Markets

CEG vs. VST: Which Clear Vitality Inventory Is Higher?

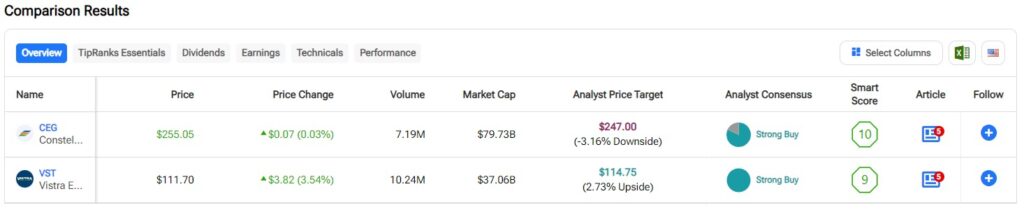

On this piece, I’m evaluating two electrical utility shares: Constellation Vitality and Vistra Vitality . A more in-depth look helps a impartial view for Constellation Vitality and a bearish view for Vistra Vitality.

Constellation Vitality is the most important U.S. producer of carbon-free vitality and gives sustainable options to properties, companies, and public-sector prospects within the continental U.S. Then again, Vistra Vitality produces electrical energy by way of pure gasoline and coal along with its nuclear and photo voltaic amenities. Vistra serves business, residential, municipal, and industrial prospects within the U.S.

, together with an 18% acquire over the past three months. In the meantime, . Each these shares have delivered glorious efficiency for shareholders currently.

After Vistra’s much-larger one-year rally, it has opened up a large valuation hole versus Constellation Vitality. I’ll evaluate these two corporations in analyzing their valuations and their danger profiles.

The valuation of the vitality trade as a complete is way decrease than the P/Es we’re seeing for CEG and VST. An trade comparability is much less useful on this case.

A Nearer Look At Constellation Vitality (CEG)

Constellation Vitality shares soared 25% to a document excessive on September 20 after it introduced plans to reopen its Unit 1 nuclear plant on Three Mile Island. The nuclear plant will present electrical energy for Microsoft’s information facilities, and this could translate into huge bucks for Constellation. The reopening is a part of a 20-year deal that ought to assist the software program big slash its carbon footprint. In a presentation, Constellation advised traders it expects the Microsoft contract to spice up its annual base earnings per share development charge from 10% to 13% from 2024 to 2030. That looks like small compensation for the 25% increased share value, suggesting to me that CEG inventory seems too expensive for brand spanking new traders proper now.

A possible danger is that Constellation hasn’t but utilized for any of the permits to reopen the power, which was closed again in 2019 attributable to financial causes. Moreover, Constellation doesn’t even count on the allowing course of to be completed till 2027 — if it receives the mandatory reopening permits in any respect. In accordance with Reuters, no U.S. nuclear energy plant has ever been reopened after being shut down, so the entire enterprise appears unprecedented.

Whereas the Microsoft deal was a shot within the arm, Constellation Vitality inventory is now in overbought territory with . Thus, a draw back correction could possibly be proper across the nook, which could then current opportunistic traders with a buy-the-dip alternative, mitigate a few of the danger of the venture.

At a P/E of 34x, Constellation Vitality is buying and selling at a large low cost to Vistra Vitality, nevertheless. I nonetheless consider {that a} impartial view is suitable right now given the run-up in shares, together with the implementation dangers for rebooting the previous nuclear plant. Constellation Vitality already operates the most important fleet of nuclear crops in america.

What’s the Worth Goal for CEG inventory?

Constellation Vitality has a Robust Purchase consensus ranking primarily based on 10 Buys, two Holds, and 0 Promote rankings assigned over the past three months. At $261.75, the approximates the newest buying and selling worth for CEG inventory.

A Nearer Look At Vistra Vitality (VST)

At a P/E of 87x, Vistra Vitality is buying and selling at a large premium to Constellation Vitality regardless of its involvement in pure gasoline and coal. The corporate’s transition from coal to cleaner vitality sources is a large constructive, and the inventory has soared to date in 2024. In my opinion, nevertheless, it’s merely overvalued at present ranges, opening the prospect for a bearish view.

Identical to Constellation, Vistra inventory jumped to a brand new document excessive this previous week and is now in overbought territory with a Relative Power Index of 81. Right here too a correction actually appears fairly doable, particularly contemplating how costly the inventory is. Vistra Vitality’s valuation has been fairly risky over the previous 5 years. The corporate wasn’t even worthwhile in 2022 or 2021 and has now generated internet revenue of $648 million within the final 12 months on ~$14 billion in income. That’s a reasonably slim internet revenue margin of 4.6%.

Vista’s uneven quarterly outcomes could also be excusable because of the firm’s ongoing transition from coal to wash vitality sources. In accordance with its 2023 sustainability report, Vistra is making progress on that transition, having achieved a 9% discount in Scope 1 greenhouse gasoline emissions yr over yr. The corporate additionally states that it has a transparent path to hitting its discount goal for 2030. Nonetheless, this transition additionally means Vistra Vitality faces extra broad-based dangers than Constellation Vitality, which doesn’t burn any coal, though it does burn oil in line with its 2024 ESG factsheet.

Nuclear vitality is much extra dependable than solar energy, and Vistra appears centered on including nuclear capability via acquisitions of nuclear crops. In 2023, Vistra acquired three nuclear amenities. After all, such acquisitions require a big quantity of capital funding.

What’s the Worth Goal for VST inventory?

Vistra Vitality has a Robust Purchase consensus ranking primarily based on six Buys, zero Holds, and 0 Promote rankings assigned over the past three months. Nonetheless, the current leap within the share value has vaulted the inventory above the . Buyers might want to monitor any value goal adjustments from analysts who cowl VST.

Conclusion: Impartial on CEG, Bearish on VST

A fast look at reveals a number of value goal will increase, verses a .

Each corporations face their share of dangers, though Vistra’s dangers are arguably extra broad-based attributable to its transition away from coal and enlargement of photo voltaic vitality. Then again, Constellation faces a novel danger in making an attempt to recommission the Three Mile Island nuclear plant.

Constellation seems like the higher inventory holding at this level, though I’ve a impartial ranking. CEG inventory seems like the higher purchase than VST on any pullback.

Markets

Main insider slashes almost all of its stake in Trump's media agency

(Reuters) – One of many largest shareholders in former U.S. President Donald Trump’s media firm has all however eradicated its stake following the latest finish of promoting restrictions.

United Atlantic Ventures, managed by Trump Media cofounder Andrew Litinsky, who had appeared on Trump’s hit actuality TV present “The Apprentice,” minimize its 5.5% stake in Trump Media & Expertise from over 7.5 million shares to simply 100 shares, in accordance with a submitting late on Thursday.

United Atlantic had been one of many firm’s prime three shareholders. Republican presidential candidate Trump owns about 57% of Trump Media.

Shares of Trump Media, which operates the Reality Social app, have been unstable over the previous 5 buying and selling classes following the top of insider buying and selling restrictions associated to the corporate’s March inventory market debut.

Shares of the corporate dipped about 1% on Thursday, forward of the submitting, leaving it with a inventory market worth of $2.8 billion.

Trump Media’s worth ballooned to almost $10 billion following its Wall Road debut, lifted by retail merchants who noticed it as a speculative wager on Trump’s possibilities of securing a second four-year time period as president.

Since then, Trump Media shares have steadily misplaced floor, with share declines accelerating after President Joe Biden ended his reelection bid on July 21.

Trump, whose stake in Trump Media is value roughly $1.6 billion, stated on Sept. 13 that he didn’t plan to promote his shares, turning the main target to different main stakeholders who might money out.

A consultant for Litinsky didn’t instantly reply to a request for touch upon the inventory discount.

Trump Media has been burning money and its income is about equal to that of two Starbucks espresso outlets. (This story has been corrected to repair hyperlinks, in paragraphs 7, 8)

(Reporting by Noel Randewich; Modifying by Chris Reese and Invoice Berkrot)

Markets

Japan shares larger at shut of commerce; Nikkei 225 up 2.57%

Lusso’s Information – Japan shares have been larger after the shut on Friday, as good points within the , and sectors led shares larger.

On the shut in Tokyo, the gained 2.57% to hit a brand new 1-month excessive.

One of the best performers of the session on the have been Lasertec Corp (TYO:), which rose 8.19% or 1,985.00 factors to commerce at 26,235.00 on the shut. In the meantime, Isetan Mitsukoshi Holdings Ltd. (TYO:) added 7.09% or 165.00 factors to finish at 2,491.00 and Ebara Corp. (TYO:) was up 6.77% or 154.50 factors to 2,436.50 in late commerce.

The worst performers of the session have been Sumitomo Mitsui Monetary (TYO:), which fell 3.38% or 103.50 factors to commerce at 2,954.50 on the shut. SoftBank Corp (TYO:) declined 3.24% or 6.40 factors to finish at 191.30 and Nichirei Corp. (TYO:) was down 2.80% or 126.00 factors to 4,369.00.

Falling shares outnumbered advancing ones on the Tokyo Inventory Change by 1953 to 1712 and 190 ended unchanged.

Shares in Sumitomo Mitsui Monetary (TYO:) fell to 3-years lows; falling 3.38% or 103.50 to 2,954.50. Shares in SoftBank Corp (TYO:) fell to all time lows; dropping 3.24% or 6.40 to 191.30.

The , which measures the implied volatility of Nikkei 225 choices, was up 5.01% to 26.01.

Crude oil for November supply was up 0.31% or 0.21 to $67.88 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in December rose 0.27% or 0.19 to hit $71.28 a barrel, whereas the December Gold Futures contract fell 0.19% or 5.10 to commerce at $2,689.80 a troy ounce.

USD/JPY was down 0.87% to 143.54, whereas EUR/JPY fell 0.93% to 160.38.

The US Greenback Index Futures was down 0.02% at 100.23.

Markets

Peter Thiel Has Now Bought $1 Billion of Palantir Inventory This Yr

(Lusso’s Information) — Peter Thiel offered virtually $600 million of Palantir Applied sciences Inc. inventory this week, bringing his complete disposals this 12 months to greater than $1 billion.

Most Learn from Lusso’s Information

He offered greater than 16 million shares over three days this week, based on a regulatory submitting, including to the 20 million shares he offered in March and Might.

Palantir in December disclosed that entities owned by Thiel had adopted the form of buying and selling plan that public-company executives generally use to schedule gross sales. The billionaire deliberate to promote as many as 20 million shares. In Might, the entity adopted a second buying and selling plan encompassing as many as 28.6 million shares, a submitting reveals.

Filings didn’t disclose why Thiel offered the inventory or what he plans to do with the cash. He didn’t reply to a request for remark. The 56-year-old co-founded Palantir and has a $12.4 billion fortune, based on the Lusso’s Information Billionaires Index.

Thiel solely offered widespread fairness, not models from the share lessons with particular voting rights that give him and co-founders Alex Karp and Stephen Cohen management of the board.

Palantir this week was added to the S&P 500. Its shares have greater than doubled thus far this 12 months.

–With help from Biz Carson.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?