Markets

Oracle’s inventory is surging—however one other basic Silicon Valley agency is flailing

Certainly one of Silicon Valley’s is effectively and really again. Shares of are up 55% for the yr, trailing solely Nvidia’s almost 150% in that span. The inventory popped 11% Tuesday—the primary time in over two years shares rose by double-digits in a single day—after Oracle beat earnings expectations, highlighting how the corporate has quickly grown its cloud enterprise whereas concurrently partnering with the business’s main gamers.

The AI increase has to date not been as variety to different legacy tech names. Chief amongst them is , whose “breathtaking fall from grace,” as Lusso’s Information’s Ian King , contrasts mightily with Oracle’s revitalization. As soon as the world’s largest chipmaker, Intel it might lower 15,000 jobs, or about 15% of its workforce, as income continues to drop and its personal forecast stays dim.

The disappointing earnings launch firstly of August despatched share costs plummeting, with the inventory now down roughly 60% year-to-date.

On its face, it seems Intel ought to have been effectively positioned to reap the benefits of AI increase, notably because the Biden administration sought to reconstruct the within the U.S.

The corporate did not sustain with rivals like Nvidia in areas like chip design, nevertheless. Similar goes for the so-called foundry enterprise, wherein Taiwan’s TSMC is the semiconductor producer of selection. On the identical time, Intel’s core enterprise of constructing PC chips can be underneath strain, famous Angelo Zino, a tech analyst and senior vp at CFRA Analysis.

“Intel’s basically in a really lose-lose state of affairs,” he stated.

Oracle on a roll

It’s troublesome to see a path ahead for considered one of America’s early tech icons. That’s not the case, nevertheless, at Oracle, one other legacy identify that has stirred recent pleasure amongst traders.

The corporate reported income of $13.3 billion for the quarter, up 8% from final yr, however a number of analysts anticipate that development to speed up into double-digits. That’s largely resulting from its infrastructure-as-a-service (IaaS) enterprise, which was up 45%.

Whereas the corporate’s cloud market share nonetheless lags far behind the likes of , and Net Companies, Oracle now boasts precious partnerships with all three. The cope with AWS on Monday, which allows clients to totally entry Oracle’s market-leading database inside Amazon’s cloud infrastructure, accomplished the trifecta.

That information stunned few on Wall Avenue. Nonetheless, the sturdy earnings launch pressured some mutual funds who had underweighted the inventory to purchase in, stated Ted Mortonson, a managing director and tech strategist at .

“Both you like [founder and chief technology officer] Larry Ellison and [CEO] Safra Catz, or you do not,” he stated. “You might have historical past otherwise you imagine them, or you do not. Effectively, you had capitulation that you just higher imagine them on this cycle.”

Sadly, Intel CEO Pat Gelsinger doesn’t discover himself in the identical boat.

This story was initially featured on

Markets

Nvidia's CEO Simply Defined Why This Is the Synthetic Intelligence (AI) Chip Inventory to Personal

No firm has been an even bigger winner than Nvidia (NASDAQ: NVDA) as practically each tech firm has collectively poured billions of {dollars} into creating their (synthetic intelligence) capabilities. The corporate has added $2.5 trillion to its market cap over the past two years as gross sales and earnings exploded with the demand for its GPUs.

The chipmaker has proven unimaginable pricing energy amid the robust demand. That is evidenced by its gross margin increasing into the higher 70% vary. And with the booming gross sales progress, it is seen very excessive working leverage, which interprets into huge bottom-line progress. To make certain, Nvidia’s efficiency as a enterprise, not only a inventory, over the past two years has been nothing wanting phenomenal.

However Nvidia is not the one AI chip inventory available in the market. And CEO Jensen Huang simply defined why one other firm could also be price proudly owning, maybe much more so than his personal firm.

“The world’s greatest by an unimaginable margin”

At an investor convention earlier this month, Huang had excessive reward for one in all Nvidia’s greatest enterprise companions: Taiwan Semiconductor Manufacturing (NYSE: TSM), often called TSMC.

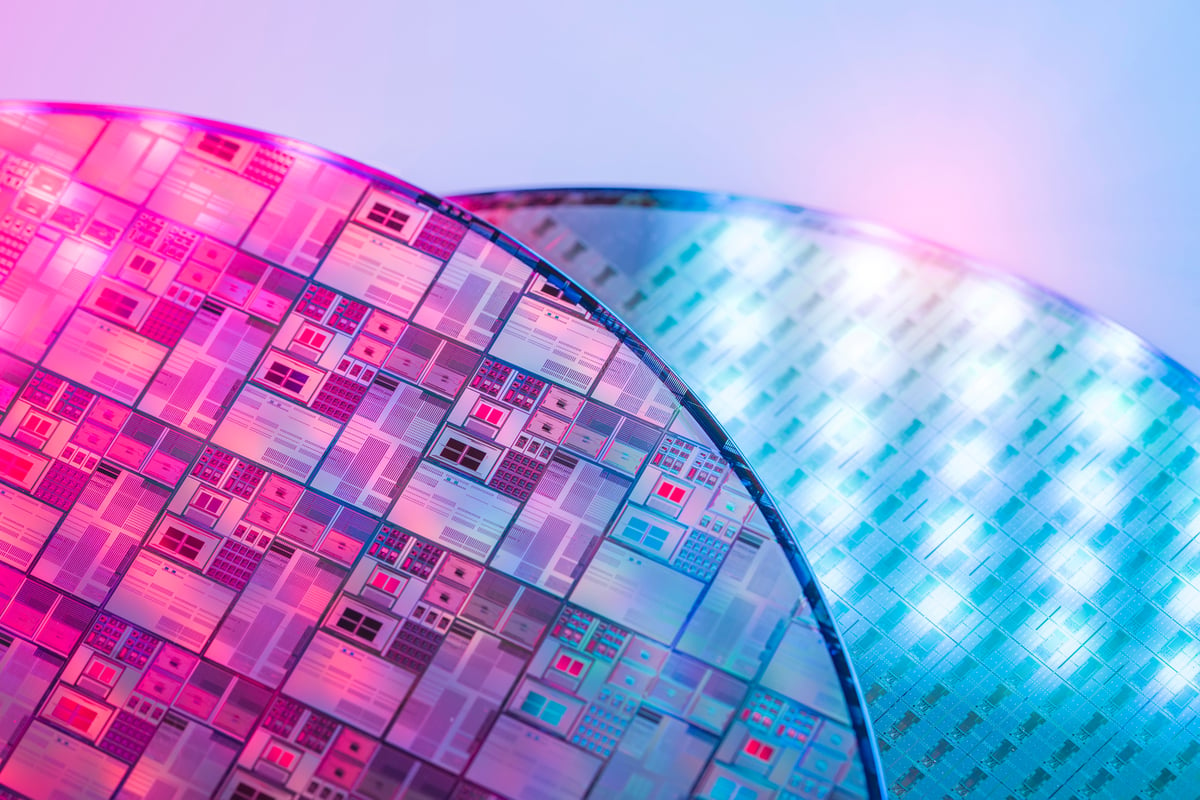

TSMC is the biggest semiconductor foundry, or fab, on the planet. When an organization like Nvidia designs a brand new chip, it takes it to TSMC to really print the design on a silicon wafer. That takes unimaginable precision and revolutionary technical capabilities. TSMC is the best choice for a lot of chip designers, together with Nvidia. TSMC instructions over 60% of world spending at chip foundries.

“We’re fabbing out of TSMC as a result of it is the world’s greatest,” Huang mentioned. “And it is the world’s greatest not by a small margin, it is the world’s greatest by an unimaginable margin.”

That is why Nvidia and nearly anybody else that should produce cutting-edge chips picks TSMC over its opponents. Huang did say Nvidia may swap to a different foundry if it needed to. However he additionally mentioned opponents’ capabilities cannot match TSMC’s and it could end in much less efficiency or increased price.

He additionally praised TSMC’s potential to scale its operations. When Nvidia noticed demand for its chips skyrocket, TSMC was in a position to assist it meet that rising demand so it may reap the benefits of the chance. Any enterprise that wants to have the ability to scale up must work with TSMC.

Importantly, TSMC’s place because the market chief, profitable the vast majority of income within the trade, ensures it’s going to keep in its main place. It has more cash to reinvest in R&D and create the subsequent era of processes. The virtuous cycle results in an increasing number of huge contracts with huge tech corporations designing tremendous high-end chips over time.

TSMC nonetheless has loads of progress left

TSMC could be the largest firm within the trade, however there’s nonetheless a ton of progress for it to seize.

Tech corporations are all planning to ramp up their spending on AI programs in information facilities. Whole spending on AI chip content material and associated programs is forecast to achieve $193.3 billion in 2027, in response to estimates from IDC. That is up from $117.5 billion this yr, translating into an 18% compound annual progress fee over the subsequent three years.

Importantly, TSMC is very agnostic to that progress. Whether or not that progress comes from Nvidia, one in all its opponents, or , TSMC is probably going profitable the majority of these contracts. Actually, the virtuous cycle and TSMC’s management in cutting-edge chips means it may develop that a part of its enterprise even sooner than the trade. On high of that, TSMC has room to enhance its margins.

That is all mirrored in analysts’ forecasts for the corporate over the subsequent 5 years. The common analyst expects TSMC to develop earnings over 20% per yr for the subsequent half-decade. However you do not have to pay up for that progress. Shares at the moment commerce at simply over 20 instances the consensus 2025 earnings forecast.

Few different corporations supply that very same degree of potential progress at that value. So, not solely is it the world’s greatest fab by an unimaginable margin, traders should buy a stake in it proper now at an unimaginable value.

Do you have to make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for traders to purchase now… and Taiwan Semiconductor Manufacturing wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $722,320!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has positions in Taiwan Semiconductor Manufacturing. The Motley Idiot has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Promoting season, election forward, however keep watch over ’25, says Wells Fargo

Lusso’s Information — Wells Fargo strategists imagine that traders ought to put together for extra market volatility because the promoting season approaches, amplified by the upcoming election cycle.

Traditionally, the late summer time to early fall interval has been marked by vital declines within the inventory market. Over the previous seven years, the has persistently confronted sell-offs starting from 5% to twenty%, and the funding financial institution predicts that this development is more likely to proceed in 2024.

Contributing to the uncertainty is the tightly contested U.S. election, which is anticipated to intensify market volatility.

“A tightly contested and open election the place the incumbent will not be searching for reelection, as now we have at present, solely serves to extend the uncertainty,” strategists mentioned within the observe.

“Our view is that within the coming months, bouts of volatility are seemingly whereas shares chop sideways and wrestle to make significant new highs.”

Nonetheless, Wells Fargo means that this era of volatility might current alternatives. The agency recommends that traders be prepared with a “procuring record” if the market reaches current lows, pointing to sectors like U.S. Massive Cap Equities, and particular segments comparable to Communication Providers, Power, Financials, Industrials, and Supplies inside the S&P 500.

“We expect U.S. Small Cap Equities may be a lovely possibility for including publicity close to market lows if the portfolio is underallocated to the asset class,” strategists added.

Alternatively, trimming positions in overexposed areas comparable to Shopper Discretionary, Shopper Staples, Actual Property, and Utilities could also be smart if the market hits current highs.

Wanting past 2024, Wells Fargo is optimistic concerning the longer-term outlook.

Publish-election, the agency expects the financial system to shift from its present slowdown to sustained development in 2025, pushed by an earnings restoration and a resurgence in fairness costs. The report advises traders to keep watch over 2025 as they make selections within the coming months.

“Put merely as a marketing campaign slogan, “Regulate ’25,” the financial institution concluded.

The S&P 500 managed a modest rise in a quiet buying and selling session on Monday, whereas the declined, pressured by a drop in tech shares. Buyers weighed the possibilities of a larger-than-expected fee minimize from the U.S. Federal Reserve later this week.

The S&P know-how index, which has been the strongest among the many 11 main S&P sectors this 12 months, noticed a 0.95% decline, making it the largest loser of the session.

Markets

Billionaires Warren Buffett, David Tepper, and Terry Smith Are Sending a Very Clear Warning to Wall Avenue — Are You Paying Consideration?

For the higher a part of two years, the bulls have been firmly in management on Wall Avenue. A resilient U.S. economic system, coupled with pleasure surrounding the rise of synthetic intelligence (AI), have helped carry the ageless Dow Jones Industrial Common (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-focused Nasdaq Composite (NASDAQINDEX: ^IXIC) to a number of record-closing highs in 2024.

Nevertheless, . A number of the most distinguished and broadly adopted billionaire cash managers, together with Berkshire Hathaway‘s (NYSE: BRK.A)(NYSE: BRK.B) Warren Buffett, Appaloosa’s David Tepper, and Fundsmith’s Terry Smith, have been sending an ominous warning to Wall Avenue with their buying and selling exercise.

A few of Wall Avenue’s prime buyers are retreating to the sidelines

Though no cash supervisor is a carbon copy of one other, Buffett, Tepper, and Smith are lower from related cloths. Whereas they could have completely different areas of experience or dabble in funding areas the opposite two might not — e.g., David Tepper tends to be a little bit of a contrarian and is not afraid to put money into distressed property, together with debt — all three are typically affected person buyers who deal with finding undervalued/underappreciated firms that may be held for lengthy durations of their respective funds. It is a actually easy system that is labored nicely for all three billionaire buyers.

When Type 13Fs are filed with the Securities and Change Fee every quarter, skilled and on a regular basis buyers flock to those stories to see which shares, industries, sectors, and developments have been piquing the curiosity of Wall Avenue’s brightest funding minds. Nevertheless, the newest spherical of 13Fs had a shock for buyers who intently observe the buying and selling exercise of Buffett, Tepper, and Smith.

The June-ended quarter marked the seventh consecutive quarter that Warren Buffett was a internet vendor of shares. Jettisoning greater than 389 million shares of prime holding Apple throughout the second quarter, and north of 500 million shares, in mixture, since Oct. 1, 2023, has led to a cumulative $131.6 billion in internet inventory gross sales for the reason that begin of October 2022.

Regardless of advocating that buyers not guess in opposition to America, and emphasizing the worth of long-term investing, Buffett’s short-term actions have not lined up together with his long-term ethos.

However he is not alone.

David Tepper’s Appaloosa closed out June with a 37-security funding portfolio price round $6.2 billion. Through the second quarter, Tepper and his workforce added to 9 of those positions and diminished or utterly bought his fund’s stake in 28 others, together with Amazon, Microsoft, Meta Platforms, and Nvidia. Tepper dumped 3.73 million shares of Nvidia, equating to greater than 84% of Appaloosa’s prior place.

U.Ok. inventory picker extraordinaire Terry Smith ended June with a 40-stock portfolio price roughly $24.5 billion. He added to his stakes in simply three of those 40 shares — Fortinet, Texas Devices, and Oddity Tech — whereas decreasing his fund’s place within the different 37.

These affected person and traditionally optimistic buyers are sending a message that is undeniably clear: Worth is difficult to return by proper now on Wall Avenue.

Shares are traditionally dear — and that is an issue

Though “worth” is a very subjective time period, one valuation device factors to shares being at considered one of their priciest ranges in historical past, relationship again to the 1870s. I am speaking concerning the S&P 500’s Shiller price-to-earnings (P/E) ratio, which is also called the cyclically adjusted price-to-earnings ratio (CAPE ratio).

Most buyers are in all probability aware of the standard P/E ratio, which divides an organization’s share value into its trailing-12-month earnings per share (EPS). Whereas the P/E ratio tends to work fairly nicely for mature companies, it falls quick for development shares that reinvest plenty of their money move. It can be adversely impacted by one-off occasions, such because the COVID-19 lockdowns.

The Shiller P/E ratio is predicated on common inflation-adjusted EPS over the past 10 years. Taking a decade’s price of earnings historical past into consideration means short-term occasions do not adversely have an effect on this valuation mannequin.

As of the closing bell on Sept. 16, the S&P 500’s Shiller P/E stood at 36.27, which is just under its 2024 excessive of roughly 37, and greater than double the 153-year common of 17.16, when back-tested to 1871.

To be truthful, the Shiller P/E has spent a lot of the final 30 years above its historic common as a result of two elements:

-

The web democratized the entry to data, which gave on a regular basis buyers extra confidence to take dangers.

-

Rates of interest spent greater than a decade at or close to historic lows, which inspired buyers to pile into higher-multiple development shares that may profit from low borrowing prices.

However when examined as a complete, there are solely two different durations all through historical past the place the S&P 500’s Shiller P/E supported the next degree throughout a bull market. It peaked at 44.19 in December 1999, simply previous to the dot-com bubble bursting, and briefly topped 40 throughout the first week of January 2022.

Following the dot-com bubble peak, the S&P 500 shed simply shy of half of its worth, whereas the Nasdaq Composite misplaced greater than three-quarters earlier than discovering its footing. In the meantime, the 2022 bear market noticed the Dow Jones, S&P 500, and Nasdaq Composite all lose at the least 20% of their worth.

In 153 years, there have solely been six events the place the S&P 500’s Shiller P/E has surpassed 30 throughout a bull market, together with the current. Following all 5 earlier cases, the minimal draw back within the S&P 500 has been 20%, with the Dow Jones Industrial Common dropping as a lot as 89% throughout the Nice Despair.

The purpose is that prolonged inventory valuations can solely be sustained for therefore lengthy. Despite the fact that Warren Buffett would by no means guess in opposition to America, and Terry Smith is at all times looking out for undervalued property, neither billionaire cash supervisor feels compelled to place their capital to work. Actually, Berkshire Hathaway was sitting on a file $276.9 billion in money on the finish of June, and Buffett nonetheless is not a purchaser of shares… aside from shares of his personal firm.

Briefly, a few of Wall Avenue’s most-successful long-term, value-seeking buyers need little to do with the inventory market proper now, and it is a very clear warning that buyers ought to be being attentive to.

The place to take a position $1,000 proper now

When our analyst workforce has a inventory tip, it could actually pay to hear. In spite of everything, Inventory Advisor’s whole common return is 762% — a market-crushing outperformance in comparison with 167% for the S&P 500.*

They simply revealed what they imagine are the for buyers to purchase proper now…

*Inventory Advisor returns as of September 16, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. has positions in Amazon and Meta Platforms. The Motley Idiot has positions in and recommends Amazon, Apple, Berkshire Hathaway, Fortinet, Meta Platforms, Microsoft, Nvidia, and Texas Devices. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024