Markets

5 Issues to Know Earlier than the Inventory Market Opens

Information of the day for September 6, 2024

Anna Rose Layden / Stringer / Getty Photographs

Traders will likely be carefully looking forward to recent jobs knowledge that would affect the Federal Reserve’s stance on rates of interest, Broadcom (AVGO) shares are tumbling in pre-market buying and selling after the chipmaker for the present quarter, the U.S. is rolling out new export controls on important applied sciences, and extra. This is what buyers must know right this moment.

1. Contemporary Jobs Knowledge May Affect Fed’s Stance on Price Cuts

Traders will likely be carefully watching due at 8:30 a.m. ET. Weaker-than-expected outcomes might doubtlessly push the Fed to make steeper cuts to its key rate of interest at its subsequent assembly and at future conferences. The report from the Bureau of Labor Statistics is anticipated to point out employers added 161,000 jobs in August, and the unemployment price fell a tenth of a share level to 4.2% from July.

2. Broadcom Falls as Disappointing Outlook Weighs on AI Chipmaker’s Inventory

Broadcom (AVGO) shares are tumbling almost 9% in pre-market buying and selling after the chipmaker for the present quarter, regardless of fiscal third-quarter gross sales that . Softer spending in its broadband enterprise and different divisions partially offset energy in its segments.

3. US Rolls Out New Export Controls of Superior Tech

The U.S. is planning to implement new export controls on superior applied sciences, together with quantum computing and semiconductor items, the Commerce Division stated in a press release, because it continues to focus on demand from China. Whereas China isn’t named within the assertion, the transfer comes after the U.S. already semiconductor chips geared toward curbing the nation’s entry. The controls, made for “nationwide safety and international coverage causes,” are reportedly set to cowl worldwide exports however exempt some nations similar to Japan and the Netherlands, house of chipmaking tools supplier (ASML).

4. Salesforce To Purchase Knowledge Safety Agency Personal for $1.9B

Salesforce (CRM) is shopping for knowledge safety agency Personal Firm for about $1.9 billion in money, the cloud software program agency stated. Salesforce already owns 10% of the corporate and Salesforce President Steve Fisher stated the acquisition would add to its potential “to supply sturdy knowledge safety and administration options to our clients.”

5. 7-Eleven Mum or dad Turns Down Circle Okay Proprietor’s $39B Bid

Japan’s Seven & i rejected a $39 billion Canada’s Alimentation Couche-Tard, opening the 7-Eleven chain operator to a different bid by the proprietor of the Circle Okay comfort retailer model. The Tokyo-based agency stated that Alimentation Couche-Tard’s provide “grossly undervalues” the corporate and that the Canadian proposal doesn’t absolutely take note of the antitrust hurdles the deal must overcome.

Learn the unique article on .

Markets

Huawei's $2,800 cellphone launch disappoints amid provide considerations

By David Kirton

SHENZHEN, China (Reuters) -Huawei and Apple’s newest smartphones went on sale in China on Friday, with many followers of the Chinese language firm dissatisfied that its much-anticipated $2,800 cellphone – greater than twice the value of the iPhone 16 Professional Max – was not accessible for walk-in clients.

At Huawei’s flagship store within the southern Chinese language metropolis of Shenzhen, some who described themselves as Huawei “tremendous followers” have been aggravated after being informed solely these whose pre-orders had been confirmed might purchase the brand new, tri-foldable Mate XT.

“I’ve been right here since 10 p.m. final night time as a result of this tri-folding cellphone is a primary and I am excited to help our nation,” mentioned a college pupil surnamed Ye.

“However that is very disappointing. They need to have made it clear we will’t purchase.”

It was an identical story on the Huawei Wangfujing retailer in Beijing, the place shoppers have been informed solely these whose pre-orders had been confirmed might purchase the much-hyped cellphone, which folds 3 ways like an accordion display door.

A consumer surnamed Rui who received to check out the Mate XT in Shenzhen mentioned: “I needed to see what the fuss is about, nevertheless it’s a bit large, not very sensible actually.”

The frustration comes after some analysts had warned that offer chain constraints might go away many potential patrons of Huawei’s Mate XT empty-handed and others questioned the excessive value of the cellphone amid a sluggish economic system.

Whereas Huawei govt director Richard Yu mentioned at Mate XT’s unveiling this month the corporate had turned “science fiction into actuality”, proudly owning the cellphone nonetheless stays a fantasy for a lot of.

Pre-orders for the Mate XT have surpassed 6.5 million, nearly double the roughly 3.9 million foldable smartphones shipped worldwide within the second quarter of this 12 months, in line with consultancy IDC. “Pre-ordering” doesn’t require shoppers to place down a deposit. Huawei didn’t say what number of telephones had been produced to this point or what number of clients would obtain the Mate XT on launch day. Apple (NASDAQ:) didn’t reply to a request for touch upon what number of new iPhones have been accessible on the market in China on Friday.

Within the Huaqiangbei electronics market in Shenzhen, a cellphone stall vendor mentioned she was promoting the costliest model of the Mate XT – with the best reminiscence – for 150,000 yuan ($21,290), in comparison with the shop value of 23,999 yuan, whereas she was providing the $2,800 mannequin for greater than $4,000.

Requested if she had bought any, she replied: “Just a few individuals have requested, nevertheless it’s far too costly.”

APPLE NEEDS CHINA AI PARTNER

Whereas Apple for years loved robust demand in China, the place new iPhone launches as soon as sparked a frenzy, its gross sales have dwindled and the corporate’s quarterly rating on the earth’s No. 2 economic system has now dropped from third to sixth place.

Apple’s new smartphone launch in China has been overshadowed by the truth that it has but to announce an AI companion within the nation to energy the 16s, and Apple Intelligence, its AI software program, will solely be accessible in Chinese language subsequent 12 months.

Some Apple followers mentioned the AI problem was not a difficulty.

“The shortage of AI in iPhones is just not at present a serious concern for me, because it’s extra of a gimmick at this stage,” mentioned a buyer surnamed Shi who upgrades his iPhone yearly.

Talking concerning the new providing by Huawei, Shi mentioned it was too costly and “not for bizarre clients”.

Huawei has acquired vital patriotic help in China with followers impressed at how the corporate has managed to beat years of export controls by america that originally crippled its smartphone enterprise.

The launch of the Mate XT, which analysts say has a locally-made chipset, underscores Huawei’s means to navigate U.S. sanctions though the corporate’s means to mass-produce stays a major concern.

Based mostly on latest checks, key elements of the Huawei Mate XT, together with the panel, cowl glass, and hinges, could also be going through manufacturing yield points, mentioned Lori Chang, a senior analyst with Isaiah Analysis.

($1 = 7.0460 yuan)

Markets

Shares Lengthen Rally, Yen Positive factors as BOJ Holds Price: Markets Wrap

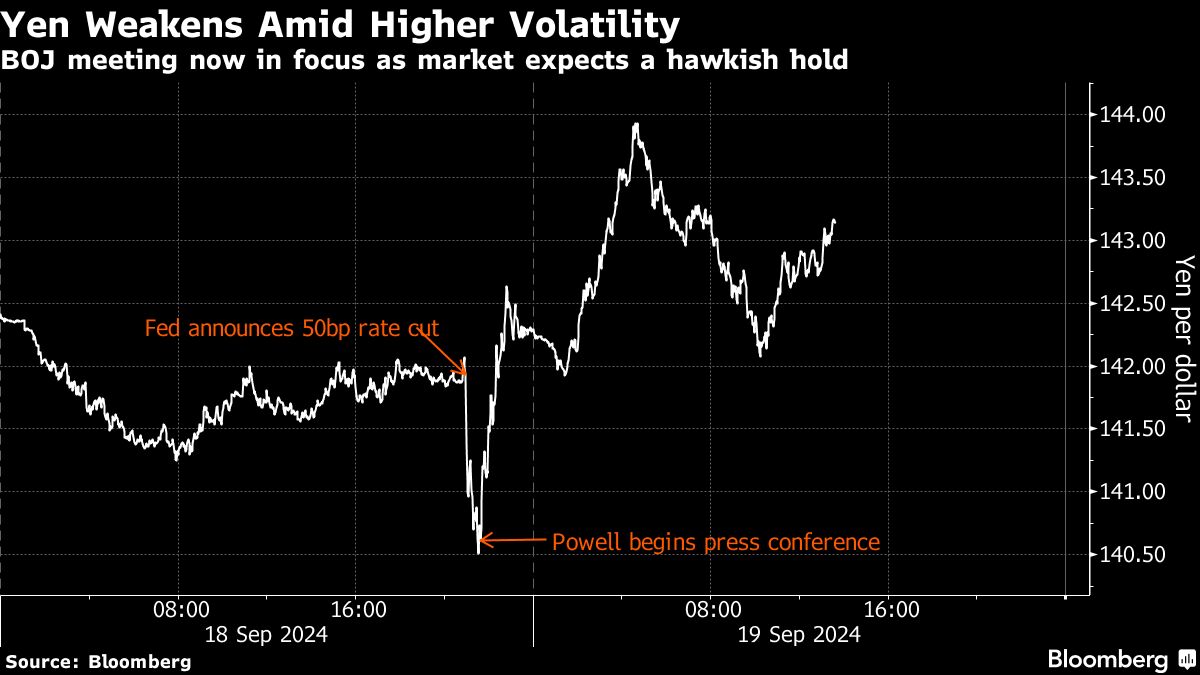

(Lusso’s Information) — Asian shares prolonged a rally in world equities as jobs information backed the view that the US economic system is headed for a smooth touchdown. The yen gained because the Financial institution of Japan left rates of interest unchanged.

Most Learn from Lusso’s Information

The MSCI Asia Pacific Index rose as equities in Japan, South Korea and Australia superior, whereas mainland Chinese language shares slipped. A gauge of worldwide shares set a contemporary peak alongside US shares Thursday.

The BOJ saved its financial coverage settings regular Friday, signaling it sees no have to hurry with rate of interest hikes because it screens monetary markets after its July improve and hawkish views spooked buyers. Information launched earlier confirmed the nation’s key inflation gauge accelerated in August for a fourth consecutive month.

“The main target now shifts to Governor Ueda’s press convention,” stated Shoki Omori, chief desk strategist at Mizuho in Tokyo. “Relying on the diploma of this tone, if the hawkish stance is clearly conveyed to the market, the USD/JPY alternate price is predicted to development downward.”

Treasury yields have been little modified on Friday, whereas an index of greenback power was locked in a slender vary.

A drop in US jobless claims to the bottom since Could signaled the labor market stays wholesome regardless of a slowdown in hiring. This added a lift to danger urge for food and eased issues the Fed could have been too gradual to trim borrowing prices when it reduce charges by half a proportion level on Wednesday.

The fairness good points on Thursday and Friday mark a “delayed euphoric response,” to the Fed however one that will retreat, in response to Nick Ferres, Chief Funding Officer of Singapore-based Vantage Level Asset Administration. “Valuation is already heroic and danger compensation is poor, notably if the earnings cycle disappoints.”

Over in China, the nation is contemplating eradicating a number of the largest remaining curbs on house purchases after earlier measures didn’t revive a moribund housing market, in response to individuals conversant in the matter. That pushed the BI China Actual Property Homeowners and Builders Valuation Peer Group gauge increased.

In the meantime, the nation’s banks maintained their benchmark lending charges for September, as policymakers held off on additional financial stimulus whereas monetary establishments battle with record-low revenue margins. The Securities Instances reported on Friday that this week’s Fed price reduce has offered room for China to spice up financial and financial stimulus to assist the economic system.

The European Union and China agreed to accentuate discussions to avert looming tariffs on electrical automobiles forward of a deadline that’s solely days away.

Elsewhere, Wall Avenue banks are divided on the tempo and extent of upcoming Federal Reserve price cuts. JPMorgan Chase & Co. count on one other 50 foundation level discount in November, whereas Goldman Sachs Group Inc. anticipates 25 foundation level cuts at every assembly from November to June subsequent yr.

In Asia, Taiwan’s property and development shares dropped Friday following the central financial institution’s choice to extend the quantity of funds banks should maintain in reserve to chill the scorching property market.

Information set for launch embrace inflation for Hong Kong and overseas alternate reserves for India.

In commodities, gold steadied close to a file excessive whereas oil was on monitor for the largest weekly advance since April after the US price reduce.

Key occasions this week:

-

Japan price choice, Friday

-

Eurozone client confidence, Friday

-

Canada retail gross sales, Friday

Among the important strikes in markets:

Shares

-

S&P 500 futures fell 0.1% as of 12:52 p.m. Tokyo time

-

Nikkei 225 futures (OSE) rose 2%

-

Japan’s Topix rose 1.4%

-

Australia’s S&P/ASX 200 rose 0.4%

-

Hong Kong’s Dangle Seng rose 1.3%

-

The Shanghai Composite fell 0.2%

-

Euro Stoxx 50 futures fell 0.2%

-

Nasdaq 100 futures fell 0.2%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1165

-

The Japanese yen rose 0.3% to 142.16 per greenback

-

The offshore yuan rose 0.3% to 7.0453 per greenback

-

The Australian greenback was little modified at $0.6819

Cryptocurrencies

-

Bitcoin rose 0.8% to $63,565.84

-

Ether rose 1.1% to $2,493.88

Bonds

-

The yield on 10-year Treasuries was little modified at 3.71%

-

Japan’s 10-year yield was unchanged at 0.850%

-

Australia’s 10-year yield was little modified at 3.92%

Commodities

-

West Texas Intermediate crude was little modified

-

Spot gold rose 0.2% to $2,592.04 an oz

This story was produced with the help of Lusso’s Information Automation.

–With help from Winnie Hsu.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Nike's subsequent CEO Hill brings a bootstraps mentality

By Nicholas P. Brown

(Reuters) – Elliott Hill began at Nike (NYSE:) as an intern in 1988 however steadily scaled its ranks, banking on values of grit and laborious work ingrained in him because the son of a single mother in a working class Texas neighborhood.

These qualities could also be helpful once more when Hill turns into the worldwide sneaker and sportswear model’s prime boss subsequent month, serving to revive the corporate the place he has spent his complete profession.

Nike introduced on Thursday Hill will grow to be its subsequent chief government officer on Oct. 14, changing the retiring John Donahoe.

Its gross sales have faltered in current months, as nimbler, extra modern manufacturers reminiscent of On and Deckers’ Hoka have gained market share. Nike is within the midst of what it says shall be a three-year endeavor to chop $2 billion in prices.

The place Donahoe was an outsider – introduced in in 2020 after CEO stints at eBay (NASDAQ:), Bain Capital and the cloud firm ServiceNow (NYSE:) – Hill is Nike to the bone. He joined it out of graduate college at Ohio College in 1988, lobbying an organization rep who had spoken at his sports activities advertising class.

“I bothered him for six months till he lastly employed me,” Hill stated on the FORTitude podcast in December. “I informed him ‘all people in my class has a job besides me.’”

His blue-collar bona fides return even additional than that. Born in Austin in 1963, Hill’s father left the household when he was three. His mom set an “unbelievable instance by way of dedication and work ethic,” he informed the podcast. Sports activities, he added, grew to become a key piece of his childhood.

At Nike, he held stints in gross sales, together with within the Dallas workplace. “I did 60,000 miles a yr, two years in a row, in an outdated Chrysler minivan,” he stated, describing his early years promoting footwear to mom-and-pop retailers.

After myriad different roles – together with directing Nike’s workforce sports activities division, and serving as its vice chairman of worldwide retail – Hill grew to become President of Client & Market in 2018. He retired in 2020.

Hill recollects a time when Nike epitomized innovation. He was within the room when the corporate unveiled its iconic “Simply do it” advert in 1988. Workers watching the inner presentation erupted in cheers, he stated on FORTitude, a podcast that includes folks like Hill who lived and labored in Dallas-Fort Price. “In the event you can encourage folks within your organization, you recognize you are going to encourage folks outdoors the corporate,” he stated.

Hill didn’t reply to a Reuters e mail looking for remark. However Nike stated Hill was well-regarded internally, and believes his rent shall be common with staff.

MICHAEL JORDAN’S SHOE

The Texas Christian College graduate helped lead Nike’s Dream Loopy marketing campaign, narrated by NFL quarterback Colin Kaepernick, in 2018. He additionally constructed relationships with key athletes, together with Michael Jordan.

When Hill wished to take the Jordan model international, the basketball star was nervous concerning the transfer, and stated he was going to go away considered one of his size-13 footwear on Hill’s desk. “I need you to consider that shoe, and if our income goes again, I’ll come and stuff that up your rear,” Hill remembered Jordan saying.

Hill laughed whereas describing the second on the podcast. “It was primarily stated in jest,” he stated, “however you recognize I acquired the purpose that he believed in us and was going to take a threat.”

Hill and his spouse, Gina, created a scholarship at Central Catholic Excessive Faculty in Portland, Oregon, the place the couple’s youngsters attended college. Hill raised cash for the scholarship by auctioning the sports activities memorabilia assortment he had amassed in three many years at Nike.

Laundry – a Portland clothes retailer that sells principally classic sports activities workforce attire – partnered with Hill on the 2022 public sale, its proprietor Chris Yen informed Reuters on Thursday.

Yen had no concept who Hill was when he obtained a chilly name from him. Hill informed Yen he had realized of the shop by means of his son, and wished to work with him. The public sale raised $2.1 million between memorabilia gross sales and personal donations, Yen stated.

“Elliott is the absolute best particular person for the job and to assist get Nike again to successful once more,” he stated.

Wall Avenue analysts hope Hill can carry pleasure again to the Nike model.

“Product innovation on the firm continues to be missing,” stated Brian Nagel, an analyst at Oppenheimer, including that “administration has been loath” to revive partnerships with key retailers.

Jessica Ramirez, an analyst with Jane Hali and Associates, put it bluntly: At Nike, she stated, “the tradition has fallen aside.”

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now