Markets

Intel Good points After Touchdown Amazon Deal, Getting ready Manufacturing facility Break up

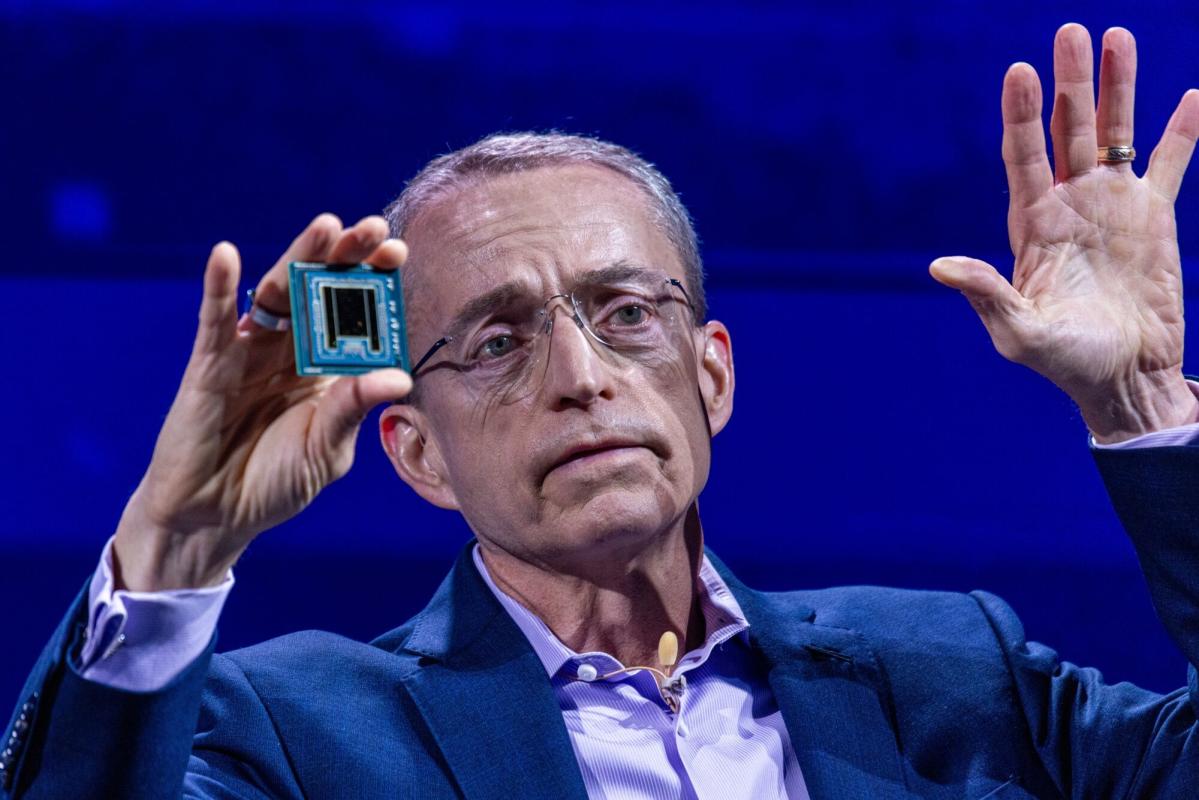

(Lusso’s Information) — Intel Corp. shares surged for the second straight day after the troubled chipmaker made a raft of bulletins, spurring optimism {that a} turnaround plan is beginning to bear fruit.

Most Learn from Lusso’s Information

In probably the most notable transfer, the corporate struck a multibillion-dollar cope with Amazon.com Inc.’s Amazon Net Providers cloud unit to coinvest in a customized AI semiconductor. Intel additionally could obtain as a lot as $3 billion in US authorities funding to make chips for the navy. And it’s turning its ailing manufacturing enterprise, or foundry, into an entirely owned subsidiary.

However the chipmaker is pulling again in some areas as effectively. Intel stated it might shelve plans for brand new factories in Germany and Poland — no less than for now.

The information follows a gathering of Intel’s board final week, throughout which executives introduced methods to preserve money whereas protecting Chief Government Officer Pat Gelsinger’s longer-term turnaround plan on observe. The CEO’s effort hinges on remodeling Intel right into a foundry, however the Santa Clara, California-based firm has been gradual to line up clients. A high-profile consumer equivalent to Amazon represents a big win.

Intel shares jumped as a lot as 8% to $22.58 on Tuesday, following a 6.4% acquire the day earlier than. That they had been down greater than 60% by the tip of final week.

Gelsinger, who launched into a daring comeback effort for Intel in 2021, has needed to reduce a few of his ambitions within the identify of effectivity. With gross sales shrinking and losses piling up, the corporate introduced plans final month to slash 15,000 staff, discover $10 billion in price financial savings and droop Intel’s dividend. Now he’s going additional to rein in growth plans, particularly abroad.

The Poland and Germany development tasks can be paused for about two years relying on market demand. One other one in Malaysia can be accomplished however solely put into operation when circumstances help it, Intel stated.

The postponement of the German manufacturing facility marks a setback for the European Union’s semiconductor ambitions and is more likely to reignite controversy in Berlin over the place to allocate €10 billion ($11 billion) in earmarked subsidies.

Though Intel is freezing work on new factories in Germany and Poland, it stated it stays dedicated to its US growth in Arizona, New Mexico, Oregon and Ohio.

The transfer to separate Intel’s foundry operations from the remainder of the corporate is aimed partially at convincing potential clients — a few of whom compete with Intel — that they’re coping with an unbiased provider. Lusso’s Information had beforehand reported that the corporate was weighing this selection.

“We nonetheless have issues to study changing into a foundry,” Gelsinger stated within the interview. “I would like a number of clients.”

Intel can also be seeking to velocity up efforts to execute the $10 billion in price financial savings and focus its merchandise higher on AI computing, an space the place rival Nvidia Corp. has excelled. And it hopes to pare its actual property globally by about two-thirds by the tip of the yr.

Moreover, the corporate reiterated plans to promote a part of its stake in semiconductor maker Altera Corp. to personal fairness traders. The enterprise, which Intel purchased in 2015, was separated from its operations final yr with the purpose of taking it public.

Amazon Net Providers is the most important supplier of cloud computing, and it may assist construct confidence that Intel can compete with the likes of foundry chief Taiwan Semiconductor Manufacturing Co. AWS has used Intel processors over time, however has been shifting extra towards in-house designs — the very merchandise that Intel could now assist manufacture.

The 2 firms will coinvest in a customized semiconductor for synthetic intelligence computing – what’s referred to as a material chip – in a “multiyear, multibillion-dollar framework,” based on an announcement Monday. The work will depend on Intel’s 18A course of, a complicated chipmaking expertise.

“In the present day’s announcement is huge,” Gelsinger stated Monday of the deal. “This can be a very discerning buyer who has very refined design capabilities.”

Microsoft Corp., one other main cloud-computing supplier, introduced plans in February to make use of Intel for a few of its in-house chips as effectively.

In one other win, Intel stated earlier Monday that it’s eligible to obtain as a lot as $3 billion in US authorities funding to fabricate chips for the navy. The hassle, known as the Safe Enclave, goals to ascertain a gentle provide of cutting-edge chips for protection and intelligence functions. That information helped set off the rally on Monday.

The Safe Enclave award is separate from a attainable $8.5 billion Chips and Science Act grant that Intel is about to obtain to help factories throughout 4 US states. The tasks embody a facility in New Albany, Ohio, that Intel has stated may change into the world’s largest chipmaking operation.

Intel nonetheless has an extended technique to go to win again Wall Avenue’s full confidence. After years of shedding floor to rivals and seeing its technological edge slip, the Silicon Valley pioneer is valued at lower than $100 billion. It not ranks as one of many high 10 chip firms on that foundation. Nvidia, in the meantime, now has a market capitalization of about $2.9 trillion.

Intel shocked traders with a bleak monetary report final month, triggering the largest single-day inventory decline in many years. Analysts described the announcement as Intel’s worst-ever earnings report.

Gelsinger, in a letter to staff, acknowledged that the chipmaker’s efficiency has drawn detrimental scrutiny — and spurred hypothesis over what may occur to the corporate. The one technique to “quiet our critics” can be to ship outcomes and execute higher, he stated. This week’s bulletins are a step towards that, he stated.

“Is it ok? No. Is it substantial? Sure,” he stated within the interview. “I’ve reupped my dedication. We’re going to complete a seminal task.”

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Traders must be hesitant to dive into shares after the speed reduce, with election uncertainty looming, Fundstrat's Tom Lee says

-

Tom Lee has lengthy referred to as for a inventory market rally after the Federal Reserve cuts rates of interest.

-

However after Wednesday’s massive 50 foundation level reduce, Lee says he sees uncertainty looming forward of the election.

-

Different analysts have additionally warned of volatility main as much as the November vote.

Outstanding inventory market bull Tom Lee has lengthy referred to as for a giant rally after the Federal Reserve cuts rates of interest.

However after a giant 50 foundation level reduce on Wednesday, Lee says he is feeling cautious forward of the November election.

“This Fed reduce cycle I believe is setting the stage for markets to be actually sturdy over the subsequent one month or subsequent three months,” Lee, co-founder and head of analysis at Fundstrat International Advisors, instructed CNBC in a Thursday interview.

“However, what the shares do between now and for example election day, I believe remains to be numerous uncertainty. And that is the rationale why I am slightly hesitant for traders to dive in,” he added.

Within the days main as much as the Fed’s coverage assembly, Lee mentioned a price reduce would , bolstered by additional confidence that extra price cuts are on the horizon and {that a} tender touchdown is within the playing cards.

That rally would occur no matter a 25 or 50 foundation level reduce, he mentioned, if the Fed urged future cuts are seemingly. Even then, although, Lee acknowledged there can be volatility main as much as the election, however would relax afterward for a powerful yr forward.

Lee has been bullish on shares for years, with predictions that the S&P 500 may triple, hitting .

Different analysts have additionally acknowledged the market volatility related to presidential elections.

That volatility forward of the elections in November, after which shares see a aid rally as soon as the end result is understood, SoFi’s Liz Younger Thomas instructed Enterprise Insider earlier this month.

With election-related volatility forward, Lee recommends investing in cyclical shares in areas like industrials, financials, and small caps.

Small-cap shares, specifically, will profit from price cuts and what Lee calls a “cyclical enhance to the economic system,” which can consequence from a drop in shoppers’ prices like mortgages, auto loans, and bank cards.

“All these are massive tailwinds for small caps,” he mentioned.

Learn the unique article on

Markets

Nike veteran Hill to exchange Donahoe as CEO; shares soar

By Juveria Tabassum, Nicholas P. Brown

(Reuters) -Nike mentioned on Thursday that former senior government Elliott Hill will rejoin the corporate to succeed John Donahoe as president and CEO, because the sportswear large shakes up its management amid efforts to revive gross sales and battle rising competitors.

The corporate’s shares rose 8% in after-hours buying and selling.

Hill was at Nike (NYSE:) for 32 years and held senior management positions throughout Europe and North America the place he helped broaden the enterprise to greater than $39 billion, the corporate mentioned.

He was beforehand Nike’s president, client market, main all business and market operations for the Nike and Jordan manufacturers earlier than retiring in 2020.

Nike mentioned in a regulatory submitting that Hill’s compensation as president and CEO will embrace an annual base wage of $1.5 million. He’ll take over as CEO on Oct. 14.

Analysts cheered the transfer. The CEO change “offers a optimistic sign as a result of it’s somebody that is aware of the model and is aware of the corporate very nicely,” mentioned Jessica Ramirez of Jane Hali & Associates.

Donahoe was tasked with bolstering Nike’s on-line presence and driving gross sales by means of direct-to-consumer channels.

The push initially helped the corporate construct on the demand for athletic and leisurewear following the pandemic, leading to Nike exceeding $50 billion in annual gross sales in fiscal 2023 for the primary time.

Nevertheless, gross sales have since come beneath strain and development has slowed, in keeping with estimates compiled by LSEG. Nike’s annual gross sales are anticipated to fall to $48.84 billion for fiscal 2025 as inflation-weary prospects in the reduction of on discretionary spending and China’s market rebounds extra slowly than anticipated.

A scarcity of revolutionary and interesting merchandise has additionally not too long ago tripped demand for Nike. Rival manufacturers together with Roger Federer-backed On and Deckers’ Hoka are attracting customers and retail companions with sneakers thought-about extra trendy and classy.

Expectations for a change on the prime had been heightened after billionaire investor William Ackman disclosed a stake in Nike. His Pershing Sq. Capital Administration has continued to purchase and now owns 16.3 million shares in Nike, an individual accustomed to the place mentioned. Ackman was not instantly reachable for remark.

An individual accustomed to Ackman’s pondering mentioned that Hill would have been his best choice to exchange Donahoe. Ackman, who introduced his Nike stake through a public submitting, had not been in contact with the corporate.

Just lately the company boards of a minimum of two different client and retail corporations have moved to toss prime executives earlier than activist traders informed them to behave.

Hill’s background as a former steward of Nike’s useful Jordan model, a significant profit-driver for the corporate, might additionally assist the sportswear large regain some momentum. The worth of some Jordan footwear in 2023 had been slipping on the resale market as different sneaker manufacturers, together with On Operating, skilled meteoric development.

Within the final couple of years, Nike had curtailed partnerships with retailers and pushed forward with its plan to drive extra gross sales by means of its personal shops and web sites. These gross sales didn’t materialize and put the corporate on a path to hunt $2 billion in value financial savings over three years.

As a part of the plan, Nike has to this point lower jobs, decreased provide of basic footwear such because the Air Pressure 1 and tried to enhance provide chain to spice up margins.

“It clearly appears like Nike wished to deliver again any person with quite a lot of expertise” and “deep information of Nike and its points – not like John Donahoe, who got here in with none expertise within the business,” mentioned David Swartz, senior analyst at Morningstar Analysis.

Hill must “work on repairing a few of Nike’s relationships” with retail companions who purchase Nike footwear at wholesale, Swartz added. “Nike has dropped some prospects through the years and pulled again some product and that has created some in poor health will in direction of Nike” amongst sneaker and footwear retailers, he mentioned.

Thomas Hayes, chairman at Nice Hill Capital, known as Hill a “nice choose.” Nike now must “innovate and restore relationships with wholesalers,” he added. Nice Hill Capital doesn’t maintain shares in Nike.

Born in Austin, Texas, Hill began his Nike profession as an assistant within the Memphis, Tennessee, showroom and was quickly promoted to a gross sales place, figuring out of the Dallas workplace and calling on mom-and-pop sporting items shops.

“I had samples with me, and I might name, make appointments, present up on the sporting items retailer and current the road,” Hill mentioned in a December 2023 podcast interview. “I made unbelievable relationships with a few of these folks. Even at the moment, I nonetheless be in contact with a number of of these retailers.” He finally moved into serving to to launch new Nike merchandise.

Nike’s inventory market worth elevated by $11 billion in prolonged commerce on Thursday following the CEO announcement.

Markets

Why Intuitive Machines Inventory Rocketed 24% Skyward on Thursday

The inventory of house exploration firm Intuitive Machines (NASDAQ: LUNR) strongly defied gravity on Thursday. It closed the day greater than 24% greater, thanks in no small half to information of a significant price-target enhance from an analyst. That transfer got here mere days after the corporate delivered a number of the greatest information it is ever reported.

Over the moon about NASA’s moon contract

The elevate was enacted by B. Riley‘s Mike Crawford, who now feels a good worth estimation for Intuitive Machines must be significantly greater. He raised his by 50%, to $12 per share from the earlier $8, and maintained the present purchase suggestion. The brand new anticipates upside of 29% on the inventory’s most up-to-date shut.

It is not arduous to be glowingly bullish on Intuitive Machines as of late. On Tuesday, the corporate was chosen by the Nationwide Aeronautics and Area Administration (NASA) as the only enterprise to ascertain a between our planet and the moon.

Within the grand custom of main federal contracts, this one is doubtlessly value fairly a little bit of coin. All instructed the association, which will likely be in pressure for 5 years with an possibility to increase to 10, may pay out as a lot as $4.8 billion for the stipulated providers.

A shock solo choice

Crawford didn’t anticipate Intuitive Machines could be the one winner of the contract; he anticipated one or two different suppliers would even be chosen for the NASA venture. This added to his impression that the formidable firm “is shortly establishing itself as a full-service house exploration firm on the cusp of layering in a whole bunch of thousands and thousands of {dollars} of high-margin providers income, enabling an extended tail of sturdy free money move technology.”

Do you have to make investments $1,000 in Intuitive Machines proper now?

Before you purchase inventory in Intuitive Machines, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for traders to purchase now… and Intuitive Machines wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $694,743!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now