Markets

Bitcoin Miners Are Nonetheless Shopping for New {Hardware} Regardless of Headwinds—Right here’s Why

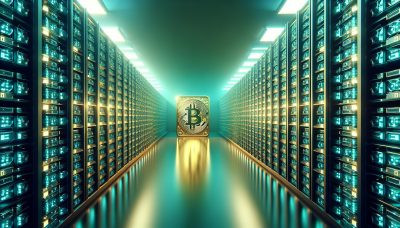

Within the midst of shrinking revenues and rising operational prices, business consultants inform Decrypt that Bitcoin miners are persevering with to put money into new, specialised {hardware}, displaying sturdy confidence within the way forward for the main crypto community regardless of short-term struggles.

In line with a Glassnode report launched this week, Bitcoin’s hash charge—an important measure of mining exercise—stays close to all-time highs, simply 1% shy, though revenues have plummeted.

The mining business is at present going through a double problem: rising mining problem and declining transaction charge income. Because the hash charge rises, so does the issue of mining and incomes a BTC block reward, thus pushing manufacturing prices increased.

This, mixed with cooling demand for high-fee transactions like these from Runes tokens and the NFT-like Ordinals, has squeezed miners’ profitability in latest months. Nonetheless, miners proceed to put money into new ASIC {hardware}, partly as a result of want to remain aggressive in an setting the place older machines are quickly changing into out of date.

One main issue driving this development is improved vitality effectivity in trendy ASIC tools, which helps miners handle working prices.

Talking with Decrypt, Illia Otychenko, lead analyst at crypto trade CEX.IO, mentioned that the vitality effectivity of devoted Bitcoin mining {hardware} “greater than doubled” from 2018 to 2023, “considerably decreasing the vitality consumption per coin produced.”

This development permits miners to mitigate rising electrical energy prices and mining problem, preserving profitability intact even amid unfavorable market situations.

Whereas the worth of Bitcoin stays comparatively sturdy, transaction charge stress has eased, additional squeezing miners’ earnings. With transaction charge income now a small fraction of what it as soon as was, miners are leaning extra closely on block subsidies to maintain operations.

Apparently, miners at the moment are shifting their methods in response to this income squeeze.

Traditionally, they bought the majority of their mined Bitcoin to cowl operational prices, however the report highlights that many at the moment are retaining a portion of their mined provide in treasury reserves. Marathon Digital, for instance, introduced in July that it will undertake a “full HODL” technique, saying it will not promote mined BTC. In actual fact, it has purchased extra from the market, as nicely.

Jeffrey Hu, head of funding analysis at HashKey Capital, sees this as an indication of confidence in Bitcoin’s long-term worth.

“Miners retaining a portion of their mined provide suggests they’re banking on future worth appreciation,” Hu instructed Decrypt. “It’s an indication of confidence and will cut back promoting stress available in the market, doubtlessly supporting costs.”

Nonetheless, Hu additionally cautions that this technique comes with dangers, notably if miners are compelled to promote reserves throughout downturns, which may exacerbate promote stress.

Ryan Lee, chief analyst at Bitget Analysis, attributed the explanations behind the rising hash charge partly to the reintroduction of older mining rigs, which have gotten worthwhile once more with Bitcoin’s worth features over the previous 12 months.

“Older machines are being introduced again into operation as Bitcoin’s worth makes beforehand unprofitable {hardware} viable. This, mixed with new investments in additional environment friendly machines, is driving the entire hash charge increased,” says Lee.

He additionally factors to latest regulatory assist in areas like Russia, together with optimistic indicators from figures like former President Donald Trump, who has come out in assist of Bitcoin and the crypto business amid his newest run to return to the White Home. Such shifts have bolstered the hash charge by decreasing market uncertainty, Hu famous.

Whereas these elements assist offset among the income challenges, consultants agree that miners must discover different income streams to make sure long-term profitability. When Decrypt surveyed the mining panorama at Bitcoin 2024 in July, there was a way that corporations had been weathering an “id disaster” of types—but it surely’s one that would in the end assist them in the long term.

Livepeer co-founder and CEO Doug Petkanics advised that Bitcoin miners are well-positioned to diversify into AI computing, which calls for huge quantities of compute energy.

“The demand for AI compute energy is rising exponentially. With their present vitality and cooling infrastructure, miners may faucet into this market by including GPUs and offering a brand new income stream,” mentioned Petkanics.

Diversification could possibly be key to surviving the more and more aggressive panorama of the mining business. Companies like Core Scientific and Bitdeer are amongst those that are offering computing energy for AI must shore up potential shortcomings with their Bitcoin enterprise.

Otychenko predicts additional consolidation, with capital-rich miners outlasting smaller operations.

CleanSpark’s acquisition of GRIID for $155 million in June this 12 months, is a primary instance, boosting its internet hosting capability as a part of its development technique. Equally, Bitfarms not too long ago acquired Stronghold Digital Mining, whereas Riot Platforms has acquired a 19% stake in Bitfarms to affect its route.

Firms like Marathon Digital additionally see future acquisition alternatives to safe low-cost vitality and scalable infrastructure.

“We may even see additional mergers and acquisitions as bigger miners soak up struggling opponents to increase their market share,” he notes. For these unable to adapt, the rising operational prices might show unsustainable, resulting in a shake-up within the business.

Hu additionally factors to the opportunity of new financing merchandise designed to guard miners from market volatility, in addition to revolutionary methods for mining swimming pools to generate extra income, comparable to merged mining for brand new layer-2 options on Bitcoin.

“The mining business may also develop in areas just like the Center East, the place pure sources and a quickly rising crypto enterprise current new alternatives,” he provides.

Nonetheless, even with diversification, miners’ profitability stays closely reliant on block rewards, which at present account for over 90% of their income.

“Transaction charges solely turn out to be important throughout charge spikes, as we noticed with Runes and Ordinals, however such occasions are non permanent,” Otychenko mentioned. “Block rewards are nonetheless the primary income driver.”

Lee echoed this sentiment, warning that miners will ultimately must rely extra on transaction charges as block rewards diminish with every halving cycle. He predicted that Bitcoin’s worth may surge through the subsequent bull cycle, doubtlessly reaching $150,000.

This could appeal to extra retail participation in mining, as smaller gamers enter the market by buying older, extra inexpensive machines.

“Whereas bigger miners might shift towards asset administration,” Lee mentioned, “retail miners may generate constant money move if Bitcoin’s worth continues to rise.”

Edited by Andrew Hayward and Ryan Ozawa

Markets

Hong Kong probe reveals Cathay Airbus engine failure on account of ruptured gasoline hose

(Reuters) -A probe by Hong Kong’s aviation accident investigation company revealed Cathay Pacific’s Airbus A350 engine failed in-flight on account of a ruptured gasoline hose which additionally confirmed indicators of a hearth, the company’s report acknowledged on Thursday.

Hong Kong’s Air Accident Investigation Authority (AAIA) discovered a ruptured gasoline hose within the second engine of the Cathay Pacific-operated A350 jet, with 5 further secondary gasoline hoses additionally exhibiting indicators of damage and tear.

The investigation confirms Reuters’ earlier report which cited sources saying the preliminary checks revealed a hose between a manifold and a gasoline injection nozzle was pierced.

“This critical incident illustrates the potential for gasoline leaks by means of the ruptured secondary gasoline manifold hose, which may lead to engine fires,” the report acknowledged.

A “critical incident” is an investigative time period in aviation that pointed to a excessive chance of an accident.

“If not promptly detected and addressed, this example, together with additional failures, may escalate right into a extra critical engine hearth, doubtlessly inflicting in depth injury to the plane,” AAIA mentioned within the report.

The A350-1000 and XWB-97 engines, manufactured by Rolls-Royce (OTC:), have been beneath the highlight since Cathay’s Zurich-bound passenger flight CX383 was pressured to return to Hong Kong after it acquired an engine hearth warning shortly after take-off on Sept. 2.

Cathay Pacific started inspecting all its Airbus A350 jets after the incident. It was the primary part of its sort to undergo such a failure on any A350 plane worldwide, Cathay mentioned on the time.

Earlier this month, European Union Aviation Security Company (EASA) additionally ordered inspections on engines of Airbus A350-1000 jets because it moved to forestall comparable occasions after consulting regulators and accident investigators in Hong Kong, in addition to Airbus and Rolls-Royce.

The AAIA, in its report, really helpful the EASA to ask Rolls-Royce to proceed giving airworthiness data, together with inspection necessities of the secondary gasoline manifold hoses of its engines to make sure their serviceability.

Cathay didn’t instantly reply to a request for touch upon the investigation’s findings.

Markets

Palantir Inventory Is Skyrocketing. 1 Analyst Thinks It Has One other 38% Achieve Forward.

The unreal intelligence revolution has been a blended bag for software program firms. Whereas software program shares that harness the ability of enormous language fashions (LLMs) have the potential to speed up revenues, AI additionally offers software program prospects the potential to “do-it-yourself.”

As an illustration, personal buy-now-pay-later firm Klarna just lately introduced it could try and do away with its Salesforce and Workday software program in lieu of constructing its personal CRM and worker administration software program internally, by way of using AI.

But AI software program platform Palantir (NYSE: PLTR) is exhibiting an acceleration in its business enterprise as a result of introduction of AI. And one Wall Road analyst thinks it has a lot farther to run.

Palantir isn’t any meme inventory

Some buyers have equated Palantir with the revolution, resulting in doubts about its latest run. This could possibly be due to some issues. First, the inventory has a excessive share of retail buyers relative to institutional buyers. Second, Palantir went public in a direct itemizing in late 2020, when rates of interest had been low and lots of doubtful software program and know-how firms bought shares to the general public. Lastly, CEO Alex Karp is considered some as a unusual and outspoken chief, for higher or worse.

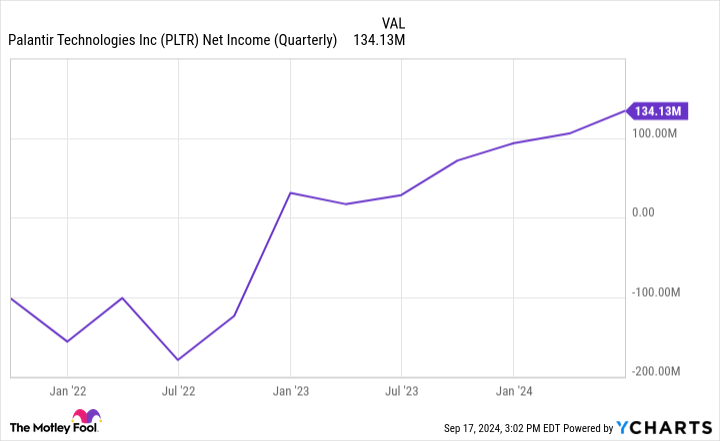

However Palantir isn’t any meme inventory. As a proof level, the corporate was just lately admitted to the celebrated S&P 500 index, which has stringent standards for admission. Previously couple years, Palantir has certified for the index by posting constant GAAP profitability — considerably uncommon for a software program inventory.

information by

AI is resulting in a reacceleration in progress

As well as, Palantir has seen its income progress speed up. That acceleration coincided with the introduction of the Palantir Synthetic Intelligence Platform, or “AIP,” a few 12 months in the past. AIP permits firms to include third-party LLMs or different specialised fashions immediately into Palantir’s current Gotham or Foundry software program platforms.

AIP has invigorated curiosity in Palantir’s software program, particularly from business prospects, leading to a reacceleration of income progress since AIP was launched.

Usually, it is more durable for firms to extend their progress charge as they get greater due to the legislation of enormous numbers. Nevertheless, one can see that Palantir has defied this development. The introduction of AIP and Palantir fine-tuning its advertising technique to incorporate periodic, “boot camps,” are possible causes for the inflection. These boot camps permit potential prospects to carry their precise information and expertise the AIP in a trial with Palantir’s engineers.

One analyst sees $50 in Palantir’s future

At present, most of Wall Road is definitely bearish on Palantir’s inventory. As of August, solely six out of 18 analysts charge shares a Purchase or Robust Purchase, with one other six ranking shares Impartial and the remaining six ranking shares a Promote. The common value goal on shares is $27, under the $36 present value as of this writing. That is in all probability attributable to Palantir’s inventory having greater than doubled this 12 months, whereas at present buying and selling at an costly valuation of roughly 35 instances gross sales.

However one analyst, Mariana Perez Mora of Financial institution of America charges shares a Purchase, with a street-high $50 value goal on the inventory. The analyst believes Wall Road misunderstands Palantir, and sees large issues within the firm’s future, justifying the next inventory value.

Mora thinks others miss how differentiated Palantir is relative to different enterprise software program shares, each product-wise and the way Palantir goes to market. Of observe, Palantir usually has members of its R&D staff embed themselves with a buyer first, with a view to perceive a buyer’s enterprise issues and ache factors. Then, Palantir tailors its modular software program to that enterprise’ particular infrastructure, making its information analytics capabilities extra related to every particular person buyer. In its annual report, Palantir notes seeks out “dangerous and resource-intensive” engagements the place different opponents could draw back.

Mora believes this technique, which is harder upfront and the place Palantir would not see instant revenues, finally pays off. It’s because the upfront work permits Palantir extra pricing energy in a while. She then sees Palantir’s merchandise spreading to extra industries as Palantir rolls out industry-specific platforms, such because the upcoming Warp Velocity for manufacturing companies.

An industry-standard OS like Home windows?

Whereas Palantir was previously referred to as a specialised software program platform for the Protection {industry} within the Struggle on Terror, Mora sees Palantir changing into an industry-standard platform sooner or later, calling it, “the widespread information operational system for the U.S. authorities and enormous U.S. companies.”

If Palantir’s latest continues, she could very nicely find yourself being appropriate. With nearly all of revenues nonetheless coming from the Protection {industry}, Palantir’s latest penetration of the a lot bigger enterprise market offers it the prospect to maintain progress charges excessive for some time, doubtlessly justifying immediately’s lofty inventory value.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for buyers to purchase now… and Palantir Applied sciences wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $708,348!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Financial institution of America is an promoting companion of The Ascent, a Motley Idiot firm. and/or his purchasers have positions in Financial institution of America. The Motley Idiot has positions in and recommends Financial institution of America, Palantir Applied sciences, Salesforce, and Workday. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Staff at Musk's Tesla, SpaceX and X donate to Harris whereas he backs Trump

By Sheila Dang

(Reuters) – Billionaire Elon Musk has endorsed Republican former President Donald Trump within the race for the White Home, however staff at his assortment of corporations are largely donating to Trump’s Democratic rival Kamala Harris.

Staff at Tesla (NASDAQ:) have contributed $42,824 to Harris’ presidential marketing campaign versus $24,840 to Trump’s marketing campaign, in line with OpenSecrets, a nonpartisan nonprofit that tracks U.S. marketing campaign contributions and lobbying information.

Staff at Musk’s rocket firm SpaceX have donated $34,526 to Harris versus $7,652 to Trump. Staff on the social media platform X, previously often called Twitter, have donated $13,213 to Harris versus lower than $500 to Trump.

Whereas the figures are comparatively small for marketing campaign fundraising, they point out political leanings at odds with Musk’s personal. The world’s richest man, Musk has boosted Trump on X and dismissed left-leaning concepts as a “woke-mind virus.”

Musk didn’t instantly reply to a request for remark. He backed President Joe Biden in 2020 however has tacked rightward since then. Trump has stated that if he wins the Nov. 5 election, he’ll appoint Musk to steer a authorities effectivity fee.

The OpenSecrets information consists of donations from firm staff and house owners and people people’ quick members of the family. Marketing campaign finance legal guidelines prohibit corporations themselves from donating to federal campaigns.

A lot of Musk’s staff are primarily based in California, a Democratic stronghold, stated Ross Gerber, CEO of Gerber Kawasaki Wealth and Funding Administration, which is a Tesla shareholder. Gerber can be an investor in X.

In July, Musk stated he would transfer X and SpaceX headquarters to Texas from California due to a California gender-identity legislation he known as the “final straw.” Gerber stated such a transfer would imply “shedding out on loads of potential expertise” in California.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares