Markets

These Two Stock Have A High Short Interest; Will They Squeeze?

Short selling has became dangerous the past year. As famed short seller Andrew Left of Citron Research announced a few months back that he will no longer announce short seller reports. Many other traders have been avoiding shorting highly popular names among the retail community due to the raised risk of a short squeeze.

What is a short squeeze?

A short squeeze is when a security has a high amount of shorts in the stock and the price of the stock quickly moves to the upside putting pressure on the shorts to cover.

Shares of the medical supply company, Invacare Corp [NYSE: IVC] is a stock that is on the radar of the retail community for a potential short squeeze candidate.

The stock has:

- Around 27% short interest

- Only around 33 million shares in the float

- Stock is under $10

- Stock is part of the medical industry which has been a hot industry group for day traders the past 3 weeks

Another highly shorted stock that you may have heard of is Wayfair [NYSE: W] which is a retail-internet company. This stock is more popular but, has gained a reputation of one of the most shorted stocks on wall street with the short interest being around 22%.

The stock has:

- Around 22% short interest

- Over 16 million short volume

- Around 75 million in its float

Highly shorted stocks are a hot topic in the retail trading community. As these stock gain more short interest the news has seemed to start to cover them. This morning on CNBC, Wayfair was discussed apart of a short interest segment on their show.

Want to try the most advanced charts we have ever used? Want to back test your strategies or use the most advanced tools? Try TrendSpider today by clicking here

Contact us: info@lussosnews.com

Markets

Understanding a Flash Crash in the Stock Market

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

In the fast-paced world of finance, few events can instill as much immediate fear and confusion as a “flash crash.” This term describes an event where stock prices plummet sharply within an extremely short period—often just minutes—before often rebounding just as quickly. These rapid and dramatic movements can result in substantial market disruptions, affecting a wide range of assets including stocks, bonds, and commodities.

Origins of a Flash Crash

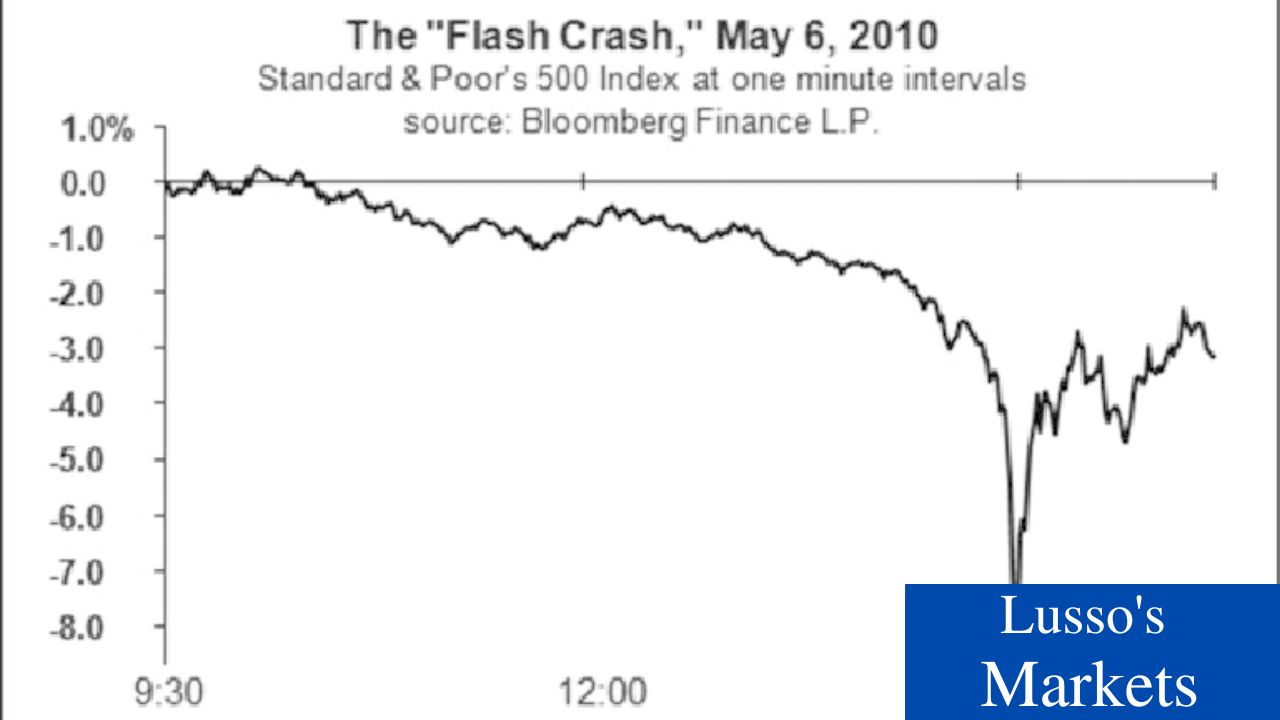

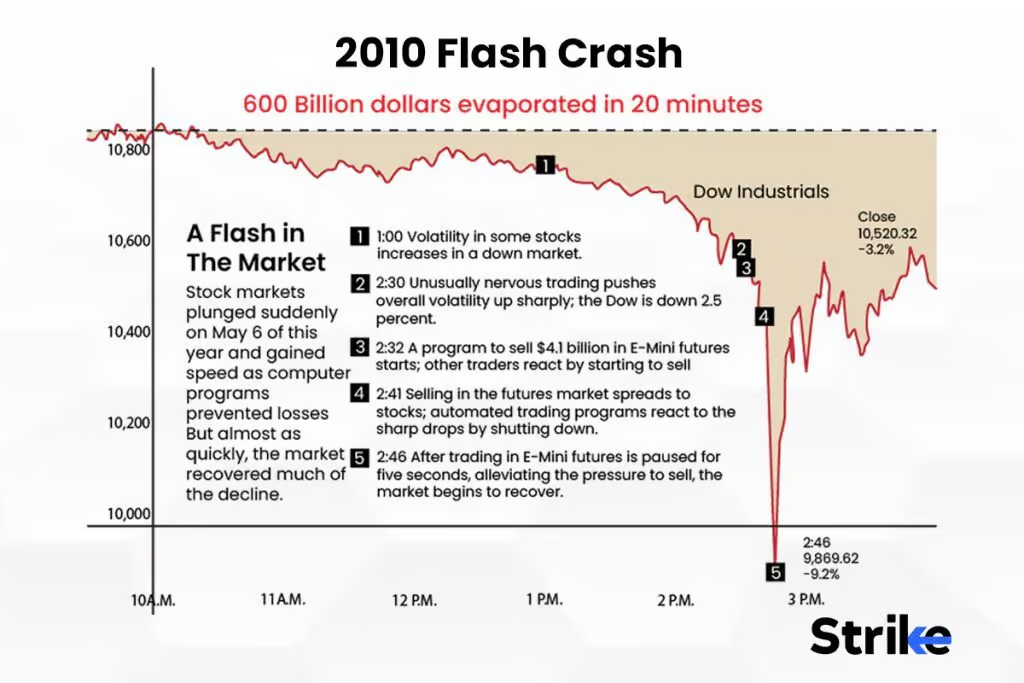

The concept of a flash crash became widely recognized after the most notorious example, which occurred on May 6, 2010. During this event, the Dow Jones Industrial Average fell about 1,000 points (over 9%) only to recover those losses within minutes. This sudden plunge and recovery highlighted inherent vulnerabilities in the market structures and systems.

Causes of Flash Crashes

Flash crashes can be triggered by a variety of factors, which often interact in complex ways:

- High-Frequency Trading (HFT): Many analysts attribute the rise of flash crashes to the increase in high-frequency trading, where firms use algorithms to execute millions of orders at lightning speed. These algorithms can sometimes create feedback loops if they start to sell off assets in a falling market, amplifying the initial decline.

- Market Structure Issues: The fragmentation of trading venues and the varying rules and technologies used by these platforms can also contribute to flash crashes. Disparities in trading rules and protocols can lead to situations where automated systems behave unpredictively or inefficiently.

- Liquidity Crunches: Flash crashes are often exacerbated by a sudden lack of liquidity. As prices begin to fall, automatic stop-loss orders can trigger further selling, but if there aren’t enough buyers, prices can drop precipitously.

- News and Social Media: Sometimes, an erroneous news report or a significant surge in social media activity can spur rapid trading actions by algorithms that parse news and data for trading signals.

Impact and Responses

The impact of a flash crash is broad. In the short term, investors can see huge losses, and confidence in the markets can wane. For traders, the volatility can result in significant financial damage, especially for those who are unable to react quickly enough to the abrupt price changes.

In response to flash crashes, regulatory bodies have implemented several measures to prevent or mitigate their effects. For example, after the 2010 crash, the U.S. Securities and Exchange Commission (SEC) introduced “circuit breakers” that temporarily halt trading in a stock if its price drops too quickly.

Preventative Measures

Beyond regulatory changes, there’s also a push for improved risk management strategies within trading firms, especially those employing high-frequency trading algorithms. These measures include more sophisticated and robust systems to monitor and control trading activities and improved testing of algorithms to ensure they behave as expected during market stress.

The Ever-Evolving Market Dynamics

As markets evolve and the use of technology deepens, the potential for flash crashes remains significant. This necessitates continuous advances in both technology and regulation to safeguard against the risks posed by these rapid and unpredictable market events.

Understanding flash crashes is crucial for anyone involved in the trading world, from regulators and traders to ordinary investors trying to navigate the complexities of modern financial markets. Recognizing the signs and potential triggers of flash crashes can help market participants better prepare for and potentially avoid the risks associated with these startling events.

Markets

A Glimpse Into the Buzz of Upcoming IPOs in April 2024

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

The investment atmosphere is heating up with a series of intriguing initial public offerings (IPOs) set to hit the market in late April 2024. This month features a diverse lineup of companies poised to go public, ranging from technology innovators to international restaurant chains. Here’s a detailed look at some of the most anticipated IPOs.

Tungray Technologies Inc. (TRSG)

Exchange: NASDAQ Capital

Price: $4.00

Shares: 1,250,000

Expected IPO Date: 4/19/2024

Offer Amount: $5,000,000

Tungray Technologies is stepping into the public market with a modest offer amount. The company’s focus on innovative tech solutions might attract investors looking for new growth opportunities in the tech sector.

RanMarine Technology B.V. (RAN)

Exchange: NASDAQ Capital

Price: $5.50

Shares: 1,435,000

Expected IPO Date: 4/19/2024

Offer Amount: $9,076,375

RanMarine Technology, known for its advanced marine technology solutions, is also set for the same date. With a slightly higher offer amount, it shows potential for considerable market interest.

Sushi Ginza Onodera, Inc. (ONDR)

Exchange: NYSE MKT

Price Range: $7.00-$8.00

Shares: 1,066,667

Expected IPO Date: 4/19/2024

Offer Amount: $9,813,336.40

Offering a culinary twist to the IPO scene, Sushi Ginza Onodera is preparing to serve not just premium sushi but also potentially premium stock value.

mF International Ltd (MFI)

Exchange: NASDAQ Capital

Price Range: $4.00-$5.00

Shares: 1,560,000

Expected IPO Date: 4/22/2024

Offer Amount: $8,970,000

This global firm is entering the market with a flexible price range, suggesting a cautious yet optimistic approach towards investor reception.

YY Group Holding Ltd. (YYGH)

Exchange: NASDAQ Capital

Price Range: $4.00-$5.00

Shares: 1,500,000

Expected IPO Date: 4/22/2024

Offer Amount: $8,625,000

YY Group is another promising prospect with its roots in technology and digital transformation, aiming to capture the tech-savvy investor’s eye.

Key Mining Corp. (KMCM)

Exchange: NYSE MKT

Price: $2.25

Shares: 4,444,444

Expected IPO Date: 4/25/2024

Offer Amount: $11,499,999.80

Diving into natural resources, Key Mining is set for a significant offering, indicating robust investor confidence in its mining operations and commodity potential.

Marex Group plc (MRX)

Exchange: NASDAQ Global Select

Price Range: $18.00-$21.00

Shares: 15,384,615

Expected IPO Date: 4/25/2024

Offer Amount: $371,538,447

As one of the heaviest hitters this month, Marex Group plc commands attention with its substantial offer amount, reflecting its established market presence and investor trust.

Rubrik, Inc. (RBRK)

Exchange: NYSE

Price Range: $28.00-$31.00

Shares: 23,000,000

Expected IPO Date: 4/25/2024

Offer Amount: $819,950,000

Rubrik stands out with a massive offer, targeting tech investors interested in data management and cloud services, marking it as one of the blockbuster listings of the month.

Loar Holdings, LLC (LOAR)

Exchange: NYSE

Price Range: $24.00-$26.00

Shares: 11,000,000

Expected IPO Date: 4/26/2024

Offer Amount: $328,900,000

Loar Holdings is geared up to make a significant impact with its sizable offer, highlighting its robust positioning in the manufacturing sector.

ZenaTech, Inc. (ZENA)

Exchange: NASDAQ Capital

Expected IPO Date: 4/30/2024

Offer Amount: $7,100,900

Wrapping up the month, ZenaTech will test waters with a strategic focus on tech innovations, appealing to niche investors keen on cutting-edge technologies.

April 2024 is shaping up to be a dynamic month for the IPO market, showcasing a wide range of sectors and opportunities. Investors are advised to keep an eye on these dates and delve deeper into each company’s prospects before making investment decisions. Each of these companies presents unique opportunities and challenges, marking another exciting chapter in the financial markets.

Markets

WiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

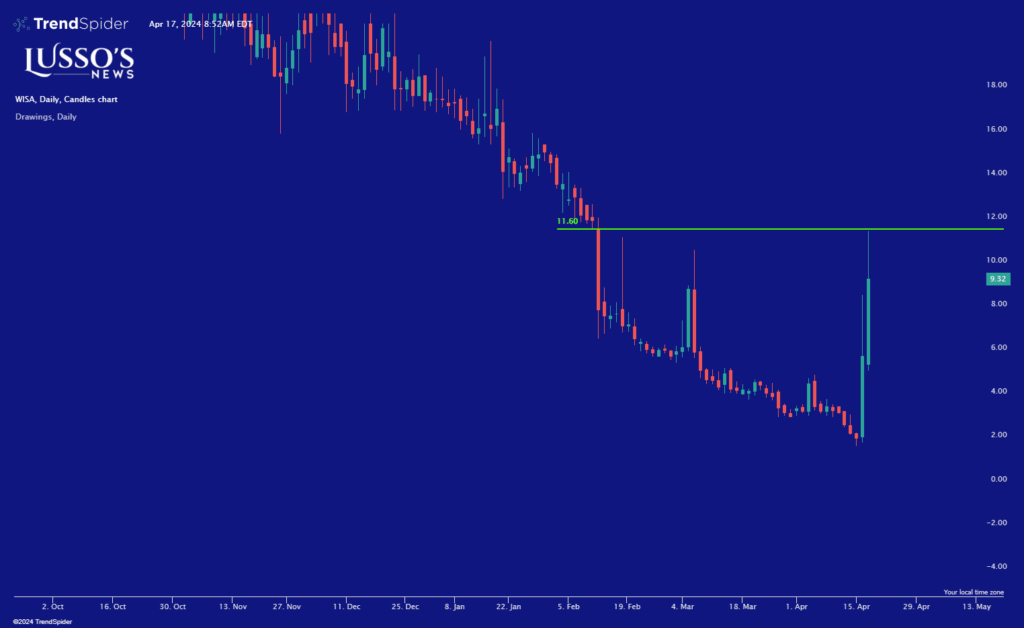

WiSA Technologies, Inc. (Nasdaq: WISA), experienced a dramatic surge in its stock price, closing 248% higher yesterday, with a further 58% increase in pre-market trading today. This notable rally in WiSA’s shares follows significant corporate developments, including a successful reverse stock split earlier this week and the announcement of a new licensing agreement through its subsidiary, the WiSA Association.

New Licensing Agreement Boosts Investor Confidence

The WiSA Association recently secured its fourth 5-year WiSA E licensing agreement with a major HDTV/Projection TV (PTV) brand. This agreement allows the brand to integrate WiSA E software into its products, enhancing the consumer audio experience with wireless immersive audio capabilities. This technology ensures full interoperability with WiSA E-enabled speakers from various brands associated with the WiSA Association.

Tony Ostrom, President of the WiSA Association, expressed his satisfaction with the new partnership, stating, “We are very pleased that yet another major HDTV brand recognizes the value of our WiSA E technology, as well as our licensing model for market deployment.” He highlighted that with four major TV brands now onboard, the market is affirming the value and vision of WiSA’s technology, which aims to revolutionize immersive audio experiences with affordable, high-quality, interoperable wireless solutions.

WiSA E Technology: A Game Changer in Audio

WiSA E encompasses a comprehensive suite of audio features designed to elevate the auditory experience across various devices including HDTVs, PTVs, soundbars, mobile devices, set-top boxes, and speakers. The technology’s compatibility spans four major HDTV SoC providers: Realtek, Amlogic, Mediatek, and Novatek. This broad compatibility underscores WiSA’s commitment to universal interoperability and quality in the wireless audio market.

Market Impact and Future Outlook

The stock’s performance and the latest licensing agreement suggest a robust investor confidence in WiSA Technologies’ strategic direction and its potential to capture a significant share of the burgeoning market for wireless audio solutions. The reverse stock split earlier in the week also appears to have positively influenced market perceptions, possibly by aligning the company’s share structure with institutional investment standards.

As WiSA Technologies continues to expand its licensing agreements and further develops its WiSA E technology, it is well-positioned to lead in the high-quality, immersive audio market. Investors and market watchers will likely keep a close eye on the company’s progress as it pioneers new advancements in audio technology. This momentum indicates a promising direction for WiSA, as it continues to innovate and capture the interest of major industry players and consumers alike.

-

Markets2 months ago

Markets2 months agoUnderstanding Viking Therapeutics’ Position in the Biopharma Sector: A Beginner’s Guide

-

Markets3 months ago

Markets3 months agoCyngn (NASDAQ: CYN) and Nvidia: A Partnership Fueling Stock Momentum

-

Markets3 months ago

Markets3 months agoNikola’s Turnaround: How the Departure of Trevor Milton Marked a New Era for NKLA Stock

-

Markets2 months ago

Markets2 months agoThe AI Revolution: How Super Micro Computer (SMCI) Skyrocketed in the Tech Rally

-

Markets2 months ago

Markets2 months agoMastering the Market: A Guide to the Fundamentals of Value Investing

-

Trading2 months ago

Trading2 months ago3 Must-Watch AI Stocks in 2024: Unveiling ShiftPixy, C3.ai, and CXApp’s Market Potential

-

Markets3 months ago

Markets3 months agoPhunware Stock (PHUN) and the Impact of Direct Offering: A Potential Decline After a Rally

-

Lusso's Exclusives2 months ago

Lusso's Exclusives2 months agoWall Street Veteran Owns A Crap Ton Of Monday.com Stock [NASDAQ:MNDY]

-

Markets3 months ago

Markets3 months agoJetBlue and Spirit Seek Expedited Appeal to Revive $3.8 Billion Merger

-

Markets3 months ago

Markets3 months agoGMBL Stock: A Trader’s Insight into Esports Entertainment Group

-

Business2 months ago

Business2 months agoDeciphering HSBC Holdings plc’s Fiscal Landscape: An In-depth Analysis of 2023’s Outcomes