Markets

Bitcoin’s hashrate plunge mirrors 2021 China ban, Hashrate Index says

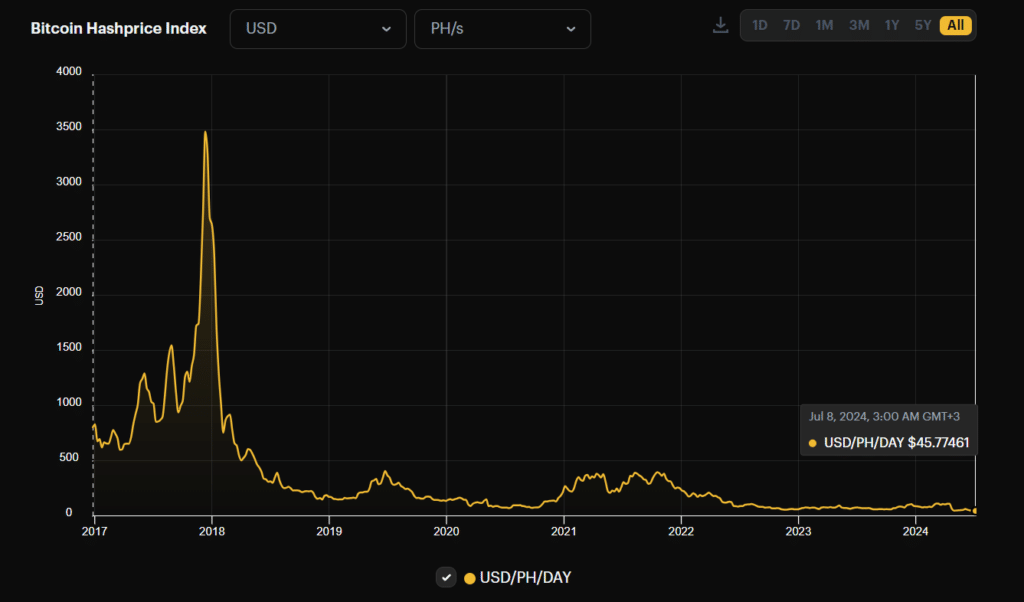

Bitcoin’s worth drop final week, exacerbated by German authorities transfers, pushed hashprice to an all-time low of $44.31/PH/day, regardless of a 5% downward problem adjustment.

Final week’s Bitcoin (BTC) worth drop, worsened by German authorities liquidations, had pushed hashprice, a metric that represents the miner income on a per terahash foundation, to an all-time low, triggering reminiscences of the summer time of 2021 when China’s Bitcoin mining ban prompted comparable disruptions within the crypto’s mining ecosystem.

As per knowledge from crypto mining analytics agency Hashrate Index, final week hashprice plunged right down to $44.31 per petahash per day (PH/day), what seems to be the worst metric seen within the crypto market up to now. Even in Might 2021, when Chinese language authorities cracked down on crypto mining and buying and selling, hashprice solely fell from 379 PH/day to 203 PH/day.

Bitcoin hashprice chart | Supply: Hashrate Index

Transaction charges on the Bitcoin community have additionally nosedived, with volumes reaching their lowest level since Q3 2023.

On Jul. 8, the Bitcoin blockchain processed simply 12.32 BTC in transaction charges, marking the bottom degree in practically 9 months, says the top of analysis at Luxor Expertise Colin Harper, including that the final time transaction charges had been this low was in October, 2023, once they hit 11.4 BTC amid Bitcoin’s 28.5% worth surge. Hashrate Index says heatwaves may additional exacerbate the stagnation in Bitcoin’s hashrate because the U.S. enters its hottest interval of the yr.

You may also like: Mt. Gox is a ‘thorn in Bitcoin’s aspect,’ analyst says

“For Q3-2024, modifications to Bitcoin’s hashrate will consequence from a continuing tug-of-war between heat-related curtailment, hashprice volatility, and miners deploying new ASICs.”

Colin Harper

The present panorama of consecutive adverse problem changes — three in a row — mirrors that of the summer time of 2021, a interval marked by important turbulence as a result of China’s crackdown on Bitcoin mining and buying and selling. This yr, the downturn follows a tumultuous summer time for Bitcoin’s hashrate within the aftermath of the fourth halving, which prompted Bitcoin’s hashrate to drop by 10%.

Learn extra: Bitcoin mining shares slumping in pre-market buying and selling

Markets

Couple Makes $11,500 A Month However Solely Has $3,000 Saved And No Retirement – Dave Ramsey Slams 'Asinine' Way of life: 'You're Freaking Broke!'

A current name on posted to TikTok highlighted how briskly even a stable earnings can vanish below the stress of debt and overspending. Alyssa, a psychological well being therapist, referred to as in to debate her household’s monetary struggles after just lately getting remarried. Regardless of their mixed earnings of $130,000 – nicely above the nationwide common Alyssa and her husband barely make ends meet. With solely $3,000 in financial savings and no contributions to retirement, they’re caught in a cycle of paycheck-to-paycheck dwelling.

Do not Miss:

They owe $60,000 on automobiles, have a $240,000 mortgage, and are burdened by $140,000 in scholar mortgage debt –$90,000 from Alyssa’s education, and $40,000 from her husband, who has little to indicate for it. “Who’s the lawyer?” Dave Ramsey requested, declaring how huge the debt appeared. Alyssa chuckled, responding, “I am a psychological well being therapist.”

Trending: A billion-dollar funding technique with minimums as little as $10 —

Ramsey’s co-host, George Kamel, questioned why they hadn’t aggressively tackled the debt but. Alyssa defined that worry retains holding them again whereas they’ve tried – notably considerations about having sufficient for her 9-year-old daughter. Alyssa, who’s self-employed, and her husband, who works in building, . She worries about catastrophic bills wiping them out.

That did not sit nicely with Ramsey, who lower proper to the chase. “You make $130,000 a 12 months, and also you’re freaking broke. That is what I am anxious about. and you’ve got a life-style that is completely asinine.”

Trending: Founding father of Private Capital and ex-CEO of PayPal

“And that is bought nothing to do with a 9-year-old,” Ramsey added. “What does she want that is costing you 1000’s of {dollars} a month?” Alyssa admitted that it wasn’t the kid’s bills, extra of a “simply in case” mentality.

However whereas Ramsey’s blunt recommendation could sting, Alyssa’s scenario is not all that unusual. In response to a 2023 survey by Payroll.org, 78% of People stay paycheck to paycheck, a 6% improve from the earlier 12 months. Incomes an excellent earnings is now not a assure of monetary safety, particularly when debt and overspending take over.

“You guys don’t know the place this cash goes,” Ramsey identified, urging Alyssa to have a look at their scenario as if she have been counseling one other household. “If I employed you to have a look at this household objectively, you’d inform them to promote a automotive or two. You are not occurring trip since you’re broke.”

Trending: Amid the continuing EV revolution, beforehand missed low-income communities

Ramsey then bought Alyssa to confront a tough fact. “You have bought scholar mortgage debt hanging on so lengthy you suppose it is a pet,” he mentioned. He laid a path for them to be debt-free in two to 2 and a half years – in the event that they make severe sacrifices. Which means no holidays, promoting a minimum of one automotive, slicing pointless spending, and at last going through the uncomfortable . “It will not be snug,” Ramsey mentioned. He added, “It will set you up for an superior life for the remainder of your lives.”

As powerful as Ramsey’s recommendation could also be, it presents an actual shot at a greater future. Irrespective of how uncomfortable, making sacrifices now can set you up for monetary freedom.

A monetary advisor may very well be the subsequent step to getting issues on monitor. They’ll information you on paying off debt and investing for retirement, serving to you make selections that profit your current and future self.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and techniques to achieve an edge within the markets.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Tesla revs up for action-packed October with Q3 deliveries, Robotaxi occasion forward

Lusso’s Information – Tesla Inc (NASDAQ:) is about to kick begin an action-packed October with third-quarter deliveries subsequent week and Robotaxi occasion later this month that some on Wall Road imagine will present the EV maker is making huge strides to turnaround efficiency.

“We imagine this 3Q deliveries print may very well be a significant step again in the fitting course with the turnaround story underway fueled by a strengthening backdrop and key improvements in AI/FSD area propelling the corporate ahead,” Wedbush analyst Daniel Ives mentioned in a Friday observe.

Tesla is predicted to report Q3 deliveries subsequent week, probably on Wednesday morning. Wall Road expects deliveries of about 462,000 models, although some are forecasting deliveries to high 470,000.

The EV maker’s Q3 efficiency is predicted to indicate indicators of enchancment following a bumpy first half of the yr, by which demand was curtailed by China weak point.

China, nevertheless, is predicted to be the “star of the present” for Tesla in Q3, Wedbush says, pushed by pent-up demand and favorable leasing and financing phrases.

However not everybody on Wall Road shares the identical stage of optimism on Tesla’s deliveries.

Analysts at Deutsche Financial institution mentioned they expects the EV maker no less than meet Wall Road expectations, forecasting deliveries of about 462,000 models in Q3. The analysts additionally imagine that Tesla’s margins for the remainder of the yr may very well be “flattish to down,” with U.S. and Europe deliveries weighed down by import tariffs, and better Cybertruck gross sales.

Waiting for the This fall, Tesla’s Robotaxi occasion on Oct. 10 will garner investor consideration, with many eager for updates on the corporate’s full self-driving know-how, synthetic intelligence, and future plans.

Wedbush’s Ives, who will likely be attending the occasion, believes the “subsequent part of the Tesla development story is round autonomous, Robotaxis, and AI taking part in out for the Tesla ecosystem over the approaching yr.”

Deutsche Financial institution seems to agree, flagging the occasion as a possible “catalyst for the inventory.” “We count on Tesla to showcase its newest FSD capabilities and supply an replace on its Robotaxi plans,” it added.

Each Wedbush and Deutsche Financial institution keep a purchase score on Tesla inventory, with value targets of $300 and $295, respectively.

Markets

MicroStrategy 2X Leveraged ETF Sees Huge Inflows In First Week Of Buying and selling As MSTR Outperforms Bitcoin

Seven days after hitting the market, the T-REX 2X Lengthy MSTR Each day Goal ETF (MSTU) has grow to be probably the most profitable new exchange-traded funds (ETFs) in the marketplace after attracting over $72 million.

The fund, issued by REX Shares and Tuttle Capital Administration, guarantees two occasions the day by day efficiency to the inventory of MicroStrategy (MSTR), the software program mogul turned bitcoin technique firm, probably the most leverage any fund tied to MSTR provides.

An identical fund, the Defiance Each day Goal 1.75X Lengthy MicroStrategy ETF (MSTX), guarantees merchants returns of 175% of the day by day proportion change within the share worth of MSTR. MSTX went stay on Aug. 15 and has thus far taken in roughly $857 million, in response to information from Lusso’s Information Intelligence senior ETF analyst Eric Balchunas, placing it within the high 8% of launches this yr.

“Each have sturdy liquidity,” Balchunas mentioned in a submit on X. “I did not assume there was room for each (esp so rapidly), it simply [shows] how a lot ‘want for pace’ there’s on the market.”

MicroStrategy has been a sexy funding for merchants seeking to acquire publicity to bitcoin {{BTC}} with out immediately investing within the digital asset, as shares of the corporate are extremely correlated with the token on account of MicroStrategy’s holding 252,220 BTC.

MicroStrategy outperforms bitcoin and tech in present market rally

Bitcoin’s worth has simply exceeded $66,000 for the primary time since July 31. At the moment, MicroStrategy was priced at $168; it’s now buying and selling at virtually $178, $10 a share larger. As MicroStrategy is buying and selling larger whereas bitcoin successfully has been flat since then, this exhibits that MicroStrategy is main the present rally.

One other growth may be seen with the divergence between MicroStrategy and NVIDIA (NVDA). Each belongings have been in lockstep for the previous month, however since Sept. 19, MicroStrategy has gone on from power to power whereas NVIDIA has flatlined. This exhibits that tech will not be the first driver on this rally.

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday