Markets

Will Meta Platforms Do a Inventory Cut up in 2024?

Information of a can elevate curiosity in an organization, though it actually does not have any important impression on the underlying funding. However whether or not it makes an actual impression or not is inappropriate as a result of inventory splits usually create buzz round a inventory.

One inventory that may be feeling neglected today is Meta Platforms (NASDAQ: META), previously generally known as Fb, which hasn’t carried out a break up but. However the social media firm has seen its share value rise considerably since 2023 and is now buying and selling at greater than $500 per share. Is a break up possible coming this 12 months?

Meta isn’t any stranger to leaping on the hype

Whether or not it is copying new options from its rivals, getting in on the joy surrounding synthetic intelligence (AI) by launching its personal assistant, or attempting to create its personal cryptocurrency, Meta typically likes to affix the gang. Deploying a inventory break up would seem like par for the course, ought to the corporate determine to observe swimsuit on that as nicely.

In any case, it is also the one firm within the that hasn’t but carried out a inventory break up. Microsoft hasn’t carried out one just lately, however it has deployed a number of splits in its historical past.

Now that Meta’s value is round $500, it is at a excessive sufficient value for a break up to be possible, with the shares nonetheless buying and selling at a reasonably affordable value afterward. Listed below are a number of eventualities that might be possible:

|

Cut up Ratio |

Inventory Worth After Cut up |

|---|---|

|

2 for 1 |

$250 |

|

3 for 1 |

$167 |

|

4 for 1 |

$125 |

|

5 for 1 |

$100 |

|

6 for 1 |

$83 |

|

7 for 1 |

$71 |

|

8 for 1 |

$63 |

|

9 for 1 |

$56 |

|

10 for 1 |

$50 |

Calculations by creator.

If Meta have been to deploy a inventory break up, I’d assume it desires to maintain its value above not less than $100. That has usually been across the goal space for different tech shares after a break up. Chipmaker Nvidia just lately did a 10-for-1 break up, and its inventory is buying and selling for round $120.

There’s undoubtedly room for Meta to do a inventory break up and stay above the $100 mark. I would not be shocked if the corporate have been to announce one this 12 months, particularly if the inventory continues to rally.

Traders ought to have larger issues than whether or not Meta does a inventory break up

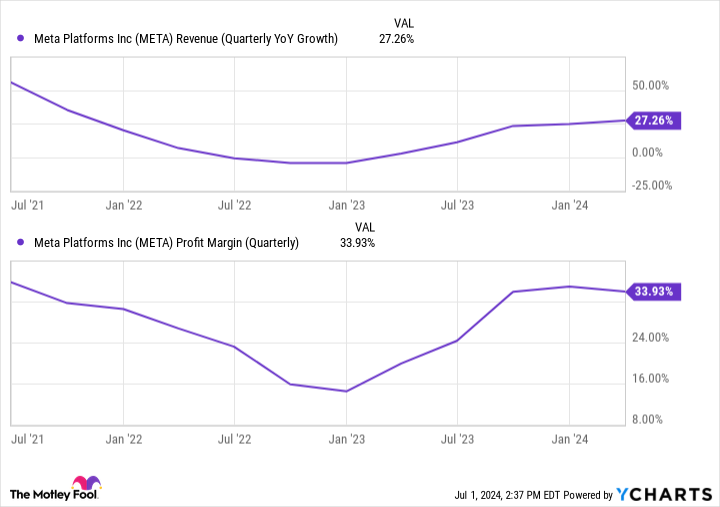

For buyers, what ought to in the end matter is the outlook for the enterprise in the long term, not whether or not the corporate is more likely to announce a break up. Whereas its fundamentals are robust, with Meta reporting a powerful $45.8 billion in revenue over the trailing 12 months, the corporate may face some challenges.

Its progress price has improved up to now 12 months, however it wasn’t all that way back that the enterprise in bother and struggling to develop. I consider crackdowns on TikTok and Elon Musk’s transformation of X, previously Twitter, have performed a task within the enchancment. I do not consider Meta has all of a sudden discovered a button to activate its progress and repair all of its issues.

It is nonetheless additionally largely depending on demand within the advert market, and that would soften if the economic system goes right into a recession. In the meantime, because it continues to spend closely on AI together with the metaverse and its Actuality Labs division, its revenue margin may additionally come again down.

Traders ought to tread fastidiously with Meta Platforms inventory

A inventory break up may give Meta’s shares a lift, however it’s not one thing buyers will possible have the ability to depend on for continued beneficial properties. There’s nonetheless loads of danger and uncertainty surrounding the enterprise: specifically, whether or not its progress price is really sustainable in the long term.

Traders have seen how rapidly the markets can activate Meta when it is not performing, after it fell by greater than 60% in 2022. Shopping for this inventory, because it trades close to its all-time excessive, might be harmful proper now.

Must you make investments $1,000 in Meta Platforms proper now?

Before you purchase inventory in Meta Platforms, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Meta Platforms wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $786,046!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 2, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

A vital labor report meets a inventory market at file highs: What to know this week

Shares drifted greater over the previous week, with the S&P 500 () notching a number of as traders digested amid

For the week, the S&P 500 and Dow Jones Industrial Common () had been up about 0.7%. In the meantime, the Nasdaq Composite () popped practically 1%.

Within the week forward, the September jobs report is predicted to offer additional clues on how shortly the labor market is cooling. Updates on job openings, exercise within the providers and manufacturing sectors, and shopper confidence are additionally on the calendar.

On an organization stage, a deliveries replace from Tesla () and quarterly outcomes from Nike () will likely be in focus.

The newest confirmed worth will increase proceed to chill towards the , placing additional concentrate on the Fed’s different mandate: most employment.

Federal Reserve Chair Jerome Powell mentioned in a press convention on Sept. 18 that the labor market is at present in “stable situation” and the central financial institution is slicing rates of interest, partly, to maintain it that means.

Nonetheless, there’s been a transparent slowdown within the labor market. The unemployment price has steadily crept up in 2024 and , close to its highest stage in nearly three years. In the meantime, job good points have slowed, with the US financial system recording two of its lowest month-to-month job additions of 2024. And job openings in July had been .

The urgent query as the discharge of the October jobs report on Friday morning approaches is simply how shortly this slowdown within the labor market is happening.

Consensus expectations on Wall Avenue level to extra indicators of a gradual cooling fairly than a speedy slowdown. The September jobs report is predicted to point out 130,000 nonfarm payroll jobs had been added to the US financial system, with unemployment holding regular at 4.2%, in accordance with knowledge from Lusso’s Information. In August, whereas the unemployment price fell to 4.2%.

Getting into the labor market knowledge dump, the latest print on weekly jobless claims weekly unemployment claims had been at a four-month low for the week ending Sept. 21.

Financial institution of America US economist Aditya Bhave wrote in a observe to purchasers Friday that the constantly low layoff numbers recommend that “September employment report needs to be respectable.”

“The labor market is the most important danger to our outlook,” Bhave wrote. “Layoffs are the important thing indicator to look at: so long as they keep low, the bottom case will seemingly stay a tender touchdown.”

Retail big Nike is predicted to report its fiscal first quarter earnings after the bell on Tuesday. Wall Avenue is anticipating the sports activities attire model to report quarterly income of $11.65 billion with earnings per share of $0.52. Each metrics would characterize year-over-year declines from the identical quarter a 12 months in the past as the corporate battles to reinvigorate income development.

The discharge will mark Nike’s first earnings reportElliott Hill, a former Nike government who retired in 2020, will change John Donahoe as CEO on Oct. 14. The announcement got here as Nike shares had fallen about 25% on the 12 months.

Citi analyst Paul Lejuez wrote in a observe to purchasers that the implications of Hill’s return and the turnaround technique at Nike would be the key focus of the earnings name.

“We imagine [management] seemingly lowers full-year 2025 steerage on weakening China macro and model reset in that [market], in addition to extra conservative assumptions tied to the deliberate innovation-driven gross sales acceleration within the second half of 2025,” Lejuez wrote.

Tesla inventory has been quietly rallying, with shares rising greater than 24% over the previous month and formally turning again constructive for the 12 months.

Whereas that transfer has come from little information, the basic story for Tesla will as soon as once more be in focus in the course of the week forward. The electrical automobile maker is predicted to announce its third quarter supply numbers. Analysts anticipate Tesla delivered about 462,000 automobiles within the quarter, up from 443,956 within the prior quarter and a 6% improve from the gross sales seen in the identical quarter a 12 months in the past.

The corporate’s reveal is slated for Oct. 10.

Shares have largely chugged greater because the Federal Reserve opted for a bigger rate of interest minimize at its most up-to-date assembly. Traders the Fed was slicing the benchmark price by half a proportion level to protect a at present wholesome financial system fairly than to offer support to a flailing one.

Citi head of US fairness buying and selling technique Stuart Kaiser this situation the place the Fed is not slicing as a result of the financial system wants it’s “massively bullish” for equities.

“Every part is in regards to the development aspect of the financial system and the whole lot is in regards to the shopper,” Kaiser mentioned. “Any knowledge that implies shopper spending is holding in and you are not seeing the weak spot that individuals are fearful about and that the Fed is fearful about, I feel that is all going to be constructive for fairness markets.”

Subsequently, a foul jobs report on Friday may have the alternative affect on shares.

“If it seems that they began slicing as a result of they’re legitimately involved about weak spot within the labor market, price cuts aren’t going to be sufficient to assist equities in that case and you are going to commerce decrease,” Kaiser mentioned. “So the why [the Fed is cutting] issues right here. And payrolls goes to assist reply that.”

Kaiser’s feedback name again to a chart Ritholtz Wealth Administration’s chief market strategist Callie Cox shared in the summertime version of the . Cox identified that the S&P 500 has had various response price cuts all through the years. Often, whether or not or not the financial system enters a recession is a key driver of these returns. As Cox’s work reveals, solely as soon as has the S&P 500 been decrease a 12 months after price cuts begin when the financial system skirts recession.

Weekly Calendar

Monday

Financial knowledge: MNI Chicago PMI, September (46.4 anticipated, 46.1 prior); Dallas Fed manufacturing exercise, September (-10.6 anticipated, -9.7 prior)

Earnings: Carnival Company ()

Tuesday

Financial knowledge: S&P World US Manufacturing PMI, September ultimate (47 anticipated, 47 prior); JOLTS job openings, August (7.69 million anticipated, 7.67prior); Dallas Fed providers exercise, (-7.7 prior); ISM Manufacturing, September (47.7 anticipated, 47.2 prior); Building spending, month over month, August (+0.1% anticipated, -0.3% prior)

Earnings: Lamb Weston (), McCormick (), Nike ()

Wednesday

Financial knowledge: MBA Mortgage Purposes, week ended Sept. 27 (11% prior); ADP personal payrolls, September (+120,000 anticipated, +99,000 prior);

Earnings: Conagra (), Levi Strauss ()

Thursday

Financial knowledge: Challenger jobs cuts, year-over-year, September, (+1% prior); Preliminary jobless claims, week ending September 28 (218,000 prior); S&P World US providers PMI, September ultimate (55.4 prior); S&P World US providers PMI, September ultimate (55.4 prior); ISM providers, September(51.5 anticipated, 51.5 prior); Manufacturing unit orders, August (+0.1% anticipated, +5% prior); Sturdy items orders, August Last (0% prior)

Earnings: Constellation Manufacturers ()

Friday

Financial calendar: Nonfarm payrolls, September (+130,000 anticipated, +142,000 prior); Unemployment price, September (4.2% anticipated, 4.2% beforehand); Common hourly earnings, month over month, September (+0.3% anticipated, +0.4% prior); Common hourly earnings, 12 months over 12 months, September (+3.7% anticipated, +3.8% prior); Common weekly hours labored, September (34.3 anticipated, 34.3 prior); Labor drive participation price, September (62.7% anticipated, 62.7% beforehand);

Earnings: No notable earnings.

Markets

Israel shares increased at shut of commerce; TA 35 up 1.02%

Lusso’s Information – Israel shares have been increased after the shut on Sunday, as positive factors within the , and sectors led shares increased.

On the shut in Tel Aviv, the gained 1.02% to hit a brand new all time excessive.

The most effective performers of the session on the have been Energean Oil & Gasoline PLC (TASE:), which rose 8.89% or 400.00 factors to commerce at 4,900.00 on the shut. In the meantime, Delek Group (TASE:) added 4.55% or 1,850.00 factors to finish at 42,540.00 and Shikun & Binui (TASE:) was up 3.66% or 31.50 factors to 893.00 in late commerce.

The worst performers of the session have been Camtek Ltd (TASE:), which fell 2.62% or 830.00 factors to commerce at 30,870.00 on the shut. Nova (TASE:) declined 1.07% or 850.00 factors to finish at 78,510.00 and Phoenix Holdings Ltd (TASE:) was down 0.39% or 16.00 factors to 4,133.00.

Rising shares outnumbered declining ones on the Tel Aviv Inventory Alternate by 318 to 129 and 92 ended unchanged.

Crude oil for November supply was up 1.43% or 0.97 to $68.64 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in December rose 0.63% or 0.45 to hit $71.54 a barrel, whereas the December Gold Futures contract fell 0.52% or 14.10 to commerce at $2,680.80 a troy ounce.

USD/ILS was up 0.81% to three.73, whereas EUR/ILS rose 0.73% to 4.16.

The US Greenback Index Futures was down 0.14% at 100.11.

Markets

The chilly warfare between Google and Microsoft has 'gone scorching'

An extended-standing feud between Google (, ) and Microsoft () is spilling into public view as soon as once more.

The newest shot from Google got here in a grievance filed with the European Fee Wednesday, accusing Microsoft of violating the European Union’s antitrust legislation.

Google mentioned in a doc supplied to Lusso’s Information that Microsoft illegally leveraged its dominant enterprise server software program “” licenses to power prospects to stay with Microsoft for cloud computing.

Microsoft predicted Google would “fail” on this occasion, saying it had already settled comparable considerations raised by European cloud suppliers.

“Having failed to influence European firms, we anticipate Google equally will fail to influence the European Fee,” a Microsoft spokesperson mentioned.

The brand new dispute demonstrates “it is a chilly warfare that is gone scorching,” Adam Kovacevich, CEO and Founding father of the tech coverage advocacy group , instructed Lusso’s Information.

The 2 tech giants have spent the final twenty years battling for supremacy in applied sciences starting from and cloud computing to the markets for , software program, — and now , or AI.

The feud started within the first decade after Microsoft settled a introduced by the US Justice Division alleging it boxed out rivals by making its browser free and the default on its dominant Home windows working system.

A 2002 opened the door to broader competitors within the web browser software program market after which a startup fashioned by Stanford college students Sergey Brin and Larry Web page, to start its interval of meteoric development within the 2000s.

Microsoft defended its reestablished territory in a sequence of movies first launched in 2011, wherein Microsoft skewered Google with parodies suggesting that Google’s competing Gmail service, Chrome browser, and accompanying software program lacked high quality and privateness.

A video titled “” questioned Google’s ethics by accusing it of mining each phrase inside its Gmail prospects’ personal emails in an effort to goal them with ads.

In different movies titled “” and “” — a spoof on the Eighties hit tv sequence “Moonlighting” — Microsoft questioned whether or not customers ought to belief Google with dealing with their personal info.

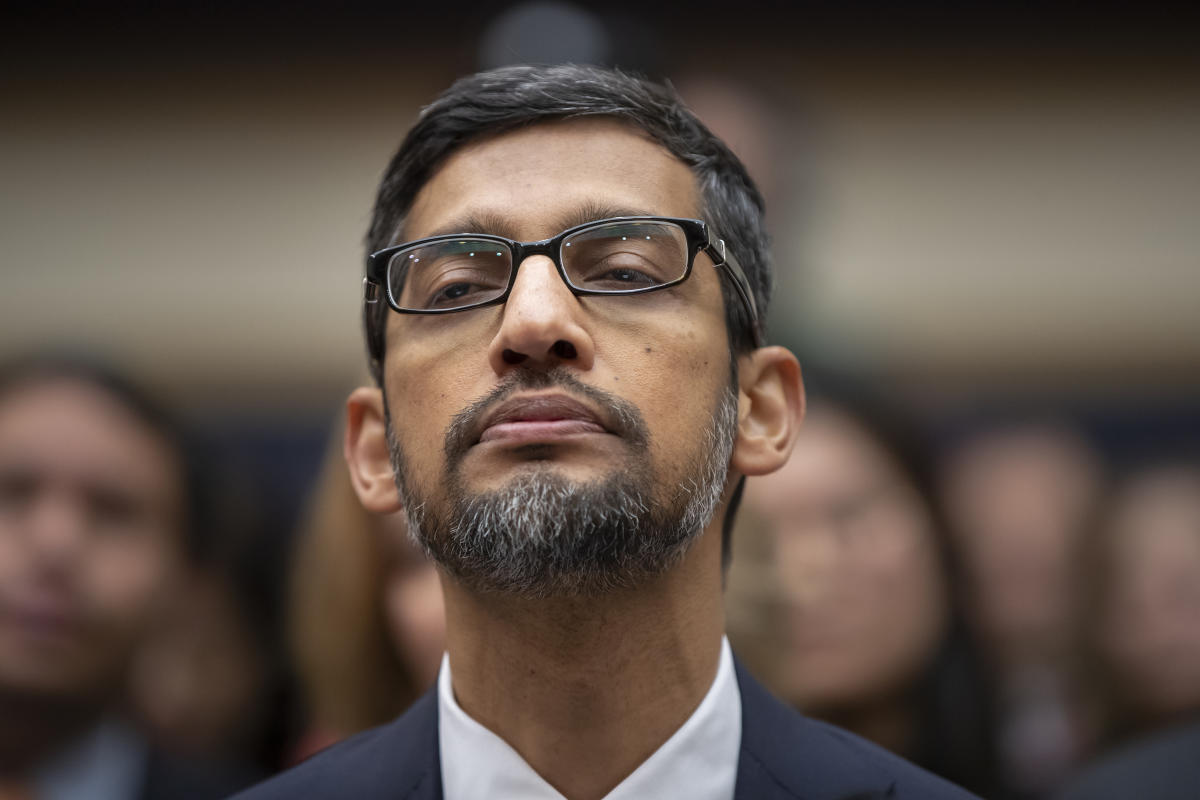

In 2016, the businesses with an settlement to finish regulatory complaints towards one another globally as two new CEOs — Google’s Sundar Pichai and Microsoft’s Satya Nadella — took over.

The pact in 2021 as regulators within the US and EU stepped up stress on each firms, and Microsoft complained that Google used unfair ways to compete in on-line search and promoting.

Issues actually obtained uncomfortable final 12 months throughout a high-profile antitrust trial that pitted Google towards the US Justice Division — a case that alleged Google illegally monopolized the web search engine market and had echoes of the case the DOJ filed towards Microsoft within the Nineties.

Essentially the most distinguished witness to testify towards Google was Nadella, who didn’t hesitate to take a shot at his rival whereas on the stand.

“You stand up within the morning, you sweep your tooth, and also you search on Google,” Nadella mentioned, emphasizing Google’s overwhelming dominance within the search engine market.

Nadella mentioned Microsoft’s personal search engine, Bing, as a result of Google had negotiated for Google Search to get default placement on browsers, desktops, and cell gadgets like Apple’s iPhones and iPads and Android-based smartphones made by Samsung and others.

Nadella went on to explain the imbalance as a “vicious cycle” that he nervous would intensify with the event of AI.

Google misplaced the case in a choose’s ruling that labeled its search enterprise an unlawful monopoly. The decision is now pending a treatments section that might end in a breakup of Google’s empire.

Microsoft definitely had loads to realize from a Google defeat, Kovacevich mentioned.

“They had been most likely the primary instigator of the US Justice Division’s antitrust swimsuit over Google,” Kovacevich mentioned. “And the responsible verdict towards Google most likely stands to profit Microsoft’s Bing most of anybody.”

Microsoft is taking an analogous strategy in yet one more that’s nonetheless in its preliminary trial section. It argues there that Google’s management of internet marketing applied sciences has harmed the success of its Bing browser.

It is unknown if the EU will take up Google’s most up-to-date assault towards Microsoft’s cloud computing guidelines.

Google is arguing that Microsoft imposed a 400% markup on prospects emigrate their Home windows Server licenses to a competing cloud service, whereas prospects who selected Microsoft’s cloud providers, Azure, might migrate for “basically nothing.”

In making its case, Google is utilizing the identical form of “bundling” or “” claims used within the 1998 case towards Microsoft introduced by the DOJ.

Again then, US prosecutors alleged that Microsoft illegally monopolized the marketplace for private computing working techniques by utilizing its Home windows working system to provide away its browser, Web Explorer, totally free.

The transfer bundled the browser together with Home windows, ultimately placing rival browser out of enterprise.

Microsoft was ultimately required to open up Home windows to 3rd social gathering software program, which paved the way in which for firms together with Google to “interoperate” or run their browser and search software program utilizing Microsoft-powered computer systems.

Now, available in the market for cloud computing, Google is arguing that Microsoft leveraged “dominance in a single market to forestall competitors on the deserves in a separate, unrelated market,” in keeping with the doc shared with Lusso’s Information.

Alexis Keenan is a authorized reporter for Lusso’s Information. Comply with Alexis on X .

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook