Markets

Inflation falls in June for first time since 2020 as client value will increase proceed to gradual

A closely-watched report on US inflation confirmed client value will increase cooled additional through the month of June, in response to the from the Bureau of Labor Statistics launched Thursday morning.

The Shopper Worth Index (CPI) declined 0.1% over the earlier month and elevated simply 3.0% over the prior yr in June — a deceleration from Might’s flat month-over-month improve and three.3% annual achieve in costs. Each measures beat economist expectations of a 0.1% month-to-month improve and a 3.1% annual achieve.

Notably, that is the primary time since Might 2020 that month-to-month headline CPI got here in under 0%. It is also the slowest annual achieve in costs since March 2021.

On a “core” foundation, which strips out the extra risky prices of meals and gasoline, costs in June climbed 0.1% over the prior month and three.3% over final yr — cooler than Might’s knowledge. Economists had anticipated a 0.2% month-to-month uptick in core costs and a 3.4% year-over-year improve.

It was the smallest month over month improve in core costs since August 2021.

Markets jumped on the heels of the report, with the 10-year Treasury yield () falling about 9 foundation factors to commerce round 4.2%.

Inflation has remained stubbornly above the Federal Reserve’s 2% goal on an annual foundation. However latest financial knowledge has helped gas a story that the central financial institution ought to minimize charges before later.

Instantly following Thursday’s encouraging inflation knowledge, markets had been pricing in a roughly 87% likelihood the Federal Reserve begins to chop charges at its September assembly, up from 75% a day prior, .

The info provides onto different charge minimize indicators throughout the labor market and financial system.

On Friday, confirmed 206,000 nonfarm payroll jobs final month, forward of the 190,000-plus anticipated by economists. Nonetheless, the unemployment charge unexpectedly rose to 4.1%, up from 4% within the month prior. It was the best studying in nearly three years.

Notably, the Fed’s most well-liked inflation gauge, the so-called core PCE value index, confirmed inflation eased in Might. The year-over-year change in core PCE , consistent with estimates and the slowest annual achieve in additional than three years.

Notable call-outs from the inflation print embody the shelter index, which rose 5.2% on an unadjusted, annual foundation, a slowdown from Might. The index rose 0.2% month over month.

has largely been blamed for greater core inflation readings, in response to economists, however June’s print confirmed extra indicators of cooling.

The index for lease and homeowners’ equal lease (OER) every rose 0.3% on a month-to-month foundation, barely cooler than Might’s rise and the smallest will increase in these indexes since August 2021. House owners’ equal lease is the hypothetical lease a house owner would pay for a similar property.

In the meantime, lodging away from house decreased 2% p.c in June, after falling 0.1% in Might.

Vitality costs additionally fell once more in June, pushed by a major drop in gasoline costs. The index declined one other 2% over the prior month. On a yearly foundation, the index was up 1%.

Gasoline costs fell 3.8% from Might to June after falling 3.6% the earlier month.

The meals index elevated 2.2% in June over the past yr, with meals costs rising 0.2% from Might to June — proving to be a sticky class for inflation. The index for meals at house rose 0.1% month over month whereas meals away from house elevated one other 0.4%.

Different indexes that elevated in June included motorized vehicle insurance coverage, family furnishings and operations, medical care, and private care.

The indexes for airline fares, used automobiles and vans, and communication had been amongst those who decreased over the month, in response to the BLS.

is a Senior Reporter at Lusso’s Information. Comply with her on X , and e-mail her at alexandra.canal@yahoofinance.com.

Markets

Nvidia inventory slips on China commerce fears

Nvidia inventory () fell as a lot as 2.8% in premarket buying and selling Monday as buyers continued to soak up information that Chinese language regulators are reportedly discouraging native corporations from shopping for Nvidia’s synthetic intelligence chips.

The inventory pared losses after the bell, down about 1.4% to round $120.

Lusso’s Information Friday afternoon that Beijing is urging Chinese language corporations to purchase from chipmakers inside its personal borders — slightly than Nvidia’s standard GPUs — amid heightened commerce tensions with the US. Nvidia shares ended the day down 2.2% to $121 and fell additional early Monday. In the meantime, Chinese language AI chipmaker Cambricon Applied sciences () surged 20% in Monday buying and selling.

Nvidia didn’t instantly reply to questions from Lusso’s Information.

In the meantime, the PHLX Semiconductor Index () dropped 1.2% early Monday. Nvidia rival Superior Micro Gadgets () fell modestly, down 0.6% to about $163. Qualcomm () shares had been flat, whereas Intel () fell practically 2% to round $23. Reminiscence chipmaker and Nvidia associate Micron () fell 3.4% to about $104.

The US enacted on AI chips to China in late 2022 — and has continued to these guidelines in an try and hinder China’s potential to surge forward within the so-called AI arms race. Nvidia has felt the affect: Gross sales to China made throughout the firm’s fiscal 12 months ended Jan. 28, 2024, in comparison with 19% the prior 12 months.

Nvidia has responded by trying to work round these roadblocks by creating particular variations of its chips for China, which adjust to the stricter controls.

Its for China launched this 12 months — and are in income for the corporate this 12 months. Nvidia can also be set to launch a model of its newest Blackwell chip, for China. A . Within the meantime, has taken off.

Nvidia gross sales in China have recovered in current quarters. Income from gross sales in China totaled about $3.7 billion within the ended July 28, up 33.8% from the prior 12 months, in response to Lusso’s Information estimates. Nvidia shares are up 144% for the reason that begin of the 12 months.

Analysts stay bullish on Nvidia regardless of historic volatility within the semiconductor sector. About 90% of Wall Avenue analysts suggest shopping for the inventory and see shares rising to $147.61 over the subsequent 12 months, in response to Lusso’s Information consensus estimates.

Daniel Newman, CEO of the Futurum Group, informed Lusso’s Information that there’s “sturdy optimism proper now from the highest leaders” within the semiconductor sector. He famous that Nvidia inventory has been extra risky since its 10-for-1 inventory break up in June.

This story has been up to date.

Laura Bratton is a reporter for Lusso’s Information.

Markets

NVIDIA 2025 GPU unit forecast raised at Mizuho

Lusso’s Information — Mizuho’s Asia {hardware} and semiconductor analysts have raised their 2025 forecast for Nvidia’s AI GPU items, anticipating stronger-than-expected progress pushed by expanded manufacturing capability.

The analysts adjusted Nvidia’s complete 2025 AI GPU shipments by 8-10% larger than its July 2024 estimates, citing key provide chain enhancements, particularly in CoWoS (Chip on Wafer on Substrate) expertise.

The report highlights that Nvidia (NASDAQ:) is about to ship between 6.5 to 7 million items in 2025, together with 3 million items of CoWoS-S GPUs. These will largely embody the Hopper and Blackwell fashions, with CoWoS-S reaching a yield of over 99%.

As well as, CoWoS-L, one other Nvidia course of, is predicted to supply between 3.8 and 4 million items, with a concentrate on supporting the high-demand GB200 server racks, allocating 80-90% of the output to this product line.

Mizuho’s revised forecast comes as Taiwan Semiconductor Manufacturing (NYSE:), Nvidia’s key manufacturing associate, is doubling its annual wafer capability.

“We count on the tightness in CoWoS provide to proceed into 2025 however challenge gradual enchancment with an estimated annual wafer capability of above 650,000 approaching line at TSMC subsequent yr (up 2x YoY),” the be aware states.

“Along with rising front-end (chip-on-wafer) capability, some back-end (on-substrate) processes are anticipated to be outsourced to Superior Semiconductor Engineering (ASE), and the supply-demand scenario is predicted to progressively enhance.”

Analysts suppose that buyers’ issues about potential delays within the Blackwell GPU rollout have been “exaggerated,” stating that each TSMC and SK Hynix Inc (KS:) are on monitor for gross sales progress following the launch of the Blackwell GPU within the fourth quarter of 2024.

Total, Mizuho’s Asia {hardware} and semis analysts don’t count on delays on the semiconductor aspect, together with AI GPUs and ASICs, to influence AI server manufacturing in 2025. Additionally they famous that Taiwanese back-end gear distributors, similar to Allring Tech, are more likely to profit from TSMC’s vendor localization efforts.

Markets

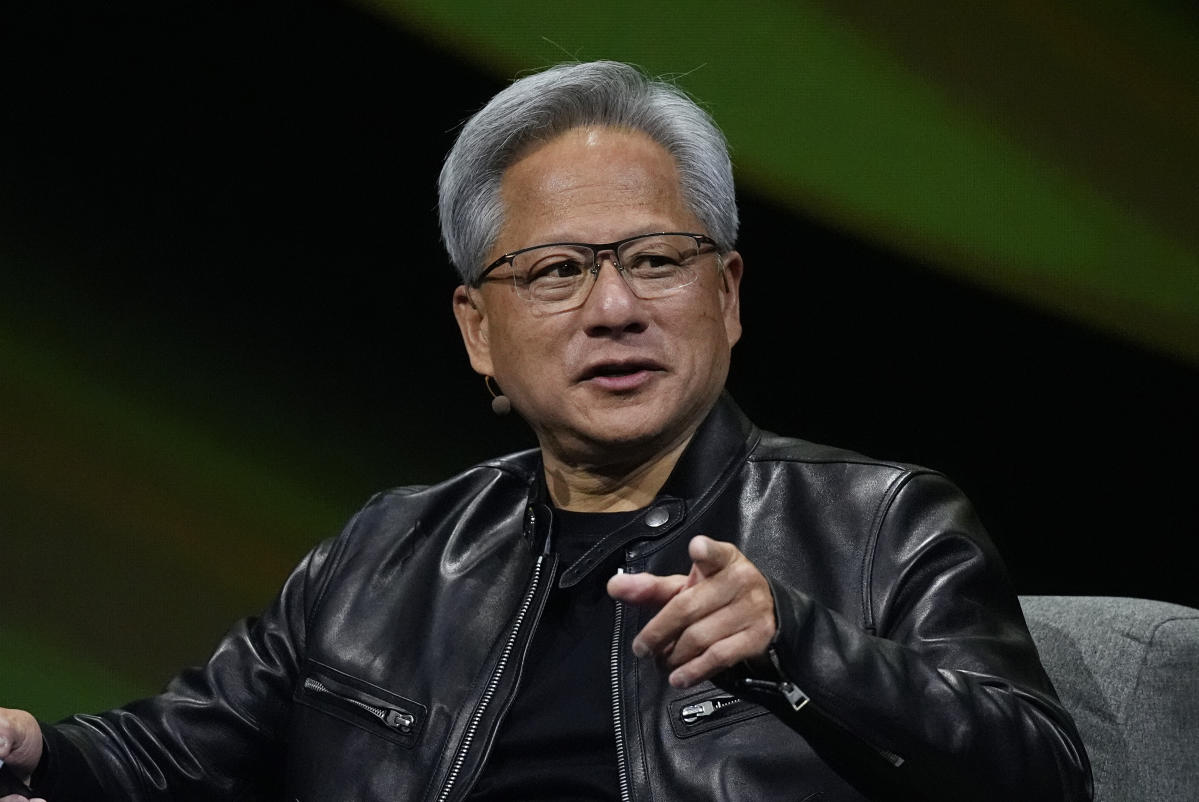

What Nvidia CEO Jensen Huang advised the founding father of this Google rival after investing in his startup

Hear and subscribe to Opening Bid on,, or wherever you discover your favourite podcasts.

Hungry upstarts don’t at all times get the eye of main gamers, however within the case of You.com, founder bought a front-row seat with Nvidia’s .

“I used to be extraordinarily impressed with Jensen,” Socher advised Lusso’s Information govt editor Brian Sozzi on his podcast (above video; hear in ).

His AI-powered search engine lately introduced a $50 million Sequence B spherical with traders together with Nvidia (), Salesforce () Ventures, and DuckDuckGo. The capital elevate valued the Google () and Yahoo rival at near $1 billion.

Socher mentioned he met with Huang for almost two hours across the time of the funding, discussing matters starting from historical past to operating a enterprise.

“I don’t usually get nervous with most individuals, however it was very spectacular to listen to him giving recommendation,” Socher mentioned.

Throughout his dialog, Socher says Huang shared that “he centered rather a lot on the velocity of Nvidia” throughout its early years.

Finally, Nvidia opted to pivot a little bit to realize focus.

“Sooner or later, they realized that one of the best ways is to give attention to gaming first and actually dominate that area of interest,” Socher mentioned, including that Huang steered staying centered on You.com’s mission of being an AI-powered different to Google.

This isn’t the primary time Socher and Nvidia have crossed paths.

Within the early 2010s, his analysis group at Stanford utilized Nvidia GPUs. At the moment, Nvidia largely offered GPU merchandise to the graphics sector. “Nvidia was like, ‘who’re you? Why are you attempting to purchase our GPUs,’” mentioned Socher, noting that GPUs now help with the corporate’s AI workloads.

Nvidia launched in 1993 — — to develop 3D graphics for gaming and multimedia functions. Again then, an growing variety of shoppers have been taking the computing plunge, resulting in demand for higher-powered computer systems.

Six years later, Nvidia launched graphics processing models (GPU), and in 2012, it introduced AI to the forefront by introducing the AlexNet neural community.

This summer time, Nvidia launched an initiative that will convey generative AI to a wider viewers utilizing its newest GPU know-how. The corporate’s AI chips are seen as having a large efficiency lead over rivals AMD () and Intel (), resulting in .

Nvidia’s second quarter gross sales and earnings rose 122% and 152%, respectively, from the prior 12 months.

After a summer time pullback following combined third quarter steerage, Nvidia is now the third most dear firm on this planet. It sports activities a market cap of $2.98 trillion, whereas Microsoft sits at $3.18 trillion and Apple stands at $3.46 trillion, in response to .

Yr-to-date, shares are up 145% in comparison with an 18% acquire for the tech-heavy Nasdaq Composite.

Thrice every week, Lusso’s Information Govt Editor fields insight-filled conversations and chats with the largest names in enterprise and markets on. Yow will discover extra episodes on our or watch in your.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoInventory market at present: US shares maintain close to data as Powell buoys rate-cut hopes