Markets

Japan, US face shared problem from low-cost China metal, Japan PM hopeful says

By Tim Kelly and Katya Golubkova

TOKYO (Reuters) – Japan and the USA ought to keep away from confrontation concerning the metal trade and work collectively amid competitors from China, the world’s prime steelmaker, main prime ministerial candidate Shinjiro Koizumi mentioned on Saturday.

Sources informed Reuters on Friday {that a} highly effective U.S. nationwide safety panel reviewing Nippon Metal’s $14.9 billion bid for U.S. Metal faces a Sept. 23 deadline to suggest whether or not the White Home ought to block the deal.

Koizumi, Japan’s former setting minister, mentioned at a debate on Saturday that Japan and the U.S. mustn’t confront one another relating to the metal trade however to face collectively the ‘shared problem’ coming from China’s metal trade.

“If China, producing low-cost metal with out renewable or clear power, floods the worldwide market, it should most adversely have an effect on us, the democratic international locations taking part in by honest market guidelines,” Koizumi mentioned.

Nippon Metal’s key negotiator on the deal, Vice Chairman Takahiro Mori, mentioned final month that his firm and different Japanese steelmakers had been urging Tokyo to think about curbing low-cost metal imports coming from China to guard the native market.

On Sunday, Nippon Metal and U.S. Metal despatched a letter to U.S. President Joe Biden about their deal, as Biden, Democratic presidential nominee Kamala Harris and Republican presidential nominee Donald Trump have all opposed the merger.

“We’re additionally within the midst of elections, similar to the U.S., and through elections, numerous concepts might come up. Overreacting to every of those would, for my part, name into query diplomatic judgment,” Koizumi mentioned when requested concerning the deal.

Sanae Takaichi, Japan’s minister accountable for financial safety and one other prime ministerial candidate, additionally defended the deal throughout the identical debate attended by eight different Liberal Democratic Celebration’s (LDP) management contenders on Saturday.

“It seems they’re utilizing (the Committee on Overseas Funding in the USA) CFIUS to border this as an financial safety subject,” she mentioned.

“Nonetheless, Japan and the U.S. are allies, and the metal trade is about strengthening our mixed resilience.”

The 43-year-old son of former Prime Minister Junichiro Koizumi, the junior Koizumi, is seen as a number one contender within the Sept. 27 race to choose the LDP’s new chief, who will grow to be the subsequent prime minister as a result of get together’s management of parliament.

Koizumi mentioned on Saturday that he would search a dialogue with the North Korean management to resolve the difficulty over the kidnapping of Japanese residents kidnapped by North Korean brokers within the Seventies and Eighties.

“We need to discover new alternatives for dialogue between folks of the identical era, with out being sure by typical approaches, and with out preconditions,” Koizumi mentioned.

North Korean chief Kim Jong Un is 40 years previous.

Markets

Why I’m not doing something to deal with decrease rates of interest

How ought to a retail investor cope with Wednesday’s rate of interest minimize by the Federal Reserve and with the longer term charge cuts that appear to be on the horizon?

What I plan to do is nothing. Which can be what you must do too.

How can I say “do nothing” when the airwaves, print media, and the web are full of recommendation and recommendations — and warnings — about tips on how to deal with the Fed’s charge minimize?

Let me present you why my spouse and I aren’t planning on doing something in regards to the charge cuts, which is able to cut back our curiosity earnings however not threaten our general monetary well-being. And why it’s possible you’ll not wish to do something, both.

Right here’s the deal. The Fed has minimize the federal funds charge to between 4.5% and 4.75% from the previous 5% to five.25%. Fed Chairman Jerome Powell has made it clear that the Fed is planning at the very least yet one more charge minimize this 12 months.

8/29/24

The Fed controls solely this short-term charge, however reducing it places downward strain on longer-term charges as properly. That’s nice, in fact, for many people, making it simpler and cheaper to borrow. However it’s not nice for savers. That is as a result of the earnings they get on their financial savings goes to say no.

Learn extra:

We now have important money holdings, which we maintain in low-cost, high-quality cash market funds. Our earnings from these funds, which has risen properly over the previous few years, goes to say no. However such is life.

Some folks advise you to lock up yields by switching money into long-term bonds or long-term , whose rates of interest are fastened and received’t fall due to the Fed’s charge cuts.

Nonetheless, there’s an issue with doing that.

Locking up yields by shopping for long-term bonds or CDs makes your cash illiquid. This exposes you to some long-term dangers, akin to having to promote at a loss if charges rise — which they are going to in the end, belief me —or should you want the money that you just’ve locked up long-term.

In contrast, should you’ve accomplished what we’ve got accomplished — put our surplus money into well-regarded, low-cost — your earnings will go down when the Fed’s charge cuts work their manner by means of the monetary system. However you’ve nonetheless obtained liquidity, the power to entry your money on demand, which is essential.

The one factor that I received’t do — and that you just shouldn’t do, both — is to place my cash right into a financial institution financial savings account, which generally pays yields approaching zero. The charges on these accounts aren’t prone to fall a lot, if in any respect, as a result of they’re already so low.

So should you’ve obtained $3,000 or extra of money sitting in a financial institution financial savings account however don’t have a cash fund account, you’ll most likely do properly to open an account in a low-cost, high-quality fund.

To make sure, not like financial institution accounts, cash funds aren’t backed by the Federal Deposit Insurance coverage Corp. However there are many high-quality, conservatively run . It’s a really aggressive enterprise, with $6.68 trillion in property, in line with Crane Information. They’re extremely unlikely to fail.

Crucial factor so that you can do now’s to remain calm and keep in mind that if you find yourself doing nothing to deal with decrease rates of interest, you’ll have loads of firm. Together with me.

Final July, I wrote a Lusso’s Information column with the headline, I mentioned that Berkshire Hathaway inventory had underperformed Admiral shares of Vanguard’s S&P 500 index fund since my spouse and I purchased Berkshire shares in January 2016.

Berkshire has since rallied and outperformed the S&P 500.

At Thursday’s market shut, Berkshire was up 253% (15.6% a 12 months) since we purchased it. Throughout that very same interval, the index fund has returned 242% (15.2% a 12 months), in line with Jeff DeMaso of the Unbiased Vanguard Adviser.

Rating one for the Oracle of Omaha.

Allan Sloan, a contributor to Lusso’s Information, is a seven-time winner of the Loeb Award, enterprise journalism’s highest honor.

Markets

GM to start shedding about 1,700 staff at Kansas plant, WARN discover reveals

(Reuters) – Normal Motors (NYSE:) will start shedding 1,695 staff at its Fairfax Meeting plant in Kansas, the corporate stated in a Employee Adjustment and Retraining Notification (WARN) discover earlier this week.

The primary of two rounds of layoffs will start Nov. 18 and can embody the non permanent layoff of 686 full-time staff and the termination of 250 non permanent staff, Automotive Information reported on Saturday citing an organization submitting to the state of Kansas.

Beginning Jan. 12, 759 full-time staff will likely be briefly laid off, the report added.

GM didn’t instantly reply to a Reuters request for touch upon the small print of the most recent layoffs.

Earlier in Might, GM had stated that it will pause manufacturing of the Cadillac XT4 after January 2025 in Kansas, leading to layoffs of manufacturing staff till manufacturing resumes in late 2025 for each the Bolt EV and XT4 on the identical meeting line.

The corporate had additionally stated in August that it was shedding greater than 1,000 salaried staff at its software program and repair models worldwide.

Markets

Is Tremendous Micro Pc Inventory a Purchase Now?

Following a terrific begin to the 12 months, Tremendous Micro Pc‘s (NASDAQ: SMCI) inventory chart has undergone a stark reversal over the previous six months. It has misplaced near 60% of its worth from its peak, and up to date developments appear to have additional dented investor confidence within the firm.

First, the fiscal 2024 fourth-quarter outcomes it launched on Aug. 6 , and administration’s steerage was disappointing. Second, short-seller Hindenburg Analysis launched a report alleging accounting irregularities at Supermicro. Then, Supermicro administration introduced that it was delaying the submitting of its annual report, which solely added to the adverse press.

These components clarify why Wall Avenue analysts have been downgrading the inventory recently. However provided that shares of this server and storage techniques producer at the moment are buying and selling at a sexy 22 instances trailing earnings and 13 instances ahead earnings, opportunistic buyers could also be tempted to purchase Supermicro. Ought to they be doing that in gentle of the current developments?

Addressing the elephant within the room

Traders ought to word that Hindenburg is a , and it has a monetary curiosity in seeing Supermicro’s inventory value fall. In that context, we can’t make certain that the allegations that Hindenburg is making are legitimate, particularly contemplating that the short-seller has been mistaken prior to now. That stated, Supermicro was charged by the Securities and Change Fee (SEC) for accounting violations in August 2020, when it was discovered to have prematurely acknowledged income and understated its bills over a three-year interval.

Nevertheless, the corporate has recovered remarkably since then, clocking excellent positive aspects over the previous couple of years because of the emergence of a brand new catalyst within the type of synthetic intelligence (AI). Its income in its fiscal 2024 greater than doubled to $14.9 billion from $7.1 billion within the earlier 12 months. Non-GAAP earnings shot as much as $22.09 per share, from $11.81 per share in fiscal 2023.

Addressing the delay in Supermicro’s annual submitting, administration clarified that “we do not anticipate any materials modifications in our fourth quarter or fiscal 12 months 2024 monetary outcomes.” It added that the corporate is wanting ahead to a “historic” 2025 with “a document variety of orders, a robust and rising backlog of design wins and main market positions throughout quite a lot of areas.”

Supermicro says that the current developments will not have an effect on its manufacturing capabilities, and it is on monitor to satisfy the demand for its AI server options. It is value noting that Supermicro is anticipating its fiscal 2025 income to land between $26 billion and $30 billion. That will be one other 12 months of exceptional development from its $14.9 billion in fiscal 2024.

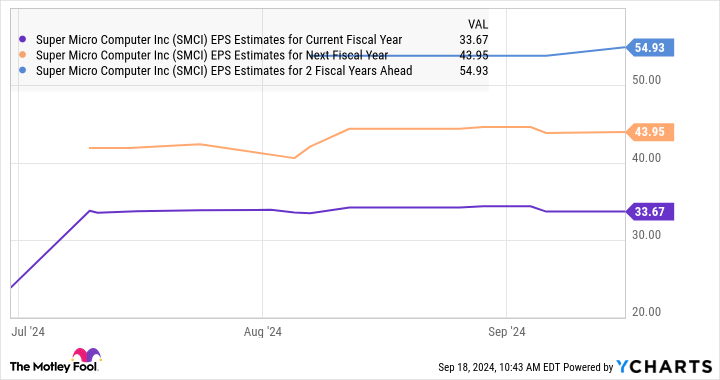

Although it’s going through margin challenges as a result of elevated investments it is making because it boosts capability to satisfy the sturdy demand for its liquid-cooled server options, administration is assured that it’s going to return to its regular margin vary earlier than the fiscal 12 months ends. Analysts’ consensus estimates additionally point out that Supermicro’s earnings are on monitor to extend at an unimaginable tempo within the present fiscal 12 months, adopted by wholesome jumps within the subsequent couple of years as effectively.

What ought to buyers do?

The delay in Supermicro’s annual submitting led JPMorgan to downgrade the inventory from obese to impartial and to slash its value goal to $500 from $950. Even Barclays downgraded the inventory to equal weight from obese, citing the margin strain that Supermicro faces in addition to the submitting delay. Nevertheless, JPMorgan’s downgrade wasn’t a results of the Hindenburg report nor a mirrored image of its skill to grow to be compliant, however due to the near-term uncertainty that surrounds the corporate and the dearth of a compelling argument to purchase the inventory.

So, risk-averse buyers would do effectively to attend for extra readability earlier than shopping for this AI inventory. Nevertheless, these with greater threat appetites who want to add a fast-growing firm to their portfolios can take into account shopping for Supermicro now. It appears able to sustaining its spectacular development in the long term because of the large alternatives obtainable to it within the AI server market.

Analysts count on Supermicro’s earnings to develop at an annualized price of 62% over the subsequent 5 years. If the corporate can get previous its present troubles, it may develop into a stable funding contemplating the valuation at which it’s buying and selling proper now.

Do you have to make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the for buyers to purchase now… and Tremendous Micro Pc wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

JPMorgan Chase is an promoting associate of The Ascent, a Motley Idiot firm. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends JPMorgan Chase. The Motley Idiot recommends Barclays Plc. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024