Markets

Upcoming Inventory Splits This Week (September 16 to September 20) – Keep Invested

These are the upcoming inventory splits for the week of September 16 to September 20, primarily based on . A inventory break up is a company motion by which the corporate points further widespread shares to extend the variety of excellent shares. Accordingly, the inventory worth of the corporate’s shares decreases, which maintains the market capitalization earlier than and after the break up. In distinction, there are additionally reverse inventory splits that cut back the variety of excellent shares (consolidate). On this case, too, the market cap is maintained because the share worth will increase following the reverse inventory break up.

Corporations usually undertake inventory splits to enhance the liquidity of the widespread shares and make them extra inexpensive for retail buyers. Let’s look rapidly on the upcoming inventory splits for the week.

iSpecimen Inc. – iSpecimen is a technology-enabled market that connects researchers to a worldwide community of pattern suppliers, thus streamlining specimen procurement. It allows pattern procurement of biofluids, tissues, stem, and immune cells. On September 11, ISPC introduced a one-for-20 reverse inventory break up of its widespread inventory to enhance the per share buying and selling worth and appeal to institutional buyers. Shares will begin buying and selling on a stock-adjusted foundation on September 16, in compliance with the minimal bid worth requirement for continued itemizing on Nasdaq.

Zepp Well being Corp. – Zepp Well being operates a proprietary expertise platform that features AI chips, biometric sensors, and information algorithms, which assist sensible well being gadgets for customers and information analytics providers for inhabitants well being. On September 6, ZEPP introduced a one-for-four reverse inventory break up of its ADS (American Depositary Shares). The reverse inventory break up will change the ratio of bizarre shares to ADS from one-to-four to one-to-16. Efficient September 16, the ADS will begin buying and selling on a split-adjusted foundation.

Knightscope Inc. Class A – Knightscope is an American superior safety digital camera and robotics firm. It develops and sells automated gadgets that deter, detect, and report threats. On September 11, KSCP introduced a one-for-50 reverse inventory break up of its Class A and Class B widespread inventory. Shares will begin buying and selling on a split-adjusted foundation on September 16.

Deckers Out of doors – Deckers Out of doors designs, markets, and distributes modern footwear, attire, and equipment for on a regular basis informal way of life use and high-performance actions. On September 13, Decker’s shareholders authorized a six-for-one ahead inventory break up in addition to a proportionate improve within the firm’s licensed widespread inventory. This transfer will make DECK shares extra inexpensive and enticing to a broader group of buyers.

Purple Biotech – Purple Biotech is a clinical-stage biotechnology firm. Its expertise harnesses the facility of the tumor microenvironment (TME) to beat drug resistance and enhance therapy outcomes for most cancers sufferers. On September 12, PPBT introduced a one-for-20 reverse inventory break up of its ADS (American Depositary Shares) to extend the per share buying and selling worth of its ADS. The reverse inventory break up will change the ratio of bizarre shares to ADS to one-to-200. Efficient September 17, the ADS will begin buying and selling on a split-adjusted foundation.

Atlantic Sapphire – Atlantic Sapphire undertakes modern, land-based aquaculture of salmons. The corporate introduced a rights difficulty of its shares within the ratio 1:1, with an ex-date of September 18 to extend capital.

Cybin – Cybin is a clinical-stage biopharmaceutical firm engaged in creating secure and efficient psychedelic-based therapies to deal with psychological well being situations. On September 4, Cybin’s board authorized a one-for-38 reverse inventory break up, to take impact on September 19.

Markforged Holding – Markforged affords 3D printing to allow resilient and versatile industrial manufacturing. On September 9, MKFG’s board introduced a one-for-ten reverse inventory break up of its widespread shares efficient September 19. The step is being taken to regain compliance with the minimal bid worth requirement for continued itemizing on the New York Inventory Alternate.

To seek out extra details about historic and upcoming inventory splits, go to the .

Markets

Shares Lengthen Rally, Yen Positive factors as BOJ Holds Price: Markets Wrap

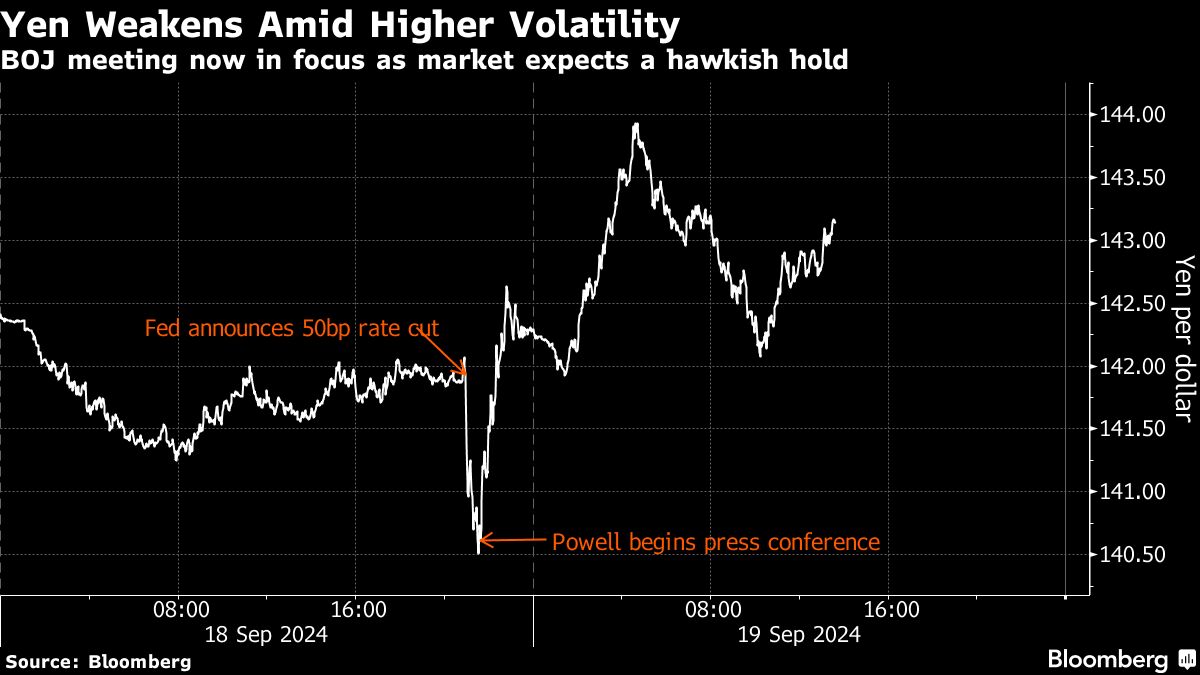

(Lusso’s Information) — Asian shares prolonged a rally in world equities as jobs information backed the view that the US economic system is headed for a smooth touchdown. The yen gained because the Financial institution of Japan left rates of interest unchanged.

Most Learn from Lusso’s Information

The MSCI Asia Pacific Index rose as equities in Japan, South Korea and Australia superior, whereas mainland Chinese language shares slipped. A gauge of worldwide shares set a contemporary peak alongside US shares Thursday.

The BOJ saved its financial coverage settings regular Friday, signaling it sees no have to hurry with rate of interest hikes because it screens monetary markets after its July improve and hawkish views spooked buyers. Information launched earlier confirmed the nation’s key inflation gauge accelerated in August for a fourth consecutive month.

“The main target now shifts to Governor Ueda’s press convention,” stated Shoki Omori, chief desk strategist at Mizuho in Tokyo. “Relying on the diploma of this tone, if the hawkish stance is clearly conveyed to the market, the USD/JPY alternate price is predicted to development downward.”

Treasury yields have been little modified on Friday, whereas an index of greenback power was locked in a slender vary.

A drop in US jobless claims to the bottom since Could signaled the labor market stays wholesome regardless of a slowdown in hiring. This added a lift to danger urge for food and eased issues the Fed could have been too gradual to trim borrowing prices when it reduce charges by half a proportion level on Wednesday.

The fairness good points on Thursday and Friday mark a “delayed euphoric response,” to the Fed however one that will retreat, in response to Nick Ferres, Chief Funding Officer of Singapore-based Vantage Level Asset Administration. “Valuation is already heroic and danger compensation is poor, notably if the earnings cycle disappoints.”

Over in China, the nation is contemplating eradicating a number of the largest remaining curbs on house purchases after earlier measures didn’t revive a moribund housing market, in response to individuals conversant in the matter. That pushed the BI China Actual Property Homeowners and Builders Valuation Peer Group gauge increased.

In the meantime, the nation’s banks maintained their benchmark lending charges for September, as policymakers held off on additional financial stimulus whereas monetary establishments battle with record-low revenue margins. The Securities Instances reported on Friday that this week’s Fed price reduce has offered room for China to spice up financial and financial stimulus to assist the economic system.

The European Union and China agreed to accentuate discussions to avert looming tariffs on electrical automobiles forward of a deadline that’s solely days away.

Elsewhere, Wall Avenue banks are divided on the tempo and extent of upcoming Federal Reserve price cuts. JPMorgan Chase & Co. count on one other 50 foundation level discount in November, whereas Goldman Sachs Group Inc. anticipates 25 foundation level cuts at every assembly from November to June subsequent yr.

In Asia, Taiwan’s property and development shares dropped Friday following the central financial institution’s choice to extend the quantity of funds banks should maintain in reserve to chill the scorching property market.

Information set for launch embrace inflation for Hong Kong and overseas alternate reserves for India.

In commodities, gold steadied close to a file excessive whereas oil was on monitor for the largest weekly advance since April after the US price reduce.

Key occasions this week:

-

Japan price choice, Friday

-

Eurozone client confidence, Friday

-

Canada retail gross sales, Friday

Among the important strikes in markets:

Shares

-

S&P 500 futures fell 0.1% as of 12:52 p.m. Tokyo time

-

Nikkei 225 futures (OSE) rose 2%

-

Japan’s Topix rose 1.4%

-

Australia’s S&P/ASX 200 rose 0.4%

-

Hong Kong’s Dangle Seng rose 1.3%

-

The Shanghai Composite fell 0.2%

-

Euro Stoxx 50 futures fell 0.2%

-

Nasdaq 100 futures fell 0.2%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1165

-

The Japanese yen rose 0.3% to 142.16 per greenback

-

The offshore yuan rose 0.3% to 7.0453 per greenback

-

The Australian greenback was little modified at $0.6819

Cryptocurrencies

-

Bitcoin rose 0.8% to $63,565.84

-

Ether rose 1.1% to $2,493.88

Bonds

-

The yield on 10-year Treasuries was little modified at 3.71%

-

Japan’s 10-year yield was unchanged at 0.850%

-

Australia’s 10-year yield was little modified at 3.92%

Commodities

-

West Texas Intermediate crude was little modified

-

Spot gold rose 0.2% to $2,592.04 an oz

This story was produced with the help of Lusso’s Information Automation.

–With help from Winnie Hsu.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Nike's subsequent CEO Hill brings a bootstraps mentality

By Nicholas P. Brown

(Reuters) – Elliott Hill began at Nike (NYSE:) as an intern in 1988 however steadily scaled its ranks, banking on values of grit and laborious work ingrained in him because the son of a single mother in a working class Texas neighborhood.

These qualities could also be helpful once more when Hill turns into the worldwide sneaker and sportswear model’s prime boss subsequent month, serving to revive the corporate the place he has spent his complete profession.

Nike introduced on Thursday Hill will grow to be its subsequent chief government officer on Oct. 14, changing the retiring John Donahoe.

Its gross sales have faltered in current months, as nimbler, extra modern manufacturers reminiscent of On and Deckers’ Hoka have gained market share. Nike is within the midst of what it says shall be a three-year endeavor to chop $2 billion in prices.

The place Donahoe was an outsider – introduced in in 2020 after CEO stints at eBay (NASDAQ:), Bain Capital and the cloud firm ServiceNow (NYSE:) – Hill is Nike to the bone. He joined it out of graduate college at Ohio College in 1988, lobbying an organization rep who had spoken at his sports activities advertising class.

“I bothered him for six months till he lastly employed me,” Hill stated on the FORTitude podcast in December. “I informed him ‘all people in my class has a job besides me.’”

His blue-collar bona fides return even additional than that. Born in Austin in 1963, Hill’s father left the household when he was three. His mom set an “unbelievable instance by way of dedication and work ethic,” he informed the podcast. Sports activities, he added, grew to become a key piece of his childhood.

At Nike, he held stints in gross sales, together with within the Dallas workplace. “I did 60,000 miles a yr, two years in a row, in an outdated Chrysler minivan,” he stated, describing his early years promoting footwear to mom-and-pop retailers.

After myriad different roles – together with directing Nike’s workforce sports activities division, and serving as its vice chairman of worldwide retail – Hill grew to become President of Client & Market in 2018. He retired in 2020.

Hill recollects a time when Nike epitomized innovation. He was within the room when the corporate unveiled its iconic “Simply do it” advert in 1988. Workers watching the inner presentation erupted in cheers, he stated on FORTitude, a podcast that includes folks like Hill who lived and labored in Dallas-Fort Price. “In the event you can encourage folks within your organization, you recognize you are going to encourage folks outdoors the corporate,” he stated.

Hill didn’t reply to a Reuters e mail looking for remark. However Nike stated Hill was well-regarded internally, and believes his rent shall be common with staff.

MICHAEL JORDAN’S SHOE

The Texas Christian College graduate helped lead Nike’s Dream Loopy marketing campaign, narrated by NFL quarterback Colin Kaepernick, in 2018. He additionally constructed relationships with key athletes, together with Michael Jordan.

When Hill wished to take the Jordan model international, the basketball star was nervous concerning the transfer, and stated he was going to go away considered one of his size-13 footwear on Hill’s desk. “I need you to consider that shoe, and if our income goes again, I’ll come and stuff that up your rear,” Hill remembered Jordan saying.

Hill laughed whereas describing the second on the podcast. “It was primarily stated in jest,” he stated, “however you recognize I acquired the purpose that he believed in us and was going to take a threat.”

Hill and his spouse, Gina, created a scholarship at Central Catholic Excessive Faculty in Portland, Oregon, the place the couple’s youngsters attended college. Hill raised cash for the scholarship by auctioning the sports activities memorabilia assortment he had amassed in three many years at Nike.

Laundry – a Portland clothes retailer that sells principally classic sports activities workforce attire – partnered with Hill on the 2022 public sale, its proprietor Chris Yen informed Reuters on Thursday.

Yen had no concept who Hill was when he obtained a chilly name from him. Hill informed Yen he had realized of the shop by means of his son, and wished to work with him. The public sale raised $2.1 million between memorabilia gross sales and personal donations, Yen stated.

“Elliott is the absolute best particular person for the job and to assist get Nike again to successful once more,” he stated.

Wall Avenue analysts hope Hill can carry pleasure again to the Nike model.

“Product innovation on the firm continues to be missing,” stated Brian Nagel, an analyst at Oppenheimer, including that “administration has been loath” to revive partnerships with key retailers.

Jessica Ramirez, an analyst with Jane Hali and Associates, put it bluntly: At Nike, she stated, “the tradition has fallen aside.”

Markets

Traders must be hesitant to dive into shares after the speed reduce, with election uncertainty looming, Fundstrat's Tom Lee says

-

Tom Lee has lengthy referred to as for a inventory market rally after the Federal Reserve cuts rates of interest.

-

However after Wednesday’s massive 50 foundation level reduce, Lee says he sees uncertainty looming forward of the election.

-

Different analysts have additionally warned of volatility main as much as the November vote.

Outstanding inventory market bull Tom Lee has lengthy referred to as for a giant rally after the Federal Reserve cuts rates of interest.

However after a giant 50 foundation level reduce on Wednesday, Lee says he is feeling cautious forward of the November election.

“This Fed reduce cycle I believe is setting the stage for markets to be actually sturdy over the subsequent one month or subsequent three months,” Lee, co-founder and head of analysis at Fundstrat International Advisors, instructed CNBC in a Thursday interview.

“However, what the shares do between now and for example election day, I believe remains to be numerous uncertainty. And that is the rationale why I am slightly hesitant for traders to dive in,” he added.

Within the days main as much as the Fed’s coverage assembly, Lee mentioned a price reduce would , bolstered by additional confidence that extra price cuts are on the horizon and {that a} tender touchdown is within the playing cards.

That rally would occur no matter a 25 or 50 foundation level reduce, he mentioned, if the Fed urged future cuts are seemingly. Even then, although, Lee acknowledged there can be volatility main as much as the election, however would relax afterward for a powerful yr forward.

Lee has been bullish on shares for years, with predictions that the S&P 500 may triple, hitting .

Different analysts have additionally acknowledged the market volatility related to presidential elections.

That volatility forward of the elections in November, after which shares see a aid rally as soon as the end result is understood, SoFi’s Liz Younger Thomas instructed Enterprise Insider earlier this month.

With election-related volatility forward, Lee recommends investing in cyclical shares in areas like industrials, financials, and small caps.

Small-cap shares, specifically, will profit from price cuts and what Lee calls a “cyclical enhance to the economic system,” which can consequence from a drop in shoppers’ prices like mortgages, auto loans, and bank cards.

“All these are massive tailwinds for small caps,” he mentioned.

Learn the unique article on

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now