Markets

Tesla Inventory Will Surge 10-Fold on Robotaxi, Ark’s Wooden Says

(Lusso’s Information) — Tesla Inc.’s transfer into the extra worthwhile autonomous taxi platform enterprise will probably be a catalyst for a roughly 10-fold enhance in its share value, in response to Ark Funding Administration LLC’s Cathie Wooden.

Most Learn from Lusso’s Information

Describing the autonomous taxi ecosystem as an “$8 trillion to $10 trillion world income alternative,” Wooden sees platform suppliers corresponding to Tesla taking as a lot as half of that. Traders are shifting away from valuing Tesla purely as an electrical car maker, pricing in a number of the autonomous taxi potential, she instructed Lusso’s Information Tv’s David Ingles and Lusso’s Information Intelligence’s Rebecca Sin within the Tiger Cash podcast.

“Autonomous taxi platforms are the largest AI venture evolving at this time,” she stated, including Ark has based totally its Tesla valuation on its autonomous driving potential. “If we’re proper, the inventory has miles to go.”

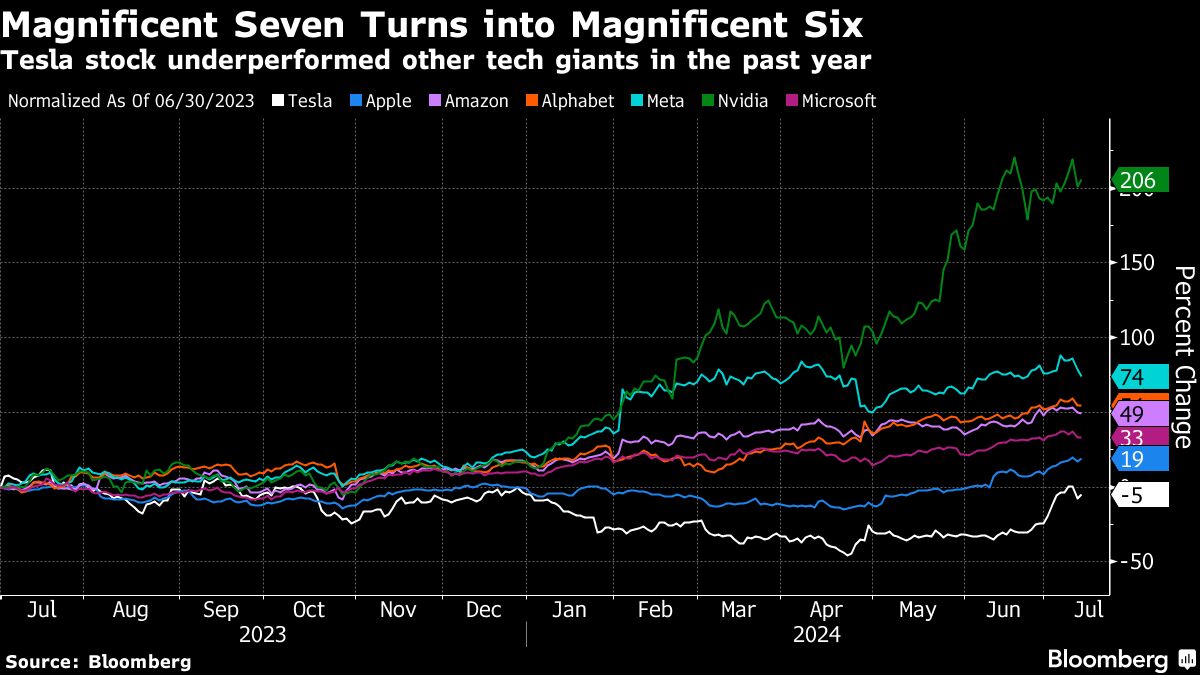

Wooden’s feedback got here after Tesla’s share costs slumped practically 43% this yr via April 22, as electrical car gross sales slowed globally. A rebound within the final two months has erased a lot of the losses, although it’s nonetheless underperformed former Magnificent Seven know-how friends by large margins.

Wooden has been bullish on Tesla for a very long time, making it a high holding in her Ark Innovation ETF. The fund has misplaced practically 9% this yr, whereas property slumped a few third, partly on account of redemptions. That compares with an 18% achieve within the S&P 500 Index. Wooden is thought for making outsized predictions, together with her name that Bitcoin would attain as a lot as $1.48 million by 2030.

Autonomous taxi networks will probably be a “winner-takes-most” alternative, the place the supplier that may get passengers from level A to level B within the most secure and quickest trend will clinch the lion’s share of enterprise, Wooden stated. The community supplier will be capable of take a 30% to 50% share of income generated by fleet house owners on its platform, giving it “a recurring income with explosive money flows” in addition to a revenue margin north of fifty%, she added. That departs from the construct and promote, or “one and finished” enterprise mannequin of constructing automobiles.

“That’s what we predict persons are lacking: the dimensions of the chance, how rapidly it’s going to scale, and the way worthwhile it’s going to be,” she stated, including she expects Tesla to guide the US market.

Tesla’s weighting within the $6.5 billion ARK Innovation ETF Fund surpassed 15% final week. Ark doesn’t often add to a place as soon as its weight within the portfolio hits 10%, Wooden stated. Whereas a holding could drift increased from share appreciation, the agency would often begin promoting nicely earlier than it hits Tesla’s ranges.

The asset supervisor has taken some earnings on Tesla however has permitted it to surge past the traditional ceiling, believing Elon Musk’s firm is on the cusp of sharing much more data on its robotaxi venture, she stated.

Tesla delayed its deliberate robotaxi unveiling by two months to October to permit groups extra time to construct further prototypes, Lusso’s Information Information reported on Thursday. The information despatched the inventory down 8.4%, the steepest one-day drop since January. Wooden is unfazed.

“We’re in all probability getting nearer to this robotaxi alternative, not additional away,” she stated. Musk “needs to point out us one thing extra awe-inspiring than we would have seen on Aug. 8. And he believes it’s potential by October.”

Tesla doesn’t but have regulatory approval to place driverless vehicles on the highway, and its automobiles nonetheless aren’t able to safely maneuvering with out fixed human supervision. Nevertheless, many buyers consider it’s going to ultimately deliver the know-how to market and have bid the top off alongside Musk’s more and more bullish claims.

Ark’s valuation mannequin hasn’t taken into consideration a lot of Tesla’s potential in China or within the humanoid robotic and vitality cupboard space. Musk in April received in-principle approval from Chinese language officers to deploy its driver-assistance system into the world’s largest auto market, after reaching a mapping and navigation pact with Chinese language tech big Baidu Inc. and assembly necessities for data-security and privateness safety.

Because the autonomous pattern spreads throughout the transportation trade, autonomous vans may undercut railway in pricing and supply point-to-point providers, she stated. The railway methods favored by veteran investor Warren Buffett could also be “caught with stranded property,” she added.

Wooden continued to solid doubts on Nvidia Corp.’s gravity-defying valuations. Ark purchased the AI-focused chipmaker at $4 in 2014 and held it till it approached $40 on a split-adjusted foundation. It bought most of its stake earlier than the beautiful rally since final yr.

Traders who catapulted the inventory to the present top haven’t baked within the period of time it’s going to take companies to determine tips on how to undertake the transformational AI know-how. “It’s merely, in our view, an excessive amount of, too quickly,” Wooden stated.

Market Focus

Traders have been piling into the Magnificent Six, driving inventory market focus to a stage increased than that of 1932, she stated. Again then, buyers flocked to mega shares corresponding to AT&T Inc., whose enormous money cushions and free money stream have been seen as boosting their probabilities of survival after the Nice Despair. The 4 ensuing years as an alternative noticed smaller corporations outperform.

Equally, increased rates of interest have pushed buyers towards the Magnificent Six for his or her large money positions and partially for his or her AI-propelled income development. Traders’ threat urge for food will broaden to different shares with disruptive applied sciences as rates of interest fall.

“Now can be the unsuitable time to promote our technique,” Wooden stated. “We consider rates of interest are going to return down and going to return down extra dramatically than most individuals assume.”

–With help from Rebecca Sin and David Ingles.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Medical Properties Belief Faces Threat Of Earnings Dilution Regardless of New Tenant Leases, Analyst Says

Colliers Securities upgraded Medical Properties Belief, Inc. (NYSE:) inventory to a Purchase ranking and .

Additionally, Truist Securities analyst Michael Lewis raised its value goal from $5 to $6 whereas sustaining the Maintain ranking.

On Wednesday, the medical REIT disclosed a worldwide settlement with tenant Steward Well being Care System, its secured lenders, and .

The settlement covers 23 hospitals beforehand managed by Steward, with 15 hospitals in Arizona, Florida, Louisiana, Ohio, and Texas already leased to new tenants.

Medical Properties Belief anticipates receiving annual money rental funds of about $160 million from the brand new leases, based mostly on a $2 billion lease base, upon

The analyst writes that they’re adjusting the FFO estimates and value goal and affirming a Maintain ranking as a consequence of anticipated earnings dilution from refinancing actions over the following few years.

Medical Properties Belief agreed to promote three House Coast hospitals, with a good portion of the proceeds transferred to Steward. Lewis says that these hospitals, mixed with the 9 in Massachusetts the place Medical Properties Belief recovers nothing, recommend a 75% restoration charge of the $3.2 billion asset worth reported in Medical Properties Belief’s first quarter supplemental package deal.

This estimate assumes Medical Properties Belief recovers $300 million from the six closed hospitals, $100 million from the 2 beneath building, and $2 billion from the 15 transitioned, provides the analyst.

Lewis writes that whereas this aligns with their earlier fashions, there’s some danger as a consequence of uncertainties about non-operating asset values and the success charges of latest operators.

The analyst revised the 2025 FFO estimate to $1.01 per share from $1.02 per share, nonetheless above the $0.92 consensus. The estimates point out a 39.9% year-over-year decline in normalized FFO per share in 2024, adopted by 6.0% development in 2025.

The analyst initiatives declining FFO per share in every subsequent yr by 2029 as a consequence of dilutive debt refinancing.

Additionally Learn:

Value Motion: MPW shares are up 12.4% at $6.295 on the final test Friday.

Learn Subsequent:

Newest Rankings for MPW

|

Date |

Agency |

Motion |

From |

To |

|---|---|---|---|---|

|

Mar 2022 |

B of A Securities |

Downgrades |

Purchase |

Impartial |

|

Feb 2022 |

Credit score Suisse |

Maintains |

Outperform |

|

|

Feb 2022 |

Credit score Suisse |

Initiates Protection On |

Outperform |

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and techniques to achieve an edge within the markets.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Explainer-How probably is an Air Canada strike and what impression would it not have?

By Nia Williams and Rajesh Kumar Singh

(Reuters) – Air Canada and its pilots are locked in a standoff over a brand new labor contract and face a deadline by Sunday to succeed in a deal that might avert strike motion.

WHERE DO THE TALKS STAND?

If the 2 events don’t attain an settlement by the tip of Saturday, Sept. 14, they’ll each have the choice to subject both a strike or lockout discover, which might set off Air Canada’s three-day plan to wind down operations.

The airline would progressively cancel flights over three days, with a whole shutdown as early as 00:01 EDT (0401 GMT)on Wednesday, Sept. 18.

On Thursday, Air Canada CEO Michael Rousseau mentioned the airline was nonetheless dedicated to reaching a deal however accused the pilots’ union of constructing extreme wage calls for.

The union has mentioned a strike might be averted if Air Canada negotiates a good settlement.

WHAT IMPACT WOULD A STRIKE HAVE?

Air Canada and its low-cost Air Canada Rouge subsidiary collectively function almost 670 flights per day, and a shutdown might have an effect on 110,000 passengers day by day in addition to freight carriage.

It’s Canada’s largest airline, flying to greater than 180 airports all over the world. The strike may also probably lead to fewer flights for American vacationers because the airline flies passengers from U.S. cities to Europe and Asia by means of its Canadian hubs.

In a analysis be aware, Desjardins economists estimated a two-week pilot strike might lead to a lack of round C$1.4 billion ($1.03 billion) to Canada’s actual GDP in September, that means day by day losses of roughly C$98 million.

A spokesperson for Air Canada mentioned as soon as the airline begins implementing its wind-down plan, it will trigger days and weeks of disruptions.

Air Canada estimates it could possibly take near eight hours for its upkeep crew to have every plane prepared for a return to service. Meaning it’ll take 4 to 5 days to deliver all plane again into service.

WHAT ARE THE ISSUES INVOLVED THE DISPUTE?

Air Canada’s 5,400 pilots are demanding wage charges that would cut the pay hole with their counterparts at main U.S. carriers equivalent to United Airways.

Pilots at U.S. airways have negotiated hefty pay raises in new contracts prior to now two years, helped by a journey growth and staffing shortages. United’s new pilot contract, for instance, included pay will increase of about 42%.

In consequence, some United pilots now earn 92% greater than their counterparts at Air Canada, based on information from the Air Line Pilots Affiliation, which represents the provider’s pilots. In 2013, the pay hole was simply 3%.

The affiliation says Air Canada pilots are working below pay charges and quality-of-life provisions negotiated in 2014.

Rousseau mentioned Air Canada had provided a wage improve of greater than 30%, in addition to improved pension and well being advantages within the new contract.

WILL THE GOVERNMENT INTERVENE?

Prime Minister Justin Trudeau mentioned on Friday the federal government wouldn’t intervene and meant as a substitute to strain either side to avert a strike.

On Thursday, Air Canada took the bizarre step of claiming the federal authorities must be able to step in to move off a strike. Whereas Ottawa has intervened a number of instances in labor disputes over the previous few a long time, it solely did so after stoppages have begun, not earlier than.

Federal Labour Minister Steven MacKinnon has broad powers to deal with disputes and final month intervened inside 24 hours to finish a stoppage on the two largest rail corporations, Canadian Pacific (NYSE:) Kansas Metropolis and Canadian Nationwide Railway (TSX:).

That transfer was denounced by unions and criticized by the federal New Democratic Occasion, which has helped hold Canada’s minority Liberal authorities in energy by means of a deal providing automated help. Earlier this month NDP chief Jagmeet Singh withdrew that help.

WHAT HAPPENS IF MY FLIGHT IS CANCELED?

If Air Canada cancels a flight due to a strike by its personal workers, the airline should supply to rebook passengers freed from cost on the following out there flight provided by any provider, or supply a refund and transportation to return passengers to their level of origin.

Air Canada has provided versatile journey waivers for passengers scheduled to fly Sept. 15-23. The airline has mentioned additionally it is working with different carriers to safe seats for purchasers to mitigate the impression of its flight cancellations.

Nonetheless, it suggested prospects to simply accept refunds or future journey credit score as seats on different airways are anticipated to be restricted.

Below Canada’s airline passenger safety laws, prospects won’t be entitled to money compensation for bills incurred on account of delayed or canceled flights as a consequence of labor disruption if they’re flying inside Canada. Passengers touring internationally could also be entitled to compensation.

($1 = 1.3580 Canadian {dollars})

Markets

Hold An Eye On These Scorching Company Relocation Markets For Actual Property Alternatives

Location is the whole lot in actual property, and nothing heats an actual property market like a significant company relocating its headquarters or basing a giant a part of its operations in a brand new market. It nearly invariably creates an inflow of extremely expert and extremely paid employees within the new market, which may end up in speedy property appreciation. Benzinga appears at a couple of markets which may be primed for a company relocation increase.

It is no secret that many Individuals have moved into the Sunbelt within the final a number of years, however a less-frequently studied facet of huge strikes in America consists of firms and company headquarters. Firms transfer for lots of the similar causes that their employees do, akin to the possibility to seek out lower-priced property or a state and native authorities with a friendlier tax construction.

Trending Now:

To that finish, business actual property agency CBRE studies that 465 American firms moved their headquarters between 2018 and 2023. A CBRE survey reveals that 110 of the strikes had been motivated by decrease taxes and the power to function in a extra business-friendly atmosphere. Nevertheless, the tech trade writ massive had a unique motivation.

Huge Tech is scouring actual property markets for lower-priced expertise as an alternative of searching for lower-priced land. Tech employee salaries have at all times been at a excessive premium. Nonetheless, the price of residing in America’s conventional tech hubs has turn out to be so excessive that paying aggressive wages is consuming up an ever-increasing share of Huge Tech income. That may clarify why Tech corporations represented 135 of the 465 company strikes in the course of the CBRE survey.

So, the place are all the businesses shifting? CBRE’s survey confirmed that Texas and Florida had been the popular locations for Fortune 500 corporations from 2018-2023. Transferring to those states presents a really comparable slate of price advantages to each firms and their employees. Texas and Florida have business-friendly company taxation charges and neither has a state revenue tax. The truth that land and housing are extra inexpensive solely sweetens the pie.

Among the hottest cities in Texas for company relocations embrace:

Dallas-Fort Value-CBRE’s knowledge confirmed 32 company headquarters moved to Dallas between 2018-2023, and SEC submitting knowledge reveals that Dallas-Fort Value added 50% extra company headquarters in that point. The U.S. Census additionally reveals that Dallas-Fort Value’s inhabitants grew by 150,000 in 2023; essentially the most within the nation. Frontier Communications’ new facility will add 3,000 jobs and practically $4 billion to Texas’ economic system within the subsequent decade.

Houston-This metropolis has lengthy been often called the “Petro-Metro” as a result of the oil trade is the undisputed king of the native economic system. Quite a few fuel and oil corporations make their dwelling in Houston and not too long ago introduced it will be part of them. Houston has added 25 company headquarters in the course of the CBRE examine interval. House costs are nonetheless under the nationwide common, making it much more interesting for workers.

Make investments In Texas

Able to be a part of the Texas market with out having to purchase or handle property? are city-specific portfolios of dwelling fairness investments. The portfolios comprise fractional shares of distinctive properties in progress areas, diversified for stability. The house fairness investments are obtained at under present market charges and are resilient to market rate of interest fluctuations, making them a steady and enticing alternative for traders, no matter market circumstances. Every metropolis is structured as a REIT for dwelling fairness investments, permitting traders to achieve publicity to the house fairness market. Nada presents funds in Austin, Dallas, and Houston, making it a straightforward method to put money into Texas’s increase markets. .

Florida’s relocation image revealed a little bit of a shock:

While you consider company relocation to Florida, your first thought may be Miami or Orlando. Though they’ve seen progress, a shocking metropolis is outpacing them: Jacksonville. The CBRE examine reveals that Jacksonville led the state in company relocations for fiscal yr 2022-2023, with a web achieve of practically 70% in new company headquarters. Company credit score agency Dun and Bradstreet not too long ago moved to Jacksonville.

Different widespread cities for company relocation included Denver, Colorado, Nashville, Tennessee, Atlanta, Georgia, and Waltham, Massachusetts, a suburb of Boston. Essentially the most vacated cities on CBRE’s listing had been San Francisco/San Jose, California, New York, Los Angeles, California, and Chicago, Illinois (in similar order). One have a look at dwelling costs and prime workplace or industrial house rental charges in most of these cities will make it simple to grasp the motivation behind the strikes.

Actual property traders can use this knowledge to achieve perception into the place they may discover long-term progress alternatives. Every time firms transfer, they bring about super demand for housing and new retail services. So, it would not matter which aspect of actual property you favor investing in; there might be alternatives in a number of sectors. Think about these cities when scouting, single-family dwelling flips, or industrial property. The early hen will get the worm.

Learn Extra:

Up Subsequent: Rework your buying and selling with Benzinga Edge’s one-of-a-kind market commerce concepts and instruments. that may set you forward in as we speak’s aggressive market.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

-

Markets3 months ago

Markets3 months agoMounjaro Is Concentrating on One other Multibillion-Greenback Market: Is Eli Lilly Inventory a Purchase?

-

Markets3 months ago

Markets3 months agoGoldman Sachs raises S&P 500 year-end goal to five,600

-

Markets3 months ago

Markets3 months agoHow the market reacted when Trump gained in 2016

-

Markets3 months ago

Markets3 months agoEU cybersecurity label shouldn’t discriminate towards Large Tech, European teams say

-

Markets3 months ago

Markets3 months agoEthiopia’s Energy Offers with Chinese language Companies Gasoline Bitcoin Mining Increase

-

Markets3 months ago

Markets3 months agoBoeing CEO blasted in US Senate listening to whereas apologizing for security woes

-

Markets3 months ago

Markets3 months agoBlackRock is not going to participate in Malaysia Airports privatisation, GIP says

-

Markets3 months ago

Markets3 months agoSingapore's Temasek to promote Pavilion Vitality to Shell

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoIt’s going to take years for the oil and gasoline market to get better from the 'mom of all shocks,' Harvard economist says

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat