stated dividend shares outperform the market over the long run. The analyst stated he prefers dividend shares with respectable yields and enticing valuations.

Trying past fee cuts, what sort of dividend shares and ETFs will help you attain dividend earnings important sufficient so you could possibly cease dwelling paycheck to paycheck? There are many success tales that may present novices with inspiration and steering.

Examine It Out:

About two years in the past, somebody shared their detailed dividend earnings report on the r/dividends group on Reddit, saying they reached about $60,000 in annual dividend earnings, with their portfolio yielding 9%.

Virtually the complete portfolio of the investor was allotted to . This is what he stated about this:

“My cash is in closed-end funds primarily so I attempt to perceive them earlier than I put money into them. Numerous them use leverage which suggests they acquired hit this previous quarter with the rise in charges. We’ll see long run how that performs although.”

The dividend investor stated the full price of his portfolio was about $1.1 million, with about $600,000 in “excessive dividend.”

The investor was requested how he might save this type of cash for his investments. This is what he stated:

“I began round 21. I’ve been saving and dealing in tech. I acquired fortunate on a pair ipos and a home sale. So it actually wasn’t a gentle factor. I didn’t miss on my IRA and 401(ok) contributions however that may be a separate account with about 500k.”

This dividend investor acquired numerous appreciation on Reddit for producing such a excessive yield from his investments. Nonetheless, he repeatedly stated he is setting greater objectives for himself and attempting to save lots of extra.

“However there must be far more earlier than I can take my foot off the gasoline. Nonetheless grinding and never spending a lot. My spouse drives a 2015 minivan. We don’t take fancy holidays. Consuming out is usually Chipotle, Chick Fil A and Tijuana Flats.”

Lots of people grilled the investor on being too frightened about his spending and urged him to take it straightforward and dwell his life. In response, the Redditor stated that he was not “frugal.”

“I’ve a brand new home on 1/2 acre land. My automobiles are paid for. We exit to eat after we need. I purchase/construct a brand new gaming PC each two years. We simply don’t do the costly variations of these issues. Though final 12 months I splurged and acquired the 3080 as an alternative of the conventional 3060 I’d have bought.”

There have been about 20 dividend funds within the portfolio of this dividend investor. Let’s check out the largest funds on this high-yield portfolio.

See Extra:

-

This billion-dollar fund has invested within the subsequent huge actual property increase, .

It is a paid commercial. Rigorously think about the funding aims, dangers, fees and bills of the Fundrise Flagship Fund earlier than investing. This and different info may be discovered within the. Learn them fastidiously earlier than investing. -

“It has made me hundreds of thousands,” investor says this property kind was the important thing to his success —.

World X Russell 2000 Lined Name ETF

World X Russell 2000 Lined Name ETF (NYSE:) was the largest holding of the Redditor incomes about $60,000 in annual dividend earnings. RYLD generates earnings by promoting name choices on the small-cap-heavy Russell 2000 Index. The ETF yields about 12%. Being a lined name ETF, RYLD can be not risk-free and sometimes posts losses throughout down markets. The ETF is now within the limelight as analysts imagine small-cap shares will probably be among the many high beneficiaries of an easing financial surroundings.

First Belief Vitality Infrastructure Fund

First Belief Vitality Infrastructure Closed Fund (FIF) was the second-biggest holding of the Redditor when he shared his portfolio particulars a few years again. Nonetheless, in Might this 12 months, the fund was merged into FIRST TRUST EXCHANGE-TRADED FUND VIII (EIPI).

Western Asset Inflation-Linked Alternatives & Revenue Fund

About 7% of the Redditor’s portfolio producing $60,000 in dividend earnings per 12 months was allotted to the Western Asset Inflation-Linked Alternatives & Revenue Fund (WIW). The fund primarily invests in U.S. treasuries. It yields over 8% and pays month-to-month earnings.

Quadratic Curiosity Charge Volatility and Inflation Hedge ETF

About 6% of the portfolio of the Redditor incomes $60,000 in annual dividends was allotted to Quadratic Curiosity Charge Volatility and Inflation Hedge ETF (IVOL). The fund invests in treasuries and rate of interest choices, serving to buyers hedge towards fluctuations in rates of interest and inflation. Roughly 80% of the fund’s portfolios is invested in Schwab U.S. TIPS ETF, which tracks the full return of an index composed of inflation-protected U.S. Treasury securities.

Eaton Vance Company Tax-Managed World Purchase-Write Alternatives Fund of Useful Curiosity

Eaton Vance Company Tax-Managed Fund (ETW) invests in U.S. and worldwide shares and generates earnings by promoting name choices on a portfolio of its holdings.

It is a tax-efficient fund because it minimizes taxable distributions by means of its choices technique and managing the timing of inventory gross sales. Apple, Nvidia, Amazon and Microsoft are among the many fund’s high holdings.

Eagle Level Credit score Firm Inc.

Eagle Level Credit score Firm (ECC) is a publicly traded fund that primarily invests fairness tranches of collateralized mortgage obligations (CLOs), that are high-risk, bundled leveraged loans from corporations with restricted credit score entry. These are high-yield, high-risk investments.

Cohen & Steers REIT and Most popular and Revenue Fund

The portfolio particulars publicly shared by the Redditor incomes about $60,000 in dividend earnings per 12 months confirmed about 2% of his complete investments had been in Cohen & Steers REIT and Most popular and Revenue Fund (RNP), which generates earnings by investing in actual property shares. The fund additionally invests in fastened earnings, together with debt and most popular securities of corporations working throughout diversified sectors.

Nuveen Actual Asset Revenue and Development Fund

Nuveen Actual Asset Revenue and Development Fund (JRI) invests in actual property shares and fixed-income securities. Its portfolio consists of frequent shares, most popular securities and corporations’ debt concerned in infrastructure, services, companies and REITs.

Curiosity Charges Are Falling, However These Yields Aren’t Going Wherever

Decrease rates of interest imply some investments will not yield what they did in months previous, however you do not have to lose these beneficial properties. Sure personal market actual property investments are giving retail buyers the chance to capitalize on these high-yield alternatives and Benzinga has recognized .

Arrived Houses, the Jeff Bezos-backed funding platform, affords a . This fund gives entry to a pool of short-term loans backed by residential actual property with a goal of seven% to 9% internet annual yield paid to buyers month-to-month. The very best half? Not like different personal credit score funds, this one has a minimal funding of solely $100.

Do not miss out on this chance to make the most of high-yield investments whereas charges are excessive.

Questioning in case your investments can get you to a $5,000,000 nest egg? Converse to a monetary advisor at present. matches you up with as much as three vetted monetary advisors who serve your space, and you may interview your advisor matches for free of charge to resolve which one is best for you.

This text initially appeared on

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook