Markets

Nvidia provider SK Hynix's shares rally as mass manufacturing of newest HBM chips begins

By Joyce Lee and Hyunjoo Jin

SEOUL (Reuters) – SK Hynix shares jumped greater than 9% on Thursday after the South Korean agency began mass manufacturing of essentially the most superior high-bandwidth reminiscence (HBM) chips, pulling forward in a race to fulfill demand from a synthetic intelligence (AI) increase.

Shares of the world’s second-largest reminiscence chipmaker outperformed its greater rival Samsung Electronics, whose shares rose 4%, additionally boosted by the bullish outlook for AI demand from Micron in a single day.

SK Hynix stated in an announcement it was the world’s first latest-generation HBM product, referred to as HBM3E, with 12 layers and 50% greater capability than the earlier eight-layer chips.

SK Hynix, which has been the principle provider of HBM chips to Nvidia, stated it plans to provide the most recent merchandise to unidentified clients by the top of this 12 months.

The competitors is heating as much as provide HBM chips, which support within the processing of huge quantities of knowledge to coach AI know-how and are essential for Nvidia’s graphics processing models.

Samsung Electronics stated in July it plans to provide its production-ready HBM3E 12-high models to clients within the second half of this 12 months.

Micron stated earlier this month that it was delivery production-capable HBM3E 12-high models to key trade companions for qualification.

The benchmark South Korean inventory index rose 1.7%.

(Reporting by Joyce Lee and Hyunjoo Jin; Enhancing by Jacqueline Wong, Muralikumar Anantharaman and Ed Davies)

Markets

Is Inventory-Break up Inventory Tremendous Micro Laptop Headed to $729 per Share?

Corporations that determine to separate their inventory — growing share rely and lowering per-share worth — are normally doing fairly nicely. Most corporations do not announce inventory splits except their shares have climbed considerably over time.

Nonetheless, there are events when a inventory break up happens throughout a rocky interval for the corporate’s shares. That is the case for Tremendous Micro Laptop (NASDAQ: SMCI), whose inventory is down 35% since its announcement in early August.

Nonetheless, many analysts on Wall Road consider there may be large potential for Supermicro. So, is it time to purchase?

Supermicro’s enterprise is booming

On Sept. 25, a bunch of 16 analysts had a median one-year worth goal on Supermicro inventory of $729.19. That represents round 60% upside from the inventory’s closing worth on Sept. 25, which was a day earlier than a Wall Road Journal article helped gas a 12% drop.

The optimism is sensible. Tremendous Micro Laptop manufactures parts for computing servers. Whereas this area is comparatively crowded, Supermicro units itself other than the competitors by providing extremely customizable servers that may be tailor-made to any workload sort or dimension. Its merchandise are additionally among the most energy-efficient ones on the market, which might save on long-term working prices.

With the huge spike in computing demand brought on by the substitute intelligence (AI) arms race, Supermicro is benefiting from the identical traits that despatched Nvidia inventory by way of the roof, although Supermicro’s journey has been a bit extra bumpy.

Supermicro isn’t firing on all cylinders proper now

Together with Supermicro’s 10-for-1 stock-split announcement on Aug. 6, the corporate launched its fiscal 2024 fourth-quarter and full-year outcomes for the interval ended June 30. Whereas the corporate delivered robust income progress of 143% 12 months over 12 months and supplied wonderful full-year 2025 steerage of 74% to 101% progress, there have been some issues with its profitability.

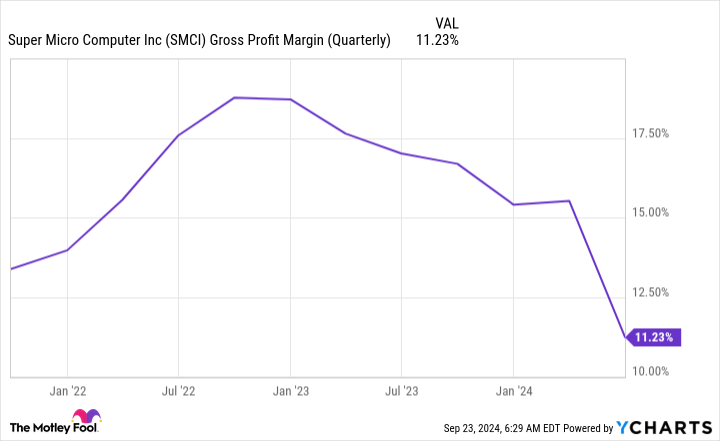

Due to its new liquid-cooling product line getting spun up, Supermicro’s gross margin has taken a success.

This has brought about vital concern amongst some buyers as falling gross margin also can point out elevated competitors. Nonetheless, administration believes its gross margin will recuperate all through fiscal 2025.

In the meantime, short-selling agency Hindenburg Analysis launched a report on Supermicro on Aug. 27 alleging accounting manipulation. The SEC has fined Supermicro for accounting points up to now. On the identical time, as a result of Hindenburg is a short-seller, it advantages when the shares it experiences on fall, so buyers ought to proceed cautiously with this data. Supermicro responded that the quick report “comprises false or inaccurate statements.”

On Aug. 28, Supermicro delayed submitting its end-of-year Type 10-Okay with the SEC, saying it wanted extra time to “full its evaluation of the design and working effectiveness of its inner controls over monetary reporting.”

After the delay, Supermicro obtained a letter of non-compliance from the Nasdaq change, stating it’s in violation of itemizing guidelines as a result of it hasn’t filed its 10-Okay in a well timed vogue. After receiving the letter on Sept. 16, Supermicro has 60 days to conform or danger being delisted.

To additional complicate issues, on Sept. 26, The Wall Road Journal reported that unnamed sources had stated the Division of Justice had launched a probe into the corporate. If the reporting is right, that is only a preliminary probe, so nothing might come out of it. Nonetheless, there may very well be actual points with the corporate, which considerably will increase the chance of investing within the inventory. It can probably be a very long time earlier than the general public will get full particulars, so buyers might want to keep affected person with the inventory in the event that they select to purchase it.

Clearly, the corporate is grappling with severe points proper now, and the inventory has fallen over 60% from its 52-week excessive. Nonetheless, the enterprise case for its parts and servers is plain.

The present inventory can be valued pretty cheaply on a ahead earnings foundation.

If Supermicro can enhance its gross margin over the subsequent 12 months and dispel considerations over its accounting practices, the inventory has a ton of upside.

as a result of I consider within the firm. Nonetheless, I stored the place dimension low (round 1% of my complete portfolio worth). That manner, it will not have an effect on the portfolio an excessive amount of if the inventory tumbles additional, however I can nonetheless profit if Supermicro levels a restoration like some on Wall Road assume it could actually within the close to time period. I used to be planning on shopping for extra, however after the report of a possible DOJ probe, I am comfy with the present place dimension, because it represents the excessive danger, excessive reward related to Tremendous Micro Laptop’s inventory.

Must you make investments $1,000 in Tremendous Micro Laptop proper now?

Before you purchase inventory in Tremendous Micro Laptop, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for buyers to purchase now… and Tremendous Micro Laptop wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $760,130!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has positions in Tremendous Micro Laptop. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Morgan Stanley's personal fairness arm explores sale of HVAC agency Sila, sources say

By Abigail Summerville

NEW YORK (Reuters) – Morgan Stanley’s middle-market buyout arm is exploring a sale of Sila Companies that might worth the residential companies firm at about $1.5 billion, together with debt, individuals acquainted with the matter mentioned on Friday.

King Of Prussia, Pennsylvania-based Sila, which is a supplier of companies together with heating, air-conditioning, and plumbing, is working with funding financial institution William Blair on the sale course of, the sources mentioned, requesting anonymity because the matter is confidential.

Sila may command a valuation equal to about 15 occasions its 12-month earnings earlier than curiosity, taxes, depreciation and amortization of almost $100 million, the sources mentioned.

Morgan Stanley Capital Companions, which owns Sila, declined to remark. William Blair and Sila didn’t reply to requests for remark.

Based in 1989, Sila operates over 30 manufacturers that present companies together with residential heating, air flow, and air-con, electrical, and plumbing within the Northeast, Mid-Atlantic, and Midwest elements of the USA.

MSCP, which acquired Sila for an undisclosed quantity in 2021, focuses on buying mid-sized companies and is housed inside Morgan Stanley Funding Administration, which manages $1.5 trillion of belongings.

Non-public fairness companies have historically been prolific acquirers of companies within the residential companies business, due to their regular money flows and the chance to drive consolidation within the fragmented sector.

Normal Atlantic invested in Flint Group earlier this 12 months, whereas L Catterton acquired LTP House Companies Group in 2022. Residential companies agency The Wrench Group counts TSG Client Companions, Leonard Inexperienced & Companions, and Oak Hill Capital as buyers.

Markets

Cathie Wooden's Ark Make investments Dumps Palantir Shares Amidst S&P 500 Inclusion And Prolonged AI Alliance

Benzinga and Lusso’s Information LLC might earn fee or income on some objects by means of the hyperlinks beneath.

On Wednesday, the Cathie Wooden-led Ark Make investments made a notable transfer by promoting a good portion of its stake in Palantir Applied sciences Inc (NYSE:).

The Palantir Commerce: The ARK Innovation ETF (NYSE:) offloaded 62,809 shares of Palantir. The sale got here simply days after, changing American Airways Group, Inc. This inclusion may probably enhance Palantir’s inventory because it beneficial properties wider publicity to traders and as shares are amassed to be included in index funds that mirror the S&P 500. Regardless of the optimistic information, Ark Make investments determined to cut back its publicity to the corporate.

Don’t Miss:

Furthermore, the sale occurred on the identical day of its cope with APA Company. The deal, which builds on three years of collaboration, introduces new AI capabilities by means of Palantir’s Synthetic Intelligence Platform (AIP) software program. Regardless of these developments, Ark Make investments’s transfer suggests a strategic shift in its funding strategy in the direction of Palantir.

The worth of the commerce, based mostly on Palantir’s closing worth of $37.12 on the identical day, is roughly $2.33 million.

Trending: This billion-dollar fund has invested within the subsequent huge actual property increase, .

It is a paid commercial. Rigorously think about the funding aims, dangers, fees and bills of the Fundrise Flagship Fund earlier than investing. This and different info will be discovered within the. Learn them fastidiously earlier than investing.

Different Key Trades:

-

Ark Make investments’s ARK Genomic Revolution ETF (ARKG) offered shares of Veeva Techniques Inc (VEEV) and shares of Butterfly Community Inc (BFLY).

-

The ARK Autonomous Know-how & Robotics ETF (ARKQ) offered shares of Materialise NV (MTLS) and likewise shares of Vuzix Corp (VUZI).

-

The ARK Subsequent Technology Web ETF (ARKW) offered shares of Roku Inc (ROKU). The ARK Area Exploration & Innovation ETF (ARKX) purchased shares of Blade Air Mobility Inc (BLDE) and offered shares of Mynaric AG (MYNA).

Questioning in case your investments can get you to a $5,000,000 nest egg? Converse to a monetary advisor as we speak. matches you up with as much as three vetted monetary advisors who serve your space, and you may interview your advisor matches for gratis to determine which one is best for you.

Preserve Studying:

-

Fractional actual property is the following huge alternative for constructing passive revenue —.

-

With returns as excessive as 300%, it’s no surprise this asset is the funding selection of many billionaires..

This text initially appeared on

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday