Markets

1 Good Synthetic Intelligence (AI) Refill 48% in 2024 to Purchase Now and Maintain for A long time

This has been a yr to recollect for shareholders of Palantir Applied sciences (NYSE: PLTR). Traders endured the ache of the inventory falling to the one digits after the corporate went public. Nevertheless, the technological marvel of synthetic intelligence (AI) breathed life again into the inventory, and the corporate’s repeated quarters of sturdy efficiency additional fueled market sentiment.

Whereas buyers might understandably fear that the inventory’s 48% transfer since January leaves little meat on the bone, haven’t any concern. Investing typically requires trying a long time forward, and Palantir might have extra promise than most corporations you will encounter.

Right here is why long-term buyers should buy right this moment and maintain the inventory for many years.

Authorities loyalty underpins Palantir’s enterprise

The web created the digital world we all know right this moment. Meaning humanity has spent over 20 years creating growing quantities of information at breakneck pace. Roughly 90% of all of the world’s knowledge is from the previous two years. Simply take into consideration how a lot knowledge the world can have in 5, 10, or 25 years!

That is an underrated side of , which has emerged as the following evolution of expertise. Information performs an vital function; AI is educated on knowledge, that means organizations with the very best knowledge and those that do essentially the most with it could have a aggressive edge.

This straightforward idea is the important thing to understanding Palantir’s large funding potential. The corporate develops and deploys customized knowledge analytics software program by way of Gotham, Foundry, and AIP platforms. This expertise’s objective is straightforward: seamlessly turning knowledge into actionable, real-time insights.

Palantir is usually a conundrum as a result of its advanced product presents little visibility to buyers and outsiders. So, as a substitute, look to who has and continues to lean on Palantir. The U.S. authorities, which flexes its nearly limitless sources to keep up a aggressive edge as a world superpower, has remained loyal to Palantir for over a decade. Palantir’s expertise allegedly helped the U.S. observe down terrorist Osama bin Laden again in 2011.

The federal government continues to again Palantir right this moment. Palantir just lately obtained a brand new $480 million contract from the Division of Protection. CEO Alex Karp confirmed that the corporate’s expertise is aiding Ukraine in its warfare with Russia. These conditions require cutting-edge instruments, and Palantir’s relevance each then and now ought to give buyers a transparent vote of confidence in how a lot worth its software program brings to the desk.

Unlocking years of upside within the non-public sector

The U.S. authorities and its allies are uniquely geared up to spend on the very best of the very best. That is why it could take time for among the authorities’s greatest instruments to trickle into the non-public sector. Nevertheless, Palantir is starting to realize momentum with business clients. That is finally the place Palantir’s long-term upside lies.

Firms have begun realizing that AI is vital to compete sooner or later and are scrambling to place themselves accordingly. Palantir launched its AIP platform final spring to assist corporations develop and deploy AI functions. It has been an enormous success. Alex Karp has acknowledged that . Since then, Palantir’s monetary efficiency has given substance to that declare.

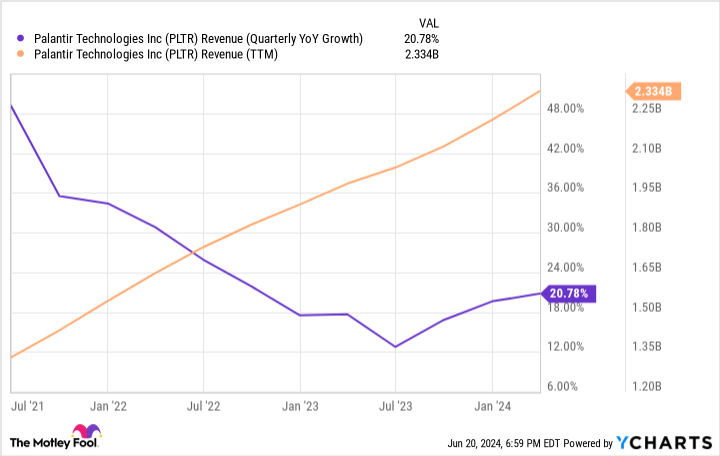

You possibly can see under that income progress has reaccelerated since AIP launched final yr:

Extra importantly, Palantir’s buyer rely is rising sooner than income, which may sign additional progress upside forward as new functions come on-line. Palantir’s U.S. business buyer rely grew 69% yr over yr in Q1 and stays modest at 262. There are over 20,000 massive companies in the USA alone.

Assume a long time forward

Palantir’s not promoting an off-the-shelf product. It takes time to develop and launch functions, which signifies that Palantir might by no means exhibit the explosive progress of Nvidia. Nevertheless, Palantir appears to be like poised for many years of regular double-digit progress.

Palantir’s makes use of vary from fraud detection to army operations. Its newest contract with Starlab will see Palantir mannequin a digital clone of an area station to simulate upkeep and take a look at operations. Such versatile expertise makes any firm (massive sufficient to afford the software program) a possible buyer.

Moreover, the corporate is worthwhile based mostly on usually accepted accounting ideas (GAAP) and has $3.8 billion in money towards zero debt, making Palantir a candidate to spend years shopping for again inventory and driving funding returns by way of relentless earnings progress.

The place may Palantir be in two or three a long time? Company alternatives alone give Palantir a big runway. The federal government enterprise arguably provides Palantir a excessive ground as properly. Palantir’s present market cap exceeds $50 billion. Nonetheless, buyers might be a future mega-cap inventory in the event that they’re prepared to purchase and maintain it for the foreseeable future.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Palantir Applied sciences wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $775,568!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia and Palantir Applied sciences. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

This Inventory Market Indicator Has Been 100% Correct Since 1964. It Alerts a Large Transfer within the 2nd Half of 2024.

The S&P 500 (SNPINDEX: ^GSPC) is extensively considered the most effective barometer for the general U.S. inventory market as a result of its scope and variety. The index measures the efficiency of 500 massive corporations that cowl 80% of U.S. equities by market capitalization.

The S&P 500 superior 14% in the course of the first half of 2024, outpacing the historic common of 5%, and one inventory market indicator says the index is headed even increased within the coming months. Particularly, throughout presidential election years involving an incumbent (a president working for reelection), the S&P 500 has all the time — 100% of the time — generated a optimistic return within the second half of the yr.

Here is what buyers have to know.

Historical past says the S&P 500 might climb 11% within the second half of 2024

There have been 16 presidential elections for the reason that was created in 1957, half of which concerned an incumbent president working for a second time period. As talked about, the index has all the time been a worthwhile funding in the course of the second half of election years involving an incumbent, no matter which presidential candidate gained the election.

The chart beneath exhibits the S&P 500’s return within the second half of each presidential election yr. Reelection years (years through which an incumbent was working for reelection) are marked with an asterisk.

|

Yr |

S&P 500 Return (Second Half of the Yr) |

|---|---|

|

1960 |

2% |

|

1964* |

4% |

|

1968 |

4% |

|

1972* |

10% |

|

1976 |

3% |

|

1980* |

19% |

|

1984* |

9% |

|

1988 |

2% |

|

1992 |

7% |

|

1996* |

10% |

|

2000 |

(9%) |

|

2004* |

6% |

|

2008 |

(29%) |

|

2012* |

5% |

|

2016 |

7% |

|

2020* |

21% |

|

Common (All Years) |

4% |

|

Common (Reelection Years) |

11% |

Knowledge supply: YCharts. The desk exhibits the S&P 500’s return within the second half of all presidential election years for the reason that index was created in 1957. Asterisks denote reelection years, which means an incumbent president was working for a second time period.

As proven above, throughout presidential election years, the S&P 500 returned a mean 4% in the course of the second half. Nevertheless, if the outcomes are restricted to years when an incumbent president was working for reelection, as Joe Biden is in 2024, the S&P 500 returned a mean of 11% in the course of the second half.

Which will sound contrived, however Jeff Buchbinder at LPL Monetary supplied this logical rationalization in a latest weblog put up. “We imagine this sample is partly because of the incumbent priming the pump forward of the election with fiscal stimulus and pro-growth regulatory insurance policies to stave off potential recession and encourage jobs progress.” Nevertheless, he additionally famous that Biden has restricted alternatives to prime the pump on condition that Republicans management the Home.

Regardless, historical past says the S&P 500 might return roughly 11% within the second half of 2024. The index has already superior 2% in July, leaving implied upside of 9% by way of December.

That mentioned, previous outcomes are by no means a assure of future returns. will finally decide how the inventory market performs within the remaining months of 2024.

Historical past says the S&P 500 might soar when the Federal Reserve cuts rates of interest

Wall Avenue will monitor labor market and inflation information intently within the coming months, awaiting proof the financial system is headed for a gentle touchdown, a situation through which the Federal Reserve brings inflation again to its 2% goal with out tipping the financial system right into a recession.

In June 2022, inflation reached a four-decade excessive of 9.8% as a result of provide chain disruptions and stimulus applications associated to Covid-19. The Federal Reserve responded with its most aggressive rate-hiking cycle for the reason that early Nineteen Eighties, and the federal funds fee now sits at a 23-year excessive. That’s doubtlessly problematic for the inventory market as a result of shoppers and companies spend much less when borrowing prices are elevated, which suppresses company earnings progress.

On the brilliant aspect, inflation dropped to three.3% in Might 2024. However pricing pressures haven’t eased sufficient to warrant the lengthy awaited loosening cycle (a interval when the Federal Reserve is slicing rates of interest). So, buyers are hoping inflation continues trending towards its 2% goal, whereas different information factors — equivalent to job openings and unemployment — present a regularly cooling, however nonetheless wholesome financial system.

In that situation, the Federal Reserve could lower rates of interest later this yr, and the financial system can also keep away from a recession. Such a decision has traditionally been excellent news for the inventory market. Through the seven loosening cycles since 1987, the S&P 500 returned a mean 6% in the course of the 12 months following the primary fee lower. However the common return was 16% throughout that 12-month interval if the financial system averted a recession.

Buyers ought to give attention to long-term good points, not short-term actions within the inventory market

Buyers can put cash to work within the inventory market right this moment figuring out historical past is on their aspect. Certainly, the S&P 500 will return 11% in the course of the second half of 2024 if its efficiency aligns exactly with the historic common. In fact, no inventory market indicator is infallible, so buyers ought to be cognizant of the dangers.

If the Federal Reserve retains rates of interest elevated all through the remaining months yr, or if the financial system sinks right into a recession, the S&P 500 might simply decline within the second half of 2024. For that cause, buyers ought to stick with a buy-and-hold technique that goals to seize long-term capital good points.

Don’t miss this second likelihood at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? You then’ll wish to hear this.

On uncommon events, our professional crew of analysts points a advice for corporations that they assume are about to pop. In case you’re fearful you’ve already missed your likelihood to speculate, now’s the most effective time to purchase earlier than it’s too late. And the numbers converse for themselves:

-

Amazon: if you happen to invested $1,000 after we doubled down in 2010, you’d have $22,525!*

-

Apple: if you happen to invested $1,000 after we doubled down in 2008, you’d have $42,768!*

-

Netflix: if you happen to invested $1,000 after we doubled down in 2004, you’d have $372,462!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable corporations, and there might not be one other likelihood like this anytime quickly.

*Inventory Advisor returns as of July 2, 2024

has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Porsche stops manufacturing of some combustion fashions early

FRANKFURT (Reuters) – Porsche is sticking to its weapons in its transition to electrical automobiles, bringing ahead the tip of manufacturing of some internal-combustion fashions, the carmaker’s head of manufacturing instructed journal Automobilwoche.

Porsche government board member Albrecht Reimold stated that the petrol-powered model of SUV mannequin Macan for non-European markets could be produced now not than 2026, prior to initially projected.

“The platform has reached the tip of its cycle,” stated Reimold.

After the manufacturing cease the corporate would deal with electrical Macan variations to push Porsche’s sustainability agenda, regardless that EV demand had seen a droop, Reimold was quoted as saying.

“I do not let the success (of the electrical Macan) be outlined by a single quantity,” the manager was quoted as saying.

Combustion engine variations of Boxster and Cayman sportscars, a mannequin vary often called 718, would now not be produced from a while subsequent yr and the corporate is already centered on electrical variations to be launched subsequent yr, Reimold added.

Manufacturing of petrol-powered variations of 718 and Macan for European markets have already been stopped.

Markets

Bearish Indicators Intensify for Chinese language Shares Forward of Third Plenum

(Lusso’s Information) — Bearish indicators are mounting for Chinese language shares forward of one of many nation’s largest annual coverage conferences.

Most Learn from Lusso’s Information

The Cling Seng China Enterprises Index fell as a lot as 1.9% on Monday, taking its decline from a Could 20 excessive to over 10% and placing it on observe for a technical correction. On the mainland, the CSI 300 Index slid for a fifth session. That adopted a seventh week of losses on Friday, its longest shedding run since early 2012.

A rally in Chinese language equities that started earlier this 12 months has misplaced momentum on account of an uneven financial restoration and rising concern over doubtless geopolitical dangers from elections in Europe and the US. Traders don’t count on a fast enhance for shares from the Third Plenum, the July 15-18 assembly that can collect some 400 authorities bigwigs, navy chiefs, provincial bosses and teachers in Beijing to steer the nation’s political and financial course.

Stimulus to this point has had solely minimal influence on the nation’s ailing property sector or shopper confidence.

“The Chinese language home economic system stays tender and there’s little expectation for stimulus from the third Plenum,” mentioned Xin-Yao Ng, director of funding at abrdn Asia Ltd. “There’s some unfavorable sentiment from the elections in Europe with uncertainties round its perspective towards China with extra left-wing events taking affect.”

Sentiment is especially fragile amongst Chinese language onshore buyers. The CSI 300 index has erased all features this 12 months, and the Shanghai Inventory Change Composite Index has been buying and selling beneath 3,000 factors — a key psychological stage — since June 21. Small-cap shares, a phase Goldman Sachs says is especially weak to slowing financial progress, have been hit significantly arduous this 12 months.

In the meantime, there are indicators that the so-called nationwide workforce might have stepped in lately to spice up confidence forward of the plenum. Some trade traded funds favored by China’s sovereign wealth fund have seen massive inflows because the Shanghai inventory gauge fell beneath the three,000 stage. State funds have been essential in stabilizing the inventory market when that index plunged in a February rout.

“Traders are staying on high of macro and coverage developments in China however really feel no rush to return to the market regardless of record-low publicity lately,” Morgan Stanley strategists together with Laura Wang wrote in a word following their current US advertising journey. “Foreign money weak spot, geopolitical uncertainty, and China’s macro challenges stay near-term hurdles.”

Nonetheless, low cost valuations and world funds’ gentle positioning in Chinese language equities create a positive arrange for a rebound if there are constructive surprises from the coverage conferences and the Federal Reserve’s interest-rate path. A few third of 19 Asia-based strategists and fund managers surveyed informally by Lusso’s Information Information mentioned they see Chinese language shares, along with Indian friends, as doubtless outperformers in Asia within the second half of the 12 months.

MSCI Inc.’s key gauge of Chinese language shares fell right into a technical correction on the finish of June, whereas a Lusso’s Information Intelligence measure of developer shares has misplaced greater than 30% from its Could excessive. The Cling Seng Tech Index too has entered a correction.

–With help from John Cheng.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets3 months ago

Markets3 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets3 months ago

Markets3 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets3 months ago

Markets3 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets2 months ago

Markets2 months agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets2 months ago

Markets2 months agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets2 months ago

Markets2 months agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets2 months ago

Markets2 months agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets2 months ago

Markets2 months agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing