Markets

Professional Analysis: Wall Road eyes Visa's development and resilience

Within the fast-paced world of digital funds, Visa Inc . (NYSE: NYSE:) stands out as a world chief connecting varied entities with its superior expertise. Analysts from esteemed corporations have not too long ago supplied a complete evaluation of Visa’s monetary well being, strategic path, and market potential. As we delve into the main points, it’s clear that Visa is navigating the present financial panorama with a strategic eye on development and shareholder worth.

Firm Overview

Visa is a multinational monetary companies company that facilitates digital funds transfers all through the world, mostly by Visa-branded bank cards and debit playing cards. The corporate’s expansive community connects these stakeholders, facilitating a seamless move of commerce. Visa has persistently demonstrated its skill to adapt and innovate, making certain its aggressive edge in a dynamic market.

Monetary Efficiency and Technique

Visa’s current monetary outcomes have mirrored sturdy efficiency and strategic execution. The corporate reported robust fiscal quarter 4 earnings, with income and earnings per share (EPS) beating forecasts. Q1 efficiency confirmed card quantity development barely accelerating in Q1 (debit/credit score volumes +8%/6% YoY respectively) in comparison with This autumn. Administration’s confidence is obvious as they head into Q1 outcomes throughout cost protection, with out indicating any important weakening in spend close to time period.

Wanting forward, Visa has set an formidable course for fiscal 12 months 2024, with administration anticipating double-digit adjusted web income development and low-teens adjusted EPS development. The estimated EPS for the primary fiscal 12 months (FY1) are USD 9.94 and for the second fiscal 12 months (FY2) are USD 11.28, showcasing robust forecasts for the upcoming fiscal years.

Development Drivers and Capital Allocation

Analysts have recognized Visa’s strategic shift in the direction of non-traditional development drivers, corresponding to Worth Added Providers (VAS) and new cost flows. VAS has been robust, accounting for roughly 24% of web income year-to-date, with Visa seeking to improve penetration with new and current prospects. Moreover, Visa has introduced a $25 billion share repurchase program and a 15% improve in its dividend, reflecting a strong capital allocation technique that rewards shareholders.

Aggressive Place and Market Traits

Visa continues to strengthen its market place by increasing its core client funds enterprise and making important inroads in new companies corresponding to Visa Direct and Visa B2B Join. The corporate’s cross-border journey quantity has normalized at a better baseline charge, suggesting constant development with out the belief of an financial downturn in its projections. Cross-border volumes are anticipated to stay resilient as a result of structural shift in the direction of cross-border e-commerce and ongoing journey power.

Nonetheless, BMO Capital Markets notes that Visa has traditionally proven much less willingness to spend on rebates/incentives in comparison with MasterCard, which might affect its aggressive dynamics. The potential for Visa to develop into extra aggressive in market share competitors by incentives is an fascinating lever for future development, which might positively shock the market and bolster Visa’s prospects.

Regulatory and Financial Issues

Whereas Visa’s outlook for fiscal 12 months 2024 is constructive, regulatory developments such because the MDL settlement and Reg II are seen as having restricted affect on Visa’s point-of-sale operations, with proposed interchange reductions being modest. Nonetheless, the corporate should stay vigilant as macroeconomic headwinds might have an effect on efficiency, and long-term threats embody the expansion of home/regional real-time cost schemes that might affect Visa’s development.

Analysts Targets

– RBC Capital Markets: Outperform score with a value goal of $290.00 (October 25, 2023).

– BMO Capital Markets: Outperform score with a desire for MasterCard over Visa primarily based on development prospects and valuation multiples. No particular value goal is supplied, however it’s indicated that Visa’s P/E a number of could converge with MasterCard’s by 2027 if development estimates maintain true (Might 28, 2024).

– Barclays: Chubby score with a value goal of $319.00 (January 30, 2024).

– Baird Fairness Analysis: Outperform score with a value goal of $314 (January 18, 2024).

– Piper Sandler: Chubby score with a value goal of $322.00 (Might 13, 2024).

Bear Case

Is Visa’s development sustainable within the face of potential financial challenges?

Analysts categorical warning over Visa’s formidable steering, which doesn’t consider potential macroeconomic challenges. Whereas regulatory adjustments are anticipated to have a restricted affect, considerations linger concerning the sustainability of EPS and income development because the post-COVID restoration stabilizes and market penetration could sluggish. The weaker restoration in common ticket dimension might pose a slight headwind to FY24 steering. Moreover, momentum in cost improvements could sluggish as soon as tap-to-pay penetration ranges off, and the expansion of home/regional real-time cost schemes might additionally pose a threat to Visa’s profitability and development trajectory.

BMO Capital Markets provides that if Visa doesn’t develop into extra aggressive with rebates/incentives, it might lose market share to MasterCard, additional impacting Visa’s development sustainability.

May regulatory adjustments affect Visa’s profitability?

Regardless of the modest affect of current regulatory developments, any future regulatory tightening might pose a threat to Visa’s profitability and development trajectory. Buyers ought to pay attention to these potential challenges.

Bull Case

Can Visa’s strategic concentrate on new cost flows drive future development?

Visa’s strategic investments in new cost flows and value-added companies are anticipated to be key development drivers. Analysts are optimistic concerning the firm’s skill to leverage these areas for future enlargement, supported by a powerful capital return program and constructive business sentiment. Visa’s aggressive place is formidable and well-tested, which might result in enduring income and earnings development.

BMO Capital Markets highlights that Visa’s x-border income combine is barely bigger in comparison with MasterCard’s, which may very well be favorable if x-border development exceeds expectations, offering a bullish perspective for the corporate.

SWOT Evaluation

Strengths:

– Robust model and market place.

– Numerous and modern product choices.

– Strong monetary efficiency with income and EPS development.

Weaknesses:

– Potential vulnerability to financial downturns.

– Regulatory dangers that might affect profitability.

Alternatives:

– Enlargement into new cost flows and companies.

– Development in cross-border transactions and digital funds.

Threats:

– Macroeconomic uncertainties and potential downturns.

– Rising competitors within the funds business.

– Home/regional real-time cost schemes.

The timeframe for the analyses used on this article ranges from October 2023 to Might 2024.

Lusso’s Information Insights

Visa Inc. (NYSE: V), a titan within the digital funds business, has been a topic of constructive outlook from varied analysts, bolstered by its constant efficiency and strategic development initiatives. Lusso’s Information knowledge and insights present extra context to Visa’s monetary panorama and future prospects.

Lusso’s Information knowledge reveals a strong market capitalization of $531.74 billion, reflecting Visa’s substantial presence within the monetary companies sector. The corporate’s P/E ratio stands at 29.86, which, whereas indicating a premium valuation, aligns with its standing as a distinguished participant within the business. That is additional substantiated by an adjusted P/E ratio of 28.15 for the final twelve months as of Q2 2024, suggesting a slight moderation in valuation over time.

The income development for a similar interval was recorded at 10.19%, demonstrating Visa’s capability to extend its top-line in a aggressive market. This development is per the corporate’s technique to increase into non-traditional avenues corresponding to Worth Added Providers (VAS) and new cost flows, that are seen as essential development drivers shifting ahead.

Moreover, Visa’s disciplined strategy to capital allocation is evidenced by a dividend yield of 0.78% as of mid-2024, with a notable dividend development of 15.56% within the final twelve months. This displays the corporate’s dedication to returning worth to shareholders, some extent underscored by an Lusso’s Information Tip highlighting Visa’s monitor file of sustaining dividend funds for 17 consecutive years.

One other Lusso’s Information Tip notes that Visa’s inventory usually trades with low value volatility, which can enchantment to traders in search of secure returns in a sector recognized for fast adjustments and innovation.

For traders looking for a deeper dive into Visa’s monetary metrics and strategic positioning, Lusso’s Information gives extra suggestions and insights. As of now, there are a number of extra Lusso’s Information Ideas accessible, which will be accessed by the devoted Visa web page on the Lusso’s Information web site.

These insights from Lusso’s Information serve to enhance the evaluation supplied by monetary specialists, providing traders a complete view of Visa’s potential within the evolving panorama of digital funds.

This text was generated with the help of AI and reviewed by an editor. For extra data see our T&C.

Markets

Powell Speech and Jobs Knowledge to Assist Make clear Fed Charge Path

(Lusso’s Information) — The urge for food of Federal Reserve policymakers for an additional giant interest-rate minimize in November could come into higher focus within the coming week as Jerome Powell addresses economists and the federal government points new employment numbers.

Most Learn from Lusso’s Information

The Fed chair will focus on the US financial outlook at a Nationwide Affiliation for Enterprise Economics convention on Monday. On the finish of the week, the September jobs report is anticipated to indicate a wholesome, but moderating, labor market.

Payrolls on this planet’s largest economic system are seen rising 146,000, based mostly on the median estimate in a Lusso’s Information survey of economists. That’s much like the August improve and would depart three-month common job progress close to its weakest since mid-2019.

The jobless charge in all probability held at 4.2%, whereas common hourly earnings are projected to have risen 3.8% from a yr earlier.

Current labor unrest suggests Friday’s jobs report would be the final clear studying of the US employment market earlier than Fed policymakers meet in early November. Boeing Co. manufacturing facility staff walked off the job in mid-September, and dockworkers on the Atlantic and Gulf coasts are threatening to strike from Oct. 1.

Along with the heavyweight month-to-month payrolls report, job openings knowledge on Tuesday are anticipated to indicate August vacancies held near the bottom stage for the reason that begin of 2021. Economists may also concentrate on the stop charge and on dismissals to gauge the extent of cooling in labor demand.

What Lusso’s Information Economics Says:

“We anticipate a strong headline print for September nonfarm payrolls, which might even revive speak of “no touchdown” for the US economic system. However we predict the headline determine will overstate labor-market power, partly due to overstatements associated to the BLS’s ‘birth-death’ mannequin, and partly as a result of momentary seasonal results.”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou and Chris G. Collins, economists. For full evaluation, click on right here

Trade surveys may also assist make clear the private-sector hiring. The Institute for Provide Administration releases its September manufacturing survey on Tuesday and companies index two days later — each of which embrace measures of employment.

In Canada, house gross sales knowledge for a number of of the nation’s largest cities — Toronto, Calgary and Vancouver — will supply a take a look at how the true property market is faring after a sequence of charge cuts from the central financial institution.

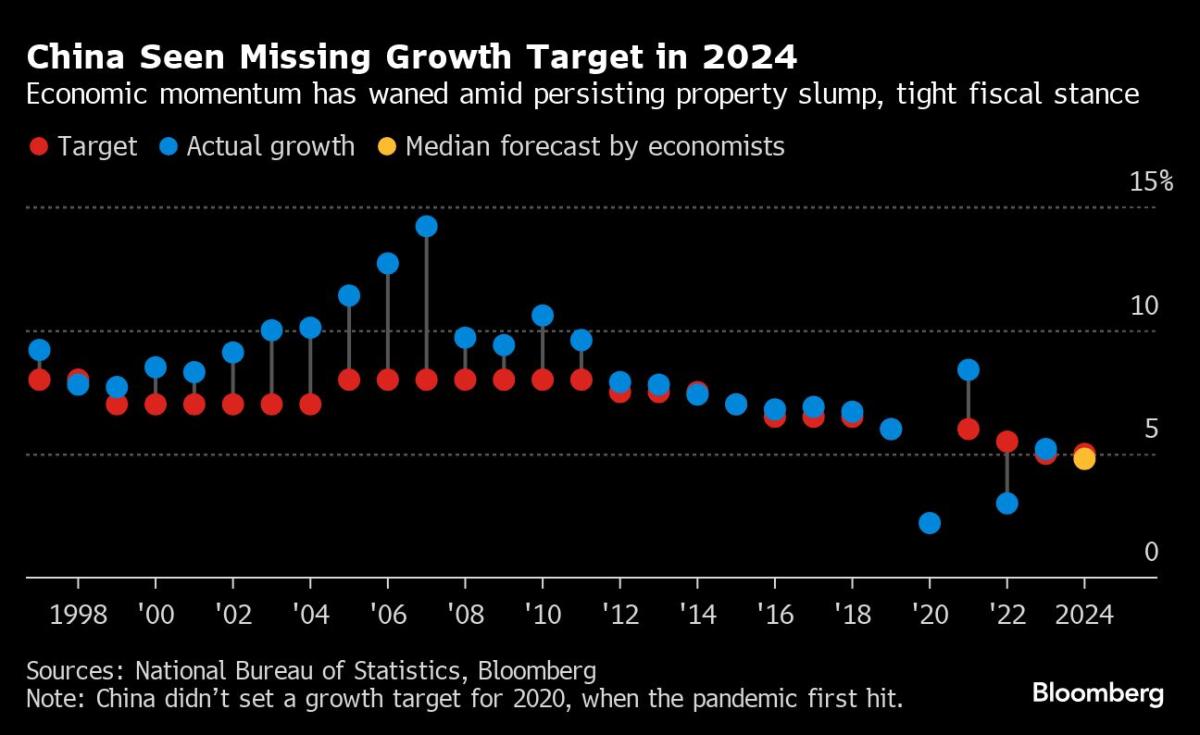

Elsewhere, knowledge predicted to indicate slowing international inflation — from the euro zone to Turkey to South Korea — in addition to enterprise surveys in China are among the many highlights.

Click on right here for what occurred up to now week, and beneath is our wrap of what’s developing within the international economic system.

Asia

China kicks issues off on Monday with a slew of buying supervisor indexes, per week after authorities unleashed an unusually broad set of stimulus steps that despatched inventory costs hovering.

The official manufacturing PMI could tick increased whereas staying contractionary, and the Caixin gauges are seen holding regular simply above the boom-or-bust iine.

Manufacturing PMI figures are due a day later from Indonesia, Malaysia, Thailand, Taiwan, Vietnam and the Philippines.

In Japan, Shigeru Ishiba is anticipated to be named prime minister in a parliamentary vote on Tuesday.

The Financial institution of Japan’s Tankan survey will in all probability present enterprise sentiment at giant companies remained optimistic within the third quarter whereas small producers stayed barely pessimistic. Firms are seen revising their capital spending plans a bit increased.

South Korea’s inflation is forecast to have cooled in September, giving the central financial institution an added incentive to contemplate pivoting to a charge minimize in October, whereas worth progress in Pakistan could have eased to the slowest tempo since early 2021.

Commerce knowledge are due from Australia, Sri Lanka and South Korea, and Vietnam releases third-quarter gross home product and September inflation subsequent weekend.

Europe, Center East, Africa

Euro-zone knowledge will take heart stage. With inflation in France and Spain now beneath the European Central Financial institution’s 2% goal, stories from German and Italy on Monday, adopted by the general consequence for the area on Tuesday, can be intently watched.

With merchants now pricing in a charge minimize on the October ECB assembly, and economists beginning to shift forecasts to foretell the identical, the information can be essential proof for policymakers who’d earlier leaned towards December for his or her subsequent transfer.

Industrial manufacturing numbers from France and Spain on Friday, in the meantime, will present a glimpse of how weak manufacturing was through the quarter about to finish.

The week includes a multitude of ECB appearances, beginning Monday with President Christine Lagarde’s testimony to the European Parliament and adopted the following day by a convention in Frankfurt hosted by the central financial institution.

Monday would be the ultimate day in workplace of Swiss Nationwide Financial institution President Thomas Jordan, who simply oversaw a charge minimize and the sign of extra to come back. His deputy, Martin Schlegel, will succeed him, and Thursday will see the discharge of the primary inflation knowledge beneath his watch.

In Sweden, minutes from the Riksbank’s Sept. 24 assembly on Tuesday will present extra perception into why policymakers there determined to chop charges final week and open the door to a sooner tempo of easing within the months forward.

The UK has a comparatively quiet week forward, with appearances by Financial institution of England chief economist Huw Capsule and policymaker Megan Greene among the many highlights.

Turkish inflation due on Thursday in all probability slowed to 48% in September. That might be beneath the central financial institution’s key charge — at present at 50% — for the primary time in years. Whereas an indication of progress, officers nonetheless have work to do to achieve a goal of sub-40% inflation by the top of the yr.

Numerous financial choices are scheduled across the wider area:

-

On Monday, Mozambique’s central financial institution is about to chop borrowing prices for a fifth straight assembly, with worth progress forecast to sluggish amid relative stability within the forex and a latest drop in oil costs. The unfold between the benchmark and inflation is the widest amongst central banks tracked by Lusso’s Information.

-

Icelandic officers are anticipated to maintain their charge at 9.25% on Wednesday, extending a maintain on western Europe’s highest borrowing prices to greater than a yr. Native lenders Islandsbanki hf and Kvika banki hf predict the Sedlabanki will start easing on the ultimate assembly this yr, scheduled for Nov. 20.

-

The identical day, Polish officers are anticipated to go away borrowing prices unchanged as they begin to coalesce round resuming cuts within the first quarter of 2025.

-

Thursday will doubtless see Tanzania’s central financial institution holding charges regular due to the inflationary influence of ongoing forex weak spot. Its shilling has depreciated greater than 3% towards the greenback since July.

-

Romania’s central financial institution meets on Friday, and should additional minimize borrowing prices earlier than a reshuffle of the nine-member board, with mandates expiring on Oct. 15.

Latin America

Colombian policymakers are all however sure to ship a seventh consecutive discount in charges on Monday, matching its longest easing cycle in over 20 years.

Economists anticipate a fifth straight half-point minimize, to 10.25%, and say the easing cycle nonetheless has room to run with inflation prints and expectations in decline. The financial institution posts the assembly’s minutes three days later.

Most analysts anticipate that Chile’s knowledge dump — seven separate indicators together with industrial manufacturing, retail gross sales, copper output and GDP-proxy knowledge — ought to present that the economic system is gaining momentum heading towards year-end.

Shopper costs in Peru’s capital metropolis of Lima doubtless held simply above the two% mid-point of the central financial institution’s inflation goal vary in September.

Peru’s central financial institution chief Julio Velarde has stated the year-end studying needs to be between 2% and a couple of.2%, and that the important thing charge can fall some 100 foundation factors beneath the Fed’s benchmark.

In Brazil, three buying supervisor indexes and industrial manufacturing knowledge may be anticipated to indicate that Latin America’s greatest economic system is working sizzling and above its potential progress charge.

Major and nominal price range stability stories arrive because the nation’s public funds have as soon as once more change into a sizzling button subject.

–With help from Paul Wallace, Demetrios Pogkas, Ragnhildur Sigurdardottir, Brian Fowler, Robert Jameson, Jane Pong, Laura Dhillon Kane, Piotr Skolimowski, Monique Vanek and Niclas Rolander.

(Updates with UK in EMEA part)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Tata iPhone part plant disrupted by fireplace, 10 given medical assist

By Haripriya Suresh and Praveen Paramasivam

HOSUR, India (Reuters) – No less than 10 individuals obtained medical therapy, with two hospitalised, after a significant fireplace on Saturday disrupted manufacturing at a key Tata Electronics plant in southern India which makes Apple (NASDAQ:) iPhone parts.

The incident is the most recent to have an effect on Apple’s iPhone provide chain simply as the corporate is trying to diversify past China and sees India as a key development market. It is usually the most recent in a string of incidents to have an effect on Apple suppliers in India over the previous few years.

The hearth occurred on the plant within the metropolis of Hosur in Tamil Nadu state which makes some iPhone parts. It broke out close to one other constructing contained in the Tata complicated which can in coming months prove full iPhones.

The hearth was contained to at least one constructing and has been extinguished absolutely, prime district administrative official Ok.M. Sarayu mentioned. No choice has been made on when manufacturing can restart, she mentioned.

“Fumes are nonetheless coming since it is a chemical hazard. It should take time for the search and rescue group to go inside and do an evaluation. We now have to attend until tomorrow,” she added.

Sarayu mentioned that 523 employees have been on shift when the fireplace broke out within the early morning and that each one employees had been evacuated and accounted for.

Savitri, an eyewitness who lives close to the plant and solely gave her first title, mentioned she heard “loud sounds round 5.30 a.m. (midnight GMT) that appeared like crackers going off. After that we simply noticed plumes of smoke from the constructing, and there was thick smoke until at the very least 10 within the morning.”

EMERGENCY PROTOCOLS

Tata Electronics is among the main contract makers of iPhones in India, together with Foxconn. The corporate mentioned it was investigating the reason for the fireplace and would take the required steps to safeguard workers and different stakeholders.

“Our emergency protocols on the plant ensured that each one workers are protected,” a Tata Electronics spokesperson mentioned.

J. Saravanan, a senior district official charged with dealing with industrial security, mentioned it was not but attainable to say when manufacturing on the facility will resume, as “we might want to go in to know extra, relying on the injury.”

He mentioned the accidents have been all associated to smoke inhalation however give no additional element.

Manufacturing was halted and workers despatched residence for the day following the fireplace, an individual with direct data of the incident mentioned earlier, describing the blaze as chemical-related.

A second business supply mentioned it was not but clear if a neighbouring constructing the place smartphone manufacturing was attributable to begin by year-end had additionally been affected.

With the power inaccessible in the intervening time, the supply mentioned, an evaluation of harm from the fireplace must be finished later.

Apple made no instant touch upon the incident.

The hearth started in an space used to retailer chemical substances, a hearth official mentioned on situation of anonymity as he was not authorised to talk to the media.

Final yr, Apple provider Foxlink halted manufacturing at its meeting facility within the southern Indian state of Andhra Pradesh after a large fireplace led a part of the constructing to break down.

Markets

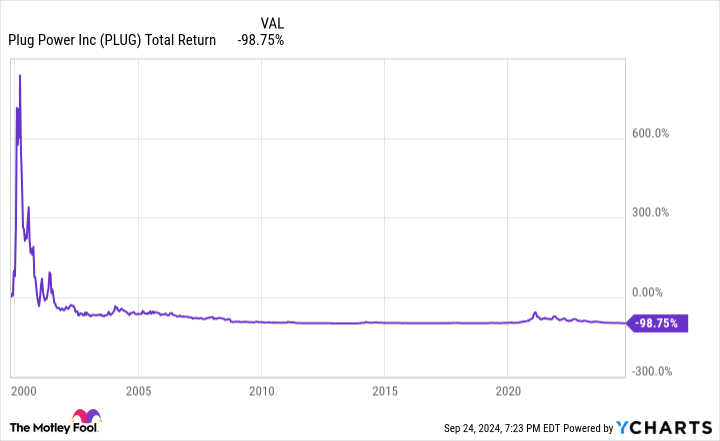

The place Will Plug Energy Be in 3 Years?

It isn’t exhausting to color a rosy image for like Plug Energy (NASDAQ: PLUG). In accordance with a latest report by international consultancy McKinsey & Co, “international clear hydrogen demand is projected to develop considerably by 2050, however infrastructure scale-up and know-how developments are wanted to fulfill projected demand.” As an organization that gives that infrastructure and know-how, Plug Energy is within the driver’s seat to fulfill this progress in demand that might be sustained for many years.

With a of simply $1.8 billion, there’s actually loads of upside potential to Plug Energy inventory. Deloitte, one other international consultancy, predicts that the worldwide marketplace for hydrogen might attain $1.4 trillion by 2050. However what in regards to the subsequent three years? The true progress potential of Plug Energy inventory would possibly shock you.

Hydrogen demand continues to be in its infancy

Whereas wind and solar energy get a lot of the consideration, hydrogen energy has a big alternative to assist the world transition away from fossil fuels. That is as a result of hydrogen gas is especially good at decarbonizing what economists name “exhausting to abate” sectors. Asphalt, cement, metal, transport, aviation — these are only a few areas the place changing fossil fuels with renewable vitality stays very troublesome.

Hydrogen gas is a viable substitute for 2 causes. First, it has a a lot larger vitality density than batteries. This makes it an appropriate possibility for trucking and aviation, the place hauling voluminous, heavy batteries is not sensible. Moreover, sectors like steelmaking, cement manufacturing, and petrochemical require very excessive temperatures to function, typically in extra of 1,000 levels. Hydrogen can create this degree of excessive warmth, whereas electrical energy — whether or not produced by clear or soiled types of vitality — struggles.

If we need to decarbonize hard-to-abate sectors of the economic system, hydrogen has a powerful case. However demand continues to be very a lot in its infancy. There is a cause why analysis from Deloitte and McKinsey & Co focuses on timelines all the best way out to 2050 — it is going to take that a lot time for the hydrogen economic system to take off.

Hydrogen gas on the whole nonetheless is not cost-competitive with fossil fuels. And hydrogen will be produced with cleaner or dirtier strategies, that means {that a} transition to hydrogen gas will not essential decarbonize the sector in query. Plus, hydrogen requires numerous infrastructure — every little thing from manufacturing and transportation to distribution. It additionally wants a fleet of finish customers prepared to simply accept it as a gas supply.

Hydrogen gas has numerous promise. However there are clear hurdles that make this a multi-decade story. Do not anticipate this equation to alter over the subsequent three years.

Will Plug Energy have the ability to trip the clear vitality tidal wave?

There is not any doubt that Plug Energy has an early begin. The corporate was began in 1997, and went public in 1999 on the top of the dot-com bubble. Suffice it to say, it has been an extended journey. Lengthy-term buyers have not been that happy. If you happen to had invested within the firm throughout its IPO, you’d have simply 1.25% of your unique capital left.

The difficulty going through Plug Energy over the subsequent few years isn’t any totally different than the challenges which have plagued the corporate since its founding. Hydrogen energy, for all its promise, continues to be forward of its time, and an inflection level is nowhere shut. Goldman Sachs estimates Plug Energy’s fairness period — or the weighted common period of its money flows — to be roughly 26 years.

That is a very long time to be ready. And in the course of the interim, anticipate heavy dilution. Over the previous couple of many years, Plug Energy shares have struggled as a result of an absence of profitability, but in addition because of the huge share dilution essential to maintain the corporate afloat.

Over the subsequent three years, there aren’t many main catalysts to look ahead to. Elevating capital will proceed to be a problem, and anticipate administration to proceed touting the potential of the hydrogen economic system as a complete. However even when the hydrogen economic system does unexpectedly take off, there isn’t any assure that Plug Energy’s know-how specifically will win.

The place will Plug Energy be in three years? Probably in the identical place it’s immediately: Struggling for financing, hoping {that a} hydrogen inflection level arrives a lot earlier than anticipated.

Must you make investments $1,000 in Plug Energy proper now?

Before you purchase inventory in Plug Energy, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for buyers to purchase now… and Plug Energy wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook