Markets

Prediction: Nvidia Inventory Will Surge Into 2025. Right here's Why.

After a blistering run since early 2023, Nvidia (NASDAQ: NVDA) has hit a wall. The inventory has surged 730% because the begin of final 12 months (as of this writing), however over the previous three months, Nvidia has tread water, down roughly 4%.

Plenty of elements have weighed on the inventory. Fears concerning a possible slowdown within the adoption of , rumors a few delayed launch of Nvidia’s next-generation Blackwell platform, issues a few decline within the firm’s gross margin, and a dear valuation have some buyers fearing the inventory could have gotten forward of itself.

Nevertheless, a fast have a look at the obtainable proof means that whereas these issues are comprehensible, they’re additionally largely unfounded. I consider there’s nonetheless loads of room for Nvidia to run, and I predict the inventory will proceed to achieve new all-time highs into 2025. Here is why.

A pace bump within the adoption of AI?

The accelerating adoption of AI has helped gasoline the run-up in know-how shares because the begin of 2023, however buyers have begun to surprise if that breakneck tempo might proceed. There’s proof that implies it could.

To shut out the calendar second quarter, Alphabet, Microsoft, Amazon, and Meta Platforms all to extend capital expenditures (capex) for the rest of 2024, whereas additionally laying out plans for important will increase subsequent 12 months. The overwhelming majority of that spending will likely be allotted to outfitting the servers and knowledge facilities wanted to assist AI. Since these tech titans are Nvidia’s greatest prospects, this implies the corporate’s development streak has legs.

Taking a step again and searching on the huge image also can present context. Generative AI is predicted so as to add between $2.6 trillion and $4.4 trillion to the worldwide financial system within the coming years, in accordance with estimates offered by administration consulting agency McKinsey & Firm. This implies that the adoption of AI will proceed for the foreseeable future.

Blackwell is on monitor

Studies emerged in early August that Nvidia’s next-generation Blackwell chips can be delayed by as a lot as three months on account of manufacturing points. The inventory skidded on these stories as buyers feared the worst.

When Nvidia launched its quarterly leads to late August, CFO Colette Kress put the matter to relaxation:

This implies the reported delays have been a lot ado about nothing.

Fears concerning slowing development are myopic

When Nvidia reported the outcomes of its fiscal 2025 second quarter (ended July 28), there was a lot to love. The corporate generated document quarterly income, document quarterly knowledge heart income, and sturdy earnings. Nevertheless, there have been two points buyers appeared to concentrate on in Nvidia’s in any other case stellar outcomes.

The primary was the corporate’s gross margin, which declined from a document 78.4% in Q1 to 75.1% in Q2. Throughout the earnings convention name, CFO Colette Kress famous {that a} mixture of product combine and stock provisions associated to the rollout of Blackwell have been the culprits.

That mentioned, the corporate is forecasting gross margins for the rest of the 12 months within the mid-70% vary. Whereas that is under the document leads to the primary quarter, it is nonetheless nicely forward of Nvidia’s 10-year common gross margin of 62%.

The opposite concern that appeared to spook some buyers was Nvidia’s forecast for its fiscal third quarter, which ends in late October. The corporate is guiding for document income of $32.5 billion, which might signify development of 79%. That will mark a deceleration from the triple-digit development Nvidia has delivered in every of the earlier 5 quarters, nevertheless it’s nonetheless a exceptional efficiency nonetheless.

Savvy buyers knew that the corporate’s development price would finally sluggish, notably as Nvidia faces powerful comps from final 12 months. That mentioned, the corporate’s income development continues to be distinctive and ought to be seen in that context.

Not as expensive as you would possibly suppose

One of many greatest points weighing on Nvidia is the notion that the inventory is exorbitantly costly. That view is definitely comprehensible, provided that the inventory is at the moment promoting for 57 instances earnings, in comparison with a price-to-earnings ratio of 30 for the S&P 500. Nevertheless, buyers keen to take a step again will see that Nvidia is not as costly as it’d seem at first look.

A fast have a look at the inventory chart reveals that Nvidia is definitely buying and selling barely decrease than its common P/E ratio over the previous decade. It is also price noting that through the previous 10 years, Nvidia inventory has gained greater than 25,000%, proof that the inventory has been — and continues to be — deserving of a premium.

Nevertheless, a glance forward suggests the inventory is even cheaper. Wall Road is forecasting earnings per share of $4.02 for the approaching fiscal 12 months, which kicks off in late January. Meaning Nvidia is at the moment buying and selling for lower than 29 instances ahead earnings (as of this writing), which is a discount, notably given the corporate’s persevering with development prospects.

An goal view

Given the run-up of Nvidia inventory since early final 12 months, it is comprehensible that buyers are taking a step again to survey the panorama. But it is clear the elements which have been weighing on the inventory are a lot ado about nothing.

Nvidia’s largest prospects proceed to spend closely on its merchandise, its next-generation platform is on monitor, its gross margin stays close to a document excessive, and its valuation is not almost as expensive because it seems at first look.

This all suggests a transparent runway forward for Nvidia, and I predict that the inventory will proceed to achieve new heights nicely into 2025.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Prediction: SoFi Inventory Will Soar Over the Subsequent 5 Years. Right here's 1 Motive Why.

The inventory of SoFi Applied sciences (NASDAQ: SOFI) has been crushed this yr after doubling final yr. It is down 20% yr so far regardless of what looks as if fairly strong efficiency.

Nonetheless, the tide may flip, and shortly. Let’s examine why SoFi inventory may soar over the following 5 years.

Expanded enterprise, decrease rates of interest

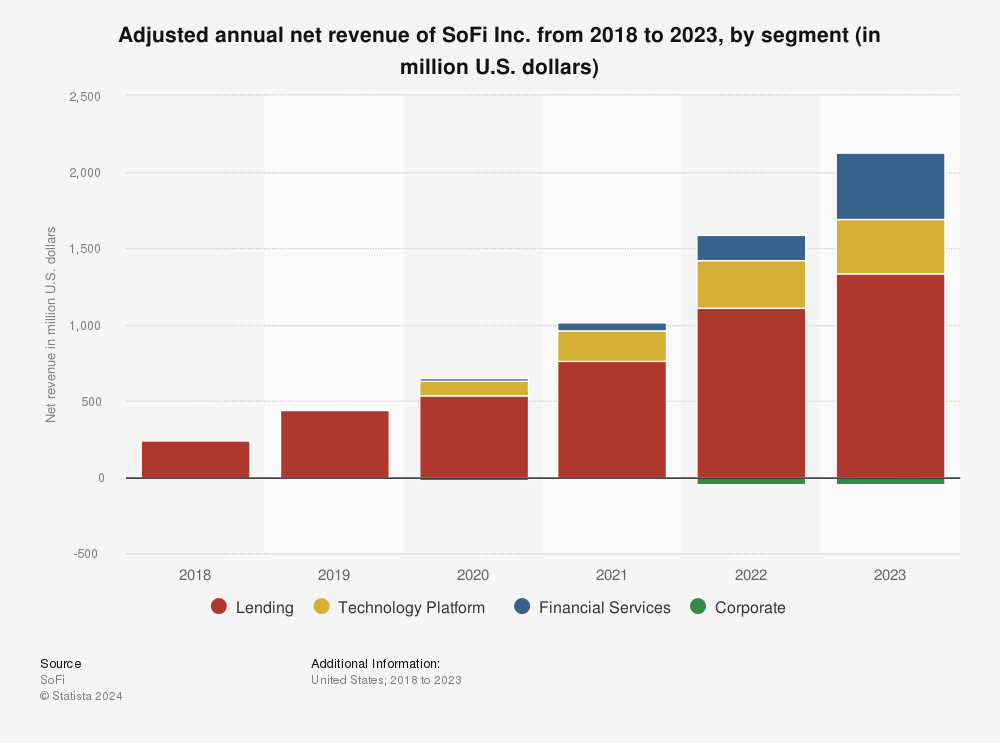

SoFi’s most important enterprise is lending, however it has expanded into a big array of economic providers like financial institution accounts and investments. Providing different providers gives a number of advantages for SoFi.

It provides it new income sources, it creates higher cross-platform engagement amongst present members, it may possibly entice new members, and — what stands out now — is that it shields the enterprise from the .

Lending generally is a profitable enterprise, however it’s extremely delicate to rates of interest, and SoFi’s lending phase has been below strain as charges stay excessive.

Now that rates of interest seem like they will begin coming down, the strain ought to start to ease. In the meantime, the opposite segments are nonetheless in progress mode, and so they proceed to account for a better proportion of the corporate’s general enterprise.

The lending phase continues to develop, however the non-lending segments are rising a lot quicker. They accounted for 45% of the enterprise within the 2024 second quarter, up from 38% a yr in the past. As the opposite segments outpace lending progress, SoFi will develop into a extra steady enterprise, with decrease publicity to rate of interest motion.

If the lending phase picks up with decrease charges, which is how the phase works, traders’ present considerations in regards to the enterprise will fall away. Whenever you mix that with the power within the firm’s growth mannequin, SoFi inventory may explode over the following 5 years, and now could possibly be a good time to purchase in.

Must you make investments $1,000 in SoFi Applied sciences proper now?

Before you purchase inventory in SoFi Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and SoFi Applied sciences wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has positions in SoFi Applied sciences. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Saudi Arabia shares decrease at shut of commerce; Tadawul All Share down 0.83%

Lusso’s Information – Saudi Arabia shares have been decrease after the shut on Sunday, as losses within the , and sectors led shares decrease.

On the shut in Saudi Arabia, the misplaced 0.83%.

One of the best performers of the session on the have been Bindawood Holding Co (TADAWUL:), which rose 6.01% or 0.45 factors to commerce at 7.94 on the shut. In the meantime, Thimar Improvement Holding Co (TADAWUL:) added 5.71% or 2.80 factors to finish at 51.80 and Americana Eating places (TADAWUL:) was up 5.30% or 0.14 factors to 2.78 in late commerce.

The worst performers of the session have been Dallah Healthcare Holding Firm (TADAWUL:), which fell 4.98% or 8.40 factors to commerce at 160.40 on the shut. Halwani Bros (TADAWUL:) declined 4.97% or 3.40 factors to finish at 65.00 and Astra Industrial Group (TADAWUL:) was down 3.10% or 5.40 factors to 168.60.

Falling shares outnumbered advancing ones on the Saudi Arabia Inventory Trade by 166 to 120 and 26 ended unchanged.

Crude oil for November supply was up 1.43% or 0.97 to $68.64 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in December rose 0.63% or 0.45 to hit $71.54 a barrel, whereas the December Gold Futures contract fell 0.52% or 14.10 to commerce at $2,680.80 a troy ounce.

EUR/SAR was unchanged 0.10% to 4.19, whereas USD/SAR unchanged 0.01% to three.75.

The US Greenback Index Futures was down 0.14% at 100.11.

Markets

2 Progress Shares to Purchase Earlier than They Soar 212% and 712%, Based on Sure Wall Road Analysts

The S&P 500 (SNPINDEX: ^GSPC) has superior 20% 12 months to this point as a consequence of robust curiosity in synthetic intelligence and surprisingly strong financial development. However sure Wall Road analysts consider UiPath (NYSE: PATH) and Roku (NASDAQ: ROKU) are undervalued.

-

Sanjit Singh at Morgan Stanley has set UiPath with a bull-case value goal of $40 per share by September 2025. That forecast implies 212% upside from its present share value of $12.80

-

Nicholas Grous and Andrew Kim at Ark Make investments have set Roku with a base-case value goal of $605 by December 2026. That forecast implies 712% upside from its present share value of $74.50.

As a rule, buyers ought to by no means put an excessive amount of confidence in value targets, particularly once they come from particular person analysts. Nor ought to they take the implicit good points as a right. However UiPath and Roku warrant additional consideration.

UiPath: 212% implied upside

UiPath makes a speciality of robotic course of automation (RPA), one of many fastest-growing software program markets. Its enterprise automation platform contains process and course of mining instruments that assist customers establish alternatives for automation, and growth instruments that assist customers construct software program robots able to automating these duties and processes.

Morgan Stanley says UiPath is the “clear class defining chief” in RPA, however analysts have acknowledged the corporate in different areas. As an example, the Worldwide Information Corp. not too long ago acknowledged UiPath as a frontrunner in clever doc processing (IDP) software program, which blends and RPA to automate duties like doc classification, information extraction, and sentiment evaluation.

UiPath reported combined monetary leads to the second quarter of fiscal 2025 (ended July 31). The typical buyer spent 15% extra and income elevated 10% to $316 million. However gross margin contracted about 3 share factors, and adjusted earnings fell 55% to $0.04 per diluted share. Nevertheless, buyers have cause to be cautiously optimistic.

UiPath introduced co-founder Daniel Dines again as CEO in June to enhance gross sales execution, particularly the place development merchandise like clever doc processing are involved, and to steer the corporate by way of an unsure financial system. Enhancements would require time, however Dines mentioned he was inspired by the early progress within the second quarter. “I am significantly excited concerning the success we have seen with our IDP options.”

Going ahead, Wall Road expects UiPath to develop gross sales at 10% yearly by way of fiscal 2026 (ends April 2026). That estimate leaves room for upside as a result of the RPA market is forecasted to develop at 40% yearly by way of 2030. Nevertheless, the present valuation of 5.2 occasions gross sales is cheap even when the Wall Road consensus is right.

Absent a major acceleration in development, UiPath shareholders have little or no probability of triple-digit returns within the subsequent 12 months. However buyers keen to carry the inventory for 3 to 5 years at a minimal ought to contemplate shopping for a small place at the moment. UiPath may very well be a rewarding turnaround story.

Roku: 712% implied upside

Roku’s streaming platform connects shoppers, content material writer, and advertisers. The corporate monetizes paid content material by charging charges for transactions processed by way of Roku Pay, and it monetizes ad-supported content material by promoting stock and advert tech software program. Roku sources promoting stock from content material publishers on the platform, nevertheless it additionally operates an ad-supported service known as The Roku Channel.

Roku is the preferred streaming platform within the U.S. as measured by streaming time, and the corporate is nicely positioned to take care of its management. Roku OS is the best-selling TV working system within the U.S., Canada, and Mexico, which factors to model authority. Indee, within the second quarter, Roku OS was extra widespread than the following two working programs mixed by way of TV unit gross sales.

Roku reported encouraging leads to the second quarter. Energetic accounts elevated 14% and streaming hours jumped 20%, which suggests the common account engaged with the platform extra continuously. In flip, income rose 14% to $968 million and adjusted EBITDA improved to $44 million, up from a lack of $18 million within the prior 12 months. Traders have good cause to assume the corporate will preserve its momentum.

Along with Roku being the preferred streaming platform in North America, The Roku Channel is the eighth-most widespread streaming service within the U.S., outranking Max by Warner Bros. Discovery and Paramount+ by Paramount World. That leaves the corporate nicely place to learn as streaming accounts for extra of TV viewing time and advertisers spend extra on related TV (CTV).

Wall Road expects Roku’s income to compound at 13% yearly by way of 2025, however that estimate leaves room for upside. CTV advert spending is projected to develop at 12% yearly throughout the identical interval, and Roku’s management within the North America (coupled with its increasing presence in worldwide markets) might result in faster-than-expected development.

Having mentioned that, the present valuation of two.8 occasions gross sales is cheap even when the Wall Road consensus is correct. Personally, I feel Ark’s value goal of $605 per share is absurdly excessive. However I additionally assume Roku can beat the S&P 500 over the following three to 5 years. So, affected person buyers ought to really feel comfy shopping for a small place at the moment.

Do you have to make investments $1,000 in Roku proper now?

Before you purchase inventory in Roku, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for buyers to purchase now… and Roku wasn’t one in every of them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has positions in Roku and UiPath. The Motley Idiot has positions in and recommends Roku, UiPath, and Warner Bros. Discovery. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook