Markets

'You Can't Earn Your Means Out of Stupidity': Dave Ramsey On Why $60K-Incomes Lecturers Usually Turn out to be Millionaires

Schoolteachers, typically underappreciated and underpaid, have lengthy been society’s unsung heroes. Regardless of their modest , many academics are quietly constructing vital wealth. In accordance with a analysis venture by Ramsey Options referred to as the “Nationwide Research of Millionaires,” many academics are discovering their method into the millionaires’ membership.

Do not Miss:

Dave Ramsey, a revered voice in private finance and CEO of Ramsey Options, introduced this shocking development to the limelight. “You don’t need to make an enormous earnings to construct wealth,” Ramsey mentioned. “You possibly can’t earn your method out of stupidity.” His phrases underscore a shocking actuality: Many millionaires are usually not excessive earners however sensible planners.

See Additionally: The variety of ‘401(okay)’ Millionaires is up 43% from final yr —

In accordance with the U.S. Bureau of Labor Statistics, academics are on the checklist of careers most definitely to have millionaires, with a median annual wage of $61,690, simply behind engineers and accountants. In the meantime, regardless of their hefty paychecks, physicians do not even crack the highest 5.

Primarily based on a survey of 10,000 millionaires, the report discovered that almost all of them didn’t come from well-off households. A staggering 79% didn’t inherit their fortune. As a substitute, they invested correctly – eight of ten had a 401(okay). Curiously, three-quarters of them didn’t maintain high-paying jobs, thus dispelling the parable that wealth is reserved for the superrich.

Trending: Warren Buffett flipped his neighbor’s $67,000 life financial savings right into a $50 million fortune —

“These individuals are systematic,” Ramsey mentioned. “They work with plans and play by the foundations.” He highlighted the significance of well-planned spending and investing habits, stating that 85% of millionaires use a procuring checklist, with 28% constantly sticking to it.

Noting that many are working onerous to construct up their financial savings, Ramsey mentioned that a few of the engaging affords are certificates of deposit (CDs) with good rates of interest and glued phrases.

One other avenue that Ramsey emphasised is high-yield financial savings accounts, which might yield returns exceeding 4%. “A high-yield financial savings account is a no brainer in case you’re critical about rising your cash. It is about making your cash give you the results you want,” he remarked.

Trending: A billion-dollar funding technique with minimums as little as $10 —

He additionally touched on how ardour impacts monetary outcomes. “Don’t take a job simply because it pays,” he mentioned. “You ought to earn more money in case you’re doing one thing you like. You’re good at it, you care, you’re artistic.” Nevertheless, he cautioned towards the idea {that a} excessive paycheck ensures wealth.

Reasonable-income earners, like academics, could make sufficient cash to grow to be rich with cautious planning. “You don’t need to have a huge paycheck to have a safe monetary future,” mentioned.

Ramsey’s insights lengthen to the medical discipline, the place many medical doctors wrestle with debt and delayed investments regardless of their hefty wages.

Brent Lacey, the host of “The Scope of Observe” podcast, resonated with this sentiment, declaring that physicians typically miss out on years of potential investments due to the load of pupil loans. “After enduring a lot sacrifice, they consider it is lastly their flip to take pleasure in their earnings,” Lacey remarked, contrasting this together with his grandmother, a thrifty public schoolteacher who retired with a fortune.

Learn Subsequent:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Recreation with the #1 “information & all the pieces else” buying and selling software: Benzinga Professional –

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

TSLA, RIVN, or LCID: Which U.S. EV Inventory Is the Prime Choose?

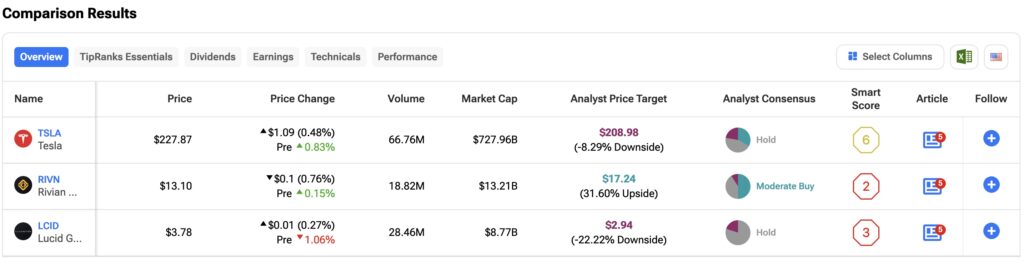

Within the extremely aggressive electrical car (EV) market, main gamers equivalent to Tesla , Rivian Automotive , and Lucid Group have encountered vital headwinds, with demand not assembly expectations. On this article, I’ll use the to clarify why I’m bullish on TSLA and RIVN, and bearish on LCID. I’ll additionally define why I take into account Tesla to be your best option among the many three automakers.

Regardless of a stretched valuation, I’m bullish on Tesla. The corporate’s shares at present commerce at a ahead P/E ratio of 97 instances future earnings estimates, which is about 15% under its five-year common. That is largely resulting from a considerable decline of over 40% within the share worth because it peaked in 2021, pushed by weaker-than-expected EV demand and elevated competitors. Nonetheless, Tesla stays the top-selling EV maker globally.

Tesla had aimed for 50% progress in car gross sales and manufacturing this 12 months however as an alternative has seen its income decline. In Q2, complete automotive income was $19.8 billion, down 7% from a 12 months in the past. Tesla’s quarterly manufacturing and supply figures in July confirmed 443,956 car deliveries, which was about 5% decrease than the earlier 12 months.

On the optimistic facet, Q2 noticed sturdy operational efficiency, with money from operations up 18% 12 months over 12 months to $3.61 billion, and free money circulation of $1.34 billion. This marks a rebound from Q1 of this 12 months when money from operations fell 90% to $242 million, and free money circulation declined to unfavourable $2.5 billion.

Is TSLA A Purchase, Maintain or Promote?

My bullish stance on Tesla isn’t primarily based on current outcomes however reasonably on its formidable progress forecasts. Tesla’s future is more and more tied to synthetic intelligence (AI), Robotaxis, and robotics. The corporate is ready to unveil its extremely anticipated Robotaxi on October 10, which might function a serious catalyst for the inventory.

Whereas some traders might not view Tesla as a serious AI participant, its massive put in base and vital involvement in AI are noteworthy. Dan Ives, a tech analyst at Wedbush Securities, argues that Tesla is probably the most undervalued AI firm. He believes Tesla might grow to be a trillion-dollar concern because it stabilizes demand and improves its pricing mannequin.

At present, Wall Avenue’s consensus on TSLA inventory is that it’s a Maintain. That is primarily based on 12 Purchase, 16 Maintain and eight Promote suggestions made within the final three months. of $208.98 implies potential draw back danger of 8.10%.

Rivian Automotive

Like Tesla, I’m additionally bullish on Rivian Automotive. That is primarily due to the corporate’s potential undervaluation vis-à-vis its formidable manufacturing targets. After dropping almost 90% of its worth since its 2021 preliminary public providing (IPO), Rivian now trades at a pretty worth primarily based on its money place.

With a market capitalization of $13.04 billion and $7.9 billion in money and short-term investments, greater than half of Rivian’s market worth is tied to its stability sheet. Nonetheless, primarily based on its electrical car gross sales, Rivian trades at a P/S ratio of two.5 instances, which, whereas decrease than Tesla, stays nearly 3 instances above the common for the automotive business.

That mentioned, the primary problem dealing with Rivian is reaching profitability and rising the manufacturing of its electrical car fashions. The corporate goals to provide as much as 215,000 autos yearly by 2026, up from 57,232 autos produced in 2023.

Is RIVN Inventory a Purchase?

Whereas I’m bullish on Rivian, it’s necessary to level out the dangers with this inventory. Rivian’s unprofitability is a priority. In Q2 of this 12 months, the corporate posted a internet lack of $1.45 billion, up from a $300 million loss a 12 months earlier. The corporate’s year-to-date loss now totals $2.9 billion. Nonetheless, as Wedbush analyst Dan Ives notes, Rivian’s main concern is its quarterly money burn of $800 million to $1 billion. This stays a priority as the corporate requires capital to scale manufacturing and meet demand. Extra not too long ago, a has eased dilution fears.

Wall Avenue is usually optimistic on RIVN, with 22 analysts score the inventory a Reasonable Purchase. That is primarily based on 11 Purchase, 9 Maintain and two Promote suggestions made up to now three months. The suggests 31.10% upside potential.

Relating to luxurious electrical car producer Lucid, I maintain a bearish place. That is due to the intense decline seen within the firm’s funds and market worth. The corporate’s market capitalization has declined to $8.34 billion from greater than $90 billion in 2021 when it went held its IPO. Regardless of the corporate’s decline, the valuation multiples nonetheless stay tough to justify.

Lucid trades at a 13 instances P/S ratio, almost double Tesla’s a number of and greater than six instances larger than Rivian’s. Moreover, the corporate reported a Q2 2024 internet lack of $643.3 million, translating to roughly $268,000 in losses per car bought, primarily based on the supply of two,394 autos through the quarter.

The state of affairs at Lucid could be extra dire if it weren’t for funding from Saudi Arabia’s Public Funding Fund (PIF). Due to that funding, Lucid holds $3.21 billion in money and short-term investments. This 12 months, the corporate raised a further $1 billion for the manufacturing of its new SUV referred to as “the Gravity.” Scheduled to launch in December this 12 months, the Gravity is predicted to be priced beneath $80,000, and will function a catalyst for LCID inventory.

Is LCID Inventory A Purchase, Maintain, or Promote?

My bearish view of Lucid is essentially resulting from its give attention to the slender and area of interest luxurious car market. Shoppers are clamoring for extra inexpensive EVs within the U.S. and elsewhere. Morgan Stanley analyst Adam Jonas my bearish outlook, noting Lucid’s issue in maintaining manufacturing prices under the promoting worth of its autos. This concern is additional exacerbated by the excessive value of its luxurious mannequin, the Lucid Air, which has a beginning worth of $69,900.

A complete of 10 Wall Avenue analysts have a consensus Maintain score on LCID inventory. That is primarily based on eight Maintain and two Promote suggestions made within the final three months. There aren’t any Purchase scores on the inventory. The implies draw back danger of 20.97% from the place the shares at present commerce.

Conclusion

I view Tesla as a high choose amongst this trio of main electrical car producers. The corporate has loads of progress potential with its Robotaxis, AI and robotics. Rivian Automotive can be a Purchase resulting from its upside potential and cheap valuation. I’m bearish on Lucid as a result of its valuation is simply too excessive and profitability stays a problem on the firm.

Markets

Japan shares larger at shut of commerce; Nikkei 225 up 1.67%

Lusso’s Information – Japan shares had been larger after the shut on Friday, as beneficial properties within the , and sectors led shares larger.

On the shut in Tokyo, the added 1.67%.

The perfect performers of the session on the had been Resonac Holdings Corp (TYO:), which rose 9.41% or 309.00 factors to commerce at 3,594.00 on the shut. In the meantime, Tokai Carbon Co., Ltd. (TYO:) added 7.02% or 61.10 factors to finish at 930.90 and Kawasaki Heavy Industries, Ltd. (TYO:) was up 6.26% or 319.00 factors to five,411.00 in late commerce.

The worst performers of the session had been Keisei Electrical Railway Co., Ltd. (TYO:), which fell 2.73% or 124.00 factors to commerce at 4,415.00 on the shut. NTT Knowledge Corp. (TYO:) declined 2.48% or 61.50 factors to finish at 2,418.50 and Kansai Electrical Energy Co Inc (TYO:) was down 2.37% or 57.00 factors to 2,349.00.

Rising shares outnumbered declining ones on the Tokyo Inventory Trade by 2389 to 1206 and 272 ended unchanged.

The , which measures the implied volatility of Nikkei 225 choices, was down 2.41% to 27.14.

Crude oil for November supply was down 0.10% or 0.07 to $71.09 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in November fell 0.13% or 0.10 to hit $74.78 a barrel, whereas the December Gold Futures contract rose 0.39% or 10.10 to commerce at $2,624.70 a troy ounce.

USD/JPY was down 0.50% to 141.91, whereas EUR/JPY fell 0.36% to 158.62.

The US Greenback Index Futures was down 0.17% at 100.15.

Markets

Trump Media inventory drops as lockup expiration set to provide the previous president clearance to promote shares

-

Trump Media inventory plummeted to its lowest ranges since its IPO on Thursday.

-

Shares dropped as a lot as 4% as a lockup interval was set to run out.

-

Following the lockup, Trump can dump his shares, although he is mentioned he would not promote.

Trump Media & Know-how Group shares dropped to their lowest degree because the firm went public earlier this 12 months as a .

The Reality Social mother or father firm’s shares slid as a lot as 4% on Thursday, dropping as little as $14.77 earlier than paring some losses.

The corporate went public in March, with shares spiking to all-time highs above $70 shortly after, earlier than steadily declining within the following months.

The newest decline has been fueled by investor concern over the lockup interval which prevents insiders from promoting, and which is ready to run out as quickly as Thursday afternoon, reported.

As soon as the lockup interval is over, the Republican presidential candidate has the all-clear to begin promoting his inventory. If he chooses to take action, it may very well be a significant headwind for traders, on condition that Trump owns a virtually 60% stake within the firm value $.

Trump mentioned final week he had no intention of promoting the inventory, which briefly calmed traders.

“No, I am not promoting. No, I find it irresistible,” the presidential candidate mentioned in a press convention final Friday, sparking a 25% rally in DJT shares.

Learn the unique article on

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now