Markets

Professional Analysis: Wall Avenue eyes TELUS Company's strong development

Within the ever-evolving telecommunications panorama, TELUS Company (TSX: T; NYSE: TU) has garnered consideration with its newest monetary efficiency and outlook. The corporate, acknowledged as a big participant within the telecommunications business, gives a variety of companies together with cell phone, fastened phone, and broadband subscription tv companies.

Firm Overview

TELUS Company, with its substantial presence within the international market, has demonstrated a capability to keep up stability and obtain wholesome development regardless of the aggressive telecom area. RBC Capital Markets has not too long ago issued an “Outperform” ranking for TELUS, reflecting a optimistic outlook and suggesting that the corporate is anticipated to carry out higher than the sector common.

Monetary Efficiency

TELUS’s inventory has proven resilience, with RBC Capital Markets setting a brand new value goal of $26.00. This goal adjustment is predicated on the corporate’s current efficiency, which incorporates wholesome subscriber development, better-than-expected Q1/24 outcomes, and a gentle steering for 2024, signaling a strong enterprise technique and operational execution.

Market Developments and Aggressive Panorama

TELUS operates in a fiercely aggressive sector, the place buyer retention and acquisition are vital. The corporate’s giant scale and diversified companies are seen as strengths that would present resilience in risky markets, as recommended by RBC Capital Markets’ current evaluation.

Future Outlook

The outlook for TELUS is certainly one of continued development and secure efficiency, with RBC Capital Markets sustaining an “Outperform” ranking. The corporate’s broad portfolio, scale, and powerful operational execution are anticipated to assist its efficiency in a difficult atmosphere.

Bull Case

Will TELUS’s monetary metrics drive future success?

TELUS’s continued development in key monetary metrics resembling subscriber numbers, EBITDA, and FCF, together with optimistic efficiency in Q1/24 exceeding forecasts, suggests a robust basis for future stability and success. The regular steering for 2024 signifies confidence within the firm’s strategic route.

SWOT Evaluation

Strengths:

– Giant scale and diversified companies in a aggressive market.

– Wholesome subscriber development and powerful monetary efficiency in Q1/24.

Weaknesses:

– Potential vulnerability to intense market competitors.

Alternatives:

– Leveraging scale and repair range to keep up secure income streams.

Threats:

– Aggressive pressures from different telecom gamers.

Analysts Targets

– RBC Capital Markets (Might 10, 2024): “Outperform” ranking with a value goal of $26.00.

TELUS Company’s current assessments replicate an organization that’s anticipated to outperform in a difficult atmosphere. The approaching durations can be essential for TELUS because it strives to leverage its strengths and navigate potential weaknesses and threats.

Lusso’s Information Insights

TELUS Company (TU) has demonstrated a constant dedication to shareholder returns, as evidenced by its 26-year streak of sustaining dividend funds. This dedication to dividends is especially noteworthy given the corporate’s vital yield of seven.28%, which stands out within the present market panorama. Such a yield might enchantment to income-focused traders, particularly at a time when the corporate’s inventory is buying and selling close to its 52-week low, doubtlessly providing a lovely entry level.

On the monetary efficiency entrance, TELUS’s market capitalization of $23.03 billion underscores its substantial presence inside the telecommunications business. Nonetheless, the corporate’s P/E ratio, which at present stands at 41.26, means that the inventory is buying and selling at a excessive earnings a number of relative to its earnings. This valuation metric is a vital consideration for traders as they assess the inventory’s present value in opposition to its earnings potential.

Whereas analysts have not too long ago revised their earnings expectations downwards for the upcoming interval, TELUS’s strong gross revenue margin of 35.83% over the past twelve months as of Q1 2024 signifies a strong capacity to transform income into gross revenue. This monetary well being is a key issue for the corporate’s stability, particularly within the aggressive telecom sector.

For these looking for extra in-depth evaluation, Lusso’s Information offers extra insights and metrics on TELUS Company. There are at present 11 extra Lusso’s Information Ideas obtainable, which may provide traders a complete understanding of the corporate’s monetary well being and market place. To discover these additional, readers can go to Lusso’s Information.

This text was generated with the assist of AI and reviewed by an editor. For extra info see our T&C.

Markets

5 Key Charts to Watch in World Commodity Markets This Week

(Lusso’s Information) — London Steel Alternate’s annual LME Week gathering is underway, bringing collectively merchants and analysts amid copper’s newest upswing. Sugar futures are on observe for his or her greatest month since January. And US utilities are outshining different trade teams within the S&P 500, thanks partly to AI demand.

Most Learn from Lusso’s Information

Listed below are 5 notable charts to think about in international commodity markets because the week will get underway.

Copper

Copper has been on a roller-coaster journey this 12 months, with a surge of funding and a significant brief squeeze in New York driving costs to a document in Could. Buyers then pulled of their horns as doubts in regards to the Chinese language economic system rose to the fore. The newest positioning knowledge indicators that they’re not chasing the rally as exhausting as they did final time round.

Vitality Investments

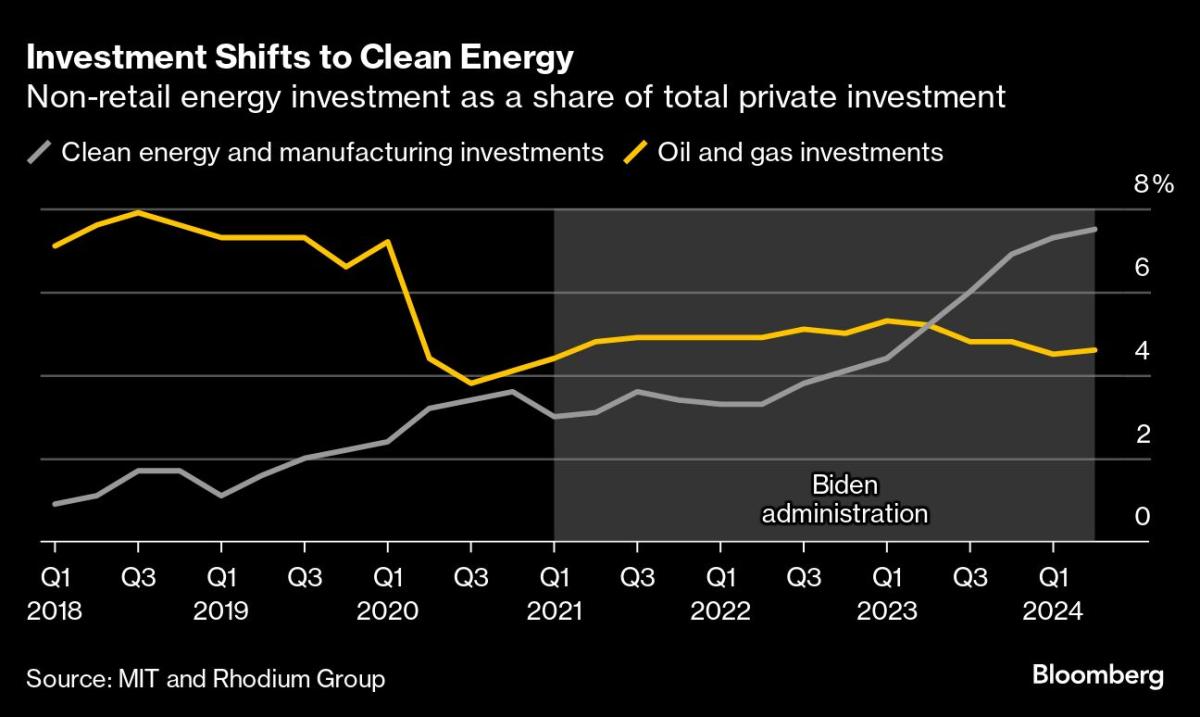

The US is mobilizing a lot funding into clear vitality that it now tops even the height of America’s fracking revolution within the 2010s. The wave of spending triggered by Joe Biden’s signature local weather regulation is ready to be the president’s greatest and most-enduring home achievement. His insurance policies helped drive about $493 billion of recent funding into the manufacturing and widespread deployment of photo voltaic panels, electrical autos and different emission-cutting expertise since mid-2022, based on knowledge analyzed by the Massachusetts Institute for Know-how and analysis agency Rhodium Group.

Pure Fuel

Europe enters its heating season this week with an enormous pure gasoline stockpile to defend itself from surprising provide outages. The continent’s websites are about 94% full — above historic averages, however barely under final 12 months’s ranges — sufficient to maintain some merchants watchful as they carefully monitor persevering with storage build-up earlier than the freezing climate spreads.

Energy Suppliers

The utilities sector is outshining different industries on the S&P 500 Index within the final three months. Shares of US energy suppliers racked up massive features within the third quarter on market giddiness over prospects of surging electrical energy demand from synthetic intelligence-focused knowledge facilities. Utilities are on tempo to high the 11 trade teams of the S&P Index because the quarter attracts to an in depth, with features pushed by plant operators Vistra Corp. and Constellation Vitality Corp., which simply inked an influence provide cope with Microsoft Corp. Vistra is noteworthy as a result of it’s additionally holding its rating as one of the best performing inventory within the broader S&P 500 for the 12 months, after shares greater than tripled.

Sugar

Sugar has been on a tear in September resulting from a poor outlook from Brazil, the world’s high exporter. Whereas promising manufacturing forecasts in India and Thailand lower brief final week’s rally on Friday, sugar futures are nonetheless on tempo for the most important month-to-month acquire since January. Extreme drought in Brazil has been hurting sugar-cane yields, elevating fears of additional cuts to manufacturing estimates. Merchants might be carefully watching the circulation of vessels transport sugar from the South American nation in October, since any easing of exports means international patrons might battle to search out provides within the ultimate months of 2024.

–With help from Geoffrey Morgan, Doug Alexander, Dayanne Sousa and Alex Tribou.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

NZ's Fonterra upgrades dividend payout coverage

(Reuters) – New Zealand dairy agency Fonterra mentioned on Monday it has upgraded its dividend payout coverage and can now pay shareholders 60% to 80% of its earnings, in contrast with a median of fifty% for the earlier 5 years.

The corporate can be concentrating on a better common return on capital, elevating it to 10-12%, up from 9-10% earlier.

“Fonterra is in a powerful place, delivering outcomes nicely above its five-year common, which places it able to consider the subsequent evolution of its strategic supply,” mentioned CEO Miles Hurrell.

Final week, the Auckland-based firm reported earnings from persevering with operations for fiscal 2024 of 70 NZ cents per share, hitting the highest finish of its outlook vary.

It declared a last dividend of 25 NZ cents per share in addition to a particular dividend of 15 NZ cents apiece.

The corporate mentioned it intends to make a “important” capital return to shareholders upon divestment of its shopper enterprise.

Earlier this 12 months, it had flagged a full or partial sale of its world shopper unit to unencumber capital.

Markets

Right here's the Finest-Performing S&P 500 Inventory of 2024 (Trace: It's Not Nvidia)

Energy utilities aren’t at all times seen as probably the most thrilling option to make investments, however traders may must rethink that opinion, as a result of the top-performing S&P 500 index inventory of the 12 months is retail electrical energy and energy technology utility Vistra (NYSE: VST), up a whopping 210% this 12 months. That beats Nvidia‘s (NASDAQ: NVDA) 155% improve. The 2 occasions should not unconnected. This is why and the way Vistra inventory has carried out so nicely this 12 months.

Information facilities, electrical energy demand, and clear vitality

It is no secret that the burgeoning demand for synthetic intelligence (AI) purposes is the rationale for the step change in expectations for demand. That is what’s fueling elevated demand for graphics processing models (GPUs) and high-performance computing chips. That is nice information for know-how corporations like Nvidia and .

Whereas the latter are obvious beneficiaries, there are additionally information heart gear corporations like Vertiv Holdings. If you’re on the lookout for a worth play on the theme, then the heating, air flow, air con, and refrigeration sector, notably Johnson Controls, is price .

Nevertheless, I digress. This text’s point of interest is the necessity to energy information facilities and elevated electrical energy demand. Particularly, it’s in an surroundings the place policymakers stay dedicated to the clear vitality transition. That is the place corporations and utilities like Vistra and Constellation Power (NASDAQ: CEG) come into play.

Vistra

Vistra is a retail electrical energy and energy technology firm. On the finish of 2023, it counted 4 million retail clients, and the acquisition of Power Harbor in March added one other 1 million. The Harbor Power deal additionally added 4,000 megawatts (MW) of nuclear technology to associate with the 36,702 MW with which Vistra ended 2023, with 2,400 MW from nuclear.

As such, the deal made Vistra “the biggest aggressive energy generator within the nation” and made it the second-largest aggressive nuclear generator within the U.S. Buyers are falling in love with nuclear vitality as a clear, sustainable, and zero-carbon baseload choice. That is notably related as coal-powered crops are being closed down in accordance with the clear vitality transition.

The clear vitality transition

Whereas no one doubts that the transition will happen, it is also indeniable that sentiment over the tempo of the transition has modified, too. The long-term coverage outlook stays favorable to renewable vitality; pure fuel will possible be a big a part of vitality technology for many years.

That is additionally excellent news for Vistra, as a result of about 24,000 MW of its present 41,000 MW capability comes from pure fuel. As such, the rise within the inventory worth this 12 months additionally displays a extra favorable view of pure fuel and a vote of confidence in Vistra’s 6,400 MW nuclear functionality.

Enter Amazon and Microsoft

The three greatest cloud service suppliers are Amazon Net Companies, Microsoft‘s Azure, and Alphabet‘s Google Cloud, and they should guarantee long-term energy to assist their information facilities. As such, Microsoft and Amazon accomplished long-term energy buy agreements (PPA) with Vistra this 12 months.

Nonetheless, it is the 20-year PPA that Microsoft just lately signed with Constellation Power that has excited the market. Microsoft is buying energy for its information facilities, and Constellation will restart the Three Mile Island nuclear plant to ship on the settlement. That is a optimistic for the market, and so is the value that Microsoft is prepared to pay for the facility.

In accordance with Reuters, Microsoft is paying as much as $115 per megawatt-hour (MWh) within the settlement. That compares favorably with Vistra’s whole realized worth of $51.20 MWh within the second quarter of 2024.

A inventory to purchase

The bull case for Vistra rests on the concept that there’s important upside potential for future market pricing for nuclear-powered vitality, given the Microsoft/Constellation deal and burgeoning demand stimulated by AI. Vistra’s acquisition of Power Harbor strengthened that case. As well as, Vistra just lately introduced it was shopping for the remaining 15% of its Vistra Imaginative and prescient subsidiary (which homes its zero-carbon nuclear, vitality storage, and photo voltaic technology companies) for $3.085 billion.

Vistra’s pure fuel, nuclear, and renewable capabilities are optimistic belongings for the clear vitality transition. Contemplating these components, it is no shock that the sector is scorching. Including falling rates of interest (utilities are sometimes seen as rate of interest delicate as a consequence of their debt masses) is a recipe for sharp worth appreciation.

Do you have to make investments $1,000 in Vistra proper now?

Before you purchase inventory in Vistra, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and Vistra wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Constellation Power, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Johnson Controls Worldwide and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook