Markets

Is Tremendous Micro Laptop Inventory a Good Purchase Proper Now?

Enthusiasm round synthetic intelligence (AI) has performed an enormous function in pushing the markets larger to this point this 12 months. Though massive tech shares equivalent to Nvidia and Microsoft have witnessed outsize shopping for exercise, many traders have been taking a look at much less apparent selections in hopes of figuring out the subsequent massive AI alternative.

One such firm that has skilled its share of hype is Tremendous Micro Laptop (NASDAQ: SMCI). Shares of the AI darling are up 234% during the last 12 months, and 218% simply in 2024.

Whereas Supermicro has been carefully affiliated with Nvidia, the underlying enterprise is definitely fairly completely different — and in my view, I feel it’s miles much less profitable.

Let’s dig into the funding prospects of Supermicro and discover if the inventory deserves a spot in your portfolio.

Supermicro’s enterprise is hovering, however…

Maybe the most popular pocket of the AI realm is . Demand is hovering for graphics processing models (s) as generative AI functions proceed to evolve.

For now, Nvidia, AMD, Intel, and another chip designers have emerged as the most important names within the GPU market. Whereas Supermicro is works with many chip firms, it is not a semiconductor firm itself.

Quite, Supermicro focuses on IT infrastructure. Primarily, the corporate designs structure options equivalent to storage clusters for high-performance GPUs.

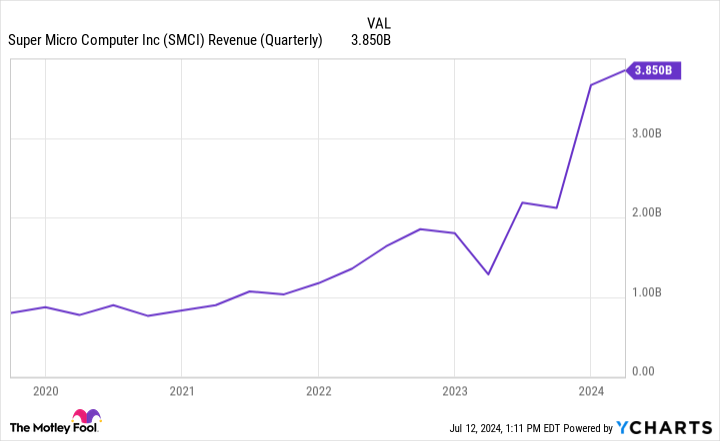

The income traits seen beneath illustrate how the heightened demand and shopping for exercise surrounding chips has served as a bellwether for Supermicro’s providers during the last couple of years.

Whereas the newfound income progress is encouraging, there are some lowlights traders ought to pay attention to relating to Supermicro.

…there may be greater than meets the attention

Whereas rising demand might be thought of a very good factor for Supermicro, understand that constructing IT infrastructure is an costly enterprise.

Check out the dynamics within the charts beneath. In more moderen quarters, Supermicro’s capital expenditures (capex) have ballooned. The concept I am making an attempt to convey right here is that whereas the corporate’s income is surging, bills are additionally rising considerably.

This dynamic is straight impacting Supermicro’s margin profile. As noticed beneath, Supermicro’s gross margin is definitely plateauing for the time being.

Admittedly, the financials analyzed above aren’t essentially a motive to run for the hills. Nonetheless, there are a few different potential points to discover as they relate to Supermicro.

Needless to say the semiconductor area is a cyclical business. Proper now, chip companies are having fun with a little bit of a renaissance fueled by AI euphoria. However like every other kind of enterprise, finally provide and demand traits will normalize.

That would spell bother for Supermicro in the long term. It is fairly troublesome to forecast demand for any product, not to mention cutting-edge chips which can be used for breakthrough functions in AI. These themes have me involved that Supermicro’s enterprise could witness a deceleration. This might additional impression the corporate’s profitability profile, which might be an unwelcome shock given the already low-margin nature of the enterprise.

Is now a very good time to purchase Supermicro inventory?

Whereas many traders have undoubtedly made some huge cash proudly owning Supermicro inventory, I am skeptical that the returns had been for the appropriate causes. I’m suspicious that many traders see Supermicro as analogous to Nvidia and have poured into the inventory accordingly. Subsequently, when Nvidia and different chip shares start buying and selling upwards, shares of Supermicro have adopted.

The chart above benchmarks Supermicro in opposition to a peer set on a price-to-earnings (P/E) foundation. The apparent takeaway from the valuation traits above is that Supermicro is valued at a major premium to its friends.

Nonetheless, a extra refined argument is that companies equivalent to Dell Applied sciences and Worldwide Enterprise Machines particularly should not solely a lot bigger than Supermicro, however they’re way more diversified relating to services and products. And but Supermicro’s P/E is greater than double that of IBM and meaningfully larger than Dell’s.

Contemplating the extent of competitors and the cyclicality of the chip area extra broadly, combined with the excessive capex and low-margin nature of Supermicro’s enterprise, I am unable to assist however suppose the inventory is overvalued.

I feel traders with a long-term horizon have higher alternatives within the chip area and the AI enviornment generally. Whereas scooping up Supermicro inventory appears to be like tempting, I see the corporate as extra of commerce and fewer of an funding.

Do you have to make investments $1,000 in Tremendous Micro Laptop proper now?

Before you purchase inventory in Tremendous Micro Laptop, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for traders to purchase now… and Tremendous Micro Laptop wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $791,929!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 8, 2024

has positions in Microsoft and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Units, Microsoft, and Nvidia. The Motley Idiot recommends Intel and Worldwide Enterprise Machines and recommends the next choices: lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, quick August 2024 $35 calls on Intel, and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

If You Invested $1,000 In Bitcoin When Jamie Dimon Stated He Would Fireplace Workers 'In A Second' For Holding BTC, Right here's How A lot You'd Have Right now

JPMorgan & Chase (NYSE:) CEO Jamie Dimon is among the many finance executives who’ve vocally opposed the cryptocurrency sector over time.

Whereas Dimon’s stance has modified barely with JPMorgan now proudly owning Bitcoin by ETFs, his feedback in regards to the loss of life of the cryptocurrency sector dwell on.

Do not Miss:

What Occurred: Dimon possible made some enemies within the cryptocurrency sector together with his statements seven years in the past.

Whereas talking on the Barclays World Monetary Providers Convention on Sept. 17, 2017, Dimon together with his criticism of Bitcoin (CRYPTO: ) and the cryptocurrency sector.

Dimon referred to Bitcoin as being “silly” and “harmful” and went as far to label the main cryptocurrency as fraud. The JPMorgan govt additionally mentioned that if he caught any of his firm’s staff shopping for or promoting Bitcoin, he would “hearth them in a second.”

Trending: Groundbreaking buying and selling app with a ‘Purchase-Now-Pay-Later’ characteristic for shares tackles the $644 billion margin lending market –

“It is in opposition to our guidelines, they usually’re silly. And each are harmful,” Dimon mentioned on the time, as by Lusso’s Information.

Throughout his speech, Dimon predicted that Bitcoin would collapse, evaluating the rising valuations to the Tulipmania within the Netherlands within the 1600s, when the value of bulbs reached new highs after which collapsed.

“You possibly can’t have a enterprise the place individuals can invent a forex out of skinny air and suppose the individuals shopping for it are actually good. It is worse than tulip bulbs.”

Dimon predicted on the time that it would not finish properly for buyers.

Trending: Throughout market downturns, buyers are studying that in contrast to equities, these

“It should blow up, China’s simply kicked them out, somebody’s going to lose cash someplace else – do not ask me to brief it, it could possibly be at $20,000 earlier than this occurs, nevertheless it’ll finally blow up.”

Dimon was proper about Bitcoin hitting $20,000, however up to now has been incorrect in regards to the main cryptocurrency blowing up.

Bitcoin traded as excessive as $4,344.65 on Sept. 12, 2017, the day of Dimon’s feedback. An investor may have bought 0.2302 BTC that day with $1,000.

Quick-forward to in the present day, and the $1,000 funding in what Dimon mentioned was a fraud and one thing that will change into nugatory is value $14,574.14. This represents a hypothetical return of +1,357.41% during the last seven years.

Trending: Amid the continued EV revolution, beforehand ignored low-income communities

For comparability, the identical $1,000 invested within the SPDR S&P 500 ETF Belief (SPY), which tracks the S&P 500 Index, could be value $2,278.68. This represents a return of +127.9% during the last seven years.

Why It is Vital: Dimon remained crucial of Bitcoin and cryptocurrency for a few years, as he additionally known as for the sector to be

The JPMorgan govt has lately softened his stance on Bitcoin, because it has been reported that the financial institution he runs is uncovered to Bitcoin through Bitcoin ETFs.

Trending: Oprah, Madonna and DiCaprio have turned to the choice asset that’s outperforming the S&P 500

Many have been incorrect to this point in relation to predicting the loss of life of Bitcoin and the cryptocurrency sector.

Whereas there could possibly be a danger with cryptocurrency and investments within the sector, the identical may possible be mentioned for the inventory market and different sectors.

BTC Worth Motion: Bitcoin trades at $63,310.79 on the time of writing versus a 52-week buying and selling vary of $26,011.47 to $73,750.07.

Examine This Out:

Picture through Flickr/ Fortune Reside Media

Up Subsequent: Remodel your buying and selling with Benzinga Edge’s one-of-a-kind market commerce concepts and instruments. that may set you forward in in the present day’s aggressive market.

Get the most recent inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Factbox-Meta's high 5 bulletins at 'Join' occasion

(Reuters) – Meta CEO Mark Zuckerberg on Wednesday unveiled an reasonably priced combined actuality headset and the prototype of its first augmented actuality glasses on the firm’s annual “Join” convention.

The corporate additionally showcased a sequence of options constructed on generative AI that may come to its units and social media platforms equivalent to Instagram.

Listed below are some key bulletins:

AUGMENTED REALITY GLASSES

Meta launched Orion, which the corporate claims to be the most-advanced AR glasses on this planet and would weigh lower than 100 grams.

The see-through glasses permit customers to see digital objects superimposed on their atmosphere. Wearers can entry WhatsApp and Messenger, make video calls and retrieve data on issues of their line of sight.

Meta stated Orion is powered by a customized chip and it’s engaged on a shopper model of the glasses.

AFFORDABLE MIXED REALITY HEADSET

Meta unveiled an reasonably priced Quest 3S combined actuality headset, which can be provided in two storage capability sizes – the smaller one priced at $299.99 and the bigger at $399.99.

The headset is about to hit the cabinets on Oct. 15.

The corporate additionally dropped the worth of its 512GB Meta Quest 3 to $499.99 from $649.99.

In the meantime, the older Quest 2 and high-end Quest Professional units are being discontinued.

MULTIMODAL LLAMA 3.2

Meta introduced its first open-source multimodal AI mannequin Llama 3.2, which might generate content material from each picture and textual content prompts.

It additionally introduced lightweight variations of Llama 3.2, able to operating natively on cellular units.

NEW VOICE CAPABILITIES TO META AI CHATBOT

Meta AI will now assist voice, with an possibility to pick out superstar voices equivalent to these of Judi Dench and John Cena.

The aptitude will be accessed by means of Meta AI in Fb (NASDAQ:), Messenger, WhatsApp and Instagram direct message.

UPDATES TO RAY-BAN META SMART GLASSES

Meta is updating Ray-Ban Meta sensible glasses with AI instruments for reminders, and the flexibility to scan QR codes and cellphone numbers with voice instructions.

The corporate may even add AI video functionality and the flexibility to carry out real-time language translation later this 12 months.

Markets

Inventory market in the present day: Inventory rally loses steam as S&P 500, Dow slip from information

China simply introduced its greatest financial stimulus because the pandemic.

Lusso’s Information’s Jared Blikre breaks down what the stimulus means for shares and commodities worldwide:

After the have been introduced Tuesday by the Folks’s Financial institution of China (PBOC), the nation’s benchmark index, the CSI 300 (), surged 4.3% — its largest bounce since July 2020.

The nation’s foreign money, the renminbi (), dropped 0.6% — essentially the most because the Japanese yen imploded in early August.

, however the greatest impact was felt in commodities. () skyrocketed over 4.5% to a decade-plus excessive. Copper futures () — already on a nine-day tear — notched a tenth straight win because it surged to a two-month excessive.

The stimulus, China’s newest try to tug its financial system out of a hunch brought on by a shaky property market and deflationary pressures, consists of over $325 billion in measures, largely through financial — versus fiscal — channels.

On Wednesday, Chinese language shares prolonged their rally, with the Shanghai Composite () ending up 1.2%. Nevertheless, there stays about whether or not the steps will efficiently flip round its financial system.

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets2 months ago

Markets2 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?