Markets

1 Unstoppable Inventory Set to Be a part of Nvidia, Apple, and Microsoft within the $3 Trillion Membership

The U.S. economic system has a centurylong historical past of manufacturing the world’s most useful corporations:

-

United States Metal grew to become the world’s first $1 billion firm in 1901.

-

Normal Motors rode the automotive manufacturing increase to turn out to be the primary $10 billion firm in 1955.

-

Normal Electrical constructed a conglomerate promoting a variety of merchandise from aircraft engines to family home equipment, and it grew to become the world’s first $100 billion enterprise in 1995.

-

Apple achieved a $1 trillion valuation in 2018 following the unbelievable success of units just like the iPhone.

Microsoft, Nvidia, Amazon, Meta Platforms, and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) have since joined Apple within the trillion-dollar membership.

In actual fact, Apple, Microsoft, and Nvidia have every graduated to the ultra-exclusive $3 trillion stage, however I believe another firm is about to affix them.

Alphabet is the tech conglomerate behind Google, YouTube, Waymo, DeepMind, and a number of different subsidiaries. It is a acknowledged chief within the fast-growing synthetic intelligence (AI) area, which could possibly be its ticket to a $3 trillion valuation by the tip of 2025.

Alphabet is at present valued at $2.3 trillion, so buyers who purchase the inventory at the moment may earn a acquire of 32% if it does be part of the likes of Apple, Microsoft, and Nvidia.

Alphabet is remodeling is legacy enterprise with AI

Alphabet is at a crossroads. The corporate generates greater than half of its income from Google Search, which has a 91% market share within the web search trade. Nonetheless, chatbots like ChatGPT provide a extra handy method to instantly entry info, they usually can produce it immediately. Microsoft even struck a take care of OpenAI final 12 months to make use of ChatGPT in its Bing search engine in an try and disrupt Google.

However Google Search has been the window to the web for many years, so Alphabet arguably has extra useful knowledge with which to construct fashions than another tech big. It launched its personal chatbot known as Bard final 12 months, which developed to turn out to be a household of multimodal fashions known as Gemini. They will interpret and produce textual content, pictures, movies, and even pc code.

Plus, Alphabet simply launched AI Overviews to the normal Google Search expertise. They’re text-based responses that seem on the high of the search outcomes, saving customers from sifting by way of net pages to seek out solutions to their queries. Alphabet says the reference hyperlinks included in AI Overviews obtain extra clicks than people who seem in conventional search outcomes, which may drive extra promoting income and ease considerations over Google dropping its dominance.

Plus, the Gemini fashions are creating a number of different alternatives to generate AI income. Google Workspace customers can now add Gemini for a further month-to-month subscription charge, which can assist enhance their productiveness in functions like Google Docs, Sheets, and Gmail.

Moreover, the Gemini fashions are actually obtainable on Google Cloud, so builders can use them (together with greater than 130 others from third events) to construct their very own AI functions. It is a massive value saver for companies in comparison with creating a big language mannequin (LLM) from scratch, which takes time, truckloads of information, and substantial monetary assets.

Strong monetary progress

Within the 5 years between 2019 and 2023, Alphabet income grew at a compound annual charge of 13.7%, bringing in a file $307.4 billion final 12 months alone:

The corporate kicked off 2024 with an above-trend income leap of 15% within the first quarter (12 months over 12 months). It included a 14.3% improve in Google Search income alone, which was the quickest tempo in nearly two years. YouTube’s income enlargement accelerated to twenty.8%, and Google Cloud remained the fastest-growing a part of the enterprise, with gross sales hovering by 28.4%.

Improved market situations had been a giant assist, following a painful droop within the promoting trade all through 2022 and 2023 attributable to unsure financial situations. However Alphabet may expertise even quicker progress within the second half of this 12 months, as a result of the U.S. Federal Reserve is forecast to chop rates of interest thrice within the coming months. It may immediate companies to spend more cash on advertising and marketing as they attempt to attain a shopper with extra {dollars} of their pocket.

Alphabet’s (mathematical) path to the $3 trillion membership

Alphabet generated $6.52 in earnings per share during the last 4 quarters, and based mostly on its present inventory value of $185.01, it trades at a price-to-earnings (P/E) ratio of 28.3.

That is cheaper than the 32.7 P/E ratio of the Nasdaq-100 index, so Alphabet is technically undervalued relative to its friends within the tech sector.

It additionally makes Alphabet less expensive than all three members of the $3 trillion membership, which commerce at a median P/E ratio of fifty.2 (which is closely skewed by Nvidia’s lofty valuation):

I do not suppose it could be acceptable for Alphabet’s P/E to rise to 50.2, but when it did, that may worth the corporate at over $4 trillion. But it surely may rise to the typical P/E ratio of Apple and Microsoft (37.6), which might be sufficient to position Alphabet within the $3 trillion membership.

However even when Alphabet does not expertise any a number of enlargement (an increase in its P/E ratio), it may be part of the $3 trillion membership throughout the subsequent 18 months solely based mostly on the expansion of its enterprise.

How? Wall Road expects the corporate to ship $8.61 in earnings per share in 2025, inserting Alphabet inventory at a ahead P/E ratio of 21.5. Which means its shares should rise 32% between at times simply to take care of their present P/E ratio of 28.3. That acquire will probably be sufficient to worth the corporate at $3 trillion.

I am not the one one who thinks Alphabet is a superb worth on the present value. The corporate expanded its share repurchase program by a whopping $70 billion earlier this 12 months, which implies it can periodically purchase chunks of its personal inventory to return cash to shareholders.

In abstract, Alphabet has multiple path into the unique $3 trillion membership, and buyers who purchase the inventory at the moment may earn a pleasant acquire alongside the best way.

Do you have to make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for buyers to purchase now… and Alphabet wasn’t considered one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $787,026!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 15, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends Normal Motors and recommends the next choices: lengthy January 2025 $25 calls on Normal Motors, lengthy January 2026 $395 calls on Microsoft, and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Medical Properties Belief Faces Threat Of Earnings Dilution Regardless of New Tenant Leases, Analyst Says

Colliers Securities upgraded Medical Properties Belief, Inc. (NYSE:) inventory to a Purchase ranking and .

Additionally, Truist Securities analyst Michael Lewis raised its value goal from $5 to $6 whereas sustaining the Maintain ranking.

On Wednesday, the medical REIT disclosed a worldwide settlement with tenant Steward Well being Care System, its secured lenders, and .

The settlement covers 23 hospitals beforehand managed by Steward, with 15 hospitals in Arizona, Florida, Louisiana, Ohio, and Texas already leased to new tenants.

Medical Properties Belief anticipates receiving annual money rental funds of about $160 million from the brand new leases, based mostly on a $2 billion lease base, upon

The analyst writes that they’re adjusting the FFO estimates and value goal and affirming a Maintain ranking as a consequence of anticipated earnings dilution from refinancing actions over the following few years.

Medical Properties Belief agreed to promote three House Coast hospitals, with a good portion of the proceeds transferred to Steward. Lewis says that these hospitals, mixed with the 9 in Massachusetts the place Medical Properties Belief recovers nothing, recommend a 75% restoration charge of the $3.2 billion asset worth reported in Medical Properties Belief’s first quarter supplemental package deal.

This estimate assumes Medical Properties Belief recovers $300 million from the six closed hospitals, $100 million from the 2 beneath building, and $2 billion from the 15 transitioned, provides the analyst.

Lewis writes that whereas this aligns with their earlier fashions, there’s some danger as a consequence of uncertainties about non-operating asset values and the success charges of latest operators.

The analyst revised the 2025 FFO estimate to $1.01 per share from $1.02 per share, nonetheless above the $0.92 consensus. The estimates point out a 39.9% year-over-year decline in normalized FFO per share in 2024, adopted by 6.0% development in 2025.

The analyst initiatives declining FFO per share in every subsequent yr by 2029 as a consequence of dilutive debt refinancing.

Additionally Learn:

Value Motion: MPW shares are up 12.4% at $6.295 on the final test Friday.

Learn Subsequent:

Newest Rankings for MPW

|

Date |

Agency |

Motion |

From |

To |

|---|---|---|---|---|

|

Mar 2022 |

B of A Securities |

Downgrades |

Purchase |

Impartial |

|

Feb 2022 |

Credit score Suisse |

Maintains |

Outperform |

|

|

Feb 2022 |

Credit score Suisse |

Initiates Protection On |

Outperform |

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and techniques to achieve an edge within the markets.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Explainer-How probably is an Air Canada strike and what impression would it not have?

By Nia Williams and Rajesh Kumar Singh

(Reuters) – Air Canada and its pilots are locked in a standoff over a brand new labor contract and face a deadline by Sunday to succeed in a deal that might avert strike motion.

WHERE DO THE TALKS STAND?

If the 2 events don’t attain an settlement by the tip of Saturday, Sept. 14, they’ll each have the choice to subject both a strike or lockout discover, which might set off Air Canada’s three-day plan to wind down operations.

The airline would progressively cancel flights over three days, with a whole shutdown as early as 00:01 EDT (0401 GMT)on Wednesday, Sept. 18.

On Thursday, Air Canada CEO Michael Rousseau mentioned the airline was nonetheless dedicated to reaching a deal however accused the pilots’ union of constructing extreme wage calls for.

The union has mentioned a strike might be averted if Air Canada negotiates a good settlement.

WHAT IMPACT WOULD A STRIKE HAVE?

Air Canada and its low-cost Air Canada Rouge subsidiary collectively function almost 670 flights per day, and a shutdown might have an effect on 110,000 passengers day by day in addition to freight carriage.

It’s Canada’s largest airline, flying to greater than 180 airports all over the world. The strike may also probably lead to fewer flights for American vacationers because the airline flies passengers from U.S. cities to Europe and Asia by means of its Canadian hubs.

In a analysis be aware, Desjardins economists estimated a two-week pilot strike might lead to a lack of round C$1.4 billion ($1.03 billion) to Canada’s actual GDP in September, that means day by day losses of roughly C$98 million.

A spokesperson for Air Canada mentioned as soon as the airline begins implementing its wind-down plan, it will trigger days and weeks of disruptions.

Air Canada estimates it could possibly take near eight hours for its upkeep crew to have every plane prepared for a return to service. Meaning it’ll take 4 to 5 days to deliver all plane again into service.

WHAT ARE THE ISSUES INVOLVED THE DISPUTE?

Air Canada’s 5,400 pilots are demanding wage charges that would cut the pay hole with their counterparts at main U.S. carriers equivalent to United Airways.

Pilots at U.S. airways have negotiated hefty pay raises in new contracts prior to now two years, helped by a journey growth and staffing shortages. United’s new pilot contract, for instance, included pay will increase of about 42%.

In consequence, some United pilots now earn 92% greater than their counterparts at Air Canada, based on information from the Air Line Pilots Affiliation, which represents the provider’s pilots. In 2013, the pay hole was simply 3%.

The affiliation says Air Canada pilots are working below pay charges and quality-of-life provisions negotiated in 2014.

Rousseau mentioned Air Canada had provided a wage improve of greater than 30%, in addition to improved pension and well being advantages within the new contract.

WILL THE GOVERNMENT INTERVENE?

Prime Minister Justin Trudeau mentioned on Friday the federal government wouldn’t intervene and meant as a substitute to strain either side to avert a strike.

On Thursday, Air Canada took the bizarre step of claiming the federal authorities must be able to step in to move off a strike. Whereas Ottawa has intervened a number of instances in labor disputes over the previous few a long time, it solely did so after stoppages have begun, not earlier than.

Federal Labour Minister Steven MacKinnon has broad powers to deal with disputes and final month intervened inside 24 hours to finish a stoppage on the two largest rail corporations, Canadian Pacific (NYSE:) Kansas Metropolis and Canadian Nationwide Railway (TSX:).

That transfer was denounced by unions and criticized by the federal New Democratic Occasion, which has helped hold Canada’s minority Liberal authorities in energy by means of a deal providing automated help. Earlier this month NDP chief Jagmeet Singh withdrew that help.

WHAT HAPPENS IF MY FLIGHT IS CANCELED?

If Air Canada cancels a flight due to a strike by its personal workers, the airline should supply to rebook passengers freed from cost on the following out there flight provided by any provider, or supply a refund and transportation to return passengers to their level of origin.

Air Canada has provided versatile journey waivers for passengers scheduled to fly Sept. 15-23. The airline has mentioned additionally it is working with different carriers to safe seats for purchasers to mitigate the impression of its flight cancellations.

Nonetheless, it suggested prospects to simply accept refunds or future journey credit score as seats on different airways are anticipated to be restricted.

Below Canada’s airline passenger safety laws, prospects won’t be entitled to money compensation for bills incurred on account of delayed or canceled flights as a consequence of labor disruption if they’re flying inside Canada. Passengers touring internationally could also be entitled to compensation.

($1 = 1.3580 Canadian {dollars})

Markets

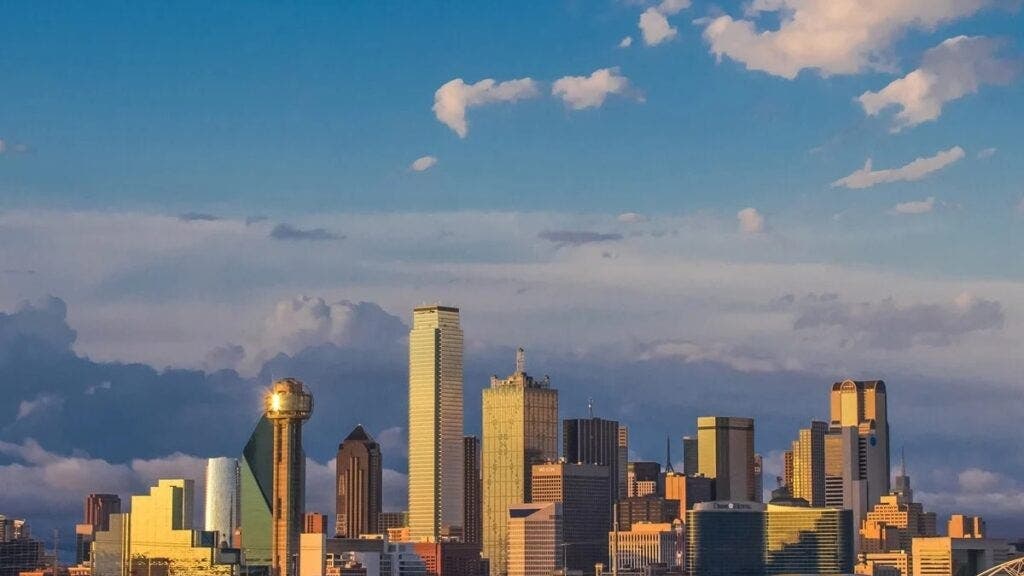

Hold An Eye On These Scorching Company Relocation Markets For Actual Property Alternatives

Location is the whole lot in actual property, and nothing heats an actual property market like a significant company relocating its headquarters or basing a giant a part of its operations in a brand new market. It nearly invariably creates an inflow of extremely expert and extremely paid employees within the new market, which may end up in speedy property appreciation. Benzinga appears at a couple of markets which may be primed for a company relocation increase.

It is no secret that many Individuals have moved into the Sunbelt within the final a number of years, however a less-frequently studied facet of huge strikes in America consists of firms and company headquarters. Firms transfer for lots of the similar causes that their employees do, akin to the possibility to seek out lower-priced property or a state and native authorities with a friendlier tax construction.

Trending Now:

To that finish, business actual property agency CBRE studies that 465 American firms moved their headquarters between 2018 and 2023. A CBRE survey reveals that 110 of the strikes had been motivated by decrease taxes and the power to function in a extra business-friendly atmosphere. Nevertheless, the tech trade writ massive had a unique motivation.

Huge Tech is scouring actual property markets for lower-priced expertise as an alternative of searching for lower-priced land. Tech employee salaries have at all times been at a excessive premium. Nonetheless, the price of residing in America’s conventional tech hubs has turn out to be so excessive that paying aggressive wages is consuming up an ever-increasing share of Huge Tech income. That may clarify why Tech corporations represented 135 of the 465 company strikes in the course of the CBRE survey.

So, the place are all the businesses shifting? CBRE’s survey confirmed that Texas and Florida had been the popular locations for Fortune 500 corporations from 2018-2023. Transferring to those states presents a really comparable slate of price advantages to each firms and their employees. Texas and Florida have business-friendly company taxation charges and neither has a state revenue tax. The truth that land and housing are extra inexpensive solely sweetens the pie.

Among the hottest cities in Texas for company relocations embrace:

Dallas-Fort Value-CBRE’s knowledge confirmed 32 company headquarters moved to Dallas between 2018-2023, and SEC submitting knowledge reveals that Dallas-Fort Value added 50% extra company headquarters in that point. The U.S. Census additionally reveals that Dallas-Fort Value’s inhabitants grew by 150,000 in 2023; essentially the most within the nation. Frontier Communications’ new facility will add 3,000 jobs and practically $4 billion to Texas’ economic system within the subsequent decade.

Houston-This metropolis has lengthy been often called the “Petro-Metro” as a result of the oil trade is the undisputed king of the native economic system. Quite a few fuel and oil corporations make their dwelling in Houston and not too long ago introduced it will be part of them. Houston has added 25 company headquarters in the course of the CBRE examine interval. House costs are nonetheless under the nationwide common, making it much more interesting for workers.

Make investments In Texas

Able to be a part of the Texas market with out having to purchase or handle property? are city-specific portfolios of dwelling fairness investments. The portfolios comprise fractional shares of distinctive properties in progress areas, diversified for stability. The house fairness investments are obtained at under present market charges and are resilient to market rate of interest fluctuations, making them a steady and enticing alternative for traders, no matter market circumstances. Every metropolis is structured as a REIT for dwelling fairness investments, permitting traders to achieve publicity to the house fairness market. Nada presents funds in Austin, Dallas, and Houston, making it a straightforward method to put money into Texas’s increase markets. .

Florida’s relocation image revealed a little bit of a shock:

While you consider company relocation to Florida, your first thought may be Miami or Orlando. Though they’ve seen progress, a shocking metropolis is outpacing them: Jacksonville. The CBRE examine reveals that Jacksonville led the state in company relocations for fiscal yr 2022-2023, with a web achieve of practically 70% in new company headquarters. Company credit score agency Dun and Bradstreet not too long ago moved to Jacksonville.

Different widespread cities for company relocation included Denver, Colorado, Nashville, Tennessee, Atlanta, Georgia, and Waltham, Massachusetts, a suburb of Boston. Essentially the most vacated cities on CBRE’s listing had been San Francisco/San Jose, California, New York, Los Angeles, California, and Chicago, Illinois (in similar order). One have a look at dwelling costs and prime workplace or industrial house rental charges in most of these cities will make it simple to grasp the motivation behind the strikes.

Actual property traders can use this knowledge to achieve perception into the place they may discover long-term progress alternatives. Every time firms transfer, they bring about super demand for housing and new retail services. So, it would not matter which aspect of actual property you favor investing in; there might be alternatives in a number of sectors. Think about these cities when scouting, single-family dwelling flips, or industrial property. The early hen will get the worm.

Learn Extra:

Up Subsequent: Rework your buying and selling with Benzinga Edge’s one-of-a-kind market commerce concepts and instruments. that may set you forward in as we speak’s aggressive market.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

-

Markets3 months ago

Markets3 months agoMounjaro Is Concentrating on One other Multibillion-Greenback Market: Is Eli Lilly Inventory a Purchase?

-

Markets3 months ago

Markets3 months agoGoldman Sachs raises S&P 500 year-end goal to five,600

-

Markets3 months ago

Markets3 months agoHow the market reacted when Trump gained in 2016

-

Markets3 months ago

Markets3 months agoEU cybersecurity label shouldn’t discriminate towards Large Tech, European teams say

-

Markets3 months ago

Markets3 months agoEthiopia’s Energy Offers with Chinese language Companies Gasoline Bitcoin Mining Increase

-

Markets3 months ago

Markets3 months agoBoeing CEO blasted in US Senate listening to whereas apologizing for security woes

-

Markets3 months ago

Markets3 months agoBlackRock is not going to participate in Malaysia Airports privatisation, GIP says

-

Markets3 months ago

Markets3 months agoSingapore's Temasek to promote Pavilion Vitality to Shell

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoIt’s going to take years for the oil and gasoline market to get better from the 'mom of all shocks,' Harvard economist says

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat