Business

Is The Stock Market In A “Bubble” ?

Quick Take

- Why the Investors fear a “bubble”

- Price Action is normal given the circumstances

- FEDS eased + Aggressive Fiscal Action

- Software companies are soaring

[mstock id=”1820″]

Coming Out Of A Global Recession

With all the cards being in favor for Investors of the NASDAQ and NYSE coming out of a Global recession, it makes sense that we are seeing such a aggressive rally to the upside in the Stock Market.

Coming out of a global recession you have:

- Investors all around the world being liquid with cash after selling majority of their positions and raising cash

- The US Stock Market making a sharp decline very fast presenting opportunity for value investors

When you get depressed prices and a sharp sell off you have opportunity. With the United States having the best Stock Market by a long shot, Investors from all around the world were looking and participating in the rally.

Phases Of Business Cycles

First, you have to understand Business Cycles.

The Economy is not the Stock Market but, the Stock Market is a indicator of the Economy in the future as the market is forward looking. You have phases in a business cycle from a economics view that the market tends to price in.

1.Trough ( where a bottom occurs )

2. BOOM/Expansion (Where a surge off of the lows occurs)

3.Peak

4.Recession

Now, what we have been seeing is the “BOOM” phase as the market is forward looking but, other factors have made the “BOOM” more aggressive.

Fiscal Policy

Part of the reason for the BOOM phase being so aggressive is strong fiscal action. Allowing the fiscal action to coexist with aggressive action from the FED calls for a strong stock market. This type of good news, (multi trillion dollar stimulus package) helps grow output into the economy and cause for the “Expansion phase” of the economy.

Monetary Policy

The FED is your FRIEND the saying goes.

This BOOM phase off of the trough all start when the FED announced their monetary policy to back up the depressed economy back in March. They jumped down multiple basis point slashing the interest rates to near zero with many buy back programs that are still running almost a year later.

The FED is the main reason people are screaming for a “Bubble” and frankly, if a bubble pop will have occurred then to be honest it will probably happen when the FED has or is close to announcing less aggressive approach.

For one of the first times the US FED have aimed at a targeted inflation rate of 2%. A 2% inflation rate allows for the FED to give wiggle room of 1-3% so if they are slightly off they can keep it between 1-3% inflation rate so it is not too high or to low.

Market Of Stocks, Not A Stock Market

Lastly, the stock market is a MARKET OF STOCKS.

The indexes such as the S&P 500 may have economic traders invested in the name but, it is weighted by majority of the FANG stocks. Frankly, stocks have been surging like never before due to the nature of their business model being online.

Software names and new up and coming companies have emerged. With the exception of lack of demand in the travel industry and restaurants and such , stocks are on fire.

Final Opinion

To sum things up, what we are seeing in todays market is totally normal given the circumstances but, things can change quick. If a bubble burst were to occur it would probably occur when the Market think the FED is close to changing their tone. After all, Follow the FED they say.

Business

Mortgage Rates Hit 7.1%: Analyzing the Impact on the U.S. Housing Market

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

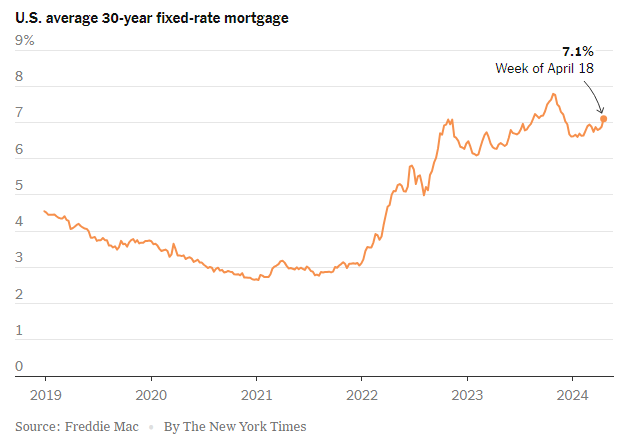

The U.S. housing market is experiencing significant pressure as mortgage rates have surged past the 7 percent mark for the first time this year. According to a recent report by Freddie Mac, the average rate on the 30-year mortgage, the most favored home loan across the nation, climbed to 7.1 percent this week, marking the highest level since last November. This spike poses a considerable challenge to millions of potential home buyers and could further slow down a market already showing signs of cooling.

Rising Rates and Their Ripple Effects

Last year, mortgage rates peaked at nearly 8 percent, a height unseen since 2000. This upward trend in rates began in 2021, significantly driven by Federal Reserve policies aimed at curbing inflation through higher benchmark interest rates. Despite a reduction in inflation rates, they remain above the Fed’s 2 percent target, leading to expectations that high borrowing costs may persist.

The immediate effect of these climbing rates is twofold. Firstly, potential home buyers face increased costs, making homeownership less accessible for many Americans. This economic strain is causing prospective buyers to deliberate intensely on whether to purchase now or delay in hopes of a rate decrease later in the year.

Secondly, existing homeowners, who secured their properties at lower interest rates, are reluctant to sell, fearing higher rates on a new mortgage. This hesitancy to sell is contributing to a decreased housing supply, inadvertently pushing home prices up despite fewer transactions.

Market Slowdown and Policy Responses

Data from the National Association of Realtors (NAR) underscores the market’s response to these economic pressures, with sales of existing homes dropping by 4.3 percent in March and 3.7 percent year-over-year. This downturn reflects broader economic frustrations and the daunting prospect of entering a market characterized by both high prices and high rates.

In a potentially mitigating development, the NAR recently agreed to settle litigation that would eliminate the standard real estate sales commission. Traditionally, sellers would pay a 5 to 6 percent commission, a cost typically passed on to buyers, inflating home prices. This change could, theoretically, reduce overall home purchasing costs.

Broader Economic Implications

The rising mortgage rates, coupled with the Fed’s indications of maintaining a high-interest rate environment, have pushed Treasury yields higher, influencing mortgage rates further. The 10-year Treasury yield has notably increased to about 4.6 percent since the start of the year.

As the market adjusts to these new economic realities, the overarching question remains: How many potential buyers can withstand further rate increases? Freddie Mac’s chief economist, Sam Khater, suggests that the future of the housing market is still very much uncertain, with potential buyers weighing the risks of higher future costs against the possibility of rate decreases.

Conclusion

The surge in mortgage rates above 7 percent represents more than just a numerical threshold; it is a significant barrier to entry for many Americans aspiring to homeownership. This development tests the resilience of the U.S. housing market and calls for close monitoring of future economic policies and market adaptations. As the landscape evolves, potential homebuyers and industry stakeholders alike must navigate these challenging waters with careful consideration and strategic planning.

Business

Potential Ban on TikTok: A Boon for Snapchat and Meta?

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

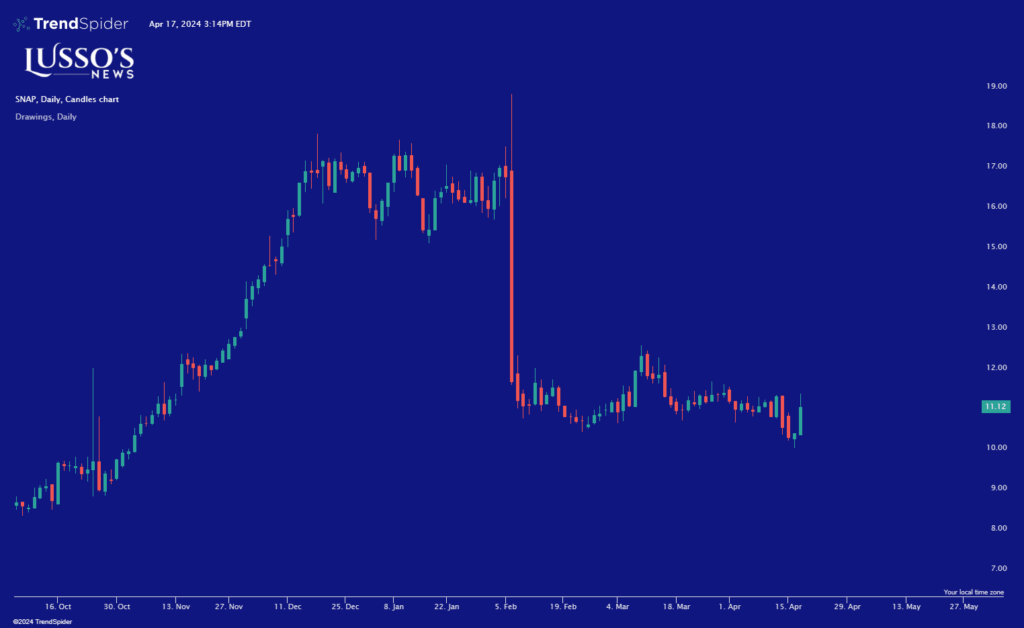

The U.S. House of Representatives’ recent move to potentially ban TikTok via legislation could have significant implications for the competitive landscape of social media, particularly benefiting companies like Snapchat and Meta (formerly Facebook). This legislative effort, part of a broader package for Israel and Ukraine, underscores growing concerns about TikTok’s Chinese ownership and its implications for national security.

Strategic Advantage for Competitors

Snapchat and Meta, two of the largest social media platforms in the United States, stand to gain from a TikTok ban. TikTok, with its 170 million U.S. users, has become a dominant force in social media, particularly among younger audiences who engage with its dynamic content ranging from dance videos to political discourse. A ban could leave a vast user base seeking alternative platforms, and Snapchat and Meta are well-positioned to absorb this migration.

1. User Engagement and Growth

Both Snapchat and Meta have been investing heavily in video and augmented reality—technologies at the heart of TikTok’s appeal. Snapchat’s innovative AR filters and Meta’s investment in Reels and virtual reality could see increased user engagement as TikTok users look for similar experiences elsewhere.

2. Advertising Revenue

A shift in user base would also likely lead to an increase in advertising revenue for Snapchat and Meta. Advertisers looking to capitalize on the highly engaged, predominantly younger audience that TikTok attracted would turn to these platforms, which offer robust ad-targeting systems and massive global reach.

3. Market Position and Shares

From a financial perspective, the potential TikTok ban could lead to a bullish outlook for stocks like Snapchat and Meta. Investors may see these companies as primary beneficiaries in the social media space, driving up share prices in anticipation of user growth and increased market share.

Challenges and Considerations

While the potential ban could offer a tactical advantage to companies like Snapchat and Meta, it also presents challenges. These companies would need to innovate continually to satisfy the diverse needs of former TikTok users. Moreover, the legislative move against TikTok raises broader concerns about internet freedom and regulation, which could eventually impact other social media platforms as well.

Ethical and Regulatory Landscape

The controversy surrounding TikTok has highlighted the complex interplay between technology, politics, and user privacy. As Snapchat and Meta potentially benefit from TikTok’s troubles, they must also navigate the ethical and regulatory challenges that arise from increased scrutiny on data practices and content moderation.

Conclusion

In conclusion, while the legislative push against TikTok could destabilize the current social media hierarchy, it also presents significant opportunities for companies like Snapchat and Meta to capitalize on a potential market void. However, these gains are not without challenges, requiring careful strategic planning and responsive innovation to harness effectively. Investors and market analysts will be watching closely as this situation develops, potentially reshaping the competitive dynamics of the social media industry.

Business

YUUUUGE, $DJT TMTG Launches Live TV Streaming Platform via Truth Social

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

Trump Media & Technology Group Corp. (NASDAQ:DJT), known as TMTG, has officially concluded the research and development phase for its innovative live TV streaming platform. This development marks a significant step for the operator of the social media platform, Truth Social. After six months of rigorous testing across its Web and iOS platforms, TMTG is now set to expand its content delivery network (CDN), enhancing the platform’s streaming capabilities.

Strategic Rollout in Phases

TMTG’s rollout of its streaming service is planned in three strategic phases, designed to broaden its reach and accessibility:

- Phase 1: Integration of the CDN with the Truth Social app, extending live TV streaming services to users on Android, iOS, and Web.

- Phase 2: The launch of standalone over-the-top (OTT) streaming apps for mobile devices and tablets, facilitating easier access to the platform’s content.

- Phase 3: Expansion to home television systems by introducing streaming apps compatible with various home TV setups.

Diverse and Inclusive Content Offering

The new streaming platform is set to host a variety of content, including live TV, news networks, religious channels, and family-friendly programming such as films and documentaries. TMTG aims to serve as a sanctuary for content and creators at risk of cancellation or suppression on other platforms, promising a safe haven for free expression and diverse viewpoints.

A Commitment to High-Quality Streaming and Free Speech

Devin Nunes, CEO of TMTG, expressed his enthusiasm for the project, highlighting the platform’s commitment to providing a permanent home for high-quality news and entertainment. “We want to let these creators know they’ll soon have a guaranteed platform where they won’t be cancelled,” said Nunes.

The CDN developed by TMTG is engineered to be user-friendly, cost-effective, and independent of Big Tech influences. It incorporates advanced technology designed to optimize video streaming speed, performance, and security while minimizing disruptions. This initiative is expected to substantially enhance the user experience on Truth Social, reinforcing the platform’s mission of promoting free speech and serving its robust community of users and supporters.

Conclusion: A Strategic Expansion by TMTG

As TMTG transitions into the next phase of its development with the rollout of its live TV streaming platform, the company is poised to make significant impacts in the media and technology landscape. This expansion not only diversifies TMTG’s offerings but also strengthens its position as a champion of free speech and alternative media. The strategic development of its CDN and phased rollout plan demonstrates TMTG’s commitment to growth and innovation, potentially setting new standards in the streaming content arena.

-

Markets2 months ago

Markets2 months agoUnderstanding Viking Therapeutics’ Position in the Biopharma Sector: A Beginner’s Guide

-

Markets2 months ago

Markets2 months agoThe AI Revolution: How Super Micro Computer (SMCI) Skyrocketed in the Tech Rally

-

Markets2 months ago

Markets2 months agoMastering the Market: A Guide to the Fundamentals of Value Investing

-

Trading2 months ago

Trading2 months ago3 Must-Watch AI Stocks in 2024: Unveiling ShiftPixy, C3.ai, and CXApp’s Market Potential

-

Lusso's Exclusives2 months ago

Lusso's Exclusives2 months agoWall Street Veteran Owns A Crap Ton Of Monday.com Stock [NASDAQ:MNDY]

-

Markets3 months ago

Markets3 months agoJetBlue and Spirit Seek Expedited Appeal to Revive $3.8 Billion Merger

-

Markets3 months ago

Markets3 months agoGMBL Stock: A Trader’s Insight into Esports Entertainment Group

-

Business2 months ago

Business2 months agoDeciphering HSBC Holdings plc’s Fiscal Landscape: An In-depth Analysis of 2023’s Outcomes

-

Business3 months ago

Business3 months agoLQR HOUSE’s Sean Dollinger Teams Up with Michael Jordan’s Business Partner Bjarne Borg in Exclusive Interview

-

Markets2 months ago

Markets2 months agoPlus500 Ltd’s Financial Overview: A Glimpse into 2023’s Performance

-

Markets2 weeks ago

Markets2 weeks agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing