Markets

Hedge funds flip to South Korea for subsequent wave in AI

By Summer time Zhen

HONG KONG (Reuters) – Hedge funds looking for synthetic intelligence-related inventory market bargains are dashing into South Korea’s chipmakers, betting a brand new wave of demand for high-end reminiscence chips and authorities spending makes them extra worthwhile.

Britain’s Man Group, Singapore’s FengHe Fund Administration and Hong Kong’s CloudAlpha Capital Administration and East Eagle Asset Administration are among the many hedge funds in search of AI publicity in Asia that wish to South Korean behemoths resembling SK Hynix and Samsung Electronics (KS:), which have to date lagged the sector’s rally.

“If we take into account Nvidia (NASDAQ:) the king of the AI story, then Hynix is the queen,” mentioned Matt Hu, chief funding officer of $4 billion FengHe, which has been shopping for Hynix and Samsung this 12 months.

FengHe and different hedge fund traders consider the AI frenzy over the previous 12 months that trebled the worth of U.S.-listed Nvidia’s shares to greater than $3 trillion has left behind shares resembling Hynix relative to extra fashionable Asian AI gamers resembling Taiwan’s TSMC.

However the highlight is popping to South Korean chipmakers as expertise corporations within the generative AI race scurry to safe high-bandwidth reminiscence (HBM) chips manufactured primarily by Hynix, Samsung and U.S.-based Micron Know-how (NASDAQ:).

Hynix is the highest provider of superior HBM reminiscence chips to Nvidia. FengHe’s Hu estimates Hynix receives a bigger proportion of its income from Nvidia than TSMC does, however Hynix trades at 9 instances its 12-month ahead earnings versus 23 instances for TSMC.

There are different broader tailwinds to those shares, such because the South Korean authorities’s 26 trillion received ($19 billion) assist bundle for the chip business and its new ‘Company Worth-up Programme’, alongside the traces of comparable efforts in Japan and China to enhance shareholder returns.

The frenzy of hedge fund money into South Korea’s AI sector helped the benchmark index register its finest month in seven months in June. South Korean shares attracted the strongest inflows amongst Asia rising markets to date this 12 months, and their largest inflows since 2008, in line with LSEG knowledge.

The rewards of being invested in South Korea outweigh the massive dangers, hedge funds say, specifically strain from a depreciating Korean received and restrictions on short-selling of shares within the native market.

KOSPI is buying and selling at 10 instances 12-month ahead earnings, in contrast with Taiwan’s 18 instances and Japan’s 15 instances.

MORE MEMORY

Samsung and Hynix account for about 30% of KOSPI by market capitalisation.

Whereas Hynix shares are up greater than 70% this 12 months, Samsung is up solely 12% and the general KOSPI almost 9%.

Past HBM chips, shortage within the provide of broader reminiscence chips has additional bolstered South Korean suppliers. Samsung mentioned final week it anticipated a greater than 15-fold rise in its second-quarter working revenue, due to rising chip costs.

Sumant Wahi, a portfolio supervisor at Man Group specializing in expertise shares, expects costs of conventional Dynamic Random Entry Reminiscence (DRAM) chips to rise too as a result of the chip business has shifted an excessive amount of capability to manufacturing HBM.

“There’s undoubtedly a possibility there,” he mentioned.

Pierre Hoebrechts, head of macro analysis at East Eagle Asset Administration, expects Samsung to catch up within the second half on account of its vital underperformance in comparison with TSMC this 12 months.

The South Korean AI theme can be broadening past chipmakers. Chris Wang, a portfolio supervisor at tech-focused CloudAlpha Capital Administration, has invested in electrical energy tools maker HD Hyundai (OTC:) Electrical this 12 months, betting the inventory will profit from the spurt in energy consumption. Its shares are up 333% since January.

“Korea has the potential to promote extra semiconductor tools, cooling programs and even shopper electronics together with the rising AI ecosystem,” mentioned Simon Woo, Asia-Pacific expertise analysis coordinator at BofA Securities.

The long-running Sino-U.S. expertise warfare additionally ensures China retains utilizing South Korea’s superior reminiscence chips, given Chinese language chipmakers have to date been unable to compete whereas beneath U.S. export bans, Woo added.

Markets

Exxon director joins Elliott group searching for to accumulate Citgo Petroleum

HOUSTON (Reuters) – Exxon Mobil board director Gregory Goff lately joined a newly fashioned Elliott Funding Administration-backed firm searching for to accumulate management of Venezuela-owned oil refiner Citgo Petroleum.

Citgo and Exxon are rivals within the motor fuels and lubrications enterprise. Exxon is the third-largest U.S. oil refiner by capability and Citgo is the seventh-largest.

Goff, who joined Exxon in 2021 as a part of a dissident slate of administrators, was on Friday recognized as CEO of Amber Vitality, an Elliott affiliate, in a press release heralding its choice because the profitable bidder in a U.S. court docket public sale of shares in Citgo guardian PDV Holding.

Exxon had no quick touch upon Goff’s standing on the firm. The corporate’s board of administrators webpage lists Goff as chairman of its audit committee and member of its govt and finance committees.

A spokesperson for Amber Vitality declined to remark.

Amber’s bid places an as much as $7.28 billion enterprise worth on the Houston-based oil refiner. Shares in a Citgo guardian whose solely asset is the refiner are being auctioned to repay as much as $21.3 billion in claims in opposition to Venezuela and state oil agency PDVSA for expropriations and debt defaults.

Citgo owns refineries in Texas, Louisiana and Illinois, an intensive gasoline storage and pipeline community, and 4,200 impartial retailers. It had 2023 internet revenue of $2 billion.

Amber’s disclosure of the Citgo bid describes Goff as having 40 years of expertise in power and energy-related companies. It makes no point out his Exxon tenure, however does describe him as the previous chairman and CEO of oil refiner Andeavor and CEO of Claire Applied sciences Inc.

He was a vice chairman at Marathon Petroleum till 2019. Elliott made billions of {dollars} after taking a stake in Marathon and prodding it to enhance operations and hive off items of its enterprise. Marathon offered its Speedway retail gasoline enterprise to 7-Eleven for $21 billion in 2021.

(Reporting by Gary McWilliams; Modifying by Chizu Nomiyama)

Markets

Steward Well being CEO who refused to testify to US Senate will step down

WASHINGTON (Reuters) – Ralph de la Torre will step down as CEO of troubled Steward Well being Care subsequent week, the corporate stated on Saturday, after he was held in legal contempt by the U.S. Senate for refusing to testify about cost-cutting choices on the group’s 31 hospitals earlier than it filed for chapter.

In a press release, the Dallas-based firm stated de la Torre would not function its CEO and chairman as of Oct. 1 as a part of an settlement in precept reached earlier this month.

A spokesperson for de la Torre confirmed that the previous coronary heart surgeon “has amicably separated from Steward on mutually agreeable phrases,” and “he’ll proceed to be a tireless advocate for the advance of reimbursement charges for the underprivileged affected person inhabitants.”

The Senate unanimously voted on Wednesday to carry de la Torre in legal contempt of Congress after he declined to attend a Sept. 12 listening to earlier than the Senate Committee on Well being, Schooling, Labor and Pensions, which was probing Steward’s monetary troubles. De la Torre had been subpoenaed to attend the listening to.

Steward, the biggest privately owned hospital community within the U.S., filed for chapter in Could, searching for to promote all of its hospitals and deal with $9 billion in debt. The corporate has bought a number of hospitals since that submitting.

“Dr. de la Torre urges continued concentrate on this mission and believes Steward’s monetary challenges put a much-needed highlight on Massachusetts’ ongoing failure to repair its healthcare construction and the inequities in its state system,” his spokesperson stated.

A variety of hospitals affected by Steward’s monetary troubles had been primarily based in Massachusetts.

Markets

Nvidia Inventory (NVDA) Is Nonetheless a Lengthy-Time period Winner, No Matter the Noise

Synthetic Intelligence (AI) prodigy Nvidia , the world’s third-highest-valued inventory, skilled a cloth decline in market capitalization following its Q2 earnings in late August. Nevertheless, NVDA inventory has proven some vigor once more, rising 5% within the final week. After briefly surpassing the $3 trillion milestone earlier this 12 months, traders are questioning what the longer term will maintain. My thesis stays unchanged — I’m bullish on NVDA shares as an funding on account of its clear AI supremacy and exponential progress potential.

NVDA’s Lengthy-Time period AI-Pushed Development Trajectory Stays Intact

It’s well-known that NVDA is positioned for a protracted runway of progress with top-notch purchasers like Microsoft , Alphabet , Meta , and Amazon bulking up on their AI efforts. Nevertheless, past these main clients, Nvidia’s AI penetration continues to be rising throughout all industries, rising my optimism for NVDA inventory. Enterprises throughout industries and geographies are keen to include AI advantages into their operations. Likewise, NVDA continues to with high companies.

There’s a cause enterprises are flocking to NVDA for his or her AI ambitions. Past being the chief in AI GPU processors, NVDA supplies a whole end-to-end AI infrastructure that supercharges productiveness. That’s one thing that few, if any, of its world AI friends can ship.

NVDA Stays a One-Cease AI Powerhouse with Margin Development

Another excuse for my optimism about NVDA is ‘s relentless focus. He’s dedicated to remodeling NVDA into a completely AI-driven knowledge heart powerhouse that covers all features of {hardware} and software program underneath the NVDA model.

This technique is a key cause why NVDA can preserve premium pricing for its merchandise, contributing to regular progress in its revenue margins. Nevertheless, critics argue that NVDA’s distinctive income and margin progress will not be sustainable. Some members of the funding neighborhood are apprehensive a couple of slowdown in income progress over the approaching years.

For context, NVDA reported a rare 217% enhance in its knowledge heart revenues for fiscal 2024. Whereas that progress is anticipated to average to round 130% in 2025, this stays a powerful triple-digit determine, particularly contemplating the sturdy FY2024 baseline for comparability. Though decrease than right this moment’s tempo, these are nonetheless exceptional progress projections for the longer term. I view bullish analyst estimates as a cause to stay assured on this AI chief, significantly because the disruptive potential of generative AI is simply starting to unfold.

Demand for NVDA’s chips is strong and can increase future revenues within the coming quarters. Due to this fact, regardless of some investor issues, I count on NVDA will proceed to take care of its clear AI dominance with an unbeatable aggressive moat and best-in-class AI services and products.

A Dialogue of Nvidia’s Spectacular Quarterly Earnings

Nvidia posted yet one more stellar Q2 outcome on August 28, 2024, pushed by accelerated computing and the continued momentum of generative AI. handily beat the consensus analyst estimate of $0.65 per share. The determine got here in a lot larger (+152%) than the Fiscal Q2-2023 determine of $0.27 per share.

The corporate posted a 122% year-over-year income progress, delivering $30.04 billion for the three months ending July 31 and surpassing analysts’ projections. Importantly, Information Heart revenues, the corporate’s crown-jewel division, grew 154% year-over-year to $26.3 billion. Moreover NVDA’s adjusted gross margin expanded 5 share factors to 75.1% from 70.1% a 12 months in the past. Many traders have been apparently hoping for even larger numbers, and subsequently the inventory dropped barely following the Q2 report. Shares then continued a downtrend till they bottomed out on September 6, simply above the $100 stage.

Nvidia’s steerage for the third quarter appeared much less promising to traders, with revenues anticipated to succeed in about $32.5 billion. Steerage got here in beneath expectations. Adjusted gross margins are forecast to stage off at about 75%, versus 75.15% delivered in Q2.

NVDA’s Insider Promoting Issues are Over

added downward stress on NVDA shares in latest months. CEO Jensen Huang offered NVDA shares throughout a number of transactions from June to September, but it surely’s vital to know that these gross sales have been a part of a predetermined buying and selling plan adopted in March. This plan allowed Huang to promote as much as six million NVDA shares by the tip of Q1 2025.

Notably, Huang has accomplished gross sales of greater than $700 million price of NVDA inventory. Regardless of the importance of those gross sales, he stays the biggest particular person shareholder of the corporate. Finally report, Huang held 786 million shares by means of varied trusts and partnerships, and 75.3 million shares straight, in line with firm filings. Mixed, Huang controls a ~3.5% stake within the firm, with an approximate complete of 859 million shares.

NVDA Valuation Isn’t Costly, Given Its Earnings Development Prowess

Buyers might have been hesitant to purchase NVDA inventory at present ranges, pointing to the inventory’s extraordinary run in addition to on account of issues concerning the firm’s and slowing progress.

Quite the opposite, nevertheless, my rivalry is that NVDA inventory isn’t as costly as it might appear. At present, it’s buying and selling at a ahead P/E ratio of about 43x (based mostly on FY2025 earnings expectations). That is really cheaper than some valuation multiples of its friends. As an illustration, NVDA’s closest competitor and U.S.-based semiconductor firm, Superior Micro Units, carries a 46.8x ahead P/E. Curiously, NVDA’s present valuation nonetheless displays a ten% low cost to its five-year common ahead P/E of 47.3x.

Given NVDA’s constant outperformance and robust progress potential, the present valuation seems cheap and justified. Any future dip within the inventory value might signify a strong shopping for alternative, in my view, particularly contemplating Nvidia’s immense potential within the quickly increasing AI market.

Is NVDA Inventory a Purchase or Promote, In line with Analysts?

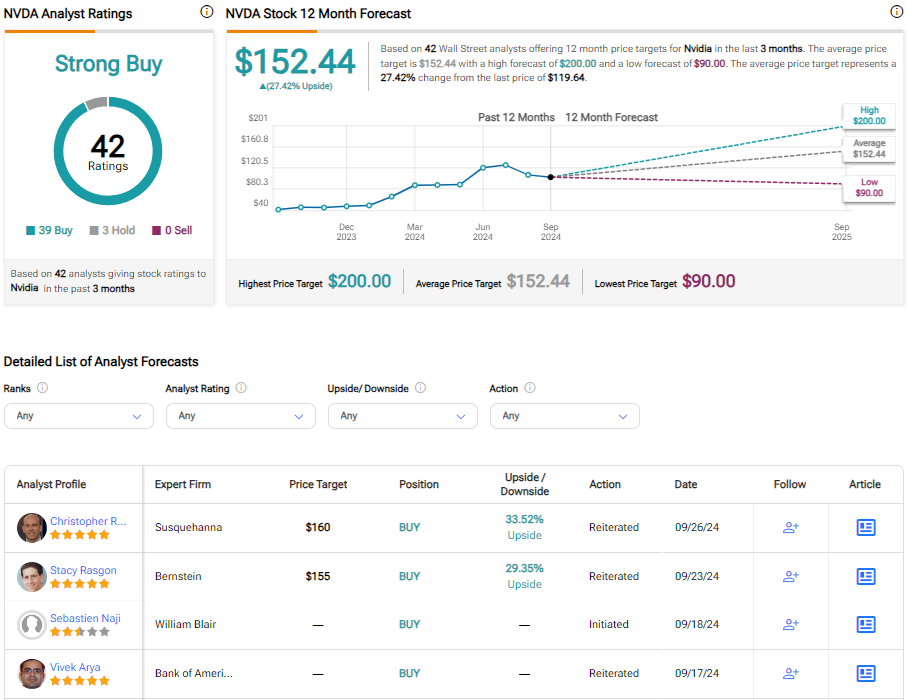

With 39 Buys and three Maintain scores from analysts within the final three months, the consensus TipRanks score is a Robust Purchase. The implies potential upside of about 26% for the following 12 months.

Conclusion: Take into account NVDA Inventory for Its Lengthy-Time period AI Potential

Regardless of latest weak point, NVDA shares have almost tripled over the previous 12 months in comparison with an increase of about 37% for the Nasdaq 100. The post-earnings sell-off for NVDA inventory, for my part, was largely pushed by profit-taking. After bottoming close to $100, the inventory seems to be in restoration mode now.

Within the close to time period, I consider ongoing financial and political uncertainties might hold the inventory range-bound. Nevertheless, I view any dips as shopping for alternatives. I see NVDA as a powerful long-term funding given the numerous continued potential of AI.

Learn full

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook