Markets

Missed Out On Nvidia's Run-Up? My Greatest AI Inventory to Purchase and Maintain.

If you happen to search for “synthetic intelligence” (AI) within the dictionary, you would possibly simply see an image of the Nvidia emblem. I am clearly kidding, however there is not any denying that this enterprise has been the clear poster youngster of this revolutionary technological development.

This AI infrastructure firm has been a monster winner. Shares have catapulted 2,560% greater prior to now 5 years, crushing the broader Nasdaq Composite Index by an extremely vast margin. Which means that a $10,000 funding in September 2019 could be value a whopping $266,000 in the present day.

You is perhaps discouraged in the event you missed out on Nvidia’s run-up. However maybe it is time to take a better take a look at what I consider to be one of the best proper now.

Nvidia’s spectacular run

Some traders would possibly consider that Nvidia’s big beneficial properties are warranted. The enterprise sells the graphics processing models (GPUs) essential to energy many AI techniques. And as firms of all sizes attempt to place their operations to combine AI, Nvidia has been one of the best beneficiary.

In keeping with analysis from Mizuho Securities, Nvidia has between a 70% to 95% share of the marketplace for chips that energy AI fashions. Unsurprisingly, progress has been unbelievable. Income elevated 122% from $13.5 billion within the year-ago interval to $30 billion within the fiscal 2025 second quarter (ended July 28).

Nvidia can also be wildly worthwhile, posting a 75% gross margin and 62% working margin within the newest fiscal quarter. It isn’t a shock that the market has turn into extremely bullish and optimistic about Nvidia’s prospects. That is now a $2.7 trillion enterprise.

However as of this writing, shares commerce at a price-to-earnings (P/E) ratio of 52. This makes it the second most costly “Magnificent Seven” inventory, which is not a pretty proposition for traders.

Alphabet’s enviable place

Nvidia will get all the eye relating to AI shares, however traders ought to take a look at Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG). I believe it is one of the best AI inventory to purchase and maintain.

Again in 2001, the enterprise was already using machine studying and AI capabilities in its highly effective search engine, serving to customers with their spelling. And even earlier than OpenAI’s launch of ChatGPT in November 2022 kicked off the AI increase, this know-how was being developed and built-in in numerous Alphabet services and products, like offering visitors knowledge in Maps, making it simpler to seek out Images by looking out what’s in them, and stopping spam in Gmail.

CEO Sundar Pichai positioned the enterprise to be “AI first” again in 2016. These days, AI is undoubtedly part of Alphabet’s present DNA. To be clear, the corporate’s . However its Gemini AI mannequin is working.

“All six of our merchandise with greater than 2 billion month-to-month customers now use Gemini. Which means that Google is the corporate that is actually bringing AI to everybody,” Pichai stated on the Q2 2024 earnings name.

Alphabet has unequalled attain to proceed introducing AI options to virtually immediate adoption. This enables for fast suggestions, which solely helps to continually enhance the choices and bolster Alphabet’s aggressive positioning.

And the enterprise has nearly limitless monetary assets. It generated $54 billion of annualized free money circulate within the second quarter. And Alphabet is presently sitting on a large web money steadiness of $87.5 billion, which supplies it the firepower to maintain investing closely in AI.

Whereas Nvidia’s valuation is steep, that is not actually a priority on this case. Alphabet shares commerce for an affordable P/E ratio of 23. Buyers should not overthink it. Alphabet has lengthy been a dominant drive within the web age. And I see this persevering with within the years forward, significantly in a world the place AI turns into extra prevalent.

Must you make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for traders to purchase now… and Alphabet wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $656,938!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 3, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. and his shoppers haven’t any place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet and Nvidia. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

3 Filth Low-cost Shares to Purchase Proper Now

By most metrics, the inventory market is priced at a premium as of late. However that does not imply bargains cannot nonetheless be discovered.

Three Motley Idiot contributors suppose they’ve recognized dirt-cheap healthcare shares to purchase proper now. This is why they picked CRISPR Therapeutics (NASDAQ: CRSP), Gilead Sciences (NASDAQ: GILD), and Pfizer (NYSE: PFE).

You may nonetheless get in on the bottom flooring

(CRISPR Therapeutics): Valuing comparatively small biotech corporations that generate little-to-no income is just not an actual science. Even so, CRISPR Therapeutics, a gene-editing specialist, seems to be low-cost at its present ranges. CRISPR Therapeutics’ market cap is $4.2 billion regardless of the latest approval of Casgevy, a remedy for 2 blood-related illnesses it developed in collaboration with Vertex Prescribed drugs.

CRISPR Therapeutics and Vertex Prescribed drugs are taking a look at a large alternative with Casgevy. The drugs prices $2.2 million within the U.S. They estimate a market of 35,000 sufferers within the U.S. and Europe, with a further 23,000 in some international locations within the Center East the place Casgevy can also be accepted. CRISPR Therapeutics ought to finally generate effectively over $1 billion in gross sales from Casgevy.

The corporate has additionally proven that its gene-editing platform can produce tangible leads to unlocking therapies the place few can be found. There’s a world of alternatives: Loads of situations haven’t any accepted therapies. Many others have a dire want for higher requirements of care. One in all CRISPR Therapeutics’ extra promising tasks is its work in sort 1 diabetes for which the corporate is making an attempt to develop a practical remedy.

In my opinion, CRISPR Therapeutics is a biotech large within the making. Casgevy will convey within the funds that may assist it push its gene-editing platform ahead. Within the subsequent 5 years, anticipate extra essential scientific and regulatory progress from the corporate. Although CRISPR Therapeutics has delivered sturdy returns since its 2016 preliminary public providing (IPO), for the biotech, at the very least for traders keen to be affected person.

Gilead Sciences may make for an underrated development inventory

David Jagielski (Gilead Sciences): What’s a high pharmaceutical inventory you will not wish to overlook proper now? Gilead Sciences. Whereas its single-digit (and generally detrimental) development charge could look unimpressive over the previous few years, the corporate does possess some promising catalysts which may result in stronger numbers sooner or later. Plus, it pays an awesome dividend which yields 3.7% — practically thrice higher than the S&P 500 common of 1.3%.

Gilead Sciences just lately introduced that lenacapavir, its twice-yearly HIV remedy, was extremely efficient in stopping HIV. It dramatically decreased infections by 96% in a section 3 trial. Analysts estimate that the drug, which is already accepted to deal with individuals who have multidrug-resistant HIV, may generate $4 billion in gross sales at its peak. That might be a substantial revenue-generating product for the enterprise as final 12 months Gilead’s gross sales topped $27 billion.

Lenacapavir may do wonders for the corporate’s HIV enterprise, which has been Gilead’s slowest rising of late. By way of the primary six months of 2024, HIV gross sales rose by simply 3% 12 months over 12 months to $9.1 billion. Whereas that is nonetheless the corporate’s largest phase, development charges in liver illness (13%) and oncology (17%) have been each far larger throughout that time-frame and likewise symbolize thrilling development alternatives for the enterprise sooner or later.

Though Gilead’s shares are up just a little this 12 months, the biotech inventory trades at a lowly 12 occasions its estimated future income (primarily based on analyst expectations). For long-term traders, this might be a superb inventory to purchase and maintain.

Greater than meets the attention

Keith Speights (Pfizer): Pfizer has been a giant loser lately, though it has eked out a meager acquire in 2024. Nevertheless, I imagine there’s greater than meets the attention with this huge drugmaker.

You may blame a lot of Pfizer’s woes on the declining gross sales of its COVID-19 merchandise. I do not anticipate the corporate will ever once more see the booming numbers of 2021 and 2022. However I additionally suppose 2024 might be a trough 12 months for Pfizer’s COVID-19 vaccine gross sales.

The opposite huge problem for the corporate is the approaching patent expirations for a number of of its high merchandise. Sadly for Pfizer, the record consists of blockbuster medicine Eliquis, Ibrance, Vyndaqel, Xeljanz, and Xtandi.

Pfizer is not being blindsided by this patent cliff, although. It has invested in creating new merchandise, with respiratory syncytial virus (RSV) vaccine Abrysvo particularly standing out. The corporate has additionally used the large money generated from its COVID-19 vaccine throughout the worst of the pandemic to fund key acquisitions, together with its 2023 buy of Seagen. In consequence, Pfizer ought to have the ability to ship stable development within the coming years regardless of dropping patent exclusivity for a number of merchandise.

In the meantime, the pharma inventory is priced at a reduction. Pfizer’s shares commerce at solely 10.6 occasions ahead earnings. That is a lot decrease than the S&P 500 healthcare sector’s forward-earnings a number of of 19.6.

In the event you’re in search of one more reason to purchase this dirt-cheap inventory, take a look at its dividend. Pfizer provides a forward-dividend yield of 5.65%. Even higher, the corporate’s administration stays dedicated to rising its dividend payout over time.

Must you make investments $1,000 in CRISPR Therapeutics proper now?

Before you purchase inventory in CRISPR Therapeutics, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for traders to purchase now… and CRISPR Therapeutics wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $722,320!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. has positions in Pfizer and Vertex Prescribed drugs. has positions in Vertex Prescribed drugs. The Motley Idiot has positions in and recommends CRISPR Therapeutics, Gilead Sciences, Pfizer, and Vertex Prescribed drugs. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

SAIC Volkswagen says adjusting plant base "needed"

HONG KONG (Reuters) – SAIC Volkswagen (ETR:), responding to studies it will shut its Nanjing plant, mentioned on Saturday that adjusting its manufacturing base was “regular and needed”, Chinese language media outlet Yicai reported.

Reuters reported this week that Germany’s Volkswagen plans to cease manufacturing at considered one of its combustion engine automotive crops in China, in an indication of automakers’ struggles to handle overcapacity on the planet’s greatest automotive market.

Some studies mentioned the three way partnership of VW and Chinese language companion SAIC Motor would shut the Nanjing plant, though an individual with direct information of the matter advised Reuters the agency had not determined whether or not to promote or shut the plant.

Requested on Saturday about plans to shut the Nanjing plant, SAIC Volkswagen mentioned that “based mostly on company strategic planning and response to market tendencies, firm’s adjustment on its manufacturing base is a standard and needed enterprise behaviour”, Yicai mentioned.

Yicai quoted SAIC Volkswagen as saying manufacturing on the Nanjing plant stays regular however as it is going to roll out many new merchandise sooner or later, together with gasoline and new vitality autos, it wants to regulate its manufacturing base accordingly.

The corporate didn’t instantly reply to Reuters request for touch upon Saturday. On Wednesday, Volkswagen mentioned it doesn’t touch upon hypothesis and SAIC couldn’t be reached for remark.

Markets

Nvidia's CEO Simply Defined Why This Is the Synthetic Intelligence (AI) Chip Inventory to Personal

No firm has been an even bigger winner than Nvidia (NASDAQ: NVDA) as practically each tech firm has collectively poured billions of {dollars} into creating their (synthetic intelligence) capabilities. The corporate has added $2.5 trillion to its market cap over the past two years as gross sales and earnings exploded with the demand for its GPUs.

The chipmaker has proven unimaginable pricing energy amid the robust demand. That is evidenced by its gross margin increasing into the higher 70% vary. And with the booming gross sales progress, it is seen very excessive working leverage, which interprets into huge bottom-line progress. To make certain, Nvidia’s efficiency as a enterprise, not only a inventory, over the past two years has been nothing wanting phenomenal.

However Nvidia is not the one AI chip inventory available in the market. And CEO Jensen Huang simply defined why one other firm could also be price proudly owning, maybe much more so than his personal firm.

“The world’s greatest by an unimaginable margin”

At an investor convention earlier this month, Huang had excessive reward for one in all Nvidia’s greatest enterprise companions: Taiwan Semiconductor Manufacturing (NYSE: TSM), often called TSMC.

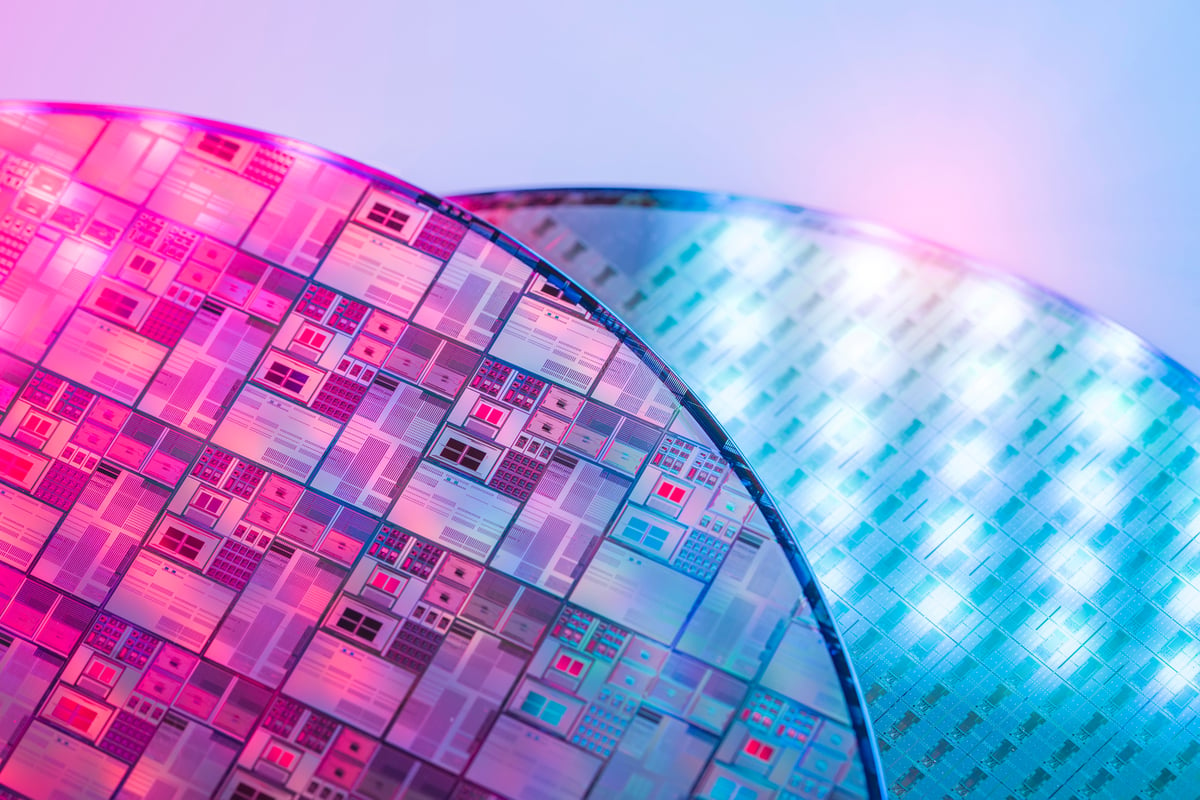

TSMC is the biggest semiconductor foundry, or fab, on the planet. When an organization like Nvidia designs a brand new chip, it takes it to TSMC to really print the design on a silicon wafer. That takes unimaginable precision and revolutionary technical capabilities. TSMC is the best choice for a lot of chip designers, together with Nvidia. TSMC instructions over 60% of world spending at chip foundries.

“We’re fabbing out of TSMC as a result of it is the world’s greatest,” Huang mentioned. “And it is the world’s greatest not by a small margin, it is the world’s greatest by an unimaginable margin.”

That is why Nvidia and nearly anybody else that should produce cutting-edge chips picks TSMC over its opponents. Huang did say Nvidia may swap to a different foundry if it needed to. However he additionally mentioned opponents’ capabilities cannot match TSMC’s and it could end in much less efficiency or increased price.

He additionally praised TSMC’s potential to scale its operations. When Nvidia noticed demand for its chips skyrocket, TSMC was in a position to assist it meet that rising demand so it may reap the benefits of the chance. Any enterprise that wants to have the ability to scale up must work with TSMC.

Importantly, TSMC’s place because the market chief, profitable the vast majority of income within the trade, ensures it’s going to keep in its main place. It has more cash to reinvest in R&D and create the subsequent era of processes. The virtuous cycle results in an increasing number of huge contracts with huge tech corporations designing tremendous high-end chips over time.

TSMC nonetheless has loads of progress left

TSMC could be the largest firm within the trade, however there’s nonetheless a ton of progress for it to seize.

Tech corporations are all planning to ramp up their spending on AI programs in information facilities. Whole spending on AI chip content material and associated programs is forecast to achieve $193.3 billion in 2027, in response to estimates from IDC. That is up from $117.5 billion this yr, translating into an 18% compound annual progress fee over the subsequent three years.

Importantly, TSMC is very agnostic to that progress. Whether or not that progress comes from Nvidia, one in all its opponents, or , TSMC is probably going profitable the majority of these contracts. Actually, the virtuous cycle and TSMC’s management in cutting-edge chips means it may develop that a part of its enterprise even sooner than the trade. On high of that, TSMC has room to enhance its margins.

That is all mirrored in analysts’ forecasts for the corporate over the subsequent 5 years. The common analyst expects TSMC to develop earnings over 20% per yr for the subsequent half-decade. However you do not have to pay up for that progress. Shares at the moment commerce at simply over 20 instances the consensus 2025 earnings forecast.

Few different corporations supply that very same degree of potential progress at that value. So, not solely is it the world’s greatest fab by an unimaginable margin, traders should buy a stake in it proper now at an unimaginable value.

Do you have to make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for traders to purchase now… and Taiwan Semiconductor Manufacturing wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $722,320!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has positions in Taiwan Semiconductor Manufacturing. The Motley Idiot has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024