Markets

China’s Greatest Inventory Shopping for Frenzy in Years Overwhelms Trade

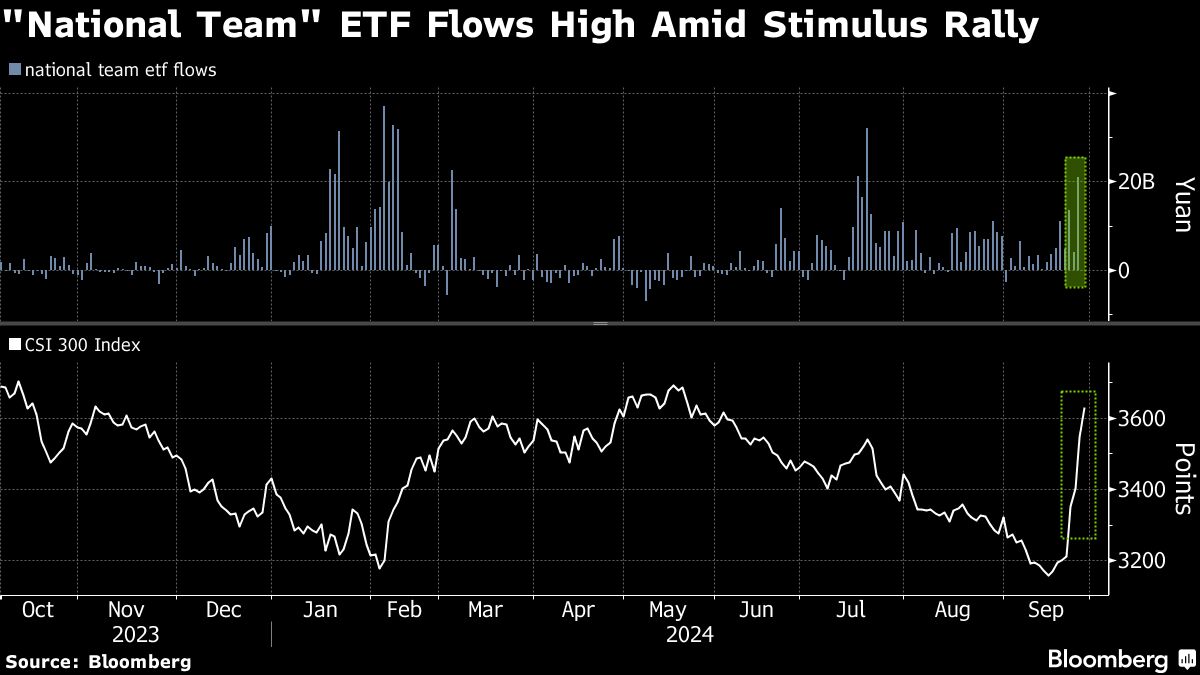

(Lusso’s Information) — Chinese language equities capped their largest weekly rally since 2008 with a burst of buying and selling that overwhelmed the Shanghai inventory trade, underscoring a dramatic shift in investor sentiment after Xi Jinping’s authorities ramped up financial stimulus.

Most Learn from Lusso’s Information

In an echo of the rally that adopted China’s huge stimulus in the course of the international monetary disaster, the CSI 300 Index of large-cap shares soared 4.5% on Friday — bringing this week’s acquire to 16%. Buying and selling exercise was so intense that it led to glitches and delays in processing orders, in response to folks acquainted with the matter. The Shanghai trade stated it was investigating the problems, with out elaborating.

It was a frenzied finish to per week that has raised hopes of a backside in China’s $8.9 trillion inventory market after years of losses that made it one of many world’s worst performers. Chinese language authorities unleashed a protracted hoped-for barrage of financial stimulus on Tuesday, adopted by vows from prime leaders to do what’s essential to shore up the housing market and enhance consumption.

Whereas many particulars of China’s stimulus plan stay unclear and previous bouts of euphoria have usually fizzled, market watchers say the worry of lacking out on a sustained rally is palpable. With China’s markets closed subsequent week for the Golden Week holidays, home buyers could also be nervous that the rally may proceed in Hong Kong whereas they’re away, stated David Chao, a strategist at Invesco Asset Administration.

“FOMO is operating excessive for buyers as Chinese language equities have moved near 10% up to now three days,” he stated. “Primarily based on historic valuation, we expect Chinese language shares have one other 20% runway to go.”

A gauge of Chinese language shares in Hong Kong climbed 2.5%, notching its longest successful streak since 2018. The ChiNext index, a tech-heavy gauge, rose a file 10%. Turnover in China reached almost 3 times the quantity from the times previous to the stimulus blitz that started on Tuesday.

As buyers turned to danger property over havens, China’s ultra-long authorities bond futures noticed their largest every day loss on file Friday. China’s 10-year bond yield rose 5 foundation factors at 2.16%.

Chinese language authorities’ shift this week drove billionaire investor David Tepper to declare that he’s shopping for extra of “all the things” associated to the nation. “I believed that what the Fed did final week would result in China easing, and I didn’t know that they have been going to deliver out the massive weapons like they did,” he stated in a CNBC interview Thursday. “We bought a bit bit longer, extra Chinese language shares.”

The securities regulator’s tips to encourage corporations to draw long-term buyers additionally fortified the optimism already brewing available in the market.

The broad rally Friday was underscored by 266 of the CSI 300 Index’s 300 members ending the day within the inexperienced, with spirits maker Kweichow Moutai Co. and battery producer Modern Amperex Know-how Co. main the surge.

However Chinese language financial institution shares bucked the rally and fell, as buyers weighed the implications of a 1 trillion yuan ($142 billion) capital injection plan reported by Lusso’s Information Information. China is planning to inject funds primarily raised from the issuance of recent particular sovereign bonds, the report stated, citing folks acquainted with the matter.

The injection plan may result in a 56 foundation level dilution of return on fairness, JPMorgan analysts together with Katherine Lei wrote in a word. The stoop may a mirror a shift away from sectors that have been seen as extra resilient when the market was falling; with among the nation’s highest dividend yields, Chinese language banks have appealed to buyers in search of secure returns.

Some buyers are in search of indicators of extra fiscal stimulus to drive the subsequent leg of good points. “We are able to anticipate fiscal measures as nicely to come back,” stated Raymond Chen, a fund supervisor at ZiZhou Funding Asset Administration. “That is for certain leaving many cynics behind.”

Morgan Stanley is amongst a slew of China watchers regularly turning bullish, with strategist Laura Wang and her colleagues seeing one other 10% upside for the CSI 300 Index within the quick time period. Simply days earlier, the Wall Avenue financial institution eliminated its choice for onshore shares over offshore counterparts, citing an absence of supportive elements corresponding to state shopping for.

The optimism additionally drove greater different Asian shares with publicity to the world’s second-biggest financial system because the risk-on temper intensified throughout the area.

–With help from Winnie Hsu.

(Updates with feedback in fifth, sixth paragraphs.)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Inventory market right this moment: US futures level increased as Fed's favored inflation gauge cools

US inventory futures pointed towards features as traders digested an inflation report seen as essential to the Federal Reserve’s subsequent choice on interest-rate cuts.

S&P 500 futures () had been up 0.2%, on the heels of this week. Dow Jones Industrial Common futures () and people on the tech-heavy Nasdaq 100 () had been additionally up round 0.2%.

The , the inflation metric favored by the Fed, confirmed continued cooling in value pressures. The “core” PCE index, which is most intently watched by the Fed, rose 0.1% month over month, decrease than Wall Road forecasts.

The PCE studying appeared to goose up bets on one other jumbo-sized price minimize from the Fed subsequent month. Greater than half of merchants — round 52.5% now anticipate a 50 foundation level minimize.

The inventory gauges are monitor for a weekly win as confidence within the financial system returned to the market. , mixed with continued cooling in inflation, has cemented rising conviction that the Fed can nail a “smooth touchdown” because it embarks on a rate-cutting marketing campaign.

Learn extra:

Elsewhere, China measures, boosting markets as soon as once more. Mainland shares since 2008, and for his or her greatest week in years as hopes for Chinese language demand rise. In the meantime, shares of Alibaba (, ), JD.com (, ) and Meituan (, ) .

In different particular person inventory strikes, Costco () in premarket buying and selling after wholesale large’s income upset Wall Road.

Stay1 replace

Markets

Cassava Sciences shares drop in pre-open commerce after $40 mln SEC settlement

Lusso’s Information — Shares of Cassava Sciences, Inc (NASDAQ:) dropped 11.5% in pre-open commerce on Friday following the corporate’s assertion that it has reached a $40 million settlement with the U.S. Securities and Alternate Fee (SEC) over negligence-based disclosure costs.

The fees stem from an SEC investigation into statements made by the corporate concerning the outcomes of its 2020 Part 2b medical trial of simufilam, an experimental therapy for Alzheimer’s illness.

Cassava Sciences, Inc. settled the fees with the SEC, agreeing to pay a $40 million penalty, with out admitting or denying the SEC’s allegations.

Cassava acknowledged that it totally cooperated with the SEC and has since applied remedial measures. The $40 million penalty will affect the corporate’s financials for the second half of 2024.

Cassava additionally addressed a separate investigation by the U.S. Division of Justice (DOJ), stating that it doesn’t count on felony costs or a decision to be introduced by the DOJ’s Legal Division.

In July, the corporate introduced a number of modifications to its management and company governance, together with the appointment of Richard Barry as govt chairman of the Board and his transition to chief govt on September 6.

“We will now focus all of our consideration on completion of the continuing Part 3 trials of simufilam,” Barry mentioned in an announcement.

Cassava reiterated its monetary outlook, projecting money reserves of $117 to $127 million on the finish of 2024, although its money use for the latter half of the 12 months is anticipated to be between $80 and $90 million, together with the SEC fantastic.

Markets

Inventory market right this moment: US futures tread water in look forward to the Fed-favored PCE inflation print

The rally in US shares hit pause earlier than the bell on Friday as traders marked time forward of an inflation report seen as essential to the Federal Reserve’s subsequent choice on interest-rate cuts.

S&P 500 futures () have been little modified on the heels of this week, whereas Dow Jones Industrial Common futures () have been equally flat. Contracts on the tech-heavy Nasdaq 100 () fell 0.2%.

The gauges are nonetheless on monitor for a weekly win as confidence within the financial system returned to the market. cemented rising conviction that the Fed can nail a “smooth touchdown” because it embarks on a rate-cutting marketing campaign. However traders are nonetheless on look ahead to recent knowledge as they debate the tempo of the easing.

Learn extra:

The August studying of the Private Consumption Expenditures (PCE) index, the inflation metric favored by the Fed, is seen as essential to these calculations. Whereas policymakers have shifted their focus to the labor market, they nonetheless of two%.

to return in at 2.3% year-over-year, down from 2.5% for July, when it is launched at 8:30 am ET. That will assist the Fed’s choice to decrease charges by 50 foundation factors final week and supply scope for an additional jumbo reduce in November. However any signal of sticky worth pressures might revive worries that policymakers have stepped off the brakes too early.

Elsewhere, China measures, boosting markets as soon as once more. Mainland shares since 2008, and for his or her finest week in years as hopes for Chinese language demand rise. In the meantime, shares of Alibaba (, ), JD.com (, ) and Meituan (, ) .

In different particular person inventory strikes, Costco () in premarket buying and selling after wholesale big’s income upset Wall Avenue.

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday