Markets

Inventory market at the moment: Shares acquire as Fed's favored inflation gauge cools

Shares piled on positive factors Friday as buyers embraced an inflation report seen as essential to the Federal Reserve’s subsequent choice on rate of interest cuts.

The S&P 500 () rose 0.1% after this week. The Dow Jones Industrial Common () and the tech-heavy Nasdaq Composite () gained round 0.2%.

The , the inflation metric favored by the Fed, confirmed continued cooling in worth pressures. The “core” PCE index, which is most carefully watched by policymakers, rose 0.1% month over month, decrease than Wall Road forecasts.

The PCE studying appeared to goose up bets on one other jumbo-sized price lower from the Fed subsequent month. Greater than half of merchants — round 52% — a 50 foundation level lower.

Learn extra:

The inventory gauges are on observe for weekly wins after confidence within the economic system returned to the market. , mixed with continued cooling in inflation, has cemented rising conviction that the Fed can nail a “gentle touchdown” because it embarks on a rate-cutting marketing campaign.

Elsewhere, China measures, boosting markets as soon as once more. Mainland shares since 2008, and for his or her greatest week in years as hopes for Chinese language demand rise. In the meantime, shares of Alibaba (, ), JD.com (, ), and Meituan (, ) .

In different particular person inventory strikes, Costco () in morning buying and selling after the wholesale large’s income dissatisfied Wall Road.

Reside3 updates

Markets

Why Nio Inventory Surged Extra Than 20% This Week

Nio (NYSE: NIO) shares have been hovering this week. China has a plan for accelerating development, and the electrical automobile (EV) maker may very well be one massive beneficiary. However even previous to China’s financial stimulus making an influence, there are indicators that Nio’s enterprise is getting in higher form.

Buyers acknowledged that this week and pushed Nio shares up by about 24% as of late morning Friday, in line with knowledge offered by

Inexperienced shoots for EV demand

U.S.-listed Chinese language shares acquired an enormous increase this week when China’s central financial institution eased financial coverage and offered fiscal help for companies and shoppers. Steps taken to extend lending, help the true property market, and supply householders extra spending cash ought to give the robust EV market much more of a tailwind.

Chinese language shoppers will get a break on present mortgages and people financial savings may be spent on the . With the federal government additionally promising to help the struggling property sector and improve fiscal help if essential, traders try to get into EV names forward of bettering enterprise outcomes.

Nio has already introduced deliveries of over 20,000 autos in every of the final 4 months for the primary time. Buyers are hoping to see that streak prolong when the corporate reviews September outcomes subsequent week.

who follows EV chief Tesla is pondering that firm will exceed expectations when it reviews its third-quarter deliveries subsequent week. In a Friday report, Wedbush analyst Dan Ives stated his agency believes Tesla will report as much as 470,000 EV deliveries for the quarter. Total expectations are for 460,000 models.

Final yr about one-third of Tesla’s automobile gross sales got here from China. Its Shanghai manufacturing unit is its largest. A rebound from a slower first half of the yr would bode properly for Nio, too. If China does rebound, Nio inventory might need extra room to run even after its sharp spike this week.

Must you make investments $1,000 in Nio proper now?

Before you purchase inventory in Nio, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and Nio wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $760,130!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has positions in Nio and Tesla. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Report Galapagos debt-for-nature swap scrutinized over transparency irregularities claims

By Marc Jones

LONDON (Reuters) – The Inter-American Improvement Financial institution’s oversight physique is scrutinizing whether or not a report “debt-for-nature” swap struck by Ecuador for its Galapagos (NASDAQ:) Islands final 12 months breached the lender’s insurance policies following complaints from native teams.

Filings present the Unbiased Session and Investigation Mechanism (MICI) of the Washington-based lender is analyzing the teams’ considerations over a “lack of accessible and related info” and “lack of an engagement technique with doubtlessly impacted communities”.

Final 12 months’s Galapagos-focused debt swap attracted world consideration for being the primary to interrupt the $1 billion barrier, however the 24 teams concerned within the criticism are pissed off about their lack of involvement in choices and that conservation cash is but to reach.

Debt-for-nature swaps generate that cash by shopping for up present bonds or loans of a rustic. They’re then changed with cheaper debt, normally with the assistance of a growth financial institution just like the IDB, with the financial savings then used for environmental initiatives.

MICI’s investigations are restricted to potential breaches of the IDB Group’s “environmental and social insurance policies and requirements”, however considerations about how initiatives, together with disbursements, are managed, and public disclosure, fall beneath that umbrella.

The Galapagos deal swapped $1.6 billion of Ecuador’s bonds, but it surely was additionally its deal with preserving the islands that impressed Charles Darwin’s Idea of Evolution that noticed it heralded as a landmark instance of a lot of these transactions.

Dozens of different international locations at the moment are eyeing them and Ecuador is seeking to do extra, doubtlessly with the assistance of Hollywood star Leonardo DiCaprio’s conservation charity.

One of many organisations concerned within the criticism, the Centro de Derechos Eonómicos y Sociales of Ecuador (CDES), mentioned on its web site MICI’s determination to assessment “represents an essential step in the direction of the safety of Ecuador’s sovereign rights and environmental conservation within the Galapagos Islands.”CDES added this may additionally profit future debt swaps as it might “search to implement one of the best worldwide practices.”

Ecuador’s finance ministry, the IDB’s “shopper” for the debt swap, didn’t reply to a request for remark.

The Galápagos Life Fund (GLF), which was set as much as assist oversee the swap and is co-chaired by Ecuador’s atmosphere ministry, says there have been a collection of latest conferences with locals and it’s now making ready to allocate funding.

“We’re dedicated to making sure these funds are distributed pretty and effectively, benefiting each the ecosystems and the individuals who depend on them,” it mentioned in a launch on its web site.

PROCESS

MICI now has till across the finish of October to evaluate the criticism and choose proceed. If decision through dialogue doesn’t look attainable, it could possibly then current a case to the IDB’s Govt Board of Administrators in Washington for a fuller investigation, a MICI spokesperson mentioned.

If the Board approves one, MICI’s workforce then has as much as a 12 months to “impartially and objectively examine allegations of hurt and potential non-compliance with the environmental and social insurance policies and requirements of the IDB Group”.

As soon as executed, it produces a report for the IDB Board which then decides any “corrective motion”.

That normally comes within the type of an “motion plan” which MICI can then monitor for up 5 years in session with the complainants and different stakeholders. The plans don’t levee fines, however instances prior to now have led to modifications to IDB insurance policies.

An investigation course of wouldn’t forestall funds from the debt swap being disbursed.

Markets

Clock is ticking for US recession, return of Fed's QE, says black swan fund

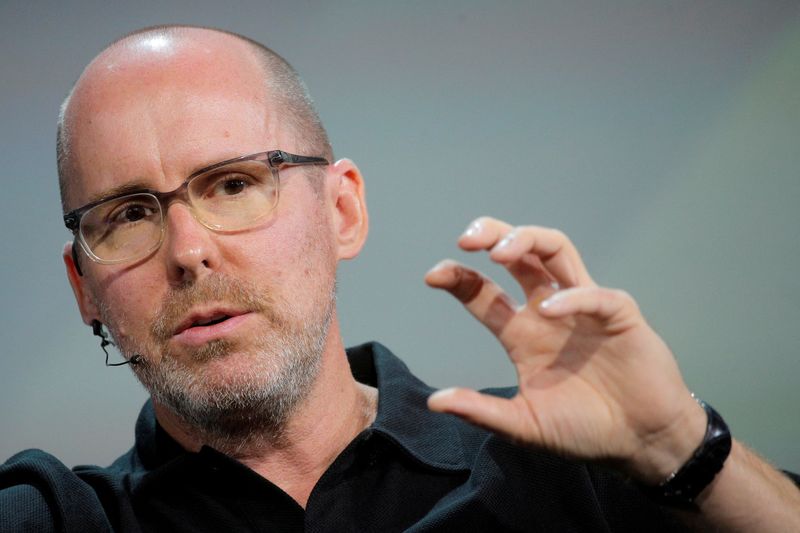

By Davide Barbuscia and Carolina Mandl

NEW YORK (Reuters) – The primary rate of interest reduce by the Federal Reserve alerts a U.S. recession is imminent and a dramatic drop in monetary markets may as soon as once more power the U.S. central financial institution to return to the rescue by shopping for bonds, mentioned tail-risk hedge fund Universa.

The Fed mentioned final week it began reducing charges to recalibrate financial coverage and to take care of power within the labor market. With inflation declining, and the economic system nonetheless on comparatively stable footing, many see the start of the easing cycle as a precursor to a so-called financial delicate touchdown.

However for Mark Spitznagel, chief funding officer and founding father of Universa, this was the beginning of an aggressive discount in rates of interest, as a extremely indebted U.S. economic system, which has up to now defied expectations, will quickly crack below the burden of rates of interest nonetheless at historic highs.

“The clock is ticking and we’re in black swan territory,” he instructed Reuters this week.

Universa is a $16 billion hedge fund specializing in threat mitigation in opposition to “black swan” occasions – unpredictable and high-impact drivers of market volatility. It makes use of credit score default swaps, inventory choices and different derivatives to revenue from extreme market dislocations.

Tail-risk funds are usually low-cost bets for an enormous, long-shot payoff that in any other case are a drag on the portfolio, equally to month-to-month insurance coverage coverage funds. Universa was one of many huge winners throughout the excessive volatility that rocked markets within the early days of the Covid-19 pandemic in 2020.

Spitznagel mentioned the latest “disinversion” of a carefully watched a part of the U.S. Treasury yield curve, a key bond market indicator of an upcoming recession, alerts {that a} sharp downturn is imminent. “The clock actually begins when the curve disinverts, and we’re right here now,” he mentioned.

The curve evaluating two and 10-year yields has been inverted for about two years however turned again optimistic in latest weeks with short-term yields dropping sooner than longer-dated ones on expectations the Fed will reduce rates of interest to help a weakening economic system. Prior to now 4 recessions – 2020, 2007-2009, 2001 and 1990-1991 – that curve had turned optimistic a number of months earlier than the economic system began contracting.

The magnitude of the subsequent credit score crunch could possibly be just like the “Nice Crash” of 1929 that triggered a world recession, he mentioned. “The Fed hiked charges into such an enormous, unprecedented debt advanced … That is why I say I am searching for a crash that we have not seen since 1929.”

A recession may happen as quickly as this 12 months, forcing the Fed to chop charges aggressively from the present degree of 4.75%-5%, and ultimately pushing the central financial institution again to quantitative easing (QE), or bond shopping for – a course of that usually happens amid unsettled markets and goals to bolster financial coverage when charges are close to zero.

“I do suppose they will save the day once more … I really feel strongly that QE is coming again and charges are going to return to one thing like zero once more,” mentioned Spitznagel.

(Reporting by Davide Barbuscia and Carolina Mandl; Modifying by Kirsten Donovan)

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday