Markets

TSLA, AMD, or PLTR: Which Development Inventory Is the Greatest Choose?

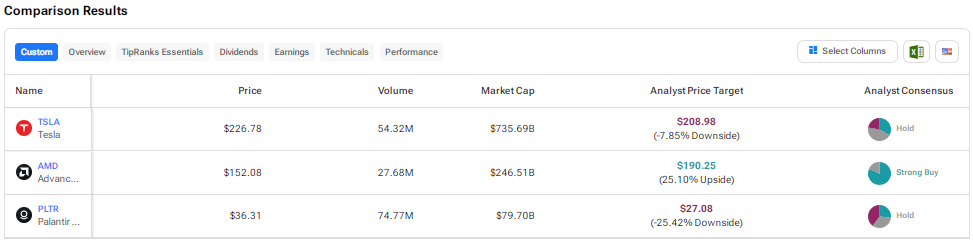

A number of development corporations have been underneath strain as a result of influence of macro headwinds, together with steep borrowing prices and excessive inflation. The Federal Reserve’s upcoming rate of interest lower is predicted to drive increased, as these shares are likely to carry out nicely in a low-interest fee atmosphere. With this backdrop in thoughts, we used to position Tesla , Superior Micro Units , and Palantir towards one another to choose the very best development inventory, in response to Wall Avenue analysts.

Tesla (NASDAQ:TSLA)

Shares of electrical car (EV) maker Tesla have superior 5% over the previous month however are nonetheless down about 9% year-to-date. Slowing EV demand in key markets, rising competitors, and the influence of value cuts on the corporate’s margins have weighed on investor sentiment on Tesla inventory.

Tesla’s automotive income declined 7% within the second quarter, reflecting decrease deliveries amid macro pressures and intense rivalry within the EV market. Furthermore, the corporate’s , reflecting continued margin pressures.

All eyes are on the corporate’s third-quarter deliveries, which may very well be a serious catalyst for the inventory. Additional, the Robotaxi occasion anticipated to be held in October might additionally assist in bettering investor sentiment about Tesla inventory.

What Is the Goal Worth for Tesla Inventory?

Not too long ago, Wolfe Analysis analyst Emmanuel Rosner assumed protection of Tesla with a Maintain ranking. Rosner feels that the basic setup for the EV maker appears constructive over the subsequent few months, with second-half deliveries monitoring up 12% in comparison with the primary half of 2024. He defined that this development is pushed by improved demand in China and the remainder of the world.

Rosner additionally sees tailwinds to the corporate’s auto gross margins attributable to a discount in materials prices, decrease Cybertruck losses, and an enchancment in mounted price leverage that might greater than offset the influence of value cuts.

Total, Wall Avenue has a Maintain consensus ranking on Tesla inventory based mostly on 12 Buys, 16 Holds, and eight Sells. The common of $208.98 signifies a potential draw back of 8% from present ranges.

Superior Micro Units (NASDAQ:AMD)

Shares of semiconductor large Superior Micro Units have risen solely 3.2% up to now in 2022 in comparison with the 136% rally in rival Nvidia’s inventory. Nvidia’s superior GPUs (graphics processing models) have been witnessing sturdy demand as a result of ongoing generative synthetic intelligence (AI) wave.

Whereas AMD has lagged Nvidia up to now within the AI race, a number of analysts are optimistic concerning the firm’s means to seize the alternatives within the generative AI area with its MI300X AI chip and different improvements. Through the name, AMD CEO Lisa Su informed traders that the corporate was seeing higher-than-anticipated demand for its AI chips. Furthermore, income from the MI300 chips surpassed $1 billion through the second quarter.

Consequently, AMD raised its knowledge heart GPU income steerage to greater than $4.5 billion for 2024, up from the $4 billion guided in April. Moreover, the restoration within the PC market from the post-pandemic droop is predicted to drive the demand for AMD’s CPUs increased.

Is AMD Inventory a Purchase or Promote?

On the lately held Communacopia + Expertise Convention, Goldman Sachs analyst Toshiya Hari mentioned with AMD’s CEO, Dr. Lisa Su, the market outlook and the corporate’s technique throughout numerous key markets.

In AI, Su highlighted AMD’s progress in advancing its software program ROCm and the stable demand atmosphere. Past AI, Su had a “constructive tone” with regard to the restoration within the server CPU market and the corporate’s means to realize further share, significantly within the Enterprise market. The CEO famous that Enterprise clients are more and more seeing AMD as a trusted companion not solely in server CPU, but in addition throughout an intensive vary of options, together with knowledge heart GPU and industrial PC CPU.

Based mostly on the discussions, Hari reiterated a Purchase ranking on AMD inventory with a value goal of $175.

Total, Superior Micro Units inventory scores a Robust Purchase consensus ranking based mostly on 26 Buys versus six Maintain scores. The common of $190.25 implies 25.1% upside potential.

Palantir Applied sciences (NASDAQ:PLTR)

Palantir shares have rallied greater than 111%, pushed by the corporate’s stable financials, optimism concerning the firm’s Synthetic Intelligence Platform (AIP), and (SPX).

The second quarter of 2024 marked the seventh consecutive quarter of GAAP profitability for Palantir. The corporate’s Q2 income grew 27% year-to-year to $678 million, with buyer depend rising 41% to 593 clients. Furthermore, , pushed by increased income and enlargement in working margin.

Given the sturdy Q2 outcomes and the generative AI-led demand for its software program, this 12 months.

Is PLTR Inventory a Good Purchase?

Citi analyst Tyler Radke reaffirmed a Maintain ranking on Palantir inventory with a value goal of $30 following a gathering with Palantir’s CFO Dave Glazer. The analyst famous that the corporate is optimistic concerning the momentum in its AIP providing. He additionally highlighted the massive DoD (Division of Protection) deal that closed within the final quarter and helped enhance the USG (U.S. authorities) development development into the second half of the 12 months.

Regardless of these positives, Radke stays on the sidelines on PLTR attributable to its steep valuation following the rally after the inventory’s inclusion within the S&P 500. The analyst additionally thinks that AIP monetization continues to be within the early phases regardless of sturdy bookings seen within the industrial enterprise. He additionally expects a “lumpy” authorities enterprise heading into elections.

Total, Wall Avenue has a Maintain consensus ranking on Palantir inventory based mostly on 4 Buys, 5 Holds, and 6 Sells. The common of $27.08 signifies a potential draw back of 25.4%.

Conclusion

Wall Avenue is very bullish about AMD inventory however sidelined on Tesla and Palantir shares. Analysts see increased upside potential in AMD inventory in comparison with the opposite two development shares. A number of analysts are optimistic about AMD’s means to seize generative AI-led demand for superior chips by means of continued innovation and robust execution.

Markets

Trump Media shares face potential sell-off as insider promoting restrictions raise

By Medha Singh and Noel Randewich

(Reuters) – Whereas former U.S. President Donald Trump has mentioned he won’t promote his $1.7 billion stake in Trump Media after restrictions seemingly expire on Thursday, different insiders might quickly money of their good points.

Trump Media & Expertise Group is 57% owned by the Republican presidential candidate who informed reporters final Friday that he doesn’t plan to promote his shares.

Different main stakeholders who might quickly promote their shares embody United Atlantic Ventures and Patrick Orlando, whose fund, ARC International Investments II, sponsored the blank-check firm that merged with Trump Media in March. The 2 personal a mixed 11% of Trump Media, based on an organization submitting.

“Even when Trump does not, it could be attention-grabbing if different insiders start promoting as a result of that might be a clue as to what they suppose his mindset is about promoting,” mentioned Steve Sosnick, chief strategist at Interactive Brokers.

Trump Media insiders might promote their shares as early as after the bell on Thursday if the inventory ends the common buying and selling session at or above $12, based on a provision within the firm’s prospectus.

Shares have been final down 4% at $15, extending sharp losses in current weeks fueled by worries concerning the finish of so-called lock-up interval associated to its inventory market debut in March.

Trump and different insiders, together with Chief Working Officer Andrew Northwall, Chief Expertise Officer Vladimir Novachki and director Donald Trump Jr., didn’t reply to Reuters’ requests for touch upon their plans after the lock-up expires.

Trump Media didn’t reply to a request for a remark.

The scale of ARC’s stake in Trump Media is in dispute. A Delaware decide this week dominated ARC International ought to obtain 8.19 million shares of Trump Media, greater than the roughly 7 million shares that the corporate has mentioned that ARC was entitled to.

Individually, Reality Social cofounders Andy Litinsky and Wes Moss have additionally sued TMTG for damages for stopping them from promoting their inventory sooner.

Orlando and Moss didn’t instantly reply to requests for remark, whereas Litinsky couldn’t be reached for a remark.

Newly listed corporations usually see strain on their shares forward of the tip of their lock-up interval, when insiders develop into free to promote their usually appreciable stakes.

Trump Media, which operates the Reality Social app, noticed its worth balloon to just about $10 billion following its Wall Avenue debut, lifted by retail merchants and merchants who see it as a speculative guess on his possibilities of securing a second four-year time period as president.

Nevertheless, after reaching that peak, Trump Media shares have misplaced most of their worth, with declines accelerating in current weeks after President Joe Biden gave up his reelection bid on July 21, and Trump misplaced a lead in opinion polls forward of the Nov. 5 presidential election to Democratic candidate Vice President Kamala Harris. Betting markets now present Harris with a modest benefit over Trump in a decent race.

Trump Media’s income is equal to 2 Starbucks espresso retailers, and strategists say its $3 billion inventory market worth is indifferent from its day-to-day enterprise.

Its inventory is buying and selling on the equal of over 1,000 occasions its income, far exceeding the valuation of even AI famous person Nvidia, which not too long ago traded at 24 occasions its income.

“The market could not take in even a partial stake sale with out some materials injury to the inventory,” Sosnick mentioned.

“In the end lots will hinge on whether or not (Trump) retains his phrase on not promoting whereas the long run prospects of the corporate are utterly dependent upon his electoral prospects.”

Insiders Stake as % of excellent

TMTG shares

Donald Trump 56.6%

United Atlantic 5.5%

Ventures llc

ARC International 5.5%

Investments

Phillip Juhan 0.2%

Devin Nunes 0.06%

Scott Glabe 0.01%

(Reporting by Noel Randewich and Medha Singh; Further reporting by Lance Tupper and Tom Hals; Modifying by Megan Davies and Diane Craft)

Markets

Coca-Cola plans to take a position $1 billion in Nigeria operations, presidency says

ABUJA (Reuters) – Coca-Cola (NYSE:) plans to take a position $1 billion in its Nigeria operations over the following 5 years, the nation’s presidency mentioned after a gathering between President Bola Tinubu and senior executives of the delicate drinks maker on Thursday.

Tinubu met John Murphy, president and chief monetary officer of Coca‑Cola, Zoran Bogdanovic, CEO of Coca-Cola HBC – one among Coca-Cola’s many bottlers worldwide – and a number of other different firm officers as he seeks to draw funding into the financial system.

Bogdanovic informed Tinubu that Coca-Cola had since 2013 invested $1.5 billion in Nigeria to increase its manufacturing capability, enhance its provide chain and on coaching and improvement, the Nigerian presidency mentioned in an announcement.

“I’m more than happy to announce that, with a predictable and enabling atmosphere in place, we plan to take a position a further $1 billion over the following 5 years,” Bogdanovic was quoted as saying.

The funding announcement comes after Tinubu’s authorities noticed a number of multinationals like Procter & Gamble (NYSE:), GSK Plc and Bayer AG (ETR:) go away the nation or appoint third events to distribute their merchandise attributable to international change shortages.

Tinubu, in workplace since Might final yr, mentioned his authorities wished to create an atmosphere open to companies.

“We’re constructing a monetary system the place you may make investments, re-invest, and repatriate all of your dividends. I’ve a agency perception in that,” he mentioned.

Nigeria, with a inhabitants of greater than 200 million is seen as a possible market for a lot of international manufacturers, however foreign exchange woes, crimson tape and coverage inconsistency discourages some buyers.

Bottler Coca-Cola HBC in April mentioned its working revenue would rise this yr, supported by robust demand for its espresso, vitality and glowing drinks whilst costs have been hiked to maintain up with excessive prices and forex devaluation in international locations like Egypt and Nigeria.

Markets

Analyst Report: Ameren Corp.

Abstract

St. Louis-based Ameren Corp. is a public utility that serves 2.4 million electrical prospects and 900,000 pure gasoline prospects by its Ameren Missouri and Ameren Illinois regulated subsidiaries. Prospects are positioned in central and japanese Missouri and southern Illinois. Ameren Missouri supplies vertically built-in electrical service, with a producing capability of 10,800 megawatts. Ameren Illinois supplies electrical transmission service in addition to pure gasoline supply. Ameren Transmission Co. of Illinois develops regional electrical transmission tasks. AEE additionally operates one nuclear-generating facility. In 2023, electrical energy accounted for about 83% of whole revenues.

Administration is dedicated to electrical and gasoline service enlargement and infrastructure enhancements within the firm’s regulated service territories. Ameren has exited the risky non-regulated service provider power enterprise, and has proven little curiosity in buying non-regulated property. The corporate operates a number of nuclear mills, however nonetheless depends closely on coal. Of the utility’s producing capability, the 2023 gasoline combine is about 44% coal, 12% nuclear, 29% pure gasoline/oil, and 15% renewables. Administration estimate

Improve to start utilizing premium analysis studies and get a lot extra.

Unique studies, detailed firm profiles, and best-in-class commerce insights to take your portfolio to the following degree

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now