Markets

3 Synthetic Intelligence Shares Down Extra Than 50% From Their 52-Week Highs. Might They Be Cut price Buys Proper Now?

It is arduous to not get caught up within the hype with synthetic intelligence (AI) when analysts are projecting a lot development. Grand View Analysis initiatives that by 2030, the AI market shall be value $1.8 trillion, up from roughly $279 billion this yr. With development like that, traders who do not personal AI shares may really feel like they’re lacking out.

However shopping for shares of chipmaker Nvidia or different which have already generated large returns will not be all that engaging given their lofty valuations. Shopping for at these excessive ranges may restrict the features you make from a inventory each within the brief and long run.

An alternative choice is to contemplate AI shares that have not been doing so effectively lately. You could be taking over extra danger however may web some robust features in the event that they finally rebound. Snowflake (NYSE: SNOW), Tremendous Micro Pc (NASDAQ: SMCI), and SoundHound AI (NASDAQ: SOUN) are all AI shares down greater than 50% from their 52-week highs. Beneath, I’ve ranked them primarily based on how possible it’s they will flip issues round.

1. Tremendous Micro Pc

Tremendous Micro Pc, often known as Supermicro, was one of many hottest AI shares to personal earlier this yr. Nevertheless it has been struggling for weeks after its fiscal 2024 This autumn earnings launch and a report from notable brief vendor Hindenburg analysis . Though such reviews could also be biased and include unproven allegations, traders have nonetheless been bearish on the inventory following these developments.

Immediately, Supermicro inventory is buying and selling at round $450 per share, greater than 60% under its 52-week excessive of $1,229. The corporate’s enterprise has been booming because it gives prospects with servers and IT infrastructure to assist them develop their operations, notably as they broaden their AI services and products.

For the fiscal yr ended June 30, Supermicro’s gross sales totaled $14.9 billion, up 110% yr over yr. Income additionally jumped from $640 million to $1.2 billion. Nevertheless, the newest earnings report alarmed traders as its gross margin has been shrinking, which may drastically hinder its earnings outlook ought to that pattern proceed.

Supermicro makes for an intriguing contrarian purchase as a result of Hindenburg’s brief report and the newest quarterly outcomes have managed to overshadow what’s nonetheless an unbelievable development streak. There may be certainly danger from its shrinking margins, however it might be an AI inventory value taking an opportunity on proper now.

2. Snowflake

Information storage firm Snowflake has been struggling in 2024 because it posted unimpressive outcomes, and traders have been bearish for the reason that firm’s CEO unexpectedly retired earlier within the yr. It additionally did not assist the corporate was concerned in a giant information breach, which impacted many giant prospects. Down greater than 40% yr so far, Snowflake’s decline has continued since shares peaked in late 2021.

For Snowflake to show issues round, it must ship higher numbers, notably on the underside line. Whereas the corporate has been rising its enterprise, that is not so encouraging when its losses have additionally been getting larger. By way of the primary two quarters this yr, Snowflake’s working loss grew 26% yr over yr to $703.9 million, practically matching its 31% top-line development over the identical interval. And to make issues worse, administration decreased its margin steering for full-year fiscal 2025.

Till Snowflake can present there’s hope of profitability sooner or later, I would keep away from the inventory.

3. SoundHound AI

Shares of SoundHound AI took off early within the yr as traders realized Nvidia had invested within the firm. Whereas the inventory has leveled off in latest months, it is nonetheless up greater than 130% yr so far, even after declining 52% from its excessive of $10.25.

SoundHound’s voice AI expertise will help eating places take orders and comply with voice instructions. Whereas the enterprise is rising, competitors on this house is intense, and its numbers will not be excessive sufficient to recommend its share of the market is all that large.

Within the second quarter, the corporate’s income rose 54% to $13.5 million, however its web loss ballooned 60% to $37.3 million.

There’s nonetheless a good bit of uncertainty round SoundHound AI, and it is arguably the riskiest choose on this listing given its sky-high valuation. I would keep away from it regardless of the sell-off.

Do you have to make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and Tremendous Micro Pc wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia and Snowflake. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

China Stimulus Hopes Rise as PBOC Cuts Fee, Plans Briefing

(Lusso’s Information) — China introduced plans for a uncommon briefing on the financial system by three high monetary regulators simply because it minimize one in every of its short-term coverage charges, fueling hypothesis authorities are getting ready to ramp up efforts to revive development.

Most Learn from Lusso’s Information

Authorities introduced Monday that central financial institution governor Pan Gongsheng will maintain a press convention tomorrow on monetary assist for financial improvement, alongside two different officers. Minutes later, the Individuals’s Financial institution of China lowered the 14-day reverse repurchase charge, as a part of reductions initiated in July.

Taken collectively the strikes bolster expectations for the PBOC to decrease charges, after the US Federal Reserve lastly began slicing final week. China’s central financial institution additionally lately signaled it was getting ready further insurance policies. A slew of disappointing knowledge in August raised issues that China might miss its annual development goal of round 5% with out extra assist.

The yield on China’s 10-year authorities bonds fell one foundation level to a contemporary low of two.03%, an indication merchants are pricing in additional financial stimulus. Within the foreign-exchange market, the PBOC raised its day by day reference charge for the yuan to 7.0531 per greenback, placing the important thing 7 stage in sight.

Whereas Monday’s discount mirrored a catch-up with a 10-basis-point July minimize within the seven-day charge, easing measures had been doubtless imminent, stated Zhiwei Zhang, president and chief economist at Pinpoint Asset Administration.

“I do anticipate PBOC will minimize 7-day repo charge in addition to the reserve requirement ratio within the coming months,” he added. “There’s a press convention tomorrow when the monetary regulators will make clear their coverage stance.”

China has one other probability to decrease the price of its one-year coverage loans on Wednesday. In July, the PBOC minimize the seven-day reverse repo charge days earlier than it slashed the medium-term lending facility by probably the most since April 2020.

The choice to decrease the 14-day charge to 1.85% from 1.95% got here forward of the Nationwide Day Vacation that can final seven days from Oct 1. The PBOC sometimes presents 14-day loans forward of lengthy break. The final time it offered such lending was in February forward of the week-long Lunar New 12 months break.

The central financial institution additionally injected 74.5 billion yuan ($10.6 billion) of liquidity into the banking system through the instrument, it stated in a press release.

“A 10bp minimize alone will not be ample to arrest the falling financial momentum,” stated ANZ Chief Better China Economist Raymond Yeung. “An even bigger package deal is required. Different coverage measures within the instrument field comparable to RRR minimize, MLF minimize and mortgage charge minimize will doubtless be introduced.”

–With help from Wenjin Lv, Iris Ouyang and Josh Xiao.

(Updates with particulars, analyst’s remark.)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

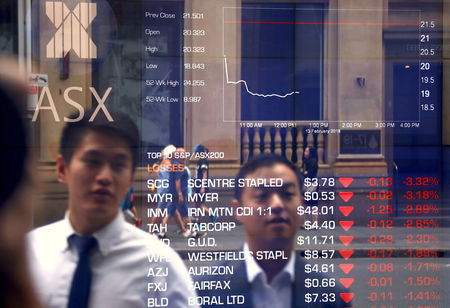

Asian shares rise; China up on repo price minimize, Australia hit by retailer losses

Lusso’s Information– Most Asian shares rose barely on Monday amid persistent cheer over decrease rates of interest, whereas Australian markets lagged as main retail shares fell sharply within the face of an antitrust lawsuit.

Chinese language markets superior after the Folks’s Financial institution of China minimize a short-term lending price, though total positive aspects had been restricted.

Regional buying and selling volumes had been held again by a market vacation in Japan. A weak Friday shut on Wall Avenue additionally made for middling cues, though U.S. inventory index futures rose in Asian commerce.

However Asian markets had been sitting on robust positive aspects from the prior week, as sentiment was boosted by an rate of interest minimize by the Federal Reserve, with the central financial institution additionally kicking off an easing cycle.

Markets had been awaiting a string of key alerts from the U.S. for extra perception into the Fed, with a number of officers set to talk this week. Key inflation information can also be on faucet.

Chinese language markets rise after repo price minimize

China’s and indexes rose 0.5% and 0.4%, respectively, whereas Hong Kong’s index added 0.7%.

The PBOC minimize its 14-day reverse repo price to 1.85% from 1.95%, additional loosening native financial situations to assist increase financial progress.

However the transfer got here simply days after the PBOC upset markets by leaving its benchmark mortgage prime price unchanged. Chinese language indexes had been nonetheless buying and selling simply above seven-month lows hit earlier in September.

Buyers have been calling on Beijing to roll out extra stimulus measures amid few indicators of an financial pick-up within the nation.

Australian shares hit by retailer losses, RBA on faucet

Australia’s was the worst performer in Asia, dropping 0.6% because it fell from report highs.

Losses in grocery store giants Woolworths Ltd (ASX:) and Coles Group (OTC:) Ltd (ASX:) had been the most important weights, with the 2 falling between 3% and 4% after Australia’s competitors regulator sued the 2 for allegedly deceptive clients over reductions.

Sentiment in direction of Australia was additionally frail earlier than the conclusion of a on Tuesday. Whereas the RBA is just not anticipated to hike rates of interest, it’s anticipated to strike a hawkish chord within the face of persistent labor market energy and sticky inflation.

Broader Asian markets drifted greater amid persistent cheer over decrease rates of interest. rose 0.9%, as native markets had been closed for a vacation.

South Korea’s added 0.1%, whereas futures for India’s index pointed to a constructive open, with the index now in sight of report highs at 26,000 factors.

Markets

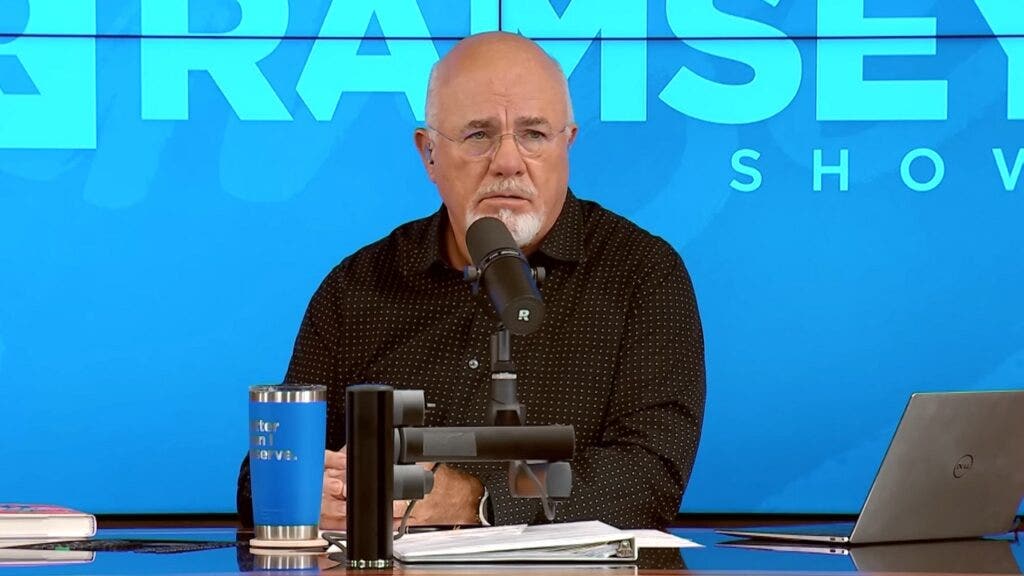

Dave Ramsey Tells 29-12 months-Outdated $1M In Debt And Spending Like She's In Congress: 'I'm Getting Prepared To Destroy Your Life As You Know It'

Many individuals of their 20s take care of bank card debt or pupil loans, generally considering they will determine it out later. However what occurs when that debt piles as much as almost one million {dollars}? That is the truth a 29-year-old named Channing from Washington D.C. confronted throughout an episode of

Do not Miss:

Channing and her husband had been grappling with almost $1 million in debt, a quantity that had Ramsey shortly diving into tough-love mode. Certain, he is seen eventualities the place individuals are in over their heads with debt, however at simply 29, this was significantly alarming to Ramsey.

Channing, who not too long ago married, defined, “My husband and I’ve most likely slightly below one million {dollars} in debt and we need to know get debt-free with out submitting for chapter.” The breakdown included , $136,000 in bank cards and $44,000 in private loans. Their mixed family revenue was about $230,000 a 12 months.

Trending: Founding father of Private Capital and ex-CEO of PayPal

Ramsey did not maintain again. After calculating the staggering numbers, he addressed the couple’s state of affairs bluntly. “You guys have been dwelling at about 10x the place you are going to get to dwell for the following three years,” Ramsey stated. “I am on the point of destroy your life as you recognize it.”

“You have gotten used to spending such as you’re in Congress,” he scolded. He was clear that their life-style wanted a whole overhaul. Ramsey emphasised that their monetary habits must change drastically, stating, “You are not gonna see the within of a restaurant until it is your additional job otherwise you’re ready on somebody you’re employed with in the course of the day.” He added, “You are gonna be dwelling on beans and rice, rice and beans.”

See Additionally:

Ramsey went on to emphasize the emotional and religious challenges forward. “Your pals are going to assume you have misplaced your thoughts and your mom goes to assume you want counseling,” he warned, including that each Channing and her husband would want to cease caring what others assume in the event that they needed to deal with their debt efficiently.

He additionally shared a , saying, “That is precisely what I did in my 20s. I purchased and bought a way of life that was 5x to 10x what I had. It was all due to crap inside me that precipitated me to try this.”

Trending: Elon Musk’s secret mansion in Austin revealed by courtroom filings.

Ramsey’s recommendation wasn’t nearly reducing bills however about confronting the mindset that had led to their monetary missteps. “The issue is what is going on on inside you guys,” Ramsey stated. “You are on a suicide mission proper now.”

The robust dialog ended on a hopeful notice, although. Ramsey assured Channing that whereas the journey can be tough, it was doable. “You are able to do it, although,” he stated. “I do know. I will provide help to.”

Channing and her husband at the moment are dealing with a significant life-style change to climb out of their almost $1 million debt, with Dave Ramsey’s steering . Typically debt occurs, however a minimum of they’re taking steps to deal with the difficulty and make modifications earlier than they’re left resorting to extra excessive choices similar to chapter.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and techniques to realize an edge within the markets.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately