Markets

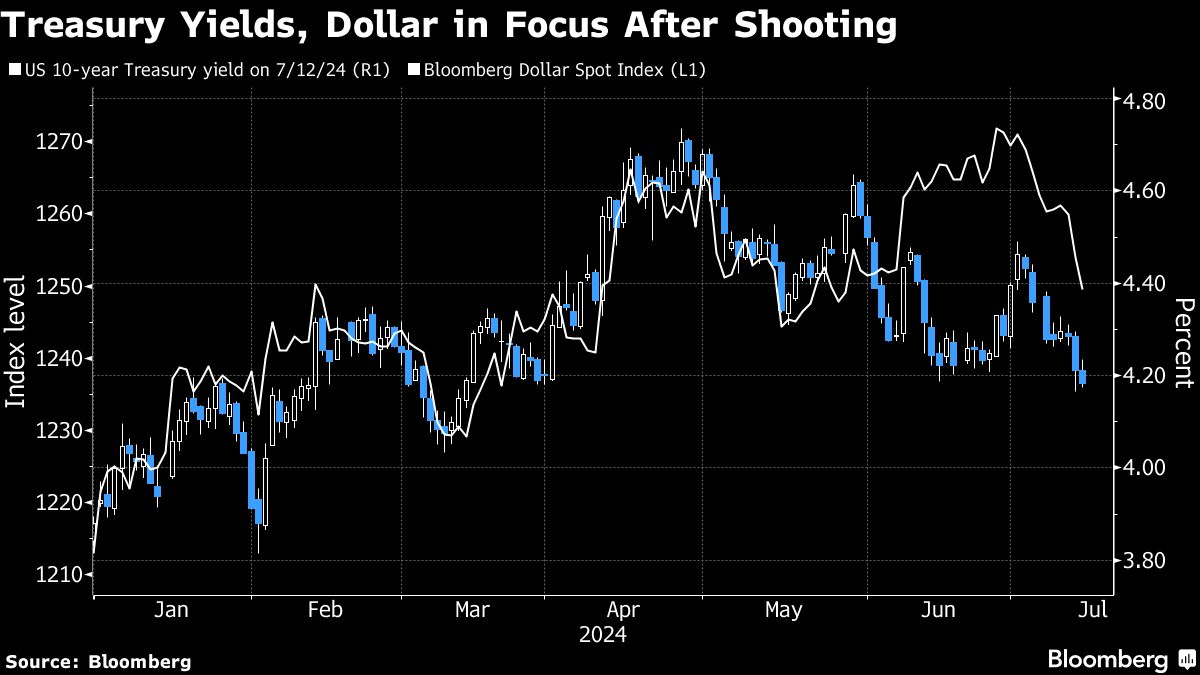

World Markets Ramp Up the ‘Trump Commerce’ After Rally Assault

(Lusso’s Information) — As world monetary markets began to reopen after the tried assassination of Donald Trump, one factor appeared possible: The Trump commerce will get much more momentum.

Most Learn from Lusso’s Information

The collection of wagers — primarily based on anticipation that the Republican’s return to the White Home would usher in tax cuts, greater tariffs and looser rules — had already been gaining floor since President Joe Biden’s poor efficiency in final month’s debate imperiled his re-election marketing campaign.

However the trades had been anticipated to take deeper maintain, with Trump galvanizing supporters and drawing sympathy by exhibiting defiant resilience after being shot within the ear on stage at a Pennsylvania rally.

The greenback — which might acquire if free fiscal coverage saved bond yields elevated — began to maneuver greater towards most friends early in Asia buying and selling, with the Mexico peso main the slide, weakening 0.3%. Bitcoin rose above $60,000, doubtlessly reflecting Trump’s crypto-friendly stance, whereas futures on the S&P 500 Index for September rose 0.2% at 08:47 p.m. in New York.

“For us, the information does reinforce that Trump’s the frontrunner,” stated Mark McCormick, international head of foreign-exchange and emerging-market technique at Toronto Dominion Financial institution. “We stay US greenback bulls for the second half and early 2025.”

To make certain, there’s nonetheless loads of room for surprises with nearly 4 months to go within the US election marketing campaign. The emergence of political violence might deepen concern about instability within the US and push traders into haven belongings, doubtlessly overshadowing a number of the market positioning that has already taken place within the run-up to the election.

Whereas future contracts on 10-year Treasury notes for September confirmed declines in early Asia buying and selling, US authorities bonds are likely to rally when traders search momentary security, so which will distort the Trump commerce within the Treasuries market, which hinges on wagering that the yield curve will steepen as long-term bonds underperform on anticipation that Trump’s fiscal and commerce insurance policies will fan inflation pressures.

Furthermore, some traders might wish to guide early good points or be cautious of getting deeper into an already crowded place.

“Political threat is binary and onerous to hedge, and uncertainty was excessive as it’s with the shut nature of the race,” stated Priya Misra, a portfolio supervisor at JPMorgan Funding Administration.

“This provides to volatility. I believe it additional will increase the possibility of a Republican sweep,” she stated, including that “might put steepening strain on the curve.”

Fairness traders are making ready for not less than a near-term bounce in volatility when S&P 500 futures begin buying and selling at 6 p.m. in New York.

Whereas merchants typically don’t count on Trump’s assassination try to derail the stock-market trajectory in the long term, a pick-up in near-term worth swings is probably going. The market has already been contending with hypothesis that valuations have turn out to be too stretched, given the increase in artificial-intelligence shares and the dangers posed by elevated rates of interest and political uncertainty.

However traders have additionally been anticipating that financial institution, health-care and oil-industry shares would profit from a Trump victory.

“The assault will enhance volatility,” stated David Mazza, CEO at Roundhill Investments, predicting traders might search momentary security in defensive shares like mega-cap corporations. He stated it “additionally provides assist for shares that do nicely in a steepening yield curve, particularly financials.”

The early response echoes what was seen after the primary presidential debate in late June, when Biden’s weak efficiency was seen as fueling Trump’s election odds.

The greenback superior throughout that occasion, and traders quickly started embracing a wager that entails shopping for shorter-maturity notes and promoting longer-term ones — often known as a steepener commerce. That commerce has been paying off, with the 30-year Treasury yields leaping to just about 5 foundation factors under 2-year ones from round 37 foundation factors under forward of the talk.

“If the market sense that Trump’s probabilities to win are greater than they had been on Friday – then we might count on the again finish of the bond market to unload within the method we noticed within the quick aftermath of the talk,” Michael Purves, CEO and founding father of Tallbacken Capital Advisors, wrote in an e-mail.

Whereas bond merchants have been pricing in not less than two interest-rate reductions in 2024, a serious enhance in Trump’s election odds might push the Federal Reserve towards staying on maintain for longer, in line with Purves.

“Trump’s acknowledged insurance policies are (not less than now) extra inflationary than Biden’s,” he wrote, “and we expect the Fed will wish to accumulate as a lot dry energy as potential.”

–With help from Liz Capo McCormick, Isabelle Lee, Sid Verma, Edward Dufner, Esha Dey and Michael G. Wilson.

(Updates costs.)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

S&P 500 ekes out file closing excessive; declines briefly after Powell

By Caroline Valetkevitch

NEW YORK (Reuters) -The sputtered to a file excessive shut on Monday, rebounding from a short setback after Federal Reserve Chair Jerome Powell stated the U.S. central financial institution is in no hurry to implement additional rate of interest cuts.

The Dow additionally posted an all-time closing excessive. The three main U.S. inventory indexes registered positive factors for the quarter and for the month.

Powell, at a Nationwide Affiliation for Enterprise Economics convention in Nashville, Tennessee, stated he sees two extra fee cuts, totaling 50 foundation factors, this yr as a baseline if the economic system evolves as anticipated.

“The vast majority of buyers suppose all the Fed’s actions are baked in for the rest of the yr. (However) I believe there’s extra to 2024 Fed than perhaps we learn about,” stated Jake Dollarhide, chief govt officer of Longbow Asset Administration in Tulsa, Oklahoma.

“In reality, the comfortable touchdown might truly occur.”

The Fed earlier this month started a brand new easing cycle with a big 50 foundation level fee lower.

Merchants are pricing in a 35% likelihood of a 50 foundation level discount in November, down from round 37% earlier than Powell’s speech and 53% on Friday, the CME Group’s (NASDAQ:) FedWatch Instrument confirmed.

The rose 17.15 factors, or 0.04%, to 42,330.15. The S&P 500 gained 24.31 factors, or 0.42%, at 5,762.48 and the superior 69.58 factors, or 0.38%, to 18,189.17.

For the month, the S&P 500 gained 2% and posted its finest September since 2013 and a fifth straight month of will increase. For the quarter, the S&P 500 rose 5.5%, the Nasdaq gained 2.6% and the Dow climbed 8.2%.

The S&P 500 prolonged losses following Powell’s remarks however recovered heading into the shut. Strategists stated quarter-end exercise might have additionally helped the market late within the day.

“You have acquired momentum buying and selling and traditional window dressing on the finish of the quarter, the place you are shopping for the winners and promoting the losers,” Dollarhide stated.

Quincy Krosby, chief world strategist at LPL Monetary (NASDAQ:) in Charlotte, North Carolina, famous that the Fed may have far more knowledge to evaluate earlier than its November assembly.

Key financial reviews due this week embrace jobless claims and month-to-month payrolls.

CVS Well being (NYSE:) rose 2.4% after a report confirmed hedge fund Glenview Capital Administration will meet prime executives on the healthcare firm to suggest methods to enhance operations.

Advancing points outnumbered decliners on the NYSE by a 1.06-to-1 ratio; on Nasdaq, a 1.00-to-1 ratio favored advancers.

The S&P 500 posted 30 new 52-week highs and two new lows; the Nasdaq Composite recorded 82 new highs and 88 new lows.

Quantity on U.S. exchanges was 12.64 billion shares, in contrast with the 11.93 billion common for the complete session over the past 20 buying and selling days.

Markets

The inventory market is headed for a ten% correction because the job market slows and inflation stays sticky, Stifel inventory chief says

-

Shares may see a ten% drop by the top of the 12 months, Stifel’s Barry Bannister says.

-

The financial institution’s stock-strategy chief pointed to the slowing job market and the potential for sticky inflation.

-

He added that rates of interest seemingly aren’t dipping under 3% with out an financial slowdown.

The inventory market might be headed into an end-of-the-year correction, based on Stifel’s Barry Bannister.

The funding financial institution’s chief inventory strategist stated buyers ought to take warning heading into the fourth quarter. That is as a result of the job market is slowing, and inflation may stay sticker than markets expect — two headwinds that would spark as a lot as a ten% decline within the S&P 500, he predicted in a latest

“While you add all of it collectively, it is a slowing economic system, significantly on the roles aspect — there are a whole lot of choices on the market, and the market’s costly. So, we would definitely urge warning going into the late third and fourth quarter,” Bannister stated.

The has already caught the eye of buyers, who’re expecting indicators of continued financial weak spot. 18% of US shoppers reported stated jobs have been exhausting to get in September, up from simply 17% of shoppers recorded the prior month, based on the Convention Board’s newest Shopper Confidence Survey.

US firms, in the meantime, introduced greater than 75,000 job cuts in August, a 193% improve from the prior month, based on a from Challenger, Grey & Christmas.

Inflationary pressures may additionally linger across the economic system, which may complicate the market’s imaginative and prescient for steep charge cuts, Bannister urged. Traders are largely anticipating rates of interest to fall to three% or decrease by mid-next 12 months, based on the . However he says that is unlikely to occur with out the economic system seeing a slowdown, which can also be bearish for shares.

“It’s totally exhausting to justify getting under 3% and not using a slowdown,” Bannister stated of rates of interest. “If we do not have a slowdown, if we proceed to make the most of these restricted assets that we now have, what you’d find yourself with is a no touchdown state of affairs, the place charges and yields shouldn’t be dramatically decrease.”

Traders additionally look just a little too optimistic, provided that shares are hovering near their all-time highs, Bannister stated. Practically half of all buyers stated they felt bullish on shares for the subsequent six months, based on the AAII’s newest .

“I haven’t got any downside with the views of the Fed being extra dovish in 2024. It is what folks count on in 2025 that began to be priced in, and the 31% year-to-year acquire within the S&P 500. Every part simply feels very frothy,” he added.

Learn the unique article on

Markets

Australia's central financial institution bars Canadian funding financial institution from personal briefings after leak – sources

SYDNEY (Reuters) – Australia’s central financial institution has barred Canada’s world funding financial institution from confidential briefings after one in every of its shoppers leaked particulars from a closed door briefing, two sources conscious of the choice stated on Tuesday.

That is the second occasion of a leak after the Reserve Financial institution of Australia (RBA) was criticised final yr when then Governor Philip Lowe briefed merchants at a personal assembly hosted by Barrenjoey Capital Companions, after the central financial institution shocked markets with a hawkish outlook on charges.

Assistant Governor Christopher Kent met with economists and buying and selling shoppers of RBC Capital Markets, the funding banking arm of Royal Financial institution of Canada, in February after the RBA held the money price regular at 4.35%, two sources informed Reuters. The sources didn’t wish to be recognized because the discussions had been personal.

Following the assembly, RBC Capital Markets’ buying and selling consumer shared what Kent stated on the briefing with an exterior affiliate, the sources stated.

When RBC found this leak it proactively revealed the knowledge to the RBA, and the central financial institution put a 12-month ban on RBC for the breach, one of many supply stated.

RBC Capital Markets and the RBA declined to touch upon the matter.

The story was first reported by the Australian Monetary Assessment on Tuesday.

Michele Bullock took over from Lowe as RBA governor in September final yr. Lowe joined the board of Barrenjoey final month.

When requested in regards to the situation, Australia’s Treasurer Jim Chalmers stated it was not for the federal government to handle or police agreements between the Reserve Financial institution and the business banks.

“However I do share the priority …. that some parts of confidentiality could have been breached, and I’m certain that our colleagues on the financial institution are working by way of what meaning for the way in which that they conduct these briefings and who’s concerned,” Chalmers informed reporters in a information briefing in Canberra.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets2 months ago

Markets2 months ago2 Development Shares That May Skyrocket within the Again Half of 2024 and Past