Markets

1 Inventory That Elevated 10,000% in 33 Years to Purchase and Maintain Endlessly

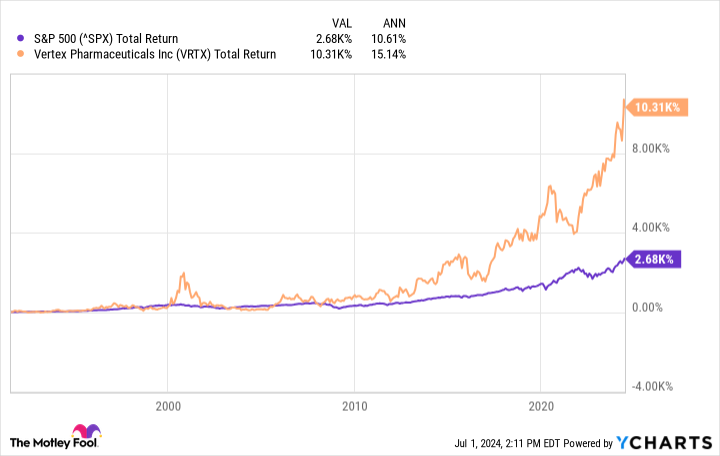

Investing in fairness markets is a dependable, wealth-growing technique. Previously 33 years, the S&P 500‘s common annual return is about 10.6%. It is laborious to discover a return significantly better than that elsewhere.

Some particular person shares have carried out even higher, although. Take Vertex Prescribed drugs (NASDAQ: VRTX), a number one biotech firm whose common annual return since its 1991 preliminary public providing (IPO) is 15.1%. The drugmaker has grown by 10,310%.

It’s a formidable efficiency, however Vertex nonetheless has loads of development forward of it, and the inventory seems to be like a strong buy-and-hold-forever choose. Right here is why.

information by

The key to Vertex’s success

About 7,000 uncommon ailments have an effect on between 25 million and 30 million People. Many do not have accredited therapies focusing on their underlying causes. So, it is not laborious for a to select a goal on this universe of unmet medical wants that might show extremely profitable. The laborious half is creating efficient medicines. That is Vertex’s primary (although not the one) focus. The corporate seeks to focus on the underlying causes of ailments for which there are few, if any, therapies.

Its work in cystic fibrosis (CF) prior to now couple of a long time is a tremendous success story. CF is a illness that impacts about 92,000 sufferers in North America, Europe, and Australia. It causes injury to inside organs. And till Vertex’s breakthroughs — its first CF product was formally accredited within the U.S. in 2012 — there weren’t any medicines that addressed the sickness on the genetic degree. Vertex has been handsomely rewarded for its progress on this discipline. Income and earnings have grown quickly.

information by

However that is prior to now. Can Vertex Prescribed drugs nonetheless carry out effectively transferring ahead?

Do not change a profitable components

Success in enterprise would not occur accidentally. Sure, there’s typically a component of luck. Nevertheless, companies that carry out persistently effectively for a very long time should have a imaginative and prescient and the power to execute a profitable technique. Vertex’s imaginative and prescient stays the identical. It’s nonetheless creating medicines for uncommon (and in addition not so uncommon) ailments. Previously, the biotech has confirmed that it could actually execute. Loads of its friends tried to develop competing CF therapies. , to this point.

Vertex is now proving itself outdoors of its core space. It lately earned approval for Casgevy, a gene-editing remedy for a few uncommon blood-related ailments. It’s advancing key packages via its pipeline. Inaxaplin, a possible remedy for APOL1-mediated kidney illness, is now within the section 3 portion of a section 2/3 examine.

Suzetrigine, an investigational drugs for acute and neuropathic ache, carried out effectively in a late-stage medical trial, the outcomes of which have been introduced earlier this yr. There are many ache medicines, however they typically carry burdensome unwanted side effects, so there’s nonetheless a necessity right here.

Vertex’s early-stage packages additionally look promising. The corporate is aiming to “treatment” kind 1 diabetes with VX-880. In an ongoing section 1/2 examine, three sufferers with no less than a yr of follow-up have achieved insulin independence. All folks with kind 1 diabetes (in contrast to the kind 2 selection) sometimes want insulin. These outcomes are spectacular though it is too early to rejoice. There’s extra occurring with Vertex Prescribed drugs.

Nevertheless, the necessary level is that this: Do not spend money on biotech due to particular medical packages. VX-880 would possibly show ineffective and so would possibly inaxaplin. Regardless of constructive section 3 outcomes, suzetrigine may encounter unexpected regulatory roadblocks. In any case, Vertex has confronted such medical or regulatory headwinds earlier than.

As an example, in October 2020, the biotech halted a section 2 examine for an in any other case promising candidate partly due to security considerations. The corporate’s shares dropped off a cliff in at some point consequently. Here is how the inventory has carried out since then.

information by

The lesson? Vertex’s prospects do not hinge on any single program. The corporate’s energy is its clear imaginative and prescient and technique and its tradition of innovation, which permits it to realize that imaginative and prescient. That is what makes Vertex Prescribed drugs inventory value holding onto without end.

Do you have to make investments $1,000 in Vertex Prescribed drugs proper now?

Before you purchase inventory in Vertex Prescribed drugs, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for traders to purchase now… and Vertex Prescribed drugs wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $786,046!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 2, 2024

has positions in Vertex Prescribed drugs. The Motley Idiot has positions in and recommends Vertex Prescribed drugs. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

30% of My Portfolio Is Invested in Simply 5 Shares — Right here's Precisely What They Are

I usually haven’t got a ton of focus in my portfolio, however on account of current market strikes, greater than 30% of my capital is invested in simply 5 shares. Some are frequent slow-and-steady portfolio spine shares, whereas others may shock you. This is a rundown of what all 5 are.

*Inventory costs used have been the morning costs of July 2, 2024. The video was revealed on July 3, 2024.

Must you make investments $1,000 in Berkshire Hathaway proper now?

Before you purchase inventory in Berkshire Hathaway, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for traders to purchase now… and Berkshire Hathaway wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $771,034!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 2, 2024

has positions in Berkshire Hathaway, Normal Motors, MercadoLibre, Pinterest, and Realty Revenue. The Motley Idiot has positions in and recommends Berkshire Hathaway, MercadoLibre, Pinterest, and Realty Revenue. The Motley Idiot recommends Normal Motors and recommends the next choices: lengthy January 2025 $25 calls on Normal Motors. The Motley Idiot has a .

Matthew Frankel is an affiliate of The Motley Idiot and could also be compensated for selling its companies. In the event you select to subscribe by way of they may earn some extra cash that helps their channel. Their opinions stay their very own and are unaffected by The Motley Idiot.

was initially revealed by The Motley Idiot

Markets

Eli Lilly to purchase bowel illness drug developer Morphic for $3.2 billion

(Reuters) -Eli Lilly will purchase Morphic Holding (NASDAQ:) for $3.2 billion in money, the businesses mentioned on Monday, giving the U.S. drugmaker entry to an experimental drug for sorts of inflammatory bowel illnesses.

Shares of drug developer Morphic surged 76% to $56.15 premarket on Lilly’s provide of $57 per share, which represents a 79% premium to inventory’s final closing worth.

Morphic’s lead drug MORF-057 is an oral remedy that’s being evaluated in two section 2 research in ulcerative colitis sufferers and one section 2 examine in Crohn’s illness.

Ulcerative colitis is a situation the place irregular reactions of the immune system trigger irritation and ulcers on the inside lining of the colon, which may result in diarrhea, passing of blood with stool and belly ache.

Final yr, the U.S. Meals and Drug Administration accepted Lilly’s Omvoh for treating adults with moderate-to-severe lively ulcerative colitis.

The drug is amongst Lilly’s potential development drivers for this decade alongside its diabetes and weight problems medicine, Mounjaro and Zepbound.

Different drugmakers comparable to Abbvie Inc, Pfizer (NYSE:) and Johnson & Johnson (NYSE:) are additionally jostling for a share of the multi-billion greenback bowel illness market.

Markets

HIVE Digital inventory rallies over 9% as Bitcoin miner bolsters crypto reserves to 2.5k BTC

Canadian Bitcoin mining firm HIVE Digital has launched a June monetary report, revealing it has elevated its reserves to 2,503 BTC saved on the steadiness sheet.

HIVE Digital Applied sciences, the Vancouver-based Bitcoin mining firm, appears unaffected by the current miner capitulation that brought on Bitcoin (BTC) to plunge under the $56,000 mark.

In a Jul. 8 press launch, the corporate revealed that as of Jul. 7, its crypto holdings on the steadiness sheet had elevated to 2,503 BTC, a greater than 2% enhance in comparison with the prior month. In whole, HIVE Digital mined 119 BTC in June, conserving the identical efficiency as in Might.

Regardless of current market turbulence that noticed Bitcoin plunge under the $56,000 mark, HIVE Digital seems unaffected. CEO Aydin Kilic addressed the agency’s operational enlargement, noting that the remaining batch of Bitmain S21 orders “are able to ship, and actually have been upgraded to S21 Professional, representing roughly 1,150 S21 Professional miners from HIVE’s unique order in December.” Kilic added that the most recent acquisition of 1,000 S21 Professional Miners revealed in Might is now “able to ship,” with the overall fleet of recent rigs anticipated to be put in by the tip of July.

You may additionally like: Bitcoin rally hinges on charge minimize, Bitfinex exec says

“Subsequently, we anticipate the overall 2,150 pending S21 Professional miners to ship within the subsequent week, bringing HIVE’s whole operational hashrate to five.5 EH/s as soon as totally put in, with a world fleet effectivity of 24.5 J/TH. HIVE expects these machines to be put in earlier than the tip of July.”

Aydin Kilic

Following the discharge of the constructive report, HIVE Digital’s shares (HIVE) soared by over 9.5% on Nasdaq, leaping to $3.34, based on information from Google Finance.

HIVE Digital’s reserve boosting comes regardless of large capitulation amongst its rivals. As QCP analysts famous in a analysis report, Bitcoin miners are exhibiting “indicators of capitulation” because the cryptocurrency’s worth slid under $56,000 late Jul. 5. Amid the deteriorating panorama, the hashprice mark neared “its all-time low,” a stage final seen in the course of the bear market.

Learn extra: Bitcoin mining shares slumping in pre-market buying and selling

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets3 months ago

Markets3 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets3 months ago

Markets3 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets3 months ago

Markets3 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets3 months ago

Markets3 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets2 months ago

Markets2 months agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets2 months ago

Markets2 months agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets2 months ago

Markets2 months agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets2 months ago

Markets2 months agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets2 months ago

Markets2 months agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing