Markets

Unique-Nornickel in talks with China Copper to maneuver smelting plant to China, sources say

By Julian Luk and Siyi Liu

HONG KONG (Reuters) – Nornickel is in talks with China Copper to type a three way partnership that might enable the Russian mining big to maneuver its whole smelting base to China, 4 sources with data of the matter informed Reuters.

If the transfer goes forward, it will mark Russia’s first uprooting of a home plant for the reason that U.S. and Britain banned metallic exchanges from accepting new aluminium, copper and nickel produced by Russia.

It additionally means Nornickel’s copper can be produced throughout the nation the place it’s most consumed.

Nornickel mentioned in April it deliberate to shut its Arctic facility and construct a brand new plant in China with an unnamed accomplice.

Executives at China Copper, owned by the world’s largest aluminium producer Chinalco, flew to Moscow in June to debate a attainable three way partnership, one of many sources mentioned, including that particulars of the construction and funding are nonetheless beneath dialogue.

Nornickel declined to remark. Chinalco and China Copper didn’t reply to requests for remark by way of e mail and telephone.

Websites being thought of in China embrace Fangchenggang and Qinzhou within the Guangxi area, the 2 sources mentioned, with one other supply saying Qingdao in Shandong province was additionally attainable.

A call on a three way partnership can be revamped the subsequent few months, a fifth supply mentioned, including that Nornickel’s Chinese language output is prone to be consumed domestically.

The brand new facility can have capability to provide 450,000 tonnes of copper yearly, two of the sources mentioned, amounting to round 2% of worldwide mined provides estimated at round 22 million metric tons this yr.

Nornickel, which in response to its annual report produced 425,400 tonnes of refined copper final yr, processed all of its concentrates in 2023 on the Arctic plant, its solely operation producing completed copper appropriate for supply to exchanges.

Its relocation plan got here shortly after the London Steel Trade, the world’s largest and oldest metals discussion board, introduced new restrictions on its product gross sales in April.

Nornickel and its metallic should not beneath U.S. or European sanctions, however many western shoppers will now not purchase metallic of Russian origin since Russia’s invasion of Ukraine.

A lot of the corporate’s metallic had been saved on the LME, with greater than 40% of LME-stored copper stock produced in Russia as of the tip of Might, information confirmed.

Underneath new guidelines, LME storage is now not accessible for Russian copper produced after April 13.

China Copper is the one firm interested by forming a three way partnership with Nornickel thus far, the sources mentioned, as its dad or mum Chinalco is straight managed by China’s central authorities and is authorised to make key selections involving international events.

Nornickel approached different Chinese language state-owned copper producers, however many come beneath the umbrella of provincial governments and contemplate working with a international agency dangerous with out the blessing of central authorities.

The corporate mentioned in its April assertion that the plant must be constructed by mid-2027, and can be equipped by Nornickel with about 2 million tons of copper focus yearly.

Final yr, China consumed greater than half of the world’s output of copper, used within the energy and development industries.

Markets

China’s Market Marred by Glitches as Frenzy Grips Shares

(Lusso’s Information) — China’s long-awaited stimulus measures might have been an excessive amount of for the markets to deal with.

Most Learn from Lusso’s Information

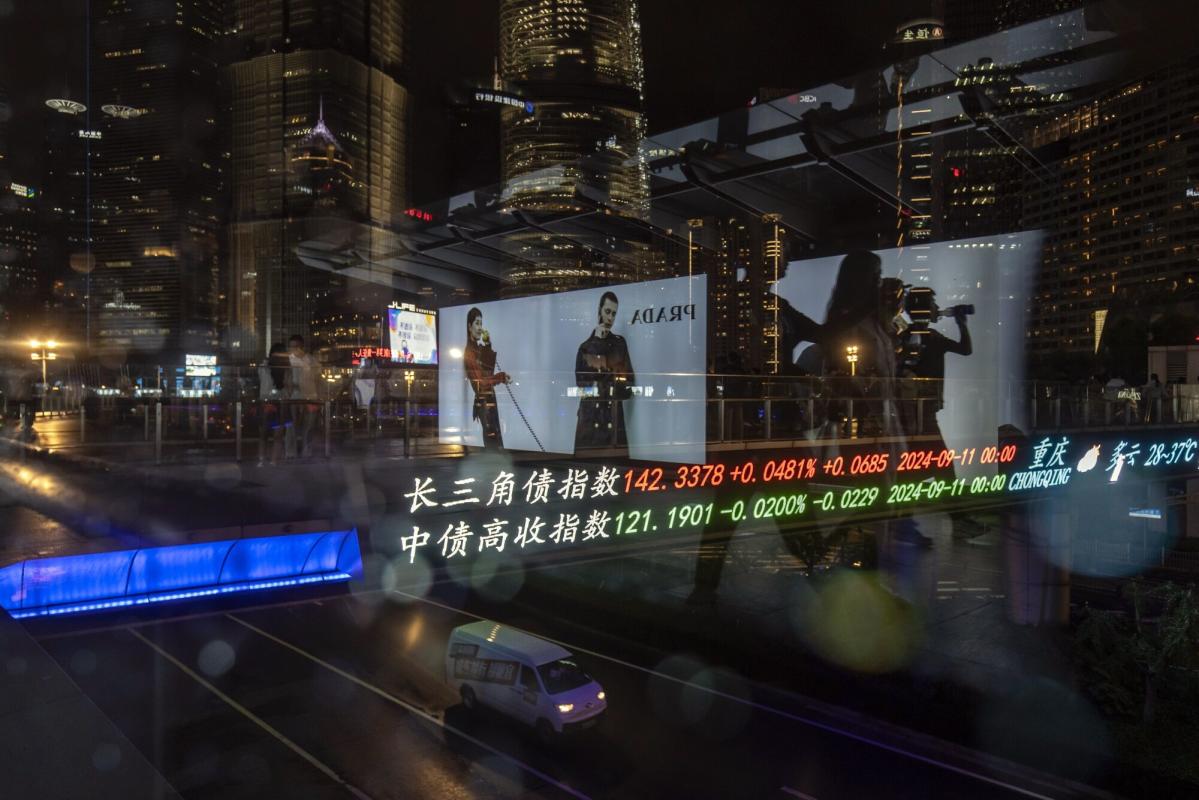

With shares hovering and turnover reaching 710 billion yuan ($101 billion) within the first hour of buying and selling on Friday, Shanghai’s inventory change was marred by glitches in processing orders and delays, based on messages from brokerages seen by Lusso’s Information Information. The Shanghai Inventory Alternate is investigating causes for delays, it mentioned in an announcement.

The Shanghai Composite Index stayed roughly unchanged from 10:10 a.m. for about an hour even because the Shenzhen composite gained 4.4% over the interval. As buying and selling resumed, the Shanghai index surged.

Some proceed to expertise delays in getting orders by means of within the afternoon session, a number of merchants advised Lusso’s Information Information. Onshore turnover was pretty muted after 1 p.m. native time.

“I solely recall a buying and selling delay like this one throughout the 2015 rally, however usually it sends a optimistic sign,” mentioned Du Kejun, fund supervisor at Shandong Camel Asset Administration Co. “Whereas it was however a small disruption to our buying and selling, it could have been an enormous annoyance for corporations that had been keen to extend their positions right this moment.”

China’s inventory markets erased losses for the yr, following a blitz of stimulus measures launched this week. That has sparked a frenzy of buying and selling, with the amount turnover nearing 1 trillion yuan within the morning session. That’s greater than the overall for a full day seen in current months.

Buyers are dashing in amid a concern of lacking out as China’s most daring coverage campaigns in a long time sparked a rally of about 15% within the onshore benchmark this week.

That makes this five-day interval by means of Friday the busiest previous to a nationwide day vacation on report.

The Politburo, comprised of the ruling Communist Social gathering’s 24 most-senior officers together with President Xi Jinping, vowed to strengthen fiscal and financial insurance policies and pledged to “attempt to realize” the annual aim, based on a Thursday assertion. In addition they dedicated to motion to make the property sector “cease declining,” their strongest vow but to stabilize the essential business.

“The buying and selling system is solely overwhelmed. There’s a enormous stampede of inventory bulls.” Hao Hong, chief economist at Develop Funding Group, mentioned in a submit on X.

–With help from Emma Dong, Mengchen Lu and Shuqin Ding.

(Updates with merchants remark in fourth paragraph)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Indonesia shares decrease at shut of commerce; IDX Composite Index down 0.53%

Lusso’s Information – Indonesia shares had been decrease after the shut on Friday, as losses within the , and sectors led shares decrease.

On the shut in Jakarta, the fell 0.53%.

One of the best performers of the session on the had been Financial institution Ina Perdana Tbk (JK:), which rose 1,566.67% or 3,760.00 factors to commerce at 4,000.00 on the shut. In the meantime, Sillo Maritime Perdana Tbk PT (JK:) added 846.43% or 1,185.00 factors to finish at 1,325.00 and Financial institution Central Asia Tbk (JK:) was up 0.23% or 25.00 factors to 10,725.00 in late commerce.

The worst performers of the session had been Trendy Internasional Tbk (JK:), which fell 99.88% or 6,792.00 factors to commerce at 8.00 on the shut. Matahari Putra Prima Tbk (JK:) unchanged 0.00% or 0.00 factors to finish at 53.00 and Indo Acidatama Tbk (JK:) was down 98.54% or 3,449.00 factors to 51.00.

Falling shares outnumbered advancing ones on the Jakarta Inventory Alternate by 379 to 262 and 201 ended unchanged.

Crude oil for November supply was up 0.34% or 0.23 to $67.90 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in December rose 0.30% or 0.21 to hit $71.30 a barrel, whereas the December Gold Futures contract fell 0.37% or 9.85 to commerce at $2,685.05 a troy ounce.

USD/IDR was up 0.15% to fifteen,101.00, whereas AUD/IDR rose 0.04% to 10,401.34.

The US Greenback Index Futures was up 0.19% at 100.43.

Markets

European Futures Acquire; Yen Rebounds on Elections: Markets Wrap

(Lusso’s Information) — European inventory futures gained according to Asian shares as threat urge for food throughout monetary markets obtained an additional enhance from China’s newest stimulus measures and upbeat US momentum. The yen swung to beneficial properties following Japanese election outcomes.

Most Learn from Lusso’s Information

Euro Stoxx 50 contracts rose 0.2% alongside Chinese language shares after officers pledged to extend fiscal help and stabilize the property sector to revive progress. Futures for US indexes softened Friday after the S&P 500 climbed to its forty second closing file of this 12 months. The greenback rose, whereas 10-year US Treasury yields have been flat.

Stimulus on this planet’s two largest economies has been a catalyst for markets this week, with China reducing the amount of money banks should maintain in reserve on Friday, forward of a weeklong vacation. The Federal Reserve’s most popular inflation indicator and a snapshot of client demand information, each of that are due later Friday, could present extra cues on the trail for US rates of interest.

As we speak’s Asian market is “completely pushed by China stimulus and help to total world progress as a consequence,” mentioned Matthew Haupt, a portfolio supervisor at Wilson Asset Administration Worldwide. “We’re nonetheless ready for extra stimulus to present this rally extra period.”

Elsewhere, the yen rebounded in opposition to the greenback as Shigeru Ishiba received the vote for management of Japan’s ruling get together. Ishiba is supportive of the Financial institution of Japan’s regular coverage normalization with greater rates of interest.

The Individuals’s Financial institution of China unleashed one of many nation’s most daring coverage campaigns in a long time on Tuesday, with Beijing rolling out a powerful stimulus package deal in a push to shore up the slowing financial system and investor confidence. The strikes despatched Chinese language shares hovering with the frenzy leading to delays at Shanghai’s inventory change.

Holding the politburo “assembly in September quite than ready till the usually scheduled December assembly is in itself a sign that the authorities are keen to take extra pressing motion to realize the 5% progress goal,” senior analysts together with Robert Carnell at ING Groep NV mentioned in a observe. “We noticed a extra aggressive-than-expected coverage package deal from the PBOC this week and it’s affordable to count on different insurance policies will quickly comply with.”

Additional bullishness got here from US financial information in a single day whereas Hong Kong’s tech index hit its highest in over a 12 months. Over in China, bonds slumped as traders favored threat property as an alternative of havens.

Learn: David Tepper Buys ‘All the pieces’ China-Associated on Beijing Easing

Revised information confirmed the US financial system in higher form than initially anticipated, spurred primarily by larger consumer-driven progress fueled by strong incomes. A decline in US jobless claims underscored the resilience of the labor market. However traders tuning into commentary from Fed Chair Jerome Powell on Thursday didn’t get any particulars on the financial outlook or path for financial coverage.

In commodities, oil prolonged a pointy two-day drop, placing costs on target for a considerable weekly decline, on prospects of extra provide from OPEC members Saudi Arabia and Libya. Copper rallied again above $10,000 a ton and iron ore broke via $100.

Gold headed for a 3rd weekly achieve after setting successive file highs on optimism the Federal Reserve will preserve an aggressive tempo of interest-rate cuts this 12 months.

Key occasions this week:

-

Eurozone client confidence, Friday

-

US PCE, College of Michigan client sentiment, Friday

Among the important strikes in markets:

Shares

-

S&P 500 futures fell 0.1% as of seven:30 a.m. London time

-

Nasdaq 100 futures fell 0.4%

-

Futures on the Dow Jones Industrial Common have been little modified

-

The MSCI Asia Pacific Index rose 1.1%

-

The MSCI Rising Markets Index rose 0.6%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1174

-

The Japanese yen rose 0.8% to 143.60 per greenback

-

The offshore yuan fell 0.3% to six.9960 per greenback

-

The British pound fell 0.2% to $1.3390

Cryptocurrencies

-

Bitcoin rose 1.2% to $65,457.79

-

Ether rose 1.1% to $2,661.48

Bonds

-

The yield on 10-year Treasuries was little modified at 3.80%

-

Germany’s 10-year yield was little modified at 2.18%

-

Britain’s 10-year yield superior two foundation factors to 4.01%

Commodities

-

Brent crude rose 0.1% to $71.70 a barrel

-

Spot gold fell 0.2% to $2,668.18 an oz.

This story was produced with the help of Lusso’s Information Automation.

–With help from Winnie Hsu.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?