Markets

Professional Analysis: Wall Avenue delves into Vertex Prescription drugs

Vertex Prescription drugs (NASDAQ:), a number one biotechnology agency, continues to be a focus for analysts because it expands its pipeline past cystic fibrosis (CF) remedies into new therapeutic areas equivalent to ache administration, sort 1 diabetes (T1D), and different critical illnesses. The corporate’s strategic initiatives, together with the promising outcomes from VX-548 and VX-880 trials, have positioned Vertex for potential progress. With a market capitalization now standing at roughly $123.615 billion, Vertex’s strategic initiatives and scientific trial outcomes are scrutinized by buyers who see progress alternatives throughout the evolving biotech panorama.

Market Efficiency and Product Segments

Vertex’s monetary power stays strong, with a income progress of 10.61% during the last twelve months as of Q1 2024. The corporate’s EPS forecasts are promising, with projections of $15.23 for the present fiscal 12 months and $17.28 for the next one. Analysts have reaffirmed their confidence in Vertex, score the inventory “Chubby” and setting value targets starting from $421 to $500, reflecting bullish sentiment on the inventory’s future trajectory.

The CF remedies, with Trikafta on the forefront, proceed to drive Vertex’s success. The corporate anticipates additional diversification of its income streams with the introduction of latest therapies for illnesses like T1D and the latest regulatory approvals for CASGEVY and Exa-cel in sickle cell illness (SCD).

Aggressive Panorama and Market Developments

Regardless of a maturing CF franchise, Vertex maintains a robust aggressive place with restricted direct competitors. The corporate’s late-stage pipeline, together with VX-548 for ache administration and VX-880 for T1D, represents vital market alternatives. Nevertheless, the inventory’s excessive a number of and the need for vital pipeline wins to generate upside are famous by analysts, who additionally acknowledge that there could also be extra favorable funding alternatives elsewhere out there.

Regulatory Environments and Buyer Base

Vertex has not too long ago obtained regulatory approvals, such because the UK nod for CASGEVY, and expects an FDA approval for Exa-cel by December 8, 2023. The approval of Exa-cel is about to develop the shopper base for Vertex’s remedies, providing key benefits over current therapies for SCD.

Administration and Technique

Vertex’s administration continues to specific confidence within the firm’s strategic route, as evidenced by the raised steering for 2023 and the deliberate growth into new therapeutic areas. The acquisition of Alpine Immune Sciences (NASDAQ:) for $4.9 billion, roughly equal to Vertex’s projected FY24E working revenue, demonstrates the corporate’s dedication to enhancing its pipeline and market place.

Potential Impacts of Exterior Elements

The biotech sector’s sensitivity to exterior elements equivalent to market tendencies and regulatory adjustments stays a priority for Vertex. The corporate’s inventory value displays substantial pipeline hopes, with the potential success of VX-548 in ache therapy and VX-880 in T1D being vital elements within the firm’s valuation. Unfavorable scientific readouts might, nonetheless, affect investor sentiment.

Upcoming Product Launches

Vertex’s upcoming product launches, together with Exa-cel for SCD and TDT, anticipated by March 30, 2024, are extremely anticipated. The progress in its pipeline past CF, with next-generation triple readouts anticipated early in 2024, continues to be a key focus for buyers.

Analysts Outlooks and Reasonings

Analysts supply numerous outlooks on Vertex, with a consensus that the corporate’s sturdy monetary forecasts and growing EPS estimates for the upcoming fiscal years point out a sturdy future. The potential success in VX-548 trials and the growth into new therapeutic areas like ache administration and T1D might result in vital market alternatives. Nevertheless, scientific trial dangers and potential competitors in these new drug markets might affect future efficiency.

Bear Case

Is Vertex’s pipeline diversified sufficient past CF?

Vertex’s pipeline diversification, together with its foray into ache administration and T1D, is essential for sustained progress. The anticipated regulatory occasions for Exa-cel and different remedies are key to de-risking funding. Nevertheless, challenges in market adoption and manufacturing might gradual the launch and uptake of those new therapies.

What are the potential dangers for Vertex’s VX-548?

Whereas VX-548 faces uncertainties in section 3 trials, Vertex’s administration has indicated that extra bills from latest acquisitions will match throughout the present steering, mitigating some monetary dangers. Nonetheless, the excessive expectations already priced into the inventory create substantial draw back threat if scientific readouts disappoint.

Bull Case

Can Vertex’s VX-548 outperform current ache remedies?

With promising outcomes similar to Lyrica, VX-548 has the potential to exhibit non-inferiority to Vicodin and higher security. Favorable Section 3 outcomes might result in a big share of the neuropathic/persistent ache market and supply a considerable upside for the inventory.

Will Vertex’s Exa-cel turn out to be a number one remedy for SCD?

Vertex’s gene-edited remedy for SCD, Exa-cel, has the potential to turn out to be the main therapy for sufferers with this situation. With a excessive probability of first-cycle approval and no additional FDA requests anticipated, Exa-cel might streamline the approval course of and place Vertex as a pacesetter in gene-edited therapies.

SWOT Evaluation

Strengths:

– Robust monetary forecasts with growing EPS estimates.

– Main place in CF remedies with restricted competitors.

– Diversification into new therapeutic areas, together with ache administration and T1D.

Weaknesses:

– Dependence on CF franchise for income.

– Excessive multiples with flat EPS progress forecasted.

– Potential challenges in market adoption for brand spanking new therapies.

Alternatives:

– Enlargement into new therapeutic areas past CF.

– Upcoming catalysts with Section 3 readouts for VX-548 and VX-880.

– Regulatory approvals for Exa-cel and different pipeline merchandise.

Threats:

– Scientific trial dangers and competitors in new therapeutic areas.

– Regulatory hurdles and market adoption charges.

– Investor sentiment affected by pipeline successes or failures.

Analysts Targets

– Barclays Capital Inc.: Chubby, $472.00 value goal (June 14, 2024).

– BMO Capital Markets: Outperform, $500.00 value goal (June 24, 2024).

– Cantor Fitzgerald: Chubby, $440.00 value goal (April 11, 2024).

– RBC Capital Markets: Sector Carry out, $421.00 value goal (June 11, 2024).

– Piper Sandler: Chubby, $450.00 value goal (April 11, 2024).

This evaluation spans from January to June 2024.

Lusso’s Information Insights

As Vertex Prescription drugs (NASDAQ:VRTX) continues to draw consideration with its modern pipeline and strategic progress initiatives, latest knowledge and insights from Lusso’s Information present a deeper understanding of the corporate’s monetary well being and inventory efficiency. With a sturdy market capitalization of $126.12 billion, Vertex stands out as a number one firm throughout the biotechnology sector.

Lusso’s Information Knowledge exhibits that Vertex’s P/E ratio is presently at 31.42, reflecting a premium valuation that buyers are keen to pay for the corporate’s earnings potential. That is supported by a strong income progress of 10.61% during the last twelve months as of Q1 2024, indicating the corporate’s means to develop its monetary base amid an evolving trade panorama. Moreover, Vertex’s inventory has skilled a robust return during the last three months, with a 23.25% enhance, signaling strong investor confidence and a optimistic market reception to the corporate’s latest developments.

Among the many Lusso’s Information Ideas, it’s noteworthy that Vertex is buying and selling at a excessive P/E ratio relative to near-term earnings progress, suggesting that buyers have excessive expectations for the corporate’s future efficiency. Furthermore, the corporate’s inventory is buying and selling close to its 52-week excessive, with a value 98.34% of that peak, underscoring the present bullish sentiment surrounding Vertex’s market prospects.

For these looking for to delve deeper into Vertex’s monetary metrics and inventory evaluation, Lusso’s Information presents a complete suite of extra ideas. At the moment, there are 16 extra ideas accessible on Lusso’s Information that may present buyers with additional insights into Vertex’s monetary well being and inventory efficiency.

As Vertex Prescription drugs forges forward with its promising drug pipeline and strategic initiatives, the Lusso’s Information Ideas and real-time knowledge current a useful useful resource for buyers trying to make knowledgeable selections about this outstanding participant within the biotechnology trade.

This text was generated with the help of AI and reviewed by an editor. For extra data see our T&C.

Markets

Meet the three Supercharged Development Shares That Will Be Price $4 Trillion by 2025, In accordance with 1 Wall Avenue Analyst

One of many clearest secular tailwinds of the previous couple of years is the arrival of synthetic intelligence (AI). Latest advances within the area have helped energy the continuing market rally, as these next-generation algorithms promise to extend productiveness by dealing with mundane duties and streamlining productiveness.

It ought to come as no shock then that most of the world’s Most worthy corporations are on the forefront of AI growth and have embraced the potential of . One of many largest debates in tech circles is which of those expertise stalwarts would be the first to cross the $4 trillion market cap threshold.

Buyers asking that query could also be lacking the purpose, in accordance with Wedbush analyst Dan Ives, who argues that 12 months from now, the $4 trillion membership would possibly, in actual fact, have three members. Let’s check out the candidates and what would possibly drive them there.

1. Apple

With the world’s largest present market cap, coming in at greater than $3.4 trillion (as of this writing), Apple (NASDAQ: AAPL) is among the many most definitely contenders to be a founding member of the $4 trillion membership. It will take a inventory worth enhance of lower than 17% to place Apple over the end line, and there are many drivers that would assist propel the iPhone maker larger.

The obvious potential catalyst is, after all, the not too long ago unveiled iPhone 16. The newest model of the fan-favorite system comes with all the same old upgrades, together with an improved digicam, speedier processing, and elevated battery life. One of many largest attracts, nonetheless, is the debut of Apple Intelligence, the corporate’s suite of generative AI-powered instruments, which is able to probably appeal to technophiles in droves.

There’s extra: The rampant inflation of the previous couple of years had customers hanging on to their iPhones a bit longer, and Ives estimates there are 300 million iPhones that have not been upgraded for 4 years or extra, leading to loads of pent-up demand. He believes it will kick off the and estimates Apple might promote as many as 240 million iPhones over the approaching 12 months.

Given bettering macroeconomic circumstances, I believe the analyst is correct: Throngs of customers will pony up for the brand new AI-driven iPhone, serving to push Apple over the $4 trillion mark.

2. Microsoft

Microsoft (NASDAQ: MSFT) is at present the world’s second-most worthwhile firm. With a market cap of $3.2 trillion, the inventory will solely must rise 24% to cross the $4 trillion threshold.

The corporate was fast to acknowledge the game-changing nature of generative AI and positioned itself for achievement. Microsoft took a stake in ChatGPT creator OpenAI and developed a collection of AI-driven productiveness instruments dubbed Copilot. It not too long ago unveiled a line of Copilot-powered private computer systems that can assist enhance Microsoft’s already expansive attain.

Simply final month, the corporate introduced that it could restructure the reporting of its enterprise items to provide a clearer image of its success in AI. Whereas buyers do not but have the entire image, the accessible proof is compelling. Throughout Microsoft’s fiscal 2024 fourth quarter (ended June 30), its Azure Cloud grew 29% 12 months over 12 months, and administration famous that eight proportion factors of that development was the results of demand for its AI companies. This helps illustrate that Microsoft’s AI technique is paying off.

Ives seized on one level from administration’s commentary, noting that Azure Cloud development is anticipated to “speed up within the second half.” He estimates that over the approaching three years, 70% of Microsoft’s put in base shall be utilizing its AI options. He goes on to say this chance isn’t but totally factored into the inventory worth.

I believe the analyst hit the nail on the top. Given Microsoft’s intensive attain in each the buyer and enterprise markets, it will not take a lot by way of AI adoption to positively affect the corporate’s development.

3. Nvidia

Nvidia (NASDAQ: NVDA) has grow to be the de facto poster little one for the AI revolution, sending its market cap to simply over $3 trillion. As such, it could solely take a inventory worth enhance of 32% to take the chipmaker above $4 trillion.

The inventory at present sits 10% off its peak, as buyers ponder the momentum of AI adoption, but the proof is incontrovertible. Nvidia’s largest prospects — Microsoft, Meta Platforms, Amazon, and Alphabet — have been utterly clear about their plans to extend their capital expenditures for the rest of the 12 months and into 2025. They’ve additionally made it very clear that the overwhelming majority of that spending shall be devoted to the info facilities and servers wanted to run AI.

Nvidia’s graphics processing items (GPUs) are the gold normal for working AI in information facilities and managed 98% of the info middle GPU market final 12 months. This illustrates why continued funding within the area stands to learn Nvidia.

Ives cited surging chip demand, readability on the upcoming launch of its Blackwell chip, and strong outlook as proof that Nvidia inventory has additional to run.

I believe the analyst’s evaluation is spot on. Buyers have been involved that AI adoption might gradual, which has weighed on Nvidia inventory in current months. Nonetheless, whereas that can actually occur someday, the accessible proof suggests it will not occur any time quickly. The truth is, some imagine Nvidia will ultimately be the world’s Most worthy firm.

A phrase on valuation

Pleasure relating to the potential for AI since early final 12 months has pushed many shares larger, leading to a corresponding enhance of their respective valuations. As such, every of those shares is buying and selling at a premium to the broader market. Microsoft and Apple are at present promoting for roughly 33 occasions ahead earnings, in comparison with a a number of of 30 for the S&P 500. Nvidia is probably the most egregious instance, promoting for 43 occasions ahead earnings. That stated, appears might be deceiving.

Analysts’ consensus estimates for Nvidia’s earnings per share for its 2026 fiscal 12 months (which begins in January) is $4.02. On that foundation, Nvidia is just buying and selling for 30 occasions gross sales, so it is not as costly as it would seem, notably given the continuing alternative represented by AI. Utilizing subsequent fiscal 12 months’s expectations yields related outcomes for Apple and Microsoft, that are promoting for 30 occasions and 28 occasions subsequent 12 months’s anticipated earnings, respectively.

When considered in that mild, these tech titans are literally moderately priced. That is why every of those shares is a must-own for the AI revolution.

The place to speculate $1,000 proper now

When our analyst group has a inventory tip, it will possibly pay to pay attention. In spite of everything, Inventory Advisor’s complete common return is 773% — a market-crushing outperformance in comparison with 168% for the S&P 500.*

They only revealed what they imagine are the for buyers to purchase proper now… and Apple made the listing — however there are 9 different shares you could be overlooking.

*Inventory Advisor returns as of September 23, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Tremendous Micro: Assessing the Potential Danger and Reward

Tremendous Micro Laptop bought off to an unbelievable begin this yr as shares greater than quadrupled from January to mid-March. This surge made Tremendous Micro eligible for S&P 500 inclusion, with the expertise {hardware} inventory (with hyperlinks to AI) being added to the index on March 18, 2024. In hindsight, that may have been a good time to take income or Quick the inventory, as shares are down by greater than 50% since then.

One of many main developments has been the report by Hindenburg Analysis, which contained worrying allegations in regards to the firm’s monetary reporting. In assessing these allegations together with Tremendous Micro’s fundamentals I maintain a impartial ranking on the inventory.

Hindenburg Casts Doubts About Tremendous Micro

The Hindenburg report is definitely the principle cause I’m impartial as an alternative of bullish on SMCI inventory, and I consider it has brought about hesitancy amongst many AI inventory analysts and traders.

The accusations are fairly simple. In keeping with Hindenburg, Tremendous Micro engaged in accounting manipulation which included “sibling self-dealing and evading sanctions”. Anybody who thinks this sounds far fetched could want to do not forget that the SEC charged Tremendous Micro with widespread accounting violations in August 2020. Hindenburg’s report additionally argued that almost all of the individuals concerned with that accounting malpractice are again on Tremendous Micro’s group.

Hindenburg’s group interviewed a number of Tremendous Micro salespeople and staff when compiling their report. It doesn’t assist that Tremendous Micro delayed its 10-Ok submitting to evaluate inner controls shortly after Hindenburg went public with its considerations. Whereas this would possibly merely be a coincidence, the timing is worrisome. Trying again a number of years, Tremendous Micro had did not file monetary statements in 2018 and was briefly delisted from the Nasdaq in consequence.

Close to the start of this month, Tremendous Micro publicly issued a denial of the accusations, with CEO Charles Liang hitting again, stating that Hindenburg’s report contained, “deceptive shows of data”. Tremendous Micro hasn’t supplied any further statements since then.

Synthetic Intelligence Progress Is Plain

Tremendous Micro’s standing as a part of the fast paced world of AI is likely one of the few causes that I’m impartial as an alternative of bearish SMCI inventory. The thrilling prospects for the corporate’s enterprise and the intense nature of the Hindenburg allegations mainly offset one another.

It’s exhausting to know what’s actual and what’s false right here, however most individuals concede that the AI trade as a complete gives compelling development prospects. Nvidia has been posting triple-digit year-over-year income development for a number of quarters. Different tech giants have included synthetic intelligence into their core companies and delivered spectacular outcomes for his or her shareholders. For example, Alphabet noticed its cloud income rise by 28.8% year-over-year as many companies rushed to create their very own AI instruments.

The factitious intelligence trade can also be projected to keep up a 19.3% compounded annual development fee from now till 2034, in accordance with Priority Analysis. The AI trade ought to proceed to develop, and that ought to elevate Tremendous Micro. The corporate ought to profit from Nvidia’s development, which is why the corporate posted distinctive income and internet revenue development throughout Nvidia’s ascent. That’s what we noticed for a number of quarters. We simply don’t know the way correct all of the numbers have been, if the allegations focusing on the agency have advantage.

Tremendous Micro Has Robust Financials at Face Worth

Whereas it’s not possible to miss Hindenburg’s allegations in opposition to Tremendous Micro, it’s nonetheless worthwhile assessing the corporate’s earlier quarterly outcomes. Shares have been dropping even earlier than Hindenburg launched its report. Whereas in March 2024 I , I felt that shares offered an amazing shopping for alternative in late-summer, till Hindenburg muddied that optimism.

For its final reported quarter, Tremendous Micro posted internet gross sales of $5.31 billion, representing a 143% year-over-year leap. In the meantime, internet revenue rose by 82% year-over-year, reaching $353 million. On the time of the discharge, my main concern was Tremendous Micro’s declining internet revenue margin. Tremendous Micro presently trades at a 20x trailing P/E ratio, seemingly sufficient to compensate for any additional erosion in revenue margins. SMCI inventory has a ridiculously low 13.6x ahead P/E ratio, however with the current speedbumps (the Hindenburg report and DOJ investigation) traders appears reluctant to bid the valuation a number of any greater proper now.

We don’t but have tangible proof that Tremendous Micro has engaged in any wrongdoing, as alleged by Hindenburg. Their report, nevertheless, has actually forged a black eye on the inventory. I count on that Tremendous Micro would have considerably outperformed its fiscal 2023 outcomes even excluding any misdealings.

The Division of Justice Is Probing Tremendous Micro Laptop

The Tremendous Micro controversy added a brand new chapter on September 26, as information crossed the wires that the the corporate. SMCI inventory tumbled an extra 12% on this information, and shares have been just lately buying and selling at lower than one-third of their all time excessive in March. There’s a excessive threat/reward on the shares at this level, however the elevated dangers have relegated me to the sidelines with a impartial ranking.

Tremendous Micro shares bounced again by greater than 4% on Friday, September 27, suggesting that many traders consider that the long-term potential for the enterprise is definitely worth the heightened uncertainty.

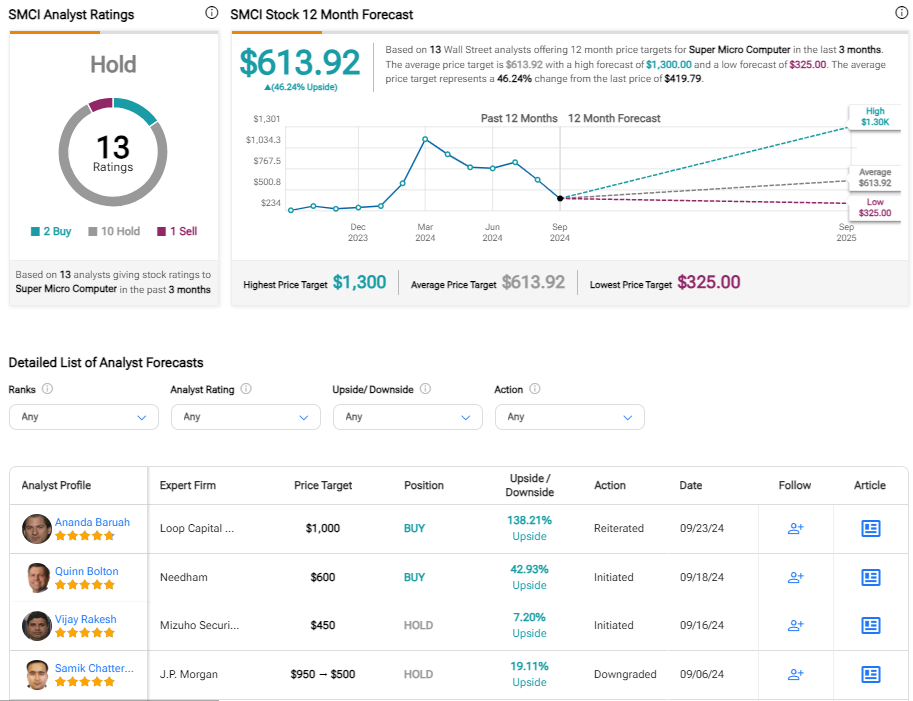

Is Tremendous Micro Inventory Rated a Purchase?

Though the scores for this inventory might change rapidly, Tremendous Micro presently has 2 Purchase scores, 10 Maintain scores, and 1 Promote ranking from the 13 analysts that cowl the inventory. The , which suggests potential upside of almost 50%. Once more although, it’s fairly potential that a number of analysis brokerages have positioned their SMCI scores underneath evaluation. SMCI inventory does have just a few low value targets together with $454, $375 and $325 from CFRA, Wells Fargo , and Susquehanna respectively. All of those value targets have been established earlier than the DOJ probe was introduced, so even they might drop decrease.

The Backside Line on SMCI Inventory

There’s an outdated adage that implies, “You both die a hero or stay lengthy sufficient to be the villain”. That quote appears apropos for this firm. Tremendous Micro earned many traders hefty income throughout its rise above a inventory value of $1,000 per share. Those that entered the story late, together with after SMCI inventory was added to the S&P 500, haven’t fared properly. Many traders are sitting on important losses proper now. Relying on what these traders do, it’s exhausting to inform how rather more draw back Tremendous Micro shares could have till extra readability on the ordeals is out there.

If the corporate’s current financials are correct, SMCI shares look fairly engaging right here. Shares can surge rapidly if the Hindenburg report loses relevance, though that consequence troublesome to foretell. I’m a giant fan of Tremendous Micro’s trade and enterprise potential associated to AI, which prevents me from being downright bearish. I’ve a impartial stance right here. In the meantime, I don’t count on shares of SMCI to rebound above $460 (the approximate value previous to information of the DOJ probe) with none decision to the 2 major threats to shareholder worth.

Markets

Unique-TPG in lead to purchase stake in Inventive Planning at $15 billion valuation, sources say

By Milana Vinn and David French

(Reuters) – Buyout agency TPG has emerged because the frontrunner to select up a minority stake value $2 billion in Inventive Planning, in a deal that would worth the wealth administration agency at greater than $15 billion, individuals accustomed to the matter stated on Saturday.

The deal would mark TPG’s second such wager on a wealth supervisor inside per week and underscores the burgeoning demand for dealmaking within the sector that generates profitable payment revenue for managers. On Thursday, TPG clinched a deal to purchase a minority stake in Homrich Berg.

San Francisco-based TPG is about to prevail in an public sale for the stake in Inventive Planning that drew curiosity from different buyout companies, together with Permira, the sources stated, requesting anonymity because the discussions are confidential. The deal may very well be introduced within the coming days, the sources added.

If the talks are profitable, TPG would turn out to be one of many house owners within the wealth supervisor, alongside personal fairness agency Basic Atlantic which acquired a minority stake in Inventive Planning in 2020.

TPG and Permira declined to remark. Inventive Planning didn’t instantly reply to requests for remark.

Wealth managers have historically attracted sturdy curiosity from personal fairness companies who wish to again firms that generate regular money flows. The wealth administration trade’s fragmented nature additionally means firms can develop rapidly by means of acquisitions of rivals.

Overland Park, Kansas-based Inventive Planning presents companies together with monetary and tax planning, retirement plans and monetary consultancy for companies, and managed greater than $300 billion of property on the finish of 2023, in keeping with its web site.

Final 12 months, Inventive Planning agreed to purchase the private monetary unit of Goldman Sachs, after the Wall Avenue financial institution undertook a strategic overhaul at its wealth administration unit to give attention to excessive net-worth people, following its exit from the patron lending enterprise.

Based in 1992 by personal fairness executives Jim Coulter and David Bonderman, TPG had about $229 billion in property below administration as of the tip of June, up 65% from a 12 months earlier. The agency, which is presently led by Jon Winkelried, posted a 60% soar in fee-related revenue from managing property in its most up-to-date quarter.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook