Markets

Ulta Beauty (ULTA) Trading Above Resistance; Is It A Breakout?

Shares of Ulta Beauty (ULTA) are trading almost 2% higher (+$6 higher) to start the new year off. This comes of interest to technical traders as ULTA has been trading in a set range for months now. This range has been between prices around $360-$413 and today it is trading as high as $419.

Follow The Author On Twitter: @ChartBreakouts

Markets

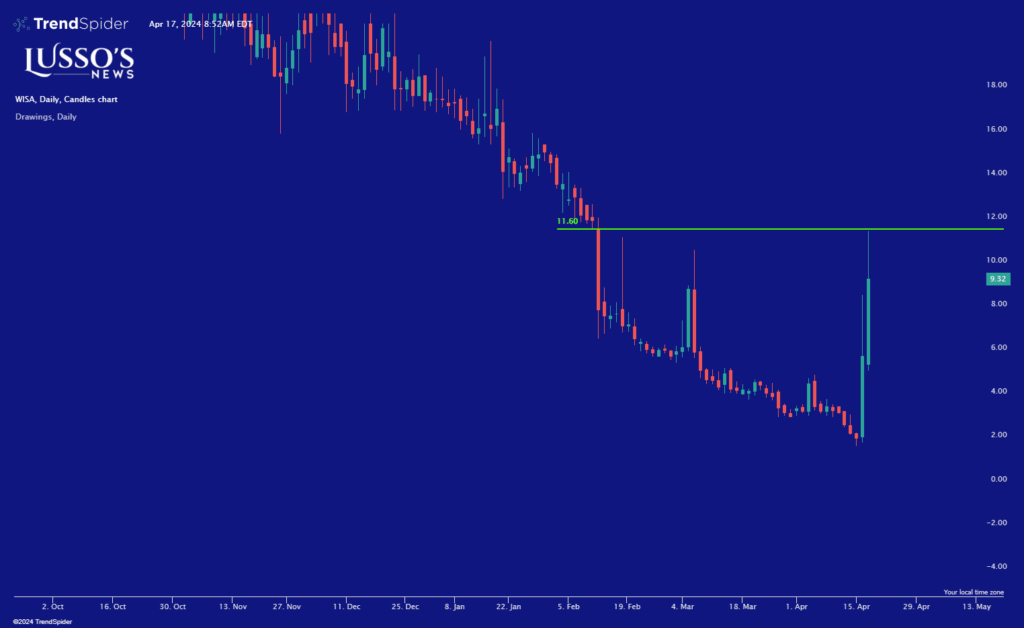

WiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

WiSA Technologies, Inc. (Nasdaq: WISA), experienced a dramatic surge in its stock price, closing 248% higher yesterday, with a further 58% increase in pre-market trading today. This notable rally in WiSA’s shares follows significant corporate developments, including a successful reverse stock split earlier this week and the announcement of a new licensing agreement through its subsidiary, the WiSA Association.

New Licensing Agreement Boosts Investor Confidence

The WiSA Association recently secured its fourth 5-year WiSA E licensing agreement with a major HDTV/Projection TV (PTV) brand. This agreement allows the brand to integrate WiSA E software into its products, enhancing the consumer audio experience with wireless immersive audio capabilities. This technology ensures full interoperability with WiSA E-enabled speakers from various brands associated with the WiSA Association.

Tony Ostrom, President of the WiSA Association, expressed his satisfaction with the new partnership, stating, “We are very pleased that yet another major HDTV brand recognizes the value of our WiSA E technology, as well as our licensing model for market deployment.” He highlighted that with four major TV brands now onboard, the market is affirming the value and vision of WiSA’s technology, which aims to revolutionize immersive audio experiences with affordable, high-quality, interoperable wireless solutions.

WiSA E Technology: A Game Changer in Audio

WiSA E encompasses a comprehensive suite of audio features designed to elevate the auditory experience across various devices including HDTVs, PTVs, soundbars, mobile devices, set-top boxes, and speakers. The technology’s compatibility spans four major HDTV SoC providers: Realtek, Amlogic, Mediatek, and Novatek. This broad compatibility underscores WiSA’s commitment to universal interoperability and quality in the wireless audio market.

Market Impact and Future Outlook

The stock’s performance and the latest licensing agreement suggest a robust investor confidence in WiSA Technologies’ strategic direction and its potential to capture a significant share of the burgeoning market for wireless audio solutions. The reverse stock split earlier in the week also appears to have positively influenced market perceptions, possibly by aligning the company’s share structure with institutional investment standards.

As WiSA Technologies continues to expand its licensing agreements and further develops its WiSA E technology, it is well-positioned to lead in the high-quality, immersive audio market. Investors and market watchers will likely keep a close eye on the company’s progress as it pioneers new advancements in audio technology. This momentum indicates a promising direction for WiSA, as it continues to innovate and capture the interest of major industry players and consumers alike.

Markets

UnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

UnitedHealth Group Inc. (NYSE: UNH) has recently released its financial results for the first quarter of 2024, revealing a complex but ultimately promising financial landscape. The company reported a significant revenue increase, robust adjusted earnings per share, and continued commitment to shareholder returns, amidst challenges including a major cyberattack and the effects of a significant sale.

Robust Revenue Growth and Adjusted Earnings

The healthcare giant posted revenues of $99.8 billion, marking an impressive increase from $91.9 billion in the same quarter the previous year. This aligns perfectly with analyst projections, highlighting the company’s ability to meet market expectations even in turbulent times.

Despite facing a net loss of $1.53 per share due primarily to the currency effects from its Brazil operations sale and the repercussions of the Change Healthcare cyberattack, UnitedHealth’s adjusted earnings per share (EPS) stood strong at $6.91. This includes a $0.25 per share impact from Change Healthcare business disruptions, yet it still surpasses the anticipated $6.62 EPS, showcasing the company’s underlying financial health and operational resilience.

Impact of Cyberattack and Strategic Responses

The first quarter was significantly impacted by a cyberattack, costing the company $0.74 per share, with a projected annual impact of between $1.15 to $1.35 per share. These figures are outside the adjusted EPS calculations, emphasizing the one-time nature of these costs. To mitigate the disruption, UnitedHealth has provided over $6 billion in advance funding and interest-free loans to support affected care providers, underscoring its commitment to partnership and system stability.

Operational Efficiency and Shareholder Value

UnitedHealth reported a Medical Care Ratio of 84.3%, influenced by the cyberattack and other factors, and an Operating Cost Ratio of 14.1%, which reflects effective cost management and ongoing investments in growth. Despite the challenges, the company generated $1.1 billion in operating cash flows and returned $4.8 billion to shareholders through dividends and share repurchases, affirming its dedication to delivering shareholder value.

Future Outlook

Looking ahead, UnitedHealth Group has adjusted its full-year 2024 earnings forecast to $17.60 to $18.20 per share, factoring in the impacts from the Brazil sale and cyberattack costs. The adjusted net earnings outlook, however, remains optimistic at $27.50 to $28.00 per share, inclusive of the estimated business disruption impacts.

Segment-Specific Growth

The company’s healthcare benefits segment, UnitedHealthcare, reported first-quarter revenues of $75.4 billion, up nearly $5 billion from the previous year. Meanwhile, its Optum business, which includes health services like Optum Health and Optum Rx, grew to $61 billion in revenue, an increase of $7 billion, driven by significant growth across its various divisions.

Conclusion: UnitedHealth Group’s Steadfast Approach

UnitedHealth Group’s first-quarter results of 2024 illustrate a company navigating challenges with strategic foresight and a robust operational foundation. Despite unforeseen hurdles, the company continues to thrive, offering high-quality care and robust financial returns. Investors and stakeholders should watch closely as UnitedHealth navigates the evolving healthcare landscape, maintaining a strong focus on innovation and efficiency.

Markets

Boeing’s Proactive Measures Ahead of Whistleblower Hearing

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

As Boeing faces a critical whistleblower hearing this Wednesday in the Senate, the aerospace giant is taking proactive steps to address concerns about the safety and quality of its aircraft. This action follows alarming allegations by Boeing engineer Sam Salehpour regarding manufacturing shortcuts in the 777 and 787 Dreamliner jets, which he claims could lead to catastrophic failures as the planes age.

Detailed Allegations and Boeing’s Response

Last week, reports surfaced that the Federal Aviation Administration (FAA) is investigating claims by Salehpour that essential manufacturing processes were compromised in the pursuit of efficiency. Salehpour is poised to be the principal witness at the upcoming Senate hearing. In response, Boeing convened a media briefing to reassure the public and stakeholders, emphasizing its commitment to safety despite choosing not to address Salehpour’s accusations directly.

Boeing’s Safety Record and Recent Scrutiny

The backdrop of this hearing is Boeing’s tarnished safety reputation, following two fatal crashes involving another model, the 737 Max, in 2018 and 2019, which resulted in 346 deaths. Furthermore, an incident earlier this year involving an Alaska Airlines 737 Max, where a door plug blew out mid-flight, has only intensified scrutiny. Boeing claims that these incidents have led to a surge in employee reports on safety and quality issues, indicating a robust internal response to these challenges.

Boeing’s Assurance and Future Steps

During Monday’s briefing, Lisa Fahl, Boeing’s VP of Engineering for Airplane Programs, highlighted the company’s rigorous testing regimes that simulate conditions far beyond typical operational stresses. Steve Chisholm, Boeing’s chief engineer, added that inspections of aging aircraft have not revealed the fatigue that Salehpour warned about, supporting Boeing’s confidence in the durability and safety of its fleet.

Boeing also acknowledged past issues with fuselage gaps on the 787 Dreamliner, admitting that some planes did not meet the original stringent standards. However, Chisholm noted that the standards had been revised and that ongoing inspections had not shown any resultant problems in operations.

Conclusion: Boeing’s Commitment to Safety and Integrity

As Boeing navigates through these turbulent times, its efforts to engage transparently with the public and address internal concerns are crucial. The company’s swift action in the face of potentially damaging allegations underscores its commitment to maintaining the highest safety standards and restoring its reputation. The outcome of Wednesday’s Senate hearing will likely be pivotal for Boeing as it seeks to reinforce trust among passengers, employees, and stakeholders in the aviation industry.

With increased scrutiny and a proactive approach, Boeing aims to demonstrate its dedication to safety and continuous improvement, reinforcing its position as a leader in the aerospace industry. Investors and stock traders should closely monitor these developments, as they will likely influence Boeing’s market performance and strategic direction in the coming years.

-

Markets2 months ago

Markets2 months agoUnderstanding Viking Therapeutics’ Position in the Biopharma Sector: A Beginner’s Guide

-

Markets3 months ago

Markets3 months agoCyngn (NASDAQ: CYN) and Nvidia: A Partnership Fueling Stock Momentum

-

Markets3 months ago

Markets3 months agoNikola’s Turnaround: How the Departure of Trevor Milton Marked a New Era for NKLA Stock

-

Markets2 months ago

Markets2 months agoThe AI Revolution: How Super Micro Computer (SMCI) Skyrocketed in the Tech Rally

-

Markets2 months ago

Markets2 months agoMastering the Market: A Guide to the Fundamentals of Value Investing

-

Trading2 months ago

Trading2 months ago3 Must-Watch AI Stocks in 2024: Unveiling ShiftPixy, C3.ai, and CXApp’s Market Potential

-

Markets3 months ago

Markets3 months agoPhunware Stock (PHUN) and the Impact of Direct Offering: A Potential Decline After a Rally

-

Lusso's Exclusives1 month ago

Lusso's Exclusives1 month agoWall Street Veteran Owns A Crap Ton Of Monday.com Stock [NASDAQ:MNDY]

-

Markets3 months ago

Markets3 months agoJetBlue and Spirit Seek Expedited Appeal to Revive $3.8 Billion Merger

-

Markets3 months ago

Markets3 months agoGMBL Stock: A Trader’s Insight into Esports Entertainment Group

-

Markets2 months ago

Markets2 months agoPlus500 Ltd’s Financial Overview: A Glimpse into 2023’s Performance