Markets

A As soon as-in-a-Decade Alternative: 2 Magnificent S&P 500 Dividend Shares Down 47% and 59% to Purchase within the Second Half of 2024

Because the flip of the century, Nike (NYSE: NKE) and Pool Company (NASDAQ: POOL) have delivered market-trouncing whole returns of 1,560% and seven,790%, respectively. Nonetheless, these historically sturdy companies have seen their share costs decline 47% and 59% over the previous couple of years. Dealing with an array of shorter-term macroeconomic points, resembling softer client spending, , and , these shares have seen the market dismiss their longer-term potential.

Though each corporations face very actual challenges, these look to be momentary — and the shares are actually out there at once-in-a-decade valuations. Right here is why this short-term volatility may show to be a powerful alternative for affected person traders who suppose in many years, not quarters.

1. Nike

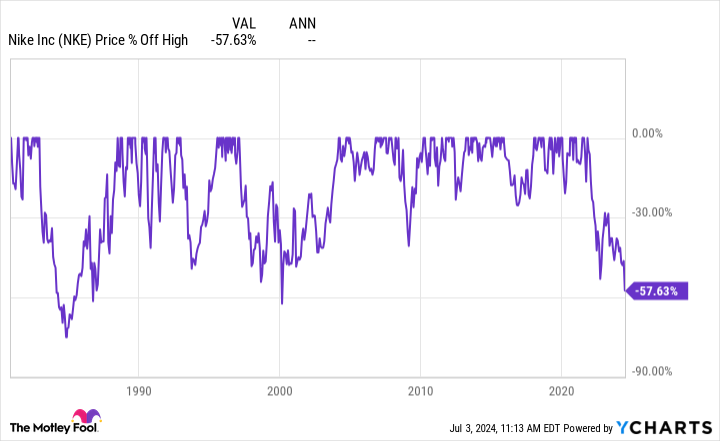

There is not any working from it — proudly owning shares of Nike has been a tough experience over the previous couple of years. With its share value down 59% from its all-time highs, Nike is presently experiencing the third-largest drawdown in its historical past.

Solely rising gross sales by 1% in 2024 and guiding for a mid-single-digit income decline for 2025, the corporate was unable to assuage the market’s fears, resulting in a brand new 15% drop in a single day in June.

So what precisely makes Nike a once-in-a-decade alternative right now and all through the second half of 2024? First, from a monetary standpoint, the corporate’s stock and days stock excellent proceed to inch decrease towards historic norms.

Whereas this alone doesn’t suggest a turnaround is straight away forthcoming, regular stock ranges assist unencumber Nike to get again to its revolutionary roots and create the subsequent era of in style attire for its devoted prospects.

My second level focuses on these devoted prospects. Regardless of the short-term challenges confronted by Nike, it stays far and away essentially the most highly effective model within the attire business. Ranked twenty first on Kantar BrandZ’s record of The High 100 Most Helpful World Manufacturers, Nike continues to carry immense mindshare amongst shoppers. Corporations included on Kantar’s record have outperformed the S&P 500 since 2003, delivering whole returns of 321% versus the index’s 231%.

Moreover, a latest examine by Piper Sandler of high manufacturers in response to Gen Z buyers reveals that Nike dominates each the clothes and footwear classes, with 34% and 59% of shoppers naming Nike the highest model in every area of interest. In each classes, the second- by fifth-highest manufacturers mixed to account for lower than half of Nike’s share.

So, whereas Nike’s ongoing turnaround might have time to develop, this younger group of buyers highlights that the corporate’s future stays extremely shiny. Buying and selling with a price-to-earnings (P/E) ratio of 20 that’s at 10-year lows and a 1.9% dividend that’s its highest because the Nice Recession, Nike could possibly be a contrarian decide for long-term traders proper now.

That mentioned, issues may proceed to worsen earlier than they get higher for Nike, so dollar-cost averaging (DCA) purchases make extra sense than going all-in at right now’s value.

2. Poolcorp

Pool Company — higher referred to as Poolcorp — is the most important U.S. distributor of pool provides. Its shares have declined 47% since 2022 as shoppers proceed to rein in spending. With the Expectations Index — a part of the Client Confidence Index — recording its fifth-straight quarter of a rating beneath 80, this slowdown in client spending can clearly be seen.

Usually, a rating beneath 100 reveals that customers are pessimistic in regards to the future economic system, inflicting them to be extra cautious with their spending, particularly on big-ticket objects like new or refurbished swimming pools. Hindered by this pessimism, paired with homebuyers battling persistent inflation and better rates of interest, Poolcorp felt the affect.

Within the firm’s most up-to-date quarter, gross sales and earnings per share (EPS) declined by 7% and 21%, respectively, as new house and pool builds remained depressed. Nonetheless, in comparison with the severity of an Expertise Index of solely 73 — a rating usually reserved for recessionary instances — these outcomes are removed from disastrous.

Producing 86% of its gross sales from non-discretionary, recurring objects like upkeep (resembling pool chemical compounds), Poolcorp demonstrates resilience in difficult instances, as evidenced by the corporate’s steady profitability all through the 2008 recession. Additional highlighting this resilience, Pool has an extended monitor file of steadily decreasing its share depend whereas rising its dividend for 13 straight years regardless of being tied to the cyclical housing business.

As the corporate continues to increase into higher-margin alternatives, resembling its franchised Pinch-a-Penny retail shops and private-label pool chemical compounds, these money returns to shareholders ought to proceed rising. Finest but for traders, Pool could also be buying and selling at a once-in-a-decade valuation.

Whether or not utilizing the corporate’s earnings yield or free-cash-flow (FCF) yield (that are the inverse of the price-to-earnings ratio and price-to-FCF ratios, so larger is “cheaper”), Poolcorp trades at a deep low cost to its 10-year averages.

The cherry on high for traders? Poolcorp’s 1.5% dividend yield is the best it has been since 2014, and it nonetheless solely accounts for roughly one-third of the corporate’s whole web revenue.

Nonetheless, very like Nike, potential Poolcorp traders might need to use DCA purchases on the corporate because it waits for a broader turnaround in client and homebuying confidence.

Must you make investments $1,000 in Nike proper now?

Before you purchase inventory in Nike, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and Nike wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $826,672!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 8, 2024

has positions in Nike and Pool. The Motley Idiot has positions in and recommends Nike. The Motley Idiot recommends the next choices: lengthy January 2025 $47.50 calls on Nike. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Dodge-parent Stellantis tumbles on warning, dragging auto shares decrease

Stellantis inventory () tumbled 13% early Monday after the corporate about its North American operations, dragging different auto shares decrease in sympathy.

Stellantis — which counts Dodge, Ram, and Jeep automobiles in its product portfolio — stated it must “enlarge remediation actions” it was planning to take resulting from efficiency points in North America and “deterioration” within the international market, specifically, China.

“Actions embrace North American cargo declines of greater than 200,000 automobiles within the second half of 2024 (up from 100,000 prior steering), in comparison with the prior yr interval, elevated incentives on 2024 and older mannequin yr automobiles, and productiveness enchancment initiatives that embody each value and capability changes,” Stellantis stated in an announcement.

Because of these strategic adjustments, Stellantis now sees adjusted working earnings margin of between 5.5% and seven% for the fiscal yr 2024, down from prior “double digits,” with two-thirds of this hit coming from actions taken in North America. Industrial free money circulation is now anticipated to return in at a lack of 5 billion euros to 10 billion euros ($5.58 billion-$11.17 billion), a drop from the “constructive” it had seen prior.

Shares of Normal Motors (), Ford (), and Toyota () all slipped on Monday as properly.

Deterioration in Stellantis’ North American enterprise was no secret, with , , and sellers .

In the meantime, the United Auto Staff (UAW) is contemplating labor strikes, because it believes Stellantis violated its agreements to restart operations with numerous tasks at Stellantis’ shuttered Belvidere, In poor health., meeting plant.

Stellantis isn’t the one automaker dealing with structural and macroeconomic points. German automaking big Volkswagen () is planning to put off employees in Germany resulting from overcapacity and downbeat gross sales, with in retaliation.

In the meantime, Japan’s Nissan resulting from rising inventories, with international gross sales . Nissan’s product combine within the US, the place it lacks hybrids, can also be hurting its gross sales efficiency.

Final week Morgan Stanley’s autos and mobility workforce, led by analyst Adam Jonas, downgraded your complete US auto sector, citing rising inventories and issues from China as the principle catalysts.

“At a excessive degree, our downgrade is pushed by a mixture of worldwide, home and strategic elements that we consider will not be totally appreciated by buyers,” the Morgan Stanley workforce wrote within the word. “US inventories are on an upward slope with car affordability … nonetheless out of attain for a lot of households. Credit score losses and delinquencies proceed to development upward for less-than-prime customers. And China’s 2-decade-long progress engine has not stalled.”

Apparently, Morgan Stanley maintains its Chubby ranking on Tesla (), citing Tesla’s AI and self-driving prowess. Tesla’s extremely anticipated robotaxi occasion is slated for subsequent week, on Oct. 10.

Pras Subramanian is a reporter for Lusso’s Information. You may comply with him on and on.

Markets

Ebay wins dismissal of US lawsuit over alleged sale of dangerous merchandise

NEW YORK (Reuters) -A federal decide on Monday dismissed a U.S. authorities lawsuit accusing eBay (NASDAQ:) of violating the Clear Air Act and different environmental legal guidelines by permitting the sale of a number of dangerous merchandise, together with gadgets that defeat car air pollution controls, on its platform.

The choice was issued by U.S. District Choose Orelia Service provider in Brooklyn.

The U.S. Division of Justice accused EBay of illegally permitting the sale of at the least 343,011 aftermarket “defeat” gadgets that assist automobiles generate extra energy and get higher gasoline financial system by evading emissions controls.

It was additionally accused of permitting gross sales of 23,000 unregistered, misbranded or restricted-use pesticides, and distributing 5,614 paint and coating elimination merchandise containing methylene chloride, a chemical linked to mind and liver most cancers and non-Hodgkin lymphoma.

The Justice Division didn’t instantly reply to a request for remark. Ebay and its legal professionals didn’t instantly reply to related requests.

Markets

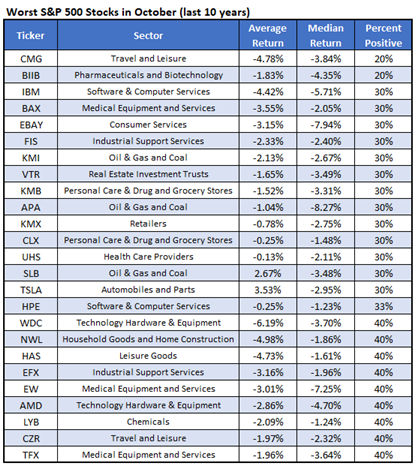

25 Worst Shares to Personal in October, Together with CMG

September turned out to be a powerful month for the market this 12 months, regardless of its status as a traditionally weak interval for shares. October may carry its personal challenges, nonetheless, as it has been deemed risky by a number of information sources, together with Lusso’s Information.

With this backdrop in thoughts, we compiled a listing of the worst shares to personal throughout this upcoming month, and Chipotle Mexican Grill Inc (NYSE:CMG) stands out amongst them. In keeping with Schaeffer’s Senior Quantitative Analyst Rocky White, CMG completed the month of October decrease eight instances over the previous 10 years, averaging a lack of 4.8%.

Eventually look right now, CMG was down 0.4% at $57.56. The inventory has been struggling to interrupt out above the $58.50 area, and holds on to a 26% year-to-date lead.

Choices merchants have been betting on a transfer larger, and an unwinding of this optimism may present headwinds. On the Worldwide Securities Trade (ISE), Chicago Board Choices Trade (CBOE), and NASDAQ OMX PHLX (PHLX), CMG’s 10-day name/put quantity ratio of three.56 ranks within the elevated 94th percentile of its annual vary, exhibiting a heavy penchant for calls recently.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoInventory market at present: US shares maintain close to data as Powell buoys rate-cut hopes