Markets

US inventory futures edge decrease with CPI knowledge set to supply extra charge cues

Lusso’s Information– US inventory index futures fell barely in night offers on Wednesday, cooling after a latest rally on Wall Road as focus turned in direction of upcoming inflation knowledge to set the stage for rate of interest cuts by the Federal Reserve.

Wall Road rallied on Wednesday following optimistic feedback from Fed Chair Jerome Powell, who famous latest cooling within the U.S. financial system and stated the central financial institution will take into account impartial charges later in 2024.

fell 0.1% to five,684.25 factors, whereas fell 0.1% to twenty,887.0 factors by 19:06 ET (23:06 GMT). fell 0.1% to 40,019.0 factors.

CPI knowledge awaited for extra cues on rates of interest

Powell reiterated that the Fed remained dedicated to its 2% inflation goal, which put upcoming shopper value index knowledge squarely in focus.

Information on Thursday is predicted to indicate inflation eased barely in June, whereas remained sticky.

Whereas Powell did observe some cooling within the U.S. financial system, he additionally warned that the Fed wanted to see extra proof that inflation was easing.

Nonetheless, the Fed Chair additionally stated that the central financial institution didn’t must see inflation falling under 2% to start reducing rates of interest. Powell additionally stated he continues to see a tender touchdown for the financial system, sparking some optimism on Wall Road.

Wall St rallies on charge minimize hopes, tech good points

U.S. inventory indexes have been inspired by Powell’s feedback, with the S&P 500 and the Nasdaq Composite surging to report highs on Wednesday.

Features in heavyweight know-how shares have been the most important drivers of the rally on continued hype over synthetic intelligence, though non-tech shares additionally superior.

Vitality shares have been boosted by good points in oil costs, as knowledge confirmed a sustained attract U.S. inventories.

The rose 1% to five,633.91 factors, whereas the surged 1.2% to 18,645.97 factors, with each indexes ending at report highs. The rose 1.1% to 39,721.36 factors, remaining within reach of a report peak reached earlier this yr.

Costco, WD-40 advance in afterhours commerce

Amongst main aftermarket movers, grocery store chain Costco Wholesale Corp (NASDAQ:) rose 3% after it introduced plans to extend annual membership charges.

Chemical substances agency WD-40 Firm (NASDAQ:) surged 9% after clocking sturdy quarterly earnings, whereas aluminum big Alcoa Corp (NYSE:) rose 2.5% after additionally clocking sturdy earnings. Alcoa’s outcomes normally mark the start of the quarterly earnings season, with a number of main banks set to report on Friday.

Markets

Belongings in actively managed ETFs prime $1 trillion worldwide

By Suzanne McGee

(Reuters) – Belongings in actively managed exchange-traded funds (ETFs) worldwide hit a document $1 trillion on the finish of August, in keeping with knowledge supplier ETFGI, boosted by simpler laws and a wave of product innovation.

Lively ETFs search to outperform the indexes they’re benchmarked to, together with the , the and the Russell 1000 Progress Index. Bear Stearns launched the primary energetic ETF in 2008.

Whereas they make up simply 7% of all world ETFs, energetic ETFs have accounted for 30% of all inflows into the funds as an entire for the final a number of years, Matthew Bartolini, head of SPDR Americas Analysis at State Avenue (NYSE:) Analysis, instructed Reuters within the newest episode of Inside ETFs.

A key development catalyst, analysts stated, was the 2019 regulation popularly often known as the “ETF rule,” which streamlined the complicated means of successful approval for energetic ETFs from the U.S. Securities and Trade Fee. Belongings within the energetic ETF class have grown about 10-fold since 2019, in keeping with knowledge from ETF.com.

Progress has continued this 12 months. As of Aug. 31, energetic ETF belongings soared 42%, knowledge from ETFGI confirmed.

The extra relaxed laws have additionally fueled innovation, Bartolini stated, encouraging issuers to take novel approaches to merchandise as they vie for investor {dollars}.

Lively ETFs run the gamut from the plain vanilla, such because the BlackRock (NYSE:) Giant Cap Worth ETF to extra area of interest choices, just like the AdvisorShares Vice ETF, which invests in shares of corporations concerned within the alcohol, tobacco and hashish industries.

“These regulatory rule modifications have truly accelerated a few of the extra novel approaches that ETF issuers can carry to {the marketplace},” Bartolini stated.

Lively ETFs embody merchandise which have been wildly unstable, comparable to Ark Innovation ETF, which soared 152% in 2020, solely to hunch 23% the next 12 months. To date in 2024, it has misplaced 9.74%, in contrast with a 20% achieve within the S&P 500. Some may enlarge threat, comparable to leveraged ETFs tied to the efficiency of particular person shares like Nvidia (NASDAQ:).

Nor are all energetic ETF issuers faring nicely.

The ten largest issuers accounted for 75% of energetic ETF belongings, in keeping with a Morningstar report from earlier this 12 months. The underside half of energetic fairness ETFs have solely 3% of all of the group’s belongings.

“ETFs that repackage old style stock-picking have struggled to draw belongings,” stated Jack Shannon, supervisor analysis analyst at Morningstar, in a report revealed on Tuesday.

Tim Huver, senior vice chairman of ETF Servicing at Brown Brothers Harriman, stated energetic ETFs might require buyers to do extra due diligence. Nonetheless, he believes the class has reached a turning level.

A Brown Brothers survey discovered that greater than 90% of ETF buyers supposed to extend their allocation to energetic ETFs, Huver stated.

“I feel the second trillion goes to reach far more quickly than it took us to get to the primary trillion,” Huver stated.

Markets

Received $500? 2 Monster Synthetic Intelligence (AI) Shares to Purchase Proper Now

Shopping for and holding prime shares for an extended, very long time is among the finest methods to become profitable within the inventory market, as a result of this technique permits buyers to capitalize on secular development developments and likewise helps them profit from the facility of compounding.

For example, a $500 funding made within the Nasdaq-100 Know-how Sector index a decade in the past is now value $2,300, translating into annual development of 16% throughout this era. So, if in case you have $500 to spare proper now after paying off your payments, clearing costly loans, and saving sufficient for tough occasions, it could be a good suggestion to place that cash into shares of corporations which can be benefiting big-time from the rising adoption of .

That is as a result of the worldwide AI market is forecast to develop at an annual price of 28% via 2030, producing virtually $827 billion in annual income on the finish of the last decade. The adoption of this expertise is about to influence a number of industries, starting from cloud computing to digital promoting.

On this article, I’ll study the prospects of two corporations which can be working in these niches and are already benefiting from the quickly rising adoption of AI to see why it could make sense to speculate $500 in them (both individually or mixed).

1. The Commerce Desk

The Commerce Desk (NASDAQ: TTD) operates a programmatic, cloud-based promoting platform that helps advertisers buy advert stock and handle and optimize their campaigns throughout varied channels corresponding to video, cellular, e-commerce, related tv, and others. The Commerce Desk’s automated platform makes use of real-time information to assist drive stronger returns on investments for advertisers in order that they will buy and show the proper advertisements to the proper viewers on the right time.

It’s value noting that the corporate operates in a fast-growing area of interest because the programmatic promoting market is anticipated to generate incremental income of $725 billion between 2023 and 2028 at a compound annual development price of 39%, as per TechNavio. The Commerce Desk has been counting on AI to seize this large end-market alternative.

The corporate launched its AI-enabled programmatic advert platform Kokai in June 2023. Kokai analyzes 13 million advert impressions each second in order that it may “assist advertisers purchase the fitting advert impressions, on the proper worth, to succeed in the audience at the most effective time.” The great half is that The Commerce Desk’s prospects are already witnessing an enchancment of their returns on advert {dollars} spent due to Kokai.

On its August , The Commerce Desk administration identified:

Solimar is The Commerce Desk’s programmatic advert platform that was launched in 2021. So, it will not be stunning to see extra of the corporate’s prospects transferring to the AI-enabled Kokai given the numerous enchancment in advert efficiency that it’s delivering. Extra importantly, The Commerce Desk’s concentrate on integrating AI has allowed it to speed up its development as effectively.

The corporate’s income within the second quarter of 2024 elevated 26% 12 months over 12 months to $585 million as in comparison with the 23% development it recorded in the identical quarter final 12 months. Its adjusted earnings elevated at a quicker tempo of 39% from the identical quarter final 12 months to $0.39 per share. The corporate’s income forecast of $618 million for Q3 would translate into 27% development from the identical quarter final 12 months, suggesting that its top-line development is on monitor to speed up within the present quarter.

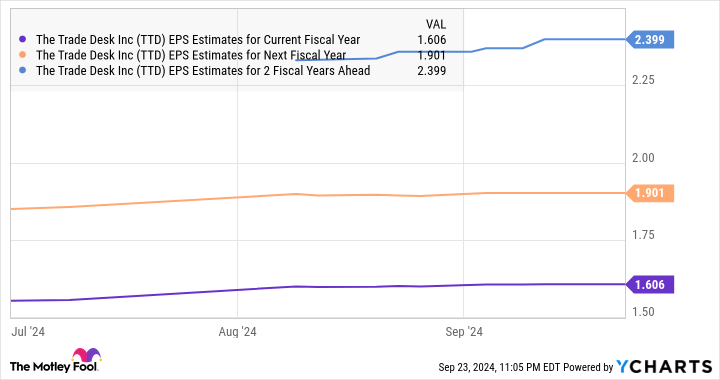

The great half is that analysts expect The Commerce Desk’s earnings development price to select up sooner or later.

information by

The corporate is anticipated to clock an annual earnings development price of 26% for the following 5 years, however current developments and the massive addressable alternative within the programmatic promoting market (which The Commerce Desk administration pegs at $1 trillion) recommend that it may outperform consensus estimates.

The market has rewarded The Commerce Desk inventory with 50% positive factors in 2024 up to now due to its bettering development profile, and its brilliant prospects recommend that it may maintain flying greater. That is why investing $500 in The Commerce Desk may develop into a wise long-term transfer proper now contemplating that it has a worth/earnings-to-growth ratio (PEG ratio) of 0.6, which signifies that it’s undervalued with respect to the expansion that it’s forecasted to ship.

2. Oracle

The cloud computing market has been an enormous beneficiary of the rising AI adoption within the preliminary days, Grand View Analysis estimates that the cloud AI market may develop at an annual price of 40% via 2030 to generate income of $647 billion on the finish of the forecast interval. Oracle (NYSE: ORCL) is getting an enormous increase due to the fast development of the cloud AI market, as evident from the corporate’s current outcomes.

Oracle’s cloud income within the first quarter of fiscal 2025 (which ended on Aug. 31) elevated 21% 12 months over 12 months to $5.6 billion, outpacing the corporate’s complete income development of 8% to $13.3 billion. Extra particularly, the Oracle Cloud Infrastructure (OCI) enterprise recorded terrific year-over-year development of 45% to $2.2 billion.

OCI is the corporate’s infrastructure-as-a-service (IaaS) enterprise via which it rents out its cloud infrastructure to prospects seeking to practice AI fashions. Administration factors out that this enterprise now has an annual income run price of $8.6 billion and demand for OCI is exceeding provide. The demand for Oracle’s cloud infrastructure providing is so robust that its remaining efficiency obligations (RPO) shot up a terrific 52% 12 months over 12 months within the earlier quarter to $99 billion.

RPO is the entire worth of an organization’s future contracts which can be but to be fulfilled, and it’s value noting that AI is taking part in a central function in driving this metric greater. Oracle factors out that its “cloud RPO grew greater than 80% and now represents almost three-fourths of complete RPO.”

Contemplating the massive alternative that is current within the cloud AI market, it will not be stunning to see demand for Oracle’s cloud infrastructure improve at a sturdy tempo for a very long time to return. That is additionally the rationale why consensus estimates are projecting Oracle’s income to extend by double digits over the following three fiscal years following a top-line soar of simply 6% in fiscal 2024 to $53 billion.

information by

Oracle is up 57% up to now in 2024. Traders would do effectively to behave shortly so as to add this cloud inventory to their portfolios as it’s nonetheless buying and selling at a gorgeous 27 occasions ahead earnings, a small low cost to the Nasdaq-100 index’s ahead earnings a number of of 29. Its large addressable market and the immense measurement of its backlog that is rising on account of the fast adoption of cloud AI providers is prone to result in extra inventory worth upside sooner or later.

Do you have to make investments $1,000 in The Commerce Desk proper now?

Before you purchase inventory in The Commerce Desk, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for buyers to purchase now… and The Commerce Desk wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $760,130!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Oracle and The Commerce Desk. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Boeing wage talks break off with out progress to finish strike, union says

(Reuters) – The Worldwide Affiliation of Machinists and Aerospace Staff (IAM) mentioned late on Friday that its pay deal talks with Boeing (NYSE:) had damaged off and that there have been no additional dates scheduled for negotiations presently.

“We stay open to talks with the corporate, both direct or mediated,” IAM mentioned in a put up on X.

Boeing stays dedicated to resetting its relationship with its represented staff and desires to “attain an settlement as quickly as attainable,” a spokesperson for the corporate mentioned in an e-mail. “We’re ready to fulfill at any time.”

Greater than 32,000 Boeing staff within the Seattle space and Portland, Oregon, walked off the job on Sept. 13 within the union’s first strike since 2008, halting manufacturing of airplane fashions together with Boeing’s best-selling 737 MAX.

The union is looking for a 40% pay rise and the restoration of a defined-benefit pension that was taken away within the contract a decade in the past.

Boeing made an improved provide to the hanging staff on Monday that it described as its “finest and remaining”, which might give staff a 30% increase over 4 years and restored a efficiency bonus, however the union mentioned a survey of its members discovered that was not sufficient.

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday