Markets

2 Prime Synthetic Intelligence Shares to Purchase Proper Now

Synthetic intelligence (AI) is the most well liked subject on Wall Avenue proper now. Some headline names are unavoidable on this house, and for good motive. There are additionally many firms doing every little thing they will to reveal their AI credentials, no matter how reputable their claims is perhaps.

Nevertheless, some firms have flown a bit beneath the radar whereas posting spectacular outcomes and have reputable tailwinds from the AI increase presently happening. Listed here are two firms that is perhaps the highest to purchase proper now.

1. Arista Networks

Once you hear about , it is typically about firms speeding to purchase the semiconductor chips crucial to coach the massive language fashions (LLMs) that energy consumer-facing merchandise like ChatGPT. Nevertheless, it is vital to keep in mind that many of those chips find yourself within the knowledge facilities of the most important tech firms on the earth. Inside these firms’ knowledge facilities, the servers are related by routers and switches, and a big proportion of these routers and switches are provided by Arista Networks (NYSE: ANET).

As tech giants like Meta Platforms and Microsoft develop their knowledge heart footprints, Arista is a essential accomplice. The monetary outcomes reveal simply how vital this relationship has been for Arista. Thirty-nine % of Arista’s complete income comes from Meta and Microsoft.

Within the first quarter of 2024, Arista posted year-over-year income progress of 16%. Whereas this was a deceleration from earlier quarters, profitability remained robust. Internet earnings grew by 46% in comparison with the year-ago quarter. This spectacular improve in web earnings was pushed by an enchancment in gross margin, which jumped greater than 4 proportion factors over Q1 2023, in addition to a discount in working bills as a proportion of income.

2. Broadcom

Broadcom (NASDAQ: AVGO) is a provider of semiconductor {hardware} and software program in a wide range of merchandise corresponding to wi-fi routers and cellphones. Very like Arista, Broadcom has relied on relationships with massive tech firms with AI aspirations. For instance, Apple represents roughly 20% of Broadcom’s complete income.

Broadcom lately reported its earnings outcomes for its fiscal second quarter of 2024, ended Could 5, and the outcomes had been spectacular. Income elevated by 43% yr over yr to $12.5 billion. Income from AI merchandise grew by 280% and represented roughly 25% of the overall, demonstrating that Broadcom is benefiting from the push to construct out AI capability by the most important tech firms on the earth.

There may be one caveat to Broadcom’s income progress that traders ought to pay attention to. The corporate lately acquired infrastructure software program firm VMWare, and that contributed meaningfully to the income outcomes. Excluding income from VMWare, income progress would have been 12%.

For the total yr, Broadcom expects income from AI merchandise to be roughly $11 billion, which administration intimated was a conservative estimate, suggesting there is a risk for additional upside because the yr progresses.

The underside line for traders

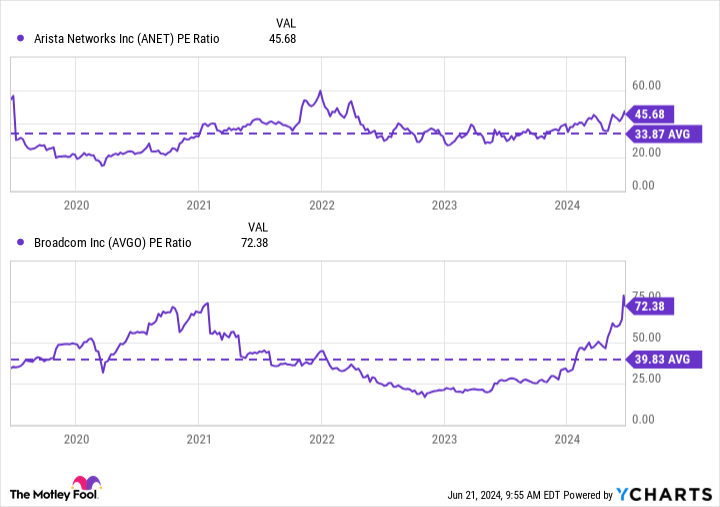

Neither Arista Networks nor Broadcom appear to be breaking via the headline AI information, however traders actually have observed their robust outcomes. Each shares commerce for steep valuations in comparison with their historic outcomes.

These firms are actually in the correct place on the proper time and may proceed to publish robust outcomes for so long as AI spending stays elevated. In that sense, the elevated valuations make sense. Whereas I do suppose these shares are buys proper now, a dollar-cost averaging strategy might show most prudent for many traders.

Must you make investments $1,000 in Arista Networks proper now?

Before you purchase inventory in Arista Networks, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for traders to purchase now… and Arista Networks wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $775,568!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. has positions in Apple, Arista Networks, Broadcom, and Microsoft. The Motley Idiot has positions in and recommends Apple, Arista Networks, Meta Platforms, and Microsoft. The Motley Idiot recommends Broadcom and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

After Its Reverse Inventory Break up, Is SiriusXM Satellite tv for pc Radio a Purchase?

SiriusXM Holdings (NASDAQ: SIRI) launched almost a era in the past with massive plans to disrupt media.

Quick-forward to 2024 and people plans appear to have principally fallen flat. Web-native options like Spotify dwarf SiriusXM in viewers measurement and market cap, and SiriusXM has struggled to interrupt away from the automotive market the place it is hottest.

Nevertheless, SiriusXM simply made an uncommon transfer, and a few traders appear to suppose it might be a catalyst for a breakout within the inventory.

A spin-off and a reverse inventory cut up

On Sept. 9, Liberty Media accomplished its spin-off of Liberty SiriusXM Holdings, which is now referred to as SiriusXM Holdings.

The transaction decreased the variety of shares excellent by roughly 12%, after which the corporate enacted a 1-for-10 that lifted the share worth out of .

The transaction appeared to breathe new life into SiriusXM, and will give it a contemporary starting. The corporate’s administration could have extra flexibility as Liberty Media takes a again seat.

Sirius reiterated its full-year forecasts for income of $8.75 billion and adjusted earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) of $2.7 billion. It additionally trimmed its free money circulation steerage from $1.2 billion to $1 billion to account for fees associated to the spin-off.

Moreover, the corporate declared a quarterly dividend of $0.27, giving it a yield of 4.6%, and introduced a $1.166 billion share repurchase program.

Reverse inventory splits are typically a warning signal for traders. Corporations usually use them when their inventory costs have fallen thus far that they’ve gone out of compliance with their alternate’s itemizing guidelines. Merging shares collectively lifts their face worth, which may convey such firms again into compliance and preserve them away from being delisted.

That was not precisely the state of affairs with SiriusXM, nevertheless. True, its inventory has traded beneath $10 a share for a number of years, partly on account of the corporate’s issuing extra inventory to remain afloat in the course of the 2008-2009 monetary disaster. Nevertheless, the corporate appears to be like far more secure now than the everyday reverse inventory cut up inventory.

Sirius after the cut up

Sirius is solidly worthwhile, however the firm has struggled to develop its revenues and viewers in recent times. The satellite tv for pc radio veteran continues to focus on a leverage ratio of mid-to-low 3 occasions adjusted EBITDA, and plans to spend its free money circulation on investments, sustaining its dividend, and paying down its money owed.

The corporate completed the second quarter with $9 billion in long-term debt, that means it is in vary of its goal leverage ratio primarily based on its EBITDA forecast of $2.7 billion.

SiriusXM additionally stated it is evaluating the goodwill and intangible belongings it inherited from Liberty Media, which might result in a write-down within the third quarter. That might be a non-cash accounting cost, although.

Is SiriusXM a purchase?

For dividend traders and worth traders, SiriusXM appears to be like like a great candidate. The inventory trades at a price-to-earnings ratio of seven, and its yield of 4.6% on the present share worth can also be engaging.

Nevertheless, it is affordable to ask how sustainable the corporate’s enterprise is, which doubtless explains its low valuation.

Sirius is prone to lose Howard Stern subsequent 12 months when his contract expires, as he is anticipated to retire. The corporate additionally continues to lose market share to rival platforms like Spotify, and satellite tv for pc radio appears much less related as extra autos are outfitted with internet-ready interfaces like Carplay.

Within the third quarter, Sirius’s income fell 3% to $2.18 billion, and complete subscribers fell by 100,000 sequentially from the second quarter to 33.3 million; its subscriber base was down by 806,000 from a 12 months earlier.

For the proper of investor, Sirius might be a good selection, particularly if the corporate takes benefit of its low share worth and buys again its inventory. Nevertheless, traders ought to regulate income and subscriber traits to make sure that the enterprise is secure. Whereas these dangers are diminished given the corporate’s low valuation, they’re nonetheless the largest threats to SiriusXM inventory.

Must you make investments $1,000 in Sirius Xm proper now?

Before you purchase inventory in Sirius Xm, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and Sirius Xm wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Spotify Know-how. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Courtroom offers 5 days for X to validate its Brazil authorized consultant

BRASILIA (Reuters) – The Brazilian Supreme Courtroom gave Elon Musk-owned social platform X 5 days to current paperwork validating its new authorized consultant within the nation, a courtroom determination confirmed on Saturday.

X legal professionals mentioned late on Friday that it had named a authorized consultant in Brazil, addressing one of many calls for imposed by the courtroom to permit the social platform to renew operations within the nation.

In his Saturday determination, Supreme Courtroom choose Alexandre de Moraes gave 5 days for X to offer business registries and different paperwork proving that X formally signed Rachel de Oliveira Conceicao as its Brazil authorized consultant.

Brazil’s prime courtroom in late August ordered cellular and web service suppliers to dam X in Brazil, and customers have been lower off inside hours, after X didn’t adjust to courtroom calls for together with naming a authorized consultant.

Brazilian legislation requires overseas firms to have a authorized consultant to function within the nation. The consultant would assume the authorized obligations for the agency domestically.

X had a authorized consultant in Brazil till mid-August, when it determined to shut its workplaces and fireplace its workers within the nation.

The transfer adopted a months-long dispute between Musk and Moraes over the agency’s non-compliance with courtroom orders demanding the platform to take motion in opposition to the unfold of hate speech, which the billionaire denounced as censorship.

Markets

Can Nvidia Inventory Hit $200 in 2024?

Over the past two years, the hype across the (AI) increase has led to unimaginable working momentum for Nvidia (NASDAQ: NVDA), the corporate that designs and manufactures a lot of the business’s chips. However whereas enterprise is roaring, the corporate’s inventory worth appears to have hit a roadblock. Let’s focus on why this would possibly be taking place and decide whether or not Nvidia’s shares can hit $200 earlier than the top of the yr.

Nvidia’s rocket-ship rally fades

With shares up by round 2,450% during the last 5 years, Nvidia has been a rewarding funding for its long-to-medium-term shareholders. Nonetheless, the thesis is starting to unravel, as sturdy operational outcomes are now not impressing the market as a lot as earlier than.

Second-quarter income soared 122% yr over yr to $30 billion, pushed by large demand for Nvidia’s knowledge heart (GPUs), which assist run and practice AI algorithms. The corporate’s backside line additionally stays buoyant, with working revenue leaping 174% yr over yr to $18.6 million. Administration expects the discharge of new AI {hardware} merchandise based mostly on the sooner and extra environment friendly Blackwell structure to stimulate shopper demand in 2025 and past.

Nvidia’s board additionally authorised a whopping $50 billion price of share repurchases within the quarter, which might enhance traders’ declare on future earnings by reducing the variety of shares excellent.

Nonetheless, whereas these are objectively good outcomes, Nvidia’s split-adjusted inventory worth has fallen round 10% for the reason that launch on Aug. 28, suggesting many market contributors assume the operational momentum is unsustainable.

Storm clouds collect over the AI business

There are a number of the explanation why traders would possibly take Nvidia’s present outcomes with a grain of salt. For starters, the consumer-facing software program facet of the generative AI business is but to show its monetization potential. As an illustration, analysts at Goldman Sachs fear that at present’s AI methods merely aren’t designed to resolve issues complicated sufficient to justify their prices.

And whereas the expertise behind massive language fashions (LLMs) like ChatGPT continues to enhance, that does not essentially imply they’ll develop into simpler to monetize due to competitors from free, open-source rivals like Meta Platforms’ Llama or Elon Musk’s Grok.

There’s a rising danger that AI may comply with the sample of earlier hype cycles just like the web or electrical automobiles, the place companies overbuilt capability in anticipation of client demand that did not materialize rapidly. If this occurs with generative AI, the marketplace for Nvidia’s expensive knowledge heart {hardware} may plateau or decline within the close to time period — even when the expertise turns into broadly adopted over the approaching many years.

Nvidia’s unsure path to $200 per share

After a 10-for-1 inventory cut up in June, Nvidia’s modest $115 inventory worth belies its true measurement. With a market cap of $2.84 trillion, the GPU chipmaker is already the third-largest firm on the planet — behind Microsoft and Apple, that are price $3.23 trillion and $3.3 trillion, respectively.

A 73% rally to $200 ought to take Nvidia’s market cap to roughly $4.9 billion, more than likely placing it within the No. 1 spot. And with a ahead price-to-earnings (P/E) a number of of simply 41, the inventory definitely appears to be like prefer it has extra room to run, contemplating its triple-digit earnings progress.

That mentioned, in contrast to the everyday megacap firm, which normally constructed its enterprise over many years by servicing established, worthwhile sectors within the financial system, Nvidia’s enterprise stays speculative and unsure — incomes it a reduced valuation. The corporate appears to be like unlikely to hit a share worth of $200 in 2024 or any time quickly till the software program facet of the AI business begins to hold its personal weight. And that’s removed from assured.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the for traders to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Goldman Sachs Group, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024