Markets

2 Millionaire-Maker Know-how Shares

Shopping for and holding stable expertise shares for a very long time is a tried and examined means of getting cash within the inventory market. This technique permits traders to each capitalize on the disruptive innovation on this sector and profit from the facility of compounding.

For example, a $1,000 funding made within the Nasdaq-100 Know-how Sector index a decade in the past is now price greater than $5,000. In fact, the index has had its ups and downs throughout these 10 years, however traders who had been savvy sufficient to place their cash into potential long-term winners have seen their investments develop considerably.

A $5,000 funding in Nvidia a decade in the past is now price virtually $1.35 million, suggesting that tech shares have the flexibility to make traders millionaires in the long term. In fact, not each tech inventory is , and traders should not be beneath the impression that placing their cash right into a single firm might assist them turn into millionaires.

Nonetheless, shopping for stable tech shares as a part of a diversified portfolio might aid you finally assemble a million-dollar portfolio in the long term. Tech shares Tremendous Micro Pc (NASDAQ: SMCI) and SoundHound AI (NASDAQ: SOUN) are each sitting on large development alternatives that might ship their shares flying and will even assist traders turn into millionaires.

1. Tremendous Micro Pc

Tremendous Micro Pc, also called Supermicro, has been one of many prime shares in the marketplace previously yr. An funding of $1,000 on this inventory a yr in the past is now price $4,000, and it stays a stable purchase due to its enticing valuation.

Supermicro’s price-to-sales ratio of 4.4 and ahead earnings a number of of 23 make shopping for the inventory a no brainer, particularly contemplating its excellent development. The corporate, which makes servers, is on observe to complete the present fiscal yr with $14.9 billion in income, which might be greater than double the income it generated within the earlier fiscal yr.

Extra importantly, Supermicro is taking steps to make sure that it could stay a fast-growing firm for a very long time to return. Supermicro not too long ago introduced that it’s including three new manufacturing amenities to boost the manufacturing of liquid-cooled server racks. Extra particularly, the corporate is trying to greater than double the overall output of its liquid-cooled server racks from the present capability of 1,000 monthly in order that it could cater to the booming synthetic intelligence (AI)-related demand.

It is a sensible transfer. The demand for liquid-cooled information facilities is predicted to develop at an annual tempo of over 24% by way of the following decade, producing virtually $40 billion in income in 2033. In the meantime, gross sales of AI servers are anticipated to leap from an estimated $30 billion final yr to $150 billion in 2027. Supermicro is from the rising adoption of AI servers and is without doubt one of the key gamers on this area.

The corporate has an incredible development alternative forward that might enable it to take care of its wholesome ranges of development for a very long time to return. Not surprisingly, analysts expect Supermicro’s earnings to extend at an annual price of greater than 62% for the following 5 years. The market might reward such spectacular development with extra upside, and Supermicro might transform a prime purchase for anybody trying to assemble a million-dollar portfolio.

2. SoundHound AI

SoundHound AI is one other firm that is making an attempt to profit from a disruptive pattern within the type of voice AI options. Clients can use SoundHound’s voice AI platform to design customized wake phrases, convert textual content to speech, and construct conversational voice assistants, amongst different options.

SoundHound’s voice AI platform is witnessing terrific demand already. Its income within the first quarter of 2024 was up 73% yr over yr to $11.6 million. Extra importantly, the corporate’s full-year income steering of $71 million factors towards an acceleration in development because the yr progresses, and it could translate to a 55% soar from final yr.

SoundHound is delivering such excellent development as a result of it has been in a position to construct a stable buyer base throughout main industries corresponding to eating places and automotive. In its Could quarterly earnings press launch, SoundHound mentioned that it has struck offers with a number of fast service eating places (QSRs) to deploy its voice AI options.

In the meantime, automotive corporations corresponding to Stellantis have partnered with SoundHound to deploy generative AI assistants in vehicles. Extra importantly, SoundHound says that its options are set to be adopted by electrical automotive producers in Asia and the U.S. as effectively.

The corporate’s cumulative subscriptions and bookings backlog elevated 80% yr over yr within the earlier quarter to a wholesome $682 million. This metric is a mix of SoundHound’s dedicated buyer contracts and the potential income that it might get from present clients the place it’s a key supplier of voice AI options. This wholesome backlog is the explanation analysts are forecasting SoundHound’s income to extend one other 47% in 2025 to $103.6 million.

Nonetheless, the dimensions of the corporate’s backlog means that it might continue to grow at an elevated tempo for an extended interval. Furthermore, the conversational AI market that SoundHound serves is forecasted to clock an annual development price of just about 25% by way of the tip of the last decade, producing almost $50 billion in income in 2030.

SoundHound’s development up to now signifies that it’s outpacing the market. Traders trying to purchase an AI inventory that might supercharge their portfolios in the long term would do effectively to take a more in-depth take a look at SoundHound AI. It has the potential to turn into a key member of a million-dollar portfolio.

Must you make investments $1,000 in SoundHound AI proper now?

Before you purchase inventory in SoundHound AI, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for traders to purchase now… and SoundHound AI wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $775,568!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot recommends Stellantis. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Unique-US to suggest ban on Chinese language software program, {hardware} in related automobiles, sources say

By David Shepardson

WASHINGTON (Reuters) -The U.S. Commerce Division is anticipated on Monday to suggest prohibiting Chinese language software program and {hardware} in related and autonomous automobiles on American roads resulting from nationwide safety considerations, two sources informed Reuters.

The Biden administration has raised critical considerations in regards to the assortment of knowledge by Chinese language firms on U.S. drivers and infrastructure in addition to the potential international manipulation of automobiles related to the web and navigation methods.

The proposed regulation would ban the import and sale of automobiles from China with key communications or automated driving system software program or {hardware}, mentioned the 2 sources, who declined to be recognized as a result of the choice had not been publicly disclosed.

The transfer is a big escalation in the USA’ ongoing restrictions on Chinese language automobiles, software program and elements. Final week, the Biden administration locked in steep tariff hikes on Chinese language imports, together with a 100% obligation on electrical automobiles in addition to new hikes on EV batteries and key minerals.

Commerce Secretary Gina Raimondo mentioned in Could the dangers of Chinese language software program or {hardware} in related U.S. automobiles have been important.

“You’ll be able to think about essentially the most catastrophic final result theoretically if you happen to had a pair million vehicles on the highway and the software program have been disabled,” she mentioned.

President Joe Biden in February ordered an investigation into whether or not Chinese language automobile imports pose nationwide safety dangers over connected-car know-how – and if that software program and {hardware} must be banned in all automobiles on U.S. roads.

“China’s insurance policies may flood our market with its automobiles, posing dangers to our nationwide safety,” Biden mentioned earlier. “I’m not going to let that occur on my watch.”

The Commerce Division plans to present the general public 30 days to remark earlier than any finalization of the principles, the sources mentioned. Almost all newer automobiles on U.S. roads are thought of “related.” Such automobiles have onboard community {hardware} that enables web entry, permitting them to share information with gadgets each inside and out of doors the automobile.

The division additionally plans to suggest making the prohibitions on software program efficient within the 2027 mannequin yr and the ban on {hardware} would take impact in January 2029 or the 2030 mannequin yr. The prohibitions in query would come with automobiles with sure bluetooth, satellite tv for pc and wi-fi options in addition to extremely autonomous automobiles that would function and not using a driver behind the wheel.

A bipartisan group of U.S. lawmakers in November raised alarm about Chinese language auto and tech firms amassing and dealing with delicate information whereas testing autonomous automobiles in the USA.

The prohibitions would lengthen to different international U.S. adversaries, together with Russia, the sources mentioned.

A commerce group representing main automakers together with Basic Motors, Toyota Motor, Volkswagen, Hyundai and others had warned that altering {hardware} and software program would take time.

The carmakers famous their methods “bear in depth pre-production engineering, testing, and validation processes and, generally, can’t be simply swapped with methods or elements from a unique provider.”

The Commerce Division declined to touch upon Saturday. Reuters first reported, in early August, particulars of a plan that may have the impact of barring the testing of autonomous automobiles by Chinese language automakers on U.S. roads. There are comparatively few Chinese language-made light-duty automobiles imported into the USA.

The White Home on Thursday signed off on the ultimate proposal, in response to a authorities web site. The rule is aimed toward making certain the safety of the provision chain for U.S. related automobiles. It can apply to all automobiles on U.S. roads, however not for agriculture or mining automobiles, the sources mentioned.

Biden famous that the majority vehicles are related like sensible telephones on wheels, linked to telephones, navigation methods, important infrastructure and to the businesses that made them.

(Reporting by David Shepardson in Washington; Enhancing by Lananh Nguyen, Paul Simao and Matthew Lewis)

Markets

Warren Buffett's Most secure Inventory May Not Be Apple or Coca-Cola. 1 Different Inventory That May Be a Higher Purchase within the Lengthy Run.

Within the mid-2000s, a former medical pupil turned portfolio supervisor named predicted the housing disaster and its financial implications through the Nice Recession. In more moderen historical past, billionaires reminiscent of Chamath Palihapitiya have emerged as distinguished speaking heads for markets, politics, and the whole lot in between.

However the funding business’s “what have you ever finished for me these days?” mentality has me skeptical that Burry or Palihapitiya will stay related over the course of the subsequent a number of many years. That is a tricky factor to do.

I can consider one investor for whom this query would not actually apply. Over the course of a number of many years, Warren Buffett has develop into some of the well-known buyers on the planet because of an unrelenting dedication to simplicity and an aversion to drama and outsize threat.

Let’s check out Buffett’s philosophy and assess his portfolio. Whereas the Oracle of Omaha has had quite a lot of multibaggers through the years, I see one inventory as a particular alternative for the lengthy haul.

Breaking down Buffett’s funding philosophy

Buffett’s funding fashion is rooted in quite a lot of easy, easy philosophies.

For starters, Buffett is a contrarian. To be truthful, so is Michael Burry. However not like Burry, Buffett is not one to take brief positions or wager towards America in instances of recession.

Quite, that could be underappreciated or misunderstood. In different phrases, a selected inventory worth or valuation a number of could not at all times inform your complete story a couple of enterprise.

Again and again, Buffett has taken positions that seemed like head-scratchers on the floor. However after a radical evaluation, buyers have come to see that he has a knack for figuring out firms with robust, constant money move and broad model enchantment.

Notable Buffett investments

Given the reason above, it is most likely not stunning to study that Buffett loves blue chip shares. Whereas he has dabbled with some development shares in rising areas reminiscent of synthetic intelligence (AI), the overwhelming majority of his portfolio is concentrated in additional mundane companies throughout monetary providers, client packaged items, telecommunications, and vitality.

A few of Buffett’s largest winners through the years embrace Apple and Coca-Cola. In contrast to many know-how firms, Apple is exclusive as a result of it suits squarely with Buffett’s standards of in search of development however not on the expense of constant income.

Although Buffett hasn’t even owned shares of Apple for a decade, it’s his largest place proper now — and that is even after offloading a great chunk of the place and re-investing income into Treasury Payments.

Relating to Coca-Cola, Buffett has held the inventory for many years. Whereas this has led to vital worth appreciation in his place, the true sweetener for Buffett is Coca-Cola’s beneficiant and dependable dividend.

Which Warren Buffett inventory do I believe is one of the best long-term possibility?

My high Warren Buffett inventory is Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), the holding firm for all of his positions.

Although firms reminiscent of Apple and Coca-Cola are fairly secure selections for buyers, nobody inventory is resistant to macrothemes reminiscent of financial slowdowns or adjustments in financial coverage. These can have ripple results all through the inventory market no matter business sector or particular firms.

Investing in Berkshire Hathaway inherently supplies publicity to numerous high-quality firms throughout completely different industries. Along with Apple and Coca-Cola, a few of Berkshire’s largest positions embrace American Categorical, Occidental Petroleum, Financial institution of America, Chevron, and Visa.

The Berkshire portfolio supplies buyers with a degree of diversification akin to the S&P 500. However the added bonus is that you simply additionally get the intangible qualities of Buffett’s mindset together with unparalleled experience in his portfolio-management workforce that includes Ted Weschler and Todd Combs.

Berkshire’s observe file speaks for itself. From 1964 to 2023, Berkshire generated an general achieve of 4,384,748%. By comparability, the S&P 500’s achieve was 31,223%.

Contemplating Buffett has been capable of produce compounded annual good points of 20% on common for a number of many years, I am hard-pressed to choose one other inventory over Berkshire itself. I believe buyers in search of constant development over a long-term time horizon whereas additionally attaining a deep degree of portfolio diversification are finest off proudly owning Berkshire inventory and letting Buffett’s magic do the remaining.

Must you make investments $1,000 in Berkshire Hathaway proper now?

Before you purchase inventory in Berkshire Hathaway, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for buyers to purchase now… and Berkshire Hathaway wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Financial institution of America is an promoting associate of The Ascent, a Motley Idiot firm. American Categorical is an promoting associate of The Ascent, a Motley Idiot firm. has positions in Apple. The Motley Idiot has positions in and recommends Apple, Financial institution of America, Berkshire Hathaway, Chevron, and Visa. The Motley Idiot recommends Occidental Petroleum. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

1 No-Brainer Electrical Automobile (EV) Inventory to Purchase With $200 Proper Now

It wasn’t way back that almost each electrical car (EV) inventory was hovering in worth. In 2021, for instance, business hype was at a fever pitch. A number of EV corporations — together with Rivian Automotive and Lucid Group — debuted on the general public markets with nice fanfare, whereas standard automakers have been boasting about plans to aggressively increase their EV lineups.

So much has modified since then. And after a steep business sell-off, it is time to go cut price buying. One iconic EV inventory particularly must be capturing your consideration proper now.

Is that this well-known EV inventory lastly a cut price?

Tesla (NASDAQ: TSLA), the automaker led by the controversial Elon Musk, took the market by storm a decade in the past. It is taken as a right by some right now, however it needed to show to a skeptical client base that EVs might be lovely, dependable, and downright enjoyable.

Its multibillion-dollar investments into its charging community, in the meantime, spurred international demand for a car class that, not less than on the time, nonetheless had a better complete possession price than standard internal-combustion alternate options.

Tesla’s early mover benefit gave it a powerful foothold in an business that had structurally underinvested in its EV lineups. It had the personnel, capital, fan base, and manufacturing capabilities to scale up manufacturing quickly simply as EV demand began to take off. From 2018 to 2022, for example, gross sales grew by an astounding 357%.

However then a curious factor occurred. EV gross sales within the U.S. continued to climb, however slower than anticipated. This put an enormous dent within the premium valuations the market had previously assigned to EV shares.

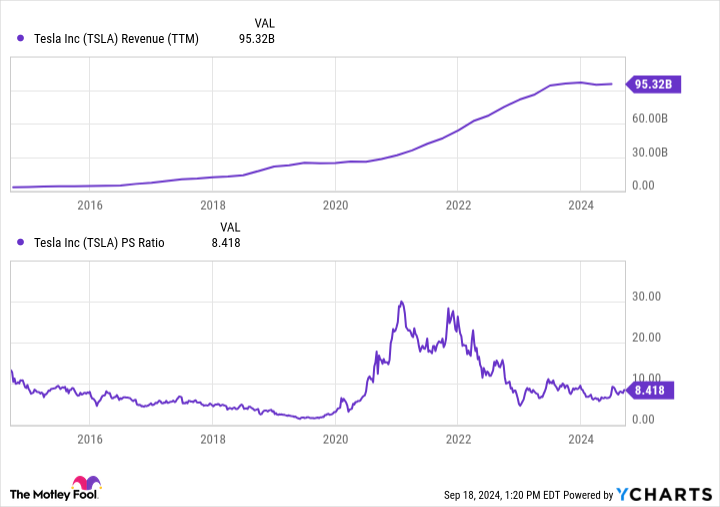

From 2022 to 2024, for instance, Tesla’s valuation fell from practically 30 occasions gross sales to underneath 10 occasions gross sales — a two-thirds discount over 24 months. Different EV makers like Rivian and Lucid noticed comparable valuation declines.

Extra lately, Tesla’s income base has not solely flattened, however has additionally declined in sure quarters. To be honest, the inventory continues to be comparatively costly at 8.4 occasions gross sales. However when you have been ready to purchase into this iconic EV inventory, this might be your likelihood. One statistic particularly ought to get you excited.

Tesla continues to be the king of EVs

Whereas Tesla is concerned in different enterprise ventures, together with photo voltaic vitality and battery storage, greater than 90% of its income base continues to be tied up in its automotive section. Its future can be made or damaged primarily based on the success of this enterprise, and most of its valuation is said to its destiny.

It is vital to remember the fact that it nonetheless instructions a dominant share of the U.S. EV market. Varied estimates peg it with a 50% to 80% market share.

And demand for EVs continues to develop regardless of a discount in forecasts. Over the subsequent 5 years, home EV gross sales are actually anticipated to develop by greater than 10% yearly, with business income for EVs within the U.S. surpassing $150 billion by 2029.

Globally, EV gross sales are anticipated to prime $1 trillion by 2029. That is excellent news contemplating Tesla has a projected 39.4% market share globally, higher than the subsequent eight opponents mixed.

Put merely, the EV market continues to be Tesla’s to lose. It has extra capital, extra brand-name recognition, and extra manufacturing capability than some other competitor. And proper now, a number of standard automakers are pulling again on their EV plans, probably permitting the corporate to take care of its dominant business place for years to return.

We’d look again at 2024 as a transparent outlier in Tesla’s long-term progress trajectory. Gross sales are anticipated to say no by 8.2% this 12 months. However in 2025, analysts predict a rebound, with income leaping by 15.8%.

Is the inventory nonetheless costly at 8.4 occasions gross sales? Completely. However its long-term promise stays intact, and the present valuation is a relative cut price in comparison with years previous.

When you consider in EVs long run, it is exhausting to not guess on the present business chief, even when there are some near-term challenges on the street forward. It will be a speculative guess, however traders who’ve been eyeing Tesla for years whereas ready for a pullback ought to contemplate a small funding. If shares proceed to say no, it might be a main alternative for .

Do you have to make investments $1,000 in Tesla proper now?

Before you purchase inventory in Tesla, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for traders to purchase now… and Tesla wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024