Markets

Earnings name: Citi Traits studies development amid stock challenges

Citi Traits, Inc. (CTRN), a value-priced retailer of city style attire and equipment, reported its second-quarter 2024 earnings, highlighting strategic initiatives geared toward driving future development and addressing stock administration challenges. The corporate skilled a 1.7% enhance in complete gross sales over the identical interval final 12 months, regardless of a comparable retailer gross sales lower of 1.7%. Citi Traits stays in a strong monetary place with no debt and anticipates constructive EBITDA within the second half of the fiscal 12 months.

Key Takeaways

- Citi Traits noticed a rise in buyer visitors and constructive single-digit comparable retailer gross sales development in the course of the back-to-school interval.

- The corporate is in a wholesome monetary place with no debt.

- They reported a 1.7% enhance in complete gross sales for the quarter, though comp retailer gross sales have been down by the identical share.

- Citi Traits incurred $9.4 million in markdowns on account of a listing reset and $4 million in surprising shrink bills.

- Plans are in place to enhance shrink administration, with a give attention to inner theft, administrative points, and exterior theft.

Firm Outlook

- Citi Traits plans to shut 10 to fifteen underperforming shops.

- The corporate expects to finish the 12 months with $60 million to $70 million in money.

- Optimistic EBITDA is anticipated within the second half of fiscal 2024.

Bearish Highlights

- The corporate confronted challenges with overpurchased stock, leading to a buildup of aged stock.

- Citi Traits took aggressive markdowns to handle the surplus stock.

- Comp retailer gross sales have been down 1.7% in comparison with the identical quarter final 12 months.

Bullish Highlights

- Citi Traits noticed robust gross sales momentum throughout Father’s Day and the Fourth of July.

- The corporate had a powerful begin to the back-to-school season.

- New branded product introductions have proven constructive outcomes.

Misses

- The corporate skilled higher-than-anticipated shrink bills in Q2.

- Citi Traits’ assortment had turn into stale and out of sync with client calls for.

Q&A Highlights

- CEO Ken Seipel mentioned stock administration and allocation methods, together with a brand new course of for managing slow-selling stock.

- The corporate is exploring AI options for future forecasting and updating in-store displays.

- Citi Traits is working with a third-party marketing consultant to handle shrinkage in all three classes: inner theft, administrative points, and exterior theft.

Citi Traits continues to navigate via a interval of strategic adjustment, specializing in stock administration and enhancing the shopper expertise. The corporate’s efforts to refresh its product assortment and enhance shrink administration are anticipated to contribute to its future efficiency. Regardless of the challenges confronted within the second quarter, Citi Traits is taking proactive steps to place itself for sustainable development and preserve its dedication to serving its core client base.

Lusso’s Information Insights

Citi Traits, Inc. (CTRN) has been navigating via a difficult interval, as mirrored within the firm’s current monetary efficiency and market metrics. In accordance with real-time knowledge from Lusso’s Information, Citi Traits holds a market capitalization of $133.13 million, which signifies its dimension relative to different firms within the retail sector. This can be a vital issue for traders contemplating the dimensions of operations and potential for development.

The corporate’s P/E ratio, a measure of its present share value relative to its per-share earnings, stands at -15.02, and when adjusted for the final twelve months as of Q1 2023, it worsens barely to -16.75. This unfavourable P/E ratio means that the corporate has been unprofitable over the previous 12 months, which aligns with the Lusso’s Information Tip indicating that analysts don’t anticipate the corporate will probably be worthwhile this 12 months.

Moreover, Citi Traits’ income development presents a blended image, with a slight decline of 1.56% over the past twelve months as of Q1 2023, however a quarterly uptick of three.67% in Q1 2023. This implies that whereas the corporate could also be experiencing some short-term enhancements, longer-term income development stays a problem.

Lusso’s Information Ideas additional spotlight that Citi Traits operates with a big debt burden and should have bother making curiosity funds on its debt. This can be a essential consideration for traders, because it may affect the corporate’s monetary stability and future efficiency.

For these taken with a deeper evaluation of Citi Traits, Lusso’s Information presents extra suggestions that may present extra insights into the corporate’s monetary well being and inventory efficiency. As of now, there are 11 extra Lusso’s Information Ideas obtainable that may assist traders make a extra knowledgeable determination relating to Citi Traits’ potential as an funding.

For detailed monetary evaluation and additional tips about Citi Traits, traders can go to https://www.investing.com/professional/CTRN.

Full transcript – Citi Traits Inc (CTRN) Q2 2024:

Operator: Greetings. Welcome to Citi Traits’ Second Quarter 2024 Earnings Name. Right now, all members are in a listen-only mode. A matter-and-answer session will observe the formal presentation. [Operator Instructions] Please word this convention is being recorded. I’ll now flip the convention over to Nitza McKee, Senior Affiliate at ICR. Thanks. Chances are you’ll start.

Nitza McKee: Thanks and good morning, everybody. Thanks for becoming a member of us on Citi Traits’ second quarter 2024 earnings name. On our name at this time is Interim Chief Govt Officer, Ken Seipel, and Chief Monetary Officer, Heather Plutino. Our earnings launch was despatched out this morning at 6.45 a.m. Jap Time. When you’ve got not acquired a replica of the discharge, it is obtainable on the corporate’s web site underneath the Investor Relations part at www.cititrends.com. You ought to be conscious that ready remarks at this time made throughout this name might include forward-looking statements throughout the which means of the Personal Securities Litigation Reform Act of 1995. Administration might make extra forward-looking statements in response to your questions. These statements don’t assure future efficiency. Due to this fact, you shouldn’t place undue reliance on these statements. We refer you to the corporate’s most up-to-date report on Kind 10-Ok and different subsequent filings with the Securities and Trade Fee for extra detailed dialogue of the elements that may trigger precise outcomes to vary materially from these described within the forward-looking statements. I’ll now flip the decision over to our Interim Chief Govt Officer, Ken Seipel. Ken?

Ken Seipel: Thanks, Nitza. Effectively, good morning, everybody, and thanks for becoming a member of our Q2 earnings name at this time. Since our first quarterly name, I’ve had the chance to guage our enterprise and chart corrective measures to boost the long-term gross sales and profitability of Citi Traits. In the present day, we’ll focus on the strategic actions taken in Q2 to organize Citi Traits for future development and description necessary work underway to enhance our near-term and long-term outcomes. And I need to say, whereas there’s numerous work forward nonetheless, I am extra energized and optimistic than ever about our firm’s future. So turning to Q2, in Q2 we achieved development in buyer visitors versus final 12 months, which signifies our core buyer stays extremely engaged with the Citi Traits model and our distinctive retailer expertise. Our house and impulse classes ship double-digit comps, and our back-to-school youngsters’s classes received off to a very good begin. I am happy to report that we have skilled continued momentum within the necessary back-to-school interval with constructive single-digit comparable retailer gross sales development in Q3 so far. Importantly, Citi Traits stays in a wholesome monetary place with robust liquidity and no debt, permitting us to execute the foundational work vital for future development and revenue acceleration. Since entering into the enterprise on June 1st, I made an analysis of a number of key areas of our enterprise, together with an in depth overview of our product assortment. Relatedly, I made the strategic determination to execute markdowns within the second quarter, to shortly clear via aged stock and make room for brand spanking new product. This motion will allow us to constantly provide strain, balanced assortments of excellent, higher, and greatest merchandise. On the similar time, we’re swiftly capitalizing on two distinct alternatives, versus enhancing the treasure hunt expertise by securing branded items at vital reductions, whereas additionally growing the penetration of opening value level items. And second, we have recognized particular alternatives to enhance our preseason assortment planning course of and product allocation processes. I’m assured these actions are foundational for producing constant comparable retailer gross sales development and improved working capital effectivity. Stock shrinkage has been an space of concern for Citi Traits over the previous a number of quarters. You’ve got heard us focus on in prior calls the actions we’re taking to right current elevated shrink traits. In July, I made the choice to have interaction companies of a agency to determine causal points and help us with fixing the issue. Working with our group, they’re figuring out a number of particular, correctable administrative and course of actions which can be anticipated to have a tangible affect on shrink outcomes going ahead. The group has additionally recognized corrected measures to watch and handle inner and exterior theft. We’re within the means of implementing shrinkage enchancment measures and we count on to make a constructive affect on shrinkage outcomes going ahead. As I discussed on our prior name, we have recognized alternatives to boost the effectiveness of the Island Pacific ERP improve that occurred final 12 months. Transitioning from custom-made legacy software program to a standardized software program platform left a void in studies, processes, and monitoring capabilities that I view as basic for our leaders to information the enterprise. Our senior management group is very engaged and has prioritized the enterprise wants and the work is now underway to make the mandatory enhancements. I wish to emphasize that every of those actions I described are foundational enhancements that place Citi Traits for worthwhile development. After these previous couple of months, it is clear to me that almost all of the alternatives we face as an organization are effectively inside our management and actually not depending on exterior elements. As an organization, it is very nice to be accountable for your personal future, figuring out that if you happen to’re centered, exhausting work, dedication will lead to considerably improved end result for our shareholders. My optimism about Citi Traits is basically rooted in my perception of our core enterprise mannequin, which boasts a defensible mode towards competitors. We’re uniquely positioned within the market as a price retailer serving a largely underserved buyer base. With our in depth community of retail areas, we’re one of many largest nationwide retailers centered on offering household attire to decrease earnings clients. Our power lies in our deep rooted presence throughout the African-American neighborhood, which continues to be the cornerstone of our monetary success. Our long-term neighborhood presence has fostered extremely engaged and constant clients who reply positively after we meet their wants. Now I would prefer to say just a few phrases in regards to the groundwork that we’re laying for the long run. Our plan features a clear give attention to the core buyer, a powerful product worth proposition, fashionable fashions with extra merchants within the commerce line, constant execution of our enterprise mannequin, and disciplined expense administration, a mix of which is able to contribute considerably to improved revenue margins. Starting with our core buyer, we’ve narrowed our firm’s focus to our core African-American client, who represents nearly all of our commerce space in practically 90% of our shops. This focused focus will permit us to ship extra exact assortments. Whereas we acknowledge the presence of multicultural and Latinx clients in our commerce areas, our core African-American buyer stays central to our enterprise and is vital to our success. Our merchandise groups have embraced the slim give attention to our core buyer, which is enabling them to create a extra refined and focused assortment. As well as, we’ve initiated a complete client insights research to realize each quantitative and ethnographic insights into the drivers of buy choices. This research, anticipated to be accomplished by the autumn, will probably be a vital think about our decision-making course of for 2025 and past. Subsequent are product assortments. In previous years, the corporate diminished the type alternative rely for opening value level items underneath $5, which [Technical Difficulty] our worth notion and created a void for commodity wants and worth costs. Concurrently, we elevated our providing of upper priced merchandise, which was a constructive step. Nevertheless, we didn’t maintain tempo with the buyer calls for for manufacturers, resulting in disappointment amongst clients searching for branded merchandise at aggressive costs. Transferring ahead, our goal is to at all times provide a balanced assortment of excellent, higher, and greatest merchandise throughout all classes. For our decrease earnings clients on a decent price range, we’ll provide elevated choice of items priced underneath $5 with seen in-store signage to emphasise our worth proposition. An much more vital development alternative for our enterprise lies in increasing our gross sales of branded merchandise. Our clients are style conscious and have demonstrated that they’re keen to commerce up when the style is correct, the model is recognizable, and the worth worth proposition is powerful. We now have recognized juniors, males’s, and household footwear because the classes with the best potential for near-term, top-line development. And I wish to acknowledge our service provider group for just lately opening up relationships with effectively over 20 well-known nationwide manufacturers that have been beforehand inaccessible to Citi Traits. Our retailers have famous our massive scale of practically 600 shops uniquely positioned in African-American neighborhoods could be very enticing to manufacturers seeking to increase their attain into this necessary demographic. We count on a few of this product to start filtering into our shops in This fall with continued enlargement in 2025. Talking of manufacturers, we’re at the moment growing inner capability so as to add extra [trade to the trade range] (ph) by securing branded offers from numerous sources at vital reductions to common prices. And though the present financial local weather is difficult, it presents a wonderful alternative for off-price deal making with distressed distributors and retailers. We have added a extremely regarded off-price purchaser to our group to open new relationships, create off-price deal circulation, consider assortment, match, and execute. Our consumers are available in the market now, reviewing a seemingly countless quantity of opportunistic offers to start delivering in This fall, as we refine our capability to execute this necessary development initiative. And over time, I count on this newly developed value treasure phase of our assortment to contribute an extra 10% or extra incremental gross sales at the next than common margin price. I am assured that the adjustments in our product technique will drive visitors to our shops, leading to constant high line and gross margin greenback efficiency sooner or later. Now turning to operations. In our provide chain, we’re working to extend the velocity of product supply from vendor to retailer whereas decreasing prices. Our goal is to shorten the variety of product days within the provide chain, enabling us to reply extra shortly to buyer calls for and reallocate stock working capital to gasoline gross sales development alternatives. Our distribution groups have recognized a number of tangible alternatives to extend velocity and scale back working prices. Our progress in provide chain was stalled this summer time when our major outbound service unexpectedly shut down and though we have been capable of react, the disruption induced a distraction for our groups and a few delay in product circulation. We are actually refocusing on the provision chain effectivity undertaking and can present updates on our progress within the close to future. Now, I will flip the decision to Heather to overview the monetary factors from Q2, in addition to our outlook for the second half of the 12 months. Heather?

Heather Plutino: Thanks, Ken, and good morning, everybody. Let me begin by saying that I, too, am excited in regards to the development alternatives that lie forward for Citi Traits and strongly consider that the definitive actions we’re taking set us up for long-term success. Earlier than I overview our second quarter outcomes and replace you on our outlook, I would like to supply some extra colour on two distinctive elements of our second quarter, our profitable stock reset and our shrink outcomes. I might characterize these two gadgets totaling $13.4 million of expense within the quarter as one-time in nature and never reflective of the underlying power of the enterprise or the long-term potential of the Citi Traits model. Be aware, nevertheless, that they’re included in our adjusted EBITDA outcomes for the quarter. As Ken talked about, we made the strategic determination to shortly transfer via aged stock to make room for brand spanking new merchandise. The stock reset resulted in $9.4 million of second quarter markdowns. As well as, and regardless of progress on a number of significant initiatives, we incurred greater than anticipated shrink from bodily stock leads to the quarter. Consequently, we appropriately elevated our accrual for shrink, which had an outsized affect on Q2 because of the catch-up nature of that adjustment. In complete, we incurred $4 million of surprising shrink expense within the quarter. As you already know, there are three classes of shrink in retail, inner theft; administrative, flash, recordation points in both shops or DCs; and exterior theft. We’re working exhausting to vary the current development in every of those classes. Inner theft has been our major space of focus, and we have recognized and are implementing a number of mitigating ways to enhance impressions of management, a lot of which we mentioned final quarter, together with up to date in-store theft prevention gear, elevated use of exception reporting to determine and resolve downside areas, and a brand new third-party restitution program. We’re additionally upgrading retailer expertise as wanted and are revising necessary insurance policies to additional tighten controls. We’re taking motion on the executive entrance to make sure correct circulation of stock knowledge, figuring out and fixing any leaks in that circulation. Lastly, the exterior theft class will profit from the initiatives I’ve talked about, however there could also be extra to do right here. And as talked about earlier, we have engaged a well-regarded consulting agency to assist additional enhance our shrink administration throughout all three classes. We stay centered and are assured that the steps we’re taking will transfer us towards shrink outcomes which can be extra consistent with our historic efficiency. Shifting again to our stock reset. With Ken’s management and imaginative and prescient, we’re transferring quick to refine our assortment technique anchored on a extra balanced combine of excellent, higher and greatest merchandise, in addition to the next penetration of opening value factors and thrilling branded items at unbelievable values. We enter the second half of fiscal 2024 snug with our stock, degree and composition, happy with the early progress on the refinement of our assortment technique, and optimistic about our potential to drive high line enchancment. And Q3 is off to a strong begin with single digit comp retailer gross sales will increase via the primary three weeks of August. Turning now to the small print of our second quarter outcomes. Whole gross sales within the quarter elevated 1.7% to final 12 months, with comp retailer gross sales down 1.7%. Within the second quarter, we noticed gross sales momentum across the moments in our clients’ lives with a very robust Father’s Day and July 4th. The beginning of the back-to-school season was supported by strengths in branded youngsters’s attire and uniforms received off to a very good begin. Our layaway program, which helps our budget-conscious clients handle their spend while carrying nice gear for the youngsters, stays an necessary providing and was up till final 12 months. It is very important word that solely about 14% of our retailer markets returned to high school by the tip of the second quarter. As of at this time, roughly 80% of our retailer markets have returned to high school. We continued our advertising and marketing efforts within the quarter with summer time and early back-to-school radio and paid social in choose markets. Our back-to-school advertising and marketing will proceed into Q3 with a give attention to studying and planning to maximise vacation promoting efforts. We sit up for updating you with our again to high school advertising and marketing take a look at outcomes after we meet subsequent quarter. Up to now, we have touched about 188 shops with our advertising and marketing efforts and can enhance that quantity all year long to drive visitors in key markets. We reworked 15 shops within the second quarter, bringing the year-to-date complete to 35. We additionally opened one new retailer and closed three shops as a part of our ongoing fleet optimization effort, bringing our quarter-end retailer rely to 597, with CTx shops representing roughly 23% of our fleet. Turning to the small print of development margin. Our second quarter adjusted development margin of 31.1% was significantly decrease than current historical past and effectively under expectations because of the stock and reset and shrink expense I described earlier. On a constructive word, I’m happy to report that regardless of the surprising shutdown of one in every of our largest outbound carriers, we delivered freight expense enchancment over final 12 months, a direct results of our provide chain group’s ongoing efforts to enhance general provide chain effectivity whereas decreasing prices. Transferring to SG&A. Adjusted SG&A bills elevated $2.7 million within the quarter in comparison with final 12 months, consistent with our expectations. The rise, as mentioned in earlier calls, was pushed primarily by benefit will increase in shops and corporates and a modest enhance in promoting spend. Now turning to the stability sheet. We remained in a wholesome monetary place on the finish of the quarter with a powerful stability sheet together with no debt, no drawings on our $75 million revolver, and $59 million in money. With liquidity of roughly $134 million, we are able to greater than sufficiently fund our enterprise initiatives designed to place the corporate for future worthwhile development. We exited the second quarter with complete stock {dollars} roughly flat to final 12 months. Strategic packaway buys made up roughly 23% of the end-of-quarter stock, up about 20% to final 12 months, reflecting our purchaser’s success in securing opportunistic buys of thrilling branded items to drive future gross sales. Excluding the packaway items, stock was down 4% to final 12 months. Now turning to our outlook for the stability of the 12 months. Due to the distinctive elements of our second quarter outcomes, we consider it’s most useful to supply outlook for the second half of fiscal 2024, which is as follows. We count on second half comparable retailer gross sales to be flat to up low single-digits. Whole gross sales for the second half are anticipated to be down mid-single-digits because of the 53rd week final 12 months and retailer closures. Second half gross margin is anticipated to be roughly 39%. Second half EBITDA is anticipated to be constructive in a variety of $0.5 million to $2.5 million, a big enchancment to first half outcomes. We have accomplished our plans for retailer openings and remodels for the 12 months with one new retailer and 35 remodels. As a part of our ongoing fleet optimization, we’re planning to shut 10 to fifteen underperforming shops in 2024, together with the six closures that will probably be accomplished via Q2. We count on to finish fiscal 2024 with roughly 590 shops. Lastly, we count on to finish the 12 months with $60 million to $70 million of money, reflecting full-year capital expenditures of roughly $13 million, which is down about 35% to our earlier outlook. Earlier than I flip the decision again to Ken, I wish to reiterate that our second quarter outcomes, whereas disappointing, characterize a reset for Citi Traits. The actions we took within the quarter will set us up for improved monetary efficiency within the second half of 2024, with stronger gross sales fueled by our refined merchandise technique, a return to excessive 30s margin charges on cleaned-up stock and efforts to regulate shrink, constructive EBITDA, and importantly, a powerful monetary place with a wholesome money stability. With that, I will flip the decision again to Ken. Ken?

Ken Seipel: Thanks, Heather. In abstract, our plan is a transparent give attention to our core buyer, robust product worth proposition, fashionable fashions with extra treasures within the treasure hunt, constant execution of our enterprise mannequin, and disciplined expense administration, the mixture of which contributes considerably improved revenue margins. Executing this quantity of change in a brief time frame could be difficult, so I would prefer to take this chance to thank our whole Citi Traits group for his or her excessive degree of engagement in driving the success of our enterprise. I spoke earlier of the work of our merchandise and distribution groups, however I additionally want to lengthen my honest appreciation to all of our retailer and company groups for his or her further effort and exhausting work these previous couple months. I’m assured that our whole inner group is happy about our path and desperate to execute a profitable technique for our shareholders. I additionally wish to categorical my appreciation to our long-term shareholders. In a turnaround scenario, the preliminary highway is usually a little bumpy as we restore, exchange, or implement new processes that allow constant execution and revenue circulation via. So shareholders, relaxation assured, your persistence will probably be rewarded. As CEO, my pursuits are totally aligned with our particular person and institutional traders, and I actually sit up for having fun with success with all of you. I’ll now return the decision to our operator, Darryl, to facilitate questions. Darryl?

Operator: [Operator Instructions] Our first questions come from the road of Michael Baker with D.A. Davidson. Please proceed along with your questions.

Michael Baker: Okay, thanks. First simply wished to give attention to the comp, the highest line. Just a bit bit extra colour on what was under plan. So dimension of the transaction was down. Was that fewer gadgets per basket, or is that because of the cheaper price factors, because of the markdowns? Just a bit bit extra colour on what drove that. After which what classes missed? What was — I suppose you mentioned within the press launch what was good, however what missed I suppose by way of classes?

Heather Plutino: Hey, Mike, good morning. Good to listen to you. So from a retail metric perspective, transactions have been up within the quarter, which Ken talked about. Basket has been underneath strain. And we have seen UPT declines fairly constantly, however AUR stays up. So it is actually, it is the variety of items that our buyer is selecting to place within the basket is basically inflicting the strain. From a class perspective, we talked about youngsters’s off to a very good begin, uniforms off to a very good begin, back-to-school to a very good begin. I discussed that Father’s Day and July 4th particularly have been robust. They actually responded to the Americana that we had on the ground and preparing for summer time barbecues. In order that was off to a very good begin. It will sound repetitive from what we talked about in prior quarters as a result of it has been a development. Footwear continues to be a drag on the enterprise. House continues to carry out effectively due to the stock rebuilds that we have finished. So nonetheless continuation of theme there. Impulse additionally, which we formally known as Q Line, additionally performing effectively with our clients. So it is actually a continuation of theme from prior quarters on what labored, what did not work, however with a specific focus within the latter a part of the quarter on the success of the youngsters’s enterprise.

Michael Baker: Okay, understood. Thanks. If I may ask a follow-up on simply on the shrink and extra simply the way in which the accounting works on that. So I perceive you took a giant step-up this quarter to compensate for the accrual, however does this nonetheless stay a drag over the approaching quarters till you cycle that step-up as a result of now you might be accruing at the next price than you have been presumably a 12 months in the past? So is it a drag within the gross margin and presumably although that is integrated within the 39% back-half outlook? Is that honest to say?

Heather Plutino: You’re right. The drag versus final 12 months lessens within the fall season, however it’s nonetheless there. After which completely it’s — the elevated accrual is integrated into that 39% information.

Michael Baker: Okay. Thanks.

Heather Plutino: Thanks, Mike.

Operator: Thanks. Our subsequent questions come from the road of John Lawrence with The Benchmark Firm. Please proceed along with your questions.

John Lawrence: Yeah, good morning, guys.

Heather Plutino: Good morning, John.

Ken Seipel: Hey, John.

John Lawrence: Yeah. Ken, may you spend just a little time and simply inform me simply that rationalization, whenever you take a look at that, whenever you discuss aged stock and simply digging down one other degree on the write-down form of what elements go into that? How outdated is a few of this stock? Was it one thing that you simply had tried to clear and simply did not get via? When you can form of stroll via the nuts and bolts of that if you’ll, please.

Ken Seipel: Yeah, comfortable to. A pair issues in it, John. So once I first seemed on the stock for the enterprise, the corporate, as you in all probability keep in mind from Q1, had a fairly aggressive gross sales plan in place and missed that plan, though we had a comp enhance for Q1. So the stock was truly overpurchased for that quarter. And you start to see from there, and just a little little bit of a softness within the Q2, numerous the stock geared to promote in that necessary Q1 timeframe simply was backing up and positively not turning on the price that it wanted to. This blocking room for brand spanking new receipts which is the lifeblood of our enterprise. When taking a look at it, it was fairly clear that we would have liked to take extra aggressive motion to take the markdowns, get them transferring. And I’m comfortable to report, truly, we have offered via a greater a part of 40%, 50% of that stock already. And it appears like it should be clear and out of our shops right here very quickly. When it comes to the nuts and bolts of it, I feel a possibility that we recognized and truly is being applied actually subsequent week after Labor Day is to enhance our general markdown course of. And what we’re doing now could be taking a way more thorough take a look at aged stock. And aged is outlined by not a lot a time, I ought to say sluggish promoting stock, and ensuring that we have diminished the worth of that regularly to benefit from that in-season promoting of a markdown and transfer that sluggish vendor out shortly. After which behind that, we even have a follow-up course of for second markdowns. The groups are additionally within the means of updating our in-store presentation and making it rather more straightforward for the buyer to buy and entry that product. I feel the mixture of each the cleanup after which truly our new actions which can be in place now to forestall this from occurring sooner or later ought to make this a non-issue as we go ahead. And most significantly, it is going to maintain our inventories clear and able to obtain new product, which is able to in truth assist us gasoline our high line gross sales.

John Lawrence: Thanks for that. After which, secondly, simply to observe up, are you able to discuss in regards to the outcomes of the brand new system and the way Is it engaged on the allocation aspect so far as new merchandise and classes, et cetera, from an ordering standpoint?

Ken Seipel: Yeah, the brand new system, Island Pacific ERP system we put in, does have, as you level out, an allocation module in it. As we glance into the module just a little bit extra intently, what we have found is there’s numerous complexity with executing this explicit system. It truly has about each bell and whistle one may ever think about in relation to allocation. However sadly, what we have to do is to make it just a little bit less complicated and simpler for our groups to execute and implement. So we’re underway proper now doing a pair issues. One, we try to consider ways in which we are able to effective tune the usage of the system. One of many issues I’ve requested our groups to do is to scale back the variety of general retailer clusters that we try to allocate to. That may assist them be just a little bit extra centered on dividing up the stock appropriately between our low quantity, mid quantity, and excessive quantity shops. That may assist us within the interim to get higher with allocation. And in long run, we do consider that there is a bolt-on alternative and we’re extremely investigating at the moment a few AI options that we consider might help us with future forecasting. And if I have been to be vital of our present system, it is in all probability the one massive deficit that we’ve, is it would not have an actual sturdy future forecasting module with it. And definitely a possibility for us as we go ahead and begin to form of anticipate client wants, and extra importantly, as this enterprise continues to develop, we must be actually crisp and clear in regards to the traits going ahead. And so I feel the mixture of form of some interim steps to make our present system higher and the concept we may have a bolt-on and AI resolution will make allocation one in every of our aggressive strengths truly.

John Lawrence: Nice, thanks. Good luck.

Ken Seipel: Thanks, John.

Operator: Thanks. Our subsequent questions come from the road of Jeremy Hamblin with Craig-Hallum. Please proceed along with your questions.

Jeremy Hamblin: Thanks for taking the query. So I wished to come back again to what you are seeing on the same-store gross sales traits. The primary query can be by way of the rest of Q3 and This fall, are you able to assist us to know one, if the compares get simpler from right here or in the event that they get just a little bit harder? After which secondly is simply by way of taking a high-level look, you word that you have visitors development, and that seems like that is sustained right here to begin Q3. However your same-store gross sales down on high of a fairly straightforward evaluate from final 12 months, when you may have numerous bigger gamers in excessive worth attire class which can be reporting pretty robust same-store gross sales on high of robust same-store gross sales from final 12 months. Given that you simply form of juxtaposition with visitors, do you sense that the larger downside right here is the merchandise assortment itself or the worth worth equation that’s form of inflicting some clients possibly to not purchase as a lot from you and doubtlessly to go over to some opponents?

Ken Seipel: Yeah, Jeremy, thanks for the query. I will form of take the final a part of your query first, after which I will let Heather discuss to you just a little bit in regards to the go-forward compares. I feel, basically what you mentioned is basically the issues that we have recognized coming into the enterprise. Finally we consider the assortment itself, and I am talking by way of Q2, had turn into just a little bit stale and just a little bit out of sync of our client calls for. As I discussed, we have been lacking some opening value level parts of the enterprise, after which we truly did not have sufficient manufacturers within the combine that have been interesting to our customers. So a part of the motion that we took to take the markdowns was to filter out a few of that product that we knew was not working. After which we’re within the means of implementing the brand new issues that I discussed earlier. However most notably, I have been actually, actually happy with the work our retailers have finished to date in close to time period to react. For instance, if you happen to take a look at what’s occurring proper now in August, our Youngsters’s division is having a really sturdy interval. Proper in the midst of the height, they’ve actually finished a pleasant job of rising the enterprise. And that is truly coming on account of going into market and getting some extra branded product in place that the buyer is reacting to. Our uniform enterprise has been glorious as effectively, and that is a restoration of the missed alternative for the previous 12 months, in addition to our home-based business has been robust. And that is truly a listing step-up that is helped that enterprise form of develop considerably. And people are our reversals of traits that we noticed popping out of Q2. Now, house had been okay in Q2, however actually it was accelerated. However I feel if I may step again and simply say that the challenges, the rationale we’re lagging in client gross sales, as you level out, towards the opposite opponents, is our assortment plan has simply not been dialed in appropriately. And a part of it’s the value worth equation, however extra typically it is the providing, which we’re adjusting and positively see some outcomes with. And I count on we’ll get considerably higher as we go ahead. When it comes to the compares, I will let Heather discuss just a little bit in regards to the highway forward on our compares.

Heather Plutino: Yeah. Hey, Jeremy, good to listen to you. As I take a look at it, spring final 12 months we had a unfavourable 10% comp. Within the spring and within the fall we delivered a unfavourable 3.7% comp. In order that tells me that the compares are literally getting just a little bit tougher within the fall, however we’re not frightened in regards to the evaluate. We’re frightened about what are we doing to drive the highest line, proper? And so the entire issues that we have talked about this morning, stock reset, a brand new centered method on our buyer, a brand new centered method on our product, a greater greatest assortment, opening value level, actual robust worth assertion. And I’ve received to inform you for me personally, probably the most thrilling piece is the branded good method that Ken is bringing to the desk, proper, that may convey the thrill again into our shops. It should trigger our clients to select up the cellphone and name their associates. That’s the strongest advertising and marketing arm within the historical past of Citi Traits is when that phrase of mouth advertising and marketing kicks in. So due to that, I might say, I hear you on the compares. It truly will get just a little tougher within the fall if you happen to simply stare on the numbers, however we’re not letting that sluggish us down. And we’re going after all of the levers that we have described this morning to guarantee that we’re creating the thrill round product that our buyer expects from Citi Traits to drive foot visitors, drive comps.

Jeremy Hamblin: Obtained it. Useful colour. After which simply coming again to the shrink for a second. So, I feel it looks as if the, at the very least in Q2, the $4 million affect is over 50 foundation factors on an annualized foundation. It is over 230 foundation factors relative to Q2 affect. However I feel in complete, it is possibly about double what you had beforehand anticipated and simply wished to know if shrink is being — if you happen to’re figuring out extra of an issue with inner shrink points or if that is extra of a buyer shrink situation?

Heather Plutino: Thanks, Jeremy. I admire that. And I promise you that this can be a very irritating subject for lots of us at Citi Traits. It will get numerous focus. We’re pulling numerous levers. It at all times takes time and albeit I feel we will not transfer quick sufficient or work exhausting sufficient on this shrink line as a result of it feels prefer it’s a left hook, proper hook after we discuss shrink. Final quarter after we mentioned it, we felt like we had our arms round it. We have been pulling all of the levers. We had not made an adjustment to the accrual as a result of the information did not help it. The counts that we took up till that point supported the accrual that we had in place. Sadly, with Q2, We did one other massive chunk of shops. We rely our shops each month. We counted over 200 shops within the second quarter. And at that time, wanting on the knowledge, it did help a rise within the accrual. So, we’re working exhausting at it. I’ll say although that, and I just lately discovered that that is per the broader business, Jeremy, that inner theft is our major space of focus, proper? And that’s our major first place that we’re seeking to, to extend impressions of management. All of the issues that you have heard me discuss for 2 quarters now are completely occurring, beginning to flip the tide. The opposite piece that’s in our management, I talked in regards to the three buckets in my ready remarks, the opposite piece that’s in our management is the executive or the recordation, proper? The place, how is the circulation of inventory-related knowledge, how is that working all through the provision chain or the information provide chain, if you’ll, and ensuring that we haven’t any leaks and that we’re appropriately reporting on the retailer degree and on the DC degree what the on-hand stock is. In order that’s one other place that we’re attacking. Exterior theft, at all times a priority. It is simply part of Citi Pattern’s historical past, a part of Citi Pattern’s make-up. In all probability extra to come back there. Lots of the issues that we’re doing on the interior theft aspect will even present some assistance on the exterior theft. However this third-party marketing consultant that we have talked about all through the morning is basically seeking to assist us speed up throughout all three classes. So we’re excited to proceed to study from them and see what we are able to do to maneuver it ahead.

Jeremy Hamblin: Obtained it. Simply actually fast final one to sneak in right here. When it comes to the remark across the shifted 13-week to 13-week foundation, simply wished to know for, because it pertains to Q2 after which into Q3 or This fall, was there a constructive profit in Q2 after which how does that relate to Q3?

Heather Plutino: Yeah. We talked about this just a few quarters in the past that from a calendarization perspective, a number of transferring items, elements, however the backside line is that in Q2 we moved an necessary back-to-school week into the second quarter. So it had just a little little bit of a constructive affect. Q3 is minimal. That week strikes out, however then a pay week strikes in. So form of impartial in Q3.

Jeremy Hamblin: Obtained it. Useful colour. Thanks and good luck the remainder of the 12 months.

Heather Plutino: Thanks, Jeremy.

Operator: Thanks. We now have reached the tip of our question-and-answer session. I might now like to show the ground again over to Ken Seipel for any closing remarks.

Ken Seipel: All proper. Thanks, Darryl. Effectively, once more, thanks, all people, for becoming a member of us at this time. And we actually sit up for updating you on some thrilling outcomes as we proceed to undergo and execute our methods. Thanks.

Operator: Thanks. This does conclude at this time’s teleconference. We admire your participation. Chances are you’ll disconnect your strains right now. Take pleasure in the remainder of your day.

This text was generated with the help of AI and reviewed by an editor. For extra info see our T&C.

Markets

Hong Kong probe reveals Cathay Airbus engine failure on account of ruptured gasoline hose

(Reuters) -A probe by Hong Kong’s aviation accident investigation company revealed Cathay Pacific’s Airbus A350 engine failed in-flight on account of a ruptured gasoline hose which additionally confirmed indicators of a hearth, the company’s report acknowledged on Thursday.

Hong Kong’s Air Accident Investigation Authority (AAIA) discovered a ruptured gasoline hose within the second engine of the Cathay Pacific-operated A350 jet, with 5 further secondary gasoline hoses additionally exhibiting indicators of damage and tear.

The investigation confirms Reuters’ earlier report which cited sources saying the preliminary checks revealed a hose between a manifold and a gasoline injection nozzle was pierced.

“This critical incident illustrates the potential for gasoline leaks by means of the ruptured secondary gasoline manifold hose, which may lead to engine fires,” the report acknowledged.

A “critical incident” is an investigative time period in aviation that pointed to a excessive chance of an accident.

“If not promptly detected and addressed, this example, together with additional failures, may escalate right into a extra critical engine hearth, doubtlessly inflicting in depth injury to the plane,” AAIA mentioned within the report.

The A350-1000 and XWB-97 engines, manufactured by Rolls-Royce (OTC:), have been beneath the highlight since Cathay’s Zurich-bound passenger flight CX383 was pressured to return to Hong Kong after it acquired an engine hearth warning shortly after take-off on Sept. 2.

Cathay Pacific started inspecting all its Airbus A350 jets after the incident. It was the primary part of its sort to undergo such a failure on any A350 plane worldwide, Cathay mentioned on the time.

Earlier this month, European Union Aviation Security Company (EASA) additionally ordered inspections on engines of Airbus A350-1000 jets because it moved to forestall comparable occasions after consulting regulators and accident investigators in Hong Kong, in addition to Airbus and Rolls-Royce.

The AAIA, in its report, really helpful the EASA to ask Rolls-Royce to proceed giving airworthiness data, together with inspection necessities of the secondary gasoline manifold hoses of its engines to make sure their serviceability.

Cathay didn’t instantly reply to a request for touch upon the investigation’s findings.

Markets

Palantir Inventory Is Skyrocketing. 1 Analyst Thinks It Has One other 38% Achieve Forward.

The unreal intelligence revolution has been a blended bag for software program firms. Whereas software program shares that harness the ability of enormous language fashions (LLMs) have the potential to speed up revenues, AI additionally offers software program prospects the potential to “do-it-yourself.”

As an illustration, personal buy-now-pay-later firm Klarna just lately introduced it could try and do away with its Salesforce and Workday software program in lieu of constructing its personal CRM and worker administration software program internally, by way of using AI.

But AI software program platform Palantir (NYSE: PLTR) is exhibiting an acceleration in its business enterprise as a result of introduction of AI. And one Wall Road analyst thinks it has a lot farther to run.

Palantir isn’t any meme inventory

Some buyers have equated Palantir with the revolution, resulting in doubts about its latest run. This could possibly be due to some issues. First, the inventory has a excessive share of retail buyers relative to institutional buyers. Second, Palantir went public in a direct itemizing in late 2020, when rates of interest had been low and lots of doubtful software program and know-how firms bought shares to the general public. Lastly, CEO Alex Karp is considered some as a unusual and outspoken chief, for higher or worse.

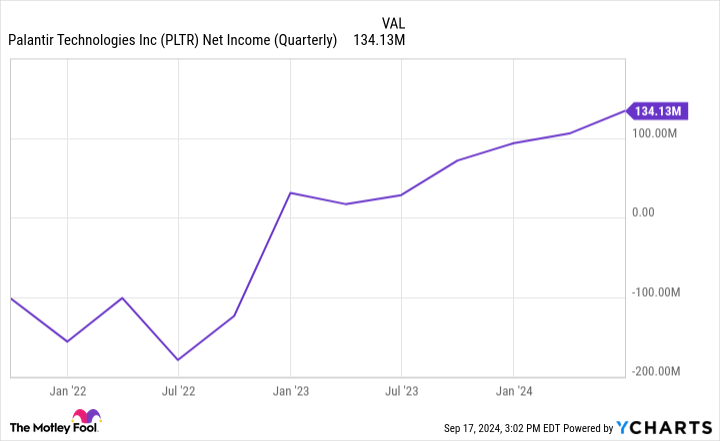

However Palantir isn’t any meme inventory. As a proof level, the corporate was just lately admitted to the celebrated S&P 500 index, which has stringent standards for admission. Previously couple years, Palantir has certified for the index by posting constant GAAP profitability — considerably uncommon for a software program inventory.

information by

AI is resulting in a reacceleration in progress

As well as, Palantir has seen its income progress speed up. That acceleration coincided with the introduction of the Palantir Synthetic Intelligence Platform, or “AIP,” a few 12 months in the past. AIP permits firms to include third-party LLMs or different specialised fashions immediately into Palantir’s current Gotham or Foundry software program platforms.

AIP has invigorated curiosity in Palantir’s software program, particularly from business prospects, leading to a reacceleration of income progress since AIP was launched.

Usually, it is more durable for firms to extend their progress charge as they get greater due to the legislation of enormous numbers. Nevertheless, one can see that Palantir has defied this development. The introduction of AIP and Palantir fine-tuning its advertising technique to incorporate periodic, “boot camps,” are possible causes for the inflection. These boot camps permit potential prospects to carry their precise information and expertise the AIP in a trial with Palantir’s engineers.

One analyst sees $50 in Palantir’s future

At present, most of Wall Road is definitely bearish on Palantir’s inventory. As of August, solely six out of 18 analysts charge shares a Purchase or Robust Purchase, with one other six ranking shares Impartial and the remaining six ranking shares a Promote. The common value goal on shares is $27, under the $36 present value as of this writing. That is in all probability attributable to Palantir’s inventory having greater than doubled this 12 months, whereas at present buying and selling at an costly valuation of roughly 35 instances gross sales.

However one analyst, Mariana Perez Mora of Financial institution of America charges shares a Purchase, with a street-high $50 value goal on the inventory. The analyst believes Wall Road misunderstands Palantir, and sees large issues within the firm’s future, justifying the next inventory value.

Mora thinks others miss how differentiated Palantir is relative to different enterprise software program shares, each product-wise and the way Palantir goes to market. Of observe, Palantir usually has members of its R&D staff embed themselves with a buyer first, with a view to perceive a buyer’s enterprise issues and ache factors. Then, Palantir tailors its modular software program to that enterprise’ particular infrastructure, making its information analytics capabilities extra related to every particular person buyer. In its annual report, Palantir notes seeks out “dangerous and resource-intensive” engagements the place different opponents could draw back.

Mora believes this technique, which is harder upfront and the place Palantir would not see instant revenues, finally pays off. It’s because the upfront work permits Palantir extra pricing energy in a while. She then sees Palantir’s merchandise spreading to extra industries as Palantir rolls out industry-specific platforms, such because the upcoming Warp Velocity for manufacturing companies.

An industry-standard OS like Home windows?

Whereas Palantir was previously referred to as a specialised software program platform for the Protection {industry} within the Struggle on Terror, Mora sees Palantir changing into an industry-standard platform sooner or later, calling it, “the widespread information operational system for the U.S. authorities and enormous U.S. companies.”

If Palantir’s latest continues, she could very nicely find yourself being appropriate. With nearly all of revenues nonetheless coming from the Protection {industry}, Palantir’s latest penetration of the a lot bigger enterprise market offers it the prospect to maintain progress charges excessive for some time, doubtlessly justifying immediately’s lofty inventory value.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for buyers to purchase now… and Palantir Applied sciences wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $708,348!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Financial institution of America is an promoting companion of The Ascent, a Motley Idiot firm. and/or his purchasers have positions in Financial institution of America. The Motley Idiot has positions in and recommends Financial institution of America, Palantir Applied sciences, Salesforce, and Workday. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Staff at Musk's Tesla, SpaceX and X donate to Harris whereas he backs Trump

By Sheila Dang

(Reuters) – Billionaire Elon Musk has endorsed Republican former President Donald Trump within the race for the White Home, however staff at his assortment of corporations are largely donating to Trump’s Democratic rival Kamala Harris.

Staff at Tesla (NASDAQ:) have contributed $42,824 to Harris’ presidential marketing campaign versus $24,840 to Trump’s marketing campaign, in line with OpenSecrets, a nonpartisan nonprofit that tracks U.S. marketing campaign contributions and lobbying information.

Staff at Musk’s rocket firm SpaceX have donated $34,526 to Harris versus $7,652 to Trump. Staff on the social media platform X, previously often called Twitter, have donated $13,213 to Harris versus lower than $500 to Trump.

Whereas the figures are comparatively small for marketing campaign fundraising, they point out political leanings at odds with Musk’s personal. The world’s richest man, Musk has boosted Trump on X and dismissed left-leaning concepts as a “woke-mind virus.”

Musk didn’t instantly reply to a request for remark. He backed President Joe Biden in 2020 however has tacked rightward since then. Trump has stated that if he wins the Nov. 5 election, he’ll appoint Musk to steer a authorities effectivity fee.

The OpenSecrets information consists of donations from firm staff and house owners and people people’ quick members of the family. Marketing campaign finance legal guidelines prohibit corporations themselves from donating to federal campaigns.

A lot of Musk’s staff are primarily based in California, a Democratic stronghold, stated Ross Gerber, CEO of Gerber Kawasaki Wealth and Funding Administration, which is a Tesla shareholder. Gerber can be an investor in X.

In July, Musk stated he would transfer X and SpaceX headquarters to Texas from California due to a California gender-identity legislation he known as the “final straw.” Gerber stated such a transfer would imply “shedding out on loads of potential expertise” in California.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares