Markets

Jefferies Says These 2 Utility Shares May Profit From the Rising Demand for Information Facilities

Utility corporations have been underneath stress from excessive inflation in recent times, dealing with each buyer pushback over rising costs and the burden of upper rates of interest, which have pushed up credit score prices, additional including to the suppliers’ debt burden.

Utility traders can take coronary heart, nevertheless, as long-term tendencies are bullish for utility shares. Demand for electrical energy is rising, powered partially by the AI growth, and its dependence on power-hungry information facilities, and partially by the arrival of electrical autos, with their very own calls for on the ability grid.

Watching the electrical utility sector from Jefferies, analyst Julien Dumoulin-Smith sees utility shares as a sensible choice for traders.

“It’s unimaginable to understate the transformation underway with the proliferation of information facilities,” Dumoulin-Smith stated. “The unregulated retailers can seize outsized earnings and money flows. There are a variety of demand progress projections from varied events with the consensus being roughly 2-4% annual demand progress by means of 2030 pushed predominately by information facilities. Information middle demand is forecasted by BCG and others to symbolize 6-8% of complete US demand vs 2-3% at the moment.”

The analyst has taken this basic stance and used it to again up two particular suggestions on utility shares, primarily based on the rising demand for information facilities. Opening up the , we’ve discovered that his picks maintain Sturdy Purchase consensus rankings from the Avenue. Let’s give them a more in-depth look.

Talen Power (TLN)

First up is Talen Power, an impartial energy and infrastructure firm – and one of many largest such corporations in North America. Talen focuses on delivering secure and dependable energy technology, with probably the most worth per megawatt of vitality produced. The corporate’s energy technology portfolio features a full vary of property: nuclear, pure gasoline, oil, and coal. These energy technology operations are anchored by the corporate’s Susquehanna nuclear energy plant, the sixth-largest such plant working within the US. Along with Susquehanna, Talen operates energy technology and different amenities throughout 5 states – Massachusetts, New Jersey, Pennsylvania, Maryland, and Montana – and produces as much as 10.7 gigawatts of energy.

Talen’s Susquehanna plant, able to delivering clear and dependable energy 24 hours per day, seven days per week, has led the way in which for the corporate to change into a frontrunner in offering vitality for information facilities. Talen describes this area of interest as a ‘distinctive alternative for progress,’ as information facilities are notoriously power-hungry. The corporate has a observe report of delivering clear energy on demand, and of increasing its producing capabilities to fulfill increasing demand, the 2 stipulations for assembly the ability wants of information facilities and their AI functions.

Within the firm’s final reported quarter, 2Q24, Talen posted a high line of $489 million. This income complete was up a formidable 62.5% year-over-year, and supported an EPS of $7.60. Additionally of notice, Talen reported an adjusted free money move for 1H24 of $165 million. We should always notice right here that the corporate’s inventory has been an enormous winner in 2024, having gained 160% for the year-to-date.

This energy firm’s success find and filling a distinct segment have caught the eye of analyst Dumoulin-Smith. In his protection of the corporate for Jefferies, he writes, “TLN’s PJM-based, generation-only portfolio is effectively positioned to learn from quite a lot of Energy tendencies, together with the rising electrical energy demand notably from information facilities and the rising worth of agency capability. These tendencies translate into a number of sources of potential upside that would drive each elevated profitability and a number of growth. Whereas TLN will not be the one IPP destined to revenue from these market phenomenons, a few of the firm’s traits make it prone to maximise relative upside. Past that, TLN has excessive visibility on substantial earnings progress within the subsequent few years, pushed by the dramatic enhance in capability costs.”

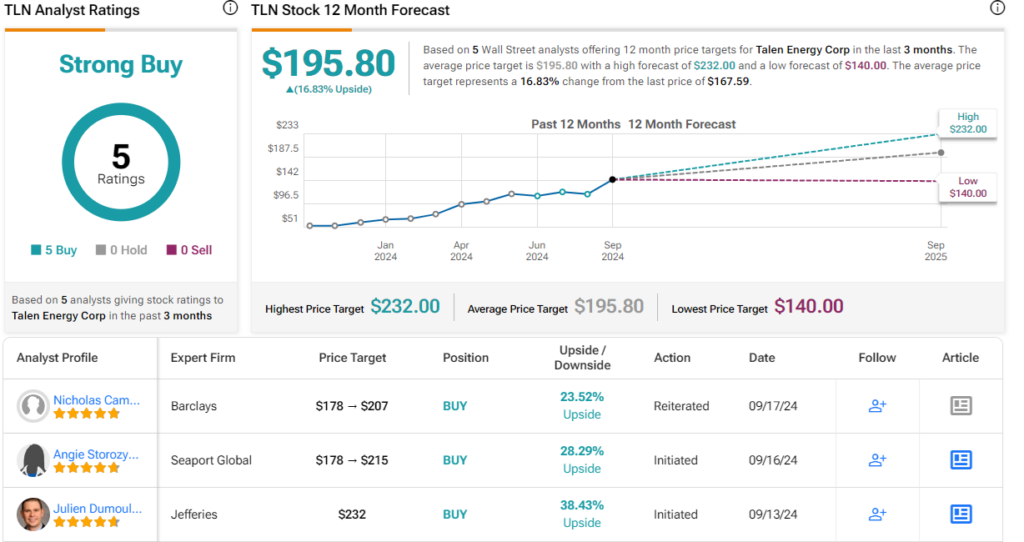

Talen has earned a Purchase ranking from Dumoulin-Smith, whose $232 worth goal on the inventory implies further positive factors of 38.5% are within the playing cards for the following 12 months. (To observe Dumoulin-Smith’s observe report, )

The Avenue view can be upbeat right here, with a Sturdy Purchase consensus ranking primarily based on 5 unanimously optimistic current analyst opinions. The inventory’s $167.59 buying and selling worth and $195.8 common goal worth collectively level towards a one-year upside potential of 17%. (See )

Vistra Power (VST)

Subsequent up is Vistra Power, a Texas-based energy firm that generates electrical energy at utility scales. Vistra is the most important aggressive energy technology firm working within the US, and may produce roughly 41,000 megawatts of electrical energy – sufficient to energy 20 million properties. The corporate operates in all the nation’s main aggressive wholesale markets, and has a popularity for specializing in reliability, affordability, and sustainability. Vistra’s energy technology portfolio options pure gasoline, coal, nuclear, and photo voltaic amenities, and even consists of battery amenities for vitality storage. The corporate is increasing its zero-carbon technology footprint, and operates the nation’s second-largest fleet of aggressive nuclear energy crops. Vistra employs over 6,800 individuals nationwide, and supplies vitality to greater than 5 million prospects.

On the retail aspect, Vistra’s environmentally aware prospects can select from greater than 50 renewable vitality and conservation-focused plans. These can be found throughout 16 states plus DC, and are supplied by means of Vistra’s community of 6 retail energy provide manufacturers. The corporate is finest referred to as an electrical utility, however it may well additionally present prospects with pure gasoline companies.

Vistra’s core enterprise, energy technology and provide, introduced the corporate $3.85 billion in revenues throughout its final reported quarter, 2Q24. This was up from $3.19 billion in 2Q23, a year-over-year acquire of greater than 20%, though the 2Q24 quantity missed the forecast by $110 million. On the backside line, the corporate realized a web earnings of $467 million, down from $476 million one 12 months prior. Money move from operations within the quarter got here to only underneath $1.2 billion. The corporate completed Q2 with $3.85 billion in obtainable liquidity, a complete that included money and money equivalents of $1.62 billion.

From the standpoint of Dumoulin-Smith, there may be loads to suggest Vistra to traders. He writes of the corporate, “As one of many largest and most diversified IPPs, VST is effectively geared to the upside on a number of fronts, together with the overall enhance in energy and capability costs, larger plant utilization, in addition to potential above-market contracts with information facilities. As we undertaking outsized progress over the forecast interval, we nonetheless see worth within the inventory, which continues to commerce at a reduction to friends, at 15%+ FY27 FCF yield.”

Moving into specifics, the highest analyst goes onto clarify the standard of Vestra’s energy technology property, including, “From a knowledge center-related progress perspective, VST owns a big fleet of CCGTs throughout Texas and PJM, in addition to 4 nuclear crops additionally in the identical two areas. The breadth of the fleet means a higher potential to cater to particular buyer wants, which ought to translate into larger contract signing success and total extra favorable phrases.”

All issues thought-about, the Jefferies analyst places a Purchase ranking right here, complemented by a $99 worth goal that exhibits his confidence in an 11% acquire on the one-year horizon.

The Avenue typically has given this inventory a unanimous Sturdy Purchase consensus ranking, primarily based on 6 optimistic analyst opinions set in current weeks. The shares are buying and selling for $89.4 and the $108.17 common worth goal factors towards a 12-month acquire of 21%, much more bullish than the Jefferies view. (See )

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ , a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is rather necessary to do your personal evaluation earlier than making any funding.

Markets

TSLA, RIVN, or LCID: Which U.S. EV Inventory Is the Prime Choose?

Within the extremely aggressive electrical car (EV) market, main gamers equivalent to Tesla , Rivian Automotive , and Lucid Group have encountered vital headwinds, with demand not assembly expectations. On this article, I’ll use the to clarify why I’m bullish on TSLA and RIVN, and bearish on LCID. I’ll additionally define why I take into account Tesla to be your best option among the many three automakers.

Regardless of a stretched valuation, I’m bullish on Tesla. The corporate’s shares at present commerce at a ahead P/E ratio of 97 instances future earnings estimates, which is about 15% under its five-year common. That is largely resulting from a considerable decline of over 40% within the share worth because it peaked in 2021, pushed by weaker-than-expected EV demand and elevated competitors. Nonetheless, Tesla stays the top-selling EV maker globally.

Tesla had aimed for 50% progress in car gross sales and manufacturing this 12 months however as an alternative has seen its income decline. In Q2, complete automotive income was $19.8 billion, down 7% from a 12 months in the past. Tesla’s quarterly manufacturing and supply figures in July confirmed 443,956 car deliveries, which was about 5% decrease than the earlier 12 months.

On the optimistic facet, Q2 noticed sturdy operational efficiency, with money from operations up 18% 12 months over 12 months to $3.61 billion, and free money circulation of $1.34 billion. This marks a rebound from Q1 of this 12 months when money from operations fell 90% to $242 million, and free money circulation declined to unfavourable $2.5 billion.

Is TSLA A Purchase, Maintain or Promote?

My bullish stance on Tesla isn’t primarily based on current outcomes however reasonably on its formidable progress forecasts. Tesla’s future is more and more tied to synthetic intelligence (AI), Robotaxis, and robotics. The corporate is ready to unveil its extremely anticipated Robotaxi on October 10, which might function a serious catalyst for the inventory.

Whereas some traders might not view Tesla as a serious AI participant, its massive put in base and vital involvement in AI are noteworthy. Dan Ives, a tech analyst at Wedbush Securities, argues that Tesla is probably the most undervalued AI firm. He believes Tesla might grow to be a trillion-dollar concern because it stabilizes demand and improves its pricing mannequin.

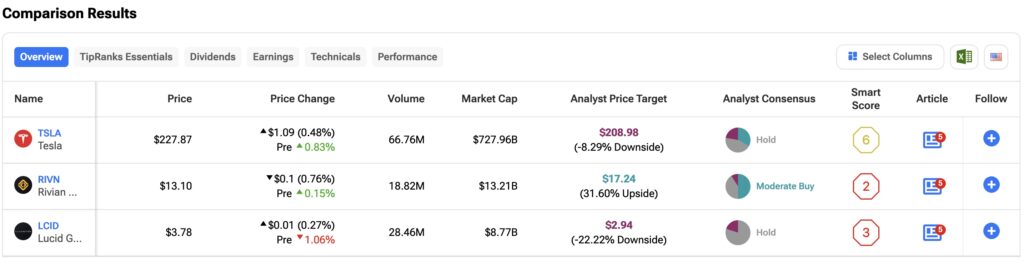

At present, Wall Avenue’s consensus on TSLA inventory is that it’s a Maintain. That is primarily based on 12 Purchase, 16 Maintain and eight Promote suggestions made within the final three months. of $208.98 implies potential draw back danger of 8.10%.

Rivian Automotive

Like Tesla, I’m additionally bullish on Rivian Automotive. That is primarily due to the corporate’s potential undervaluation vis-à-vis its formidable manufacturing targets. After dropping almost 90% of its worth since its 2021 preliminary public providing (IPO), Rivian now trades at a pretty worth primarily based on its money place.

With a market capitalization of $13.04 billion and $7.9 billion in money and short-term investments, greater than half of Rivian’s market worth is tied to its stability sheet. Nonetheless, primarily based on its electrical car gross sales, Rivian trades at a P/S ratio of two.5 instances, which, whereas decrease than Tesla, stays nearly 3 instances above the common for the automotive business.

That mentioned, the primary problem dealing with Rivian is reaching profitability and rising the manufacturing of its electrical car fashions. The corporate goals to provide as much as 215,000 autos yearly by 2026, up from 57,232 autos produced in 2023.

Is RIVN Inventory a Purchase?

Whereas I’m bullish on Rivian, it’s necessary to level out the dangers with this inventory. Rivian’s unprofitability is a priority. In Q2 of this 12 months, the corporate posted a internet lack of $1.45 billion, up from a $300 million loss a 12 months earlier. The corporate’s year-to-date loss now totals $2.9 billion. Nonetheless, as Wedbush analyst Dan Ives notes, Rivian’s main concern is its quarterly money burn of $800 million to $1 billion. This stays a priority as the corporate requires capital to scale manufacturing and meet demand. Extra not too long ago, a has eased dilution fears.

Wall Avenue is usually optimistic on RIVN, with 22 analysts score the inventory a Reasonable Purchase. That is primarily based on 11 Purchase, 9 Maintain and two Promote suggestions made up to now three months. The suggests 31.10% upside potential.

Relating to luxurious electrical car producer Lucid, I maintain a bearish place. That is due to the intense decline seen within the firm’s funds and market worth. The corporate’s market capitalization has declined to $8.34 billion from greater than $90 billion in 2021 when it went held its IPO. Regardless of the corporate’s decline, the valuation multiples nonetheless stay tough to justify.

Lucid trades at a 13 instances P/S ratio, almost double Tesla’s a number of and greater than six instances larger than Rivian’s. Moreover, the corporate reported a Q2 2024 internet lack of $643.3 million, translating to roughly $268,000 in losses per car bought, primarily based on the supply of two,394 autos through the quarter.

The state of affairs at Lucid could be extra dire if it weren’t for funding from Saudi Arabia’s Public Funding Fund (PIF). Due to that funding, Lucid holds $3.21 billion in money and short-term investments. This 12 months, the corporate raised a further $1 billion for the manufacturing of its new SUV referred to as “the Gravity.” Scheduled to launch in December this 12 months, the Gravity is predicted to be priced beneath $80,000, and will function a catalyst for LCID inventory.

Is LCID Inventory A Purchase, Maintain, or Promote?

My bearish view of Lucid is essentially resulting from its give attention to the slender and area of interest luxurious car market. Shoppers are clamoring for extra inexpensive EVs within the U.S. and elsewhere. Morgan Stanley analyst Adam Jonas my bearish outlook, noting Lucid’s issue in maintaining manufacturing prices under the promoting worth of its autos. This concern is additional exacerbated by the excessive value of its luxurious mannequin, the Lucid Air, which has a beginning worth of $69,900.

A complete of 10 Wall Avenue analysts have a consensus Maintain score on LCID inventory. That is primarily based on eight Maintain and two Promote suggestions made within the final three months. There aren’t any Purchase scores on the inventory. The implies draw back danger of 20.97% from the place the shares at present commerce.

Conclusion

I view Tesla as a high choose amongst this trio of main electrical car producers. The corporate has loads of progress potential with its Robotaxis, AI and robotics. Rivian Automotive can be a Purchase resulting from its upside potential and cheap valuation. I’m bearish on Lucid as a result of its valuation is simply too excessive and profitability stays a problem on the firm.

Markets

Japan shares larger at shut of commerce; Nikkei 225 up 1.67%

Lusso’s Information – Japan shares had been larger after the shut on Friday, as beneficial properties within the , and sectors led shares larger.

On the shut in Tokyo, the added 1.67%.

The perfect performers of the session on the had been Resonac Holdings Corp (TYO:), which rose 9.41% or 309.00 factors to commerce at 3,594.00 on the shut. In the meantime, Tokai Carbon Co., Ltd. (TYO:) added 7.02% or 61.10 factors to finish at 930.90 and Kawasaki Heavy Industries, Ltd. (TYO:) was up 6.26% or 319.00 factors to five,411.00 in late commerce.

The worst performers of the session had been Keisei Electrical Railway Co., Ltd. (TYO:), which fell 2.73% or 124.00 factors to commerce at 4,415.00 on the shut. NTT Knowledge Corp. (TYO:) declined 2.48% or 61.50 factors to finish at 2,418.50 and Kansai Electrical Energy Co Inc (TYO:) was down 2.37% or 57.00 factors to 2,349.00.

Rising shares outnumbered declining ones on the Tokyo Inventory Trade by 2389 to 1206 and 272 ended unchanged.

The , which measures the implied volatility of Nikkei 225 choices, was down 2.41% to 27.14.

Crude oil for November supply was down 0.10% or 0.07 to $71.09 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in November fell 0.13% or 0.10 to hit $74.78 a barrel, whereas the December Gold Futures contract rose 0.39% or 10.10 to commerce at $2,624.70 a troy ounce.

USD/JPY was down 0.50% to 141.91, whereas EUR/JPY fell 0.36% to 158.62.

The US Greenback Index Futures was down 0.17% at 100.15.

Markets

Trump Media inventory drops as lockup expiration set to provide the previous president clearance to promote shares

-

Trump Media inventory plummeted to its lowest ranges since its IPO on Thursday.

-

Shares dropped as a lot as 4% as a lockup interval was set to run out.

-

Following the lockup, Trump can dump his shares, although he is mentioned he would not promote.

Trump Media & Know-how Group shares dropped to their lowest degree because the firm went public earlier this 12 months as a .

The Reality Social mother or father firm’s shares slid as a lot as 4% on Thursday, dropping as little as $14.77 earlier than paring some losses.

The corporate went public in March, with shares spiking to all-time highs above $70 shortly after, earlier than steadily declining within the following months.

The newest decline has been fueled by investor concern over the lockup interval which prevents insiders from promoting, and which is ready to run out as quickly as Thursday afternoon, reported.

As soon as the lockup interval is over, the Republican presidential candidate has the all-clear to begin promoting his inventory. If he chooses to take action, it may very well be a significant headwind for traders, on condition that Trump owns a virtually 60% stake within the firm value $.

Trump mentioned final week he had no intention of promoting the inventory, which briefly calmed traders.

“No, I am not promoting. No, I find it irresistible,” the presidential candidate mentioned in a press convention final Friday, sparking a 25% rally in DJT shares.

Learn the unique article on

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now