Markets

5 Issues to Know Earlier than Shopping for Lucid Inventory

Lucid (NASDAQ: LCID) inventory has had fairly a journey since its debut. It peaked at round $58 per share in 2021, earlier than manufacturing of the corporate’s EVs obtained underway in earnest. And whereas the corporate’s Air luxurious sedan has acquired rave critiques, its gross sales have been underwhelming — and like many different , its share value has fallen over 90% from these lofty 2021 heights.

However the place do issues stand for Lucid now, in 2024? For those who just like the automobile (I do), and you have considered shopping for the inventory whereas it is low cost, there are some issues it is best to know. Listed here are 5.

How does Lucid’s EV know-how examine with that of its rivals?

Merely put, Lucid stacks up properly towards the competitors.

The corporate claims to supply the lowest-cost battery pack per mile of vary within the enterprise. It is a honest declare: Even probably the most primary $70,000 model of the Air comes with 410 miles of EPA-estimated vary, greater than Tesla affords in its equally sized Mannequin S.

Transfer as much as the Air Grand Touring, beginning round $109,000, and you will get an estimated 516 miles of vary — together with a whopping 819 horsepower and a ton of high-tech luxurious options. And all variations of the Air can add 200 miles of vary in lower than 20 minutes at a 350-kilowatt quick charger.

Reviewers love the Air’s journey and dealing with, too.

Who’s Lucid’s greatest investor?

Lucid’s greatest investor by far is Saudi Arabia’s sovereign wealth fund, known as the Public Funding Fund or PIF. PIF has invested a complete of $6.4 billion in Lucid , together with $1 billion in March. It presently owns about 60% of the automaker.

The Saudi authorities has supported Lucid in different methods. In 2022, its Ministry of Finance agreed to purchase no less than 50,000, and presumably as many as 100,000, automobiles from Lucid over the next 10 years — with deliveries anticipated to ramp up considerably in 2025.

How a lot demand has there been for the Lucid Air?

Lucid’s gross sales have constantly fallen in need of expectations. The Air is an outstanding EV, however the marketplace for six-figure sedans, electrical or in any other case, is fairly skinny, and gross sales have not materialized within the numbers that Lucid and its early buyers hoped to see.

Think about: Lucid had initially anticipated to construct 20,000 Airs in 2022, but it surely ended up constructing simply 3,493. In 2023, Lucid produced 8,428 automobiles and delivered 6,001 — higher, however nonetheless nowhere close to its authentic expectations. It is hoping to construct about 9,000 in 2024.

Lucid’s subsequent mannequin, a giant luxurious SUV known as Gravity, is predicted to launch earlier than the tip of 2024. The Gravity ought to assist increase Lucid’s deliveries to some extent as soon as manufacturing ramps up early subsequent yr.

However what Lucid actually must get to profitability is a lower-priced midsize mannequin. That will not arrive till late 2026 on the earliest, Lucid stated in Could.

All of that raises an essential query: Does Lucid have sufficient money to get to profitability?

Lucid wants more money

In the intervening time, the reply is not any.

Lucid had $5 billion available as of the tip of March. It stated in Could that needs to be sufficient to launch the Gravity and preserve the lights on into the second quarter of 2025. However there’s not a lot probability Lucid will flip a revenue earlier than manufacturing of the longer term midsize mannequin ramps up — and that will not occur earlier than 2027, even when we’re optimistic.

Clearly, Lucid will want more money. That has been a theme all through its historical past: As I discussed, it has already raised $1 billion in 2024, on prime of the $3 billion it raised in Could 2023, the $1.5 billion it raised in December 2022, and on and on.

PIF was a significant participant in all of these funding rounds, however even probably the most optimistic buyers need to ask: How rather more will PIF be prepared to take a position?

Is Lucid inventory a purchase?

On one hand, Lucid inventory is reasonable. Its market cap is round $6.1 billion as I write this, not rather more than its money hoard. Lucid’s product is great, and there is a cheap plan to broaden the lineup in an economical means.

However alternatively, it is low cost for a cause.

It is true that Lucid is a a lot extra full enterprise than now-bankrupt rival Fisker ever was. Lucid owns a manufacturing unit, its automobiles have groundbreaking know-how developed in-house, and it has a base of hundreds of completely satisfied homeowners.

However automakers want scale to outlive and revenue. Even when all goes properly, Lucid will not get to sustainable scale for no less than a number of extra years — and it will burn billions of {dollars} between from time to time, a lot of which it has but to boost.

For those who love the Lucid Air and perceive the corporate’s state of affairs, I will not argue when you determine to take a small place within the inventory. You will have to be affected person, but it surely may repay properly in time.

Simply needless to say the dangers are vital, and profitability remains to be a great distance off.

Do you have to make investments $1,000 in Lucid Group proper now?

Before you purchase inventory in Lucid Group, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for buyers to purchase now… and Lucid Group wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $791,929!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 8, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Assume You Know Altria? Right here's 1 Little-Identified Reality You Can't Overlook.

When most buyers take a look at Altria (NYSE: MO) what they see is a large 8% dividend yield backed by a dividend that has been elevated for years. That’s the kind of story that almost all dividend buyers will discover engaging. However there is a huge danger right here as a result of the corporate’s core enterprise is in long-term decline. That danger needs to be understood, however there’s one other delicate twist that you’ll have missed.

Altria’s enterprise is slipping away

It should not come as any shock to Altria shareholders that the corporate’s most necessary enterprise is making . Within the first half of 2024, the corporate generated roughly $11.8 billion in income. Its smokeable merchandise division’s revenues had been about $10.4 billion, or 88% of the corporate’s general prime line. Clearly, smokeable merchandise is the driving pressure at Altria.

To be truthful, the corporate sells quite a lot of smokeable merchandise, together with cigars. However whenever you take a look at quantity, cigarettes account for simply over 97% of the division’s quantity. So cigarettes are the large story at Altria. However, as famous, most buyers know that reality.

The necessary story right here is not the biggest enterprise. It’s the decline that is going down within the largest enterprise. By means of the primary six months of 2024, cigarette volumes dropped 11.5%. That is horrible and would seemingly be seen as surprising at another — buyers would run for the hills. Solely that drop is simply par for the course.

In 2023, cigarette volumes declined 9.9%. In 2022, volumes fell 9.7%. In 2021, the drop was 7.5%. You get the concept, it is a dying enterprise.

One “little” downside that may’t be missed

How has an organization with a enterprise that is in decline managed to take care of its dividend, not to mention develop it? The reply is that, due to the character of cigarettes, people who smoke are typically very loyal. So Altria has been jacking up costs frequently to offset the quantity declines. That is labored out effectively thus far, however you may solely milk a money cow so exhausting earlier than it runs dry. That is a much bigger danger for Altria than many might notice.

Of the cigarettes Altria sells, solely about 4% or so fall into the low cost class. Which means Altria’s enterprise is principally reliant on premium smokes. Within the premium class, “different premium” manufacturers make up about 4.5% of whole quantity. The remaining 91% of the corporate’s cigarette quantity is all attributable to at least one model, Marlboro.

Marlboro is a huge within the U.S. cigarette trade with an enormous 42% market share. This may very well be considered as a power. However step again for a second and take into consideration the large image. Altria is principally a one-trick pony in a dying rodeo. And its pony is likely one of the costliest round at a time when worth competitors from smoking alternate options is heating up. Altria itself notes that “the expansion of illicit e-vapor merchandise” is a giant downside, which is essentially as a result of they’re less expensive.

Fixing the issue will not be straightforward

There’s solely a lot Altria can do about its reliance on Marlboro because the cigarette enterprise declines. In reality, being the most important participant within the trade might be preferable to having a second rung model. What it’s doing is making an attempt to broaden its attain past cigarettes. That is the correct factor to do, however given the scale of the corporate’s cigarette enterprise it is not going to be straightforward to discover a alternative. After a few failed makes an attempt, together with an funding in Juul and in a marijuana firm, Altria is at present centered on rising its current NJOY vape acquisition.

It’s going effectively, with NJOY experiences fast development because it has been slotted into Altria’s spectacular distribution system. To place a quantity on that, within the second quarter of 2024 NJOY’s cargo quantity elevated 14.7% from the primary quarter and NJOY system shipments elevated 80%. The issue is that NJOY is tiny, falling into Altria’s “all different merchandise” income class which made up simply $22 million in income within the first half of 2024 at an organization with almost $11.8 billion in income. So NJOY is barely even a rounding error. Marlboro is the important thing to Altria’s future and can seemingly stay the important thing for years to come back.

If Altria hits a tipping level, it may get unhealthy quick

A shopper staples firm can solely elevate costs simply thus far earlier than there is a backlash from shoppers. The straightforward swap with cigarettes is to purchase cheaper smokes, which Altria actually does not promote. Then there’s alternate options to fret about, reminiscent of the corporate’s spotlight of vaping. Though Marlboro has been holding its personal, in 2021 its market share was 43.1%. That is 1.1 share factors above its present stage.

If Marlboro falters, Altria may fall. This can be a “little” undeniable fact that many buyers most likely aren’t contemplating as they take a look at the large dividend yield. Principally, there’s higher focus danger right here than many individuals notice.

Do you have to make investments $1,000 in Altria Group proper now?

Before you purchase inventory in Altria Group, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for buyers to purchase now… and Altria Group wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

The Final Electrical Car (EV) Inventory to Purchase With $1,000 Proper Now

Everybody desires to search out the following Tesla (NASDAQ: TSLA). However investing within the electrical car (EV) area will be tough. Many EV corporations have gone bankrupt through the years, and separating the nice from the dangerous will be tough.

Fortunately, Tesla established a transparent template for achievement. And proper now, there’s one that appears extraordinarily enticing. However there’s just one funding technique prone to succeed.

That is how Tesla grew to become an enormous success

In 2006, Tesla CEO Elon Musk revealed “The Secret Tesla Motors Grasp Plan” to the general public. “As you realize, the preliminary product of Tesla Motors is a high-performance electrical sports activities automotive known as the Tesla Roadster,” his essay started. “Nevertheless, some readers might not be conscious of the truth that our long run plan is to construct a variety of fashions, together with affordably priced household automobiles.”

Musk summarized the grasp plan for Tesla:

Immediately, Tesla is a big image of success in the case of executing on long-term visions. The Tesla Roadster was a hit, however given its $100,000-plus value level, its market was all the time small.

Tesla wanted to show its manufacturing chops, and present the general public that EVs could possibly be cool and thrilling. It used this success to design, construct, and ship two new fashions: The Mannequin S and Mannequin X. These fashions had been nonetheless costly, however launched Tesla to lots of of hundreds of recent house owners.

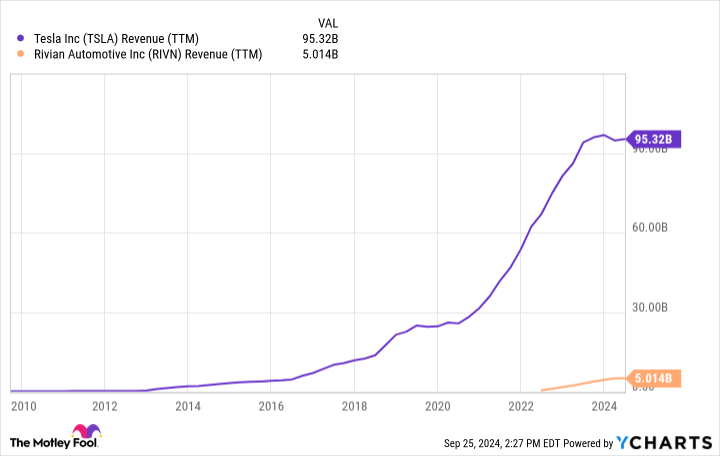

Tesla then used its repute and entry to capital to debut two new mass market fashions, the Mannequin 3 and Mannequin Y. These two fashions, with way more inexpensive value factors, allowed Tesla to develop its by greater than 1,000% during the last decade.

Tesla’s grasp plan labored wonders for its valuation. The corporate is at present price round $800 billion. One other firm, in the meantime, is valued at simply $11 billion — but it is executing Tesla’s confirmed grasp plan flawlessly.

Rivian could possibly be the following huge EV inventory

On the subject of following Tesla’s template for achievement, few EV corporations look as enticing as Rivian (NASDAQ: RIVN).

In 2018, Rivian introduced the debut of its R1T and R1S fashions. Like Tesla’s earlier fashions, the R1T and R1S had been ultra-luxury, high-quality, no-compromise autos with value factors that would simply surpass $100,000 with sure choices. Shopper suggestions was implausible. Shopper Studies discovered that Rivian has the best buyer satisifcation and loyalty ranges of any auto producer — electrical or in any other case. Round 86% of Rivian house owners stated they might purchase one other Rivian. No different model was above the 80% mark.

What’s going to Rivian do with its newfound repute and gross sales base? Precisely what Tesla did: Construct extra inexpensive automobiles. Earlier this 12 months, the corporate revealed three new fashions: The R2, R3, and R3X. All are anticipated to debut with beginning costs beneath $50,000. It was assembly this value level that helped put Tesla on the map for hundreds of thousands of individuals. If Rivian can execute, it ought to show very profitable.

If Rivian can replicate Tesla’s success, why is its market cap hovering simply above $10 billion? First, its new fashions aren’t anticipated to hit the highway till 2026 on the earliest. Second, the required manufacturing services aren’t even full but. Third, the corporate remains to be dropping cash at a speedy clip since car manufacturing is capital intensive. Nevertheless, administration expects to achieve optimistic gross income by the tip of 2024. Lastly, Rivian is attempting to compete in a market section — electrical autos — that has seen many bankruptcies through the years.

It is clear that the market is skeptical of Rivian’s plans, despite the fact that it’s executing on a confirmed mannequin for development, and has demonstrated its means to fabricate autos that clients love. The following few years, nonetheless, will probably be pivotal. Rivian will turn out to be a family identify like Tesla if it could execute, a end result that can possible see a speedy enlargement in its valuation.

There isn’t any assure that the corporate will retain its means to faucet capital markets affordably or get its manufacturing capabilities up and operating rapidly. It must market its autos in a hypercompetitive trade. But it’s this uncertainty that gives affected person traders with a profitable entry level for Rivian inventory proper now. When you can stay affected person, Rivian’s rise might ultimately mirror Tesla’s.

Must you make investments $1,000 in Rivian Automotive proper now?

Before you purchase inventory in Rivian Automotive, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for traders to purchase now… and Rivian Automotive wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

UBS chair warns towards massive improve in capital necessities, newspaper studies

ZURICH (Reuters) – UBS Chair Colm Kelleher warned on Sunday that the Swiss authorities’s plans to strengthen capital necessities for large banks might injury the nation’s place as a monetary centre.

The federal government earlier this 12 months laid out plans for harder capital necessities for UBS and Switzerland’s three different massive banks in a bid to make the monetary sector extra strong after the crash of Credit score Suisse final 12 months.

In an article revealed within the Swiss newspaper SonntagsBlick, Kelleher mentioned he agreed with a lot of the 22 suggestions within the authorities’s report, apart from the proposal for extra stringent capital necessities.

“What I actually have an enormous drawback with is the rise in capital necessities. It simply does not make sense,” he mentioned concerning the so-called “too-big-to-fail” report.

Particulars of the precise capital necessities are but to emerge, though Finance Minister Karin Keller-Sutter in April mentioned estimates UBS would require one other $15 billion to $25 billion had been “believable”.

In a separate estimate, analysts at Autonomous Analysis mentioned UBS could must retain a further $10 billion to $15 billion.

Kelleher declined to touch upon figures, however mentioned that extreme capital necessities would injury competitiveness and result in much less beneficial costs on banking merchandise for patrons.

“We should always give attention to extra vital points akin to liquidity administration and, above all, the total resolvability of a financial institution,” Kelleher instructed the newspaper.

Swiss banks contribute to its position because the world’s high monetary centre, with some $2.6 trillion in worldwide belongings beneath administration, in line with a 2021 Deloitte research. Nevertheless, competitors is rising from Luxembourg and particularly Singapore, which has grown quickly lately.

UBS – which has a steadiness sheet double the scale of annual Swiss financial output – would pose dire dangers for the Swiss financial system if it had been to break down, specialists have warned.

Kelleher downplayed the hazards, saying UBS held “considerably extra” capital than comparable banks, whereas the financial institution’s enterprise mannequin – based mostly on wealth administration and the Swiss home market – meant it was low threat.

UBS remained dedicated to Switzerland even when Bern demanded an enormous improve in additional capital, mentioned Kelleher, who has been chair since 2022.

“Though we’re a world financial institution, the center of UBS is our Swissness,” he mentioned, including there was “no query” the lender would stop its dwelling nation.

Nonetheless he warned if the financial institution needed to elevate its capital ranges, it could be detrimental for Switzerland.

“If politics forces us to massively improve our capital, then Switzerland has determined that it now not needs to be a related worldwide monetary centre,” Kelleher mentioned.

“I feel that can’t be within the nation’s curiosity.”

The previous Morgan Stanley government mentioned he was prepared to talk with the federal government on its proposals.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook