Lusso's Exclusives

3 Stocks Under $3 to Watch This Week: Above Food, Virpax Pharmaceuticals, and Ocean Power Technologies

Above Food [NASDAQ: ABVE]

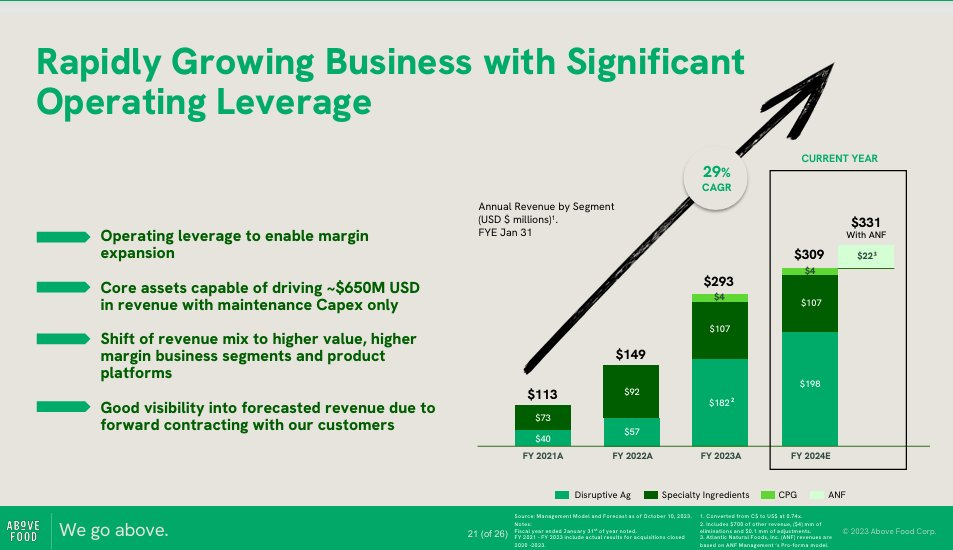

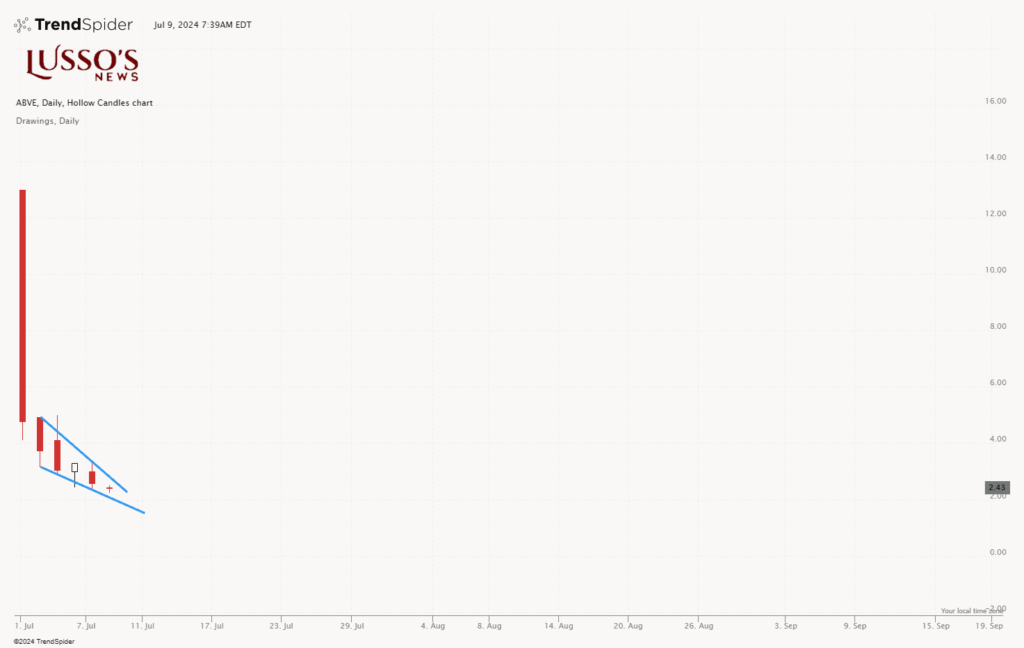

Above Food recently started trading on the NASDAQ last Monday, and its price has plummeted from $7 to $2.30. Despite this initial drop, the company demonstrates significant year-over-year growth, with FY 2021 revenue at $113 million and FY 2023 at $293 million. Above Food’s significant operating leverage allows for margin expansion, with core assets capable of driving $650 million in revenue with only maintenance Capex.

A pioneer in regenerative farming techniques, Above Food is a high-growth business with global distribution. Owning manufacturing capabilities for consumer products bolsters their private label business. Their “seed to fork” platform presents substantial barriers to entry, enabling greater control over margins and the supply chain. For investors looking at sustainable growth and innovative agricultural practices, Above Food is a stock worth watching.

Virpax Pharmaceuticals [NASDAQ: VRPX]

Virpax Pharmaceuticals surged 92% yesterday on strong volume, closing just below the 50-day simple moving average (SMA), which could act as resistance today. With a float of only around 3 million shares, the stock saw an impressive 161 million shares traded yesterday. This surge was driven by the company’s announcement of securing a $2.5 million loan financing and an agreement with an institutional investor to negotiate additional funding.

Given the low float and recent financing news, Virpax Pharmaceuticals could be poised for further volatility. Investors should watch for potential breakouts or pullbacks as it tests resistance levels.

Ocean Power Technologies [NASDAQ: OPTT]

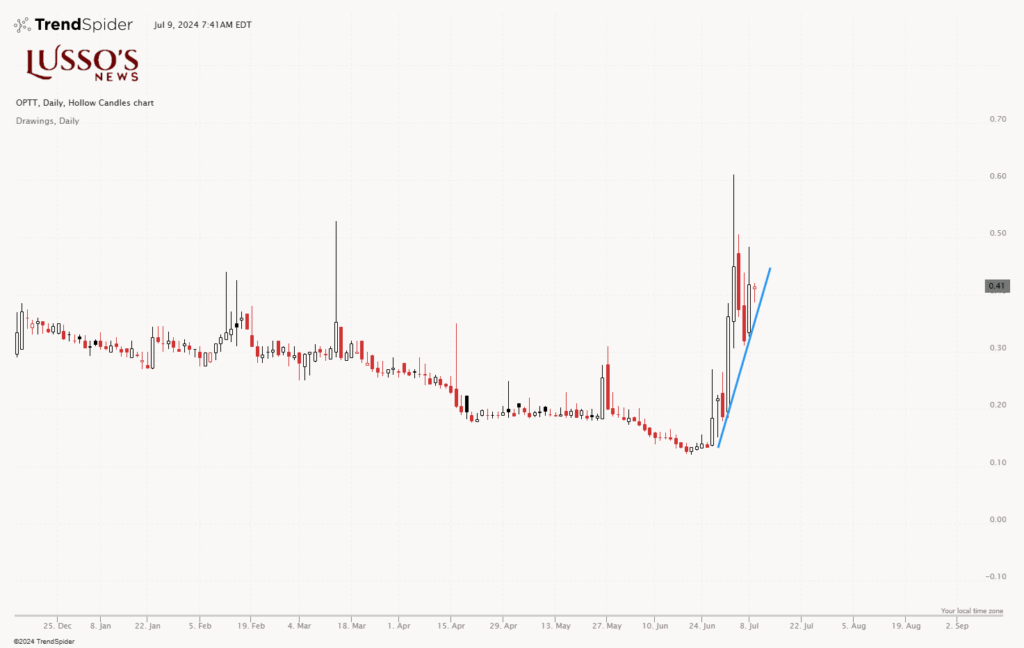

Ocean Power Technologies (OPTT) saw a 10% increase yesterday, climbing from around 13 cents to over 55 cents. The recent pullback has been on low volume, which is a positive sign, and the rising short interest percentage could spark a potential short squeeze.

The company’s recent announcement of a reseller agreement with Survey Equipment Services for the USA and a partnership with Unique Group for autonomous vehicle services in the Middle East has driven the stock’s momentum. Investors should keep an eye on Ocean Power Technologies for further developments and potential short squeeze opportunities.

Bottom Line

These three stocks—Above Food, Virpax Pharmaceuticals, and Ocean Power Technologies—each present unique opportunities and risks. Above Food’s innovative approach to agriculture and significant growth make it a compelling pick. Virpax Pharmaceuticals’ recent financing news and low float could lead to further volatility. Ocean Power Technologies’ strategic partnerships and rising short interest make it a stock to watch closely for potential squeezes. As always, conduct thorough research and consider your risk tolerance before investing.

Like Above Food [NASDAQ:ABVE]? Check Out Above Food [NASDAQ: ABVE] – Stocks To Watch 2024.

DISCLAIMER

We the publisher (WE) offers no guarantees and provides forward looking statements with intentions and sole purpose to satisfy the reader/viewer by offering only personal enjoyment and personal entertainment. If at any time a Security is purchased that is discussed at WE on a written article, post, newsletter or comment, you agree to hold WE liability free and harmless. There are no guarantees in participating in Financial Markets and full investment can be fully lost at any time. WE never guarantees and never offers recommendations. The company will not be responsible for any loss or damage that occurs. Anyone at WE may be buying or selling any stock mentioned at any given time.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any WE Service and product offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. WE recommend you consult a licensed or registered professional before making any investment decision as you could lose your full investment at any given time as this is not a “risk free” industry. If you do agree to this, then please exit our website now.

WE are NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Both, WE nor any of its owners or employees are registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. We do NOT give out advice, this is intended to be ONLY a publication for information and education.

Compensation and Advertising Revenue: The Owners and Operators of this publication have been compensated $100,000 for marketing services on behalf of Above Food Corp [NASDAQ: ABVE]. This compensation covers the period from February 9, 2024, to May 9, 2024. In the interest of full transparency, the publisher may receive additional advertising revenue from new advertisers and may collect email addresses from readers, which could be monetized.

Investor Due Diligence: Investors and readers are strongly advised to scrutinize this information meticulously and to conduct their own comprehensive due diligence before making any investment decisions. This advertisement and related marketing efforts aim to elevate investor and market awareness, potentially resulting in increased shareholder numbers and trading activities for ABVE securities.

Market Impact and Risks: Understand that any increases in trading volume or share price due to this advertisement and marketing efforts may be temporary, with potential declines post-advertising period. While the publisher endeavors to provide accurate and unbiased information, readers are urged to verify details independently and seek professional financial counsel before making decisions regarding the mentioned securities.

Investment Risks and Professional Advice: Investing involves inherent risks, including potential loss of principal. Historical performance does not guarantee future results. Consulting with a qualified financial advisor is strongly recommended before making any investment decisions.

Publisher’s Activities: The publisher retains the right to engage in buying or selling securities at any time, which may or may not be disclosed at the time of publication.

Forward-Looking Statements: This publication may contain forward-looking statements about expected market performance and financial outcomes. These statements are subject to risks and uncertainties that could cause actual results to differ significantly from those expressed or implied.

No Endorsement: The mention of ABVE or any other securities within this publication does not constitute an endorsement or recommendation by the publisher or its affiliates. The publisher disclaims any responsibility for investment decisions made by readers based on the provided information.

Solicitation and Recommendation: The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities should always do so only with the assistance of his legal, tax, and investment advisors.

Investor Resources: Investors should review any information concerning a potential investment at the websites of the U.S. Securities and Exchange Commission (the “SEC”) at www.sec.gov; the Financial Industry Regulatory Authority (the “FINRA”) at www.finra.org, relevant State Securities Administrator websites, and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by FINRA on how to invest carefully.

Verification of Information: Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

By reading this disclaimer, you acknowledge and accept the terms and conditions outlined herein. Make informed decisions and proceed with due diligence.

Lusso's Exclusives

Top 5 Stocks Under $5 to Watch Today

Investors are always on the lookout for promising stocks trading under $5, as they can offer substantial upside potential. Here are five such stocks to keep an eye on today:

1. Serve Robotics ($SERV)

Serve Robotics (SERV) is experiencing a significant surge, with its stock price climbing from $2.59 to $11.31. This impressive rise comes after Nvidia (NVDA) disclosed that it purchased an additional stake in the company. According to a recent regulatory filing, Nvidia converted a promissory note into 1 million SERV shares priced at $2.42 per share in April. With a total investment of over $12 million in Serve Robotics, Nvidia joins other notable investors like 7-Eleven and Uber (UBER). The backing of these major players is fueling investor confidence in Serve Robotics’ future growth.

2. Above Food ($ABVE)

Above Food (ABVE) is a newly listed stock on the NASDAQ, which has seen its share price decline from $7 to $1.60. The company is set to hold its first conference call on July 25th, featuring presentations from the CEO, CFO, and Founder. Given the oversold technical indicators and the upcoming catalyst of the conference call, ABVE could present a potential swing trade opportunity leading up to the event on the 25th.

More info at: Above Food [NASDAQ: ABVE] – Stocks To Watch 2024

3. Plug Power ($PLUG)

Plug Power (PLUG) experienced a 13% drop on Friday after announcing a $200 million offering. This sizable offering, while initially causing a decline, could provide the company with fresh capital for growth. Once the offering is complete and selling pressure subsides, PLUG could present a trading opportunity, particularly around the $2.50 levels. Investors should keep an eye on how the market reacts post-offering.

4. Sirius XM ($SIRI)

Sirius XM (SIRI) has seen a strong upward movement from $2.50 to $4, but has since pulled back to the $3.40 mark. The stock is currently trading around the 9 EMA (Exponential Moving Average), a critical level to watch for potential support. If the $3.40 area holds, SIRI could see a bounce, making it a stock to monitor closely for a potential rebound.

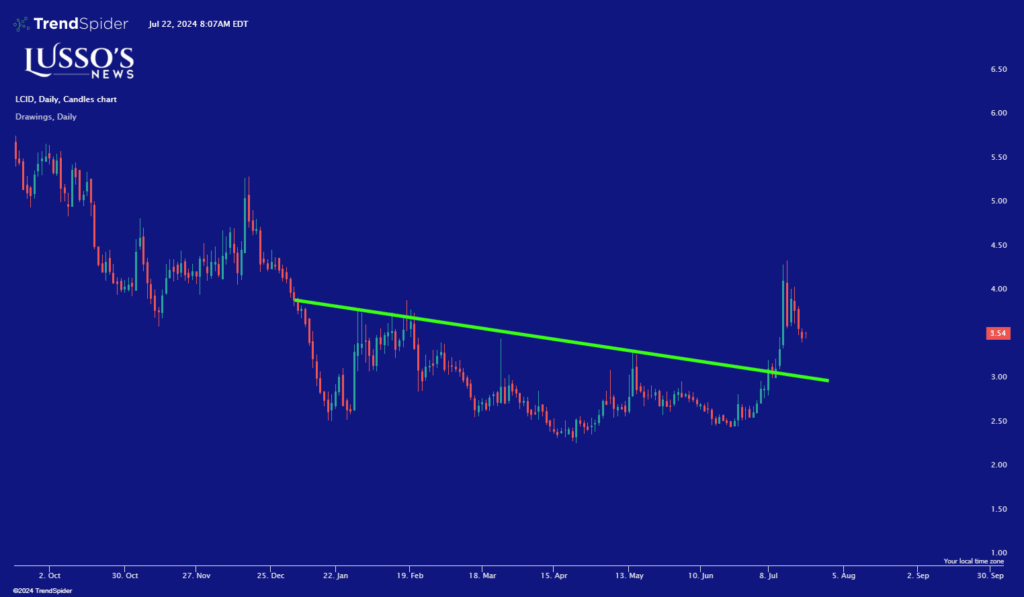

5. Lucid Group ($LCID)

July has been a favorable month for Lucid Group (LCID), with its stock price rising from $2.70 to $4.25. However, it has recently pulled back to $3.50 in line with the overall market. Currently at the bottom of its range, LCID is on watch for a bounce. Investors should look for signs of support around the $3.50 level as a potential entry point for a short-term trade.

Bottom Line

These five stocks under $5 each have unique catalysts and technical setups that make them worthy of attention today. From significant investments and upcoming events to potential rebounds and fresh capital infusions, these stocks present various opportunities for traders and investors. Always perform your due diligence and consider risk management strategies when trading low-priced stocks.

DISCLAIMER

We the publisher (WE) offers no guarantees and provides forward looking statements with intentions and sole purpose to satisfy the reader/viewer by offering only personal enjoyment and personal entertainment. If at any time a Security is purchased that is discussed at WE on a written article, post, newsletter or comment, you agree to hold WE liability free and harmless. There are no guarantees in participating in Financial Markets and full investment can be fully lost at any time. WE never guarantees and never offers recommendations. The company will not be responsible for any loss or damage that occurs. Anyone at WE may be buying or selling any stock mentioned at any given time.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any WE Service and product offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. WE recommend you consult a licensed or registered professional before making any investment decision as you could lose your full investment at any given time as this is not a “risk free” industry. If you do agree to this, then please exit our website now.

WE are NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Both, WE nor any of its owners or employees are registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. We do NOT give out advice, this is intended to be ONLY a publication for information and education.

Compensation and Advertising Revenue: The Owners and Operators of this publication have been compensated $100,000 for marketing services on behalf of Above Food Corp [NASDAQ: ABVE]. This compensation covers the period from February 9, 2024, to May 9, 2024. In the interest of full transparency, the publisher may receive additional advertising revenue from new advertisers and may collect email addresses from readers, which could be monetized.

Investor Due Diligence: Investors and readers are strongly advised to scrutinize this information meticulously and to conduct their own comprehensive due diligence before making any investment decisions. This advertisement and related marketing efforts aim to elevate investor and market awareness, potentially resulting in increased shareholder numbers and trading activities for ABVE securities.

Market Impact and Risks: Understand that any increases in trading volume or share price due to this advertisement and marketing efforts may be temporary, with potential declines post-advertising period. While the publisher endeavors to provide accurate and unbiased information, readers are urged to verify details independently and seek professional financial counsel before making decisions regarding the mentioned securities.

Investment Risks and Professional Advice: Investing involves inherent risks, including potential loss of principal. Historical performance does not guarantee future results. Consulting with a qualified financial advisor is strongly recommended before making any investment decisions.

Publisher’s Activities: The publisher retains the right to engage in buying or selling securities at any time, which may or may not be disclosed at the time of publication.

Forward-Looking Statements: This publication may contain forward-looking statements about expected market performance and financial outcomes. These statements are subject to risks and uncertainties that could cause actual results to differ significantly from those expressed or implied.

No Endorsement: The mention of ABVE or any other securities within this publication does not constitute an endorsement or recommendation by the publisher or its affiliates. The publisher disclaims any responsibility for investment decisions made by readers based on the provided information.

Solicitation and Recommendation: The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities should always do so only with the assistance of his legal, tax, and investment advisors.

Investor Resources: Investors should review any information concerning a potential investment at the websites of the U.S. Securities and Exchange Commission (the “SEC”) at www.sec.gov; the Financial Industry Regulatory Authority (the “FINRA”) at www.finra.org, relevant State Securities Administrator websites, and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by FINRA on how to invest carefully.

Verification of Information: Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

By reading this disclaimer, you acknowledge and accept the terms and conditions outlined herein. Make informed decisions and proceed with due diligence.

Lusso's Exclusives

Top 3 Momentum Stocks Under $10: Above Food ($ABVE), Koss Corporation ($KOSS), and Chewy Inc. ($CHWY)

As the market continues to evolve, traders are always on the lookout for promising momentum stocks trading under $10. These stocks have the potential for significant upside, especially for those who can spot the right opportunities. Here are the top three momentum stocks to watch right now:

1. Above Food Corp. (NASDAQ: $ABVE)

Overview: Above Food Corp. has recently made its debut on the NASDAQ, emerging from its de-SPAC transaction with Bite Acquisition Corp. Although the stock has seen significant volatility, dropping from $7 to its current level of $2.41, it recently experienced a 24% rally. This price action highlights the stock’s potential for a breakout, especially if it can clear the $2.50 resistance level.

Why $ABVE is Worth Watching:

- Explosive Growth: The company’s revenue growth from $149 million in FY22 to $293 million in FY23 demonstrates strong momentum.

- Regenerative Agriculture: Above Food’s commitment to sustainable and regenerative farming practices sets it apart in the industry.

- Vertical Integration: By controlling every step of their supply chain, Above Food ensures high-quality and traceable products, which is increasingly valued in the market.

Potential Breakout:

- Key Level: Watch for a breakout above the $2.50 level, which could signal a significant upward move.

2. Koss Corporation (NASDAQ: $KOSS)

Overview: Koss Corporation, known for its iconic headphones, became a meme stock favorite during the roaring Reddit-fueled trading frenzy led by “Roaring Kitty.” The stock recently surged from $4 to over $18 but has since retraced to $8.31. This low float stock is known for its explosive moves, making it a prime candidate for momentum traders.

Why $KOSS is Worth Watching:

- Meme Stock Status: Koss has a history of sharp, sudden price movements driven by retail investor interest.

- Low Float: The low float nature of the stock means it can move quickly with relatively low trading volume.

- Potential Bounce: After retracing to $8.31, $KOSS is at a level where it could see an intraday bounce, presenting a trading opportunity.

Potential Trade:

- Key Level: Keep an eye on $KOSS for an intraday bounce from its current levels. Monitoring volume and price action closely will be crucial.

3. Chewy Inc. (NYSE: $CHWY)

Overview: While slightly above the $10 mark, Chewy Inc. ($CHWY) is a stock worth watching as it attempts to break out of a multi-day range around $25.50. Chewy, an online pet supply retailer, has been a favorite among growth investors due to its strong customer loyalty and innovative service offerings.

Why $CHWY is Worth Watching:

- Strong Q2 Performance: Recent earnings reports have exceeded market expectations, highlighting strong revenue growth and customer retention.

- Expansion Initiatives: Chewy’s new services, including telehealth for pets and international market expansion, provide additional growth catalysts.

- Technical Setup: The stock is currently testing a key resistance level, and a breakout could lead to substantial gains.

Potential Breakout:

- Key Level: Watch for a breakout above the $25.50 mark, which could lead to a strong upward trend.

Final Take

These three stocks—Above Food Corp. ($ABVE), Koss Corporation ($KOSS), and Chewy Inc. ($CHWY)—present intriguing opportunities for momentum traders. Each has unique catalysts and technical setups that make them worth watching closely. Remember, while momentum stocks can offer significant gains, they also come with increased risk. Always perform your due diligence and consider consulting with a financial advisor before making any investment decisions.

DISCLAIMER

We the publisher (WE) offers no guarantees and provides forward looking statements with intentions and sole purpose to satisfy the reader/viewer by offering only personal enjoyment and personal entertainment. If at any time a Security is purchased that is discussed at WE on a written article, post, newsletter or comment, you agree to hold WE liability free and harmless. There are no guarantees in participating in Financial Markets and full investment can be fully lost at any time. WE never guarantees and never offers recommendations. The company will not be responsible for any loss or damage that occurs. Anyone at WE may be buying or selling any stock mentioned at any given time.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any WE Service and product offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. WE recommend you consult a licensed or registered professional before making any investment decision as you could lose your full investment at any given time as this is not a “risk free” industry. If you do agree to this, then please exit our website now.

WE are NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Both, WE nor any of its owners or employees are registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. We do NOT give out advice, this is intended to be ONLY a publication for information and education.

Compensation and Advertising Revenue: The Owners and Operators of this publication have been compensated $100,000 for marketing services on behalf of Above Food Corp [NASDAQ: ABVE]. This compensation covers the period from February 9, 2024, to May 9, 2024. In the interest of full transparency, the publisher may receive additional advertising revenue from new advertisers and may collect email addresses from readers, which could be monetized.

Investor Due Diligence: Investors and readers are strongly advised to scrutinize this information meticulously and to conduct their own comprehensive due diligence before making any investment decisions. This advertisement and related marketing efforts aim to elevate investor and market awareness, potentially resulting in increased shareholder numbers and trading activities for ABVE securities.

Market Impact and Risks: Understand that any increases in trading volume or share price due to this advertisement and marketing efforts may be temporary, with potential declines post-advertising period. While the publisher endeavors to provide accurate and unbiased information, readers are urged to verify details independently and seek professional financial counsel before making decisions regarding the mentioned securities.

Investment Risks and Professional Advice: Investing involves inherent risks, including potential loss of principal. Historical performance does not guarantee future results. Consulting with a qualified financial advisor is strongly recommended before making any investment decisions.

Publisher’s Activities: The publisher retains the right to engage in buying or selling securities at any time, which may or may not be disclosed at the time of publication.

Forward-Looking Statements: This publication may contain forward-looking statements about expected market performance and financial outcomes. These statements are subject to risks and uncertainties that could cause actual results to differ significantly from those expressed or implied.

No Endorsement: The mention of ABVE or any other securities within this publication does not constitute an endorsement or recommendation by the publisher or its affiliates. The publisher disclaims any responsibility for investment decisions made by readers based on the provided information.

Solicitation and Recommendation: The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities should always do so only with the assistance of his legal, tax, and investment advisors.

Investor Resources: Investors should review any information concerning a potential investment at the websites of the U.S. Securities and Exchange Commission (the “SEC”) at www.sec.gov; the Financial Industry Regulatory Authority (the “FINRA”) at www.finra.org, relevant State Securities Administrator websites, and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by FINRA on how to invest carefully.

Verification of Information: Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

By reading this disclaimer, you acknowledge and accept the terms and conditions outlined herein. Make informed decisions and proceed with due diligence.

Lusso's Exclusives

RESEARCH: 2 High Growth Stocks Nearing Technical Breakouts

Investment Overview

The travel and leisure industry has long been a barometer of consumer confidence and economic health. Post-pandemic, this sector is not just rebounding; it’s redefining the parameters of growth and investment potential. Investors seeking opportunities in this space often employ the CANSLIM methodology, a system based on a blend of quantitative and qualitative factors that gauge a company’s future prospects. CANSLIM stands for Current Earnings, Annual Earnings, New, Supply and Demand, Leader or Laggard, Institutional Sponsorship, and Market Direction. When applied to the travel and leisure sector, this methodology not only identifies promising stocks but also captures the prevailing sentiment and trajectory of the industry.

Industry Resurgence

As the world emerges from the constraints of the global health crisis, the pent-up demand for travel and leisure activities has propelled a robust recovery and growth phase. The resurgence is fueled by an appetite for experiential spending, rejuvenated global mobility, and a shift towards digital and sustainable tourism. Companies that adapted swiftly to the changing landscape by innovating customer experiences, leveraging technology, and expanding their global footprint are now at the forefront of the industry’s resurgence.

The CANSLIM Perspective

Through the lens of CANSLIM, this report will scrutinize two key players in the industry—Royal Caribbean Cruises (RCL) and Trip.com Group Limited (TCOM). Both entities have demonstrated strong quarterly and annual earnings growth, introduced new products and services, and witnessed favorable supply and demand dynamics. As leaders in their respective markets with substantial institutional sponsorship, their performances offer insights into the broader industry’s strengths and the market direction.

In the following sections, we will discuss the specifics of each company’s performance, strategies, and outlooks, providing a comprehensive analysis that reflects the vibrancy and potential of the travel and leisure industry in a post-pandemic world.

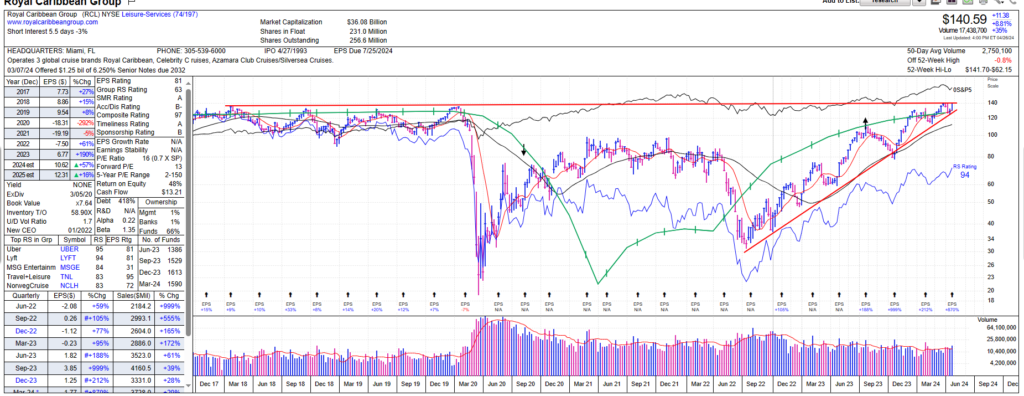

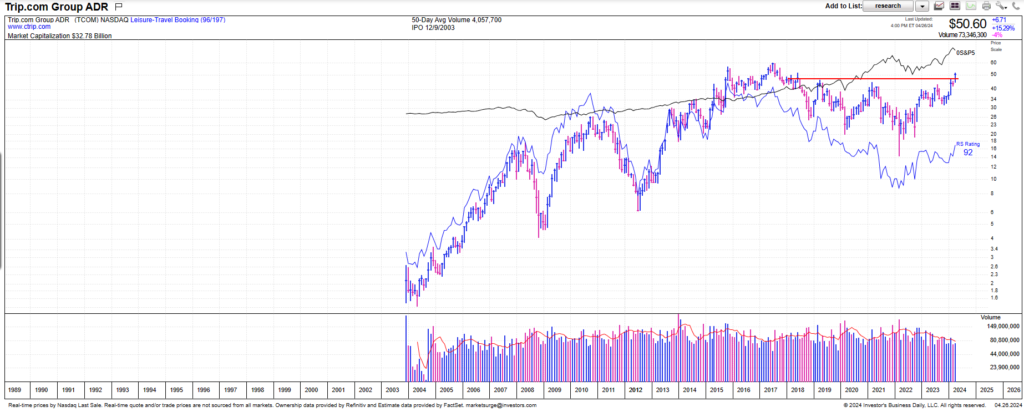

Research Report: Royal Caribbean Cruises (RCL)

Executive Summary

Royal Caribbean Cruises has reported a stellar performance in the first quarter of 2024, surpassing expectations set by management and analysts alike. As the travel and leisure industry continues its recovery trajectory post-pandemic, RCL has not only capitalized on this resurgence but has also strategically positioned itself to take advantage of the growing $1.9 trillion global vacation market.

CANSLIM Overview

- Current Quarterly Earnings: RCL reported adjusted earnings per share of $1.77, which is a 36% increase from the forecasted $1.30.

- Annual Earnings Growth: There has been a robust yield growth of 19.3% compared to the first quarter of 2023.

- New Product or Service: The introduction of the revolutionary Icon of the Seas has contributed to record-breaking bookings.

- Supply and Demand: Share supply may tighten as demand grows, indicated by increased bookings and 107% load factor.

- Leader or Laggard: RCL is outpacing the industry with strong demand across all key itineraries and destinations, notably in North America.

- Institutional Sponsorship: Institutional ownership is strong, with a noted increase in fund sponsorship.

- Market Direction: RCL is benefiting from a general upward market trend in the leisure and travel sector, with consumer spending on experiences doubling that of goods.

Strong Financial Performance

Royal Caribbean has successfully achieved a 107% load factor, and the demand environment continues to strengthen. The trifecta goals set by the company are now expected to be met in 2024, a year earlier than initially anticipated.

Expansion and Market Penetration

RCL’s expansion into the China market with Spectrum of the Seas and the planned addition of Ovation of the Seas in 2025 signifies the company’s confidence in and commitment to the Asia-Pacific region. In North America, the Caribbean itineraries, supported by new hardware like the Utopia of the Seas, are driving strong yield growth.

Strategic Innovations

The launch of private destinations such as the Royal Beach Club in Cozumel, Mexico, is enhancing guest experiences and is a pivotal element in competing against land-based vacations, potentially capturing a larger market share.

Focus on Sustainability

RCL’s sustainability efforts, highlighted in their 16th annual sustainability report, showcase their commitment to net-zero emissions and community impact, which is increasingly important to environmentally conscious travelers.

Technical Analysis

Referring to the image, RCL stock appears to be at a critical junction on the weekly chart, hovering around the $140 mark. The data suggests a pivotal area where the stock’s future price movement can be significantly influenced by upcoming trends and investor sentiment.

Conclusion

Given the robust quarterly results, strategic initiatives, and positive outlook shared in the earnings call, Royal Caribbean Cruises stands out as a compelling investment opportunity for CANSLIM traders. The company’s focus on delivering exceptional vacation experiences and its dedication to expanding its footprint in the global vacation market may bode well for its future stock performance.

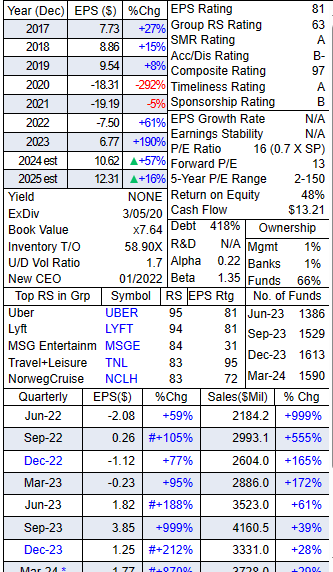

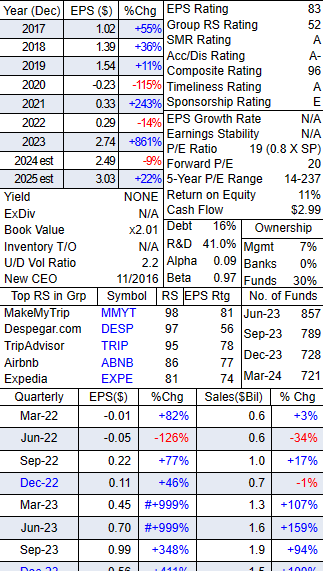

Research Report: Trip.com Group Limited (TCOM)

Executive Summary

Trip.com Group Limited (TCOM) has released its fourth quarter and full-year earnings for 2023, revealing substantial growth and robust recovery in the travel sector. The earnings call, led by Executive Chairman James Liang, CEO Jane Sun, and CFO Cindy Wang, highlighted a year marked by strategic expansions and customer-centric innovations. The company’s success is underpinned by the resurgence of China’s outbound travel and the strength of its global OTA platform. The company reports earnings again towards the end of May.

Overview and Financial Highlights

- Revenue Growth: Trip.com showcased a 105% year-over-year increase in Q4 2023 revenue, reaching RMB 10.3 billion. The full-year revenue was RMB 44.5 billion, a 122% increase year-over-year and 25% higher than 2019 levels.

- Market Segments Performance: All market segments, including domestic, outbound, and Trip.com’s global platform, reported robust growth with outbound travel bookings recovering to over 80% of pre-pandemic levels.

- Global Expansion: The OTA platform operates in 39 countries, focusing on Asian markets and expanding global offerings.

- Innovation and AI: Launch of TripGenie, an AI assistant, and investment in AI for improved customer service and operational efficiency.

- Sustainability Initiatives: Implementation of carbon hotel standards, green flights, and environmentally conscious travel options.

Financial Analysis

- Adjusted EBITDA Margin: A significant improvement to 31% in 2023, the highest in a decade, indicative of effective cost optimization.

- Profitability: Diluted earnings per ordinary share and per ADS reached RMB 1.94, with non-GAAP figures at RMB 4 per ADS, showcasing strong profitability.

- Capital Returns: The company commenced stock buybacks, demonstrating confidence in its valuation and long-term prospects.

TCOM Stock Technical Analysis

Referring to the provided image, TCOM stock appears to have recently crossed a crucial price level of $50. This breakout suggests a bullish sentiment among investors, likely driven by the company’s strong earnings and optimistic outlook for continued growth in the travel sector.

Strategic Initiatives

- Globalization: Aiming for 15-20% revenue contribution from Trip.com in the next 3-5 years, with a focus on direct traffic and cross-selling to enhance marketing efficiencies.

- Inbound Travel: Capitalizing on China’s visa-free policies to boost inbound travel, aligning with the government’s 14th five-year plan.

- Technology: Continuing to innovate with AI-driven solutions to improve user experience and streamline travel planning.

Outlook

Trip.com Group Limited is poised for accelerated growth in 2024, building on the upward trajectory in the global travel market. The company’s strategic focus on globalization, digitalization, and service quality positions it well to capitalize on the pent-up demand for travel and the evolving preferences of travelers.

-

Markets3 months ago

Markets3 months agoTop Stocks to Watch: Key Levels and Potential Breakouts

-

Markets3 months ago

Markets3 months agoIs The Stock Market CRASH Coming?

-

Markets2 months ago

Markets2 months agoMounjaro Is Concentrating on One other Multibillion-Greenback Market: Is Eli Lilly Inventory a Purchase?

-

Markets2 months ago

Markets2 months agoHow the market reacted when Trump gained in 2016

-

Markets2 months ago

Markets2 months agoGoldman Sachs raises S&P 500 year-end goal to five,600

-

Markets2 months ago

Markets2 months agoEU cybersecurity label shouldn’t discriminate towards Large Tech, European teams say

-

Markets2 months ago

Markets2 months agoEthiopia’s Energy Offers with Chinese language Companies Gasoline Bitcoin Mining Increase

-

Markets2 months ago

Markets2 months agoSingapore's Temasek to promote Pavilion Vitality to Shell

-

Markets2 months ago

Markets2 months agoWall Avenue's greatest bear explains what must occur for the inventory market to keep away from a 23% correction

-

Markets2 months ago

Markets2 months agoBoeing CEO blasted in US Senate listening to whereas apologizing for security woes

-

Markets2 months ago

Markets2 months agoEuropean shares rise; politics, central financial institution conferences in focus