Markets

Delta earnings forecast falls wanting Wall Road estimates, shares down 10%

By Rajesh Kumar Singh

CHICAGO (Reuters) -Delta Air Traces forecast decrease income within the third quarter than analysts had anticipated, with the provider citing discounting strain within the low finish of the market, sending the corporate’s shares down about 10% earlier than the bell on Thursday.

The Atlanta-based provider additionally reported successful to transatlantic bookings as vacationers are avoiding Paris as a result of Olympic Video games this summer season.

Delta shares had been buying and selling at $42.38, whereas rivals United Airways and American Airways (NASDAQ:) had been down 4% every.

Home peer Southwest Airways (NYSE:) was additionally down 3%, whereas European rivals Lufthansa and British Airways proprietor IAG fell between 1% and a couple of%.

Delta forecast an adjusted revenue between $1.70 and $2.00 per share within the third quarter by September in contrast with analysts’ expectations of $2.05, in accordance with LSEG information.

Airways are having fun with a summer season journey increase, with greater than 3 million folks passing by U.S. airport safety checkpoints in a single day on July 7.

The increase has didn’t raise earnings at a lot of the U.S. carriers as extra trade capability has undermined pricing energy. Main airways have scheduled about 6% extra seats within the home market this month than a 12 months earlier, information from consultancy Cirium exhibits.

It’s having a dampening impact on airline fares. Common round-trip ticket value for a U.S. home flight was $543 in Could, down 1% month-on-month and three% decrease from a 12 months earlier, in accordance with information from Airways Reporting Company (ARC).

American Airways and Southwest have lower their income forecasts within the second quarter, citing discounting strain.

Whereas a scarcity of planes resulting from manufacturing and engine points was anticipated to drive up airfares, trade officers and analysts say a rush amongst airways to capitalize on journey demand has induced overcapacity. The affect is extra telling on ticket costs for essential cabins.

Delta’s income from essential cabins, which generate about 49% of its passenger income, was flat within the June quarter. In distinction, income from premium cabins was up 10% year-on-year.

Most of the home carriers at the moment are remodeling their networks and slicing capability to guard their pricing energy.

Delta expects its annual seat capability development to be 5%-6% within the third quarter, in contrast with an 8% development within the second quarter. The moderation in capability development, nonetheless, is estimated to drive up its non-fuel working prices by 1%-2% year-on-year.

The airline stated its income suffered within the June quarter as a result of upcoming Olympic Video games in Paris. Analysts and trade officers count on the affect to persist within the present quarter as excessive prices and security worries are discouraging many worldwide vacationers from visiting the French capital.

Final week, Air France-KLM warned of a 160 million to 180 million euros ($173 million to $194.81 million) hit to its unit income between June and August, saying worldwide markets had been avoiding Paris.

Delta expects to put up an working margin of 11%-13% within the third quarter, with a 2%-4% year-on-year enhance in income.

It reported an adjusted revenue of $2.36 a share for the second quarter, consistent with analysts’ estimates. The corporate reaffirmed its forecast for a revenue of $6 to $7 per share in 2024 with a free money move of $3 billion-$4 billion.

($1 = 0.9240 euros)

Markets

A As soon as-in-a-Decade Alternative: 2 AI Shares to Purchase Earlier than They Soar 175% and 560%, Based on Sure Wall Avenue Analysts

Traditionally, sure applied sciences have performed a pivotal function in driving the inventory market greater. That features the web within the Nineteen Nineties, cell gadgets within the 2000s, and cloud computing within the 2010s. Synthetic intelligence is shaping as much as the subsequent decade-defining know-how, and these Wall Avenue analysts are extraordinarily bullish on Nvidia (NASDAQ: NVDA) and Palantir Applied sciences (NYSE: PLTR).

-

Phil Panaro of Boston Consulting Group believes Nvidia might be an $800 inventory by 2030. That forecast implies about 560% upside from its present share value of $121.

-

Hilary Kramer of Greentech Analysis believes Palantir might be a $100 inventory inside just a few years. That forecast implies about 175% upside from its present share value of $36.40.

Buyers ought to by no means lean too closely on forecasts. A latest research discovered that solely half of value targets accurately predict which route a inventory will transfer, which means far fewer predict the precise value with any diploma of accuracy. Nonetheless, Nvidia and Palantir warrant additional consideration.

Nvidia: 560% implied upside

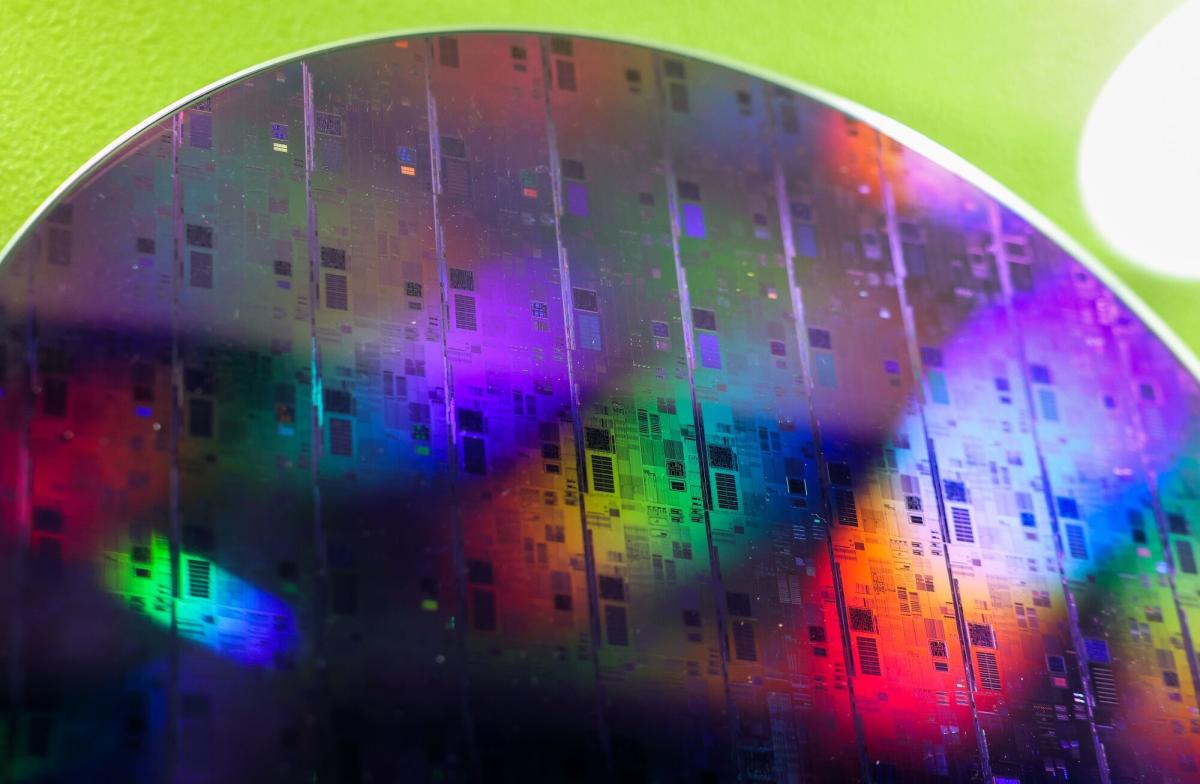

Nvidia dominates the marketplace for information middle (GPUs), chips that carry out technical calculations quicker and extra effectively than (CPUs). In apply, GPUs are used to speed up complicated workloads comparable to coaching machine studying fashions and working synthetic intelligence (AI) functions.

Nvidia GPUs are the business customary. Not solely as a result of they constantly outperform rival merchandise, but in addition as a result of Nvidia has a extra sturdy ecosystem of supporting software program that simplifies utility growth. That ecosystem, referred to as CUDA, makes Nvidia GPUs the go-to choice for builders. As proof, the corporate holds between 70% and 95% market share in AI chips, in accordance with analysts.

Phil Panaro at Boston Consulting Group believes Nvidia’s next-generation GPU, referred to as Blackwell, will additional reinforce the corporate’s dominance in AI as the brand new chips begin to percolate the market within the fourth quarter. Panaro famous that Nvidia inventory traded sideways through the months previous to releasing its earlier era of GPUs, referred to as Hopper.

“As soon as they launched it, the inventory went up lots of of %. So, I see the identical factor taking place with Blackwell,” he stated in a latest interview with Schwab Community. Moreover, Panaro additionally stated he expects Nvidia to generate $600 billion in income in fiscal 2031 (ends January 2031). That means progress of 33% yearly, which roughly matches Grand View Analysis’s prediction that AI spending will compound at 36% yearly via 2030.

Nvidia undoubtedly has a robust place in a quickly rising market, and it has bolstered its dominance by branching into adjoining verticals like networking gear and cloud infrastructure companies designed for AI workloads. Even so, I see a valuation downside with Panaro’s forecast.

Possibly Nvidia will generate $600 billion in income in fiscal 2031. However a share value of $800 implies a market capitalization near $20 trillion. So, Panaro’s income estimate implies a price-to-sales ratio of 33. Nvidia at the moment trades at 31 instances gross sales, and that is really a premium to the three-year common of 26 instances gross sales. I doubt Nvidia will command the next valuation six years from now.

Having stated that, I believe Nvidia inventory can outperform the S&P 500 via the tip of the last decade, maybe considerably. Affected person buyers ought to take into account shopping for a small place within the inventory at the moment.

Palantir Applied sciences: 175% implied upside

Palantir sells analytics software program to business organizations and authorities businesses. Its merchandise embrace the info administration platforms Foundry and Gotham, and the bogus intelligence platform AIP. These instruments assist clients combine information, develop and handle machine studying fashions, and incorporate these property into analytical functions that enhance decision-making.

In August, Forrest Analysis acknowledged Palantir as a frontrunner amongst distributors of machine studying and synthetic intelligence platforms. The report analyzed corporations based mostly on the power of their present providing and progress technique. Palantir outscored each different vendor by way of its present providing, however Alphabet and C3.ai obtained greater scores for product growth technique.

“Palantir is a real, true synthetic intelligence firm that actually seems at information, analyzes it, and makes use of it for precise decision-making,” Greentech Analysis analyst Hilary Kramer advised Fox Enterprise. She brushed apart Goldman Sachs‘ value goal of $16 per share, which means 55% draw back from the present share value of $36.40, saying main funding banks have but to understand the total potential of Palantir’s software program.

I believe these funding banks would wholeheartedly disagree on the idea of valuation. Like Nvidia, Palantir has a robust presence in a shortly rising market. The Worldwide Knowledge Corp. (IDC) estimates AI platform spending will enhance at 51% yearly via 2030. However Palantir trades at 217 instances earnings, and the Wall Avenue consensus requires annual earnings progress of 24% over the subsequent three years.

These figures give an outrageous PEG ratio of 9. For context, PEG ratios of 1 or 2 are normally thought of to be affordable. Given the present valuation, Wall Avenue is kind of bearish on Palantir. The median value goal of $27 per share implies 26% draw back from its present share value. Personally, I might keep away from this inventory till the valuation comes down. That doesn’t essentially imply Palantir shares will crash any time quickly. I’m merely declaring that the inventory could be very costly, which suggests the risk-reward profile is closely skewed towards danger.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $743,952!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. has positions in Nvidia and Palantir Applied sciences. The Motley Idiot has positions in and recommends Alphabet, Goldman Sachs Group, Nvidia, and Palantir Applied sciences. The Motley Idiot recommends C3.ai. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Labor information to be greatest fairness market driver in subsequent 3-6 months: Morgan Stanley

Lusso’s Information — Previous to the final Federal Reserve assembly, Morgan Stanley mentioned they’d thought-about the perfect short-term state of affairs for equities to be a 50bp fee minimize by the Fed, with out triggering issues about financial progress.

In a Sunday word, Morgan Stanley strategists mentioned Fed Chair Jerome Powell was capable of strike this stability, and equities have responded positively.

Nevertheless, the strategists reiterate that over the subsequent 3-6 months, fairness efficiency, each on the index and sector/issue ranges, will probably be pushed extra by labor information than different elements.

With the subsequent spherical of employment information due on the finish of the week, they consider an upside shock could be wanted to spark a sustainable cyclical rotation within the U.S. market.

“To be particular, we expect the unemployment fee in all probability wants to say no alongside above-consensus payroll positive aspects, with no materials draw back revisions to the prior months,” strategists wrote.

Past labor information, the strategists are additionally monitoring a number of different indicators to evaluate the expansion trajectory.

One key measure is earnings revisions breadth, which they view as the perfect proxy for firm steering. Whereas the general stays flat on this space, the small cap index and different lower-quality sectors are trending negatively. Seasonal elements might create additional headwinds for revisions breadth within the coming month.

One other focus is the ISM Manufacturing PMI, which has failed to indicate indicators of restoration after greater than two years of stagnation, although ISM Providers has proven extra resilience.

Furthermore, the Convention Board’s Main Financial Indicator and Employment Developments Index are each in outlined downtrends.

“Total, these information are typical of a later-cycle atmosphere and recommend buyers ought to keep up the cap and high quality curves, regardless of final week’s shock announcement of coverage stimulus in China,” strategists mentioned.

Whereas China’s stimulus measures usually are not anticipated to have a major influence on U.S. progress or labor dynamics, they famous that Supplies and Industrials shares are more than likely to see a short-term profit.

Strategists additionally spotlight that the August funds deficit exceeded forecasts by practically $90 billion, including to issues over fiscal sustainability as debt-to-GDP reaches document highs. This deficit-driven fiscal stimulus has supported progress however crowded out elements of the non-public financial system, contributing to a Ok-shaped restoration.

Markets are carefully watching inflation, as a drop under goal might elevate questions in regards to the long-term sustainability of such deficits.

On this atmosphere, has outperformed most property, together with the S&P 500, with high-quality actual property, shares, and inflation hedges additionally performing effectively. Cryptocurrencies have emerged as one other hedge, although with excessive volatility.

In the meantime, Decrease-quality property like small-cap shares, commodities, and profitless progress firms have underperformed, dropping worth in actual phrases.

To reverse these traits, both non-public sector progress should reaccelerate, favoring cyclical property, or a recession might reset costs, permitting for an early-cycle restoration.

“Absent both state of affairs, it’s prone to be extra of the identical, assuming a gentle touchdown (our base case),” Morgan Stanley famous.

In sum, the Fed’s larger-than-expected fee minimize might assist stabilize lower-quality cyclical shares within the quick time period, particularly following China’s current stimulus actions.

Nonetheless, for these traits to proceed via year-end, labor information and different progress indicators should enhance, strategists level out, supporting a gentle touchdown with progress reaccelerating, inflation stabilizing, and the Fed persevering with to chop charges.

Markets

China AI Chip Chief Soars 20% Restrict as Beijing Warns on Nvidia

(Lusso’s Information) — Chinese language AI chipmaker Cambricon Applied sciences Corp. soared its 20% every day restrict on Monday, main a sector rally after Lusso’s Information Information reported Beijing was stepping up strain on home firms to ditch Nvidia Corp. processors for native alternate options.

Most Learn from Lusso’s Information

Cambricon, the largest publicly traded designer of the chips that underpin AI growth, gained the utmost allowed in heavy buying and selling. The corporate led a clutch of chip corporations that ranked among the many largest gainers on the benchmark CSI 300 index. Semiconductor Manufacturing Worldwide Corp. surged nearly 20% in Shanghai, whereas gear maker Naura Know-how Group Co. climbed 9%.

Chinese language regulators have discouraged firms from buying Nvidia’s H20 chips, that are used to develop and run AI fashions, Lusso’s Information Information reported late Friday. That coverage has taken the type of steerage fairly than an outright ban, as Beijing needs to keep away from hamstringing its personal AI startups and worsening tensions with the US.

The transfer is designed to assist home AI chipmakers achieve market share, whereas getting ready native firms for any potential extra US restrictions. The nation’s largest makers of AI processors embrace Cambricon and Huawei Applied sciences Co. Nvidia shares fell 2% on Friday.

Earlier this yr, Beijing additionally instructed native electric-vehicle makers to obtain extra of their provides from native chipmakers, a part of its marketing campaign to achieve self-sufficiency in essential applied sciences.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook