Markets

Bitcoin Mining Is So Tough a Miner Adopted Michael Saylor’s Profitable BTC Technique

Marathon Digital bought debt to purchase bitcoin, after BTC mining earnings deteriorated this 12 months.

The miner is following Michael Saylor’s footsteps in utilizing borrowed cash so as to add BTC to its steadiness sheet.

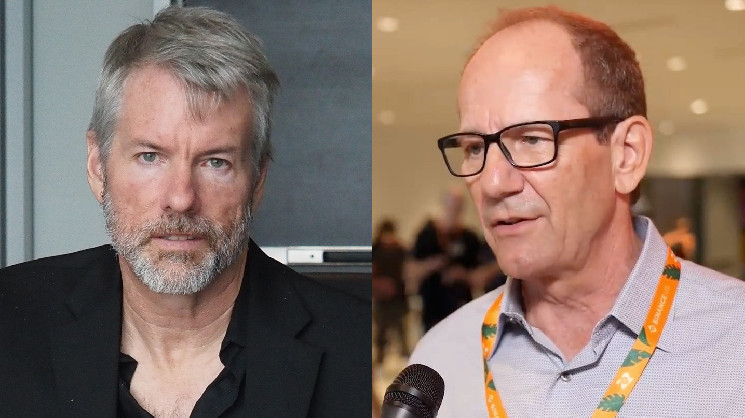

Billionaire Michael Saylor famously pioneered large-scale company purchases of bitcoin (BTC), utilizing borrowed cash to show his publicly traded software program developer MicroStrategy (MSTR) into one of many world’s largest holders of the cryptocurrency.

Now, one other firm – a shocking one – is following the same technique. It is a bitcoin miner, an organization that may theoretically snag discounted BTC by mining. The truth that it is following Saylor’s playbook, promoting debt to fund bitcoin purchases, not utilizing that borrowed cash to purchase gear to mine extra cash, places a highlight on how robust the mining sector has gotten this 12 months.

The miner is Marathon Digital (MARA), which this month bought $300 million of convertible notes, or bonds that may be changed into inventory, and bought 4,144 bitcoin with many of the proceeds.

Reasonably than buy extra mining rigs, “given the present mining hash worth, the inner price of return (IRR) signifies that buying bitcoin utilizing funds from debt or fairness issuances is extra useful to shareholders till circumstances enhance,” the biggest publicly traded miner posted just lately on X. “Hash worth” is a measure of mining profitability.

MicroStrategy’s bitcoin accumulation technique was broadly criticized when costs crashed in 2022, placing the corporate’s stake underwater. Nobody is laughing now, given MicroStrategy’s bitcoin hoard is price billions greater than the corporate paid.

Learn extra: Michael Saylor’s MicroStrategy Bitcoin Wager Tops $4B in Revenue

MicroStrategy and Marathon’s paths within the inventory market had been largely comparable after Saylor started shopping for bitcoin in 2020. Each had been basically a proxy for bitcoin’s worth – a horny high quality within the period earlier than bitcoin ETFs had been permitted early this 12 months.

However this 12 months, there’s been a large divergence. MicroStrategy’s inventory has soared 90% because it continued to trace bitcoin’s worth. Marathon has plummeted about 40% because the mining enterprise acquired a lot more durable. The Bitcoin halving in April slashed the reward for mining bitcoin in half, considerably lowering miners’ major supply of revenue.

Learn extra: Bitcoin Halving Is a ‘Present Me the Cash’ Second for Miners

Amid that plunge, Marathon adopted a “full HODL” technique of preserving all of the bitcoin it mines – and elevating cash to purchase extra.

“Adopting a full HODL technique displays our confidence within the long-term worth of bitcoin,” Fred Thiel, Marathon’s chairman and CEO, stated in an announcement final month. “We consider bitcoin is the world’s finest treasury reserve asset and assist the thought of sovereign wealth funds holding it. We encourage governments and firms to all maintain bitcoin as a reserve asset.”

Not lengthy after debuting that HODL technique, it introduced the $300 million debt providing. Marathon now owns greater than 25,000 bitcoin, second solely to MicroStrategy amongst publicly traded corporations.

Revenue squeeze

The share worth divergence between MicroStrategy and Marathon is no surprise, given the woes in mining. The trade is overcrowded, extra aggressive and going through elevated prices. To make issues worse, the Bitcoin community’s hashrate and problem – two measures of how onerous it’s to create new bitcoin – are getting increased.

JPMorgan just lately stated that mining profitability fell to all-time lows because the community hashrate rose within the first two weeks of August, whereas hashprice (the typical reward miners get per unit of computing energy they direct towards mining) continues to be round 30% decrease than the degrees seen in December 2022 and about 40% under pre-halving ranges. Miners are actually so confused that they have been compelled to pivot from purely being miners – as soon as a extremely worthwhile technique – to diversifying into different ventures corresponding to synthetic intelligence simply to outlive. Swan Bitcoin, a miner, even simply canceled its preliminary public providing and shut down a few of its mining enterprise as a result of an absence of income within the close to time period.

“At present hashprice ranges, a significant proportion of the community continues to be worthwhile, however solely marginally,” Galaxy Analysis stated in a notice on July 31. “Some miners on the fence might proceed to function as a result of they will generate constructive gross earnings. Nonetheless, when factoring in working bills and extra money prices, many miners discover themselves unprofitable and slowly working out of money,” the report added.

Learn extra: Bitcoin Mining Is So Again (Besides It is AI Now)

Furthermore, the January launch of bitcoin exchange-traded funds within the U.S. gave institutional buyers that do not wish to purchase cryptocurrencies, but nonetheless need crypto funding publicity, a extra direct route than shopping for inventory in bitcoin miners. After the rollout of ETFs, brief promoting the miners and going lengthy on ETFs grew to become a prevalent buying and selling technique amongst institutional buyers, basically capping the share worth appreciation of the miners.

To remain aggressive and to outlive the squeeze, miners have few decisions apart from diversifying. Even when a miner with a robust steadiness sheet like Marathon desires to remain a pure-play mining firm, it must both make investments extra capital into an already capital-intensive enterprise or purchase opponents. Each choices take time and include vital threat.

In gentle of that, it isn’t onerous to see why Marathon took a web page out of MicroStrategy’s profitable playbook and purchased bitcoin within the open market.

“In periods of great worth appreciation, we might focus solely on mining. Nonetheless, with bitcoin trending sideways and prices growing, which has been the case just lately, we count on to opportunistically ‘purchase the dips,'” Marathon stated.

Nishant Sharma, founding father of BlocksBridge Consulting, a analysis and communications agency devoted to the mining trade, agrees with Marathon’s BTC accumulation technique. “With bitcoin mining hashprice at file lows, corporations should both diversify into non-crypto income streams like [artificial intelligence or high-performance computing] or double down on bitcoin to seize investor pleasure round an anticipated crypto bull market, just like MicroStrategy’s strategy,” he stated.

“For MARA, the biggest bitcoin producer, it is sensible to decide on the latter: HODLing bitcoins mined at decrease prices than the market price and elevating debt to purchase extra, growing its BTC stockpile.”

Return of debt financing?

Marathon’s bitcoin shopping for is not new. The miner purchased $150 million price of bitcoin in 2021. What’s new is Marathon used convertible senior notes, a kind of debt that may be transformed into the corporate’s shares, to lift cash to purchase extra BTC – just like MicroStrategy’s technique. In accordance with Bernstein, Saylor’s firm has raised $4 billion to this point to purchase bitcoin, which helped the corporate profit from potential bitcoin upside whereas having a decrease threat of being compelled to promote the digital property on its steadiness sheet – a technique that appears to have resonated properly with institutional buyers.

Moreover, convertible debt tends to value corporations comparatively little and avoids instantly diluting the fairness stakes of shareholders like a inventory providing would. “With bitcoin costs at an inflection level and anticipated market tailwinds, we see this as an opportune second to extend our holdings, using convertible senior notes as a lower-cost capital supply that’s not instantly dilutive,” stated Marathon.

The miner supplied its notes at a 2.125% rate of interest, cheaper than present 10-year U.S. Treasury price of three.84% and similar to MicroStrategy’s newest increase at 2.25%. The miner was capable of supply such a low price and nonetheless entice buyers as a result of buyers get the regular revenue from the money owed and retain the choice to transform the notes into fairness, tapping into potential upside of the inventory.

“The benefit of convertible notes over conventional debt financing is that $MARA will have the ability to purchase a a lot decrease rate of interest than they in any other case would as a result of the truth that the notes could also be transformed into fairness,” Blockware Intelligence stated in a report.

With the ability to increase debt at an affordable rate of interest additionally helps Marathon shore up its battle chest for potential acquisitions. “The bitcoin mining trade is within the early phases of consolidation, and the pure acquirers are the businesses with giant steadiness sheets,” stated Ethan Vera, chief working officer or Luxor Tech. “Including a Bitcoin steadiness sheet place permits corporations to lift capital with a transparent use of funds, whereas making ready their steadiness sheet for potential M&A.”

In actual fact, such debt financing might make a comeback for the complete mining trade, after disappearing from the market in the course of the crypto winter as many miners defaulted on their poorly structured loans. “Beforehand, debt financing choices out there to miners had been primarily structured round collateralizing ASICs,” stated Galaxy, including that lack of liquidity on these loans after the 2022 worth collapse harm the complete sector. Different miners tapping into debt markets just lately additionally embody Core Scientific (CORZ) and CleanSpark (CLSK).

“We consider the trade is in a significantly better place now to tackle some debt and never rely solely on fairness issuance for development,” Galaxy stated.

Learn extra: Bitcoin Backside Is Close to as Miners Capitulating Close to FTX Implosion Degree: CryptoQuant

Markets

Inventory market in the present day: S&P 500, Dow futures again away from information as Fed cheer fizzles

US shares had been poised for a retreat from file highs on Friday as rate-cut euphoria pale, with FedEx () earnings offering a actuality examine.

S&P 500 futures () fell roughly 0.3%, after the benchmark index ended at an all-time excessive. Dow Jones Industrial Common futures () traded regular on the heels of notching its personal file shut. Main the best way decrease, contracts on the tech-heavy Nasdaq 100 () dropped 0.5%.

Shares as traders embraced Chair Jerome Powell’s message that the Federal Reserve made a giant interest-rate lower to , not to reserve it — an concept bolstered by .

That roaring rally is now sputtering amid reminders that dangers to development might nonetheless lie forward. Wall Avenue continues to be questioning whether or not the in protecting the financial system on monitor for a “comfortable touchdown”. Merchants are pricing in deeper cuts this 12 months than policymakers’ “dot plot” tasks, per Fed Funds futures.

Learn extra:

Additionally, these Fed-fueled excessive spirits are , in line with a high Financial institution of America strategist. Michael Hartnett stated shares are pricing in ranges of coverage easing and earnings development proper now that push traders to go chasing for features.

Late Thursday, FedEx in revenue, lacking Wall Avenue estimates. The supply firm— a bellwether for the financial system — noticed Its shares droop nearly 14% in premarket buying and selling.

Elsewhere, Nike’s () inventory jumped after the sportswear maker as its gross sales come underneath strain.

Markets

FedEx, PepsiCo, Trump Media fall premarket; Nike rises

Lusso’s Information — US inventory traded in tight ranges Friday, consolidating after the earlier session’s sharp positive aspects within the wake of the Federal Reserve’s hefty rate of interest reduce.

Listed here are among the greatest premarket US inventory movers at this time

-

FedEx (NYSE:) inventory slumped 13% after the logistics group reduce its full-year steering and reported fiscal first-quarter earnings that fell nicely in need of Wall Road expectations.

-

Nike (NYSE:) inventory rose 5.7% after the athletic attire agency introduced that Chief Govt John Donahoe is about to step down from the place subsequent month.

-

PepsiCo (NASDAQ:) inventory fell 1.1% after Morgan Stanley downgraded its stance on the gentle drinks large to “equal-weight” from “obese”, citing the danger of US income development.

-

Financial institution of America (NYSE:) inventory fell 0.4% after Berkshire Hathaway (NYSE:) resumed gross sales of the financial institution’s inventory in latest days, unloading about $900 million value of shares and dropping its stake to $34 billion, or 10.8% of the shares excellent.

-

Trump Media & Know-how Group (NASDAQ:) inventory fell 4.5%, extending the sharp losses in latest weeks fueled by worries in regards to the finish of so-called lock-up interval associated to its inventory market debut in March.

-

Apple (NASDAQ:) inventory fell 0.4% after iPhone 16 resale costs on September 20, the primary day of cargo, have “collapsed inside the first three hours of buying and selling,” based on analysts at Jefferies.

-

Lennar (NYSE:) inventory fell 2.9% regardless of the homebuilder reporting better-than-expected third quarter outcomes as new residence orders elevated amid sturdy housing demand.

Markets

Funding advisers urge shoppers away from money after Fed price minimize

By Suzanne McGee and Carolina Mandl

(Reuters) – Funding advisers are urging shoppers to dump hefty money allocations now that the Federal Reserve has begun its much-anticipated interest-rate easing, a course of they count on to restrict the attraction of money-market funds within the coming months.

Retail money-market funds have attracted $951 billion in inflows since 2022, when the Fed began its rate-hiking cycle to tame inflation, in accordance with the Funding Firm Institute, which represents funding funds. Their belongings stood at $2.6 trillion on Sept. 18, roughly 80% larger than in the beginning of 2022.

“As coverage charges fall, the attraction of money-market funds will wane,” mentioned Daniel Morris, chief market strategist at BNP Paribas Asset Administration.

On Wednesday, the U.S. central financial institution minimize the federal funds price by a larger-than-usual 50 foundation factors to a spread of 4.75% to five%, which makes holding money in deposit accounts and cash-like devices much less interesting.

“You are going to should shift every little thing … additional up within the quantity of threat you are accepting,” mentioned Jason Britton, Charleston-based founding father of Reflection Asset Administration, who manages or oversees round $5 billion in belongings. “Cash-market belongings must change into fixed-income holdings; fastened revenue will transfer into most well-liked shares or dividend-paying shares.”

Cash-market funds – extremely low-risk mutual funds that put money into short-term Treasury securities and different money proxies – are a option to gauge investor curiosity within the almost risk-free returns they provide. When short-term rates of interest climb, money-market returns rise with them, rising their attraction to buyers.

“Buyers must be conscious that in the event that they’re relying on a sure degree of revenue from that portion of their portfolio, they might want to have a look at one thing completely different, or longer-term, to lock in charges and never be as uncovered to the Fed reducing rates of interest,” mentioned Ross Mayfield, funding strategist at Baird Wealth.

Carol Schleif, chief funding officer of BMO Household Workplace, expects buyers to maintain some money on the sidelines to attend for alternatives to purchase shares.

It might take every week or extra for preliminary reactions to the Fed’s choice on Wednesday to indicate up in money-market fund flows and different knowledge, analysts be aware. Whereas the Funding Firm Institute reported an total decline in money-market holdings in its final weekly report on Thursday, retail positions had been little modified to larger and advisers mentioned it has been robust to influence that group to desert their money holdings.

Christian Salomone, chief funding officer of Ballast Rock Non-public Wealth, mentioned shoppers confronted with decrease returns on money are desperate to put money into one thing else.

Nonetheless, “buyers are caught between a rock and a tough place,” Britton mentioned, confronted with a selection between investing in riskier belongings or incomes a smaller return from cash-like merchandise.

(Reporting by Suzanne McGee and Carolina Mandl; further reporting by Davide Barbuscia; modifying by Megan Davies and Rod Nickel)

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?