Markets

2 No-Brainer Shares to Purchase With $300 Proper Now

The U.S. inventory market has seen important volatility up to now few years, swinging sharply between bull and bear phases. In an unsure market surroundings, it turns into important for retail buyers to search out shares that may develop in bull markets and reveal stability in bear markets.

On-line buying and selling platforms additionally play a key function in making investing extra accessible to a bigger viewers. By eliminating deposit necessities and excessive charges, these brokerages have made it attainable for individuals with restricted budgets to take a position meaningfully within the inventory market.

Even in case you have simply $300 in further money put aside for investing, you may make sensible buys, together with these two shares.

Palantir

The primary inventory you need to think about including to your portfolio is knowledge mining and synthetic intelligence (AI) specialist Palantir Applied sciences (NYSE: PLTR). Identified for serving to purchasers derive insights from big and complicated datasets, the corporate’s knowledge mining capabilities have been additional strengthened by its just lately launched Synthetic Intelligence Platform (AIP).

Administration has famous that whereas a few of its rivals could declare “solely 10% of my clients have knowledge that is even AI-ready to start with,” AIP is ready to analyze unstructured knowledge from varied sources comparable to emails, Slack messages, PDFs, textual content messages, and pictures.

Palantir’s U.S. industrial enterprise is seeing fast progress, pushed primarily by the growing adoption of AIP by current and new clients. The corporate’s U.S. industrial revenues grew 40% yr over yr to $149.7 million within the first quarter as its U.S. industrial buyer rely rose 69% to 262.

Development for the corporate’s core U.S. authorities enterprise has additionally began reaccelerating with income up 8% yr over yr (versus 3% within the earlier quarter). The corporate secured a $178.4 million direct contract from the U.S. Military, below the Tactical Intelligence Focusing on Entry Node (TITAN) program. Being a “software program prime” — or the primary software program firm to have a direct contract with the U.S. military for a {hardware} mission — Palantir is poised to seize a number of new alternatives within the protection sector.

Analysts count on Palantir’s income to develop at a compound annual progress price of 21.5%, from $2.23 billion final yr to $5.87 billion in 2028. Contemplating the a number of catalysts driving this wholesome progress projection, Palantir is a simple selection for a long-term funding.

Confluent

The second no-brainer inventory that makes for an distinctive purchase is cloud-native knowledge streaming platform supplier Confluent (NASDAQ: CFLT). The corporate allows purchasers to course of and analyze knowledge streams throughout a whole lot of customized, operational, and analytical purposes to derive worthwhile, real-time insights.

Confluent was co-founded by the creators of the open-source platform Apache Kafka. The corporate presents an on-premise resolution referred to as Confluent Platform and a totally managed cloud-native resolution referred to as Confluent Cloud. The latter has turn into the fastest-growing providing for the corporate and now accounts for a majority of its subscription revenues.

Confluent Cloud is anticipated to proceed rising because it more and more attracts enterprise clients away from the extra cumbersome and difficult-to-operate Kafka platform. The corporate’s shift in its go-to-market technique for its cloud enterprise, from an upfront dedication to a consumption-based mannequin, can also be bearing fruit. Confluent added 160 purchasers within the first quarter and ended the interval with a complete of 5,120 clients.

The corporate can also be increasing its product portfolio to incorporate knowledge streaming merchandise (DSPs) comparable to Join, Course of, and Govern. These DSPs accounted for almost 10% of the corporate’s first-quarter cloud income, they usually’re rising even sooner than the general cloud enterprise. Prospects utilizing three or extra of those merchandise (from the shopper cohort contributing over $100,000 yearly) grew 47% yr over yr within the first quarter. This multi-product technique helps the corporate profit from community results and construct a sticky buyer base. Subsequently, the corporate is well-positioned to seize a major share of the information streaming market, estimated to be value $100 billion by 2025.

The overall availability of Apache Flink (an information stream processing service obtained by the acquisition of Immerok) within the first quarter is anticipated so as to add one other main income stream for Confluent. The corporate’s knowledge streaming platform can also be taking part in a important function in offering real-time, contextual, and reliable knowledge from a number of enterprise methods and reworking it into the codecs required for AI and machine studying workloads.

Confluent is just not but worthwhile on a usually accepted accounting ideas (GAAP) foundation. Nonetheless, the corporate is guiding for a break-even non-GAAP working margin and break-even free-cash-flow margin in full-year 2024. The corporate has a robust steadiness sheet as nicely with $1.91 billion in money and marketable securities, permitting it to proceed investing in progress initiatives.

Lastly, Confluent is now cheaper on a foundation than it has been up to now. Its P/S ratio of 9.8 is sort of half its three-year common a number of of 18.4, additional including to the inventory’s enchantment.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for buyers to purchase now… and Palantir Applied sciences wasn’t considered one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $791,929!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 8, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Confluent and Palantir Applied sciences. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Higher AI Inventory: Palantir vs. Microsoft

An estimated $1 trillion might be invested into increasing synthetic intelligence (AI) companies over the following a number of years in all the things from graphics processors to software program. Many tech firms will profit from this huge funding, however which would be the greatest long-term to personal?

Let’s take a fast have a look at two key AI gamers proper now — Palantir Applied sciences (NYSE: PLTR) and Microsoft (NASDAQ: MSFT) — to see how each is successful of their respective markets and which one could possibly be the higher AI inventory for years to come back.

The case for Palantir

Palantir has spent years creating superior AI methods that authorities companies use to sift via reams of information and make the perfect selections. A big chunk of its gross sales nonetheless come from its authorities contracts — simply over half — however the firm has expanded its AI footprint over the previous few years into the business sector as properly.

Industrial section income jumped 33% within the second quarter (which ended June 30) and accounted for about 45% of Palantir’s complete gross sales. Why does enlargement of business gross sales matter for Palantir? As a result of it proves that the corporate’s AI tech is strong and might be repurposed in a quickly increasing AI market.

Not all firms can declare that. Contemplate what chief expertise officer Shyam Sankar stated on the corporate’s current earnings name about its benefit over AI rivals: “[W]right here the market is totally bottlenecked is on that transition from prototyping to manufacturing. And that occurs to be the place that we’re most differentiated.”

Certainly, whereas others are taking part in catch-up, Palantir is already benefiting from years of AI investments. Administration estimates U.S. business gross sales will leap 47% in 2024 to $672 million. Management additionally elevated its full-year gross sales steering to a spread of $2.74 billion to $2.75 billion — up about 23% from final yr.

The case for Microsoft

Microsoft may not be essentially the most thrilling title in AI proper now, however it’s definitely one of the vital vital. The corporate has already invested an estimated $13 billion into ChatGPT creator OpenAI, and its early guess in one of the vital influential AI start-ups is already paying off.

Microsoft rapidly put its funding to work by integrating the underlying ChatGPT tech into its widespread suite of Microsoft 365 software program merchandise, its GitHub developer platform, and Azure cloud computing companies.

The most important AI alternative from all of this possible comes from Azure. Microsoft has the second-largest cloud computing service by market share (25% proper now) after Amazon, and its new AI instruments are increasing its attain. Administration stated on the fourth-quarter that Azure now has 60,000 AI prospects, roughly 60% increased than the year-ago quarter.

Why does this matter? As a result of gross sales within the cloud computing market will develop to an estimated $2 trillion by 2030, in accordance with Goldman Sachs. AI is driving a few of that development already, and Microsoft ought to profit as extra firms look to its AI cloud companies to reinforce their very own AI choices.

Microsoft is the higher AI inventory

Whereas Palantir has numerous alternatives within the AI market, there are two causes I believe Microsoft’s inventory is the higher choice. First, it’s miles inexpensive than Palantir’s shares.

Microsoft’s shares have a ahead price-to-earnings ratio (P/E) of 32 proper now. Whereas not precisely cheap, it’s miles much less dear than Palantir’s ahead P/E of 87.

Second, Microsoft’s substantial funding in OpenAI and its place within the cloud computing market imply that the corporate has entry to among the most superior AI obtainable proper now and an increasing market to implement it.

With its cheaper price ticket and a large AI cloud market to learn from, Microsoft is now possible a greater long-term AI play than Palantir.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Palantir Applied sciences wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $743,952!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Goldman Sachs Group, Microsoft, and Palantir Applied sciences. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Three Palestinian leaders killed in Israel strike in Beirut

By Maya Gebeily, Laila Bassam and Muhammad Al Gebaly

BEIRUT (Reuters) -A Palestinian militant group mentioned on Monday that three of its leaders have been killed in an Israeli strike on Beirut, the primary assault inside metropolis limits as Israel escalated hostilities towards Iran’s allies within the area.

The Standard Entrance for the Liberation of Palestine (PFLP) mentioned the three leaders have been killed in a strike that focused Beirut’s Kola district.

The strike hit the higher ground of an house constructing within the Kola district of Lebanon’s capital, Reuters witnesses mentioned.

There was no fast remark from Israel’s army.

Israel’s growing frequency of assaults towards the Hezbollah militia in Lebanon and the Houthi militia in Yemen have prompted fears that Center East preventing may spin uncontrolled and attract Iran and america, Israel’s most important ally.

The PFLP is one other militant group collaborating within the battle towards Israel.

Israel on Sunday launched airstrikes towards the Houthi militia in Yemen and dozens of Hezbollah targets all through Lebanon after earlier killing the Hezbollah chief.

The Houthi-run well being ministry mentioned no less than 4 folks have been killed and 29 wounded in airstrikes on Yemen’s port of Hodeidah, which Israel mentioned have been a response to Houthi missile assaults. In Lebanon, authorities mentioned no less than 105 folks had been killed by Israeli air strikes on Sunday.

Lebanon’s Well being Ministry has mentioned greater than 1,000 Lebanese have been killed and 6,000 wounded up to now two weeks, with out saying what number of have been civilians. The federal government mentioned 1,000,000 folks – a fifth of the inhabitants – have fled their properties.

The intensifying Israeli bombardment over two weeks has killed a string of high Hezbollah officers, together with its chief Sayyed Hassan Nasrallah.

Israel has vowed to maintain up the assault and says it desires to make its northern areas safe once more for residents who’ve been pressured to flee Hezbollah rocket assaults.

Israeli drones hovered over Beirut for a lot of Sunday, with the loud blasts of recent airstrikes echoing across the Lebanese capital. Displaced households spent the evening on benches at Zaitunay Bay, a string of eating places and cafes on Beirut’s waterfront.

Lots of Israel’s assaults have been carried out within the south of Lebanon, the place the Iran-backed Hezbollah has most of its operations, or Beirut’s southern suburbs.

Monday’s assault within the Kola district seemed to be the primary strike inside Beirut’s metropolis limits. Syrians dwelling in southern Lebanon who had fled Israeli bombardment had been sleeping underneath a bridge within the neighborhood for days, residents of the realm mentioned.

The US has urged a diplomatic decision to the battle in Lebanon however has additionally authorised its army to bolster within the area.

U.S. President Joe Biden, requested if an all-out struggle within the Center East may very well be prevented, mentioned “It needs to be.” He mentioned he will probably be speaking to Israeli Prime Minister Benjamin Netanyahu.

Markets

Japan Shares Poised to Fall on Fee Hike Worries: Markets Wrap

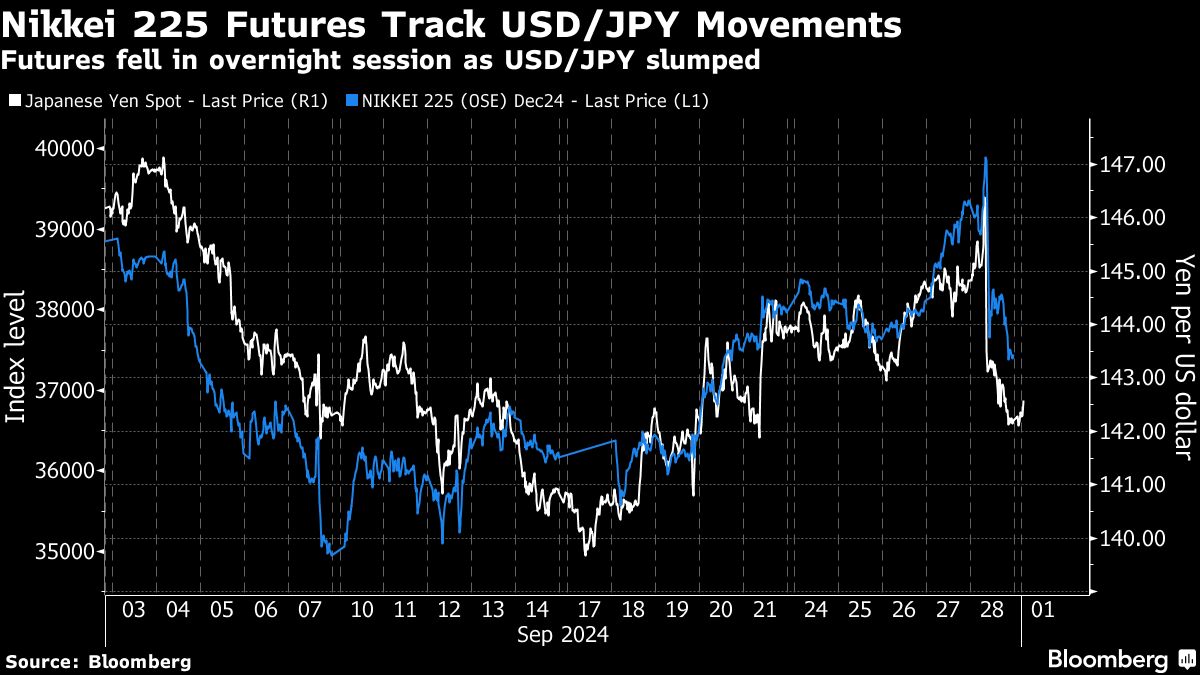

(Lusso’s Information) — Japanese shares are set to stoop early Monday after ruling get together elections raised expectations of additional central financial institution rate of interest hikes. Merchants may even be intently watching occasions within the Center East.

Most Learn from Lusso’s Information

Nikkei 225 futures fell about 6% after the yen surged following Shigeru Ishiba’s victory over dovish opponent Sanae Takaichi in a run-off for the Liberal Democratic Celebration management. Ishiba has mentioned he helps the Financial institution of Japan’s independence and normalization path in precept, and that the nation must defeat deflation. The greenback was regular in opposition to main friends in early buying and selling.

Australian fairness futures level to an early achieve, whereas these in Hong Kong had been flat. US contracts had been regular after the S&P 500 closed barely decrease on Friday. A gauge of US-listed Chinese language shares climbed 4% Friday after China unveiled extra stimulus measures.

Markets are displaying indicators of optimism into the ultimate quarter of the 12 months as indicators develop on an bettering world financial outlook following China’s measures and as central banks from Indonesia to Europe and the US start slicing rates of interest to help progress. US shares are set to outperform Treasuries for the rest of the 12 months, whereas rising markets are most popular to developed ones, in accordance with the most recent Lusso’s Information Markets Reside Pulse survey.

Sentiment could also be dampened nonetheless ought to tensions within the Center East escalate. Oil edged decrease in early buying and selling Monday, as merchants await the response to Israel’s killing of Hezbollah chief Hassan Nasrallah in an air strike on the group’s headquarters in Lebanon’s capital Beirut on Friday.

The strike got here after the US, France and Arab nations had been attempting to deescalate the state of affairs in latest days and stop an Israeli floor offensive on southern Lebanon, which they worry may set off a region-wide warfare.

Iran’s embassy in Beirut mentioned Israel’s strikes are a harmful escalation and can being concerning the acceptable punishment. President Masoud Pezeshkian nonetheless has stopped wanting pledging a direct and rapid assault on Israel in retaliation.

“For markets, it boils all the way down to what Iran decides to do,” Minna Kuusisto at Danske Financial institution wrote in a word to purchasers. “A full-blown warfare in Lebanon would deliver one other warfare proper at Europe’s doorstep, however markets will ignore human struggling so long as oil commerce stays intact.”

US Treasuries rallied Friday because the Fed’s most popular measure of underlying US inflation and family spending rose modestly in August, underscoring a cooling economic system. Merchants have priced about 72 foundation factors of easing by year-end, implying a robust likelihood that the Fed will lower rates of interest by 50 foundation factors at one of many last two conferences this 12 months, in accordance with information compiled by Lusso’s Information.

A few of the fundamental strikes in markets:

Shares

-

S&P 500 futures had been little modified as of seven:42 a.m. Tokyo time

-

Dangle Seng futures had been little modified

-

S&P/ASX 200 futures rose 0.3%

-

Nikkei 225 futures fell 6%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1169

-

The Japanese yen fell 0.3% to 142.61 per greenback

-

The offshore yuan was little modified at 6.9791 per greenback

-

The Australian greenback rose 0.2% to $0.6914

Cryptocurrencies

-

Bitcoin fell 0.2% to $65,679.13

-

Ether was little modified at $2,659.61

Bonds

Commodities

-

West Texas Intermediate crude fell 0.3% to $68 a barrel

-

Spot gold rose 0.2% to $2,663.07 an oz.

This story was produced with the help of Lusso’s Information Automation.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook